Key Insights

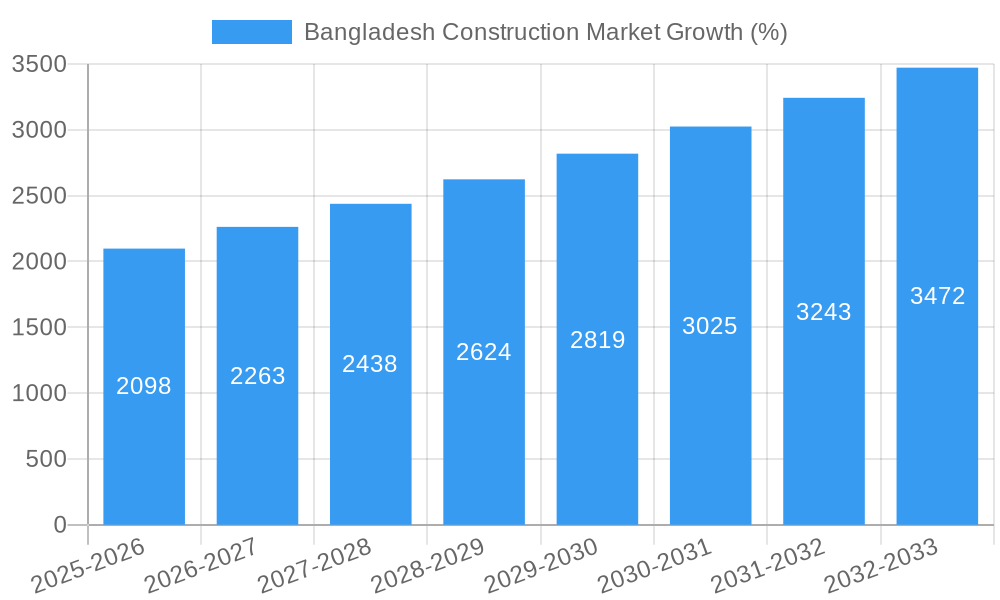

The Bangladesh construction market, valued at $32.33 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.42% from 2025 to 2033. This expansion is driven by several key factors. Significant government investments in infrastructure development, particularly in transportation (roads, railways, bridges) and energy & utilities projects, are fueling demand. Rapid urbanization and a growing population are increasing the need for residential and commercial construction. Furthermore, the improving economic conditions in Bangladesh are attracting foreign investment, boosting the construction sector. Key segments like residential construction, driven by a rising middle class and increased demand for housing, and infrastructure development, supported by government initiatives like the construction of new metro lines and expressways, are showing particularly strong growth trajectories. However, challenges remain. Land acquisition complexities, regulatory hurdles, and potential material price fluctuations could pose constraints to the market's full potential.

The competitive landscape is fragmented, with both large multinational corporations like KEC International and several prominent local players such as Anan Construction, Concord Engg & Construction Ltd, and Mir Akhter Hossain Limited vying for market share. The sector is witnessing increasing adoption of advanced construction technologies and sustainable building practices. This trend is likely to accelerate in the coming years, improving efficiency and reducing environmental impact. To maintain this positive growth trajectory, addressing the challenges related to regulatory streamlining and skilled labor availability will be crucial. Continued government support for infrastructure projects and private sector investment will be essential to unlock the full potential of the Bangladesh construction market.

Bangladesh Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Bangladesh construction market, encompassing historical performance (2019-2024), current status (2025), and future projections (2025-2033). The study delves into market segmentation, key players, growth drivers, challenges, and emerging opportunities, offering invaluable insights for industry stakeholders. With a focus on key market trends and detailed analysis, this report is an essential resource for businesses seeking to navigate and capitalize on the dynamic Bangladesh construction landscape. The report uses Million (M) for all values.

Bangladesh Construction Market Concentration & Innovation

The Bangladesh construction market exhibits a moderately concentrated landscape, with a few large players holding significant market share. While precise market share figures for individual companies are unavailable, key players like Anan Construction, Concord Engg & Construction Ltd, Mir Akhter Hossain Limited, Pubali Construction, and others hold substantial influence. Innovation is driven by government initiatives promoting sustainable construction practices and technological advancements. However, the regulatory framework can sometimes pose challenges, with bureaucratic hurdles impacting project timelines. The market sees limited product substitution, primarily due to cost and material availability constraints. End-user trends reveal a growing preference for sustainable and technologically advanced building materials. M&A activity remains moderate, with deal values in the range of xx M USD annually. Future consolidation is expected.

- Market Concentration: Moderately concentrated, dominated by a few large firms.

- Innovation Drivers: Government initiatives, technological advancements, and rising demand for sustainable construction.

- Regulatory Framework: Moderate challenges due to bureaucratic procedures.

- Product Substitution: Limited due to cost factors and availability.

- End-User Trends: Increasing preference for sustainable and technologically advanced solutions.

- M&A Activity: Moderate, with annual deal values estimated at xx M USD.

Bangladesh Construction Market Industry Trends & Insights

The Bangladesh construction market demonstrates strong growth potential, driven by robust urbanization, increasing infrastructure development, and a growing middle class. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, exceeding the historical CAGR of xx% (2019-2024). Technological disruptions, including the adoption of Building Information Modeling (BIM) and prefabrication techniques, are gradually reshaping industry practices. However, challenges remain, including skills shortages, supply chain bottlenecks, and land acquisition complexities. Market penetration of new technologies remains relatively low but shows strong upward trajectory. Consumer preference leans toward high-quality, durable, and cost-effective constructions. Competitive dynamics are primarily characterized by price competition and securing government contracts.

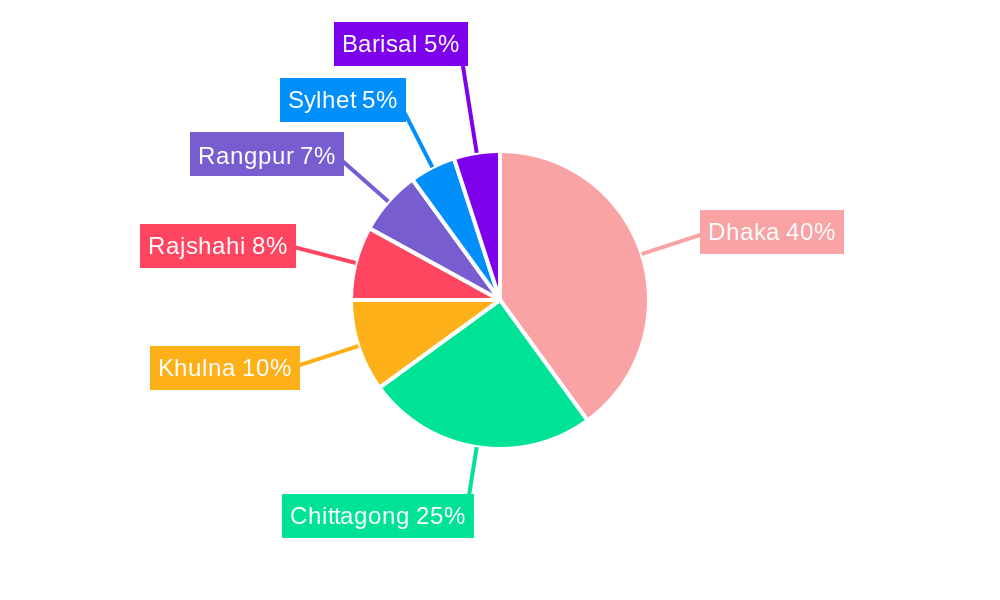

Dominant Markets & Segments in Bangladesh Construction Market

The Infrastructure (Transportation) segment currently dominates the Bangladesh construction market. This sector's dominance is primarily driven by the government's ambitious infrastructure development plans, encompassing road networks, railways, and port expansions. Residential construction constitutes a significant portion of the overall market, fueled by a rising population and urbanization.

Infrastructure (Transportation):

- Key Drivers: Government initiatives like the development of Matarbari port and Dhaka's MRT Line 1. Significant investments from foreign entities.

- Dominance Analysis: Largest segment due to substantial government investment and long-term development plans.

Residential:

- Key Drivers: Rapid urbanization, population growth, and rising disposable incomes.

- Dominance Analysis: A major segment, driven by increasing housing demand in urban areas.

Commercial:

- Key Drivers: Growth in the service sector and foreign direct investment.

- Dominance Analysis: Moderate growth compared to infrastructure and residential segments.

Industrial:

- Key Drivers: Growth in manufacturing and export-oriented industries.

- Dominance Analysis: Relatively smaller segment compared to others.

Energy and Utilities:

- Key Drivers: Expanding energy needs and investments in power generation and distribution networks.

- Dominance Analysis: Growing steadily, but still smaller than the infrastructure segment.

Bangladesh Construction Market Product Developments

The Bangladesh construction market is witnessing the adoption of innovative building materials, such as precast concrete and sustainable construction techniques. Technological advancements, such as BIM and 3D printing, are slowly gaining traction. However, widespread adoption is hindered by cost and skilled labor constraints. This adoption offers superior efficiency and potentially reduces costs in the long run.

Report Scope & Segmentation Analysis

This report segments the Bangladesh construction market by sector: Residential, Commercial, Industrial, Infrastructure (Transportation), and Energy and Utilities. Each segment's growth projection, market size, and competitive dynamics are analyzed in detail. For instance, the Infrastructure (Transportation) segment shows the highest growth potential, driven by government investments. The Residential segment is experiencing steady growth due to urbanization. The Commercial sector reflects moderate growth tied to economic development. While Industrial and Energy & Utilities sectors demonstrate consistent growth, they remain comparatively smaller segments.

Key Drivers of Bangladesh Construction Market Growth

The Bangladesh construction market's growth is propelled by several key factors:

- Government Initiatives: Significant investments in infrastructure projects.

- Economic Growth: Rising disposable incomes and urbanization driving housing demand.

- Foreign Direct Investment (FDI): Increased investments in infrastructure and industrial projects.

- Technological Advancements: Adoption of modern construction techniques and materials.

Challenges in the Bangladesh Construction Market Sector

The Bangladesh construction market faces several challenges:

- Regulatory Hurdles: Bureaucratic processes can delay project timelines and increase costs.

- Supply Chain Issues: Shortages of skilled labor and construction materials.

- Land Acquisition: Complex land acquisition procedures can impede project commencement.

- Infrastructure Deficiencies: Existing infrastructure limitations can hamper project execution.

Emerging Opportunities in Bangladesh Construction Market

Emerging opportunities include:

- Green Building Technologies: Growing demand for sustainable and energy-efficient buildings.

- Prefabrication: Increased use of prefabricated components to reduce construction time and costs.

- Infrastructure Development: Continued government investments in large-scale infrastructure projects.

Leading Players in the Bangladesh Construction Market Market

- Anan Construction

- Concord Engg & Construction Ltd

- Mir Akhter Hossain Limited

- Pubali Construction

- Suvastu Engineering

- Western Engineering (Pvt ) Ltd

- Infratech Construction Company Ltd

- Toma Group Ltd

- Mazid Sons Constructions Ltd

- KEC International Ltd

Key Developments in Bangladesh Construction Market Industry

- March 2023: Japan pledged USD 1.27 Billion for three infrastructure projects, including the Matarbari commercial port, significantly boosting the infrastructure segment.

- October 2022: The commencement of Dhaka's MRT Line 1, the country's first metro, marks a landmark event, signifying increased investment in mass transit infrastructure.

Strategic Outlook for Bangladesh Construction Market Market

The Bangladesh construction market presents significant long-term growth potential. Continued government investment in infrastructure, coupled with private sector participation and technological advancements, will drive market expansion. The focus on sustainable construction practices and infrastructure development promises significant opportunities for both domestic and international players. The market's inherent resilience and growth trajectory make it an attractive investment destination.

Bangladesh Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastruture (Transportation)

- 1.5. Energy and Utilities

Bangladesh Construction Market Segmentation By Geography

- 1. Bangladesh

Bangladesh Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Infrastructure4.; Shortage of Skilled Labours

- 3.4. Market Trends

- 3.4.1. Growth in Infrastructure Activities is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastruture (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Anan Construction**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Concord Engg & Construction Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mir Akhter Hossain Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pubali Construction

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Suvastu Engineering

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Western Engineering (Pvt ) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Infratech Construction Company Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toma Group Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mazid Sons Constructions Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 KEC International Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Anan Construction**List Not Exhaustive

List of Figures

- Figure 1: Bangladesh Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bangladesh Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Bangladesh Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bangladesh Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Bangladesh Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Bangladesh Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Bangladesh Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Bangladesh Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Construction Market?

The projected CAGR is approximately 6.42%.

2. Which companies are prominent players in the Bangladesh Construction Market?

Key companies in the market include Anan Construction**List Not Exhaustive, Concord Engg & Construction Ltd, Mir Akhter Hossain Limited, Pubali Construction, Suvastu Engineering, Western Engineering (Pvt ) Ltd, Infratech Construction Company Ltd, Toma Group Ltd, Mazid Sons Constructions Ltd, KEC International Ltd.

3. What are the main segments of the Bangladesh Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.33 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities.

6. What are the notable trends driving market growth?

Growth in Infrastructure Activities is driving the market.

7. Are there any restraints impacting market growth?

4.; Limited Infrastructure4.; Shortage of Skilled Labours.

8. Can you provide examples of recent developments in the market?

March 2023: Japan was to provide USD 1.27 billion to Bangladesh for 3 infrastructure projects, including the building of Matarbari commercial port in Southeast, according to Bangladesh's Finance Ministry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Construction Market?

To stay informed about further developments, trends, and reports in the Bangladesh Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence