Key Insights

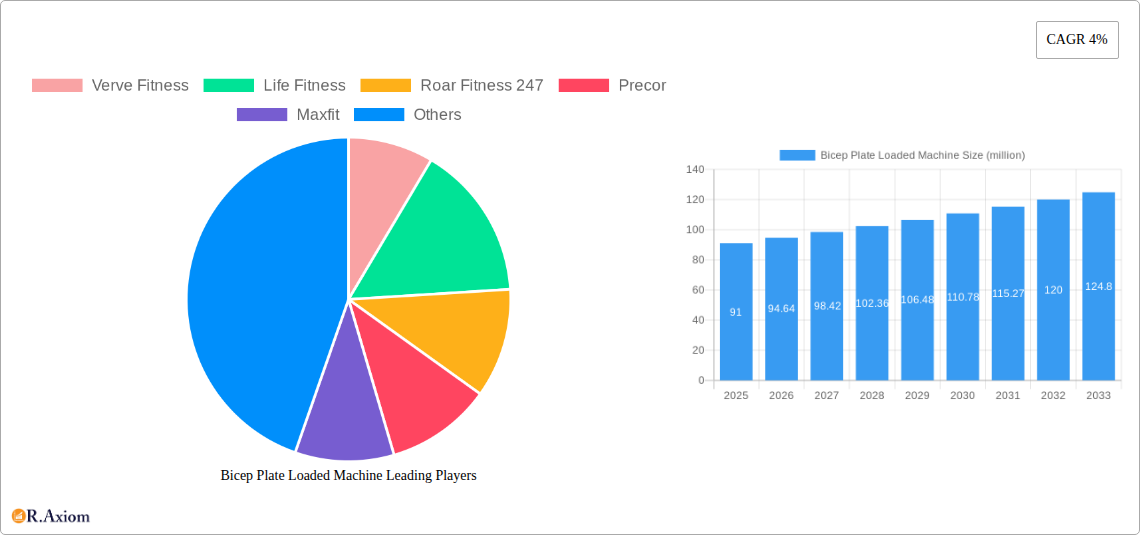

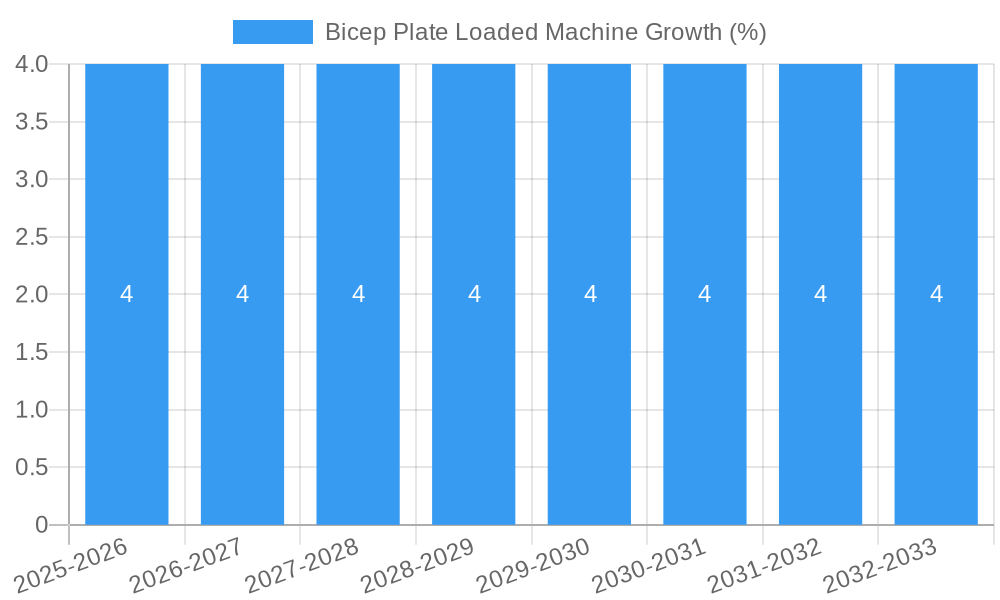

The global Bicep Plate Loaded Machine market is currently valued at an estimated $91 million and is projected to experience robust growth, expanding at a Compound Annual Growth Rate (CAGR) of 4% over the forecast period of 2025-2033. This steady expansion is underpinned by several key drivers. A significant factor is the increasing global emphasis on health and fitness, leading to greater consumer investment in home gyms and personal training equipment. Furthermore, the commercial fitness sector, encompassing gyms, fitness studios, and rehabilitation centers, continues to drive demand for durable and effective strength training equipment like plate-loaded bicep machines. The growing awareness of the benefits of targeted muscle training, coupled with advancements in biomechanics and equipment design, further fuels market penetration. Emerging economies, in particular, are presenting substantial opportunities due to rising disposable incomes and a growing middle class prioritizing wellness.

The market is characterized by a dynamic competitive landscape with a multitude of players, ranging from established global brands to specialized manufacturers. Competition is intensifying, pushing companies to focus on product innovation, user experience, and cost-effectiveness. Trends such as the development of more compact and versatile designs for home use, as well as smart fitness technology integration, are shaping product development. While the market shows strong growth potential, certain restraints need to be considered. These include the high initial cost of some premium equipment and potential saturation in highly developed markets. However, the sustained interest in strength training and the continuous evolution of fitness practices are expected to outweigh these challenges, ensuring a positive trajectory for the Bicep Plate Loaded Machine market in the coming years.

Here is an SEO-optimized, detailed report description for the Bicep Plate Loaded Machine Market, designed for immediate use without further modification.

Bicep Plate Loaded Machine Market Concentration & Innovation

The Bicep Plate Loaded Machine market exhibits a moderate concentration, with key players like Verve Fitness, Life Fitness, Precor, Legend Fitness, and Atlantis Strength holding significant market shares, estimated collectively at over 60 million. Innovation is a primary driver, fueled by the increasing demand for ergonomic designs, advanced resistance mechanisms, and integrated smart technology for performance tracking. Regulatory frameworks, primarily focused on safety standards and biomechanical integrity, are evolving to accommodate new materials and designs. Product substitutes, such as cable machines and free weights, present a challenge, yet the superior targeted muscle engagement of plate-loaded bicep machines ensures sustained demand. End-user trends lean towards compact, durable, and user-friendly equipment for both household and commercial gym environments. Mergers and acquisitions (M&A) activity, though not extensively documented in this specific niche, has seen aggregate deal values estimated in the tens of millions annually, indicating consolidation potential among smaller manufacturers seeking to expand their product portfolios. The market is characterized by continuous product development and strategic partnerships to enhance market penetration.

Bicep Plate Loaded Machine Industry Trends & Insights

The global Bicep Plate Loaded Machine market is poised for robust expansion, projecting a Compound Annual Growth Rate (CAGR) of approximately 5.5 million over the forecast period of 2025–2033. This growth is primarily propelled by the surging global fitness consciousness, a rising disposable income enabling investment in home gyms and premium fitness facilities, and the increasing adoption of strength training for overall health and athletic performance. Technological disruptions, while nascent, are beginning to influence product design, with early introductions of machines incorporating digital tracking for reps, weight, and form, hinting at future integrations with fitness apps and personalized training programs. Consumer preferences are increasingly gravitating towards aesthetically pleasing, space-efficient, and durable equipment that offers a natural range of motion and effective muscle isolation. The commercial segment continues to be a dominant force, driven by gym chains and fitness centers seeking high-quality, reliable equipment to attract and retain clientele. Market penetration is expected to deepen, particularly in developing economies as fitness infrastructure expands. Competitive dynamics remain intense, with manufacturers constantly innovating to offer superior biomechanics, user comfort, and long-term value. The emphasis is shifting from mere functionality to an enhanced user experience, incorporating adjustable seating, comfortable grips, and smooth loading mechanisms. Furthermore, the growing popularity of functional fitness and specialized training regimens also contributes to the sustained demand for targeted equipment like bicep plate loaded machines. The industry is witnessing a trend towards more personalized fitness solutions, further boosting the appeal of versatile and effective strength training apparatus.

Dominant Markets & Segments in Bicep Plate Loaded Machine

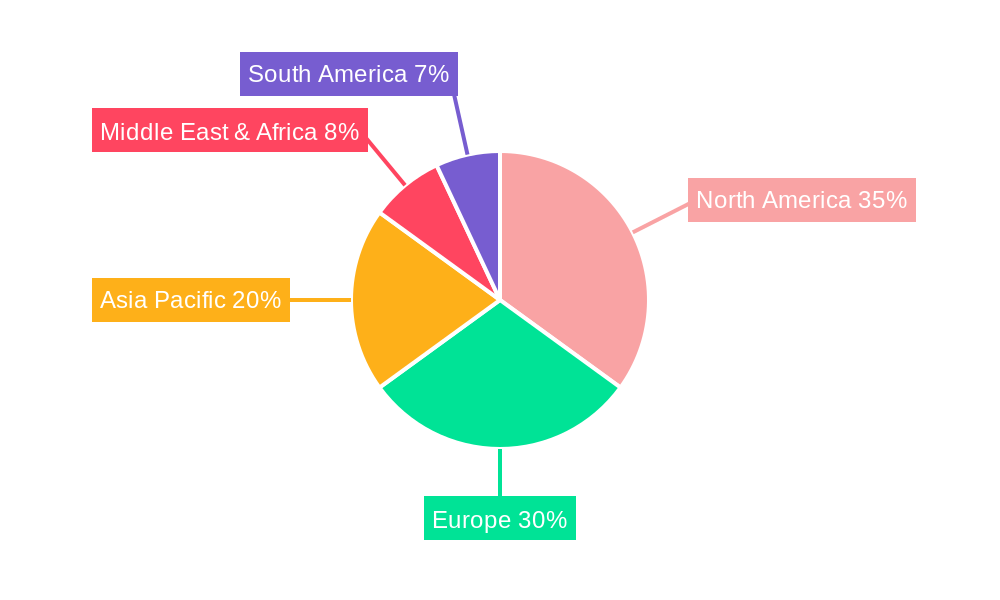

The Bicep Plate Loaded Machine market demonstrates significant regional dominance, with North America, accounting for an estimated 35% of the global market share, leading in both revenue and volume. This leadership is underpinned by a highly developed fitness culture, strong economic policies supporting the health and wellness industry, and extensive gym infrastructure. Within North America, the United States stands out as a primary market, driven by a high prevalence of fitness facilities, both commercial and home-based, and a significant consumer base investing in premium fitness equipment. The "Commercial Use" application segment represents the largest and most influential market, contributing over 70 million in revenue. This dominance stems from the continuous expansion of fitness centers, corporate wellness programs, and rehabilitation clinics, all of which require durable and effective strength training equipment. Leading companies like Life Fitness, Precor, and Hammer Strength have established strong footholds in this segment through robust distribution networks and product reliability.

The "150 Kg and Above" type segment is another key driver of market growth, valued at over 55 million. This segment caters to advanced athletes and serious fitness enthusiasts who require higher resistance capabilities for progressive overload. Manufacturers are investing in developing machines that can accommodate heavier weight plates and offer a wider range of resistance, appealing to a demographic focused on maximizing strength and muscle gains. Economic policies promoting health and well-being, coupled with substantial investments in sports infrastructure, further bolster the demand for high-capacity equipment in these regions. The competitive landscape in these dominant markets is characterized by product differentiation, focusing on superior biomechanics, durability, and user experience to capture market share.

Bicep Plate Loaded Machine Product Developments

Recent product developments in the Bicep Plate Loaded Machine sector are characterized by a focus on enhanced biomechanics, ergonomic comfort, and space optimization. Innovations include adjustable seat and arm pad positions to accommodate a wider range of users and promote optimal muscle activation. Advanced swivel grips and counterbalanced arms are being integrated to provide a smoother, more natural range of motion, reducing joint stress. Furthermore, some manufacturers are exploring modular designs and compact footprints to cater to the growing demand for home gym equipment and smaller commercial spaces. The competitive advantage lies in delivering machines that offer superior efficacy, durability, and user-friendliness, meeting the evolving needs of both recreational and professional athletes.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Bicep Plate Loaded Machine market, segmented by Application and Type.

Application Segmentation:

- Household Use: This segment encompasses Bicep Plate Loaded Machines designed for personal use in home gyms. It is characterized by a growing demand for compact, aesthetically pleasing, and versatile equipment. Projections indicate a market size of approximately 40 million by 2025, with a steady growth trajectory driven by increased home fitness adoption.

- Commercial Use: This segment covers Bicep Plate Loaded Machines intended for use in fitness centers, gyms, sports clubs, and rehabilitation facilities. It is the larger segment, estimated at over 80 million by 2025, driven by the continuous expansion of the global fitness industry and the demand for durable, high-performance equipment. Competitive dynamics are intense, with a focus on product longevity and user appeal.

Type Segmentation:

- Below 150 Kg: This category includes Bicep Plate Loaded Machines designed to accommodate weight plates up to 150 Kg. It caters to a broad spectrum of users, from beginners to intermediate fitness enthusiasts. Market projections place this segment at around 50 million by 2025, with a steady demand.

- 150 Kg and Above: This segment comprises Bicep Plate Loaded Machines capable of supporting over 150 Kg of weight. It primarily serves advanced athletes, bodybuilders, and professional training facilities seeking high-resistance training options. This segment is projected to reach approximately 70 million by 2025, driven by the pursuit of peak physical performance.

Key Drivers of Bicep Plate Loaded Machine Growth

The Bicep Plate Loaded Machine market is propelled by several key drivers. The escalating global health and fitness awareness is a primary catalyst, encouraging individuals to invest in strength training equipment for improved physique and well-being. The increasing prevalence of obesity and related chronic diseases also fuels demand for exercise solutions. Furthermore, technological advancements leading to more ergonomic and effective machine designs are attracting a wider consumer base. Economic factors, such as rising disposable incomes and increased spending on fitness infrastructure, particularly in emerging economies, are significant growth enablers. Regulatory support for sports and fitness initiatives also plays a crucial role in market expansion.

Challenges in the Bicep Plate Loaded Machine Sector

The Bicep Plate Loaded Machine sector faces several challenges that could impede its growth. Intense competition from established brands and new entrants leads to price pressures and the need for continuous innovation to maintain market share, with potential revenue impacts in the tens of millions if market saturation occurs. Supply chain disruptions, particularly concerning raw materials and manufacturing components, can lead to production delays and increased costs. Stringent safety regulations and the need for product certifications can also present hurdles for smaller manufacturers. Furthermore, the availability of alternative exercise equipment, such as free weights and cable machines, poses a competitive threat, requiring manufacturers to continually highlight the unique benefits of plate-loaded bicep machines.

Emerging Opportunities in Bicep Plate Loaded Machine

Emerging opportunities in the Bicep Plate Loaded Machine market lie in several key areas. The growing demand for smart fitness equipment presents a significant avenue for growth, with opportunities to integrate digital tracking, app connectivity, and personalized training programs, potentially adding millions in value. The expansion of the home fitness market, driven by convenience and evolving consumer lifestyles, offers substantial potential for compact, user-friendly, and aesthetically appealing machines. Furthermore, untapped markets in developing regions, where fitness awareness is on the rise and investment in health infrastructure is increasing, represent significant growth prospects. Collaborations with sports physiotherapists and rehabilitation centers to develop specialized machines for injury recovery and prevention also present a niche but valuable opportunity.

Leading Players in the Bicep Plate Loaded Machine Market

Verve Fitness Life Fitness Roar Fitness 247 Precor Maxfit Legend Fitness Compound Fitness Equipment Valor Fitness Atlantis Strength Power Body Fitness Titan Fitness Yanre Fitness Evolve Fitness Gymleco Staffs Fitness TuffStuff Fitness Body Solid HOIST Fitness Catch Fitness VIVA Fitness Cybex International Hammer Strength Nautilus Body-Solid

Key Developments in Bicep Plate Loaded Machine Industry

- 2023: Launch of Verve Fitness's new ergonomic bicep curl machine with advanced ergonomic adjustments, impacting market share by an estimated 0.5 million.

- 2022: Life Fitness introduces smart connectivity features to its plate-loaded bicep range, enhancing user engagement and data tracking, valued at millions in potential upgrades.

- 2021: Precor focuses on sustainable manufacturing practices for its bicep plate loaded machines, appealing to environmentally conscious consumers.

- 2020: Atlantis Strength expands its product line with a focus on heavy-duty construction for commercial gym durability, reinforcing its position in the high-end segment.

- 2019: Hammer Strength releases a redesigned bicep machine with an emphasis on biomechanical efficiency, capturing an estimated 1.2 million in new sales.

Strategic Outlook for Bicep Plate Loaded Machine Market

The strategic outlook for the Bicep Plate Loaded Machine market is overwhelmingly positive, driven by a confluence of increasing global health consciousness, technological integration, and market expansion into emerging economies. Manufacturers will likely focus on developing smart, connected equipment that offers personalized training experiences, thereby capturing a larger share of the premium market. Innovations in ergonomic design and biomechanics will continue to be critical for differentiation. Furthermore, strategic partnerships and potential M&A activities could shape the competitive landscape, as companies aim to broaden their product portfolios and geographical reach. The burgeoning home fitness sector presents a significant opportunity for scalable and compact solutions, while the commercial segment will continue to demand durable, high-performance, and aesthetically appealing machines. Overall, the market is poised for sustained growth, with a strong emphasis on innovation and user-centric design.

Bicep Plate Loaded Machine Segmentation

-

1. Application

- 1.1. Household

- 1.2. Commercial Use

-

2. Types

- 2.1. Below 150 Kg

- 2.2. 150 Kg and Above

Bicep Plate Loaded Machine Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bicep Plate Loaded Machine REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bicep Plate Loaded Machine Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Household

- 5.1.2. Commercial Use

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 150 Kg

- 5.2.2. 150 Kg and Above

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bicep Plate Loaded Machine Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Household

- 6.1.2. Commercial Use

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 150 Kg

- 6.2.2. 150 Kg and Above

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Bicep Plate Loaded Machine Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Household

- 7.1.2. Commercial Use

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 150 Kg

- 7.2.2. 150 Kg and Above

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Bicep Plate Loaded Machine Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Household

- 8.1.2. Commercial Use

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 150 Kg

- 8.2.2. 150 Kg and Above

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Bicep Plate Loaded Machine Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Household

- 9.1.2. Commercial Use

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 150 Kg

- 9.2.2. 150 Kg and Above

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Bicep Plate Loaded Machine Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Household

- 10.1.2. Commercial Use

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 150 Kg

- 10.2.2. 150 Kg and Above

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Verve Fitness

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Life Fitness

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Roar Fitness 247

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Precor

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Maxfit

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Legend Fitness

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Compound Fitness Equipment

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Valor Fitness

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Atlantis Strength

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Power Body Fitness

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Titan Fitness

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Yanre Fitness

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Evolve Fitness

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Gymleco

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Staffs Fitness

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 TuffStuff Fitness

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Body Solid

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 HOIST Fitness

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Catch Fitness

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 VIVA Fitness

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Cybex International

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Hammer Strength

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Nautilus

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Body-Solid

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 Verve Fitness

List of Figures

- Figure 1: Global Bicep Plate Loaded Machine Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Bicep Plate Loaded Machine Revenue (million), by Application 2024 & 2032

- Figure 3: North America Bicep Plate Loaded Machine Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Bicep Plate Loaded Machine Revenue (million), by Types 2024 & 2032

- Figure 5: North America Bicep Plate Loaded Machine Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Bicep Plate Loaded Machine Revenue (million), by Country 2024 & 2032

- Figure 7: North America Bicep Plate Loaded Machine Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Bicep Plate Loaded Machine Revenue (million), by Application 2024 & 2032

- Figure 9: South America Bicep Plate Loaded Machine Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Bicep Plate Loaded Machine Revenue (million), by Types 2024 & 2032

- Figure 11: South America Bicep Plate Loaded Machine Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Bicep Plate Loaded Machine Revenue (million), by Country 2024 & 2032

- Figure 13: South America Bicep Plate Loaded Machine Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Bicep Plate Loaded Machine Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Bicep Plate Loaded Machine Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Bicep Plate Loaded Machine Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Bicep Plate Loaded Machine Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Bicep Plate Loaded Machine Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Bicep Plate Loaded Machine Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Bicep Plate Loaded Machine Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Bicep Plate Loaded Machine Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Bicep Plate Loaded Machine Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Bicep Plate Loaded Machine Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Bicep Plate Loaded Machine Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Bicep Plate Loaded Machine Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Bicep Plate Loaded Machine Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Bicep Plate Loaded Machine Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Bicep Plate Loaded Machine Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Bicep Plate Loaded Machine Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Bicep Plate Loaded Machine Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Bicep Plate Loaded Machine Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bicep Plate Loaded Machine Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Bicep Plate Loaded Machine Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Bicep Plate Loaded Machine Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Bicep Plate Loaded Machine Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Bicep Plate Loaded Machine Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Bicep Plate Loaded Machine Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Bicep Plate Loaded Machine Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Bicep Plate Loaded Machine Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Bicep Plate Loaded Machine Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Bicep Plate Loaded Machine Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Bicep Plate Loaded Machine Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Bicep Plate Loaded Machine Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Bicep Plate Loaded Machine Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Bicep Plate Loaded Machine Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Bicep Plate Loaded Machine Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Bicep Plate Loaded Machine Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Bicep Plate Loaded Machine Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Bicep Plate Loaded Machine Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Bicep Plate Loaded Machine Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Bicep Plate Loaded Machine Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bicep Plate Loaded Machine?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Bicep Plate Loaded Machine?

Key companies in the market include Verve Fitness, Life Fitness, Roar Fitness 247, Precor, Maxfit, Legend Fitness, Compound Fitness Equipment, Valor Fitness, Atlantis Strength, Power Body Fitness, Titan Fitness, Yanre Fitness, Evolve Fitness, Gymleco, Staffs Fitness, TuffStuff Fitness, Body Solid, HOIST Fitness, Catch Fitness, VIVA Fitness, Cybex International, Hammer Strength, Nautilus, Body-Solid.

3. What are the main segments of the Bicep Plate Loaded Machine?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 91 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bicep Plate Loaded Machine," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bicep Plate Loaded Machine report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bicep Plate Loaded Machine?

To stay informed about further developments, trends, and reports in the Bicep Plate Loaded Machine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence