Key Insights

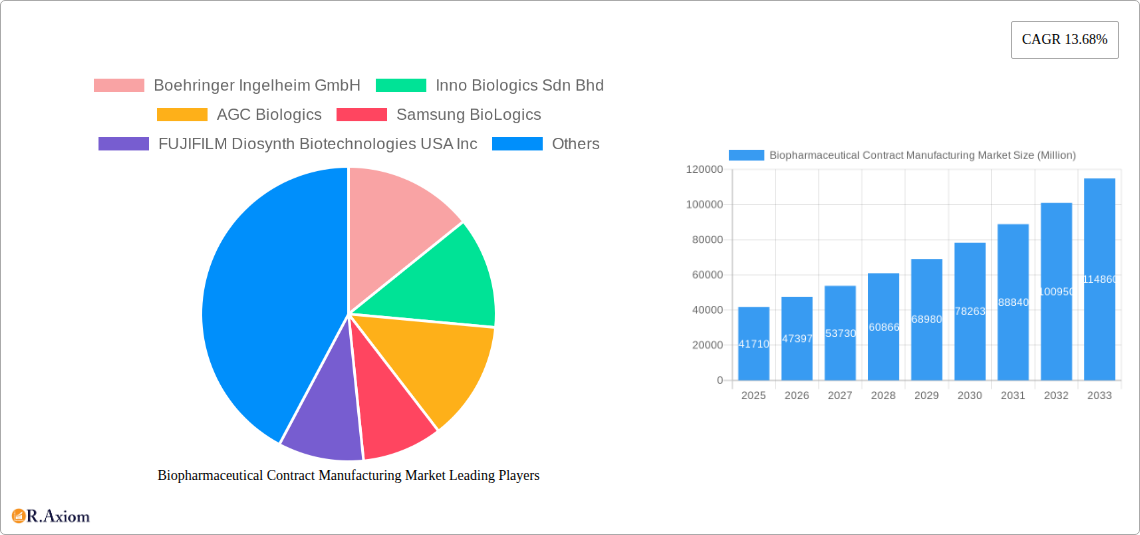

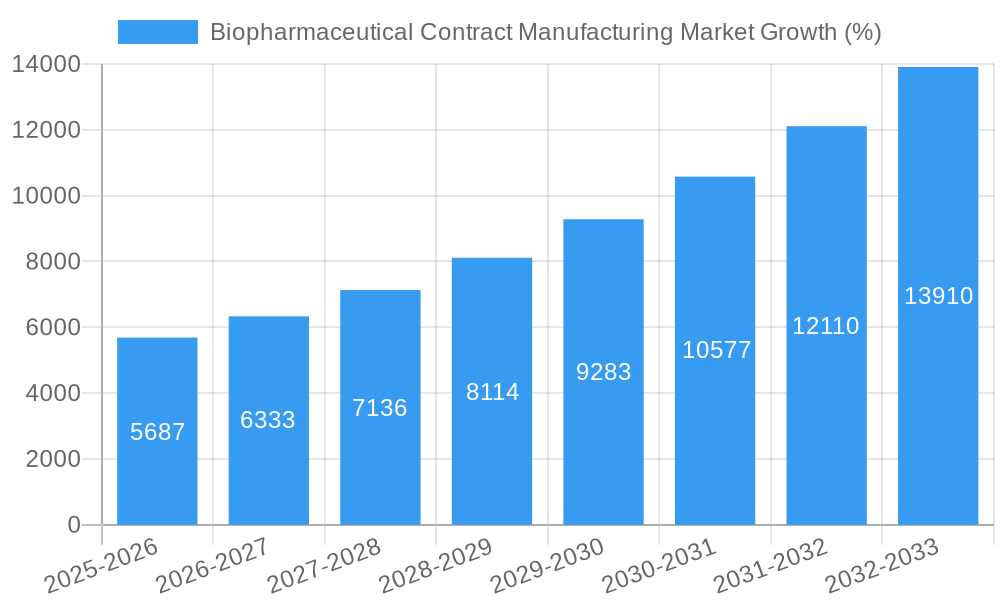

The biopharmaceutical contract manufacturing market is experiencing robust growth, projected to reach $41.71 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 13.68% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of chronic diseases globally necessitates higher drug production volumes, exceeding the capacity of many pharmaceutical companies. This drives outsourcing to contract manufacturers, who offer specialized expertise and scalable infrastructure for processes like peptide/protein production, antibody development, vaccine manufacturing, and biosimilar creation. Furthermore, the rising demand for biologics, particularly in emerging markets like Asia-Pacific, is significantly contributing to market growth. Stringent regulatory requirements and a growing focus on quality control further incentivize companies to leverage the expertise of established contract manufacturers, ensuring product safety and regulatory compliance. Technological advancements, particularly in cell line development and process optimization, also contribute to efficiency gains and cost reductions, making contract manufacturing an increasingly attractive option.

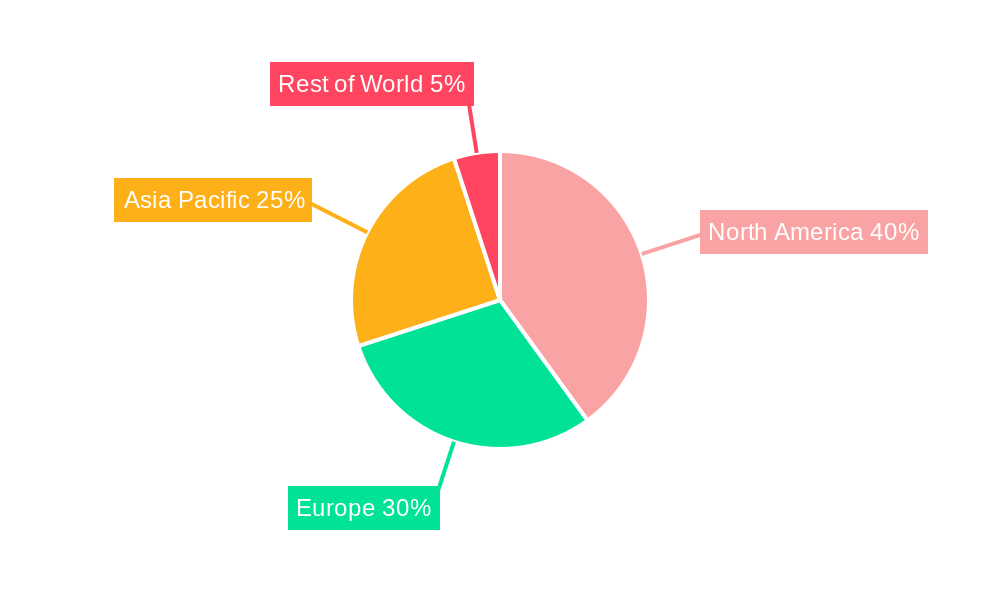

Competition within the market is intense, with established players like Boehringer Ingelheim, Samsung BioLogics, and Lonza competing alongside emerging players. However, the market is expected to remain fragmented, with opportunities for both large-scale manufacturers and specialized niche players. Regional variations in growth are anticipated, with North America and Europe maintaining significant market shares, driven by strong regulatory frameworks and established pharmaceutical industries. However, rapid expansion in Asia-Pacific, particularly in China and India, is poised to significantly reshape the market landscape in the coming years. Factors potentially hindering growth include pricing pressures, fluctuating raw material costs, and the complexities associated with managing global supply chains. Nevertheless, the long-term outlook remains positive, driven by continuous innovation and the ever-increasing need for efficient and reliable biopharmaceutical production.

Biopharmaceutical Contract Manufacturing Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Biopharmaceutical Contract Manufacturing Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages rigorous research methodologies and incorporates data from credible sources to offer a precise forecast for 2025-2033. The market is segmented by product type, encompassing Peptides/Proteins, Antibodies, Vaccines, Biosimilars, and Other Product Types. Leading players like Boehringer Ingelheim GmbH, Inno Biologics Sdn Bhd, AGC Biologics, Samsung BioLogics, and others are profiled, providing an in-depth competitive landscape analysis. The report's value is significantly enhanced by the inclusion of key industry developments and a strategic outlook for the forecast period.

Biopharmaceutical Contract Manufacturing Market Market Concentration & Innovation

The Biopharmaceutical Contract Manufacturing market demonstrates a moderately concentrated landscape, with a few large players holding significant market share. While precise market share figures for each company are unavailable at this time (xx%), the top 10 players collectively account for a substantial portion (estimated xx%) of the global revenue. This concentration is driven by substantial capital investments required for advanced manufacturing facilities, stringent regulatory compliance, and the specialized expertise needed for handling complex biopharmaceutical products.

Innovation within the market is fueled by several factors:

- Technological Advancements: Continuous advancements in bioprocessing technologies, such as single-use systems, continuous manufacturing, and cell line engineering, are driving efficiency gains and enhancing production capabilities.

- Regulatory Landscape: Evolving regulatory guidelines and standards necessitate continuous innovation in quality control, process validation, and data management. This drives investment in cutting-edge technologies and practices within CDMOs.

- Product Diversification: The market is witnessing a surge in demand for complex biologics like cell and gene therapies, requiring CDMOs to invest in new technologies and expertise.

- Mergers & Acquisitions (M&A): Significant M&A activity has reshaped the market, with larger players acquiring smaller companies to expand their capabilities and market reach. While precise deal values are not publicly available for all transactions (xx Million), several deals have involved hundreds of Millions, demonstrating the industry's consolidation trend.

Biopharmaceutical Contract Manufacturing Market Industry Trends & Insights

The Biopharmaceutical Contract Manufacturing market is experiencing robust growth, driven by several key factors. The increasing outsourcing trend among pharmaceutical and biotechnology companies is a major contributor, as companies focus on core competencies and reduce capital expenditures. This trend is further amplified by the rising demand for biologics, particularly in the areas of oncology, immunology, and infectious diseases. The market's CAGR for the period 2025-2033 is projected to be xx%, indicating strong sustained growth. Market penetration for contract manufacturing services is increasing across all segments, with particularly strong growth anticipated in emerging markets (xx%).

Technological disruptions are reshaping the industry. Advancements in process analytical technology (PAT), automation, and artificial intelligence (AI) are enhancing efficiency, reducing production costs, and improving product quality. This creates significant opportunities for CDMOs that embrace these technologies and offer advanced manufacturing solutions. Consumer preferences, while less directly impactful than in other sectors, influence the demand for specific product types. The increasing focus on personalized medicine and targeted therapies drives the need for specialized contract manufacturing services for smaller batch sizes and bespoke formulations. The competitive dynamics are characterized by both consolidation and innovation, with major players expanding their capabilities while emerging CDMOs are specializing in niche areas.

Dominant Markets & Segments in Biopharmaceutical Contract Manufacturing Market

While precise market share data is confidential for specific regions and countries, the North American market is projected to maintain its leading position throughout the forecast period, driven by a robust pharmaceutical industry, significant investment in R&D, and stringent regulatory frameworks.

Dominant Segments by Product Type:

- Antibodies: This segment holds the largest market share due to the significant number of antibody-based therapeutics currently in development and on the market. Key drivers include the increasing prevalence of chronic diseases and the effectiveness of antibody therapies in various therapeutic areas.

- Peptides/Proteins: This segment exhibits strong growth due to advancements in peptide and protein engineering and the development of novel therapeutic proteins.

- Vaccines: This segment is experiencing heightened demand, driven by the ongoing need for infectious disease vaccines and the emergence of new vaccines for various diseases.

- Biosimilars: This segment is growing rapidly, driven by the increasing demand for cost-effective alternatives to expensive biologics.

Key Drivers for the Dominant Regions (e.g., North America):

- Strong Pharmaceutical Industry: A robust and well-established pharmaceutical industry provides a large customer base for contract manufacturing services.

- High R&D Investment: Significant investments in research and development fuel the demand for CDMOs to support the manufacturing of new drugs and biologics.

- Favorable Regulatory Environment: Clear and supportive regulatory frameworks enhance the attractiveness of the region for biopharmaceutical manufacturing.

Biopharmaceutical Contract Manufacturing Market Product Developments

Recent years have witnessed significant advancements in biopharmaceutical contract manufacturing, including the adoption of single-use technologies, continuous manufacturing, and process intensification techniques. These advancements are improving productivity, reducing costs, and enhancing the speed of drug development and delivery. Further, the increased focus on cell and gene therapies necessitates highly specialized technologies and manufacturing processes, which is driving further innovation within the sector. This focus on advanced technologies provides a competitive advantage to CDMOs capable of offering these specialized services.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Biopharmaceutical Contract Manufacturing market, segmented by product type:

- Peptides/Proteins: This segment is expected to experience substantial growth due to the rising demand for protein-based therapeutics and the development of innovative protein engineering techniques. The competitive landscape within this segment is characterized by several established and emerging players.

- Antibodies: The antibody segment is expected to maintain its dominant market share. Market size is significant (xx Million) and projected to further expand (xx Million by 2033). Competition is intense among established players with significant capacity.

- Vaccines: This segment displays robust growth, driven by increasing public health concerns. Market size is substantial (xx Million) and displays strong future growth (xx Million by 2033). Competition is driven by specialization and geographic reach.

- Biosimilars: This rapidly expanding segment presents significant opportunities. Market size is rapidly expanding (xx Million) and is projected to grow substantially (xx Million by 2033). Competition is intense, driven by cost and regulatory factors.

- Other Product Types: This segment includes various other biopharmaceutical products, and will likely experience moderate growth, driven by the expanding pipeline of novel therapeutics.

Key Drivers of Biopharmaceutical Contract Manufacturing Market Growth

The Biopharmaceutical Contract Manufacturing market is propelled by several key drivers:

- Rising Demand for Biologics: The increasing prevalence of chronic diseases and the growing success of biologic therapies are fueling substantial demand.

- Outsourcing Trends: Pharmaceutical and biotechnology companies increasingly outsource manufacturing activities to focus on R&D and core competencies.

- Technological Advancements: Continuous improvements in bioprocessing technologies enhance efficiency, reduce costs, and improve product quality, attracting more outsourcing.

- Stringent Regulatory Requirements: CDMOs are investing in state-of-the-art facilities and technologies to meet increasingly stringent regulatory requirements, resulting in higher quality products.

Challenges in the Biopharmaceutical Contract Manufacturing Market Sector

The Biopharmaceutical Contract Manufacturing market faces several challenges:

- Stringent Regulatory Compliance: Meeting stringent regulatory guidelines for GMP (Good Manufacturing Practices) and other quality standards requires significant investment and expertise.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of raw materials and other essential components, leading to production delays and increased costs.

- Competitive Pressures: The market is characterized by intense competition, with established players and new entrants vying for market share. Price pressures and competition to attract highly skilled personnel are particularly salient.

- Capacity Constraints: Demand often outstrips supply, leading to capacity constraints and potentially impacting timelines.

Emerging Opportunities in Biopharmaceutical Contract Manufacturing Market

Several emerging opportunities exist within the Biopharmaceutical Contract Manufacturing market:

- Cell and Gene Therapies: The rapidly growing cell and gene therapy market presents significant opportunities for specialized CDMOs possessing the expertise and facilities to handle these complex products.

- Personalized Medicine: The increasing focus on personalized medicine creates opportunities for CDMOs to provide customized manufacturing services for smaller batch sizes.

- Emerging Markets: Expanding biopharmaceutical industries in emerging markets offer significant growth potential for CDMOs with a global footprint.

- Digitalization and Automation: The adoption of advanced technologies such as AI and automation will drive efficiency gains and improve productivity.

Leading Players in the Biopharmaceutical Contract Manufacturing Market Market

- Boehringer Ingelheim GmbH

- Inno Biologics Sdn Bhd

- AGC Biologics

- Samsung BioLogics

- FUJIFILM Diosynth Biotechnologies USA Inc

- Lonza Group

- ProBioGen AG

- JRS Pharma (Celonic)

- WuXi Biologics

- INCOG BioPharma Services

- Rentschler Biotechnologie GmbH

- Pressure BioSciences

*List Not Exhaustive

Key Developments in Biopharmaceutical Contract Manufacturing Market Industry

- September 2022: Shuttle Pharmaceuticals Holdings Inc. entered an agreement with TCG GreenChem, Inc. to manufacture Ropidoxuridine, a lead clinical sensitizer drug candidate, impacting the market by demonstrating outsourcing for clinical trial materials.

- January 2022: INCOG BioPharma Services announced nearing completion of its new manufacturing facility and global headquarters, signaling increased capacity and impacting the competitive landscape in the sterile injectables segment.

Strategic Outlook for Biopharmaceutical Contract Manufacturing Market Market

The Biopharmaceutical Contract Manufacturing market is poised for continued strong growth, driven by the factors outlined above. The increasing complexity of biopharmaceutical products, coupled with the rising demand for outsourcing services, will create significant opportunities for CDMOs that can adapt to the changing market landscape and invest in cutting-edge technologies. Companies that can successfully navigate the challenges of regulatory compliance, supply chain management, and intense competition will be well-positioned to capture market share and achieve sustainable growth. The strategic focus should be on developing specialized capabilities, adopting advanced technologies, and expanding into high-growth segments like cell and gene therapies to capture the market's significant future potential.

Biopharmaceutical Contract Manufacturing Market Segmentation

-

1. Product Type

- 1.1. Peptides/Proteins

- 1.2. Antibodies

- 1.3. Vaccines

- 1.4. Biosimilars

- 1.5. Other Product Types

Biopharmaceutical Contract Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Biopharmaceutical Contract Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Outsourcing by Biopharmaceutical Firms; Increasing Investments in Research and Development; Expansion in the Service Offering of CMOs

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Requirements; Increasing Logistics Costs

- 3.4. Market Trends

- 3.4.1. The Vaccine Segment is Expected to Hold Significant Share in the Market over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Peptides/Proteins

- 5.1.2. Antibodies

- 5.1.3. Vaccines

- 5.1.4. Biosimilars

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Peptides/Proteins

- 6.1.2. Antibodies

- 6.1.3. Vaccines

- 6.1.4. Biosimilars

- 6.1.5. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Peptides/Proteins

- 7.1.2. Antibodies

- 7.1.3. Vaccines

- 7.1.4. Biosimilars

- 7.1.5. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Peptides/Proteins

- 8.1.2. Antibodies

- 8.1.3. Vaccines

- 8.1.4. Biosimilars

- 8.1.5. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Peptides/Proteins

- 9.1.2. Antibodies

- 9.1.3. Vaccines

- 9.1.4. Biosimilars

- 9.1.5. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Peptides/Proteins

- 10.1.2. Antibodies

- 10.1.3. Vaccines

- 10.1.4. Biosimilars

- 10.1.5. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Biopharmaceutical Contract Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Boehringer Ingelheim GmbH

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Inno Biologics Sdn Bhd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 AGC Biologics

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Samsung BioLogics

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 FUJIFILM Diosynth Biotechnologies USA Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Lonza Group

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 ProBioGen AG

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 JRS Pharma (Celonic)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 WuXi Biologics

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 INCOG BioPharma Services

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Rentschler Biotechnologie GmbH

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Pressure BioSciences*List Not Exhaustive

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Boehringer Ingelheim GmbH

List of Figures

- Figure 1: Global Biopharmaceutical Contract Manufacturing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Asia Pacific Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Asia Pacific Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East and Africa Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Middle East and Africa Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Middle East and Africa Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East and Africa Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: South America Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Product Type 2024 & 2032

- Figure 29: South America Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: South America Biopharmaceutical Contract Manufacturing Market Revenue (Million), by Country 2024 & 2032

- Figure 31: South America Biopharmaceutical Contract Manufacturing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: GCC Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Africa Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Middle East and Africa Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 36: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 44: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Australia Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Asia Pacific Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 52: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: GCC Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Africa Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Middle East and Africa Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 57: Global Biopharmaceutical Contract Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Brazil Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Argentina Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America Biopharmaceutical Contract Manufacturing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biopharmaceutical Contract Manufacturing Market?

The projected CAGR is approximately 13.68%.

2. Which companies are prominent players in the Biopharmaceutical Contract Manufacturing Market?

Key companies in the market include Boehringer Ingelheim GmbH, Inno Biologics Sdn Bhd, AGC Biologics, Samsung BioLogics, FUJIFILM Diosynth Biotechnologies USA Inc, Lonza Group, ProBioGen AG, JRS Pharma (Celonic), WuXi Biologics, INCOG BioPharma Services, Rentschler Biotechnologie GmbH, Pressure BioSciences*List Not Exhaustive.

3. What are the main segments of the Biopharmaceutical Contract Manufacturing Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Outsourcing by Biopharmaceutical Firms; Increasing Investments in Research and Development; Expansion in the Service Offering of CMOs.

6. What are the notable trends driving market growth?

The Vaccine Segment is Expected to Hold Significant Share in the Market over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Requirements; Increasing Logistics Costs.

8. Can you provide examples of recent developments in the market?

September 2022: Shuttle Pharmaceuticals Holdings Inc. entered an agreement with TCG GreenChem, Inc. to manufacture Ropidoxuridine, the company's lead clinical sensitizer drug candidate, for use in formulating the drug product for testing in clinical trials of Ropidoxuridine and RT of cancers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biopharmaceutical Contract Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biopharmaceutical Contract Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biopharmaceutical Contract Manufacturing Market?

To stay informed about further developments, trends, and reports in the Biopharmaceutical Contract Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence