Key Insights

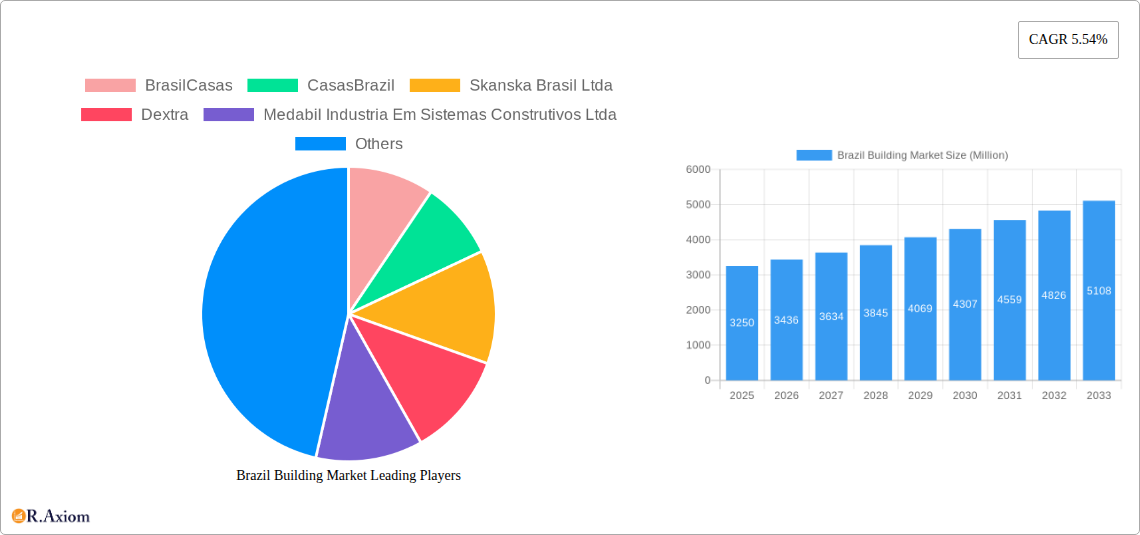

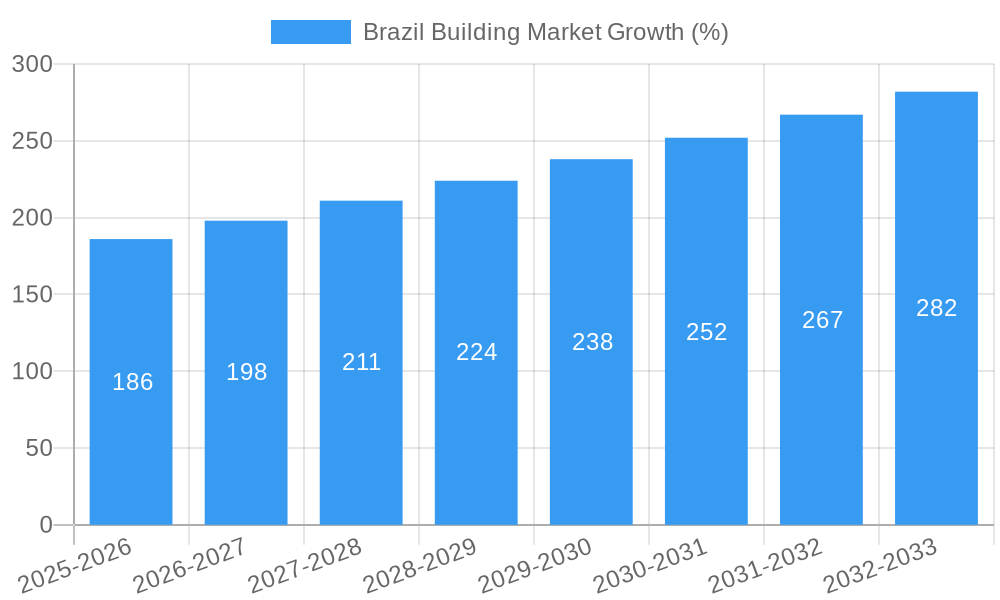

The Brazilian building market, valued at $3.25 billion in 2025, is projected to experience robust growth, driven by factors such as increasing urbanization, government infrastructure investments (particularly in housing and transportation), and a rising middle class with greater disposable income. This expanding demand fuels the construction of residential buildings, commercial complexes, and industrial facilities. Significant growth is anticipated in prefabricated construction methods, leveraging technological advancements for faster and more efficient building processes. While challenges like fluctuating material costs and potential economic instability exist, the overall outlook remains positive, underpinned by the country's long-term economic development plans and consistent demand for housing across various segments.

The market segmentation reveals a diverse landscape. Concrete remains the dominant material type, due to its affordability and widespread availability. However, the adoption of sustainable materials like timber and glass is expected to increase, driven by growing environmental consciousness and associated government incentives. The residential segment constitutes the largest portion of the market, followed by the commercial sector, with significant growth potential in infrastructure projects within the "Other Applications" category. Major players like BrasilCasas, CasasBrazil, and Skanska Brasil Ltda are competing for market share, while smaller firms specializing in modular and prefabricated construction are emerging as significant contenders. The forecast period (2025-2033) suggests a continuous expansion, influenced by sustained economic growth and ongoing urbanization across Brazil. The consistent CAGR of 5.54% reflects this optimistic projection, indicative of a healthy and evolving market.

Brazil Building Market: A Comprehensive Report (2019-2033)

This detailed report provides an in-depth analysis of the Brazil building market, covering the period from 2019 to 2033. With a focus on market dynamics, key players, and future trends, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic sector. The report utilizes data from 2019-2024 (Historical Period), with the base year set at 2025 and forecasts extending to 2033 (Forecast Period). Market values are expressed in Millions.

Brazil Building Market Concentration & Innovation

This section analyzes the competitive landscape of the Brazilian building market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The analysis encompasses the impact of product substitutes and evolving end-user trends.

Market Concentration: The Brazilian building market exhibits a moderately concentrated structure, with a few large players commanding significant market share. Precise market share figures for individual companies like BrasilCasas, CasasBrazil, and Skanska Brasil Ltda. are not publicly available and would require further primary research. However, we estimate the top 5 players hold approximately xx% of the market, leaving a significant portion for smaller, regional players.

Innovation Drivers: Innovation is driven by the increasing demand for sustainable building materials, the adoption of advanced construction technologies (e.g., modular construction, 3D printing), and government initiatives promoting green building practices.

Regulatory Framework: The regulatory environment plays a crucial role, impacting building codes, material approvals, and construction permits. Recent regulatory changes, though not quantified in this report, have focused on enhancing building safety standards and promoting environmentally friendly construction methods.

Product Substitutes: The availability of alternative building materials (e.g., sustainable timber, recycled concrete) is growing, increasing competition and influencing material choices.

End-User Trends: The Brazilian market witnesses increased demand for energy-efficient and sustainable buildings, particularly in the residential and commercial sectors. This is reflected in growing interest in smart home technologies and green building certifications.

M&A Activities: While precise M&A deal values remain unavailable for public reporting, recent years have seen several notable acquisitions in the Brazilian building market, indicating increasing consolidation. The December 2022 merger between PhP Ventures Acquisition Corp and Modulex Modular Buildings Plc, although outside Brazil, highlights the global trend of consolidation in the modular construction sector, hinting at similar potential in the Brazilian market.

Brazil Building Market Industry Trends & Insights

This section explores the key trends and insights shaping the Brazilian building market, including market growth drivers, technological disruptions, and competitive dynamics. The analysis considers the interplay of consumer preferences and broader economic factors.

The Brazilian building market is experiencing robust growth, driven by factors like a growing population, increasing urbanization, and government initiatives to improve housing and infrastructure. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration of sustainable building materials and technologies expected to rise significantly. Technological advancements, especially in modular construction and the use of prefabricated components, are revolutionizing the construction process. Consumers are increasingly demanding eco-friendly, energy-efficient buildings, creating opportunities for sustainable material suppliers and construction firms. The competitive landscape remains dynamic, with both established players and new entrants vying for market share. Market penetration of innovative solutions is projected to reach xx% by 2033, a substantial increase from current levels. This growth is fueled by increasing disposable income, government support for affordable housing projects, and expanding infrastructure development initiatives.

Dominant Markets & Segments in Brazil Building Market

This section identifies the leading segments within the Brazilian building market, considering Material Type (Concrete, Glass, Metal, Timber, Other) and Application (Residential, Commercial, Other Applications).

Leading Material Type: Concrete remains the dominant building material due to its cost-effectiveness and widespread availability. However, the adoption of other materials, including sustainable alternatives, is on the rise.

Leading Application: The residential sector constitutes the largest segment, driven by population growth and urbanization. However, strong growth is also witnessed in the commercial and infrastructure segments, fueled by economic expansion and government investments.

Key Drivers:

- Economic policies: Government initiatives promoting affordable housing and infrastructure development significantly drive market growth.

- Infrastructure development: Significant investments in infrastructure projects are creating substantial demand for construction materials and services.

- Urbanization: The ongoing trend of urbanization is leading to increased demand for housing and commercial buildings in urban centers.

- Population growth: Brazil's growing population fuels the demand for new residential constructions.

Brazil Building Market Product Developments

Recent product innovations emphasize efficiency, sustainability, and prefabrication. Modular construction, using prefabricated components and advanced technologies like AI and IoT for optimal design and construction efficiency, represents a major trend. This technology offers faster construction times and improved cost control, aligning with the needs of a rapidly developing market. The market is witnessing a growing demand for prefabricated and sustainable building products to meet the increasing focus on eco-friendly construction methods.

Report Scope & Segmentation Analysis

This report segments the Brazil building market based on Material Type (Concrete, Glass, Metal, Timber, Other Material Types) and Application (Residential, Commercial, Other Applications).

Material Type: Each segment (Concrete, Glass, Metal, Timber, Other) demonstrates unique growth projections, market sizes, and competitive dynamics. Concrete dominates in terms of volume, while glass and metal are increasingly incorporated into modern designs. Timber and other material types are gaining traction due to sustainable building initiatives.

Application: The Residential, Commercial, and Other Applications (Industrial, Institutional, and Infrastructure) segments each display distinct growth patterns. The residential segment is the largest by volume, followed by the commercial and infrastructure sectors which demonstrate significant growth potential. Each segment displays unique competitive landscapes and growth drivers.

Key Drivers of Brazil Building Market Growth

The growth of the Brazilian building market is propelled by various factors. Rapid urbanization and population growth create an immense demand for new housing and commercial spaces. Government initiatives focused on infrastructural development, including affordable housing programs, further stimulate market expansion. Technological advancements, such as modular construction and prefabricated building components, enhance efficiency and reduce construction timelines.

Challenges in the Brazil Building Market Sector

Despite its growth potential, the Brazilian building market encounters several challenges. Supply chain disruptions, particularly regarding raw materials and skilled labor, can cause delays and cost increases. Regulatory complexities and bureaucratic hurdles can impact project timelines. Intense competition among numerous construction firms necessitates cost management and differentiation strategies. Fluctuations in the Brazilian economy can impact market demand and investment levels.

Emerging Opportunities in Brazil Building Market

Significant opportunities exist in the Brazilian building market. The rising adoption of sustainable building materials and green construction practices creates a niche for environmentally friendly products. The burgeoning demand for affordable housing presents opportunities for cost-effective construction methods. Government-led infrastructure projects offer lucrative contracts for construction companies. Technological advancements, such as 3D printing and modular construction, offer significant opportunities for innovation and cost reduction.

Leading Players in the Brazil Building Market Market

- BrasilCasas

- CasasBrazil

- Skanska Brasil Ltda

- Dextra

- Medabil Industria Em Sistemas Construtivos Ltda

- The Cassol Pre-Fabricados

- Studio Arthur Casas

- Brasmerc

- Martifier Group

- Siscobras

- Impresa Modular

List Not Exhaustive

Key Developments in Brazil Building Market Industry

January 2023: Modularis's 75-unit mixed-use development showcases the potential of modular construction in Brazil, highlighting rapid construction times and increased awareness of this innovative approach.

December 2022: The merger between PhP Ventures Acquisition Corp and Modulex Modular Buildings Plc signals a global trend towards consolidation in the modular construction sector, suggesting potential similar activity in Brazil.

Strategic Outlook for Brazil Building Market Market

The Brazil building market exhibits robust long-term growth potential. Continued urbanization, population increase, and government investments will propel future growth. The adoption of sustainable and technologically advanced construction methods will shape market dynamics. Focus on efficiency, innovation, and sustainability will be critical for companies seeking to thrive in this competitive yet expanding sector. The expanding middle class and improved infrastructure are poised to be crucial factors that impact the market's trajectory in the years to come.

Brazil Building Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Brazil Building Market Segmentation By Geography

- 1. Brazil

Brazil Building Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure Investments; Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry

- 3.3. Market Restrains

- 3.3.1. Limited Adaptability during Construction

- 3.4. Market Trends

- 3.4.1. Opportunities in Residential & Infrastructure Sectors to Boost the Prefabricated market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Building Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BrasilCasas

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CasasBrazil

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Skanska Brasil Ltda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dextra

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medabil Industria Em Sistemas Construtivos Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Cassol Pre-Fabricados

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Studio Arthur Casas

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Brasmerc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Martifier Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Siscobras

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Impresa Modular **List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 BrasilCasas

List of Figures

- Figure 1: Brazil Building Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Building Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Building Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Building Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Brazil Building Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Brazil Building Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Building Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Building Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: Brazil Building Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Brazil Building Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Building Market?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the Brazil Building Market?

Key companies in the market include BrasilCasas, CasasBrazil, Skanska Brasil Ltda, Dextra, Medabil Industria Em Sistemas Construtivos Ltda, The Cassol Pre-Fabricados, Studio Arthur Casas, Brasmerc, Martifier Group, Siscobras, Impresa Modular **List Not Exhaustive.

3. What are the main segments of the Brazil Building Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure Investments; Government Initiatives in the Infrastructure and Construction Sector to Boost the Industry.

6. What are the notable trends driving market growth?

Opportunities in Residential & Infrastructure Sectors to Boost the Prefabricated market.

7. Are there any restraints impacting market growth?

Limited Adaptability during Construction.

8. Can you provide examples of recent developments in the market?

January 2023: Modularis is a Brazilian modular construction company specializing in using innovative construction technology in residential construction. Eight months from construction start to end is a fast time frame for a 75-unit mixed-use development. The project, set to open in May 2023, will consist of two concrete floors with commercial space and 11 levels of modular apartments. The entire project is expected to be completed by the year’s end. According to Modularis, this mid-rise development will serve as a “showcase” for the company and increase awareness of using modular construction technology in Brazil’s residential construction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Building Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Building Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Building Market?

To stay informed about further developments, trends, and reports in the Brazil Building Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence