Key Insights

The Brazilian life and non-life insurance market is poised for substantial expansion, with a projected Compound Annual Growth Rate (CAGR) of 7.2% from 2024 to 2033. The market size is estimated at 233.7 billion in 2024. Growth drivers include rising middle-class incomes, government initiatives promoting financial inclusion, and increasing consumer awareness of risk management. Sophisticated product offerings and diversified distribution channels, encompassing both digital and traditional methods, are further stimulating market adoption.

Brazil Life and Non-Life Insurance Market Market Size (In Billion)

The market segmentation includes product types (life and non-life, with sub-categories such as health, property, and auto), distribution channels, and geographic regions. Key market players, including Bradesco Seguros, MAPFRE VIDA, Porto Seguro, and Tokio Marine, actively compete through product innovation and strategic alliances.

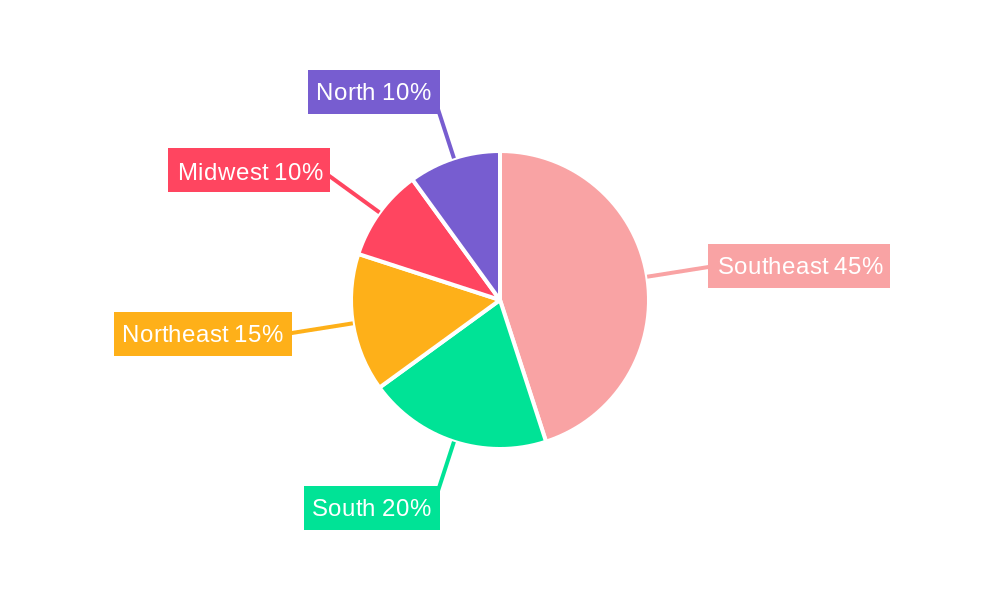

Brazil Life and Non-Life Insurance Market Company Market Share

Market growth faces potential headwinds from economic volatility, inflation impacting consumer spending, and regulatory changes, alongside challenges in efficient claims processing. Nevertheless, the long-term outlook remains optimistic, underpinned by demographic trends, increasing urbanization, and the integration of technology within insurance operations. The forthcoming years are expected to witness significant advancements in digital insurance solutions and personalized offerings, driving increased penetration across Brazil's diverse market segments.

Brazil Life and Non-Life Insurance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Brazilian life and non-life insurance market from 2019 to 2033, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), with 2025 as the estimated year. The report leverages extensive market research, data analysis, and expert opinions to deliver actionable intelligence on market dynamics, growth drivers, and emerging opportunities.

Brazil Life and Non-Life Insurance Market Market Concentration & Innovation

This section analyzes the competitive landscape of the Brazilian life and non-life insurance market, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. Key players like Bradesco Seguros SA, MAPFRE VIDA SA, and Porto Seguro Companhia de Seguros Gerais dominate the market, although the exact market share for each player varies year to year. The market exhibits moderate concentration, with a few large players holding significant shares but smaller companies also contributing substantially. The current market size is estimated at xx Million, with an expected CAGR of xx% over the forecast period.

- Market Concentration: The top 5 players control approximately xx% of the market.

- Innovation Drivers: Technological advancements, especially in digital insurance and telematics, are pushing innovation. Regulatory changes aimed at improving consumer protection and market efficiency also drive innovation.

- Regulatory Framework: The Brazilian insurance regulatory framework, while evolving, remains a significant influence on market behavior, with varying degrees of influence on pricing, product offerings, and distribution channels.

- Product Substitutes: The rise of fintech companies offering alternative financial products poses a potential threat to traditional insurers.

- End-User Trends: Growing demand for health insurance and protection products, coupled with increasing financial literacy and awareness of risk, drive market growth.

- M&A Activity: The Brazilian insurance market has witnessed several mergers and acquisitions in recent years, with deal values varying from xx Million to xx Million depending on the size and scope of the companies involved.

Brazil Life and Non-Life Insurance Market Industry Trends & Insights

This section delves into the key trends and insights shaping the Brazilian life and non-life insurance market. The market is experiencing robust growth fueled by a combination of factors, including a rising middle class, increasing demand for insurance products, and government initiatives promoting financial inclusion. Technological advancements are reshaping the industry landscape. The penetration rate of insurance products in Brazil remains relatively low compared to developed markets, indicating substantial potential for growth. Competitive dynamics are intensifying, with both established players and new entrants vying for market share. The market is expected to maintain its robust growth trajectory in the coming years.

- Market Growth Drivers: Expanding middle class, rising disposable incomes, government initiatives, and increasing awareness of insurance benefits.

- Technological Disruptions: Digital insurance platforms, Insurtech, AI, and telematics are transforming distribution, underwriting, and claims management.

- Consumer Preferences: Increased demand for customized products, digital-first interactions, and transparent pricing models.

- Competitive Dynamics: Intense competition among established players and the emergence of agile Insurtech companies.

Dominant Markets & Segments in Brazil Life and Non-Life Insurance Market

This section identifies the leading segments within the Brazilian life and non-life insurance market. While specific regional breakdowns require further data analysis, urban centers generally exhibit higher penetration rates than rural areas. The health insurance segment is expected to experience robust growth driven by increasing healthcare costs and government health insurance reforms. The life insurance market continues to grow, driven by the demand for retirement and protection products, though the market remains relatively underpenetrated.

- Key Drivers of Dominance:

- Economic Policies: Government support for financial inclusion, tax incentives, and regulations influencing market dynamics.

- Infrastructure: Improved digital infrastructure facilitates the adoption of digital insurance solutions.

- Demographics: A growing and increasingly affluent population fuels demand for insurance products.

- Dominance Analysis: The dominance of specific regions or segments is complex and requires a detailed analysis of market penetration, consumption patterns, and regulatory factors. This data analysis will be available in the full report.

Brazil Life and Non-Life Insurance Market Product Developments

The Brazilian life and non-life insurance market is witnessing significant product innovations, driven by technological advancements and evolving consumer needs. Insurers are increasingly leveraging technology such as artificial intelligence and machine learning for improved risk assessment, personalized product offerings, and streamlined claims processing. The focus is on integrating technology to improve customer experience, reduce operational costs, and enhance product competitiveness. New products are emerging that cater to specific customer needs and target emerging market segments. Digital-first solutions are gaining popularity.

Report Scope & Segmentation Analysis

This report comprehensively segments the Brazilian life and non-life insurance market based on various criteria, including product type (life insurance, health insurance, property & casualty insurance, etc.), distribution channel (direct sales, agents, brokers, online platforms), and geographic location. Growth projections vary across segments reflecting varying market dynamics.

- Life Insurance Segment: This segment encompasses a range of products such as term life insurance, whole life insurance, and retirement products. Growth is driven by increased awareness of financial security needs.

- Non-Life Insurance Segment: This includes products such as health, auto, home, and commercial insurance. Growth is supported by rising asset ownership and increasing concerns about risks.

Key Drivers of Brazil Life and Non-Life Insurance Market Growth

Several factors are driving growth in the Brazilian life and non-life insurance market. The expansion of the middle class and rising disposable incomes are primary contributors. Government initiatives promoting financial inclusion and increasing awareness of insurance benefits further stimulate demand. Technological advancements are revolutionizing the industry, leading to greater efficiency and improved customer experience. Furthermore, regulatory reforms enhancing market transparency and consumer protection are fostering market growth.

Challenges in the Brazil Life and Non-Life Insurance Market Sector

Despite the significant growth potential, the Brazilian life and non-life insurance market faces certain challenges. These include regulatory hurdles impacting market entry and operations, limited financial literacy among the population which limits market penetration, and the need to navigate complex bureaucratic processes. Competition from both established players and new entrants also creates pressure. High inflation rates and economic volatility can impact investment returns and consumer confidence.

Emerging Opportunities in Brazil Life and Non-Life Insurance Market

Significant opportunities exist in the Brazilian life and non-life insurance market. The rising adoption of digital technologies offers immense opportunities for insurers to improve service delivery, expand customer reach, and introduce innovative products. The underpenetrated market leaves considerable room for growth. Untapped market segments, particularly in rural areas, also present substantial growth potential.

Leading Players in the Brazil Life and Non-Life Insurance Market Market

- Bradesco Seguros SA

- MAPFRE VIDA SA

- Porto Seguro Companhia de Seguros Gerais

- Tókio Marine Seguradora SA

- ALIANCA DO BRASIL SEGUROS SA

- Sompo Seguros SA

- BRADESCO VIDA E PREVIDENCIA SA

- Liberty Seguros SA

- ITAU VIDA E PREVIDENCIA SA

- Allianz Seguros SA

Key Developments in Brazil Life and Non-Life Insurance Market Industry

- September 2022: MAPFRE and Swiss Life Asset Managers revitalized their real estate collaboration, with a pan-European co-investment organization acquiring a building in Madrid. This demonstrates strategic partnerships and investment activity in the market.

- July 2022: Bradesco Sade launched updated applications with improved user experience and features. This highlights the focus on digital transformation and customer service enhancement within the industry.

Strategic Outlook for Brazil Life and Non-Life Insurance Market Market

The Brazilian life and non-life insurance market presents a compelling investment opportunity with significant growth potential. Continued economic growth, increasing financial inclusion, and technological advancements will drive market expansion. Insurers that successfully adapt to the changing market landscape, embrace technological innovation, and deliver exceptional customer experiences will be best positioned to capitalize on the opportunities ahead.

Brazil Life and Non-Life Insurance Market Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Other Non-life Insurances

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

Brazil Life and Non-Life Insurance Market Segmentation By Geography

- 1. Brazil

Brazil Life and Non-Life Insurance Market Regional Market Share

Geographic Coverage of Brazil Life and Non-Life Insurance Market

Brazil Life and Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Awareness About The Importance of Insurance; Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Rising Awareness About The Importance of Insurance; Increasing Disposable Incomes

- 3.4. Market Trends

- 3.4.1. Low Penetration of Life and Non-Life Insurance Turns Out to be an Opportunity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Life and Non-Life Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Other Non-life Insurances

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bradesco Seguros SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MAPFRE VIDA SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Porto Seguro Companhia de Seguros Gerais

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tókio Marine Seguradora SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALIANCA DO BRASIL SEGUROS SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sompo Seguros SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BRADESCO VIDA E PREVIDENCIA SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Liberty Seguros SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ITAU VIDA E PREVIDENCIA SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allianz Seguros SA**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bradesco Seguros SA

List of Figures

- Figure 1: Brazil Life and Non-Life Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Life and Non-Life Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 2: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Insurance type 2020 & 2033

- Table 5: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Brazil Life and Non-Life Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Life and Non-Life Insurance Market ?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Brazil Life and Non-Life Insurance Market ?

Key companies in the market include Bradesco Seguros SA, MAPFRE VIDA SA, Porto Seguro Companhia de Seguros Gerais, Tókio Marine Seguradora SA, ALIANCA DO BRASIL SEGUROS SA, Sompo Seguros SA, BRADESCO VIDA E PREVIDENCIA SA, Liberty Seguros SA, ITAU VIDA E PREVIDENCIA SA, Allianz Seguros SA**List Not Exhaustive.

3. What are the main segments of the Brazil Life and Non-Life Insurance Market ?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 233.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness About The Importance of Insurance; Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Low Penetration of Life and Non-Life Insurance Turns Out to be an Opportunity.

7. Are there any restraints impacting market growth?

Rising Awareness About The Importance of Insurance; Increasing Disposable Incomes.

8. Can you provide examples of recent developments in the market?

September 2022 - By selling a fresh package of assets to the pan-European co-investment entity they established in April of last year, MAPFRE and Swiss Life Asset Managers have revitalized their real estate collaboration for investing in outstanding European workplaces. A pan-European co-investment organization purchased a building from El Corte Inglés in Madrid at 13 Calle Alberto Bosch as part of this new package. This structure was formerly the Royal Spanish Football Federation's headquarters and is just a few meters from Retiro Park.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Life and Non-Life Insurance Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Life and Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Life and Non-Life Insurance Market ?

To stay informed about further developments, trends, and reports in the Brazil Life and Non-Life Insurance Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence