Key Insights

The Business Aviation MRO market is poised for robust expansion, driven by the increasing global business jet fleet, the imperative for aging aircraft maintenance, and the sustained demand for superior operational efficiency and safety. The market is projected to reach $90.85 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 4.75% from the base year 2024. Key segments include Engine MRO, recognized for its complexity and cost, followed by Component MRO, Interior MRO, and Airframe MRO, each addressing critical aircraft maintenance needs. Field maintenance is emerging as a significant growth area, emphasizing rapid, on-site solutions to minimize operational disruptions.

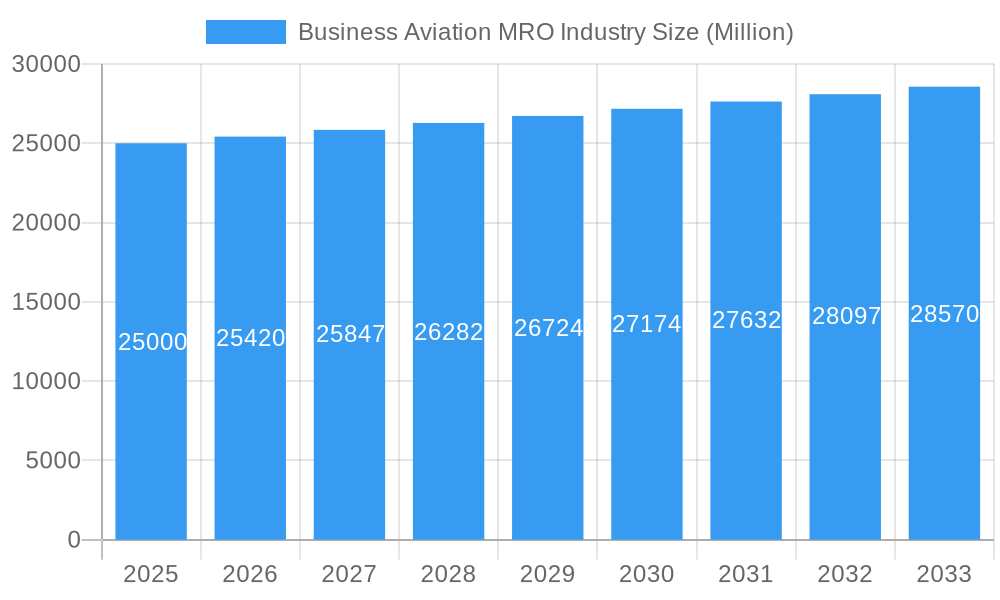

Business Aviation MRO Industry Market Size (In Billion)

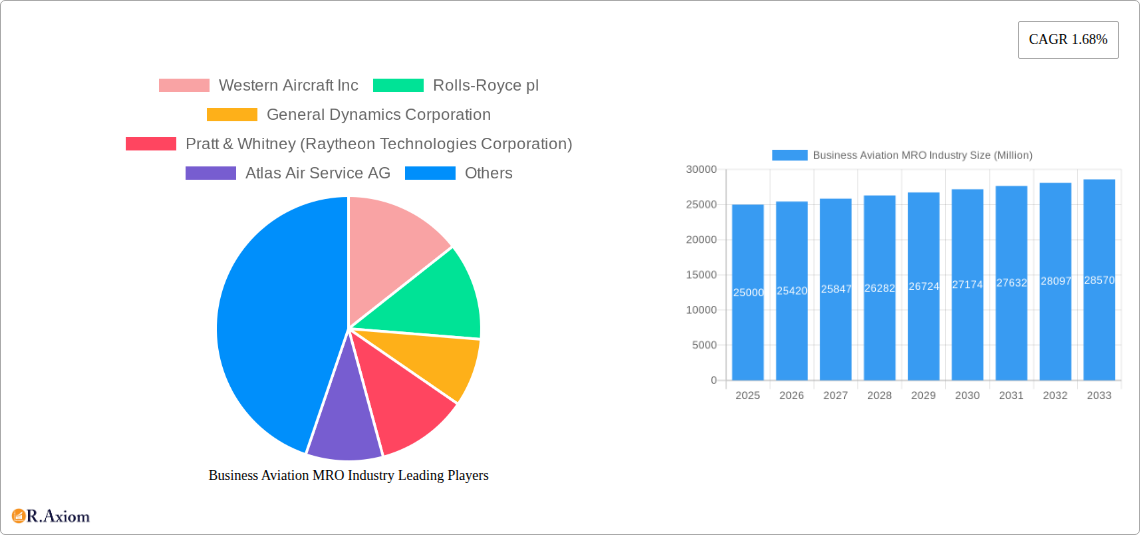

Major industry leaders, including Rolls-Royce, Pratt & Whitney, and Lufthansa Technik, are strategically enhancing their capabilities through investments in cutting-edge technologies and service portfolio expansion to address evolving operator demands. The competitive landscape is characterized by intense rivalry, with companies prioritizing specialization, premium service quality, and optimized turnaround times for a competitive advantage.

Business Aviation MRO Industry Company Market Share

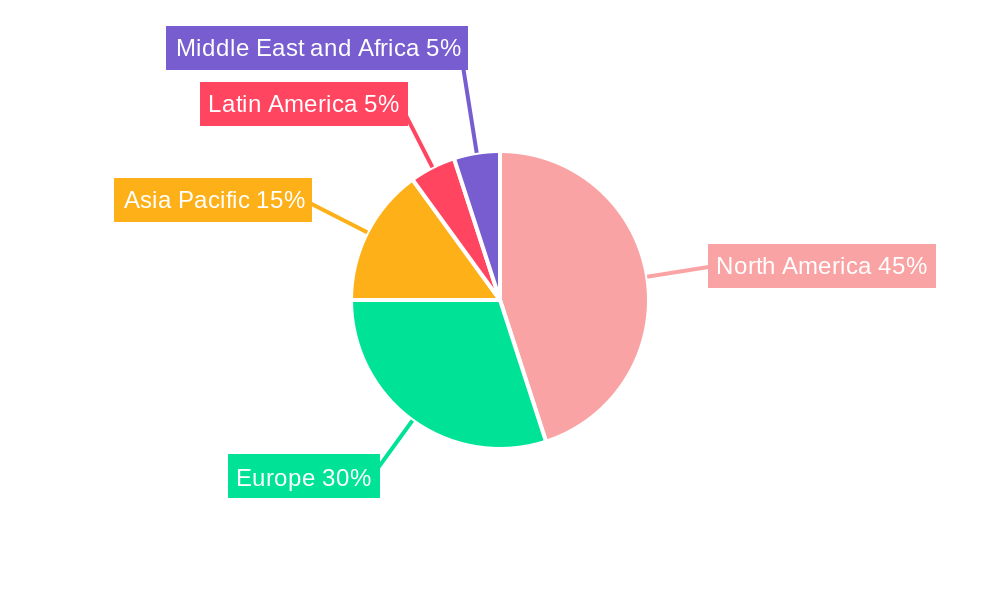

North America currently leads the Business Aviation MRO market due to a high concentration of business jet operators and a mature MRO infrastructure. The Asia-Pacific region presents substantial growth prospects, propelled by rapid economic development and the escalating adoption of business aviation in emerging economies. Europe maintains a significant market share, supported by its established aviation sector and extensive business jet fleet.

While market growth may be subject to fluctuations from factors such as volatile fuel prices and economic downturns, the long-term outlook remains exceptionally positive. The persistent demand for safe and efficient business aviation operations ensures continued market expansion throughout the forecast period.

Business Aviation MRO Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Business Aviation MRO (Maintenance, Repair, and Overhaul) industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Business Aviation MRO Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the business aviation MRO market, examining market concentration, innovation drivers, regulatory impacts, and strategic activities. The industry exhibits a moderately concentrated structure, with several major players commanding significant market share. For example, Rolls-Royce plc and Pratt & Whitney (Raytheon Technologies Corporation) hold substantial positions in the engine MRO segment, while companies like Lufthansa Technik AG and ExecuJet Aviation Group AG are prominent in other areas. Market share fluctuations are driven by technological advancements, M&A activities, and evolving customer preferences.

- Market Concentration: The top 5 players account for approximately xx% of the global market share (2024 estimate).

- Innovation Drivers: Advanced technologies like AI-powered predictive maintenance, digital twin technology, and additive manufacturing are significantly impacting the sector, driving efficiency and cost reductions.

- Regulatory Framework: Stringent safety regulations and evolving certification processes influence operational strategies and investment decisions within the industry.

- Product Substitutes: The absence of readily available substitutes for specialized MRO services maintains high barriers to entry.

- End-User Trends: Increasing demand for sophisticated maintenance solutions and a focus on operational efficiency drive industry growth.

- M&A Activities: The past five years have witnessed several notable M&A deals, with transaction values exceeding xx Million in aggregate. These activities aim to expand service offerings, enhance geographic reach, and access new technologies. Examples include (but are not limited to) the acquisitions of smaller MRO providers by larger companies.

Business Aviation MRO Industry Industry Trends & Insights

The business aviation MRO market is experiencing robust growth fueled by several factors, including the increasing global business aviation fleet, the rising demand for reliable and efficient maintenance solutions, and technological advancements. The market is witnessing a shift towards more predictive and data-driven maintenance strategies, reducing downtime and optimizing operational costs. Consumer preferences are leaning toward integrated MRO solutions and a focus on long-term service agreements. Competitive dynamics are shaped by technological innovation, expansion into new markets, and the consolidation of industry players.

The market is characterized by a high degree of specialization, with companies often focusing on specific MRO types or aircraft models. This specialization fosters the development of expertise and allows for tailored solutions, while simultaneously leading to greater complexities within the supply chain. The sector’s growth is projected to continue at a strong pace, driven by increasing air travel demand, expanding business aviation fleets, and continuous technological improvements. The CAGR for the industry is estimated to be xx% during the forecast period (2025-2033). Market penetration is highest in developed regions, but developing economies are also witnessing significant growth in business aviation activities, creating untapped opportunities.

Dominant Markets & Segments in Business Aviation MRO Industry

The North American region currently dominates the global business aviation MRO market, driven by a large fleet of business jets, robust infrastructure, and a strong economic base. However, Asia-Pacific is emerging as a significant growth market, boosted by rapid economic expansion and increased business travel. Within MRO types, Engine MRO and Airframe MRO are the largest segments due to their higher cost and complexity.

- Key Drivers of Dominance (North America):

- Strong business aviation fleet size

- Well-developed infrastructure and skilled workforce

- High disposable incomes and business travel activity

- Proactive regulatory environment fostering safety and innovation

- Key Drivers of Growth (Asia-Pacific):

- Rapid economic growth and rising disposable incomes

- Increasing business travel and expansion of business aviation fleets

- Government support for infrastructure development

- Increasing demand for advanced MRO services

Segment Analysis:

- Engine MRO: Dominated by large OEMs (Original Equipment Manufacturers) such as Rolls-Royce and Pratt & Whitney, this segment benefits from long-term service agreements and technologically complex maintenance needs.

- Component MRO: This segment is characterized by a fragmented landscape with numerous specialized companies catering to specific component types, benefiting from specialized expertise and aftermarket demand.

- Interior MRO: Growing rapidly due to increasing demand for customized and luxurious cabin interiors, with a concentration of highly skilled companies focusing on design and refurbishment.

- Airframe MRO: This segment encompasses major maintenance and repair activities on the aircraft structure, requiring extensive hangar space and specialized equipment.

- Field Maintenance: This involves on-site maintenance and repair services and often utilizes mobile maintenance units and experienced technicians.

Business Aviation MRO Industry Product Developments

The industry showcases continuous innovation, with a focus on predictive maintenance using data analytics and AI, digital twin technology for virtual maintenance planning, and the adoption of additive manufacturing for rapid prototyping and part replacement. These technologies enhance efficiency, reduce maintenance costs, and improve aircraft availability. The market fit for these innovations is excellent, driven by rising operational costs and the increasing demand for higher aircraft utilization rates.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the business aviation MRO market based on MRO type: Engine MRO, Component MRO, Interior MRO, Airframe MRO, and Field Maintenance. Each segment is analyzed based on market size, growth projections, competitive dynamics, and key technological trends. The report also includes a detailed regional analysis covering North America, Europe, Asia-Pacific, and the rest of the world. Growth projections vary across segments, with Engine and Airframe MRO expected to witness robust growth due to the complexity and high cost of maintenance on these components. Competitive dynamics are intense, with a mix of large OEMs and specialized MRO providers.

Key Drivers of Business Aviation MRO Industry Growth

Several factors fuel the growth of the business aviation MRO industry:

- Technological advancements: Predictive maintenance, AI-driven diagnostics, and 3D printing improve efficiency and reduce downtime.

- Increased demand for business aviation: Growing global business travel and a surge in private jet ownership drive the need for maintenance services.

- Stringent safety regulations: Stricter compliance requirements stimulate investment in advanced maintenance technologies.

Challenges in the Business Aviation MRO Industry Sector

The industry faces several significant challenges:

- Supply chain disruptions: Global events and geopolitical factors can impact the availability of parts and materials, leading to delays and increased costs. (Estimated impact: xx Million in lost revenue in 2024).

- Highly skilled labor shortages: The demand for qualified technicians and engineers far exceeds supply, pushing up labor costs.

- High capital expenditure: Investments in new facilities, equipment, and technologies represent a significant financial burden.

Emerging Opportunities in Business Aviation MRO Industry

Significant opportunities exist for growth in the Business Aviation MRO market:

- Expansion into emerging markets: Rapid economic development in Asia-Pacific and other regions provides significant growth potential.

- Adoption of digital technologies: Companies leveraging digitalization for predictive maintenance and optimized operations gain a competitive edge.

- Development of sustainable MRO practices: Companies adopting eco-friendly repair and maintenance procedures can gain a reputational advantage.

Leading Players in the Business Aviation MRO Industry Market

- Western Aircraft Inc

- Rolls-Royce plc

- General Dynamics Corporation

- Pratt & Whitney (Raytheon Technologies Corporation)

- Atlas Air Service AG

- ExecuJet Aviation Group AG

- Lufthansa Technik AG

- DC Aviation GmbH

- Bombardier Inc

- Flying Colours Corp

- Constant Aviation LLC

- Comlux Aviation Services LLC

Key Developments in Business Aviation MRO Industry Industry

- December 2022: Embraer-X partnered with Pulse Aviation to integrate Beacon, a maintenance coordination platform, enhancing efficiency and communication within the MRO process.

- March 2022: Embraer signed a service agreement with Avantto, demonstrating the growth of comprehensive maintenance programs.

- December 2021: ExecuJet MRO Services Malaysia announced the construction of a new MRO facility, signifying investment in capacity expansion in the Asia-Pacific region.

Strategic Outlook for Business Aviation MRO Industry Market

The future of the business aviation MRO market appears promising, driven by ongoing fleet growth, increasing technological advancements, and the expansion into new markets. Companies that can successfully adapt to the changing industry landscape, investing in digital technologies and sustainable practices, are poised to capitalize on the significant opportunities presented by this growing sector. The increasing focus on predictive maintenance and digital solutions will be a major growth catalyst in the coming years. The market is expected to consolidate further, with larger players acquiring smaller MRO providers.

Business Aviation MRO Industry Segmentation

-

1. MRO Type

- 1.1. Engine MRO

- 1.2. Component MRO

- 1.3. Interior MRO

- 1.4. Airframe MRO

- 1.5. Field Maintenance

Business Aviation MRO Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Business Aviation MRO Industry Regional Market Share

Geographic Coverage of Business Aviation MRO Industry

Business Aviation MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Components MRO Segment of the Market is Expected to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Engine MRO

- 5.1.2. Component MRO

- 5.1.3. Interior MRO

- 5.1.4. Airframe MRO

- 5.1.5. Field Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. North America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Engine MRO

- 6.1.2. Component MRO

- 6.1.3. Interior MRO

- 6.1.4. Airframe MRO

- 6.1.5. Field Maintenance

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Europe Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Engine MRO

- 7.1.2. Component MRO

- 7.1.3. Interior MRO

- 7.1.4. Airframe MRO

- 7.1.5. Field Maintenance

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. Asia Pacific Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Engine MRO

- 8.1.2. Component MRO

- 8.1.3. Interior MRO

- 8.1.4. Airframe MRO

- 8.1.5. Field Maintenance

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Latin America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Engine MRO

- 9.1.2. Component MRO

- 9.1.3. Interior MRO

- 9.1.4. Airframe MRO

- 9.1.5. Field Maintenance

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Middle East and Africa Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Engine MRO

- 10.1.2. Component MRO

- 10.1.3. Interior MRO

- 10.1.4. Airframe MRO

- 10.1.5. Field Maintenance

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Western Aircraft Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rolls-Royce pl

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pratt & Whitney (Raytheon Technologies Corporation)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Atlas Air Service AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ExecuJet Aviation Group AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lufthansa Technik AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DC Aviation GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombardier Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flying Colours Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Constant Aviation LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Comlux Aviation Services LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Western Aircraft Inc

List of Figures

- Figure 1: Global Business Aviation MRO Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 3: North America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 4: North America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 7: Europe Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 8: Europe Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 11: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 12: Asia Pacific Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 15: Latin America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 16: Latin America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 19: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 20: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 2: Global Business Aviation MRO Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 4: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 6: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 8: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 10: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 12: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Aviation MRO Industry?

The projected CAGR is approximately 4.75%.

2. Which companies are prominent players in the Business Aviation MRO Industry?

Key companies in the market include Western Aircraft Inc, Rolls-Royce pl, General Dynamics Corporation, Pratt & Whitney (Raytheon Technologies Corporation), Atlas Air Service AG, ExecuJet Aviation Group AG, Lufthansa Technik AG, DC Aviation GmbH, Bombardier Inc, Flying Colours Corp, Constant Aviation LLC, Comlux Aviation Services LLC.

3. What are the main segments of the Business Aviation MRO Industry?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.85 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Components MRO Segment of the Market is Expected to Witness Highest Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Embraer-X signed a contract with Pulse Aviation for the use of Beacon, the maintenance coordination platform connecting resources and professionals for faster return-to-service aircraft. Pulse Aviation, a Florida-based business aviation company that offers MRO services, will use Beacon to improve maintenance coordination, make it easier to communicate about maintenance events involving all different types of aircraft models, foster teamwork, enhance knowledge sharing, and speed up workflows related to maintenance events.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Aviation MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Aviation MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Aviation MRO Industry?

To stay informed about further developments, trends, and reports in the Business Aviation MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence