Key Insights

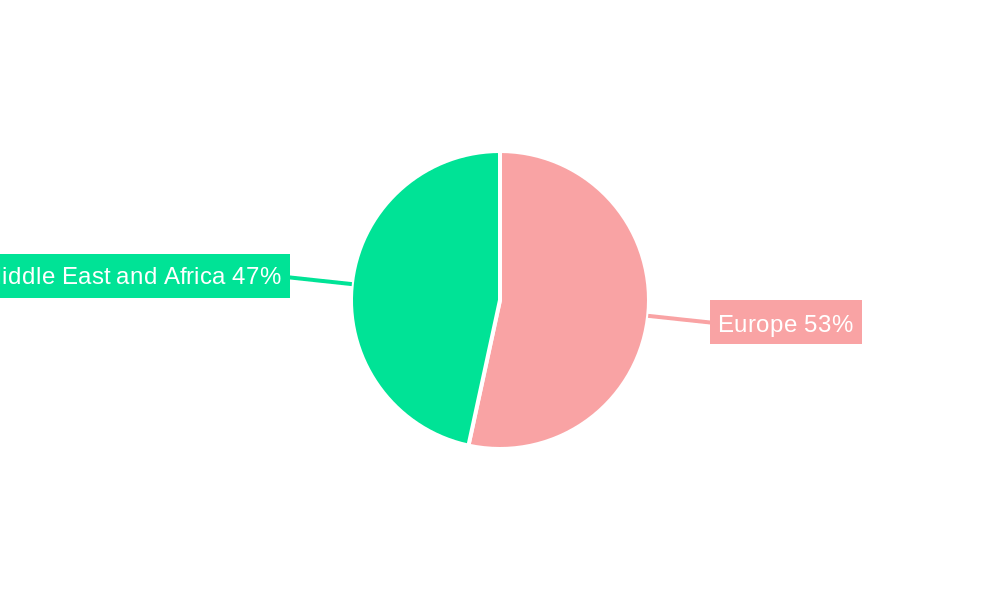

The EMEA (Europe, Middle East, and Africa) aviation infrastructure market, valued at $1.03 billion in 2025, is projected to experience robust growth, driven by increasing passenger traffic, expansion of existing airports, and the development of new aviation hubs across the region. A Compound Annual Growth Rate (CAGR) of 4.42% from 2025 to 2033 indicates a significant expansion of this sector. Key drivers include rising air travel demand fueled by economic growth and tourism, the need for modernized airport facilities to accommodate larger aircraft and increased passenger volumes, and governmental investments in infrastructure development. This growth is particularly prominent in regions experiencing rapid economic development, such as the Middle East and parts of Africa, which are witnessing the construction of numerous new airports and expansions of existing ones. Growth in commercial airport infrastructure is expected to significantly outpace that of military and general aviation airports due to the higher volume of passenger traffic and associated commercial activity. Within infrastructure types, the construction of new terminals and runway expansions will likely drive significant market share.

EMEA Aviation Infrastructure Industry Market Size (In Billion)

However, the market faces challenges. Economic downturns, geopolitical instability in certain regions, and potential delays in securing regulatory approvals for new projects pose restraints to growth. The competitive landscape is characterized by large multinational construction firms like Balfour Beatty, Bechtel, and Vinci Airports, alongside regional players. These companies are constantly competing for large-scale projects, often necessitating strategic partnerships and innovative financing models to secure contracts and maintain profitability. The strategic segmentation within the market (Airport Type and Infrastructure Type) necessitates a tailored approach for companies seeking to optimize their market share. The ongoing emphasis on sustainability within the construction industry is also shaping this market, with increasing demand for eco-friendly materials and construction techniques. Europe will continue to be a major market, particularly in countries like the UK, Germany, and France, while substantial growth potential also exists within the Middle East and Africa, driven by ongoing infrastructure projects and economic expansion.

EMEA Aviation Infrastructure Industry Company Market Share

This detailed report provides a comprehensive analysis of the EMEA Aviation Infrastructure Industry, covering market size, growth projections, key players, and emerging trends from 2019 to 2033. The report leverages extensive primary and secondary research to offer actionable insights for industry stakeholders, investors, and strategic decision-makers. With a base year of 2025 and a forecast period spanning 2025-2033, this report is your essential guide to navigating the complexities of this dynamic market.

EMEA Aviation Infrastructure Industry Market Concentration & Innovation

The EMEA aviation infrastructure market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. While precise market share figures for individual companies are proprietary, key players like Balfour Beatty Plc, Royal BAM Group nv, and Bechtel Corporation command substantial portions of the market, often through large-scale project wins. The market exhibits a strong emphasis on innovation driven by the need for enhanced efficiency, sustainability, and passenger experience. Regulatory frameworks, particularly concerning environmental regulations and safety standards, exert significant influence. Product substitutes, while limited, include alternative materials and construction techniques focused on reducing environmental impact. End-user trends point towards a preference for technologically advanced and sustainable infrastructure solutions. Mergers and acquisitions (M&A) activity has been moderate, with deal values typically ranging from xx Million to xx Million, reflecting strategic consolidation efforts among major players.

- Key Players: Balfour Beatty Plc, Royal BAM Group nv, Bechtel Corporation, STRABAG SE, Skanska AB.

- M&A Activity (2019-2024): xx number of deals totaling approximately xx Million USD.

- Innovation Drivers: Sustainability, passenger experience improvements, technological advancements in construction and materials.

- Regulatory Influence: Stringent safety standards and environmental regulations are shaping market dynamics.

EMEA Aviation Infrastructure Industry Industry Trends & Insights

The EMEA aviation infrastructure market demonstrates robust growth, driven by increasing air passenger traffic, government investments in infrastructure development, and the ongoing expansion of existing airports. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of Building Information Modeling (BIM) and advanced construction materials, are enhancing efficiency and reducing project timelines. Consumer preferences are shifting toward airports that offer seamless travel experiences, enhanced security, and sustainable practices. Competitive dynamics are characterized by fierce competition amongst established players and the emergence of specialized niche players offering innovative solutions. Market penetration of advanced technologies varies across regions and infrastructure types, with higher penetration observed in major hub airports.

Dominant Markets & Segments in EMEA Aviation Infrastructure Industry

The Western European region currently dominates the EMEA aviation infrastructure market, followed by the Middle East and North Africa regions. Within this landscape, the Commercial Airport segment accounts for the largest share, driven by the continuous growth of air travel.

Key Drivers:

- Economic Growth: Strong economic activity in several EMEA countries fuels the demand for aviation infrastructure upgrades and expansions.

- Government Policies: Supportive government policies and funding initiatives are stimulating airport development and modernization projects.

- Tourism: The booming tourism sector in many parts of EMEA fuels the demand for enhanced airport capacity and facilities.

Dominant Segments:

- Airport Type: Commercial Airports lead, followed by Military and General Aviation Airports. Growth in low-cost carrier activity is particularly impacting the commercial airport segment.

- Infrastructure Type: Terminals are the largest segment, followed by Taxiways and Runways, reflecting the critical role of passenger processing and aircraft movement. Hangars and Aprons are also significant segments.

EMEA Aviation Infrastructure Industry Product Developments

Recent product innovations include the use of sustainable building materials, prefabricated components for faster construction, and smart technologies to improve airport operations and passenger experience. These developments offer competitive advantages by reducing construction times, enhancing efficiency, and improving environmental performance. The market is witnessing increased adoption of automation, digital twin technology, and data analytics to optimize airport management and reduce operational costs. This trend aligns with the overall market preference for advanced technologies that improve sustainability and enhance the passenger experience.

Report Scope & Segmentation Analysis

This report segments the EMEA aviation infrastructure market by airport type (Commercial, Military, General Aviation) and infrastructure type (Terminal, Control Tower, Taxiway and Runway, Apron, Hangar, Other). Each segment's growth projections, market size, and competitive dynamics are meticulously analyzed. The Commercial Airport segment is expected to experience the highest growth, followed by the Terminal infrastructure type. Growth forecasts incorporate considerations of economic outlook, regulatory changes, and technological advancements.

Key Drivers of EMEA Aviation Infrastructure Industry Growth

Several factors fuel growth: rising passenger numbers, government investments, privatization of airports boosting private investment, and technological advancements facilitating efficient and sustainable construction. The expansion of low-cost carriers further stimulates demand for new and upgraded infrastructure. Stringent safety and environmental regulations, while posing challenges, also create opportunities for innovative solutions and specialized expertise.

Challenges in the EMEA Aviation Infrastructure Industry Sector

The industry faces challenges including securing funding for large-scale projects, navigating complex regulatory environments, managing supply chain disruptions, and intense competition among major players. Fluctuations in currency exchange rates and global economic uncertainty also impact project viability and profitability. The environmental impact of construction and operation is a growing concern.

Emerging Opportunities in EMEA Aviation Infrastructure Industry

Opportunities exist in sustainable infrastructure development, smart airport technologies, the integration of renewable energy sources, and expansion into underserved regions. The growing demand for air travel in emerging economies within EMEA presents significant growth potential. The focus on enhancing passenger experience through innovative technologies and improved airport design offers further opportunities.

Leading Players in the EMEA Aviation Infrastructure Industry Market

- Balfour Beatty Plc

- Royal BAM Group nv

- Bechtel Corporation

- STRABAG SE

- Skanska AB

- VINCI Airports

- Limak Group of Companies

- ALEC Engineering & Contracting LL

- BIC Contracting LLC

- Bouygues Construction S A

- TAV Construction

- Eiffage S A

- Impresa Pizzarotti & C S p A

Key Developments in EMEA Aviation Infrastructure Industry Industry

- May 2023: Poland announces plans for the Solidarity Hub (CPK) airport in Warsaw, a USD 870 Million project.

- February 2023: The Airport Council of Europe allocates USD 440 Million to expand Zvartnots International Airport.

Strategic Outlook for EMEA Aviation Infrastructure Industry Market

The EMEA aviation infrastructure market is poised for continued growth, driven by long-term trends in air travel, economic development, and technological innovation. Opportunities abound for companies that can effectively navigate regulatory hurdles, embrace sustainable practices, and leverage technological advancements to deliver efficient and passenger-centric airport infrastructure. The market's future depends significantly on effective management of environmental concerns and adaptability to evolving passenger expectations.

EMEA Aviation Infrastructure Industry Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangar

- 2.6. Other Infrastructure Types

EMEA Aviation Infrastructure Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdon

- 1.2. Germany

- 1.3. France

- 1.4. Russia

- 1.5. Italy

- 1.6. Denmark

- 1.7. Rest of Europe

-

2. Middle East and Africa

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Egypt

- 2.4. Qatar

- 2.5. Turkey

- 2.6. South Africa

- 2.7. Rest of Middle East and Africa

EMEA Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of EMEA Aviation Infrastructure Industry

EMEA Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Airport to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangar

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.3.2. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. Europe EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 6.1.1. Commercial Airport

- 6.1.2. Military Airport

- 6.1.3. General Aviation Airport

- 6.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.2.1. Terminal

- 6.2.2. Control Tower

- 6.2.3. Taxiway and Runway

- 6.2.4. Apron

- 6.2.5. Hangar

- 6.2.6. Other Infrastructure Types

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 7. Middle East and Africa EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 7.1.1. Commercial Airport

- 7.1.2. Military Airport

- 7.1.3. General Aviation Airport

- 7.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.2.1. Terminal

- 7.2.2. Control Tower

- 7.2.3. Taxiway and Runway

- 7.2.4. Apron

- 7.2.5. Hangar

- 7.2.6. Other Infrastructure Types

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Balfour Beatty Plc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Royal BAM Group nv

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Bechtel Corporation

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 STRABAG SE

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Skanska AB

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 VINCI Airports

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Limak Group of Companies

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 ALEC Engineering & Contracting LL

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 BIC Contracting LLC

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Bouygues Construction S A

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 TAV Construction

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Eiffage S A

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Impresa Pizzarotti & C S p A

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.1 Balfour Beatty Plc

List of Figures

- Figure 1: Global EMEA Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 3: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 4: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 5: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 6: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 9: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 10: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 11: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 12: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 5: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdon EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Italy EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Denmark EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 15: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 16: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Arab Emirates EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Egypt EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Turkey EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EMEA Aviation Infrastructure Industry?

The projected CAGR is approximately 4.42%.

2. Which companies are prominent players in the EMEA Aviation Infrastructure Industry?

Key companies in the market include Balfour Beatty Plc, Royal BAM Group nv, Bechtel Corporation, STRABAG SE, Skanska AB, VINCI Airports, Limak Group of Companies, ALEC Engineering & Contracting LL, BIC Contracting LLC, Bouygues Construction S A, TAV Construction, Eiffage S A, Impresa Pizzarotti & C S p A.

3. What are the main segments of the EMEA Aviation Infrastructure Industry?

The market segments include Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Airport to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: Poland announced its plans to build a state-of-the-art airport in Warsaw. The Solidarity Hub, or CPK, which will serve as the Central and Eastern European main air transit hub, is scheduled to become operational in the summer of 2028. The CPK, with a price tag of around USD 870 million, is one of the costliest infrastructure projects currently being built in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EMEA Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EMEA Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EMEA Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the EMEA Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence