Key Insights

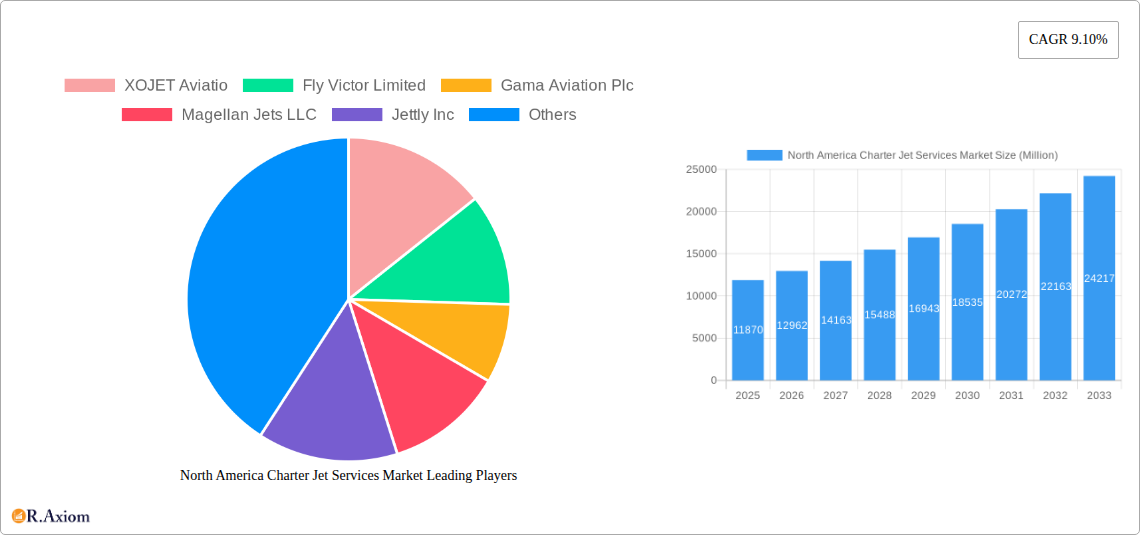

The North America charter jet services market, valued at $11.87 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 9.10% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing affluence of high-net-worth individuals and corporations is significantly boosting demand for convenient and luxurious private air travel. Secondly, the rise of on-demand charter services and advanced booking platforms, offering greater accessibility and flexibility, is contributing to market expansion. Furthermore, business travel, particularly for time-sensitive executives and corporate groups, remains a major driver, requiring faster and more efficient travel options than commercial airlines. Finally, the ongoing improvements in aircraft technology, offering enhanced fuel efficiency, safety features, and passenger comfort, are making charter jet services increasingly appealing.

North America Charter Jet Services Market Market Size (In Billion)

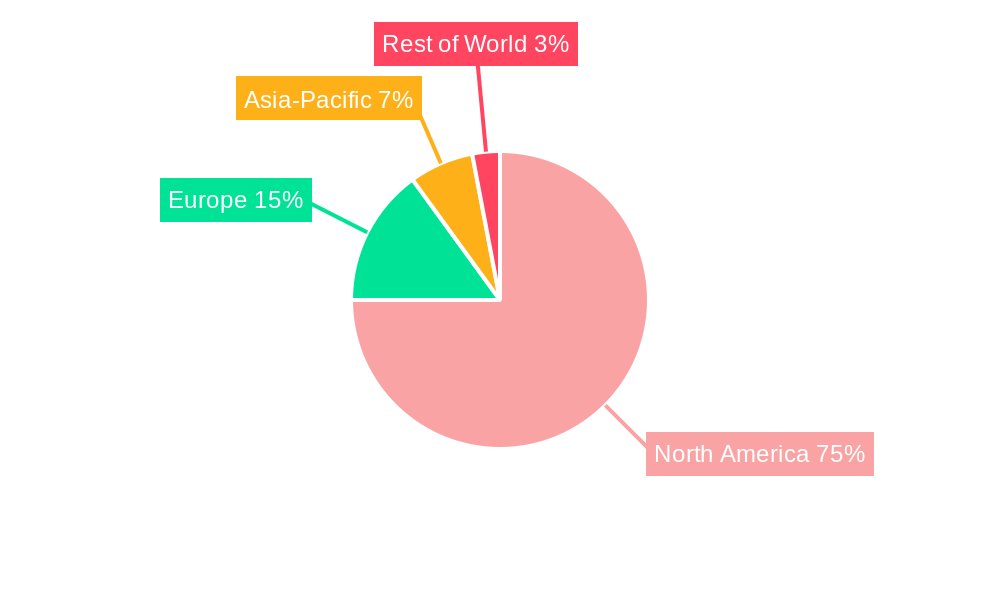

The market segmentation reveals a diverse landscape. While data on specific segment sizes within North America is unavailable, it's likely the mid-size and large aircraft segments command the largest market share, catering to larger corporate groups and families. The light aircraft segment will likely appeal to individual travellers and smaller groups and while this is likely a smaller portion of the overall market, its growth rate will still mirror the trend of the overall market and might even experience a steeper growth curve. Competition in the market is fierce, with established players like NetJets IP LLC and VistaJet Group Holding Limited competing against newer entrants and disruptive technology companies. Regional differences exist, with the United States expected to dominate the North American market due to its larger economy and higher concentration of high-net-worth individuals. However, Canada and Mexico are also expected to show significant growth, driven by increasing tourism and business activities. Restraints on growth might include fluctuating fuel prices, economic downturns impacting discretionary spending, and potential regulatory changes affecting private aviation.

North America Charter Jet Services Market Company Market Share

North America Charter Jet Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America charter jet services market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and future growth potential. The report segments the market by aircraft size (Light, Mid-size, Large) and identifies key players shaping the industry landscape.

North America Charter Jet Services Market Concentration & Innovation

The North American charter jet services market exhibits a moderately concentrated structure, with a few major players holding significant market share. NetJets IP LLC and VistaJet Group Holding Limited are estimated to command a combined xx% market share in 2025, reflecting their extensive fleet size and established brand recognition. However, the market also accommodates several smaller, niche players focusing on specific customer segments or geographical areas. This concentration is influenced by substantial capital investment required for aircraft acquisition, maintenance, and operational infrastructure. Innovation is driven by technological advancements, such as improved flight management systems, enhanced safety features, and the integration of advanced communication and entertainment technologies. Regulatory frameworks, including safety standards and emission regulations, significantly impact market dynamics. The market also witnesses competition from alternative travel modes, like scheduled airlines offering premium services and high-speed rail networks. Furthermore, mergers and acquisitions (M&A) activity are significant, with deal values exceeding $xx Million in the past five years. Several smaller charter companies are acquired by larger firms to consolidate market share, expand operations, and gain access to new technologies.

- Market Share: NetJets IP LLC and VistaJet Group Holding Limited hold an estimated combined xx% market share in 2025.

- M&A Activity: Deal values exceeded $xx Million over the past five years.

- Innovation Drivers: Technological advancements, improved safety features, enhanced customer experience.

- Regulatory Impact: Safety standards, emission regulations significantly influence market operations.

North America Charter Jet Services Market Industry Trends & Insights

The North American charter jet services market is poised for substantial growth, exhibiting a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising disposable incomes among high-net-worth individuals, increased demand for convenient and luxurious travel experiences, and the expansion of business travel. Technological disruptions, such as the proliferation of mobile apps for booking and managing charter flights, have enhanced market accessibility and efficiency. Consumer preferences are shifting toward personalized services, customized flight plans, and environmentally friendly options, pushing operators to innovate and adapt. Competitive dynamics are intense, with players differentiating themselves through premium services, loyalty programs, and strategic partnerships. The market penetration rate for charter jet services among the affluent population in North America is currently at xx%, with significant room for further expansion given the growing number of high-net-worth individuals.

Dominant Markets & Segments in North America Charter Jet Services Market

The United States remains the dominant market within North America for charter jet services. The high concentration of high-net-worth individuals, a robust business travel sector, and well-developed aviation infrastructure significantly contribute to this dominance.

- Key Drivers in the US Market:

- High concentration of HNWIs.

- Robust business travel sector.

- Extensive airport infrastructure and well-developed air traffic management systems.

- Favorable regulatory environment.

Among aircraft size segments, the Mid-size category holds the largest market share in 2025, driven by its versatility and suitability for both business and leisure travel. The Light segment is expected to experience modest growth due to its cost-effectiveness, while the Large segment caters to a niche market of corporate travel, high-end leisure, and potentially group travel requirements, showing significant growth potential.

- Mid-size Segment Dominance: Versatility, suitability for business and leisure travel.

- Light Segment Growth: Cost-effectiveness and suitability for short distances.

- Large Segment Potential: Cater to corporate groups, high-end leisure, and potentially group travel.

North America Charter Jet Services Market Product Developments

Recent product innovations within the charter jet services market focus on enhancing customer experience, improving operational efficiency, and incorporating sustainability initiatives. Companies are investing in advanced technology, like predictive maintenance systems and enhanced in-flight entertainment, to offer a superior travel experience. Moreover, there's a growing focus on implementing sustainable practices, including the use of biofuels and carbon offsetting programs. This increased focus on customer experience, operational efficiency, and sustainability provides a significant competitive advantage in this market.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the North America charter jet services market, segmented by aircraft size:

Light Jets: This segment caters to shorter-distance flights and smaller groups. The growth of this segment is driven by cost-effectiveness and efficiency for short-haul trips. The market size for light jets in 2025 is estimated at $xx Million, with a projected CAGR of xx% during the forecast period.

Mid-size Jets: The largest segment, this category caters to a broader range of travel needs, balancing passenger capacity and range effectively. The market size in 2025 is estimated at $xx Million, with a projected CAGR of xx% during the forecast period. Competitive dynamics are intense, with operators focusing on service differentiation.

Large Jets: This segment caters to high-end clientele and large groups, often for long-haul flights. The market size in 2025 is estimated at $xx Million, with a projected CAGR of xx% during the forecast period, driven by the rising number of UHNWIs and expansion into new markets.

Key Drivers of North America Charter Jet Services Market Growth

Several factors contribute to the growth of the North America charter jet services market. The rising disposable income among high-net-worth individuals directly fuels demand for luxury travel. The increasing preference for convenient and personalized travel experiences, avoiding the hassles of commercial airlines, also significantly impacts market growth. Furthermore, advancements in technology, such as enhanced safety features and improved flight management systems, further boost market expansion. Finally, the expansion of business aviation, particularly amongst large corporations, contributes significantly to overall market growth.

Challenges in the North America Charter Jet Services Market Sector

The North American charter jet services market faces several challenges. Stringent regulatory requirements and safety standards increase operational costs. Fluctuations in fuel prices significantly affect profitability. Intense competition among operators necessitates continuous innovation and service differentiation to maintain market share. Moreover, economic downturns can decrease demand, especially within the business travel segment. These factors create a dynamic and challenging operating environment for businesses in the sector. These challenges collectively impact market growth and profitability.

Emerging Opportunities in North America Charter Jet Services Market

Several emerging opportunities exist within the market. The growing demand for sustainable aviation solutions creates avenues for eco-friendly charter options. Technological advancements, such as the development of autonomous flight systems, could transform operational efficiency. Expansion into underserved markets and strategic partnerships with luxury travel providers present significant growth potential. Moreover, targeting a younger demographic with customized travel packages and leveraging technology to enhance the overall customer experience represents another avenue for future market expansion.

Leading Players in the North America Charter Jet Services Market Market

Key Developments in North America Charter Jet Services Market Industry

- 2023 Q3: VistaJet announced a significant expansion of its fleet with the addition of new large-cabin aircraft.

- 2022 Q4: NetJets launched a new sustainability initiative, aiming to reduce its carbon footprint.

- 2021 Q2: XOJET acquired a smaller charter operator, expanding its geographic reach.

- 2020 Q1: Several companies introduced enhanced hygiene protocols in response to the COVID-19 pandemic.

Strategic Outlook for North America Charter Jet Services Market Market

The North America charter jet services market is poised for continued growth, driven by increasing demand from high-net-worth individuals, businesses, and tourism sectors. Technological advancements will further enhance operational efficiency and customer experience, creating new opportunities for innovation and differentiation. Sustained economic growth in key markets and the focus on sustainability will significantly impact market dynamics. The strategic focus of companies will be on enhancing customer service, improving operational efficiency, and adopting sustainable practices to maintain competitive advantage and capitalize on the market's growth potential.

North America Charter Jet Services Market Segmentation

-

1. Aircraft Size

- 1.1. Light

- 1.2. Mid-size

- 1.3. Large

-

2. Geography

- 2.1. United States

- 2.2. Canada

North America Charter Jet Services Market Segmentation By Geography

- 1. United States

- 2. Canada

North America Charter Jet Services Market Regional Market Share

Geographic Coverage of North America Charter Jet Services Market

North America Charter Jet Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Large Jet Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Charter Jet Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 5.1.1. Light

- 5.1.2. Mid-size

- 5.1.3. Large

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 6. United States North America Charter Jet Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 6.1.1. Light

- 6.1.2. Mid-size

- 6.1.3. Large

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 7. Canada North America Charter Jet Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 7.1.1. Light

- 7.1.2. Mid-size

- 7.1.3. Large

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Size

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 XOJET Aviatio

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Fly Victor Limited

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Gama Aviation Plc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Magellan Jets LLC

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Jettly Inc

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 VistaJet Group Holding Limited

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Executive Jet Management Inc

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 PrivateFly LLC

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Stratos Jet Charters Inc

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Delta Airlines Inc

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 NetJets IP LLC

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.1 XOJET Aviatio

List of Figures

- Figure 1: North America Charter Jet Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Charter Jet Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Charter Jet Services Market Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 2: North America Charter Jet Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: North America Charter Jet Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Charter Jet Services Market Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 5: North America Charter Jet Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: North America Charter Jet Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: North America Charter Jet Services Market Revenue Million Forecast, by Aircraft Size 2020 & 2033

- Table 8: North America Charter Jet Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: North America Charter Jet Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Charter Jet Services Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the North America Charter Jet Services Market?

Key companies in the market include XOJET Aviatio, Fly Victor Limited, Gama Aviation Plc, Magellan Jets LLC, Jettly Inc, VistaJet Group Holding Limited, Executive Jet Management Inc, PrivateFly LLC, Stratos Jet Charters Inc, Delta Airlines Inc, NetJets IP LLC.

3. What are the main segments of the North America Charter Jet Services Market?

The market segments include Aircraft Size, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.87 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Large Jet Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Charter Jet Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Charter Jet Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Charter Jet Services Market?

To stay informed about further developments, trends, and reports in the North America Charter Jet Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence