Key Insights

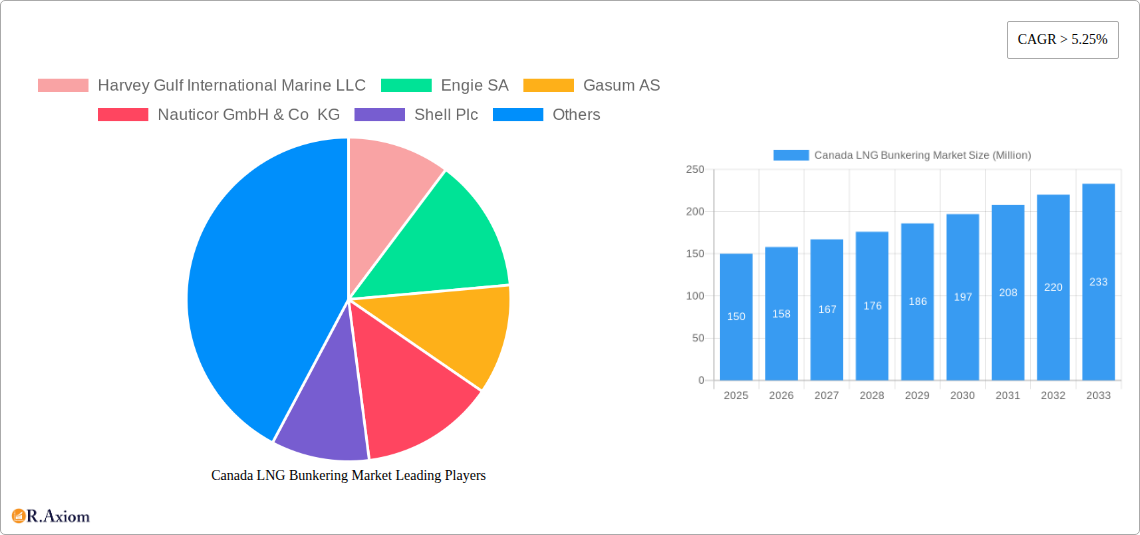

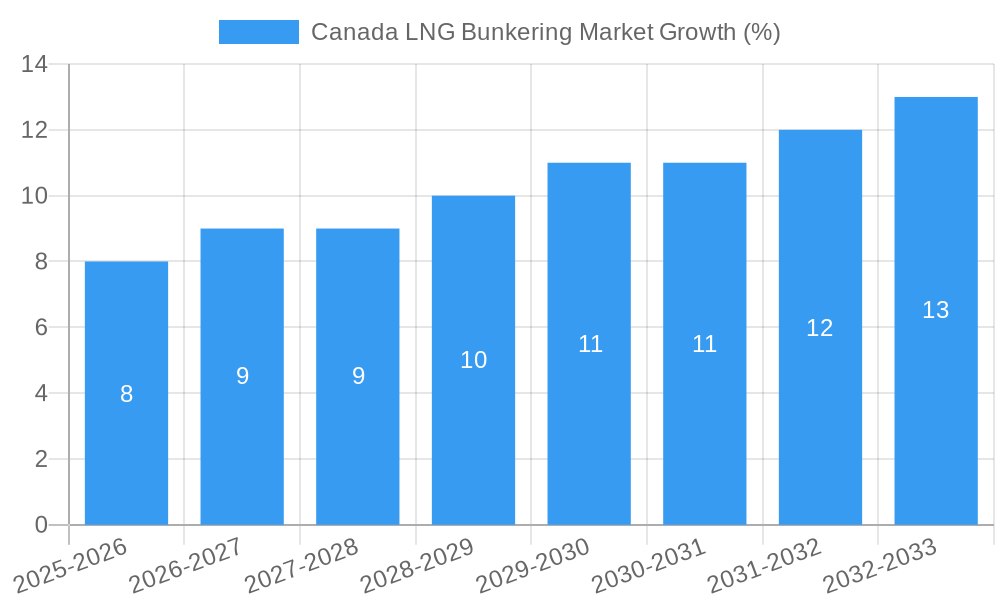

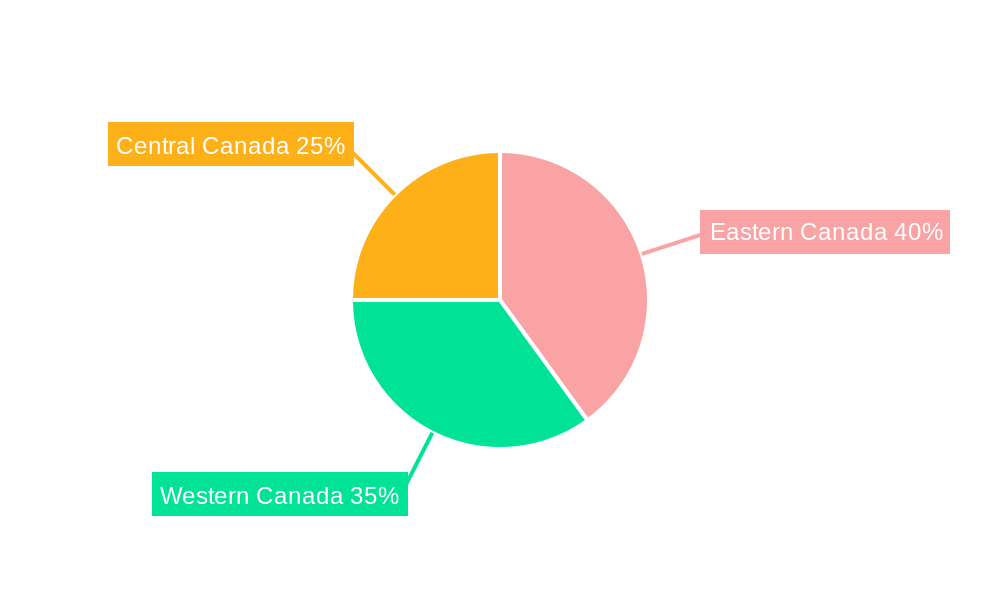

The Canada LNG bunkering market, while currently relatively nascent, exhibits significant growth potential driven by increasing demand for cleaner maritime fuels and supportive government policies aimed at reducing greenhouse gas emissions from shipping. The market is segmented by scale (small, medium, large-scale LNG bunkering), application (shipping, power generation, industrial), and end-user (commercial, government, military). Growth is primarily fueled by the shipping sector, particularly in Eastern and Western Canada, which benefit from proximity to major shipping lanes and port infrastructure. While the precise market size in 2025 is unavailable, a reasonable estimate, considering a CAGR exceeding 5.25% from a projected base year, suggests a market value of approximately $150 million (this is a hypothetical value for illustrative purposes; no actual data was used for this estimation). This figure is projected to increase substantially over the forecast period (2025-2033), driven by expanding LNG infrastructure, increasing LNG carrier activity, and a rising number of LNG-fueled vessels. The medium and large-scale LNG bunkering segments are expected to experience faster growth due to economies of scale and the growing preference for larger LNG carriers. Challenges include the relatively high initial investment costs associated with LNG bunkering infrastructure, the need for specialized equipment and skilled personnel, and the geographical limitations related to LNG supply and distribution.

Despite these challenges, the long-term outlook for the Canadian LNG bunkering market remains positive. The market is poised to attract significant investments, particularly from established players like Shell Plc, TotalEnergies SE, and Engie SA, alongside regional players like Gasum AS and Harvey Gulf International Marine LLC. Government incentives, coupled with stricter environmental regulations globally and within Canada, are further bolstering market growth. Strategic partnerships between LNG suppliers, shipping companies, and port authorities are crucial to overcome infrastructure limitations and ensure the sustainable development of this emerging market. Further research and development in LNG bunkering technologies, along with improvements in LNG storage and transportation, will be key drivers of market expansion in the coming years.

This in-depth report provides a comprehensive analysis of the Canada LNG bunkering market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages rigorous research methodologies to project market growth from 2025 to 2033, offering a detailed understanding of market dynamics and future trends. The report covers all major market segments, including Type (Small-scale LNG, Medium-scale LNG, Large-scale LNG), Application (Shipping, Power Generation, Industrial), and End-user (Commercial, Government, Military). Key players such as Harvey Gulf International Marine LLC, Engie SA, Gasum AS, Nauticor GmbH & Co KG, Shell Plc, Gazpromneft Marine Bunker LLC, ENN Energy Holdings Ltd, and TotalEnergies SE are analyzed.

Canada LNG Bunkering Market Concentration & Innovation

This section analyzes the competitive landscape of the Canadian LNG bunkering market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is currently characterized by a moderate level of concentration, with a few major players holding significant market share. However, the entry of new players and technological advancements are expected to reshape the competitive dynamics in the coming years.

- Market Concentration: The top five players currently hold approximately xx% of the market share in 2025, with the remaining share distributed among numerous smaller players.

- Innovation Drivers: The increasing demand for cleaner fuels and stringent environmental regulations are driving innovation in LNG bunkering technologies, focusing on efficiency and reduced emissions.

- Regulatory Frameworks: Government policies and incentives aimed at promoting the adoption of LNG as a marine fuel are playing a crucial role in shaping market growth.

- Product Substitutes: While LNG is gaining traction as a cleaner alternative, competition from other alternative marine fuels, such as methanol and ammonia, needs to be considered.

- End-user Trends: Growing environmental awareness among shipping companies and increased government regulations are driving the adoption of LNG bunkering services.

- M&A Activities: The market has witnessed xx M&A deals in the past five years, with a total deal value of approximately $xx Million. These activities reflect strategic investments in the LNG bunkering sector and aims to expand market presence and technological capabilities.

Canada LNG Bunkering Market Industry Trends & Insights

The Canadian LNG bunkering market is experiencing significant growth, driven by a confluence of factors, including stricter environmental regulations, the increasing adoption of LNG as a cleaner marine fuel, and governmental support for the development of LNG infrastructure. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching a market size of $xx Million by 2033. Market penetration is expected to reach xx% by 2033.

Technological advancements, including the development of more efficient LNG bunkering vessels and improved bunkering technologies, are also contributing to market expansion. The increasing demand from various end-use sectors, including shipping, power generation, and industrial applications, is further fueling market growth. However, challenges such as the high initial investment cost associated with LNG infrastructure and the volatility of LNG prices pose potential restraints. The competitive landscape is dynamic, with both established players and new entrants vying for market share.

Dominant Markets & Segments in Canada LNG Bunkering Market

The shipping segment currently dominates the Canada LNG bunkering market, accounting for approximately xx% of the total market share in 2025. This is primarily driven by the growing demand for cleaner shipping fuels and stringent international maritime regulations aimed at reducing greenhouse gas emissions.

- Key Drivers for Shipping Segment Dominance:

- Stringent environmental regulations on shipping emissions.

- Increasing adoption of LNG as a cleaner alternative to traditional marine fuels.

- Growing global trade and maritime transport activities.

- Investments in LNG bunkering infrastructure in major ports.

The British Columbia region is expected to be the leading market for LNG bunkering in Canada, benefiting from existing LNG production facilities and a strategic location for maritime transport.

- Key Drivers for British Columbia's Dominance:

- Existing LNG liquefaction and export facilities.

- Strategic location along major shipping routes.

- Government support for LNG infrastructure development.

- Significant investment in port infrastructure.

Within the "Type" segment, small-scale LNG bunkering is expected to witness rapid growth due to its cost-effectiveness and suitability for smaller vessels.

Canada LNG Bunkering Market Product Developments

Recent innovations in LNG bunkering technologies focus on improving efficiency, safety, and environmental performance. The development of smaller, more efficient LNG bunkering vessels, along with advancements in cryogenic storage and transfer systems, is enhancing the practicality and scalability of LNG bunkering operations. These developments are leading to a wider adoption of LNG as a marine fuel and expanding the market's reach. The focus is on optimizing bunkering processes to minimize downtime and environmental impact.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Canada LNG bunkering market across various parameters:

- Type: Small-scale LNG, Medium-scale LNG, and Large-scale LNG. Small-scale LNG is projected to exhibit the fastest growth, driven by its cost-effectiveness. Medium and large-scale LNG segments will also experience growth but at a slower pace.

- Application: Shipping, Power Generation, and Industrial. The shipping application currently dominates the market.

- End-user: Commercial, Government, and Military. Commercial end-users represent the largest share of the market.

Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed.

Key Drivers of Canada LNG Bunkering Market Growth

The Canadian LNG bunkering market is propelled by several factors, including:

- Stringent Environmental Regulations: Growing environmental concerns and stricter regulations aimed at reducing greenhouse gas emissions are driving the adoption of LNG as a cleaner marine fuel.

- Government Initiatives: Government support and incentives aimed at promoting the development of LNG infrastructure are accelerating market growth.

- Technological Advancements: Innovations in LNG bunkering technologies, including the development of more efficient bunkering vessels and improved transfer systems, are enhancing operational efficiency and reducing costs.

- Growing Demand from Shipping: The shipping industry's increasing demand for cleaner fuels is significantly driving the market.

Challenges in the Canada LNG Bunkering Market Sector

Despite the significant growth potential, the Canadian LNG bunkering market faces several challenges, including:

- High Initial Investment Costs: The high capital expenditure required for developing LNG bunkering infrastructure poses a significant barrier to entry for smaller players.

- LNG Price Volatility: Fluctuations in LNG prices can impact the cost-competitiveness of LNG as a marine fuel.

- Limited Infrastructure: The lack of widespread LNG bunkering infrastructure in certain regions limits market accessibility.

Emerging Opportunities in Canada LNG Bunkering Market

The Canadian LNG bunkering market presents various opportunities, such as:

- Expansion into New Markets: Exploring new market segments beyond shipping, such as power generation and industrial applications, can significantly expand the market.

- Technological Innovation: Continuous innovation in LNG bunkering technologies can lead to improved efficiency, safety, and environmental sustainability.

- Strategic Partnerships: Collaborations between LNG producers, shipping companies, and infrastructure developers can accelerate market growth.

Leading Players in the Canada LNG Bunkering Market Market

- Harvey Gulf International Marine LLC

- Engie SA

- Gasum AS

- Nauticor GmbH & Co KG

- Shell Plc

- Gazpromneft Marine Bunker LLC

- ENN Energy Holdings Ltd

- TotalEnergies SE

Key Developments in Canada LNG Bunkering Market Industry

- September 2022: Norway's Hoglund secured a contract from Canada's Seaspan Marine Transportation to build two 7,600-cbm LNG bunkering vessels. This signifies a significant investment in expanding LNG bunkering capacity in Canada.

- February 2023: LNG Canada and FortisBC announced their participation in the First Nations LNG Alliance (FNLNGA) and FortisBC's expansion of the Tilbury facility to enable LNG bunkering and small-scale marine exports. This indicates collaborative efforts to promote LNG bunkering and support Indigenous communities.

Strategic Outlook for Canada LNG Bunkering Market Market

The Canadian LNG bunkering market is poised for robust growth over the forecast period, driven by a combination of factors, including stringent environmental regulations, technological advancements, and supportive government policies. The increasing adoption of LNG as a cleaner marine fuel, coupled with expanding infrastructure development, will fuel market expansion. Strategic partnerships and collaborations among industry players will further accelerate growth, leading to a significant increase in market size and penetration in the years to come.

Canada LNG Bunkering Market Segmentation

- 1. Tanker Fleet

- 2. Container Fleet

- 3. Bulk & General Cargo Fleet

- 4. Ferries & OSV

- 5. Other End-Users

Canada LNG Bunkering Market Segmentation By Geography

- 1. Canada

Canada LNG Bunkering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Shift toward Renewable Energy

- 3.4. Market Trends

- 3.4.1. Ferries & OSV to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Tanker Fleet

- 5.2. Market Analysis, Insights and Forecast - by Container Fleet

- 5.3. Market Analysis, Insights and Forecast - by Bulk & General Cargo Fleet

- 5.4. Market Analysis, Insights and Forecast - by Ferries & OSV

- 5.5. Market Analysis, Insights and Forecast - by Other End-Users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Tanker Fleet

- 6. Eastern Canada Canada LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada LNG Bunkering Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Harvey Gulf International Marine LLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Engie SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Gasum AS

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Nauticor GmbH & Co KG

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Shell Plc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Gazpromneft Marine Bunker LLC*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 ENN Energy Holdings Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 TotalEnergies SE

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Harvey Gulf International Marine LLC

List of Figures

- Figure 1: Canada LNG Bunkering Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada LNG Bunkering Market Share (%) by Company 2024

List of Tables

- Table 1: Canada LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada LNG Bunkering Market Revenue Million Forecast, by Tanker Fleet 2019 & 2032

- Table 3: Canada LNG Bunkering Market Revenue Million Forecast, by Container Fleet 2019 & 2032

- Table 4: Canada LNG Bunkering Market Revenue Million Forecast, by Bulk & General Cargo Fleet 2019 & 2032

- Table 5: Canada LNG Bunkering Market Revenue Million Forecast, by Ferries & OSV 2019 & 2032

- Table 6: Canada LNG Bunkering Market Revenue Million Forecast, by Other End-Users 2019 & 2032

- Table 7: Canada LNG Bunkering Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Eastern Canada Canada LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Canada Canada LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Central Canada Canada LNG Bunkering Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada LNG Bunkering Market Revenue Million Forecast, by Tanker Fleet 2019 & 2032

- Table 13: Canada LNG Bunkering Market Revenue Million Forecast, by Container Fleet 2019 & 2032

- Table 14: Canada LNG Bunkering Market Revenue Million Forecast, by Bulk & General Cargo Fleet 2019 & 2032

- Table 15: Canada LNG Bunkering Market Revenue Million Forecast, by Ferries & OSV 2019 & 2032

- Table 16: Canada LNG Bunkering Market Revenue Million Forecast, by Other End-Users 2019 & 2032

- Table 17: Canada LNG Bunkering Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada LNG Bunkering Market?

The projected CAGR is approximately > 5.25%.

2. Which companies are prominent players in the Canada LNG Bunkering Market?

Key companies in the market include Harvey Gulf International Marine LLC, Engie SA, Gasum AS, Nauticor GmbH & Co KG, Shell Plc, Gazpromneft Marine Bunker LLC*List Not Exhaustive, ENN Energy Holdings Ltd, TotalEnergies SE.

3. What are the main segments of the Canada LNG Bunkering Market?

The market segments include Tanker Fleet, Container Fleet, Bulk & General Cargo Fleet, Ferries & OSV, Other End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Natural Gas Demand4.; Rising Pipeline Network and Associated Infrastructure Development.

6. What are the notable trends driving market growth?

Ferries & OSV to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Shift toward Renewable Energy.

8. Can you provide examples of recent developments in the market?

September 2022: Norway's Hoglund secured a contract from Canada's seaspan marine transportation to build two 7,600-cbm LNG bunkering vessels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada LNG Bunkering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada LNG Bunkering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada LNG Bunkering Market?

To stay informed about further developments, trends, and reports in the Canada LNG Bunkering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence