Key Insights

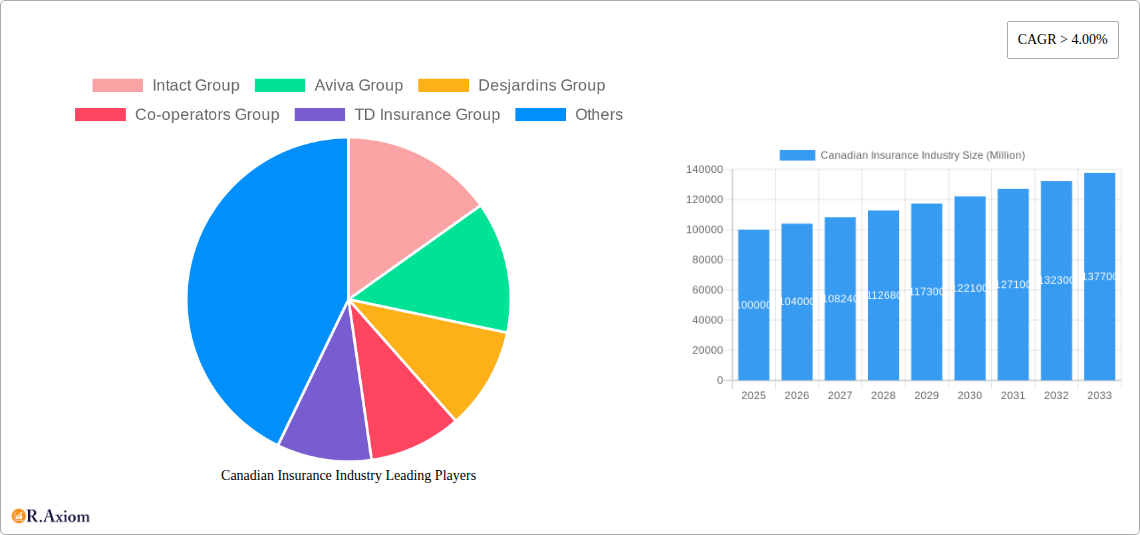

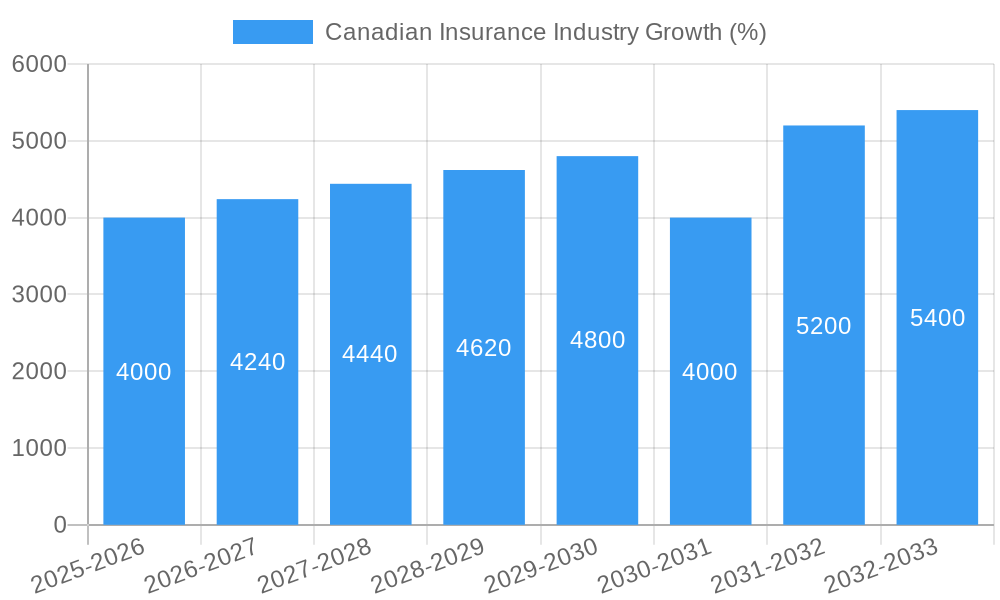

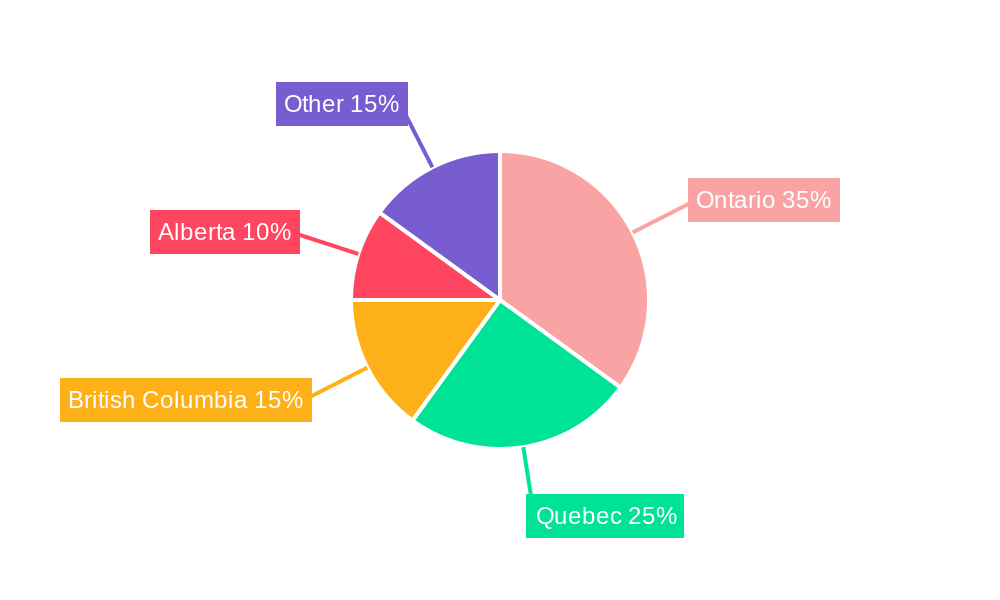

The Canadian insurance industry, valued at approximately $100 billion CAD in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4% through 2033. This expansion is driven by several key factors. Firstly, Canada's aging population necessitates increased demand for health and long-term care insurance. Secondly, rising awareness of financial protection needs, coupled with increasing wealth and disposable income, fuels demand for various insurance products, including auto, home, and life insurance. Technological advancements, such as AI-powered risk assessment and digital distribution channels, are also contributing to market growth by streamlining operations and improving customer experience. However, regulatory changes and increasing competition among established players like Intact, Aviva, Desjardins, and newer entrants present ongoing challenges. The industry's segmentation reflects this diversity, with significant markets in personal lines (auto, home), commercial lines (business insurance), and life and health insurance. While specific regional data is not provided, it's reasonable to assume a concentration of market share in densely populated provinces like Ontario and Quebec.

The competitive landscape is characterized by a mix of domestic and international players. While major established firms dominate, smaller regional insurers and specialized niche providers contribute to the industry's dynamism. The coming decade will likely see continued consolidation within the sector, driven by mergers and acquisitions aimed at achieving economies of scale and expanding market reach. Further growth will be significantly influenced by the successful adaptation of insurers to emerging trends such as climate change (resulting in increased demand for specific coverage), the rising adoption of telematics in auto insurance, and the continuous evolution of customer expectations for digital services. Effective management of operational costs, investment in technological infrastructure, and the development of innovative product offerings will be crucial for continued success in this dynamic market.

Canadian Insurance Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian insurance industry, covering market dynamics, competitive landscape, and future growth prospects from 2019 to 2033. The study period is 2019–2024 (Historical Period), with 2025 as the Base Year and Estimated Year. The forecast period extends from 2025-2033. This report is essential for insurance companies, investors, and industry stakeholders seeking to understand and navigate the evolving Canadian insurance market.

Canadian Insurance Industry Market Concentration & Innovation

This section analyzes the level of market concentration within the Canadian insurance sector, identifying key players and their market share. We explore the drivers of innovation, including technological advancements and regulatory changes, alongside an examination of product substitutes and the impact of mergers and acquisitions (M&A) activity. The analysis considers end-user trends and their influence on market dynamics.

Market Concentration: The Canadian insurance market is characterized by a relatively concentrated landscape, with a few dominant players holding significant market share. Intact Financial Corporation, Aviva Canada, and Desjardins Insurance are among the leading players, collectively commanding xx% of the market in 2024. Precise market share figures are detailed within the full report.

Innovation Drivers: Technological advancements such as AI, big data analytics, and Insurtech are driving innovation, leading to more personalized products, efficient claims processing, and enhanced customer experiences. Regulatory changes, particularly regarding data privacy and cybersecurity, are also influencing innovation strategies.

M&A Activity: The Canadian insurance sector has witnessed significant M&A activity in recent years, including the failed USD 30 billion merger between Aon and Willis in 2021. Further analysis within the report details the value and impact of M&A deals on market consolidation and competitive dynamics. The acquisition of Omega General Insurance Company by Accelerant Holdings in 2021 represents a notable example of market entry and expansion. The total value of M&A deals in the period 2019-2024 is estimated to be xx Million.

Product Substitutes: The rise of alternative risk financing mechanisms such as peer-to-peer insurance and captive insurers presents emerging competitive pressures on traditional insurance providers.

Canadian Insurance Industry Industry Trends & Insights

This section delves into the key trends shaping the Canadian insurance industry, including market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. We provide a detailed examination of the compound annual growth rate (CAGR) and market penetration for various segments. The analysis covers the period from 2019 to 2033, with a specific focus on the post-2025 forecast.

Market growth is anticipated to be driven by factors such as increasing insurance awareness, expanding middle class, rising disposable income, and government initiatives to promote insurance penetration.

Technological disruption is transforming the industry through automation, digitalization, and the use of data analytics. This leads to enhanced efficiency, improved customer experience, and new product development opportunities.

Shifting consumer preferences are influencing the demand for innovative products and personalized services. Consumers are increasingly demanding digital-first solutions and transparent pricing structures. This is driving insurance providers to improve their digital channels and adapt to changing expectations.

Competitive dynamics are influenced by the level of market concentration, pricing strategies, product innovation, and customer acquisition efforts. The entry of new players and the expansion of existing ones further contribute to a dynamic competitive landscape. The projected CAGR for the period 2025-2033 is estimated at xx%. Market penetration is expected to reach xx% by 2033.

Dominant Markets & Segments in Canadian Insurance Industry

This section identifies the leading markets and segments within the Canadian insurance industry. We provide a comprehensive analysis of the factors driving their dominance, including economic policies, infrastructure development, and demographic trends.

Dominant Region: Ontario is expected to remain the largest market throughout the forecast period, driven by its large population, strong economy, and well-developed infrastructure. This is detailed further in the report, supported by relevant data and analysis of other regions.

Key Drivers of Dominance:

- Economic Growth: Strong economic growth in leading regions fuels higher insurance demand.

- Population Density: Higher population density translates to a larger pool of potential customers.

- Infrastructure Development: Robust infrastructure supports economic activity and insurance needs.

- Government Policies: Supportive regulatory frameworks and government initiatives stimulate market expansion.

Canadian Insurance Industry Product Developments

This section summarizes the key product innovations in the Canadian insurance market, highlighting technological trends and their impact on market fit and competitive advantages. New product development is driven by technological advancements, changing customer preferences, and evolving risks. Insurers are incorporating digital technologies to offer more customized and efficient products. This includes the use of telematics in auto insurance, AI-powered fraud detection, and personalized risk assessment.

Report Scope & Segmentation Analysis

This report segments the Canadian insurance market based on various criteria including insurance type (life, health, property & casualty), distribution channel (direct, brokers, agents), and customer segment (individual, corporate). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail within the report.

Key Drivers of Canadian Insurance Industry Growth

Several factors contribute to the growth of the Canadian insurance industry. Technological advancements enhance efficiency and customer experience. Economic growth increases insurance demand, particularly in areas like property and auto insurance. Furthermore, supportive regulatory frameworks foster market stability and attract investment.

Challenges in the Canadian Insurance Industry Sector

The Canadian insurance industry faces several challenges. Regulatory hurdles can increase compliance costs and limit innovation. Supply chain disruptions and natural catastrophes present significant risks and uncertainty. Intense competition requires insurers to constantly innovate and differentiate themselves. The impact of these factors on profitability and growth is analyzed and quantified in the full report.

Emerging Opportunities in Canadian Insurance Industry

The Canadian insurance market offers several promising opportunities. Growing demand for specialized insurance products, like cyber insurance, presents new market segments. Emerging technologies, such as blockchain and IoT, can drive innovation and operational efficiency. Changes in consumer behaviour and preferences create opportunities for personalized products and services.

Leading Players in the Canadian Insurance Industry Market

- Intact Group

- Aviva Group

- Desjardins Group

- Co-operators Group

- TD Insurance Group

- Wawanesa Mutual Insurance Company

- RSA Group

- Economical Group

- Travelers Group

- Northbridge Group

Key Developments in Canadian Insurance Industry Industry

- June 2021: Accelerant Holdings entered the Canadian market through the acquisition of Omega General Insurance Company, expanding its reach and adding to market competition.

- July 2021: The termination of the USD 30 billion merger agreement between Aon and Willis impacted the global insurance brokerage landscape, influencing consolidation strategies and competitive dynamics within the Canadian market.

Strategic Outlook for Canadian Insurance Industry Market

The Canadian insurance industry's future growth is driven by several factors: expanding digitalization, increasing demand for customized solutions, and the emergence of new risks. The market presents exciting opportunities for insurers who can adapt to changing consumer preferences and leverage technological advancements to improve efficiency and customer experience. The projected growth in various insurance segments indicates a promising outlook for market expansion and profitability.

Canadian Insurance Industry Segmentation

-

1. Insurance Type

- 1.1. Property

- 1.2. Auto

- 1.3. Other Insurance Types

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agents

- 2.3. Banks

- 2.4. Other Distribution Channels

Canadian Insurance Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Canadian Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of Artificial Intelligence in Property and Casualty Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Canadian Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Property

- 5.1.2. Auto

- 5.1.3. Other Insurance Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agents

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America Canadian Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Property

- 6.1.2. Auto

- 6.1.3. Other Insurance Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct

- 6.2.2. Agents

- 6.2.3. Banks

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. South America Canadian Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Property

- 7.1.2. Auto

- 7.1.3. Other Insurance Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct

- 7.2.2. Agents

- 7.2.3. Banks

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Europe Canadian Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Property

- 8.1.2. Auto

- 8.1.3. Other Insurance Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct

- 8.2.2. Agents

- 8.2.3. Banks

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. Middle East & Africa Canadian Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Property

- 9.1.2. Auto

- 9.1.3. Other Insurance Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct

- 9.2.2. Agents

- 9.2.3. Banks

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Asia Pacific Canadian Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Property

- 10.1.2. Auto

- 10.1.3. Other Insurance Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct

- 10.2.2. Agents

- 10.2.3. Banks

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intact Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aviva Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Desjardins Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Co-operators Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TD Insurance Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wawanesa Mutual Insurance Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RSA Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Economical Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Travelers Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Northbridge Group**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Intact Group

List of Figures

- Figure 1: Global Canadian Insurance Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Canadian Insurance Industry Revenue (Million), by Insurance Type 2024 & 2032

- Figure 3: North America Canadian Insurance Industry Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 4: North America Canadian Insurance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Canadian Insurance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Canadian Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Canadian Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Canadian Insurance Industry Revenue (Million), by Insurance Type 2024 & 2032

- Figure 9: South America Canadian Insurance Industry Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 10: South America Canadian Insurance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: South America Canadian Insurance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: South America Canadian Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Canadian Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Canadian Insurance Industry Revenue (Million), by Insurance Type 2024 & 2032

- Figure 15: Europe Canadian Insurance Industry Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 16: Europe Canadian Insurance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Europe Canadian Insurance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Europe Canadian Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Canadian Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Canadian Insurance Industry Revenue (Million), by Insurance Type 2024 & 2032

- Figure 21: Middle East & Africa Canadian Insurance Industry Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 22: Middle East & Africa Canadian Insurance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Middle East & Africa Canadian Insurance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Middle East & Africa Canadian Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Canadian Insurance Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Canadian Insurance Industry Revenue (Million), by Insurance Type 2024 & 2032

- Figure 27: Asia Pacific Canadian Insurance Industry Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 28: Asia Pacific Canadian Insurance Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Canadian Insurance Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Canadian Insurance Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Canadian Insurance Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Canadian Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Canadian Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Global Canadian Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Canadian Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Canadian Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 6: Global Canadian Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Canadian Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Canadian Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 12: Global Canadian Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Canadian Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Canadian Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 18: Global Canadian Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Canadian Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Canadian Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 30: Global Canadian Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Canadian Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Canadian Insurance Industry Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 39: Global Canadian Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global Canadian Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Canadian Insurance Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadian Insurance Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Canadian Insurance Industry?

Key companies in the market include Intact Group, Aviva Group, Desjardins Group, Co-operators Group, TD Insurance Group, Wawanesa Mutual Insurance Company, RSA Group, Economical Group, Travelers Group, Northbridge Group**List Not Exhaustive.

3. What are the main segments of the Canadian Insurance Industry?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Adoption of Artificial Intelligence in Property and Casualty Insurance.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2021: Aon and Willis, the world's second and third-biggest commercial property and casualty brokerage, terminated their USD 30 billion combination agreement. The proposed agreement was initially announced in March of 2020.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadian Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadian Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadian Insurance Industry?

To stay informed about further developments, trends, and reports in the Canadian Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence