Key Insights

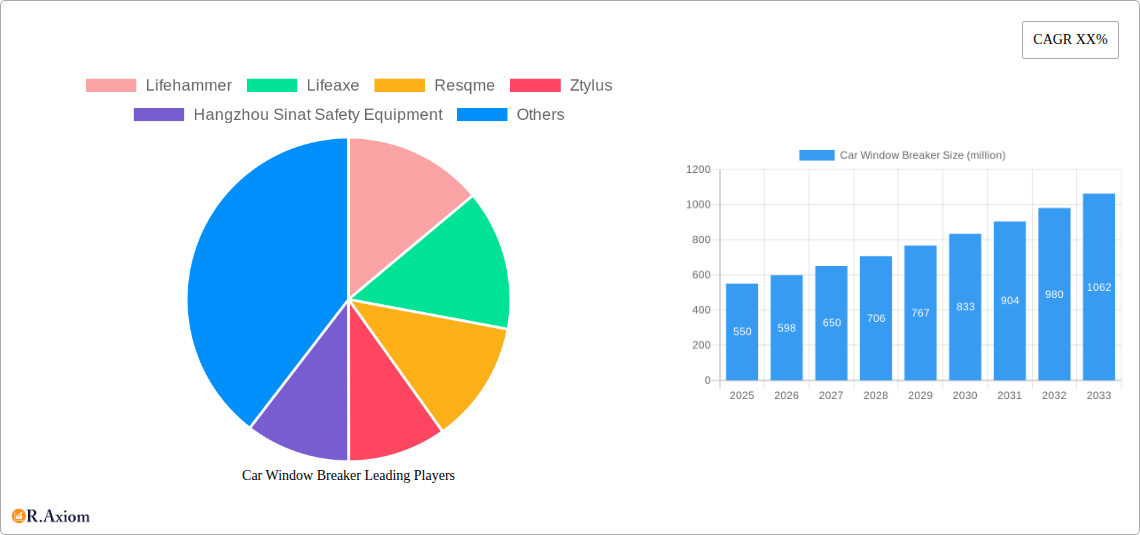

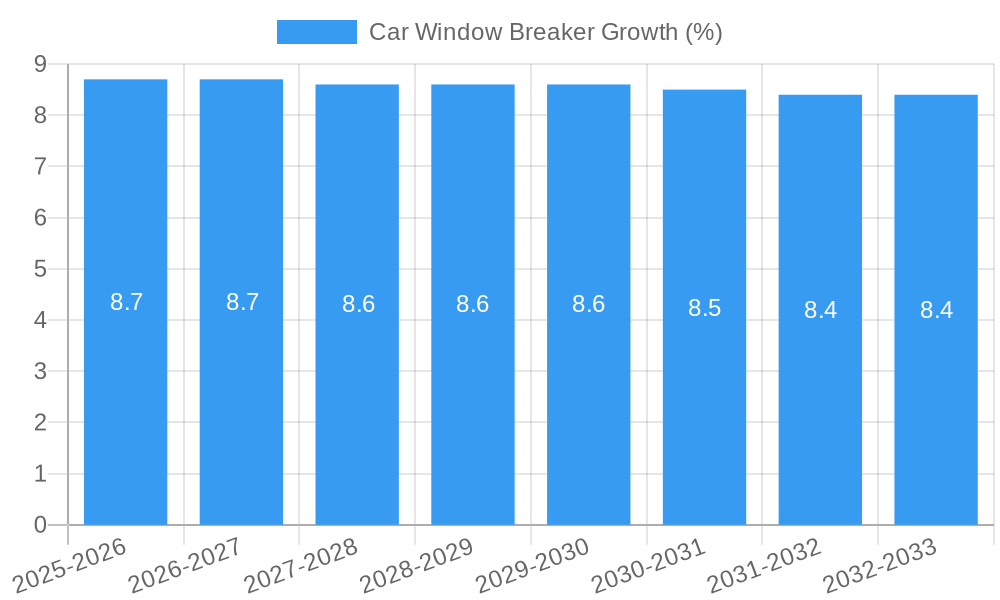

The global car window breaker market is poised for significant growth, projected to reach an estimated USD 550 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% anticipated from 2025 to 2033. This expansion is fueled by increasing global vehicle production and a heightened awareness of road safety, especially concerning emergency egress. The rising number of vehicles on the road, coupled with stringent regulations in certain regions mandating the inclusion of safety tools, directly contributes to market expansion. Furthermore, the growing adoption of advanced safety features in vehicles, including integrated window breaking tools, also plays a pivotal role. The market is characterized by a strong demand for reliable and easy-to-use devices that can quickly shatter tempered car windows in emergency situations. Key drivers include government initiatives promoting road safety, the growing trend of in-car emergency kits, and increasing consumer consciousness regarding personal safety.

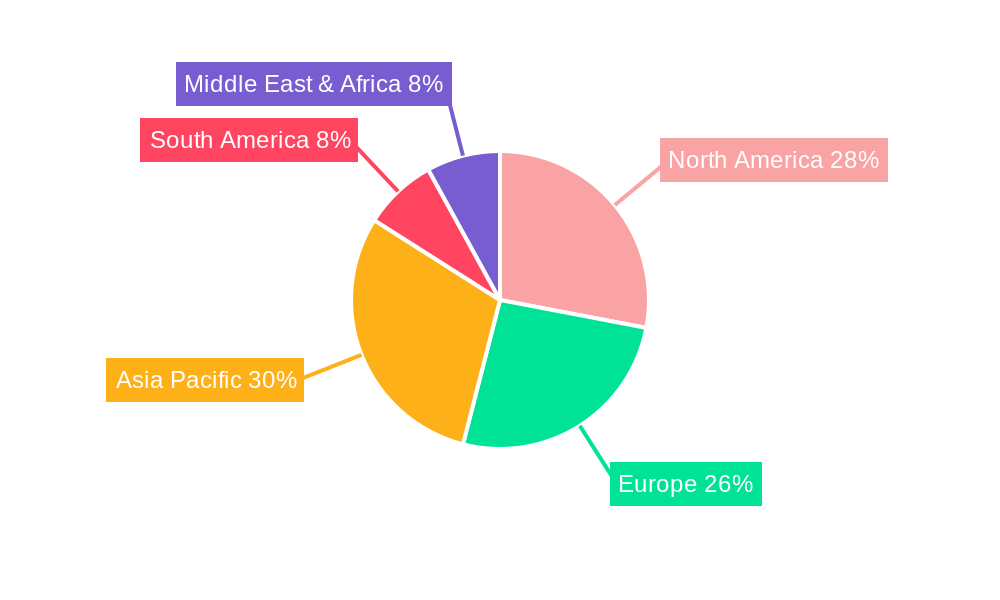

The market segmentation reveals distinct growth avenues. The "Private Car" application segment is expected to dominate due to the sheer volume of passenger vehicles, while the "Commercial Vehicle" segment is anticipated to see steady growth driven by fleet safety mandates and the need for rapid response in professional settings. In terms of product types, the "Spring Window Breaker" is likely to maintain its lead due to its simplicity and effectiveness, while the "Static Punching Window Breaker" may gain traction with advancements in design and portability. Geographically, Asia Pacific, led by China and India, is emerging as a significant growth hub owing to its massive automotive manufacturing base and expanding consumer market. North America and Europe, with their established safety consciousness and regulatory frameworks, will continue to be major revenue contributors, while emerging markets in the Middle East & Africa and South America present substantial untapped potential for market players. The competitive landscape features a mix of established safety equipment manufacturers and specialized car accessory providers, all vying to innovate and expand their market reach through product differentiation and strategic partnerships.

Car Window Breaker Market Concentration & Innovation

The car window breaker market, while appearing niche, demonstrates a growing concentration driven by safety regulations and increasing consumer awareness of emergency preparedness. Key players like Lifehammer, Lifeaxe, and Resqme are at the forefront, actively innovating to enhance product efficacy and user-friendliness. Innovation drivers include the development of more robust yet compact designs, multi-functional tools incorporating seatbelt cutters, and integration with vehicle safety systems. Regulatory frameworks, particularly in regions with stringent automotive safety standards, are indirectly fostering market growth by mandating or recommending such safety devices. Product substitutes, such as traditional hammers or blunt objects, exist but lack the specialized design and effectiveness of dedicated car window breakers. End-user trends show a clear preference for portable, reliable, and easy-to-use devices, especially among families and individuals who frequently travel. M&A activities, though currently in nascent stages, are expected to rise as larger automotive safety equipment manufacturers seek to consolidate their offerings and capture market share. The estimated market value of M&A deals is projected to reach several million over the forecast period, indicating increasing consolidation and investment in this sector. Market share within the top five players is estimated to be over 60 million, with significant fragmentation among smaller, regional manufacturers.

Car Window Breaker Industry Trends & Insights

The car window breaker industry is poised for substantial growth, driven by a confluence of factors including increasing automotive safety consciousness, evolving regulatory landscapes, and technological advancements in emergency tools. The market penetration of car window breakers, while currently modest, is projected to expand significantly as awareness campaigns and mandatory safety equipment mandates gain traction globally. The compound annual growth rate (CAGR) for the car window breaker market is estimated to be between 8.0% and 10.0% during the forecast period of 2025–2033. This growth is fueled by several key drivers. Firstly, escalating road accidents and the growing number of vehicles on the road necessitate effective emergency escape solutions. Secondly, governmental initiatives and automotive safety standards are increasingly emphasizing the importance of in-car safety tools, thereby encouraging manufacturers to produce and consumers to purchase car window breakers. Technological disruptions are playing a crucial role, with manufacturers continuously innovating to develop more compact, durable, and user-friendly devices. The integration of seatbelt cutters and the development of spring-loaded mechanisms have significantly improved the functionality and appeal of these products. Consumer preferences are shifting towards devices that are lightweight, easily accessible within the vehicle, and designed for quick deployment in high-stress situations. The rise of DIY culture and a general increase in preparedness mindset among individuals also contribute to the growing demand. Competitive dynamics within the industry are characterized by both established brands and emerging players. Companies are focusing on product differentiation through features, materials, and branding to capture market share. The aftermarket segment is particularly dynamic, with a continuous influx of new products and design variations. Furthermore, the increasing adoption of commercial vehicles in logistics and transportation sectors also presents a significant growth avenue, as these vehicles often carry higher risks and require robust safety equipment. The global automotive aftermarket industry, valued in the hundreds of millions, provides a fertile ground for car window breaker market expansion.

Dominant Markets & Segments in Car Window Breaker

The car window breaker market exhibits distinct regional dominance and segment preferences, driven by a combination of regulatory pressures, economic conditions, and consumer behavior. Asia Pacific, particularly China and India, is emerging as a dominant region due to its massive automotive production and sales volume, coupled with a growing emphasis on road safety and government mandates for emergency equipment. The sheer number of private cars on the road in these nations, estimated to be in the hundreds of millions, translates into a vast potential consumer base for car window breakers.

Private Car Segment Dominance: The Private Car application segment is unequivocally the largest and most dominant within the car window breaker market. This is attributed to the sheer volume of private vehicles globally, estimated to exceed one billion. Factors contributing to its dominance include:

- Consumer Awareness: Increased public awareness regarding road safety and the importance of emergency preparedness kits in personal vehicles.

- Family Safety: Parents and guardians prioritizing the safety of their families, leading to higher adoption rates.

- Affordability: Generally lower price points compared to commercial vehicle safety solutions make them accessible to a broader consumer base.

- Aftermarket Sales: The vast aftermarket for car accessories and safety devices further fuels the demand in this segment, with projected sales in the hundreds of millions.

Spring Window Breaker Type Dominance: Within the types of car window breakers, the Spring Window Breaker segment currently holds a dominant position. This dominance is largely due to its:

- Ease of Use: Requiring minimal physical strength, making it suitable for a wide demographic, including women, the elderly, and children.

- Reliability: Proven effectiveness in shattering tempered glass, a common material for car side and rear windows.

- Portability and Compactness: Easy to store in glove compartments or keychains, with an estimated market size in the hundreds of millions.

- Cost-Effectiveness: Generally more affordable than some of the more advanced static punching mechanisms.

While the Commercial Vehicle segment is growing, its dominance is yet to rival that of private cars due to lower unit sales and different procurement cycles. Similarly, Static Punching Window Breakers, while offering robust solutions, are often more expensive and may require more precise application, limiting their widespread adoption in the mass-market private car segment. Economic policies supporting automotive safety and infrastructure development in emerging economies will further solidify the dominance of these key segments.

Car Window Breaker Product Developments

Recent product developments in the car window breaker market focus on enhanced safety, portability, and multi-functionality. Innovations include spring-loaded mechanisms that require less force for activation, integrated seatbelt cutters with improved blade safety, and even smart devices with location-tracking capabilities. Companies are also exploring more durable materials and ergonomic designs for easier handling under stress. The competitive advantage lies in offering reliable, user-friendly solutions that address specific consumer pain points, such as quick access and guaranteed effectiveness. These advancements are driving market fit by aligning product features with growing consumer demand for comprehensive emergency preparedness tools, with estimated market value of these innovations reaching millions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global car window breaker market, covering the period from 2019 to 2033, with a base year of 2025. The market is segmented based on Application and Type to offer granular insights.

Application: Private Car: This segment encompasses car window breakers designed for personal vehicles. It is expected to witness robust growth due to the sheer volume of private cars worldwide and increasing consumer focus on family safety. Market size for this segment is projected to reach several million by 2033. Competitive dynamics are characterized by a wide range of brands catering to various price points.

Application: Commercial Vehicle: This segment includes car window breakers intended for use in commercial fleets such as trucks, buses, and taxis. Growth is driven by fleet safety regulations and the need to ensure driver and passenger safety. Market size is estimated to be in the hundreds of millions. Competition involves specialized suppliers offering durable and compliant solutions.

Type: Spring Window Breaker: This segment focuses on window breakers utilizing a spring-loaded mechanism. It is currently the dominant type due to its ease of use and effectiveness on tempered glass. This segment is expected to continue its strong performance, with market size projected in the hundreds of millions. Key competitive advantages include user-friendliness and affordability.

Type: Static Punching Window Breaker: This segment covers window breakers that require manual force to puncture the glass. While effective, they may require more physical effort. Growth projections for this segment are steady, with market size in the tens of millions. Competition centers on durability and specialized applications where higher force is beneficial.

Key Drivers of Car Window Breaker Growth

The car window breaker market is propelled by a confluence of powerful growth drivers. Escalating global road accident statistics and an increasing number of vehicles on the road are fundamental to this expansion, creating a constant need for effective emergency escape tools. Growing consumer awareness regarding personal safety and the importance of preparedness, amplified by media coverage of accidents and effective rescues, is a significant psychological driver. Furthermore, evolving regulatory frameworks in numerous countries, mandating or strongly recommending the inclusion of emergency safety equipment like car window breakers in vehicles, are creating a consistent demand. Technological advancements in manufacturing and design, leading to more compact, user-friendly, and multi-functional devices, also stimulate market growth by enhancing product appeal and effectiveness, contributing to projected market value in the hundreds of millions.

Challenges in the Car Window Breaker Sector

Despite its promising growth trajectory, the car window breaker sector faces several challenges. Regulatory hurdles, particularly in regions with less stringent automotive safety standards, can slow down market penetration and adoption. Supply chain issues, including the sourcing of raw materials and manufacturing disruptions, can impact production volumes and cost-effectiveness. Intense competitive pressures from a crowded aftermarket and the potential for low-cost, less reliable alternatives to flood the market can also hinder growth for established brands. Consumer perception, with some viewing car window breakers as an unnecessary expense, requires continuous effort in education and awareness campaigns. Quantifiable impacts of these challenges could lead to a XX% slowdown in projected growth rates.

Emerging Opportunities in Car Window Breaker

Emerging opportunities in the car window breaker market are multifaceted and ripe for exploitation. The increasing adoption of electric vehicles (EVs) presents a unique opportunity, as their specific safety considerations and internal designs might necessitate specialized window breaker solutions. Expansion into developing economies with burgeoning automotive markets and rising disposable incomes offers significant untapped potential, with projected market penetration rates expected to rise by XX% over the forecast period. The growing trend of subscription-based vehicle ownership and car-sharing services also creates new avenues for B2B sales and integrated safety packages. Furthermore, innovations in smart technology, such as integrated warning systems or distress signal activation linked to window breakers, could open up entirely new product categories and revenue streams, with potential market value in the tens of millions.

Leading Players in the Car Window Breaker Market

- Lifehammer

- Lifeaxe

- Resqme

- Ztylus

- Hangzhou Sinat Safety Equipment

- Cixi Jinmao Car Parts

- Cuxus

- Raniaco

- Wonderoto

- Ecomcrest

Key Developments in Car Window Breaker Industry

- 2023 August: Launch of the "Lifehammer Evolution" featuring an enhanced spring mechanism and integrated seatbelt cutter.

- 2023 December: Resqme announces a strategic partnership with a major automotive dealership network to offer their products as an optional accessory.

- 2024 February: Hangzhou Sinat Safety Equipment expands its product line with a focus on durable, heavy-duty window breakers for commercial vehicles.

- 2024 April: Lifeaxe introduces a new, compact keychain-style window breaker with a patented quick-release mechanism.

- 2024 June: Ztylus showcases a prototype of a smart car window breaker with integrated GPS tracking and emergency alert functions.

Strategic Outlook for Car Window Breaker Market

The strategic outlook for the car window breaker market is exceptionally positive, fueled by a persistent and growing demand for automotive safety solutions. The key growth catalysts will revolve around continued product innovation, focusing on user-friendliness, multi-functionality, and integration with emerging automotive technologies. Expansion into underpenetrated markets in developing regions, coupled with targeted marketing campaigns to increase consumer awareness, will be crucial for sustained growth. Furthermore, strategic collaborations with automotive manufacturers and insurance providers can create significant market access and foster a culture of safety. The market is poised for further consolidation, with potential for M&A activities that will reshape the competitive landscape and drive value creation, with an estimated market expansion in the hundreds of millions over the forecast period.

Car Window Breaker Segmentation

-

1. Application

- 1.1. Private Car

- 1.2. Commercial Vehicle

-

2. Types

- 2.1. Spring Window Breaker

- 2.2. Static Punching Window Breaker

Car Window Breaker Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Car Window Breaker REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Car Window Breaker Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Private Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Spring Window Breaker

- 5.2.2. Static Punching Window Breaker

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Car Window Breaker Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Private Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Spring Window Breaker

- 6.2.2. Static Punching Window Breaker

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Car Window Breaker Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Private Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Spring Window Breaker

- 7.2.2. Static Punching Window Breaker

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Car Window Breaker Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Private Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Spring Window Breaker

- 8.2.2. Static Punching Window Breaker

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Car Window Breaker Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Private Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Spring Window Breaker

- 9.2.2. Static Punching Window Breaker

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Car Window Breaker Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Private Car

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Spring Window Breaker

- 10.2.2. Static Punching Window Breaker

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Lifehammer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lifeaxe

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Resqme

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ztylus

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hangzhou Sinat Safety Equipment

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cixi Jinmao Car Parts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cuxus

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Raniaco

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wonderoto

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ecomcrest

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lifehammer

List of Figures

- Figure 1: Global Car Window Breaker Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Car Window Breaker Revenue (million), by Application 2024 & 2032

- Figure 3: North America Car Window Breaker Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Car Window Breaker Revenue (million), by Types 2024 & 2032

- Figure 5: North America Car Window Breaker Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Car Window Breaker Revenue (million), by Country 2024 & 2032

- Figure 7: North America Car Window Breaker Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Car Window Breaker Revenue (million), by Application 2024 & 2032

- Figure 9: South America Car Window Breaker Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Car Window Breaker Revenue (million), by Types 2024 & 2032

- Figure 11: South America Car Window Breaker Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Car Window Breaker Revenue (million), by Country 2024 & 2032

- Figure 13: South America Car Window Breaker Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Car Window Breaker Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Car Window Breaker Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Car Window Breaker Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Car Window Breaker Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Car Window Breaker Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Car Window Breaker Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Car Window Breaker Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Car Window Breaker Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Car Window Breaker Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Car Window Breaker Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Car Window Breaker Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Car Window Breaker Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Car Window Breaker Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Car Window Breaker Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Car Window Breaker Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Car Window Breaker Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Car Window Breaker Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Car Window Breaker Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Car Window Breaker Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Car Window Breaker Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Car Window Breaker Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Car Window Breaker Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Car Window Breaker Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Car Window Breaker Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Car Window Breaker Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Car Window Breaker Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Car Window Breaker Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Car Window Breaker Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Car Window Breaker Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Car Window Breaker Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Car Window Breaker Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Car Window Breaker Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Car Window Breaker Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Car Window Breaker Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Car Window Breaker Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Car Window Breaker Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Car Window Breaker Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Car Window Breaker Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Window Breaker?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Car Window Breaker?

Key companies in the market include Lifehammer, Lifeaxe, Resqme, Ztylus, Hangzhou Sinat Safety Equipment, Cixi Jinmao Car Parts, Cuxus, Raniaco, Wonderoto, Ecomcrest.

3. What are the main segments of the Car Window Breaker?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Car Window Breaker," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Car Window Breaker report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Car Window Breaker?

To stay informed about further developments, trends, and reports in the Car Window Breaker, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence