Key Insights

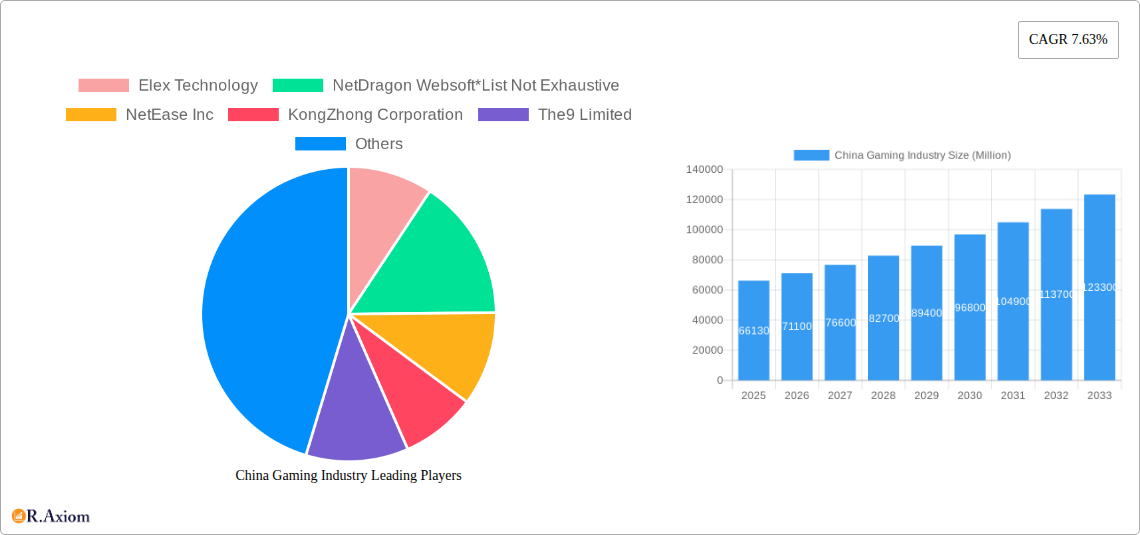

The China gaming market, a significant global player, is projected to reach \$66.13 billion in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.63% from 2019 to 2033. This growth is fueled by several key factors. The rising penetration of smartphones and affordable internet access has democratized gaming, expanding the player base significantly. Furthermore, the increasing popularity of esports and the development of innovative game genres, including mobile gaming's explosive growth, continue to drive market expansion. Government support for the digital economy and a large, young, and digitally savvy population also contribute positively. However, challenges remain. Stringent regulations on game content and playtime, particularly concerning minors, coupled with increasing competition within the industry, could potentially impede growth. The dominance of large established companies like Tencent and NetEase also presents obstacles for smaller players seeking to enter or thrive in this competitive landscape.

Market segmentation reveals a diverse landscape. While PC and console gaming retain a significant presence, mobile gaming is the fastest-growing segment, capturing a substantial portion of the market share due to its accessibility and affordability. The leading companies—Tencent Holdings, NetEase Inc., and others—contribute significantly to the market's value, leveraging their strong brands and extensive game portfolios. Geographical concentration is evident, with China representing the primary market focus for this analysis. The forecast period (2025-2033) suggests continued expansion, though potential regulatory changes and evolving consumer preferences will require ongoing monitoring to accurately predict future market behavior. Understanding these dynamic forces is crucial for investors and businesses operating within or seeking entry into the thriving Chinese gaming industry.

China Gaming Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China gaming industry, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is essential for industry stakeholders, investors, and anyone seeking to understand the dynamics of this rapidly evolving market. The report includes detailed analysis of major players such as Tencent Holdings, NetEase Inc, and others, along with key market segments (PC, Console, Mobile). The report projects a market value exceeding xx Million by 2033.

China Gaming Industry Market Concentration & Innovation

The China gaming market exhibits a high degree of concentration, with a few dominant players controlling a significant market share. Tencent Holdings and NetEase Inc. are the undisputed leaders, commanding a combined market share exceeding xx%. This dominance stems from their extensive game portfolios, strong distribution networks, and substantial investment in research and development. However, smaller players are emerging, particularly in niche genres and on mobile platforms. Innovation is a key driver, with continuous advancements in game mechanics, graphics, and technology. The regulatory framework, while stringent, is evolving, creating both challenges and opportunities. Mergers and acquisitions (M&A) activity remains significant, with deal values reaching xx Million annually in recent years, reflecting the industry's consolidation trend. The increasing adoption of cloud gaming and esports is contributing to market innovation. Substitutes for traditional gaming are emerging such as virtual and augmented reality experiences. End-user trends showcase a shift toward mobile gaming and a growing preference for casual and free-to-play titles.

- Market Share: Tencent Holdings (xx%), NetEase Inc. (xx%), Others (xx%)

- M&A Deal Values (2020-2024): Average xx Million annually.

- Key Innovation Drivers: Technological advancements, evolving consumer preferences, regulatory changes.

China Gaming Industry Industry Trends & Insights

The China gaming market is experiencing robust growth, fueled by several key trends. Rising smartphone penetration, increased internet access, and a burgeoning young population contribute to a massive player base. The market is expected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven primarily by mobile gaming. Technological disruptions, such as the rise of cloud gaming and esports, are reshaping the industry landscape. Consumer preferences are evolving, with a shift towards casual games, free-to-play models, and personalized gaming experiences. Competitive dynamics are intensifying, with both established and emerging companies vying for market share. Market penetration remains high for Mobile games, exceeding xx%, indicating significant growth potential in other gaming segments.

Dominant Markets & Segments in China Gaming Industry

The mobile gaming segment dominates the China gaming market, driven by widespread smartphone adoption, affordability, and accessibility. This dominance is projected to continue throughout the forecast period, with mobile games accounting for xx% of the total market revenue in 2025. Key drivers include:

- Economic Policies: Government support for the digital economy and a large, young, and tech-savvy population.

- Infrastructure: Extensive mobile network coverage and widespread internet penetration.

PC gaming maintains a substantial market share, driven by hardcore gamers and the availability of high-quality titles. Console gaming, while smaller, is experiencing growth, boosted by the introduction of new consoles and an expanding market for esports. The coastal regions of China, particularly major cities like Shanghai and Beijing, represent the most significant markets due to higher disposable income and tech adoption.

China Gaming Industry Product Developments

Product innovation is central to the China gaming industry. Companies are continuously releasing new titles, upgrading existing games, and incorporating cutting-edge technologies such as virtual reality (VR) and augmented reality (AR) to enhance the gaming experience. The focus on mobile gaming has led to the development of numerous casual and free-to-play games designed to cater to the preferences of a wider audience. The integration of social features and esports into games is also driving innovation, creating more engaging and competitive environments. These innovative products cater to the evolving needs and preferences of the Chinese gaming market, offering competitive advantages.

Report Scope & Segmentation Analysis

This report segments the China gaming market by platform:

PC Games: The PC gaming segment is characterized by a strong presence of established titles and a dedicated player base. Growth is expected to be moderate, driven by continued innovation and the popularity of esports. Market size in 2025 is projected to be xx Million.

Console Games: The console gaming market is smaller compared to PC and mobile gaming but is showing signs of growth, driven by increasing console accessibility and the popularity of gaming events. Market size in 2025 is estimated to be xx Million.

Mobile Games: This is the largest and fastest-growing segment, fuelled by high smartphone penetration and the popularity of free-to-play models. The market size in 2025 is projected at xx Million.

Key Drivers of China Gaming Industry Growth

Several factors contribute to the growth of the China gaming industry. Technological advancements, such as enhanced graphics, improved game mechanics, and the rise of cloud gaming, significantly enhance the gaming experience. Economic factors, including rising disposable incomes and increased spending power among young consumers, drive demand. Supportive regulatory policies, though subject to change, provide a framework for industry development. The flourishing esports scene further fuels industry growth, attracting sponsorships and investments.

Challenges in the China Gaming Industry Sector

The China gaming industry faces several challenges, including stringent government regulations on game content and publishing, impacting the release of new titles and affecting revenue streams. Supply chain disruptions can affect the production and distribution of gaming hardware and software, potentially impacting sales and profitability. Intense competition among established and emerging gaming companies creates pressure on pricing and profitability margins. These challenges can collectively result in a projected xx% decrease in revenue if not properly addressed within the next 5 years.

Emerging Opportunities in China Gaming Industry

The China gaming industry presents significant opportunities for growth. Expanding into new market segments, such as VR/AR gaming and cloud gaming, holds immense potential. Leveraging advanced technologies, such as AI and blockchain, to create innovative gaming experiences can unlock new avenues for revenue generation. Catering to evolving consumer preferences and expanding into rural areas to tap into untapped markets offers significant opportunities.

Leading Players in the China Gaming Industry Market

- Elex Technology

- NetDragon Websoft

- NetEase Inc

- KongZhong Corporation

- The9 Limited

- 37 Interactive Entertainment

- Perfect World Games

- Tencent Holdings

- Beijing Kunlun Technology Co Ltd

- Shanda Games

Key Developments in China Gaming Industry Industry

- September 2022: Tencent Holdings and NetEase received approval to launch new paid games, signaling a potential easing of regulatory restrictions. Seventy-three online games received publishing licenses.

- August 2022: NetEase Inc. acquired Quantic Dream SA, strengthening its game development capabilities and expanding its portfolio.

Strategic Outlook for China Gaming Industry Market

The future of the China gaming industry looks promising, with continued growth driven by technological advancements, evolving consumer preferences, and a vast player base. Strategic investments in new technologies, such as cloud gaming and VR/AR, will be crucial for capturing market share and achieving sustained growth. Adapting to evolving regulatory landscapes and maintaining focus on innovation will determine long-term success in this dynamic market. The industry is expected to experience significant expansion throughout the forecast period, achieving a market value exceeding xx Million by 2033.

China Gaming Industry Segmentation

- 1. China Gaming Market Sizing & Forecast

- 2. Gamers Population in China

- 3. Gamers Population Age and Gender

-

4. Market Segmentation Platform

- 4.1. PC Games

- 4.2. Console Games

- 4.3. Mobile Games

- 5. PC Games

- 6. Console Games

- 7. Mobile Games

- 8. Top 20 Android Games & Apps in China

- 9. Top 20 iOS Games & Apps in China

- 10. Suspension of Gaming Licenses in China

- 11. Foreign Companies Share in Chinese Gaming Industry

China Gaming Industry Segmentation By Geography

- 1. China

China Gaming Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Advancement in Technological Developments

- 3.3. Market Restrains

- 3.3.1. Fluctuating Government Regulations Regarding Gaming Industry

- 3.4. Market Trends

- 3.4.1. Mobile Games Occupies the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Gaming Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by China Gaming Market Sizing & Forecast

- 5.2. Market Analysis, Insights and Forecast - by Gamers Population in China

- 5.3. Market Analysis, Insights and Forecast - by Gamers Population Age and Gender

- 5.4. Market Analysis, Insights and Forecast - by Market Segmentation Platform

- 5.4.1. PC Games

- 5.4.2. Console Games

- 5.4.3. Mobile Games

- 5.5. Market Analysis, Insights and Forecast - by PC Games

- 5.6. Market Analysis, Insights and Forecast - by Console Games

- 5.7. Market Analysis, Insights and Forecast - by Mobile Games

- 5.8. Market Analysis, Insights and Forecast - by Top 20 Android Games & Apps in China

- 5.9. Market Analysis, Insights and Forecast - by Top 20 iOS Games & Apps in China

- 5.10. Market Analysis, Insights and Forecast - by Suspension of Gaming Licenses in China

- 5.11. Market Analysis, Insights and Forecast - by Foreign Companies Share in Chinese Gaming Industry

- 5.12. Market Analysis, Insights and Forecast - by Region

- 5.12.1. China

- 5.1. Market Analysis, Insights and Forecast - by China Gaming Market Sizing & Forecast

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Elex Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NetDragon Websoft*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NetEase Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KongZhong Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The9 Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 37 Interactive Entertainment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Perfect World Games

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tencent Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Kunlun Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shanda Games

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Elex Technology

List of Figures

- Figure 1: China Gaming Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Gaming Industry Share (%) by Company 2024

List of Tables

- Table 1: China Gaming Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Gaming Industry Revenue Million Forecast, by China Gaming Market Sizing & Forecast 2019 & 2032

- Table 3: China Gaming Industry Revenue Million Forecast, by Gamers Population in China 2019 & 2032

- Table 4: China Gaming Industry Revenue Million Forecast, by Gamers Population Age and Gender 2019 & 2032

- Table 5: China Gaming Industry Revenue Million Forecast, by Market Segmentation Platform 2019 & 2032

- Table 6: China Gaming Industry Revenue Million Forecast, by PC Games 2019 & 2032

- Table 7: China Gaming Industry Revenue Million Forecast, by Console Games 2019 & 2032

- Table 8: China Gaming Industry Revenue Million Forecast, by Mobile Games 2019 & 2032

- Table 9: China Gaming Industry Revenue Million Forecast, by Top 20 Android Games & Apps in China 2019 & 2032

- Table 10: China Gaming Industry Revenue Million Forecast, by Top 20 iOS Games & Apps in China 2019 & 2032

- Table 11: China Gaming Industry Revenue Million Forecast, by Suspension of Gaming Licenses in China 2019 & 2032

- Table 12: China Gaming Industry Revenue Million Forecast, by Foreign Companies Share in Chinese Gaming Industry 2019 & 2032

- Table 13: China Gaming Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: China Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Gaming Industry Revenue Million Forecast, by China Gaming Market Sizing & Forecast 2019 & 2032

- Table 16: China Gaming Industry Revenue Million Forecast, by Gamers Population in China 2019 & 2032

- Table 17: China Gaming Industry Revenue Million Forecast, by Gamers Population Age and Gender 2019 & 2032

- Table 18: China Gaming Industry Revenue Million Forecast, by Market Segmentation Platform 2019 & 2032

- Table 19: China Gaming Industry Revenue Million Forecast, by PC Games 2019 & 2032

- Table 20: China Gaming Industry Revenue Million Forecast, by Console Games 2019 & 2032

- Table 21: China Gaming Industry Revenue Million Forecast, by Mobile Games 2019 & 2032

- Table 22: China Gaming Industry Revenue Million Forecast, by Top 20 Android Games & Apps in China 2019 & 2032

- Table 23: China Gaming Industry Revenue Million Forecast, by Top 20 iOS Games & Apps in China 2019 & 2032

- Table 24: China Gaming Industry Revenue Million Forecast, by Suspension of Gaming Licenses in China 2019 & 2032

- Table 25: China Gaming Industry Revenue Million Forecast, by Foreign Companies Share in Chinese Gaming Industry 2019 & 2032

- Table 26: China Gaming Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Gaming Industry?

The projected CAGR is approximately 7.63%.

2. Which companies are prominent players in the China Gaming Industry?

Key companies in the market include Elex Technology, NetDragon Websoft*List Not Exhaustive, NetEase Inc, KongZhong Corporation, The9 Limited, 37 Interactive Entertainment, Perfect World Games, Tencent Holdings, Beijing Kunlun Technology Co Ltd, Shanda Games.

3. What are the main segments of the China Gaming Industry?

The market segments include China Gaming Market Sizing & Forecast, Gamers Population in China, Gamers Population Age and Gender, Market Segmentation Platform, PC Games, Console Games, Mobile Games, Top 20 Android Games & Apps in China, Top 20 iOS Games & Apps in China, Suspension of Gaming Licenses in China, Foreign Companies Share in Chinese Gaming Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Advancement in Technological Developments.

6. What are the notable trends driving market growth?

Mobile Games Occupies the Largest Market Share.

7. Are there any restraints impacting market growth?

Fluctuating Government Regulations Regarding Gaming Industry.

8. Can you provide examples of recent developments in the market?

September 2022: Tencent Holdings and NetEase, two of China's largest video game companies, got approval to launch new paid games for the first time since July last year, indicating Beijing's relaxation of a two-year crackdown on the tech sector. Seventy-three online games, including 69 mobile games, were given publishing licenses by the National Press and Publication Administration. Licenses were also granted to CMGE Technology Group., Leiting, XD Inc, and Zhong Qing Bao.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Gaming Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Gaming Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Gaming Industry?

To stay informed about further developments, trends, and reports in the China Gaming Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence