Key Insights

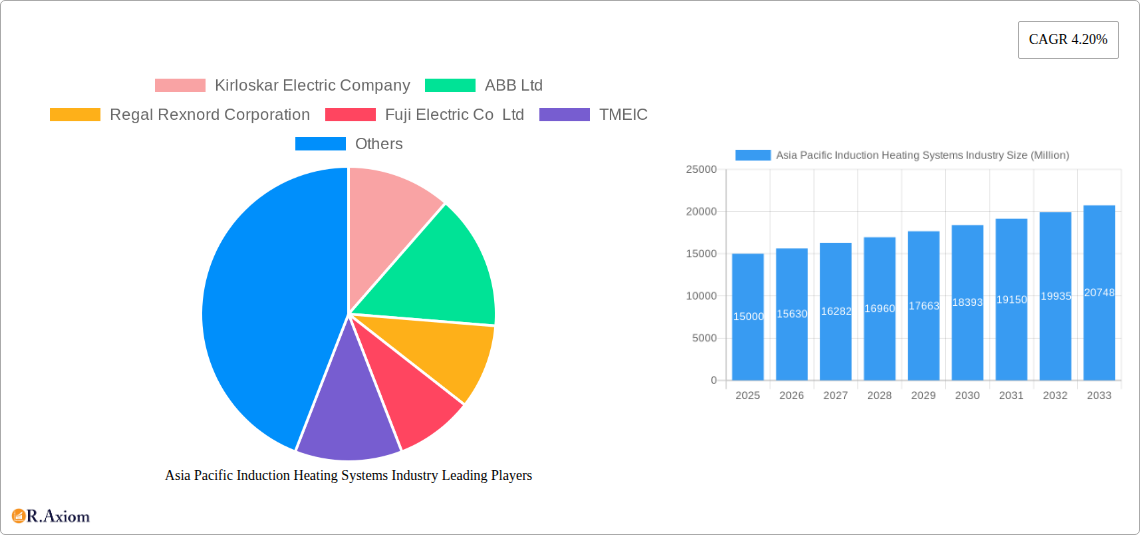

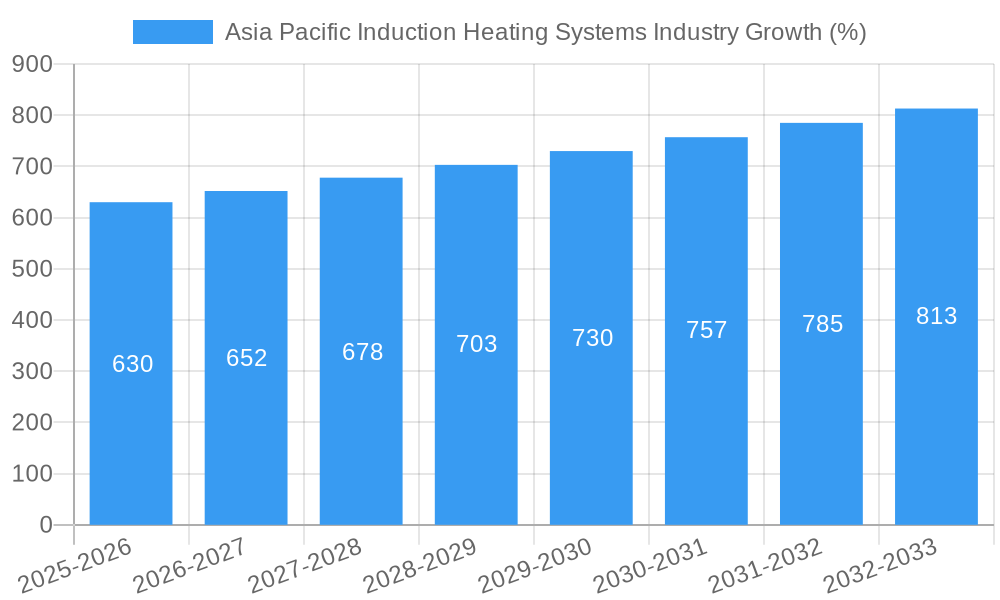

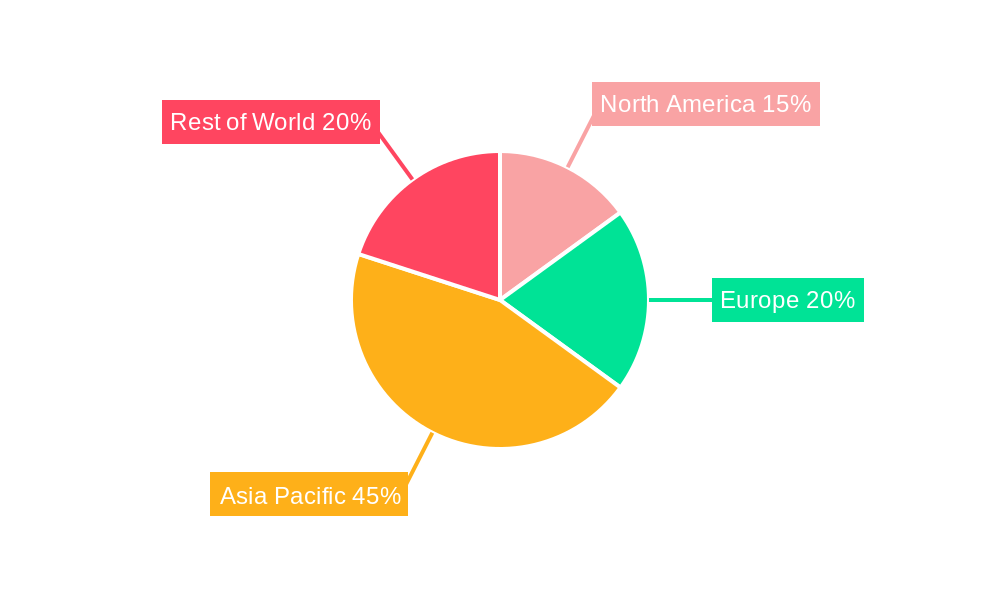

The Asia Pacific induction heating systems market, exhibiting a Compound Annual Growth Rate (CAGR) of 4.20%, presents a significant opportunity for growth. Driven by increasing automation in manufacturing across sectors like automotive, food and beverage, and chemical processing, the demand for energy-efficient and precise heating solutions is fueling market expansion. The region's robust industrial infrastructure, coupled with government initiatives promoting technological advancements, further contributes to this positive trajectory. While the market is segmented by type (hardware, software, services) and end-user industry (automotive, food and beverage, chemicals, pharmaceuticals, etc.), the hardware segment currently holds the largest market share due to the widespread adoption of induction heating equipment in various applications. Growth is particularly strong in countries like China, Japan, South Korea, and India, reflecting these nations' robust manufacturing sectors and substantial investments in industrial modernization. However, high initial investment costs associated with induction heating systems and the need for skilled technicians can pose challenges to market penetration, particularly in smaller enterprises. Nevertheless, the long-term benefits of energy efficiency and improved process control are expected to overcome these initial barriers, fostering sustained market growth throughout the forecast period (2025-2033).

The competitive landscape is characterized by a mix of established global players like ABB, Siemens, and Fuji Electric, alongside regional manufacturers. These companies are focusing on product innovation, strategic partnerships, and expansion into new markets to maintain their market positions. Future growth will likely be influenced by advancements in power electronics, the development of more robust and reliable systems, and the increasing integration of smart manufacturing technologies within the induction heating landscape. The continued expansion of the automotive, electronics, and renewable energy sectors in the Asia Pacific region will further stimulate demand for advanced induction heating systems, solidifying its role as a key technology in various industrial processes. The market is poised for considerable expansion, particularly in emerging economies within the region, offering lucrative opportunities for both established players and new entrants.

Asia Pacific Induction Heating Systems Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific induction heating systems industry, covering market size, growth drivers, challenges, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, investors, and policymakers.

Asia Pacific Induction Heating Systems Industry Market Concentration & Innovation

The Asia Pacific induction heating systems market exhibits a moderately concentrated landscape, with a handful of dominant players holding significant market share. Kirloskar Electric Company, ABB Ltd, Regal Rexnord Corporation, Fuji Electric Co Ltd, TMEIC, SEALOCEAN, Nidec Corporation, WEG SA, and Siemens AG are some of the key players shaping the industry. Precise market share data for each company is unavailable, but preliminary estimates suggest that the top five players collectively account for approximately xx% of the total market revenue in 2025. Innovation is a key driver, with ongoing developments in energy efficiency, control systems, and application-specific designs. Regulatory frameworks concerning energy consumption and environmental impact significantly influence industry growth. The market sees some substitution from traditional heating methods, but the advantages of induction heating, such as precision and efficiency, maintain strong demand. Mergers and acquisitions (M&A) activity remains relatively low, with deal values averaging around USD xx Million annually in the recent past, primarily focused on strengthening regional presence or acquiring specialized technologies. End-user trends favor automation and improved process control, driving demand for sophisticated induction heating solutions.

Asia Pacific Induction Heating Systems Industry Industry Trends & Insights

The Asia Pacific induction heating systems market is experiencing robust growth, driven by increasing industrial automation, rising energy efficiency concerns, and the expanding adoption of induction heating across diverse end-user industries. The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as advancements in power electronics and control algorithms, are improving the efficiency and precision of induction heating systems, fueling market expansion. Consumer preferences are shifting towards energy-efficient and environmentally friendly solutions, boosting the demand for induction heating. Competitive dynamics are intense, with companies focusing on product innovation, cost optimization, and expansion into new geographical markets. Market penetration is relatively high in established industrial sectors, such as automotive and metal processing, but significant opportunities exist in emerging sectors like food processing and renewable energy.

Dominant Markets & Segments in Asia Pacific Induction Heating Systems Industry

The Asia Pacific induction heating systems market is dominated by the Hardware segment, accounting for xx% of the total market revenue in 2025. Within end-user industries, the Automotive sector demonstrates the highest demand for induction heating systems, with xx% of the market share. Among the listed countries, China is projected to be the leading market in 2025 due to robust industrial growth and substantial government investments in infrastructure development.

Key Drivers in China:

- Rapid industrialization and infrastructure development

- Favorable government policies promoting energy efficiency

- High demand from the automotive and electronics sectors

Detailed Dominance Analysis: The dominance of the hardware segment stems from the core technological component of induction heating systems. The automotive sector’s high demand is linked to the widespread application of induction heating in metal forming and heat treatment processes. China's dominance is fueled by its massive manufacturing base and its push for technological advancement.

Asia Pacific Induction Heating Systems Industry Product Developments

Recent product innovations focus on enhanced efficiency, precise temperature control, and improved durability. New applications are emerging in areas such as 3D printing and additive manufacturing. Competitive advantages hinge on technological superiority, cost-effectiveness, and customized solutions tailored to specific end-user requirements. The trend is toward smart, connected systems with remote monitoring and predictive maintenance capabilities.

Report Scope & Segmentation Analysis

This report segments the Asia Pacific induction heating systems market by type (Hardware, Software, Services), end-user industry (Food, Tobacco, and Beverage, Automotive, Chemical and Petrochemical, Energy and Utilities, Pharmaceutical, Oil and Gas, Other End-user Industries), and country (United Arab Emirates, Saudi Arabia, Israel, Oman, Rest of Middle-East). Each segment presents unique growth dynamics, competitive intensity, and market size projections. For instance, the software segment is anticipated to experience high growth due to the increasing demand for advanced control systems, while the automotive sector will remain a key driver due to its significant demand. Country-specific analyses highlight regional differences in market development and growth prospects.

Key Drivers of Asia Pacific Induction Heating Systems Industry Growth

Several factors propel the growth of the Asia Pacific induction heating systems industry. Technological advancements in power electronics and control systems lead to greater efficiency and precision. Government policies promoting energy efficiency and sustainable manufacturing practices provide further support. The rising demand from key end-user industries, especially automotive and electronics, fuels strong market growth. Increasing investments in infrastructure and industrial automation accelerate the adoption of induction heating technologies.

Challenges in the Asia Pacific Induction Heating Systems Industry Sector

Despite the positive outlook, challenges remain. High initial investment costs can hinder adoption, especially for smaller companies. Supply chain disruptions related to component availability can impact production and delivery timelines. Intense competition among established and emerging players can pressure profit margins. Regulatory compliance and environmental concerns necessitate continuous innovation for more sustainable induction heating solutions.

Emerging Opportunities in Asia Pacific Induction Heating Systems Industry

Several opportunities exist for growth. The expanding renewable energy sector creates new applications for induction heating in solar and wind power generation. The adoption of Industry 4.0 principles opens avenues for smart, connected induction heating systems. New materials and advanced manufacturing processes are enabling the development of more efficient and durable systems. Expansion into emerging markets with growing industrial bases presents significant potential.

Leading Players in the Asia Pacific Induction Heating Systems Industry Market

- Kirloskar Electric Company

- ABB Ltd

- Regal Rexnord Corporation

- Fuji Electric Co Ltd

- TMEIC

- SEALOCEAN

- Nidec Corporation

- WEG SA

- Siemens AG

Key Developments in Asia Pacific Induction Heating Systems Industry Industry

- December 2021: Nidec Global Appliance announced a USD 18 Million investment to expand production capacity for variable speed motors used in HVAC systems by 1.5 Million units annually. This signifies a significant expansion in the support infrastructure for induction heating systems.

Strategic Outlook for Asia Pacific Induction Heating Systems Industry Market

The Asia Pacific induction heating systems market is poised for sustained growth, driven by technological advancements, increasing industrialization, and a growing focus on energy efficiency. The rising adoption of induction heating across diverse end-user industries, coupled with favorable government policies, will create significant opportunities for market players. Strategic investments in research and development, coupled with expansion into new markets, will be crucial for achieving long-term success.

Asia Pacific Induction Heating Systems Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Induction Heating Systems Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Induction Heating Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Higher Energy Efficiency; Rising Need of Power Savings in Residential and Industrial Sectors

- 3.3. Market Restrains

- 3.3.1. High Cost of Adoption

- 3.4. Market Trends

- 3.4.1. Industrial Applications to Register Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Induction Heating Systems Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Kirloskar Electric Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Regal Rexnord Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Fuji Electric Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 TMEIC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 SEALOCEAN*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Nidec Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 WEG SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Siemens AG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Kirloskar Electric Company

List of Figures

- Figure 1: Asia Pacific Induction Heating Systems Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Induction Heating Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Asia Pacific Induction Heating Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: New Zealand Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailand Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia Pacific Induction Heating Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Induction Heating Systems Industry?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Asia Pacific Induction Heating Systems Industry?

Key companies in the market include Kirloskar Electric Company, ABB Ltd, Regal Rexnord Corporation, Fuji Electric Co Ltd, TMEIC, SEALOCEAN*List Not Exhaustive, Nidec Corporation, WEG SA, Siemens AG.

3. What are the main segments of the Asia Pacific Induction Heating Systems Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Higher Energy Efficiency; Rising Need of Power Savings in Residential and Industrial Sectors.

6. What are the notable trends driving market growth?

Industrial Applications to Register Significant Growth Rate.

7. Are there any restraints impacting market growth?

High Cost of Adoption.

8. Can you provide examples of recent developments in the market?

December 2021 - Nidec Global Appliance has initiated a substantial production capacity expansion. The additional capacity will support variable speed motors under the U.S Motors and Rescue brands, focused on heating, ventilation, and air conditioning (HVAC) systems. The investment of approximately USD 18 million will increase production capacity by 1.5 million units per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Induction Heating Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Induction Heating Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Induction Heating Systems Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Induction Heating Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence