Key Insights

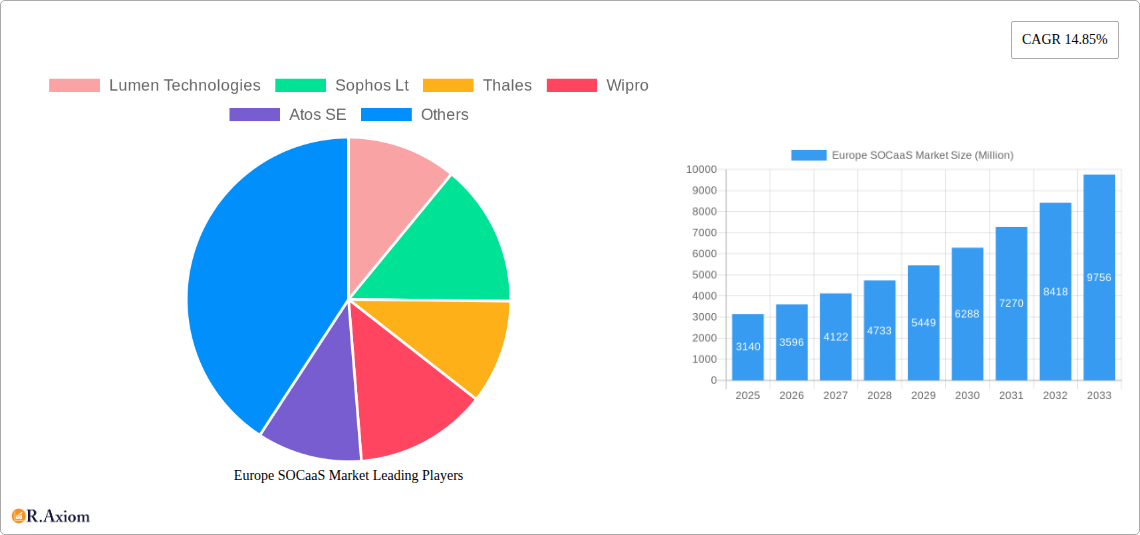

The European Security Operations Center as a Service (SOCaaS) market is experiencing robust growth, driven by the increasing adoption of cloud technologies, the rising prevalence of cyber threats, and the escalating demand for advanced security solutions among organizations of all sizes. The market, valued at €3.14 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 14.85% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the increasing complexity of IT infrastructure, coupled with a shortage of skilled cybersecurity professionals, is compelling organizations to outsource their security operations. Secondly, SOCaaS offers cost-effectiveness and scalability, making it an attractive proposition for both SMEs and large enterprises. The BFSI, IT & Telecom, and Retail & Consumer Goods sectors are leading adopters, driven by the need to protect sensitive customer data and maintain operational resilience. Germany, the United Kingdom, and France represent the largest national markets within Europe, reflecting their advanced digital economies and stringent data protection regulations.

The market's segmentation reveals further insights. While large enterprises currently dominate, the growing awareness of cybersecurity risks among SMEs is expected to significantly boost their segment's growth in the coming years. Furthermore, the increasing adoption of AI and machine learning in SOCaaS solutions is streamlining security operations, improving threat detection and response capabilities. However, challenges such as data privacy concerns, integration complexities with existing security systems, and the need for robust service level agreements (SLAs) could act as potential restraints to market expansion. Nonetheless, the overall outlook for the European SOCaaS market remains positive, with continuous innovation and increasing demand expected to drive substantial growth throughout the forecast period. The competitive landscape is marked by both established players and emerging vendors, leading to ongoing innovation and competitive pricing.

Europe SOCaaS Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe SOCaaS (Security Operations Center as a Service) market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth drivers, competitive landscape, and future opportunities for industry stakeholders. With a focus on actionable intelligence, this report is essential for businesses seeking to navigate this rapidly evolving sector. The base year for this report is 2025, with estimations for 2025 and forecasts spanning 2025-2033. The historical period covered is 2019-2024. The market is segmented by organization size (SMEs, Large Enterprises), end-user (IT & Telecom, BFSI, Retail & Consumer Goods, Healthcare, Manufacturing, Government, Other End Users), and country (United Kingdom, Germany, France, Italy, Spain, Austria, Nordics, Benelux). The report values are in Millions.

Europe SOCaaS Market Concentration & Innovation

The Europe SOCaaS market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the market is also characterized by a high degree of innovation, driven by advancements in AI, machine learning, and cloud technologies. The market share of the top 5 players is estimated to be approximately xx%. Mergers and acquisitions (M&A) activity has been significant, with deal values totaling xx Million in the last three years. Key drivers for this activity include expanding market reach, gaining access to new technologies, and strengthening competitive positioning. Regulatory frameworks such as GDPR and NIS2 are shaping the market, while the emergence of advanced threat detection technologies, such as extended detection and response (XDR), constitutes a significant substitute for traditional SOCaaS offerings. End-user trends indicate a growing preference for cloud-based SOCaaS solutions due to their scalability, cost-effectiveness, and flexibility.

- Market Concentration: Top 5 players hold approximately xx% market share.

- Innovation Drivers: AI, Machine Learning, Cloud Technologies, XDR.

- M&A Activity: Total deal value of xx Million over the last 3 years.

- Regulatory Landscape: GDPR, NIS2 significantly influence market practices.

Europe SOCaaS Market Industry Trends & Insights

The Europe SOCaaS market is experiencing robust growth, driven by the increasing adoption of cloud-based security solutions, rising cyber threats, and stringent data privacy regulations. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Market penetration is currently at approximately xx% and is expected to reach xx% by 2033. Technological disruptions, such as the rise of AI-powered threat detection and response systems, are transforming the competitive landscape. Consumer preferences are shifting towards integrated security platforms that provide comprehensive protection across multiple environments. Competitive dynamics are characterized by intense rivalry among established players and emerging startups, leading to innovation and price competition.

Dominant Markets & Segments in Europe SOCaaS Market

The United Kingdom currently holds the largest market share within Europe, followed by Germany and France. This dominance is attributed to factors such as:

- United Kingdom: Strong IT infrastructure, high cybersecurity awareness, and a large number of multinational corporations.

- Germany: Robust economic growth, significant investments in digital transformation, and a focus on data protection.

- France: Growing adoption of cloud technologies and increasing government initiatives to promote cybersecurity.

Amongst the segments, Large Enterprises account for the largest share of the market due to their greater cybersecurity budgets and complex IT infrastructure. Within end-users, the BFSI (Banking, Financial Services, and Insurance) sector demonstrates significant growth due to increased regulatory pressure and high-value targets for cyberattacks.

- Key Drivers (by Country): Strong IT infrastructure, high cybersecurity awareness, economic growth, government initiatives, investments in digital transformation.

- Key Drivers (by Segment): Large budgets, complex IT infrastructure (Large Enterprises), stringent regulations and high-value targets (BFSI).

Europe SOCaaS Market Product Developments

Recent product innovations in the Europe SOCaaS market are focused on integrating AI and machine learning capabilities to enhance threat detection, automate response actions, and improve overall security posture. The market is also seeing the emergence of integrated security platforms that consolidate various security functions into a single platform, providing improved visibility and streamlined management. These solutions offer enhanced security by leveraging automation and threat intelligence to counter evolving cyber threats. The market fit is strong due to the growing demand for scalable, cost-effective, and comprehensive security solutions.

Report Scope & Segmentation Analysis

By Organization Size: The market is segmented into SMEs and Large Enterprises. Large Enterprises are expected to exhibit faster growth due to higher IT spending.

By End User: The report analyzes the IT and Telecom, BFSI, Retail and Consumer Goods, Healthcare, Manufacturing, Government, and Other End Users segments. The BFSI sector is anticipated to dominate due to stringent regulatory requirements.

By Country: The report covers the United Kingdom, Germany, France, Italy, Spain, Austria, Nordics, and Benelux. The UK and Germany are projected to maintain their leading positions.

Key Drivers of Europe SOCaaS Market Growth

The Europe SOCaaS market is propelled by several factors, including:

- Increased Cyber Threats: The rising frequency and sophistication of cyberattacks are driving demand for robust security solutions.

- Stringent Data Privacy Regulations: Regulations like GDPR necessitate compliance, pushing organizations towards robust security measures.

- Cloud Adoption: The increasing reliance on cloud computing necessitates specialized security solutions.

- Technological Advancements: Innovations in AI, ML, and XDR are improving security capabilities.

Challenges in the Europe SOCaaS Market Sector

The Europe SOCaaS market faces challenges such as:

- High Implementation Costs: The initial investment in SOCaaS solutions can be substantial for some organizations.

- Skill Shortages: The lack of skilled cybersecurity professionals hinders effective implementation and management.

- Integration Complexity: Integrating SOCaaS solutions with existing IT infrastructure can be challenging.

- Vendor Lock-in: Choosing a specific vendor can result in dependence and difficulties switching providers.

Emerging Opportunities in Europe SOCaaS Market

Emerging opportunities include:

- Expansion into Emerging Markets: The growing digitalization of smaller European countries presents untapped potential.

- Focus on Niche Solutions: Catering to specific industry needs with tailored SOCaaS offerings is gaining traction.

- Development of XDR Solutions: The integration of XDR capabilities significantly enhances threat detection and response.

- Integration with IoT Security: Addressing the security vulnerabilities of IoT devices opens new market avenues.

Leading Players in the Europe SOCaaS Market Market

- Lumen Technologies

- Sophos Lt

- Thales

- Wipro

- Atos SE

- Cloudflare Inc

- ConnectWise LLC

- Teceze Limited

- Ontinue Inc

- Plusserver

Key Developments in Europe SOCaaS Market Industry

- November 2023: Infosys expands its European presence with a new proximity center in Sofia, Bulgaria, focusing on BFSI cybersecurity and AI-driven solutions.

- January 2024: Beeks Group partners with BlueVoyant to offer enhanced MXDR services and improve cloud security solutions for the banking sector.

Strategic Outlook for Europe SOCaaS Market Market

The future of the Europe SOCaaS market appears promising, with continued growth driven by increasing cyber threats, stringent regulations, and ongoing technological advancements. The market's expansion into new sectors and geographical regions, coupled with the development of innovative security solutions, presents significant opportunities for both established players and new entrants. The integration of AI and ML will play a crucial role in enhancing the efficiency and effectiveness of SOCaaS platforms, further driving market growth.

Europe SOCaaS Market Segmentation

-

1. Organization Size

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. End User

- 2.1. IT and Telecom

- 2.2. BFSI

- 2.3. Retail and Consumer Goods

- 2.4. Healthcare

- 2.5. Manufacturing

- 2.6. Government

- 2.7. Other End Users

Europe SOCaaS Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe SOCaaS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Adoption of Pay-per-use Model Owing to Reduction in Capex; Rapid Adoption of Cloud Deployment in SMEs; Mobile Workforce and Associated Vulnerabilities

- 3.3. Market Restrains

- 3.3.1. Challenges Associated With Data Control and Total Cost of Ownership

- 3.4. Market Trends

- 3.4.1. Retail and Consumer Goods to be the Fastest Growing End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe SOCaaS Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecom

- 5.2.2. BFSI

- 5.2.3. Retail and Consumer Goods

- 5.2.4. Healthcare

- 5.2.5. Manufacturing

- 5.2.6. Government

- 5.2.7. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Germany Europe SOCaaS Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe SOCaaS Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe SOCaaS Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe SOCaaS Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe SOCaaS Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe SOCaaS Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe SOCaaS Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Lumen Technologies

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sophos Lt

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Thales

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Wipro

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Atos SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Cloudflare Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 ConnectWise LLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Teceze Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ontinue Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Plusserver

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Lumen Technologies

List of Figures

- Figure 1: Europe SOCaaS Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe SOCaaS Market Share (%) by Company 2024

List of Tables

- Table 1: Europe SOCaaS Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe SOCaaS Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 3: Europe SOCaaS Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe SOCaaS Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe SOCaaS Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe SOCaaS Market Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 14: Europe SOCaaS Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Europe SOCaaS Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe SOCaaS Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe SOCaaS Market?

The projected CAGR is approximately 14.85%.

2. Which companies are prominent players in the Europe SOCaaS Market?

Key companies in the market include Lumen Technologies, Sophos Lt, Thales, Wipro, Atos SE, Cloudflare Inc, ConnectWise LLC, Teceze Limited, Ontinue Inc, Plusserver.

3. What are the main segments of the Europe SOCaaS Market?

The market segments include Organization Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Adoption of Pay-per-use Model Owing to Reduction in Capex; Rapid Adoption of Cloud Deployment in SMEs; Mobile Workforce and Associated Vulnerabilities.

6. What are the notable trends driving market growth?

Retail and Consumer Goods to be the Fastest Growing End-user Industry.

7. Are there any restraints impacting market growth?

Challenges Associated With Data Control and Total Cost of Ownership.

8. Can you provide examples of recent developments in the market?

January 2024 - The cloud computing and analytics supplier for the world's financial markets, Beaks Group, partnered with BlueVoyant, a cybersecurity company that identifies, verifies, and addresses internal and external threats. Beeks group will receive BlueVoyant's renowned managed extended detection and response (MXDR) services, which boost operational resilience and security. Beeks will provide improved cloud security solutions for the banking industry by utilizing BlueVoyant solution as part of its current Microsoft technology infrastructure; Beeks will be able to run an around-the-clock comprehensive security operations center (SOC) with the aid of BlueVoyant services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe SOCaaS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe SOCaaS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe SOCaaS Market?

To stay informed about further developments, trends, and reports in the Europe SOCaaS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence