Key Insights

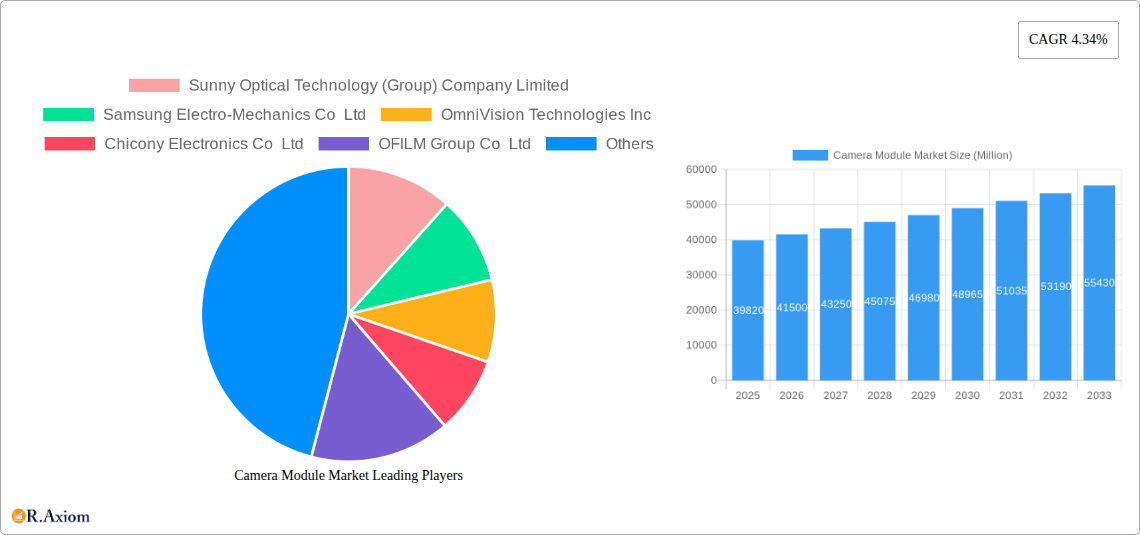

The global camera module market, valued at $39.82 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for high-resolution imaging in smartphones, coupled with the proliferation of advanced features like multi-camera systems, AI-powered image processing, and improved low-light performance, are major catalysts. The automotive industry's integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies is another significant driver, demanding sophisticated camera modules with enhanced capabilities. Furthermore, expanding applications in consumer electronics (beyond mobile), healthcare (medical imaging), security (surveillance systems), and industrial automation are contributing to market expansion. The market segmentation reveals a strong focus on image sensors and camera module assembly, reflecting the technological complexity and value added at these stages of the production process. Leading players like Sunny Optical, Samsung Electro-Mechanics, and OmniVision Technologies are competing intensely, driving innovation and price competitiveness.

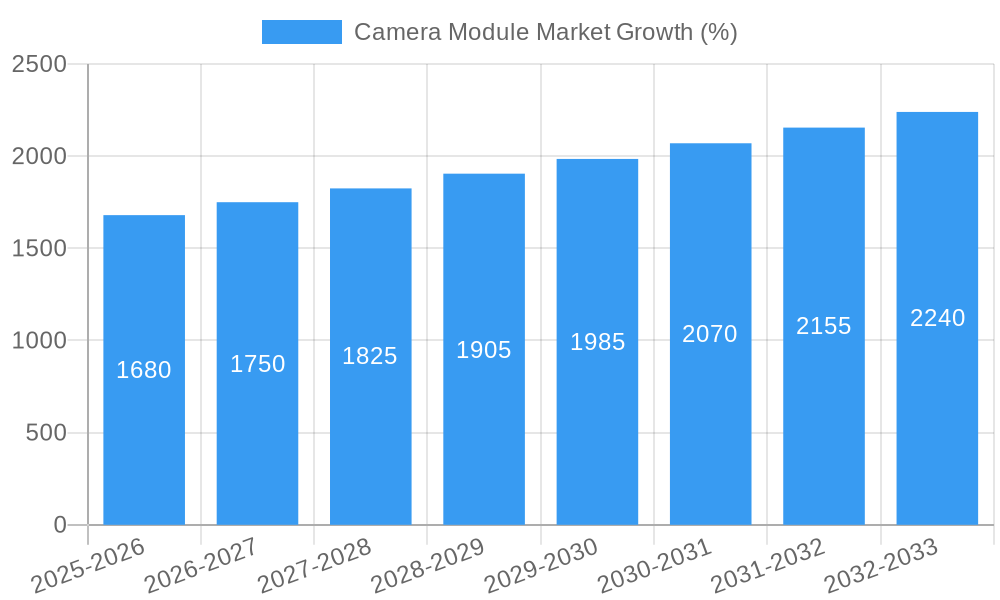

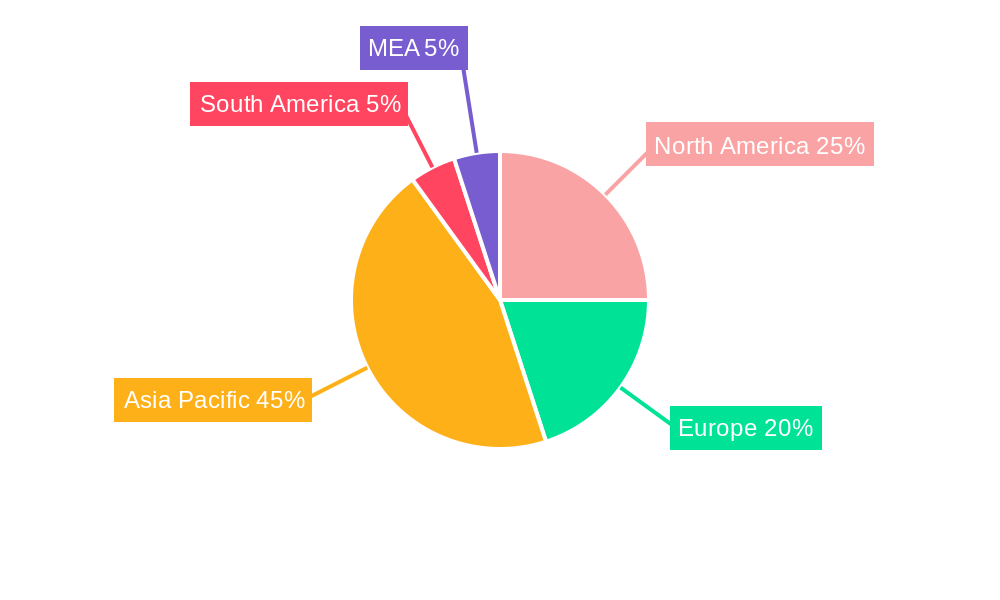

Growth is expected to be consistent, with a compound annual growth rate (CAGR) of 4.34% from 2025 to 2033. However, certain restraints exist, primarily the cost of incorporating advanced features into camera modules and the challenges of maintaining high production yields while incorporating miniaturization and advanced functionalities. Regional analysis suggests strong growth in Asia-Pacific, driven by substantial manufacturing and consumption in China, India, and South Korea. North America and Europe are also significant markets, but their growth may be comparatively slower, reflecting their market maturity. The diverse range of applications ensures the long-term viability of the camera module market, with continued innovation likely to shape its future trajectory. The market is anticipated to reach approximately $60 billion by 2033, representing a significant increase over the 2025 valuation. This projection takes into account the predicted growth in diverse applications along with the ongoing technological improvements in camera module technologies.

Camera Module Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Camera Module Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with 2025 as the base year, this report meticulously examines market trends, competitive dynamics, and future growth prospects. The study encompasses detailed segmentation by component (Image Sensor, Lens, Camera Module Assembly, VCM Suppliers (AF & OIS)) and application (Mobile, Consumer Electronics (Excl. Mobile), Automotive, Healthcare, Security, Industrial), providing a granular understanding of market performance across various segments. Key players like Sunny Optical, Samsung Electro-Mechanics, OmniVision Technologies, and others are analyzed, revealing their market share and strategic moves. The report also incorporates recent industry developments, projecting the market's future trajectory with precision and accuracy.

Camera Module Market Concentration & Innovation

The Camera Module Market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Sunny Optical Technology (Group) Company Limited, Samsung Electro-Mechanics Co Ltd, and OmniVision Technologies Inc. are among the key players, fiercely competing through product innovation and strategic partnerships. Market share fluctuates based on technological advancements, manufacturing capabilities, and customer relationships. The estimated market share of Sunny Optical in 2025 is xx%, followed by Samsung Electro-Mechanics at xx% and OmniVision Technologies at xx%. Innovation in this sector is driven by the continuous demand for higher resolution, improved image quality, and advanced features like autofocus and optical image stabilization (OIS). Regulatory frameworks, particularly those related to data privacy and component sourcing, significantly influence market dynamics. The increasing adoption of advanced imaging technologies in various applications fuels product diversification. Mergers and acquisitions (M&A) activities contribute to market consolidation, with recent deals valued at approximately xx Million USD impacting market dynamics through increased capacity and technological integration. End-user trends towards miniaturization and enhanced functionality are pushing the industry toward smaller, higher-performing camera modules.

Camera Module Market Industry Trends & Insights

The Camera Module Market is experiencing robust growth, driven by several factors. The increasing penetration of smartphones and other consumer electronics, coupled with the rising demand for high-resolution images and video, is a primary growth catalyst. The automotive industry's shift towards advanced driver-assistance systems (ADAS) and autonomous vehicles is further boosting market demand. Technological disruptions, such as the development of advanced image sensors and lens technologies, are enhancing image quality and functionality. Consumer preferences for superior image quality and innovative features, including multi-camera systems and computational photography, are shaping market trends. The market's competitive dynamics are characterized by intense rivalry among established players and emerging entrants, leading to continuous innovation and price competition. The CAGR for the Camera Module Market during the forecast period (2025-2033) is estimated at xx%, with market penetration exceeding xx% in key regions by 2033. This growth is fueled by the increasing integration of cameras in diverse applications, from healthcare and security to industrial automation.

Dominant Markets & Segments in Camera Module Market

The Mobile segment currently dominates the Camera Module Market, accounting for the largest market share, driven by the explosive growth of smartphones worldwide. Key drivers for this segment include the increasing demand for high-resolution cameras in smartphones and the ongoing technological advancements in mobile camera technology. Asia, particularly China, remains the dominant region due to its large consumer electronics market and robust manufacturing base.

Key Drivers for Mobile Segment Dominance:

- High smartphone penetration rates globally

- Increasing demand for high-resolution and multi-camera systems

- Continuous innovation in mobile camera technologies

Key Drivers for other segments:

- Consumer Electronics (Excl. Mobile): Growing demand for high-quality cameras in tablets, laptops, and other consumer electronics devices.

- Automotive: The rapid growth of ADAS and autonomous vehicles is significantly driving the demand for high-performance camera modules.

- Healthcare: Increasing use of imaging technologies in medical diagnosis and treatment procedures is fueling demand for specialized camera modules.

- Security: Growing security concerns and the need for advanced surveillance systems are driving the adoption of high-resolution and low-light camera modules.

- Industrial: Expanding automation and robotics in industrial settings drive demand for robust, high-performance camera modules.

The Image Sensor segment holds the largest share within the "By Component" category, followed by the Lens and Camera Module Assembly segments. This is attributed to the increasing demand for higher-resolution image sensors to meet consumer expectations for improved image quality.

Camera Module Market Product Developments

Recent product innovations focus on enhancing image quality, miniaturization, and cost reduction. Advances in image sensor technology, such as higher pixel counts and improved low-light performance, are driving this trend. The development of smaller, more efficient lenses and camera module assemblies is critical for integrating cameras into increasingly compact devices. These advancements are reflected in the market by increased adoption rates in various applications, including smartphones, automobiles, and medical devices. Competitive advantages are derived from superior image quality, lower power consumption, and more compact designs, along with innovative features like advanced autofocus systems and improved stabilization capabilities.

Report Scope & Segmentation Analysis

This report analyzes the Camera Module Market across various segments. By Component: Image Sensor, Lens, Camera Module Assembly, and VCM Suppliers (AF & OIS) are examined, detailing their growth projections, market sizes, and competitive landscapes. The Image Sensor segment shows substantial growth driven by advancements in sensor technology, particularly in higher resolution and low-light performance. The Lens segment’s growth is tied to improvements in optical design and manufacturing processes. Camera Module Assembly segment growth reflects the rising demand for integrated camera solutions, while VCM Suppliers (AF & OIS) are crucial for improved auto-focus and image stabilization.

By Application: Mobile, Consumer Electronics (excluding Mobile), Automotive, Healthcare, Security, and Industrial segments are explored. Each segment’s growth is influenced by factors specific to its application, such as the proliferation of smartphones for Mobile, the expansion of ADAS for Automotive, or increasing medical imaging needs for Healthcare. The analysis offers detailed insights into the size, growth potential, and key competitive dynamics of each segment.

Key Drivers of Camera Module Market Growth

The Camera Module Market's growth is fueled by several key factors. The proliferation of smartphones and other smart devices is a major driver, with increased demand for higher-resolution cameras. The automotive industry's adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies is another significant growth catalyst. Technological advancements, such as the development of advanced image sensors and lens technologies, are continuously improving image quality and expanding the capabilities of camera modules. Furthermore, the increasing use of camera modules in diverse applications, including healthcare, security, and industrial automation, is expanding the market's overall growth potential.

Challenges in the Camera Module Market Sector

The Camera Module Market faces several challenges. Supply chain disruptions can significantly impact production and delivery times, particularly given the complex global supply chains involved. Intense competition among established and emerging players leads to price pressure and requires continuous innovation to maintain market share. Stringent regulatory requirements regarding data privacy and environmental regulations pose additional hurdles for manufacturers. These challenges affect production efficiency, profitability, and overall market growth, potentially limiting the overall market size and profitability for some players.

Emerging Opportunities in Camera Module Market

Emerging opportunities abound in the Camera Module Market. The growing adoption of augmented reality (AR) and virtual reality (VR) technologies presents significant growth potential, requiring high-performance camera modules for seamless user experiences. The increasing demand for high-quality camera modules in various industrial applications, such as robotics and automation, represents another lucrative opportunity. The expansion into new markets, especially in developing economies with rising consumer spending, offers significant growth potential. Finally, the development of innovative camera technologies, such as multispectral imaging and 3D sensing, opens new avenues for market expansion.

Leading Players in the Camera Module Market Market

- Sunny Optical Technology (Group) Company Limited

- Samsung Electro-Mechanics Co Ltd

- OmniVision Technologies Inc

- Chicony Electronics Co Ltd

- OFILM Group Co Ltd

- AMS OSRM AG

- STMicroelectronics NV

- Fujifilm Corporation

- LG Innotek Co Ltd

- Sharp Corporation

- Cowell E Holdings Inc

- Sony Group Corporation

- LuxVisions Innovation Limited (Lite-On Technology Corporation)

- On Semiconductor (Semiconductor Components Industries LLC)

- Primax Electronics Ltd

Key Developments in Camera Module Market Industry

November 2023: Samsung launched a Camera Assistant update (version 2.0.00.0) for One UI 5.1 and higher, enhancing features like Upscale digital zoom and Distortion Correction. This signifies ongoing efforts to improve image quality and user experience within existing devices, impacting the demand for advanced camera processing capabilities.

June 2023: LG Innotek announced a USD 995 Million investment in its Vietnam facility to expand camera module production, primarily targeting Apple's iPhone. This highlights the significant investment and capacity expansion occurring in the market, particularly to meet the high demand from major players like Apple.

Strategic Outlook for Camera Module Market Market

The Camera Module Market presents a promising outlook, driven by continuous technological advancements and increasing demand across diverse applications. The market's future growth is expected to be fueled by the increasing integration of camera modules in smart devices, automotive applications, healthcare equipment, and industrial automation. Companies need to focus on innovation, strategic partnerships, and efficient supply chain management to succeed in this dynamic and competitive market. The development of advanced features, such as improved low-light performance, higher resolutions, and enhanced processing capabilities, will continue to drive market growth and shape future market trends. The opportunities in emerging markets and the ongoing demand for high-quality imaging solutions will significantly contribute to the overall market growth in the years to come.

Camera Module Market Segmentation

-

1. Component

- 1.1. Image Sensor

- 1.2. Lens

- 1.3. Camera Module Assembly

- 1.4. VCM Suppliers (AF & OIS)

-

2. Application

- 2.1. Mobile

- 2.2. Consumer Electronics (Excl. Mobile)

- 2.3. Automotive

- 2.4. Healthcare

- 2.5. Security

- 2.6. Industrial

Camera Module Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Camera Module Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.34% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Market Demand for Advanced Driver Assistance Systems in Vehicles; Increased Use of Security Cameras in Households and Commercial Establishments

- 3.3. Market Restrains

- 3.3.1. Complicated Manufacturing and Supply Chain Challenges

- 3.4. Market Trends

- 3.4.1. The Mobile Segment is Expected to Hold a Notable Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Image Sensor

- 5.1.2. Lens

- 5.1.3. Camera Module Assembly

- 5.1.4. VCM Suppliers (AF & OIS)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Mobile

- 5.2.2. Consumer Electronics (Excl. Mobile)

- 5.2.3. Automotive

- 5.2.4. Healthcare

- 5.2.5. Security

- 5.2.6. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Image Sensor

- 6.1.2. Lens

- 6.1.3. Camera Module Assembly

- 6.1.4. VCM Suppliers (AF & OIS)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Mobile

- 6.2.2. Consumer Electronics (Excl. Mobile)

- 6.2.3. Automotive

- 6.2.4. Healthcare

- 6.2.5. Security

- 6.2.6. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Image Sensor

- 7.1.2. Lens

- 7.1.3. Camera Module Assembly

- 7.1.4. VCM Suppliers (AF & OIS)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Mobile

- 7.2.2. Consumer Electronics (Excl. Mobile)

- 7.2.3. Automotive

- 7.2.4. Healthcare

- 7.2.5. Security

- 7.2.6. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Image Sensor

- 8.1.2. Lens

- 8.1.3. Camera Module Assembly

- 8.1.4. VCM Suppliers (AF & OIS)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Mobile

- 8.2.2. Consumer Electronics (Excl. Mobile)

- 8.2.3. Automotive

- 8.2.4. Healthcare

- 8.2.5. Security

- 8.2.6. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Image Sensor

- 9.1.2. Lens

- 9.1.3. Camera Module Assembly

- 9.1.4. VCM Suppliers (AF & OIS)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Mobile

- 9.2.2. Consumer Electronics (Excl. Mobile)

- 9.2.3. Automotive

- 9.2.4. Healthcare

- 9.2.5. Security

- 9.2.6. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Image Sensor

- 10.1.2. Lens

- 10.1.3. Camera Module Assembly

- 10.1.4. VCM Suppliers (AF & OIS)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Mobile

- 10.2.2. Consumer Electronics (Excl. Mobile)

- 10.2.3. Automotive

- 10.2.4. Healthcare

- 10.2.5. Security

- 10.2.6. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Image Sensor

- 11.1.2. Lens

- 11.1.3. Camera Module Assembly

- 11.1.4. VCM Suppliers (AF & OIS)

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Mobile

- 11.2.2. Consumer Electronics (Excl. Mobile)

- 11.2.3. Automotive

- 11.2.4. Healthcare

- 11.2.5. Security

- 11.2.6. Industrial

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. North America Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. North America Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United States

- 16.1.2 Canada

- 16.1.3 Mexico

- 17. MEA Camera Module Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 Saudi Arabia

- 17.1.3 South Africa

- 17.1.4 Rest of Middle East and Africa

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Sunny Optical Technology (Group) Company Limited

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Samsung Electro-Mechanics Co Ltd

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 OmniVision Technologies Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Chicony Electronics Co Ltd

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 OFILM Group Co Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 AMS OSRM AG

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 STMicroelectronics NV

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Fujifilm Corporation

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 LG Innotek Co Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Sharp Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Cowell E Holdings Inc

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Sony Group Corporation

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 LuxVisions Innovation Limited (Lite-On Technology Corporation)

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 On Semiconductor (Semiconductor Components Industries LLC)

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Primax Electronics Ltd

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.1 Sunny Optical Technology (Group) Company Limited

List of Figures

- Figure 1: Global Camera Module Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Camera Module Market Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Camera Module Market Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Camera Module Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Camera Module Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Camera Module Market Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe Camera Module Market Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Camera Module Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Camera Module Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Camera Module Market Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Camera Module Market Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Camera Module Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Camera Module Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Camera Module Market Revenue (Million), by Component 2024 & 2032

- Figure 33: Australia and New Zealand Camera Module Market Revenue Share (%), by Component 2024 & 2032

- Figure 34: Australia and New Zealand Camera Module Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Australia and New Zealand Camera Module Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Australia and New Zealand Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Camera Module Market Revenue (Million), by Component 2024 & 2032

- Figure 39: Latin America Camera Module Market Revenue Share (%), by Component 2024 & 2032

- Figure 40: Latin America Camera Module Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Camera Module Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Camera Module Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Camera Module Market Revenue (Million), by Component 2024 & 2032

- Figure 45: Middle East and Africa Camera Module Market Revenue Share (%), by Component 2024 & 2032

- Figure 46: Middle East and Africa Camera Module Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Camera Module Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Camera Module Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Camera Module Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Camera Module Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Camera Module Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Camera Module Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Camera Module Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Camera Module Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Camera Module Market Revenue Million Forecast, by Component 2019 & 2032

- Table 51: Global Camera Module Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Camera Module Market Revenue Million Forecast, by Component 2019 & 2032

- Table 54: Global Camera Module Market Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Camera Module Market Revenue Million Forecast, by Component 2019 & 2032

- Table 57: Global Camera Module Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Camera Module Market Revenue Million Forecast, by Component 2019 & 2032

- Table 60: Global Camera Module Market Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Camera Module Market Revenue Million Forecast, by Component 2019 & 2032

- Table 63: Global Camera Module Market Revenue Million Forecast, by Application 2019 & 2032

- Table 64: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

- Table 65: Global Camera Module Market Revenue Million Forecast, by Component 2019 & 2032

- Table 66: Global Camera Module Market Revenue Million Forecast, by Application 2019 & 2032

- Table 67: Global Camera Module Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Camera Module Market?

The projected CAGR is approximately 4.34%.

2. Which companies are prominent players in the Camera Module Market?

Key companies in the market include Sunny Optical Technology (Group) Company Limited, Samsung Electro-Mechanics Co Ltd, OmniVision Technologies Inc , Chicony Electronics Co Ltd, OFILM Group Co Ltd, AMS OSRM AG, STMicroelectronics NV, Fujifilm Corporation, LG Innotek Co Ltd, Sharp Corporation, Cowell E Holdings Inc, Sony Group Corporation, LuxVisions Innovation Limited (Lite-On Technology Corporation), On Semiconductor (Semiconductor Components Industries LLC), Primax Electronics Ltd.

3. What are the main segments of the Camera Module Market?

The market segments include Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Market Demand for Advanced Driver Assistance Systems in Vehicles; Increased Use of Security Cameras in Households and Commercial Establishments.

6. What are the notable trends driving market growth?

The Mobile Segment is Expected to Hold a Notable Market Share.

7. Are there any restraints impacting market growth?

Complicated Manufacturing and Supply Chain Challenges.

8. Can you provide examples of recent developments in the market?

November 2023: Samsung updated the Camera Assistant module in the Good Lock app, adding new features for the camera on models that run on One UI 5.1 or higher to receive the version 2.0.00.0 update of Camera Assistant. The new feature, Upscale digital zoom, can take a photo with a resolution that decreases because of zoom and upscale it to the key the user previously selected. Another new feature, Distortion Correction, will automatically fix bowing or bending lines caused by the lens and perspective distortion. Users can use the module to modify or turn off some settings that cannot be changed using the regular camera app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Camera Module Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Camera Module Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Camera Module Market?

To stay informed about further developments, trends, and reports in the Camera Module Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence