Key Insights

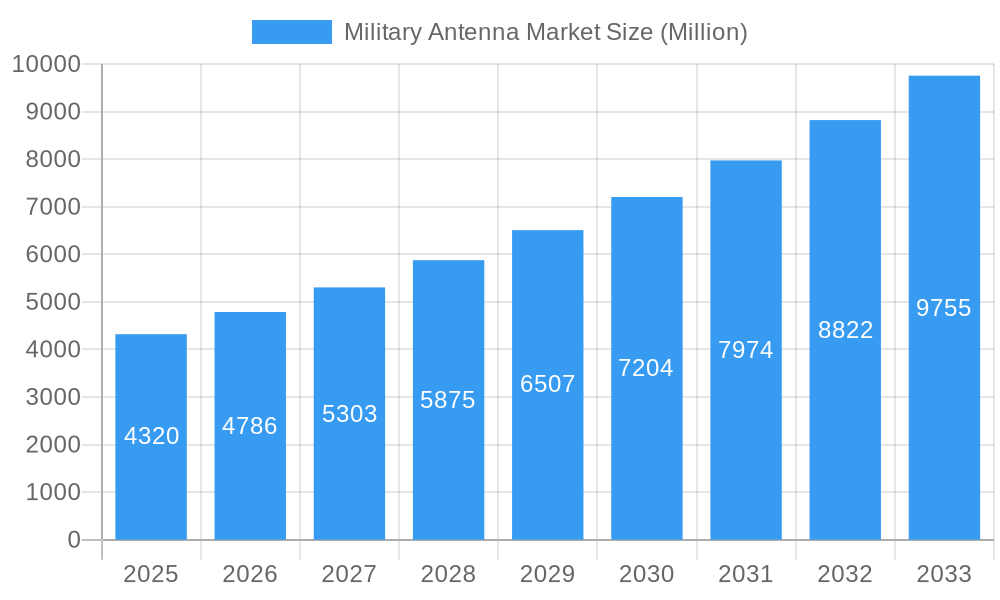

The global Military Antenna Market is poised for substantial expansion, with a projected market size of USD 4.32 billion in 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 10.94% through 2033. This robust growth is fueled by escalating geopolitical tensions, increased defense spending worldwide, and the continuous integration of advanced communication technologies in military operations. The demand for high-performance, resilient, and versatile antennas is paramount for enabling secure and reliable command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) systems. Key drivers include the modernization of legacy military platforms, the development of sophisticated electronic warfare capabilities, and the growing need for interoperability across diverse military branches and allied forces. The increasing adoption of satellite communication for beyond-line-of-sight operations and the deployment of unmanned systems further bolster market expansion.

Military Antenna Market Market Size (In Billion)

The market is characterized by a dynamic evolution of antenna types and frequency bands to meet the demanding requirements of modern warfare. Flat panel antennas are gaining traction due to their low profile, aerodynamic advantages for airborne and maritime platforms, and suitability for mobile ground applications. Similarly, advancements in Ku/Ka and X-band frequencies are enabling higher bandwidth and data transfer rates, crucial for sophisticated surveillance and communication needs. While the market benefits from strong growth drivers, certain restraints, such as the high cost of research and development for cutting-edge antenna technologies and the complex regulatory landscape governing defense procurement, warrant consideration. Nonetheless, the persistent drive for technological superiority and enhanced operational effectiveness in defense sectors worldwide ensures a promising trajectory for the Military Antenna Market in the coming years.

Military Antenna Market Company Market Share

Military Antenna Market: Comprehensive Industry Analysis & Growth Forecast (2019-2033)

This in-depth report provides a definitive analysis of the global Military Antenna Market, offering critical insights into market dynamics, growth trajectories, and competitive landscapes. Covering the historical period of 2019-2024, base year 2025, and a robust forecast period of 2025-2033, this study is indispensable for stakeholders seeking to understand and capitalize on opportunities within this vital sector. With an estimated market size of $xx million in 2025, the report delves into intricate segmentation by frequency band, antenna type, and application, supported by an exhaustive list of key industry players and recent developments.

Military Antenna Market Market Concentration & Innovation

The Military Antenna Market exhibits a moderate level of concentration, characterized by the presence of established defense contractors and a growing number of specialized technology firms. Innovation remains a primary driver, fueled by the relentless pursuit of enhanced communication capabilities, reduced electronic signatures, and increased battlefield awareness. Key innovation drivers include advancements in phased array technology, the integration of artificial intelligence for adaptive antenna performance, and the development of highly resilient antennas capable of operating in contested electromagnetic environments. Regulatory frameworks, particularly those governing defense procurement and spectrum allocation, significantly influence market entry and product development. The market faces limited direct product substitutes due to the unique performance and reliability demands of military applications, though advancements in alternative communication methods could pose indirect challenges. End-user trends lean towards miniaturization, increased bandwidth, multi-band operability, and secure, jam-resistant communication solutions. Mergers and acquisitions (M&A) activity, with an estimated deal value of $xx million in the historical period, has been strategic, focusing on acquiring specialized technologies or expanding market reach. Key players are actively investing in R&D, with an estimated $xx million in R&D expenditure within the historical period, to maintain a competitive edge.

Military Antenna Market Industry Trends & Insights

The Military Antenna Market is poised for significant expansion, driven by escalating geopolitical tensions, the modernization of armed forces globally, and the increasing reliance on networked warfare. The projected Compound Annual Growth Rate (CAGR) for the forecast period is xx%, indicating robust market penetration across various defense applications. A primary growth driver is the continuous demand for advanced communication systems that support persistent surveillance, intelligence, surveillance, and reconnaissance (ISR) operations, and seamless data transfer in real-time. Technological disruptions are primarily centered around the development of electronically steered antennas (ESAs), including flat-panel antennas, which offer superior agility, reduced size, weight, and power (SWaP) characteristics, and conformal integration capabilities compared to traditional parabolic antennas. The increasing adoption of Software-Defined Radios (SDRs) also necessitates compatible, adaptable antenna solutions. Consumer preferences, in this context, are dictated by military end-users demanding highly reliable, secure, and versatile communication platforms that can operate effectively across diverse and challenging operational theaters. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a strong emphasis on meeting stringent military specifications and qualification requirements. The market penetration of advanced antenna technologies is expected to reach xx% by the end of the forecast period, signifying a substantial shift towards next-generation solutions.

Dominant Markets & Segments in Military Antenna Market

The K/KU/KA Band frequency segment is experiencing substantial growth and is anticipated to dominate the Military Antenna Market. This dominance is driven by the increasing utilization of high-frequency satellite communications for rapid data transmission, secure command and control, and advanced ISR capabilities. The inherent wider bandwidths offered by these bands are critical for supporting data-intensive military operations.

- Key Drivers for K/KU/KA Band Dominance:

- High Bandwidth Requirements: Modern military operations necessitate the transmission of vast amounts of data, including high-resolution imagery, video feeds, and complex sensor data, which K/KU/KA bands efficiently support.

- Satellite Constellation Expansion: The proliferation of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellite constellations, such as those from OneWeb and Starlink, are increasingly being leveraged by military forces, requiring antennas optimized for these frequencies.

- Advanced Communication Needs: Applications like high-speed drone connectivity, secure satellite uplinks/downlinks, and beyond-line-of-sight (BLOS) communications are heavily reliant on these frequency bands.

The Flat Panel Antenna type segment is projected to be the fastest-growing and a major contributor to market value. The increasing demand for low-profile, conformal, and electronically steerable antennas is directly fueling the adoption of flat panel designs.

- Key Drivers for Flat Panel Antenna Dominance:

- Reduced SWaP: Flat panel antennas are significantly lighter and more compact than traditional parabolic antennas, making them ideal for integration into airborne platforms, vehicles, and portable equipment.

- Electronically Steered Capabilities: ESAs offer rapid beam steering without mechanical movement, providing agility and quick re-tasking capabilities essential for dynamic military environments.

- Conformal Integration: Their flat design allows for seamless integration into the surfaces of aircraft, vehicles, and ships, minimizing aerodynamic drag and radar cross-section.

- LEO/MEO Satellite Compatibility: Flat panel antennas are inherently well-suited for tracking the rapid movement of satellites in LEO and MEO constellations.

The Airborne application segment is expected to exhibit the highest growth rate within the Military Antenna Market. The evolving nature of aerial warfare, the proliferation of unmanned aerial vehicles (UAVs), and the need for robust in-flight communication and data links are paramount drivers.

- Key Drivers for Airborne Application Dominance:

- UAV Communication: The exponential growth in the deployment of UAVs for surveillance, reconnaissance, and combat missions requires specialized antennas for reliable command, control, and data transmission.

- Network-Centric Warfare: Airborne platforms are critical nodes in modern network-centric warfare, requiring seamless connectivity for real-time data sharing and situational awareness.

- ISR Capabilities: Airborne ISR platforms rely heavily on advanced antenna systems for collecting and transmitting intelligence, surveillance, and reconnaissance data.

- Next-Generation Fighter Jets & Helicopters: Modern military aircraft are increasingly being equipped with advanced integrated communication systems, often featuring flat panel or conformal antennas.

While the K/KU/KA Band, Flat Panel Antenna, and Airborne segments are poised for significant growth, other segments also represent substantial market value. The Space application, for instance, will continue to demand high-performance antennas for satellite communication, earth observation, and space-based ISR. The Maritime sector will see increased adoption of robust, weather-resistant antennas for naval vessels and offshore operations. The Land segment will focus on mobile and tactical communication solutions for ground forces. VHF and UHF Band antennas will remain crucial for tactical battlefield communications, while C Band and X Band will continue to be utilized for specific radar and communication applications. Parabolic Reflector Antennas will persist in applications where high gain and directional accuracy are paramount and SWaP is less critical, such as ground stations.

Military Antenna Market Product Developments

Recent product developments in the Military Antenna Market highlight a strong trend towards enhanced connectivity and adaptability. Kymeta Corporation's June 2023 partnership with OneWeb for its electronically steered Peregrine u8 LEO terminal, now commercially available for the maritime sector, marks a significant advancement in flat panel antenna technology for LEO satellite networks. This innovation provides seamless, high-throughput connectivity for maritime forces. Concurrently, Intellian Technologies' March 2023 announcement of its new Advanced Development Center (ADC) in Maryland, USA, underscores a strategic focus on flat panel antenna and terminal technologies. This expansion signals a commitment to meeting the growing demand for phased array antennas from enterprise, government, and maritime customers, further solidifying the importance of these advanced solutions in the military communications landscape. These developments emphasize miniaturization, ease of deployment, and the ability to leverage emerging satellite constellations.

Report Scope & Segmentation Analysis

This report segmentatively analyzes the Military Antenna Market across several key dimensions to provide a granular understanding of market dynamics and growth potential.

Frequency Band Segmentation: The market is analyzed across C Band, K/KU/KA Band, S and L Band, X Band, VHF and UHF Band, and Other Frequency Bands. Each band caters to specific military communication needs, ranging from tactical radio communications (VHF/UHF) to high-bandwidth satellite links (K/KU/KA). Growth projections and market sizes are detailed for each, considering their unique applications and technological advancements.

Antenna Type Segmentation: The study segments the market by Flat Panel Antenna, Parabolic Reflector Antenna, Horn Antenna, Fiberglass Reinforced Plastic Antenna, Iron Antenna with Mold Stamping, and Other Antenna Types. The rapid adoption of Flat Panel Antennas, driven by their SWaP benefits and ESA capabilities, is a key focus, with detailed analysis of market share and growth drivers for each type, including the continued relevance of Parabolic Reflector Antennas for specific high-gain applications.

Application Segmentation: The market is segmented into Space, Land, Maritime, and Airborne applications. Each application area presents distinct communication challenges and opportunities. The Airborne segment is expected to witness the highest growth, fueled by UAV proliferation and advanced aerial ISR needs. Detailed analysis includes market sizes, growth forecasts, and competitive dynamics specific to each application, highlighting the evolving requirements of modern military operations.

Key Drivers of Military Antenna Market Growth

The Military Antenna Market's growth is propelled by several interconnected factors. Escalating global defense spending, driven by geopolitical uncertainties and the need for modernized military capabilities, is a primary catalyst. The increasing adoption of network-centric warfare doctrines necessitates robust, high-bandwidth communication systems, fostering demand for advanced antennas. Furthermore, the continuous evolution of battlefield technologies, including the widespread deployment of Unmanned Aerial Vehicles (UAVs) and advanced sensor systems, requires sophisticated antenna solutions for data transmission and control. Technological advancements, particularly in phased array technology and electronically steered antennas (ESAs), are also significant drivers, offering improved performance, reduced size, and enhanced adaptability. The integration of artificial intelligence (AI) for adaptive antenna functionality and the development of resilient communication systems capable of operating in contested electromagnetic spectrum environments further contribute to market expansion.

Challenges in the Military Antenna Market Sector

Despite its robust growth prospects, the Military Antenna Market faces several challenges that could impede its full potential. Stringent and lengthy qualification processes for military-grade equipment can delay product introductions and market penetration. High research and development (R&D) costs associated with cutting-edge antenna technologies, coupled with the need for specialized manufacturing capabilities, present significant financial hurdles. Supply chain disruptions, exacerbated by global events and the reliance on specialized components, can impact production timelines and cost-effectiveness. Intense competition from established players and emerging technological innovators necessitates continuous investment in R&D and product differentiation. Furthermore, evolving threat landscapes and the rapid pace of technological change require constant adaptation, making it challenging to maintain a competitive edge.

Emerging Opportunities in Military Antenna Market

The Military Antenna Market presents numerous emerging opportunities driven by technological innovation and evolving defense strategies. The increasing reliance on Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellite constellations for secure, high-bandwidth communication offers a significant opportunity for flat-panel antenna manufacturers. The growing demand for electronic warfare (EW) capabilities and resilient communication systems creates a market for antennas designed for advanced jamming resistance and spectrum awareness. The proliferation of small satellites (smallsats) and cube-sats in military applications opens new avenues for miniaturized and cost-effective antenna solutions. Furthermore, the integration of AI and machine learning into antenna systems for adaptive beamforming, signal optimization, and autonomous operation represents a significant technological frontier. The expansion of military drone programs across all domains (air, land, and sea) continues to drive demand for specialized communication antennas.

Leading Players in the Military Antenna Market Market

- Honeywell International Inc

- Gilat Satellite Networks Ltd

- Airbus DS Government Solutions Inc (Airbus SE)

- Viasat Inc

- L3Harris Technologies Inc

- CPI International Inc

- Kymeta Corporation

- COBHAM LIMITED (AI Convoy (Luxembourg) S a r l)

- Norsat International Inc

- Macdonald Dettwiler and Associates Ltd (Maxar Technologies)

Key Developments in Military Antenna Market Industry

- June 2023: Kymeta announced its partnership with Low Earth Orbit (LEO) satellite communications company OneWeb, launching Kymeta's electronically steered Peregrine u8 LEO terminal. This terminal is now commercially available, becoming the first flat panel antenna to serve the maritime market on OneWeb's LEO network.

- March 2023: Intellian Technologies announced the opening of its new Advanced Development Center (ADC) in Maryland, USA. This center serves as the primary design and engineering hub for Intellian's flat panel antenna and terminal technologies, reflecting growing interest from enterprise, government, and maritime customers for phased array antennas and positioning it for growth.

Strategic Outlook for Military Antenna Market Market

The strategic outlook for the Military Antenna Market remains exceptionally positive, driven by a confluence of factors that underscore its critical importance in modern defense operations. The ongoing global push for military modernization, coupled with increasing geopolitical instability, will continue to fuel substantial investments in advanced communication technologies. The rapid expansion of satellite constellations, particularly LEO and MEO, presents a significant growth catalyst for flat-panel and electronically steered antennas, enabling resilient and high-bandwidth connectivity for a wide range of military applications, from ISR to command and control. Furthermore, the increasing sophistication of electronic warfare capabilities and the need for secure, jam-resistant communications will drive innovation in antenna design and functionality. The proliferation of unmanned systems across all domains will further accelerate the demand for specialized, compact, and highly reliable antenna solutions. Strategic collaborations, focused R&D in areas like AI-driven antenna adaptation, and the development of multi-band, multi-constellation compatible antennas will be key to capturing future market opportunities.

Military Antenna Market Segmentation

-

1. Frequency Band

- 1.1. C Band

- 1.2. K/KU/KA Band

- 1.3. S and L Band

- 1.4. X Band

- 1.5. VHF and UHF Band

- 1.6. Other Frequency Bands

-

2. Antenna Type

- 2.1. Flat Panel Antenna

- 2.2. Parabolic Reflector Antenna

- 2.3. Horn Antenna

- 2.4. Fiberglass Reinforced Plastic Antenna

- 2.5. Iron Antenna with Mold Stamping

- 2.6. Other Antenna Types

-

3. Application

- 3.1. Space

- 3.2. Land

- 3.3. Maritime

- 3.4. Airborne

Military Antenna Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Military Antenna Market Regional Market Share

Geographic Coverage of Military Antenna Market

Military Antenna Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Space Exploration Projects; Increasing Adoption of Small Satellites

- 3.3. Market Restrains

- 3.3.1. Maintenance for Addressing Poor Transmission of Signals

- 3.4. Market Trends

- 3.4.1. Space Application is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Antenna Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Frequency Band

- 5.1.1. C Band

- 5.1.2. K/KU/KA Band

- 5.1.3. S and L Band

- 5.1.4. X Band

- 5.1.5. VHF and UHF Band

- 5.1.6. Other Frequency Bands

- 5.2. Market Analysis, Insights and Forecast - by Antenna Type

- 5.2.1. Flat Panel Antenna

- 5.2.2. Parabolic Reflector Antenna

- 5.2.3. Horn Antenna

- 5.2.4. Fiberglass Reinforced Plastic Antenna

- 5.2.5. Iron Antenna with Mold Stamping

- 5.2.6. Other Antenna Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Space

- 5.3.2. Land

- 5.3.3. Maritime

- 5.3.4. Airborne

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Frequency Band

- 6. North America Military Antenna Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Frequency Band

- 6.1.1. C Band

- 6.1.2. K/KU/KA Band

- 6.1.3. S and L Band

- 6.1.4. X Band

- 6.1.5. VHF and UHF Band

- 6.1.6. Other Frequency Bands

- 6.2. Market Analysis, Insights and Forecast - by Antenna Type

- 6.2.1. Flat Panel Antenna

- 6.2.2. Parabolic Reflector Antenna

- 6.2.3. Horn Antenna

- 6.2.4. Fiberglass Reinforced Plastic Antenna

- 6.2.5. Iron Antenna with Mold Stamping

- 6.2.6. Other Antenna Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Space

- 6.3.2. Land

- 6.3.3. Maritime

- 6.3.4. Airborne

- 6.1. Market Analysis, Insights and Forecast - by Frequency Band

- 7. Europe Military Antenna Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Frequency Band

- 7.1.1. C Band

- 7.1.2. K/KU/KA Band

- 7.1.3. S and L Band

- 7.1.4. X Band

- 7.1.5. VHF and UHF Band

- 7.1.6. Other Frequency Bands

- 7.2. Market Analysis, Insights and Forecast - by Antenna Type

- 7.2.1. Flat Panel Antenna

- 7.2.2. Parabolic Reflector Antenna

- 7.2.3. Horn Antenna

- 7.2.4. Fiberglass Reinforced Plastic Antenna

- 7.2.5. Iron Antenna with Mold Stamping

- 7.2.6. Other Antenna Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Space

- 7.3.2. Land

- 7.3.3. Maritime

- 7.3.4. Airborne

- 7.1. Market Analysis, Insights and Forecast - by Frequency Band

- 8. Asia Pacific Military Antenna Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Frequency Band

- 8.1.1. C Band

- 8.1.2. K/KU/KA Band

- 8.1.3. S and L Band

- 8.1.4. X Band

- 8.1.5. VHF and UHF Band

- 8.1.6. Other Frequency Bands

- 8.2. Market Analysis, Insights and Forecast - by Antenna Type

- 8.2.1. Flat Panel Antenna

- 8.2.2. Parabolic Reflector Antenna

- 8.2.3. Horn Antenna

- 8.2.4. Fiberglass Reinforced Plastic Antenna

- 8.2.5. Iron Antenna with Mold Stamping

- 8.2.6. Other Antenna Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Space

- 8.3.2. Land

- 8.3.3. Maritime

- 8.3.4. Airborne

- 8.1. Market Analysis, Insights and Forecast - by Frequency Band

- 9. Rest of the World Military Antenna Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Frequency Band

- 9.1.1. C Band

- 9.1.2. K/KU/KA Band

- 9.1.3. S and L Band

- 9.1.4. X Band

- 9.1.5. VHF and UHF Band

- 9.1.6. Other Frequency Bands

- 9.2. Market Analysis, Insights and Forecast - by Antenna Type

- 9.2.1. Flat Panel Antenna

- 9.2.2. Parabolic Reflector Antenna

- 9.2.3. Horn Antenna

- 9.2.4. Fiberglass Reinforced Plastic Antenna

- 9.2.5. Iron Antenna with Mold Stamping

- 9.2.6. Other Antenna Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Space

- 9.3.2. Land

- 9.3.3. Maritime

- 9.3.4. Airborne

- 9.1. Market Analysis, Insights and Forecast - by Frequency Band

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Gilat Satellite Networks Lt

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Airbus DS Government Solutions Inc (Airbus SE)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Viasat Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 L3harris Technologies Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CPI International Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kymeta Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 COBHAM LIMITED (AI Convoy (Luxembourg) S a r l )

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Norsat International Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Macdonald Dettwiler and Associates Ltd (Maxar Technologies)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Military Antenna Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Military Antenna Market Revenue (Million), by Frequency Band 2025 & 2033

- Figure 3: North America Military Antenna Market Revenue Share (%), by Frequency Band 2025 & 2033

- Figure 4: North America Military Antenna Market Revenue (Million), by Antenna Type 2025 & 2033

- Figure 5: North America Military Antenna Market Revenue Share (%), by Antenna Type 2025 & 2033

- Figure 6: North America Military Antenna Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Military Antenna Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Military Antenna Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Military Antenna Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Military Antenna Market Revenue (Million), by Frequency Band 2025 & 2033

- Figure 11: Europe Military Antenna Market Revenue Share (%), by Frequency Band 2025 & 2033

- Figure 12: Europe Military Antenna Market Revenue (Million), by Antenna Type 2025 & 2033

- Figure 13: Europe Military Antenna Market Revenue Share (%), by Antenna Type 2025 & 2033

- Figure 14: Europe Military Antenna Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Military Antenna Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Military Antenna Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Military Antenna Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Military Antenna Market Revenue (Million), by Frequency Band 2025 & 2033

- Figure 19: Asia Pacific Military Antenna Market Revenue Share (%), by Frequency Band 2025 & 2033

- Figure 20: Asia Pacific Military Antenna Market Revenue (Million), by Antenna Type 2025 & 2033

- Figure 21: Asia Pacific Military Antenna Market Revenue Share (%), by Antenna Type 2025 & 2033

- Figure 22: Asia Pacific Military Antenna Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Military Antenna Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Military Antenna Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Military Antenna Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Military Antenna Market Revenue (Million), by Frequency Band 2025 & 2033

- Figure 27: Rest of the World Military Antenna Market Revenue Share (%), by Frequency Band 2025 & 2033

- Figure 28: Rest of the World Military Antenna Market Revenue (Million), by Antenna Type 2025 & 2033

- Figure 29: Rest of the World Military Antenna Market Revenue Share (%), by Antenna Type 2025 & 2033

- Figure 30: Rest of the World Military Antenna Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest of the World Military Antenna Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Military Antenna Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Military Antenna Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Military Antenna Market Revenue Million Forecast, by Frequency Band 2020 & 2033

- Table 2: Global Military Antenna Market Revenue Million Forecast, by Antenna Type 2020 & 2033

- Table 3: Global Military Antenna Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Military Antenna Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Military Antenna Market Revenue Million Forecast, by Frequency Band 2020 & 2033

- Table 6: Global Military Antenna Market Revenue Million Forecast, by Antenna Type 2020 & 2033

- Table 7: Global Military Antenna Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Military Antenna Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Military Antenna Market Revenue Million Forecast, by Frequency Band 2020 & 2033

- Table 12: Global Military Antenna Market Revenue Million Forecast, by Antenna Type 2020 & 2033

- Table 13: Global Military Antenna Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Military Antenna Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Military Antenna Market Revenue Million Forecast, by Frequency Band 2020 & 2033

- Table 20: Global Military Antenna Market Revenue Million Forecast, by Antenna Type 2020 & 2033

- Table 21: Global Military Antenna Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Military Antenna Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Military Antenna Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Military Antenna Market Revenue Million Forecast, by Frequency Band 2020 & 2033

- Table 29: Global Military Antenna Market Revenue Million Forecast, by Antenna Type 2020 & 2033

- Table 30: Global Military Antenna Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Military Antenna Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Antenna Market?

The projected CAGR is approximately 10.94%.

2. Which companies are prominent players in the Military Antenna Market?

Key companies in the market include Honeywell International Inc, Gilat Satellite Networks Lt, Airbus DS Government Solutions Inc (Airbus SE), Viasat Inc, L3harris Technologies Inc, CPI International Inc, Kymeta Corporation, COBHAM LIMITED (AI Convoy (Luxembourg) S a r l ), Norsat International Inc, Macdonald Dettwiler and Associates Ltd (Maxar Technologies).

3. What are the main segments of the Military Antenna Market?

The market segments include Frequency Band, Antenna Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Space Exploration Projects; Increasing Adoption of Small Satellites.

6. What are the notable trends driving market growth?

Space Application is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Maintenance for Addressing Poor Transmission of Signals.

8. Can you provide examples of recent developments in the market?

June 2023: Kymeta announced its partnership with low Earth orbit (LEO) satellite communications company OneWeb launch of Kymeta's electronically steered Peregrine u8 LEO terminal, which is now commercially available, becoming the first flat panel antenna to serve the maritime market on OneWeb's LEO network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Antenna Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Antenna Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Antenna Market?

To stay informed about further developments, trends, and reports in the Military Antenna Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence