Key Insights

The global Mass Transit Security market is projected for substantial growth, expected to reach USD 46.13 billion by 2025, expanding at a CAGR of 6.2% through 2033. This expansion is driven by the critical need to enhance passenger safety and operational efficiency across public transportation networks. Key market drivers include an increase in security threats and the demand for advanced surveillance and threat detection technologies. Government initiatives and investments in upgrading security infrastructure, including video surveillance, passenger and baggage screening, and cargo inspection, further bolster market trajectory. Innovations in AI and machine learning are pivotal for predictive threat analysis and real-time response.

Mass Transit Security Market Market Size (In Billion)

The market is segmented by transportation modes, with Roadways and Airways anticipated to lead due to their extensive use and associated security challenges. Application segments like Video Surveillance and Passenger & Baggage Screening are expected to dominate, addressing the immediate need for visible security and efficient passenger management. Geographically, the Asia Pacific region, fueled by rapid urbanization and increasing passenger volumes in countries such as China, Japan, and India, is poised for the fastest growth. North America and Europe, with established infrastructure and stringent regulations, will remain significant markets. High initial investment costs and data privacy concerns may present challenges, but the fundamental requirement for secure public spaces will ensure sustained market momentum.

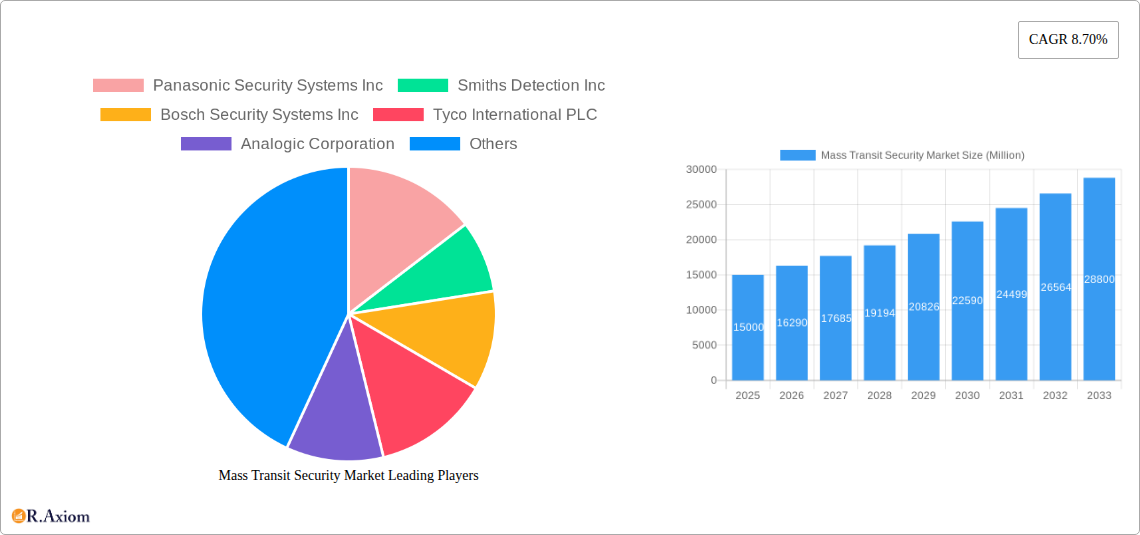

Mass Transit Security Market Company Market Share

This comprehensive report delivers in-depth analysis and strategic intelligence on the global Mass Transit Security market. It covers the historical period (2019-2024) and forecasts growth through 2033, using 2025 as the base year. The market is characterized by a robust CAGR of 6.2% and is projected to reach USD 46.13 billion by 2025, up from an estimated USD 46.13 billion in 2025.

Mass Transit Security Market Market Concentration & Innovation

The Mass Transit Security Market exhibits a moderate to high concentration, with key players actively driving innovation to meet escalating security demands. Major companies like Panasonic Security Systems Inc, Smiths Detection Inc, and Bosch Security Systems Inc are investing heavily in research and development for advanced solutions. Innovation is primarily fueled by the need for sophisticated threat detection, real-time monitoring, and seamless integration of disparate security systems. Regulatory frameworks, such as enhanced passenger screening mandates and critical infrastructure protection guidelines, are significant drivers. Product substitutes are limited due to the specialized nature of transit security, but advancements in AI-powered analytics and drone surveillance present potential disruptive forces. End-user trends favor integrated, intelligent, and user-friendly security platforms that minimize operational disruption while maximizing safety. Mergers and acquisitions (M&A) are prevalent, with notable deals in the historical period exceeding USD 500 Million, indicating consolidation and strategic expansion.

Mass Transit Security Market Industry Trends & Insights

The Mass Transit Security Market is experiencing dynamic growth driven by a confluence of factors aimed at enhancing passenger safety and operational efficiency. The increasing frequency and sophistication of security threats globally have made robust security measures in public transportation systems an absolute necessity. This has led to substantial government investments and mandates for advanced security technologies across all modes of transit. Technological disruptions are rapidly reshaping the market, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) into video surveillance and threat detection systems becoming a dominant trend. These technologies enable predictive analytics, anomaly detection, and automated responses, significantly augmenting human capabilities. The adoption of Internet of Things (IoT) devices further facilitates the creation of interconnected security networks, allowing for real-time data sharing and centralized monitoring. Consumer preferences are increasingly leaning towards secure and reliable transit experiences, pushing operators to prioritize visible security measures and efficient passenger flow management. Competitive dynamics are characterized by fierce innovation, strategic partnerships, and a focus on providing end-to-end security solutions. Companies are differentiating themselves through specialized offerings, such as advanced baggage screening technologies, intelligent video analytics, and robust access control systems. The market penetration of integrated security solutions is steadily increasing, reflecting a move away from fragmented systems towards holistic security management. This continuous evolution ensures that the Mass Transit Security Market remains a vital and growing sector.

Dominant Markets & Segments in Mass Transit Security Market

The Mass Transit Security Market is heavily influenced by regional geopolitical factors and the specific security needs of different transportation modes.

Dominant Region: North America and Europe currently dominate the market due to stringent security regulations, high public transit ridership, and significant investments in modernizing security infrastructure. The presence of leading global security solution providers in these regions further bolsters their market share.

Dominant Transportation Segment: Railways represent a significant segment, driven by the need to secure extensive networks, high passenger volumes, and the vulnerability of train infrastructure to threats. The increasing focus on metro and high-speed rail security globally contributes to this dominance.

- Key Drivers for Railways:

- High passenger density and potential for mass casualty events.

- Vast and often exposed infrastructure requiring continuous monitoring.

- Government mandates for enhanced rail security protocols.

- Integration of smart technologies for real-time threat detection.

- Key Drivers for Railways:

Dominant Application Segment: Video Surveillance is the most prominent application, encompassing a wide range of functionalities from real-time monitoring and incident recording to facial recognition and behavioral analysis. The falling costs and increasing sophistication of video surveillance technologies have made them indispensable.

Key Drivers for Video Surveillance:

- Deterrent effect on criminal activity and terrorism.

- Evidence gathering for investigations and prosecutions.

- Real-time situational awareness for security personnel.

- Integration with AI for advanced threat detection and anomaly identification.

Passenger & Baggage Screening System: This segment is crucial for preventing the introduction of dangerous items into transit systems. Advanced X-ray scanners, explosive detection systems (EDS), and walk-through metal detectors are increasingly deployed.

Cargo Inspection System: With the rise of integrated logistics and freight movement via transit networks, the need for secure cargo inspection is growing, particularly for high-value or sensitive shipments.

Perimeter Intrusion Detection: Protecting critical transit infrastructure, such as stations, depots, and tracks, from unauthorized access is paramount, driving demand for sophisticated perimeter security solutions.

Fire Safety & Detection System: Ensuring the safety of passengers and assets in the event of a fire is a fundamental security requirement, leading to the widespread adoption of advanced fire detection and suppression systems.

Tracking and Navigation: While primarily operational, integrated tracking and navigation systems enhance security by providing real-time location data of vehicles and personnel, aiding in emergency response and route security.

Other Applications: This includes access control systems, communication systems, and cybersecurity solutions tailored for transit networks.

The interplay of these segments, driven by ongoing technological advancements and evolving security threats, dictates the overall market trajectory.

Mass Transit Security Market Product Developments

Recent product developments in the Mass Transit Security Market focus on enhanced intelligence, automation, and integration. Innovations in AI-powered video analytics are enabling predictive threat identification and anomaly detection, moving beyond simple surveillance. Advanced sensor technologies for passenger and baggage screening are improving detection rates for explosives and prohibited items with faster throughput. Furthermore, the development of integrated security platforms allows for seamless data flow between different systems, providing a unified view of the security landscape. These advancements offer significant competitive advantages by increasing operational efficiency, reducing false alarms, and improving overall passenger safety.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Mass Transit Security Market across key transportation modes and application areas.

Airways: This segment includes security solutions for airports, air traffic control, and passenger screening, with a projected market size of USD 4,500 Million by 2033. Growth is driven by stringent aviation security regulations and the constant threat of terrorism.

Waterways: Focusing on port security, maritime transit, and ferry terminals, this segment is estimated to reach USD 1,800 Million by 2033. Growth is attributed to the increasing volume of global trade and the need to secure critical maritime choke points.

Railways: This is a significant segment, covering metro systems, high-speed rail, and conventional train networks. The projected market size is USD 7,200 Million by 2033, fueled by high passenger volumes and the need for comprehensive security.

Roadways: This segment encompasses bus terminals, public road transport, and associated infrastructure security, estimated at USD 1,500 Million by 2033. Growth is influenced by the widespread use of public road transport and the need for localized security solutions.

Video Surveillance: This application is projected to reach USD 6,500 Million by 2033, driven by its versatility in monitoring, incident response, and advanced analytics.

Passenger & Baggage Screening system: This vital application is expected to grow to USD 4,200 Million by 2033, essential for preventing threats at entry points.

Cargo Inspection System: Expected to reach USD 2,800 Million by 2033, this segment is growing with the integration of freight into public transit.

Perimeter Intrusion Detection: This segment is forecast to reach USD 1,900 Million by 2033, crucial for protecting fixed transit infrastructure.

Fire Safety & Detection System: Projected at USD 1,300 Million by 2033, ensuring basic safety and asset protection.

Tracking and Navigation: Estimated at USD 1,000 Million by 2033, enhancing operational awareness and response capabilities.

Other Applications: This segment, including access control and cybersecurity, is expected to reach USD 1,800 Million by 2033.

Key Drivers of Mass Transit Security Market Growth

The Mass Transit Security Market is propelled by a combination of critical factors. Escalating global security concerns, including terrorism and crime, necessitate enhanced protective measures for public transportation systems. Government mandates and regulations, such as increased passenger screening and infrastructure protection, are significant catalysts. Technological advancements in areas like AI-powered video analytics, advanced threat detection, and integrated security platforms are enabling more effective and efficient security solutions. Furthermore, the substantial increase in public transit ridership worldwide, particularly in emerging economies, creates a larger user base requiring comprehensive security. The ongoing modernization of transit infrastructure also presents opportunities for deploying state-of-the-art security systems.

Challenges in the Mass Transit Security Market Sector

Despite robust growth, the Mass Transit Security Market faces several challenges. High implementation and maintenance costs of advanced security technologies can be a significant barrier for some transit authorities, especially in budget-constrained regions. Integrating disparate legacy systems with new technologies can lead to interoperability issues and operational complexities. Regulatory compliance across different jurisdictions can also be challenging, requiring tailored solutions. The rapid pace of technological evolution necessitates continuous upgrades, adding to the overall cost burden. Lastly, ensuring data privacy and security for the vast amounts of information collected by surveillance and screening systems is a growing concern.

Emerging Opportunities in Mass Transit Security Market

Emerging opportunities in the Mass Transit Security Market are driven by innovation and evolving threat landscapes. The integration of biometric authentication for passenger identification and access control presents a significant growth area. The development and deployment of predictive analytics powered by AI and machine learning to proactively identify potential threats are highly sought after. The expansion of drone surveillance for monitoring large transit areas and detecting anomalies offers a new dimension to security. Furthermore, the increasing focus on cybersecurity for transit networks, to protect against cyber-attacks on operational technology, opens up new avenues for specialized security providers. The growing demand for sustainable and energy-efficient security solutions also presents an emerging niche.

Leading Players in the Mass Transit Security Market Market

- Panasonic Security Systems Inc

- Smiths Detection Inc

- Bosch Security Systems Inc

- Tyco International PLC

- Analogic Corporation

- Security Electronic Equipment Co Ltd

- Rapiscan Systems

- OSI Systems Inc

- Nice Systems Inc

- Axis Communications AB

- IndigoVision Group PLC

- L-3 Communications Holdings Inc

- Nuctech Company Limited

Key Developments in Mass Transit Security Market Industry

- 2023: Launch of next-generation AI-powered video analytics platforms by several key players, enhancing threat detection capabilities.

- 2023: Increased adoption of touchless screening technologies for passenger and baggage screening in response to public health concerns.

- 2022: Major M&A activities within the market, with companies consolidating to offer end-to-end security solutions.

- 2021: Significant investment in cybersecurity solutions for transit networks due to rising cyber threats.

- 2020: Introduction of advanced sensor technologies for improved detection of chemical, biological, and radiological threats in transit.

Strategic Outlook for Mass Transit Security Market Market

The strategic outlook for the Mass Transit Security Market is overwhelmingly positive, driven by an unyielding demand for enhanced safety and security in public transportation. The increasing integration of cutting-edge technologies like AI, IoT, and advanced analytics will be central to future growth, offering more predictive and proactive security measures. Strategic partnerships and mergers will continue to shape the competitive landscape, favoring companies that can provide comprehensive, end-to-end security solutions. Furthermore, a growing emphasis on user experience and operational efficiency will encourage the development of intelligent, less intrusive security systems. The market is poised for sustained expansion as governments and transit operators prioritize the safety of millions of daily commuters.

Mass Transit Security Market Segmentation

-

1. Transportation

- 1.1. Airways

- 1.2. Waterways

- 1.3. Railways

- 1.4. Roadways

-

2. Application

- 2.1. Video Surveillance

- 2.2. Passenger & Baggage Screening system

- 2.3. Cargo Inspection System

- 2.4. Perimeter Intrusion Detection

- 2.5. Fire Safety & Detection System

- 2.6. Tracking and Navigation

- 2.7. Other Applications

Mass Transit Security Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East

Mass Transit Security Market Regional Market Share

Geographic Coverage of Mass Transit Security Market

Mass Transit Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Constant Need for Public Safety Solutions; Massive Transportation Infrastructural Development; Ongoing Adoption of Smart Transportation

- 3.3. Market Restrains

- 3.3.1. ; High Intial Investment and Infrastructure Cost

- 3.4. Market Trends

- 3.4.1. Increase in Air Traffic is Anticipated to Generate Demand in Airways Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mass Transit Security Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Airways

- 5.1.2. Waterways

- 5.1.3. Railways

- 5.1.4. Roadways

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Video Surveillance

- 5.2.2. Passenger & Baggage Screening system

- 5.2.3. Cargo Inspection System

- 5.2.4. Perimeter Intrusion Detection

- 5.2.5. Fire Safety & Detection System

- 5.2.6. Tracking and Navigation

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. North America Mass Transit Security Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transportation

- 6.1.1. Airways

- 6.1.2. Waterways

- 6.1.3. Railways

- 6.1.4. Roadways

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Video Surveillance

- 6.2.2. Passenger & Baggage Screening system

- 6.2.3. Cargo Inspection System

- 6.2.4. Perimeter Intrusion Detection

- 6.2.5. Fire Safety & Detection System

- 6.2.6. Tracking and Navigation

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Transportation

- 7. Europe Mass Transit Security Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transportation

- 7.1.1. Airways

- 7.1.2. Waterways

- 7.1.3. Railways

- 7.1.4. Roadways

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Video Surveillance

- 7.2.2. Passenger & Baggage Screening system

- 7.2.3. Cargo Inspection System

- 7.2.4. Perimeter Intrusion Detection

- 7.2.5. Fire Safety & Detection System

- 7.2.6. Tracking and Navigation

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Transportation

- 8. Asia Pacific Mass Transit Security Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transportation

- 8.1.1. Airways

- 8.1.2. Waterways

- 8.1.3. Railways

- 8.1.4. Roadways

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Video Surveillance

- 8.2.2. Passenger & Baggage Screening system

- 8.2.3. Cargo Inspection System

- 8.2.4. Perimeter Intrusion Detection

- 8.2.5. Fire Safety & Detection System

- 8.2.6. Tracking and Navigation

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Transportation

- 9. Latin America Mass Transit Security Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transportation

- 9.1.1. Airways

- 9.1.2. Waterways

- 9.1.3. Railways

- 9.1.4. Roadways

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Video Surveillance

- 9.2.2. Passenger & Baggage Screening system

- 9.2.3. Cargo Inspection System

- 9.2.4. Perimeter Intrusion Detection

- 9.2.5. Fire Safety & Detection System

- 9.2.6. Tracking and Navigation

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Transportation

- 10. Middle East Mass Transit Security Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Transportation

- 10.1.1. Airways

- 10.1.2. Waterways

- 10.1.3. Railways

- 10.1.4. Roadways

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Video Surveillance

- 10.2.2. Passenger & Baggage Screening system

- 10.2.3. Cargo Inspection System

- 10.2.4. Perimeter Intrusion Detection

- 10.2.5. Fire Safety & Detection System

- 10.2.6. Tracking and Navigation

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Transportation

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Panasonic Security Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Smiths Detection Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bosch Security Systems Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tyco International PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Analogic Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Security Electronic Equipment Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rapiscan Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OSI Systems Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nice Systems Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Axis Communications AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IndigoVision Group PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 L-3 Communications Holdings Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nuctech Company Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Panasonic Security Systems Inc

List of Figures

- Figure 1: Global Mass Transit Security Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Mass Transit Security Market Revenue (billion), by Transportation 2025 & 2033

- Figure 3: North America Mass Transit Security Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 4: North America Mass Transit Security Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Mass Transit Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Mass Transit Security Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Mass Transit Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Mass Transit Security Market Revenue (billion), by Transportation 2025 & 2033

- Figure 9: Europe Mass Transit Security Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 10: Europe Mass Transit Security Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Mass Transit Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Mass Transit Security Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Mass Transit Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Mass Transit Security Market Revenue (billion), by Transportation 2025 & 2033

- Figure 15: Asia Pacific Mass Transit Security Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 16: Asia Pacific Mass Transit Security Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Mass Transit Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Mass Transit Security Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Mass Transit Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Mass Transit Security Market Revenue (billion), by Transportation 2025 & 2033

- Figure 21: Latin America Mass Transit Security Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 22: Latin America Mass Transit Security Market Revenue (billion), by Application 2025 & 2033

- Figure 23: Latin America Mass Transit Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Mass Transit Security Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Mass Transit Security Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Mass Transit Security Market Revenue (billion), by Transportation 2025 & 2033

- Figure 27: Middle East Mass Transit Security Market Revenue Share (%), by Transportation 2025 & 2033

- Figure 28: Middle East Mass Transit Security Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East Mass Transit Security Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East Mass Transit Security Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Mass Transit Security Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Mass Transit Security Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 2: Global Mass Transit Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Mass Transit Security Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Mass Transit Security Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 5: Global Mass Transit Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Mass Transit Security Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: US Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Mass Transit Security Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 10: Global Mass Transit Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Mass Transit Security Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Germany Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: UK Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Mass Transit Security Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 17: Global Mass Transit Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 18: Global Mass Transit Security Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: China Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Japan Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: India Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Mass Transit Security Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Mass Transit Security Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 24: Global Mass Transit Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 25: Global Mass Transit Security Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Mass Transit Security Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 27: Global Mass Transit Security Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global Mass Transit Security Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mass Transit Security Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Mass Transit Security Market?

Key companies in the market include Panasonic Security Systems Inc, Smiths Detection Inc, Bosch Security Systems Inc, Tyco International PLC, Analogic Corporation, Security Electronic Equipment Co Ltd, Rapiscan Systems, OSI Systems Inc, Nice Systems Inc *List Not Exhaustive, Axis Communications AB, IndigoVision Group PLC, L-3 Communications Holdings Inc, Nuctech Company Limited.

3. What are the main segments of the Mass Transit Security Market?

The market segments include Transportation, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.13 billion as of 2022.

5. What are some drivers contributing to market growth?

; Constant Need for Public Safety Solutions; Massive Transportation Infrastructural Development; Ongoing Adoption of Smart Transportation.

6. What are the notable trends driving market growth?

Increase in Air Traffic is Anticipated to Generate Demand in Airways Segment.

7. Are there any restraints impacting market growth?

; High Intial Investment and Infrastructure Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mass Transit Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mass Transit Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mass Transit Security Market?

To stay informed about further developments, trends, and reports in the Mass Transit Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence