Key Insights

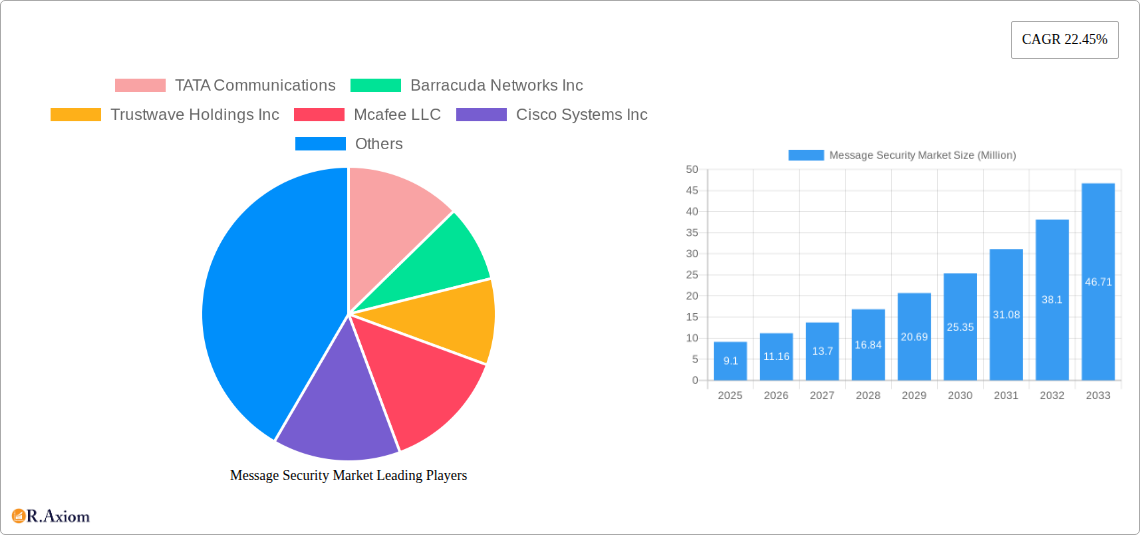

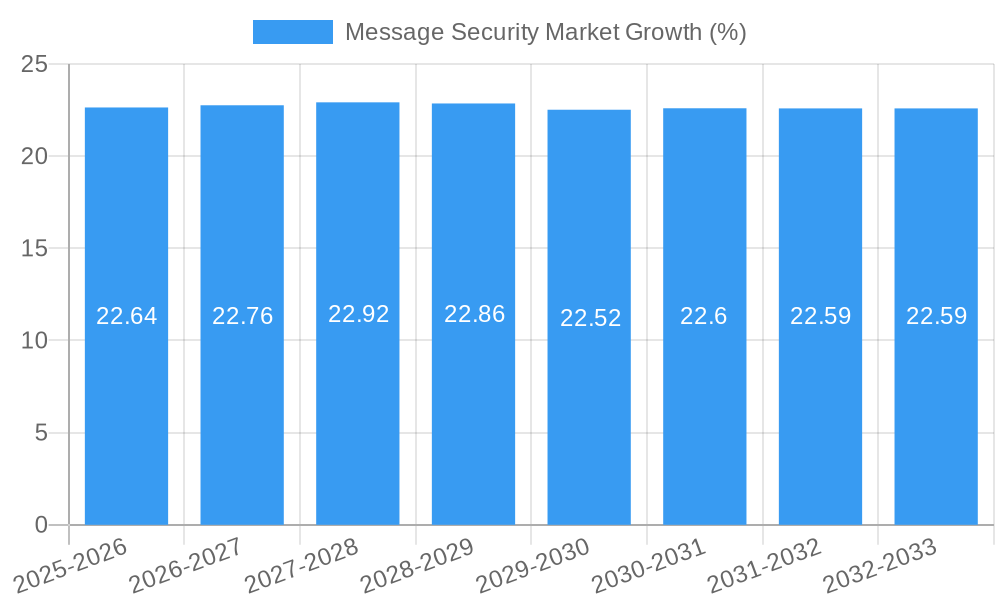

The global Message Security Market is poised for remarkable expansion, projected to reach USD 9.10 million by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 22.45% through to 2033. This significant surge is primarily propelled by the escalating volume and sophistication of cyber threats targeting communication channels, including email and SMS. Organizations across all sectors are recognizing the critical need to safeguard sensitive information and maintain operational integrity against phishing, malware, and data breaches. The widespread adoption of cloud-based solutions is a major catalyst, offering scalability, flexibility, and cost-effectiveness compared to traditional on-premise deployments. This shift is democratizing access to advanced message security for businesses of all sizes, fostering a more secure digital communication landscape.

Key growth drivers include the increasing regulatory compliance requirements worldwide, compelling businesses to invest in robust data protection measures. The burgeoning e-commerce sector, alongside the critical BFSI, healthcare, and government industries, are significant adopters of advanced message security solutions due to the sensitive nature of the data they handle. Emerging trends such as the integration of AI and machine learning for proactive threat detection, enhanced user authentication, and the growing demand for secure collaboration tools are further fueling market momentum. However, challenges such as the high cost of implementation for some advanced solutions and the persistent shortage of skilled cybersecurity professionals may pose moderate restraints to the market's rapid ascent, requiring strategic investment in talent development and accessible technology.

This in-depth report provides a detailed analysis of the global message security market, offering critical insights into its current landscape, future trajectory, and competitive dynamics. Covering the period from 2019 to 2033, with a base year of 2025, this research is essential for stakeholders seeking to understand market growth drivers, technological innovations, regulatory influences, and emerging opportunities within this vital cybersecurity sector.

Message Security Market Market Concentration & Innovation

The message security market exhibits a moderate level of concentration, with a few key players holding significant market share while a broader ecosystem of emerging companies contributes to rapid innovation. Driven by escalating cyber threats and the increasing sophistication of attack vectors targeting communication channels, innovation in this sector is primarily focused on advanced threat detection, artificial intelligence (AI) and machine learning (ML) for predictive analysis, and robust encryption protocols. Regulatory frameworks, such as GDPR and CCPA, are increasingly stringent, pushing companies to adopt comprehensive message security solutions to ensure compliance and data privacy, thereby acting as a significant innovation catalyst. Product substitutes, while present in the form of basic email filters, lack the comprehensive protection offered by dedicated message security solutions, highlighting the market's distinct value proposition. End-user trends reveal a growing demand for unified security platforms that integrate message security with broader cybersecurity strategies. Mergers and acquisitions (M&A) activity is expected to remain robust, with an estimated M&A deal value of over $10 Billion in the historical period (2019-2024) as larger players seek to acquire innovative technologies and expand their market reach. Companies like TATA Communications, Barracuda Networks Inc, and Proofpoint Inc. are at the forefront of this consolidation and innovation drive.

Message Security Market Industry Trends & Insights

The global message security market is poised for substantial growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period (2025–2033). This robust expansion is underpinned by several key trends. The escalating volume and complexity of cyberattacks, including phishing, ransomware, and business email compromise (BEC), are compelling organizations across all sectors to invest heavily in advanced message security solutions. The increasing adoption of cloud-based services and remote work models has expanded the attack surface, making secure communication channels paramount. Furthermore, stringent data privacy regulations worldwide are compelling businesses to implement comprehensive security measures to protect sensitive information transmitted via email, SMS, and other messaging platforms.

Technological advancements are continuously shaping the market. The integration of AI and ML algorithms is enabling message security platforms to better identify and neutralize sophisticated threats in real-time, moving beyond signature-based detection to behavioral analysis. Zero-trust architectures are also gaining traction, demanding granular control and continuous verification of message access and content. Consumer preferences are shifting towards solutions that offer seamless integration, ease of use, and comprehensive protection without compromising user experience. The competitive dynamics are intensifying, with established players like Cisco Systems Inc., Microsoft Corporation, and Trend Micro Incorporated investing heavily in R&D to maintain their market leadership, while agile startups are introducing disruptive technologies. Market penetration is estimated to reach over 70% of enterprises by 2033, indicating a strong demand for these critical security services.

Dominant Markets & Segments in Message Security Market

The message security market is characterized by significant dominance across various segments, driven by distinct economic, technological, and regulatory factors.

Deployment Type: The Cloud segment is currently the dominant deployment type, accounting for an estimated 75% of the market share in 2025. This dominance is fueled by the scalability, flexibility, and cost-effectiveness of cloud-based solutions, which are particularly attractive to small and medium-sized enterprises (SMEs) and rapidly growing organizations. The ease of deployment and maintenance offered by cloud platforms aligns with the increasing trend of digital transformation and the adoption of Software-as-a-Service (SaaS) models. On-premise solutions, while still relevant for organizations with specific security and compliance requirements, represent a smaller but stable segment.

Type: Email security is the largest and most critical segment within the message security market, holding an estimated 80% of the market share in 2025. Email remains a primary communication channel for businesses and a common vector for cyberattacks. Consequently, the demand for robust email security solutions, including anti-spam, anti-phishing, malware protection, and data loss prevention (DLP) capabilities, is exceptionally high. SMS security is an emerging segment with growing importance due to the rise of mobile communication and the associated threats, such as smishing.

End User Industry: The BFSI (Banking, Financial Services, and Insurance) sector is a dominant end-user industry, representing approximately 30% of the market share in 2025. This dominance stems from the highly sensitive nature of financial data handled by these institutions, making them prime targets for cybercriminals. Stringent regulatory compliance mandates and the imperative to protect customer trust drive substantial investments in advanced message security.

- Key Drivers for BFSI Dominance:

- High volume of sensitive financial transactions.

- Strict regulatory compliance requirements (e.g., PCI DSS, SOX).

- Reputational risk associated with data breaches.

- The Government sector also represents a significant segment, driven by national security concerns and the need to protect critical infrastructure and sensitive citizen data.

- Healthcare is another crucial segment due to the protected health information (PHI) transmitted daily, necessitating robust HIPAA compliance and data security.

- Retail and E-commerce sectors are increasingly investing in message security to protect customer data and prevent fraudulent transactions.

- Manufacturing, Media and Entertainment, and Education sectors are also substantial contributors, each with unique security needs driven by the nature of their operations and the data they handle.

- Key Drivers for BFSI Dominance:

Message Security Market Product Developments

Recent product developments in the message security market are characterized by a strong emphasis on AI-driven threat intelligence and unified security platforms. Companies are enhancing their offerings with advanced features like behavioral analysis, natural language processing (NLP) for detecting nuanced phishing attempts, and automated response capabilities. The integration of message security into broader cybersecurity ecosystems, providing a consolidated view of threats and risks, is a key trend. These innovations aim to deliver proactive defense against evolving cyber threats, improve detection rates, and reduce the time to respond to security incidents, thereby offering customers enhanced protection and operational efficiency.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Message Security Market across several key segments to provide a granular understanding of market dynamics and growth opportunities. The Deployment Type segmentation includes Cloud and On-Premise solutions, examining the distinct adoption rates and market drivers for each. The Type segmentation delves into Email security and SMS security, highlighting the paramount importance of email protection and the growing significance of mobile messaging security. Furthermore, the End User Industry segmentation provides in-depth analysis across BFSI, Government, Healthcare, Media and Entertainment, Retail and E-commerce, Manufacturing, Education, and Other End User Industries. Each segment is assessed for its current market size, projected growth rates, and the specific competitive dynamics influencing its evolution.

Key Drivers of Message Security Market Growth

The message security market is experiencing robust growth driven by several interconnected factors. The persistent and evolving nature of cyber threats, including sophisticated phishing attacks, ransomware, and business email compromise (BEC), is compelling organizations to prioritize advanced security measures. The widespread adoption of cloud computing and remote work models has expanded the digital attack surface, necessitating comprehensive security for all communication channels. Regulatory mandates, such as GDPR and CCPA, imposing strict data protection and privacy requirements, further fuel demand for robust message security solutions. Technological advancements, particularly in AI and machine learning for predictive threat detection, are enabling more effective and proactive security, driving market expansion.

Challenges in the Message Security Market Sector

Despite the strong growth, the message security market faces several challenges. The rapidly evolving threat landscape requires continuous investment in research and development to keep pace with sophisticated attack techniques, posing a significant financial burden. The complexity of integrating new security solutions with existing IT infrastructure can be a barrier for some organizations. Ensuring compliance with a patchwork of global data privacy regulations adds complexity and cost for vendors and users alike. Furthermore, the cybersecurity talent shortage makes it difficult for organizations to effectively manage and deploy advanced security solutions, impacting overall market adoption and efficacy.

Emerging Opportunities in Message Security Market

Emerging opportunities in the message security market are centered around the increasing demand for integrated security platforms and the expansion of security solutions to new communication channels. The growing adoption of AI and machine learning offers significant potential for developing more intelligent and predictive threat detection systems. The rise of the Internet of Things (IoT) and connected devices presents new avenues for message security, protecting the communication streams of these devices. Furthermore, the increasing focus on data privacy and compliance in emerging economies is opening up new geographical markets for advanced message security solutions.

Leading Players in the Message Security Market Market

- TATA Communications

- Barracuda Networks Inc

- Trustwave Holdings Inc

- Mcafee LLC

- Cisco Systems Inc

- Microsoft Corporation

- Proofpoint Inc

- Trend Micro Incorporated

- Mimecast Limited

- Sophos Ltd

- Forcepoint Software company

Key Developments in Message Security Market Industry

- April 2022 - Trend Micro Incorporated announced the launch of Trend Micro One, a unified cybersecurity platform with a growing list of ecosystem technology partners that enables customers to understand better, communicate, and lower their cyber risk. The unified security platform method provides a continuous lifecycle of risk and threat assessment, including the discovery of attack surfaces, an analysis of cyber risk, and threat mitigation and response.

- April 2022 - Tata Communications International Pte Ltd., a wholly-owned subsidiary of Tata Communications Ltd., a global digital ecosystem enabler, announced strengthened variants of the IZO Internet WAN for global enterprises. IZO Internet WAN provides high-quality Internet services and consistent network experiences through various service options, including broadband Internet, with predictable and dependable network services that provide access to more than 150+ regions. It now allows businesses to transmit data seamlessly between branch offices and data centers, between branch offices and clouds, and across different clouds. Businesses can easily and quickly manage their regional and international networks. New variations have been made available for businesses in the North American, European, United Kingdom & Ireland, and Asia-Pacific markets.

Strategic Outlook for Message Security Market Market

- April 2022 - Trend Micro Incorporated announced the launch of Trend Micro One, a unified cybersecurity platform with a growing list of ecosystem technology partners that enables customers to understand better, communicate, and lower their cyber risk. The unified security platform method provides a continuous lifecycle of risk and threat assessment, including the discovery of attack surfaces, an analysis of cyber risk, and threat mitigation and response.

- April 2022 - Tata Communications International Pte Ltd., a wholly-owned subsidiary of Tata Communications Ltd., a global digital ecosystem enabler, announced strengthened variants of the IZO Internet WAN for global enterprises. IZO Internet WAN provides high-quality Internet services and consistent network experiences through various service options, including broadband Internet, with predictable and dependable network services that provide access to more than 150+ regions. It now allows businesses to transmit data seamlessly between branch offices and data centers, between branch offices and clouds, and across different clouds. Businesses can easily and quickly manage their regional and international networks. New variations have been made available for businesses in the North American, European, United Kingdom & Ireland, and Asia-Pacific markets.

Strategic Outlook for Message Security Market Market

The strategic outlook for the message security market is exceptionally positive, driven by an unyielding demand for robust cybersecurity solutions. The continuous evolution of cyber threats necessitates ongoing innovation, creating sustained opportunities for vendors developing advanced, AI-powered defenses. The global push for data privacy and regulatory compliance will continue to be a significant growth catalyst. Strategic imperatives for market players include focusing on integrated, cloud-native solutions, expanding into emerging markets, and fostering strategic partnerships to create comprehensive security ecosystems. The anticipated growth in the BFSI, Government, and Healthcare sectors, coupled with the increasing digitization across all industries, will ensure a strong and expanding market for effective message security.

Message Security Market Segmentation

-

1. Deployment Type

- 1.1. Cloud

- 1.2. On-Premise

-

2. Type

- 2.1. Email

- 2.2. SMS

-

3. End User Industry

- 3.1. BFSI

- 3.2. Government

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Retail and E-commerce

- 3.6. Manufacturing

- 3.7. Education

- 3.8. Other End User Industries

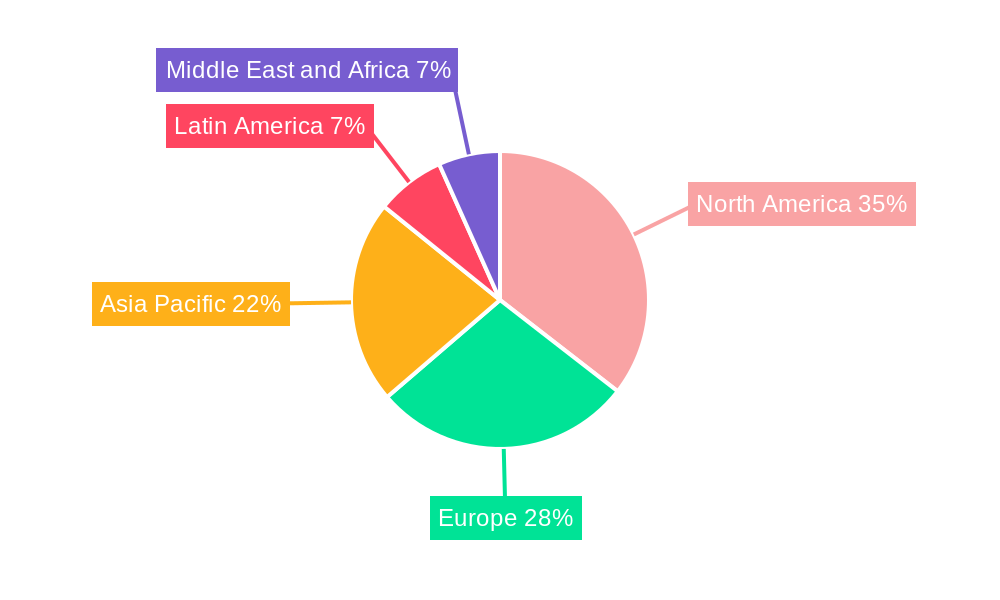

Message Security Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Message Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Protecting the Confidential Information from Malware Threats; Increasing Popularity of Cloud-based and Virtual Appliance-based Solutions

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness about Cyberattacks; Increasing Complexity in Implementing Various Messaging Security Solution

- 3.4. Market Trends

- 3.4.1. Applications in BFSI to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Message Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. Cloud

- 5.1.2. On-Premise

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Email

- 5.2.2. SMS

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. BFSI

- 5.3.2. Government

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Retail and E-commerce

- 5.3.6. Manufacturing

- 5.3.7. Education

- 5.3.8. Other End User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America Message Security Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. Cloud

- 6.1.2. On-Premise

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Email

- 6.2.2. SMS

- 6.3. Market Analysis, Insights and Forecast - by End User Industry

- 6.3.1. BFSI

- 6.3.2. Government

- 6.3.3. Healthcare

- 6.3.4. Media and Entertainment

- 6.3.5. Retail and E-commerce

- 6.3.6. Manufacturing

- 6.3.7. Education

- 6.3.8. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe Message Security Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. Cloud

- 7.1.2. On-Premise

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Email

- 7.2.2. SMS

- 7.3. Market Analysis, Insights and Forecast - by End User Industry

- 7.3.1. BFSI

- 7.3.2. Government

- 7.3.3. Healthcare

- 7.3.4. Media and Entertainment

- 7.3.5. Retail and E-commerce

- 7.3.6. Manufacturing

- 7.3.7. Education

- 7.3.8. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Pacific Message Security Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. Cloud

- 8.1.2. On-Premise

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Email

- 8.2.2. SMS

- 8.3. Market Analysis, Insights and Forecast - by End User Industry

- 8.3.1. BFSI

- 8.3.2. Government

- 8.3.3. Healthcare

- 8.3.4. Media and Entertainment

- 8.3.5. Retail and E-commerce

- 8.3.6. Manufacturing

- 8.3.7. Education

- 8.3.8. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Latin America Message Security Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. Cloud

- 9.1.2. On-Premise

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Email

- 9.2.2. SMS

- 9.3. Market Analysis, Insights and Forecast - by End User Industry

- 9.3.1. BFSI

- 9.3.2. Government

- 9.3.3. Healthcare

- 9.3.4. Media and Entertainment

- 9.3.5. Retail and E-commerce

- 9.3.6. Manufacturing

- 9.3.7. Education

- 9.3.8. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Middle East and Africa Message Security Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. Cloud

- 10.1.2. On-Premise

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Email

- 10.2.2. SMS

- 10.3. Market Analysis, Insights and Forecast - by End User Industry

- 10.3.1. BFSI

- 10.3.2. Government

- 10.3.3. Healthcare

- 10.3.4. Media and Entertainment

- 10.3.5. Retail and E-commerce

- 10.3.6. Manufacturing

- 10.3.7. Education

- 10.3.8. Other End User Industries

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. North America Message Security Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Message Security Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Message Security Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Message Security Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Message Security Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 TATA Communications

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Barracuda Networks Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Trustwave Holdings Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Mcafee LLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Cisco Systems Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Microsoft Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Proofpoint Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Trend Micro Incorporated

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Mimecast Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Sophos Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Forcepoint Software compan

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 TATA Communications

List of Figures

- Figure 1: Global Message Security Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Message Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Message Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Message Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Message Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Message Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Message Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 13: North America Message Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 14: North America Message Security Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Message Security Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Message Security Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 17: North America Message Security Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 18: North America Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Message Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Message Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 21: Europe Message Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 22: Europe Message Security Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Message Security Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Message Security Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 25: Europe Message Security Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 26: Europe Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Message Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Message Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 29: Asia Pacific Message Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 30: Asia Pacific Message Security Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Message Security Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Message Security Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 33: Asia Pacific Message Security Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 34: Asia Pacific Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Message Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Message Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 37: Latin America Message Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 38: Latin America Message Security Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Message Security Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Message Security Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 41: Latin America Message Security Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 42: Latin America Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Message Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Message Security Market Revenue (Million), by Deployment Type 2024 & 2032

- Figure 45: Middle East and Africa Message Security Market Revenue Share (%), by Deployment Type 2024 & 2032

- Figure 46: Middle East and Africa Message Security Market Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East and Africa Message Security Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East and Africa Message Security Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 49: Middle East and Africa Message Security Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 50: Middle East and Africa Message Security Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Message Security Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Message Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Message Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 3: Global Message Security Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Message Security Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 5: Global Message Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Message Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Message Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Message Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Message Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Message Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Message Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 17: Global Message Security Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Message Security Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 19: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Message Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 21: Global Message Security Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Message Security Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 23: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Message Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 25: Global Message Security Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global Message Security Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 27: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Message Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 29: Global Message Security Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Message Security Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 31: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Message Security Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 33: Global Message Security Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Message Security Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 35: Global Message Security Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Message Security Market?

The projected CAGR is approximately 22.45%.

2. Which companies are prominent players in the Message Security Market?

Key companies in the market include TATA Communications, Barracuda Networks Inc, Trustwave Holdings Inc, Mcafee LLC, Cisco Systems Inc, Microsoft Corporation, Proofpoint Inc, Trend Micro Incorporated, Mimecast Limited, Sophos Ltd, Forcepoint Software compan.

3. What are the main segments of the Message Security Market?

The market segments include Deployment Type, Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Protecting the Confidential Information from Malware Threats; Increasing Popularity of Cloud-based and Virtual Appliance-based Solutions.

6. What are the notable trends driving market growth?

Applications in BFSI to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Awareness about Cyberattacks; Increasing Complexity in Implementing Various Messaging Security Solution.

8. Can you provide examples of recent developments in the market?

April 2022 - Trend Micro Incorporated announced the launch of Trend Micro One, a unified cybersecurity platform with a growing list of ecosystem technology partners that enables customers to understand better, communicate, and lower their cyber risk. The unified security platform method provides a continuous lifecycle of risk and threat assessment, including the discovery of attack surfaces, an analysis of cyber risk, and threat mitigation and response.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Message Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Message Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Message Security Market?

To stay informed about further developments, trends, and reports in the Message Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence