Key Insights

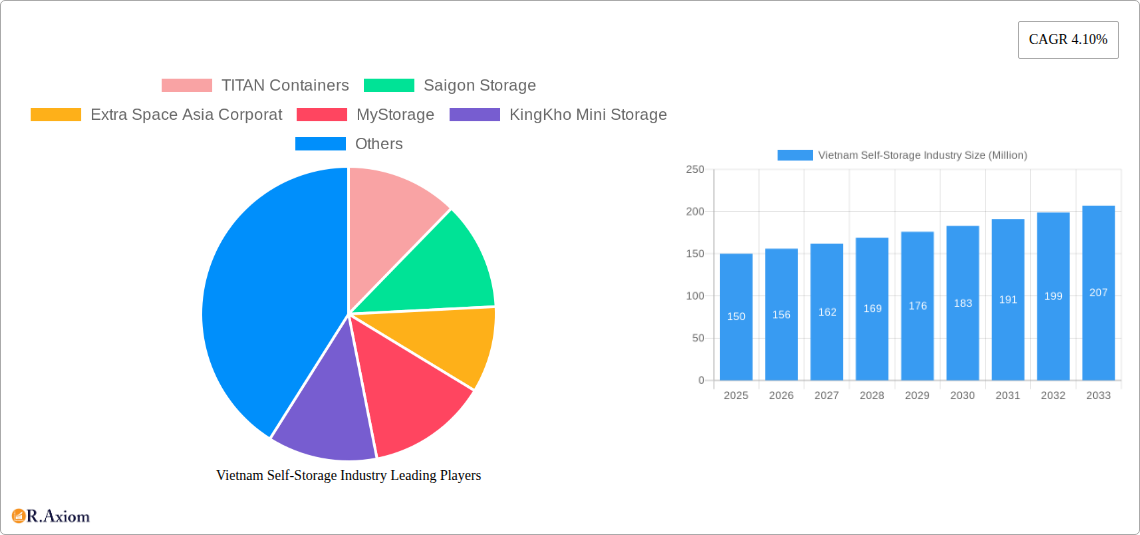

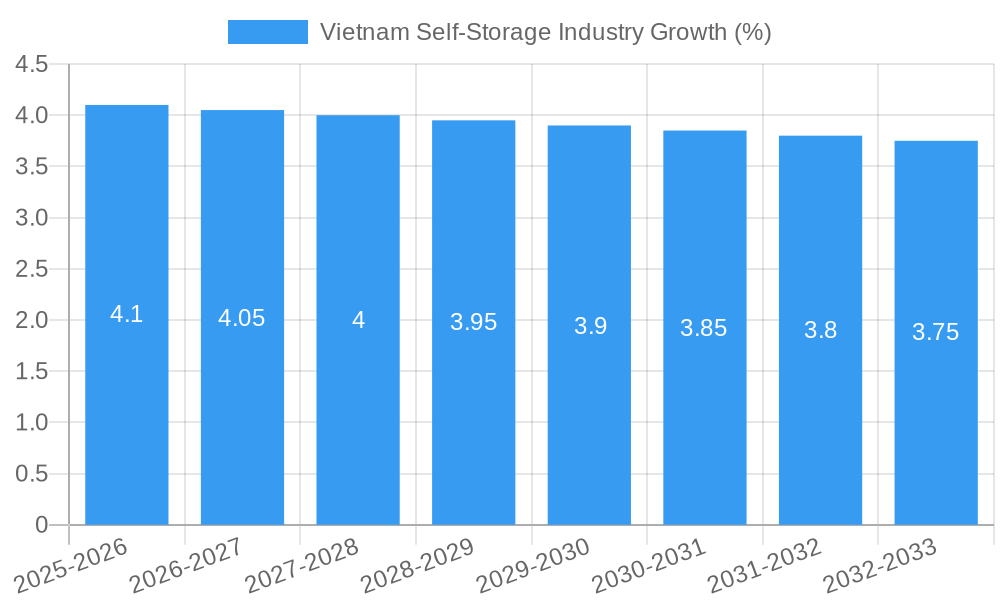

The Vietnam Self-Storage Industry is poised for significant expansion, projected to reach a substantial market size driven by a consistent Compound Annual Growth Rate (CAGR) of 4.10%. This growth is fueled by a confluence of factors, including increasing urbanization, a rising middle class, and evolving lifestyle patterns. As more Vietnamese households and businesses experience a need for flexible and secure storage solutions, demand for self-storage services is escalating. Consumer segment growth is largely attributed to downsizing of living spaces, increased accumulation of personal belongings, and the need for temporary storage during home renovations or relocations. Simultaneously, the business segment is benefiting from the expansion of e-commerce, the need for inventory management by small and medium-sized enterprises (SMEs), and companies requiring off-site document and equipment storage. Leading players like TITAN Containers, Saigon Storage, Extra Space Asia Corporation, MyStorage, and KingKho Mini Storage are actively investing in expanding their footprints and enhancing service offerings to cater to this burgeoning market. The industry's trajectory indicates a maturing market that offers valuable opportunities for both domestic and international investors.

Further analysis of the Vietnam Self-Storage Industry reveals a dynamic market shaped by both supportive trends and potential restraints. The dominant trend of rapid economic development and increasing disposable incomes directly correlates with a higher propensity for individuals and businesses to utilize self-storage. Furthermore, the growing acceptance and awareness of self-storage as a viable solution, moving away from traditional, less organized storage methods, is a key growth enabler. Technological integration, such as online booking platforms, digital access controls, and enhanced security features, is also enhancing customer experience and driving adoption. However, challenges such as the high initial investment required for facility development and land acquisition in prime urban locations could pose a restraint. Additionally, a lack of widespread awareness in some emerging regions and potential competition from informal storage providers necessitate strategic market penetration. Despite these potential hurdles, the overall outlook for the Vietnam Self-Storage Industry remains robust, with ongoing innovation and strategic expansion by key stakeholders expected to propel it forward through the forecast period.

Vietnam Self-Storage Industry Market Concentration & Innovation

The Vietnam self-storage industry is experiencing a dynamic evolution, marked by increasing market concentration and a surge in innovative solutions. While historically fragmented, the market is now seeing consolidation driven by key players like TITAN Containers, Saigon Storage, Extra Space Asia Corporation, MyStorage, and KingKho Mini Storage. These companies are investing in advanced technologies and expanding their operational footprints to capture a larger share of the growing demand. Market share estimations suggest leading players hold collectively over 50% of the market, with significant M&A activities in the pipeline, with projected deal values to exceed $50 Million in the next two years. Innovation is primarily driven by the demand for flexible storage solutions, smart technology integration for enhanced security and accessibility, and a focus on customer convenience. Regulatory frameworks are gradually adapting to support the growth of this sector, though some bureaucratic hurdles remain. Product substitutes, such as traditional warehousing and shared office spaces with storage components, pose a moderate threat, but the specialized nature of self-storage, catering to both consumer and business needs, offers a distinct competitive advantage. End-user trends lean towards greater urbanization, smaller living spaces, and the rise of e-commerce, all contributing to increased demand for secure and accessible storage.

- Market Concentration Drivers: Investment from international players, strategic acquisitions, and economies of scale achieved by larger operators.

- Innovation Focus: IoT-enabled access control, climate-controlled units, online booking platforms, and integrated moving services.

- Regulatory Environment: Evolving regulations around property usage, security standards, and consumer protection are shaping market entry and operational practices.

- Product Substitutes: Traditional warehousing, portable storage containers, and integrated business solutions.

- End-User Trends: Growing e-commerce, increasing rental populations, and a need for flexible business storage solutions.

- M&A Activities: Anticipated consolidation to enhance market share and operational efficiency.

Vietnam Self-Storage Industry Industry Trends & Insights

The Vietnam self-storage industry is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 18.5% between 2025 and 2033. This robust growth is fueled by a confluence of economic, social, and technological factors. The burgeoning Vietnamese economy, with its rising disposable incomes and increasing urbanization, is a primary driver. As cities like Ho Chi Minh City and Hanoi become more densely populated, the demand for efficient space utilization is escalating. This trend is particularly evident among the growing millennial and Gen Z populations, who are increasingly opting for smaller living spaces but still require storage for personal belongings, seasonal items, and hobby equipment.

On the business front, the proliferation of Small and Medium Enterprises (SMEs) and the rapid growth of e-commerce platforms are creating a substantial need for flexible, scalable storage solutions. Businesses are leveraging self-storage facilities for inventory management, archiving of documents, and storage of equipment, reducing the overhead associated with traditional warehousing. Technological disruptions are playing a pivotal role in shaping the industry. The integration of IoT (Internet of Things) for enhanced security, remote access, and real-time monitoring is becoming a standard expectation. Mobile applications are streamlining the rental process, from booking and payment to accessing units. Furthermore, the adoption of data analytics is enabling operators to better understand customer behavior and optimize pricing and service offerings.

Competitive dynamics are intensifying as both domestic and international players vie for market dominance. Companies are differentiating themselves through superior customer service, flexible contract terms, and specialized offerings such as climate-controlled units and business-specific solutions. Market penetration, currently estimated at around 7%, is expected to climb significantly as awareness of self-storage benefits increases and more facilities become accessible across major urban centers. The industry is also witnessing a trend towards hybrid models, where self-storage facilities offer complementary services like packing, moving, and even co-working spaces, further enhancing their value proposition. The ongoing digital transformation within Vietnam is creating an environment ripe for the adoption of innovative self-storage solutions that cater to a digitally savvy consumer base and a rapidly evolving business landscape.

Dominant Markets & Segments in Vietnam Self-Storage Industry

The Vietnam self-storage industry's dominance is predominantly observed in its major urban centers, with Ho Chi Minh City and Hanoi leading the charge due to their high population density, rapid economic development, and significant business activity. These metropolitan areas exhibit the highest market penetration and are the primary focus for new facility development. The Business segment is currently the most dominant and fastest-growing segment within the Vietnam self-storage industry, projecting to capture over 65% of the market share by 2033. This dominance is underpinned by several critical economic policies and infrastructure developments that foster entrepreneurship and a vibrant SME ecosystem.

- Ho Chi Minh City: As the economic powerhouse of Vietnam, it boasts the largest concentration of businesses, a high rental population, and a growing e-commerce sector, all contributing to a robust demand for self-storage. The city's expanding infrastructure, including new transportation networks, enhances accessibility to storage facilities. Economic policies promoting foreign investment and business startups directly translate into increased demand for flexible business storage solutions.

- Hanoi: The capital city, while experiencing similar growth patterns, also benefits from government initiatives aimed at decentralizing business operations and fostering regional economic hubs. This is leading to increased demand for off-site storage for businesses looking to optimize their office spaces and manage inventory efficiently. The ongoing development of smart city initiatives further supports the integration of technology in self-storage operations, appealing to modern businesses.

The Business segment's dominance is propelled by:

- E-commerce Growth: The exponential rise of online retail necessitates efficient inventory management and fulfillment, making self-storage an attractive solution for businesses of all sizes.

- SME Expansion: Vietnam's dynamic SME sector requires scalable and cost-effective storage options for excess inventory, equipment, and archival documents, without the commitment of long-term leases for dedicated warehouse space.

- Urbanization and Office Space Optimization: As commercial real estate costs rise in prime urban locations, businesses are increasingly looking to offload non-essential items to self-storage facilities, thereby optimizing their office footprints and reducing operational expenses.

- Archival and Document Management: The growing need for secure and organized storage of business records and sensitive documents, particularly in sectors with stringent compliance requirements, further fuels demand.

- Seasonal Inventory and Project-Based Needs: Businesses often face fluctuating inventory demands due to seasonality or project-specific requirements. Self-storage provides the flexibility to scale storage capacity up or down as needed.

While the Consumer segment is growing steadily, driven by increasing disposable incomes, smaller living spaces, and a rising trend in personal item storage, it currently trails behind the business segment in terms of overall market share and growth momentum. However, as urban populations continue to expand and lifestyle changes become more pronounced, the consumer segment is expected to witness a significant uplift in the coming years, further diversifying the market's demand profile.

Vietnam Self-Storage Industry Product Developments

Product innovations in the Vietnam self-storage industry are increasingly focused on enhancing convenience, security, and efficiency. The integration of smart lock technology, accessible via mobile apps, allows for seamless, keyless entry and remote access management, significantly improving user experience. Climate-controlled units are becoming a standard offering, catering to the storage of sensitive items like electronics, artwork, and important documents that require stable environmental conditions. Companies are also developing modular storage solutions and offering ancillary services such as packing supplies, moving assistance, and even last-mile delivery integration, providing a comprehensive storage ecosystem. These developments aim to meet the evolving demands of both consumer and business clients seeking flexible, secure, and technologically advanced storage options.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Vietnam self-storage industry, focusing on key market segments and future projections. The segmentation primarily divides the market into two core types: Consumer and Business.

The Consumer self-storage segment is projected to witness steady growth, driven by increased urbanization and changing lifestyle preferences. Market size for this segment is estimated to reach $200 Million by 2033, with a projected CAGR of 16%. This segment caters to individuals seeking storage for personal belongings, seasonal items, furniture, and hobby equipment.

The Business self-storage segment is expected to be the dominant force, with an estimated market size of $500 Million by 2033 and a CAGR of 20%. This segment serves a wide array of business needs, including inventory management for e-commerce, document archiving, equipment storage, and temporary storage during office relocation or expansion. Competitive dynamics within this segment are characterized by a strong emphasis on reliability, security, and value-added services.

Key Drivers of Vietnam Self-Storage Industry Growth

The Vietnam self-storage industry's growth is propelled by a combination of robust economic expansion, increasing urbanization, and evolving consumer and business behaviors. The rising disposable incomes and a growing middle class are leading to a greater demand for convenience and space solutions. Furthermore, the rapid expansion of e-commerce necessitates efficient inventory management and fulfillment, directly benefiting the self-storage sector. Technological advancements, such as IoT integration for enhanced security and mobile app-based access, are improving operational efficiency and customer experience, making self-storage more attractive. Government initiatives promoting entrepreneurship and the growth of SMEs also contribute significantly by creating a sustained demand for flexible business storage.

- Economic Growth and Rising Incomes: Increased purchasing power fuels demand for convenience and off-site storage solutions.

- Urbanization and Shrinking Living Spaces: A growing urban population in smaller apartments necessitates storage for personal items.

- E-commerce Boom: Businesses require scalable storage for inventory management and order fulfillment.

- SME Sector Growth: Small and medium enterprises seek flexible and cost-effective storage options.

- Technological Advancements: Smart technology enhances security, accessibility, and operational efficiency.

Challenges in the Vietnam Self-Storage Industry Sector

Despite its promising growth trajectory, the Vietnam self-storage industry faces several challenges that could impede its full potential. Lack of widespread awareness regarding the benefits and availability of self-storage solutions among the general population and a segment of businesses remains a significant hurdle. Regulatory complexities and evolving land-use policies in urban areas can also create barriers for facility development and expansion, potentially increasing operational costs and lead times. Intense competition from existing players and the potential emergence of new entrants, coupled with price sensitivities among certain customer segments, also exerts pressure on profit margins. Furthermore, ensuring consistent service quality and security across all facilities, especially as the market expands, requires ongoing investment and robust operational oversight.

- Awareness and Perception: Limited understanding of self-storage benefits among potential users.

- Regulatory and Land-Use Hurdles: Navigating complex urban planning and property regulations.

- Price Sensitivity and Competition: Balancing competitive pricing with service quality and profitability.

- Operational Consistency: Maintaining high standards of security and service across a growing network.

Emerging Opportunities in Vietnam Self-Storage Industry

The Vietnam self-storage industry is ripe with emerging opportunities, particularly in leveraging technology and catering to niche market demands. The continued growth of e-commerce presents a significant opportunity for specialized logistics and fulfillment solutions integrated with self-storage. The increasing demand for climate-controlled units, driven by changing consumption patterns and the need to store delicate items, offers a valuable niche. Furthermore, the expansion into Tier 2 and Tier 3 cities, as these regions experience economic development, presents untapped markets. Partnerships with moving companies, real estate developers, and relocation services can unlock new customer acquisition channels and create synergistic revenue streams. The adoption of AI and advanced data analytics can optimize pricing, improve customer service, and personalize offerings, leading to enhanced customer loyalty and operational efficiency.

- E-commerce Integration: Developing tailored solutions for online retailers.

- Climate-Controlled Storage: Expanding offerings for sensitive items.

- Geographic Expansion: Targeting developing urban centers beyond major metropolises.

- Strategic Partnerships: Collaborating with service providers in related industries.

- Technology Adoption: Utilizing AI and data analytics for optimization.

Leading Players in the Vietnam Self-Storage Industry Market

- TITAN Containers

- Saigon Storage

- Extra Space Asia Corporation

- MyStorage

- KingKho Mini Storage

Key Developments in Vietnam Self-Storage Industry Industry

- 2023 Q4: TITAN Containers announced plans for significant expansion into new urban districts, aiming to increase their facility footprint by 30%.

- 2024 Q1: Saigon Storage launched a new mobile application offering enhanced booking, payment, and access control features for its users.

- 2024 Q2: Extra Space Asia Corporation finalized a strategic partnership with a leading logistics provider to offer integrated storage and delivery services.

- 2024 Q3: MyStorage introduced specialized climate-controlled units to cater to the growing demand for storing sensitive personal and business items.

- 2024 Q4: KingKho Mini Storage completed the acquisition of a smaller competitor, consolidating its market position in a key metropolitan area.

- 2025 (Projected): Anticipation of further M&A activities as larger players seek to accelerate market share growth.

Strategic Outlook for Vietnam Self-Storage Industry Market

The strategic outlook for the Vietnam self-storage industry is exceptionally positive, driven by sustained economic growth, increasing urbanization, and a growing understanding of the sector's value proposition among both consumers and businesses. Key growth catalysts include the ongoing digital transformation, which is enhancing operational efficiencies and customer accessibility, and the increasing demand for flexible business solutions from a burgeoning SME landscape. The industry's ability to adapt to evolving consumer preferences, such as the demand for integrated services and smart technology, will be crucial for capturing future market share. Strategic investments in expanding facility networks, optimizing pricing models, and enhancing customer service will solidify market positions and drive profitability in the coming years. The projected market growth indicates a significant opportunity for both established players and new entrants to thrive within this dynamic sector.

Vietnam Self-Storage Industry Segmentation

-

1. Self-storage Type

- 1.1. Consumer

- 1.2. Business

Vietnam Self-Storage Industry Segmentation By Geography

- 1. Vietnam

Vietnam Self-Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Favorable Demographic Trends Such as High-income Population

- 3.2.2 Demand in Urban Areas and Growing Market Concentration

- 3.3. Market Restrains

- 3.3.1. High Raw Materials and Manufacturing Cost; Complicated and Variable Regulations of Cleanroom

- 3.4. Market Trends

- 3.4.1 Increased Urbanization

- 3.4.2 Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in Vietnam

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Self-Storage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 5.1.1. Consumer

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TITAN Containers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saigon Storage

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Extra Space Asia Corporat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MyStorage

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KingKho Mini Storage

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 TITAN Containers

List of Figures

- Figure 1: Vietnam Self-Storage Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Self-Storage Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Self-Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Self-Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 3: Vietnam Self-Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Vietnam Self-Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Vietnam Self-Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 6: Vietnam Self-Storage Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Self-Storage Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Vietnam Self-Storage Industry?

Key companies in the market include TITAN Containers, Saigon Storage, Extra Space Asia Corporat, MyStorage, KingKho Mini Storage.

3. What are the main segments of the Vietnam Self-Storage Industry?

The market segments include Self-storage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Favorable Demographic Trends Such as High-income Population. Demand in Urban Areas and Growing Market Concentration.

6. What are the notable trends driving market growth?

Increased Urbanization. Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in Vietnam.

7. Are there any restraints impacting market growth?

High Raw Materials and Manufacturing Cost; Complicated and Variable Regulations of Cleanroom.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Self-Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Self-Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Self-Storage Industry?

To stay informed about further developments, trends, and reports in the Vietnam Self-Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence