Key Insights

The China Real-Time Payments Industry is poised for phenomenal expansion, projected to reach a significant market size of USD 5.46 billion by 2025, with an exceptionally robust Compound Annual Growth Rate (CAGR) of 32.60%. This rapid ascent is primarily fueled by a confluence of powerful drivers, including the pervasive adoption of mobile payment technologies, a rapidly digitizing economy, and increasing consumer demand for instant, seamless financial transactions. The market is characterized by its dynamic nature, with Person-to-Person (P2P) and Person-to-Business (P2B) payment segments experiencing substantial growth as individuals and enterprises alike embrace the convenience and efficiency of real-time transfers. Leading global and domestic players such as VISA Inc., Fiserv Inc., WeChat Pay (Tencent Holdings Ltd), FIS Global, JD.com (JDPay), Mastercard Inc., ACI Worldwide Inc., Alipay (Alibaba Group), PayPal Holdings Inc., and Apple Inc. are actively shaping this landscape through continuous innovation and strategic investments. The nation's strong commitment to technological advancement and its vast, digitally-savvy population provide a fertile ground for real-time payments to become the dominant mode of transaction.

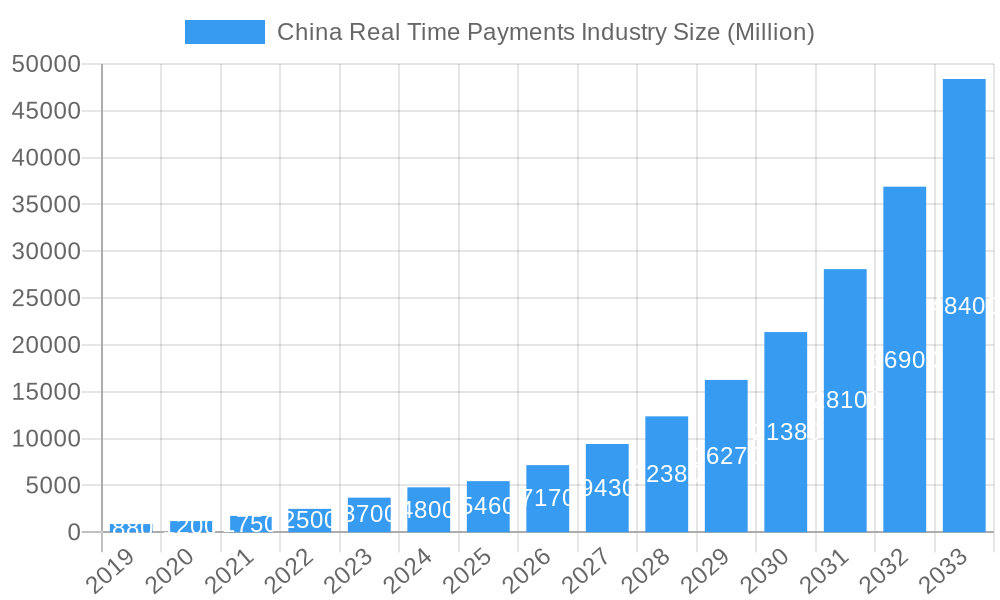

China Real Time Payments Industry Market Size (In Million)

Further driving this growth are evolving consumer behaviors and supportive government initiatives aimed at fostering a cashless society and enhancing financial inclusion. The increasing penetration of smartphones and the widespread availability of high-speed internet are fundamental enablers, allowing for the ubiquitous access to real-time payment platforms. Emerging trends such as the integration of real-time payments into e-commerce ecosystems, the rise of embedded finance, and the development of cross-border real-time payment solutions are expected to further accelerate market expansion. While the market presents immense opportunities, certain restraints, such as the need for robust cybersecurity measures and evolving regulatory frameworks, will need to be adeptly managed by industry stakeholders. Nevertheless, the sheer scale of the Chinese market, coupled with its progressive embrace of digital finance, positions the real-time payments sector for sustained and accelerated growth throughout the forecast period of 2025-2033.

China Real Time Payments Industry Company Market Share

Unlock critical insights into China's burgeoning real-time payments landscape with this comprehensive industry report. Covering the historical period of 2019–2024 and extending through a robust forecast period of 2025–2033, with 2025 as the base and estimated year, this analysis delves into market concentration, innovation drivers, dominant segments, and future strategic outlook. Equip yourself with actionable data on market share, CAGR, M&A values, and emerging opportunities to navigate this dynamic sector effectively.

China Real Time Payments Industry Market Concentration & Innovation

The China Real Time Payments Industry exhibits a highly concentrated market structure, dominated by a few key players, with WeChat Pay and Alipay commanding significant market share, estimated at over 70% of the total transaction volume. Innovation is a primary driver, fueled by technological advancements in mobile payments, AI-driven fraud detection, and the integration of payment solutions into broader digital ecosystems. Regulatory frameworks, while evolving, are largely supportive of digital payments, focusing on data security and consumer protection. Product substitutes, primarily traditional banking methods and nascent digital currency initiatives, pose a minimal threat to the entrenched real-time payment ecosystem. End-user trends highlight a strong preference for convenience, speed, and seamless user experiences, leading to increased adoption across all demographics. Mergers and Acquisitions (M&A) activities, while less frequent due to high market concentration, are strategically focused on expanding service offerings and acquiring niche technology providers. The total M&A deal value in the last three years is estimated at over 500 Million.

China Real Time Payments Industry Industry Trends & Insights

China's Real Time Payments Industry is experiencing explosive growth, propelled by a confluence of factors including widespread smartphone penetration, a rapidly digitizing economy, and a cultural shift towards cashless transactions. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 25% over the forecast period. This sustained expansion is driven by significant investments in payment infrastructure, the proliferation of mobile payment apps, and the increasing demand for instant, secure, and convenient transaction methods from both consumers and businesses. Technological disruptions, such as the integration of AI for personalized user experiences and enhanced security, blockchain for transaction transparency, and the ongoing development of Central Bank Digital Currencies (CBDCs), are continually reshaping the industry. Consumer preferences are overwhelmingly skewed towards mobile-first solutions, with a strong emphasis on peer-to-peer (P2P) and peer-to-business (P2B) transactions facilitating everyday commerce. Competitive dynamics are intense, with established giants like WeChat Pay and Alipay constantly innovating to maintain their dominance, while newer entrants and international players vie for a share of the market by offering specialized solutions and targeting underserved segments. Market penetration is already exceptionally high, with estimates suggesting over 95% of urban populations engaging in digital payments.

Dominant Markets & Segments in China Real Time Payments Industry

Within the China Real Time Payments Industry, the Peer-to-Peer (P2P) segment currently holds dominance, reflecting the widespread use of real-time payment platforms for social remittances, splitting bills, and person-to-person transfers among friends and family. This dominance is underpinned by the deep integration of P2P payment functionalities within super-apps like WeChat and Alipay, making them indispensable tools for daily social and economic interactions. The market size for P2P payments is estimated to be over 15,000 Million in 2025.

However, the Peer-to-Business (P2B) segment is experiencing rapid growth and is projected to surpass P2P in the coming years. This surge is driven by:

- Economic Policies: Government initiatives promoting digital transformation and financial inclusion are actively encouraging businesses of all sizes to adopt digital payment solutions.

- Infrastructure Development: The continuous expansion of high-speed internet and mobile network coverage across both urban and rural areas provides a robust foundation for seamless P2B transactions.

- Merchant Adoption: A vast network of merchants, from street vendors to large retailers and e-commerce platforms, are increasingly equipped to accept real-time payments, driven by the desire for faster settlement, reduced cash handling costs, and enhanced customer convenience.

- E-commerce Boom: The explosive growth of e-commerce in China directly fuels the demand for efficient P2B payment gateways that can handle high transaction volumes and provide instant confirmation. The market size for P2B payments is predicted to reach over 20,000 Million by 2033.

- Innovation in Business Solutions: Payment providers are developing tailored solutions for businesses, including integrated point-of-sale (POS) systems, online payment gateways, and simplified invoicing, further boosting P2B adoption.

China Real Time Payments Industry Product Developments

Product innovation in the China Real Time Payments Industry is characterized by a focus on seamless integration and enhanced user experience. Key developments include the integration of payment functionalities within social media platforms, e-commerce apps, and loyalty programs, creating a frictionless payment journey. Advanced features such as one-click payments, QR code scanning, and biometric authentication are becoming standard. Furthermore, the development of embedded finance solutions, where payment capabilities are integrated directly into non-financial applications, is a significant trend, offering businesses unique competitive advantages by streamlining customer interactions and sales processes.

Report Scope & Segmentation Analysis

This report meticulously analyzes the China Real Time Payments Industry, segmented primarily by the Type of Payment: P2P and P2B.

P2P (Person-to-Person) Payments: This segment encompasses all real-time transactions between individuals. It is characterized by high volume and frequency, driven by social interactions and daily financial exchanges. Projections indicate continued robust growth, with market sizes expected to expand significantly due to ingrained user habits. Competitive dynamics in this segment are dominated by super-apps offering integrated social and payment features.

P2B (Person-to-Business) Payments: This segment covers all real-time transactions between individuals and businesses, including retail purchases, online shopping, and service payments. This segment is projected to witness the highest growth rates, driven by increasing merchant adoption and the expansion of digital commerce. Market sizes are expected to surge as businesses increasingly rely on instant payment solutions for operational efficiency and customer satisfaction.

Key Drivers of China Real Time Payments Industry Growth

The growth of China's Real Time Payments Industry is propelled by several key factors. Technological advancements, particularly in mobile technology and artificial intelligence, enable faster, more secure, and personalized payment experiences. The strong government support for digital economy initiatives, including favorable regulations and infrastructure investments, creates a conducive environment for growth. The rapid expansion of e-commerce and the digital transformation of businesses are creating an ever-increasing demand for instant payment solutions. Finally, evolving consumer preferences for convenience, speed, and cashless transactions further fuel adoption across all demographics.

Challenges in the China Real Time Payments Industry Sector

Despite its rapid growth, the China Real Time Payments Industry faces certain challenges. Intense competition among major players can lead to margin pressures and increased marketing expenditure. Regulatory evolution, particularly concerning data privacy and anti-monopoly measures, requires continuous adaptation from industry participants. While market penetration is high, achieving deeper adoption in rural and lower-income segments may require targeted strategies and infrastructure improvements. Furthermore, maintaining robust cybersecurity measures against sophisticated fraud attempts remains a perpetual concern, necessitating ongoing investment in advanced security technologies.

Emerging Opportunities in China Real Time Payments Industry

Emerging opportunities in China's Real Time Payments Industry lie in the expansion of cross-border payments, facilitated by new platforms and partnerships, opening up global commerce for Chinese businesses and consumers. The development and integration of Central Bank Digital Currencies (CBDCs) present a significant opportunity for enhanced efficiency and new payment models. There is also a growing demand for specialized payment solutions for niche industries like healthcare, education, and logistics, offering avenues for innovation. Furthermore, leveraging data analytics and AI to provide personalized financial services and loyalty programs presents a lucrative path for differentiation and customer retention.

Leading Players in the China Real Time Payments Industry Market

- VISA Inc

- Fiserv Inc

- WeChat Pay (Tencent Holdings Ltd )

- FIS Global

- JDPay com (JD com)

- Mastercard Inc

- ACI Worldwide Inc

- AliPay (Alibaba Group)

- Paypal Holdings Inc

- Apple Inc

Key Developments in China Real Time Payments Industry Industry

- April 2023 - Paypal Holdings Inc. stated that it has introduced new features in addition to its complete payment solution for small businesses. The solution provides a range of payment options, such as PayPal, Venmo and Pay Later, for small businesses. Incentivizing customers to choose how they want to pay can help drive the checkout process.

- February 2023 - Yiwu, located in eastern China's Zhejiang province, launched a payment platform to facilitate global online transactions. A new payment platform Yiwu Pay aims to facilitate over 900,000 market entities as through this platform, about 2.1 million micro, small, and medium-sized enterprises along the supply chain will be able to better connect to the global market and conduct easier and safer cross-border transactions.

Strategic Outlook for China Real Time Payments Industry Market

The strategic outlook for the China Real Time Payments Industry remains exceptionally strong, driven by ongoing digital transformation and evolving consumer behaviors. Future growth catalysts include the continued expansion of mobile payment integration into diverse service sectors, the development of innovative business-to-business (B2B) payment solutions, and the increasing internationalization of Chinese payment platforms. Strategic focus will likely be on enhancing security features, leveraging big data for personalized offerings, and exploring new technological frontiers such as the metaverse and IoT payments. The anticipated rollout and adoption of China's CBDC will also reshape the competitive landscape, presenting both challenges and opportunities for existing players to adapt and innovate.

China Real Time Payments Industry Segmentation

-

1. Type of Payment

- 1.1. P2P

- 1.2. P2B

China Real Time Payments Industry Segmentation By Geography

- 1. China

China Real Time Payments Industry Regional Market Share

Geographic Coverage of China Real Time Payments Industry

China Real Time Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 32.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Penetration of Smartphone is Expected to Boost the Real Time Payments Market; Growing Need For Faster Payments and Falling Reliance on Traditional Banking

- 3.3. Market Restrains

- 3.3.1. Internet Breakdown and Bandwidth Limitation

- 3.4. Market Trends

- 3.4.1. Increasing Penetration of Smartphone across China to Propel the Real Time Payments Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Real Time Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 5.1.1. P2P

- 5.1.2. P2B

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type of Payment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 VISA Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fiserv Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WeChat Pay (Tencent Holdings Ltd )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FIS Global

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JDPay com (JD com)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mastercard Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACI Worldwide Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AliPay (Alibaba Group)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Paypal Holdings Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Apple Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 VISA Inc

List of Figures

- Figure 1: China Real Time Payments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Real Time Payments Industry Share (%) by Company 2025

List of Tables

- Table 1: China Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2020 & 2033

- Table 2: China Real Time Payments Industry Volume K Unit Forecast, by Type of Payment 2020 & 2033

- Table 3: China Real Time Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Real Time Payments Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: China Real Time Payments Industry Revenue Million Forecast, by Type of Payment 2020 & 2033

- Table 6: China Real Time Payments Industry Volume K Unit Forecast, by Type of Payment 2020 & 2033

- Table 7: China Real Time Payments Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: China Real Time Payments Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Real Time Payments Industry?

The projected CAGR is approximately 32.60%.

2. Which companies are prominent players in the China Real Time Payments Industry?

Key companies in the market include VISA Inc, Fiserv Inc, WeChat Pay (Tencent Holdings Ltd ), FIS Global, JDPay com (JD com), Mastercard Inc, ACI Worldwide Inc, AliPay (Alibaba Group), Paypal Holdings Inc, Apple Inc .

3. What are the main segments of the China Real Time Payments Industry?

The market segments include Type of Payment.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphone is Expected to Boost the Real Time Payments Market; Growing Need For Faster Payments and Falling Reliance on Traditional Banking.

6. What are the notable trends driving market growth?

Increasing Penetration of Smartphone across China to Propel the Real Time Payments Market Growth.

7. Are there any restraints impacting market growth?

Internet Breakdown and Bandwidth Limitation.

8. Can you provide examples of recent developments in the market?

April 2023 - Paypal Holdings Inc. stated that it has introduced new features In addition to its complete payment solution for small businesses, . The solution provides a range of payment options, such as PayPal, Venmo and Pay Later, for small businesses. Incentivizing customers to choose how they want to pay can help drive the checkout process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Real Time Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Real Time Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Real Time Payments Industry?

To stay informed about further developments, trends, and reports in the China Real Time Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence