Key Insights

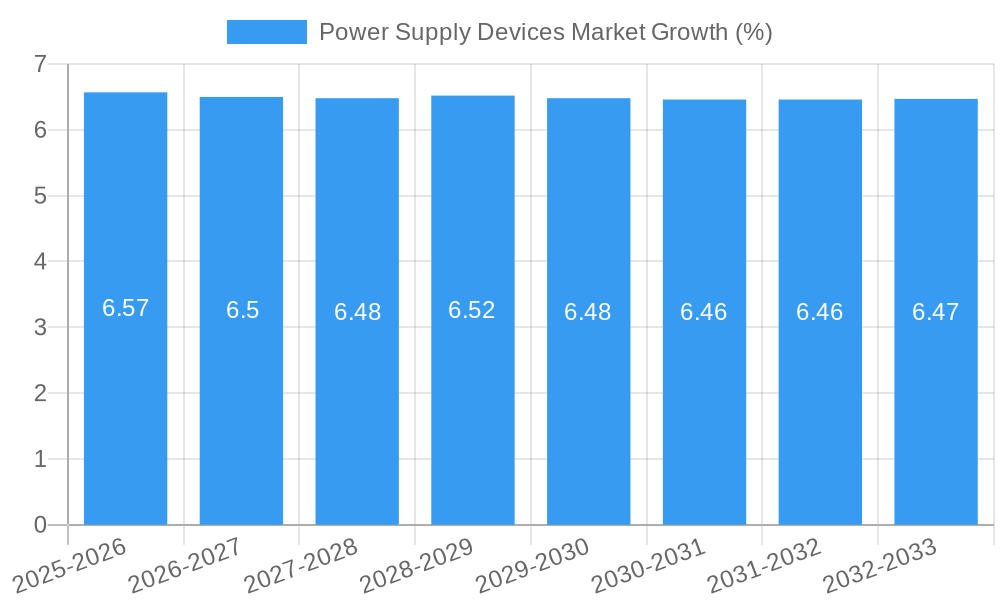

The global Power Supply Devices Market is poised for robust expansion, projected to reach a substantial USD 33.65 million by 2025 and continue its upward trajectory with a Compound Annual Growth Rate (CAGR) of 6.57% through 2033. This impressive growth is fueled by the relentless demand across a diverse range of end-user industries, including communication, industrial automation, consumer electronics, and the burgeoning automotive and transportation sectors. The increasing sophistication and proliferation of electronic devices, coupled with the critical need for reliable and efficient power solutions, are primary market drivers. Specifically, advancements in communication infrastructure, the IoT revolution, and the electrification of vehicles are creating unprecedented opportunities for AC-DC power supplies and DC-DC converters. The trend towards miniaturization and higher power density in electronic components further necessitates the development of more compact and efficient power supply solutions.

Despite the overwhelmingly positive outlook, the market encounters certain restraints that warrant strategic consideration. Supply chain complexities, geopolitical uncertainties, and the increasing regulatory landscape concerning energy efficiency and environmental impact can present challenges. However, these are increasingly being addressed through technological innovation and strategic sourcing. Leading players like Delta Electronics Inc., Lite-On Technology Corporation, and Siemens AG are at the forefront of addressing these challenges by investing in research and development for next-generation power supply technologies, focusing on enhanced energy efficiency, improved thermal management, and greater adaptability to evolving industry standards. The market is segmented into AC-DC Power Supplies and DC-DC Converters, with both segments expected to witness significant growth, driven by their integral role in powering a vast array of electronic systems.

This in-depth report provides a detailed analysis of the global Power Supply Devices Market, encompassing a comprehensive study from 2019 to 2033. With the base year set at 2025 and a forecast period extending to 2033, this report offers actionable insights into market dynamics, key trends, and future growth opportunities. The market is expected to reach an estimated value of xx Million by 2025, growing at a robust CAGR of xx% during the forecast period. This analysis will empower industry stakeholders, including manufacturers, suppliers, investors, and end-users, with critical data and strategic recommendations to navigate the evolving landscape of power supply solutions.

Power Supply Devices Market Market Concentration & Innovation

The Power Supply Devices Market exhibits a moderate level of concentration, with key players like Delta Electronics Inc, Lite-On Technology Corporation, Emerson Electric Co, Siemens AG, Salcomp PLC, Acbel Polytech Inc, Mean Well Enterprises Co Ltd, Murata Manufacturing Co Ltd, and TDK-Lambda Corporation (TDK Corporation) holding significant market shares. Innovation is a primary driver, fueled by the increasing demand for higher efficiency, smaller form factors, and enhanced reliability across various end-user industries. Regulatory frameworks, such as energy efficiency standards and safety certifications (e.g., CE, UL), play a crucial role in shaping product development and market entry. The constant evolution of end-user applications, particularly in the communication, industrial, and automotive sectors, necessitates continuous innovation in AC-DC power supplies and DC-DC converters. Product substitutes are limited due to the essential nature of power supplies, but advancements in power management techniques and alternative energy sources pose indirect competitive challenges. Mergers and acquisitions (M&A) are observed, albeit at a measured pace, as companies seek to consolidate their market positions or acquire specialized technologies. Recent M&A deal values are estimated to be in the range of xx Million, reflecting strategic consolidations and technology acquisitions.

- Market Concentration: Moderate, with a few dominant global players.

- Innovation Drivers: Energy efficiency, miniaturization, advanced protection features, integration of smart technologies.

- Regulatory Frameworks: Stringent energy efficiency standards (e.g., DOE, EU CoC), safety certifications.

- Product Substitutes: Limited direct substitutes, but alternative energy solutions are an indirect competitive factor.

- End-User Trends: Growing demand for high-density, low-profile, and intelligent power solutions.

- M&A Activities: Strategic acquisitions for technology enhancement and market expansion.

Power Supply Devices Market Industry Trends & Insights

The Power Supply Devices Market is experiencing a significant upward trajectory, driven by an insatiable demand for electricity across a multitude of interconnected devices and sophisticated industrial processes. The escalating adoption of IoT devices, the expansion of 5G infrastructure, and the increasing reliance on automation in manufacturing are primary growth catalysts. Technological disruptions, such as the widespread implementation of gallium nitride (GaN) and silicon carbide (SiC) semiconductors, are revolutionizing power supply efficiency and power density, enabling smaller and more powerful solutions. Consumer preferences are increasingly leaning towards energy-efficient, silent, and aesthetically pleasing power supplies that seamlessly integrate into smart homes and portable electronics. The competitive dynamics within the market are characterized by intense innovation, with leading companies continuously striving to offer superior performance, reduced energy consumption, and advanced features. This fierce competition also necessitates a focus on cost optimization without compromising quality. The market penetration of advanced power supply technologies is steadily increasing as industries recognize the long-term economic and environmental benefits. The projected Compound Annual Growth Rate (CAGR) for the Power Supply Devices Market is estimated at xx% during the forecast period, indicating substantial growth potential. Key trends include the shift towards modular and customizable power solutions, the integration of power factor correction (PFC) and other advanced control mechanisms, and the development of robust power supplies capable of operating in extreme environmental conditions, particularly for industrial and transportation applications. The burgeoning electric vehicle (EV) market also presents a significant avenue for growth, demanding high-power, high-efficiency onboard chargers and DC-DC converters. Furthermore, the increasing focus on renewable energy sources and energy storage systems is creating new demands for specialized power conversion and management solutions. The evolution of communication networks, from Wi-Fi 6 to future iterations, will also require more sophisticated and efficient power delivery systems. The industrial sector's drive towards Industry 4.0 and smart factories necessitates reliable and intelligent power solutions that can support complex automation and data processing. The consumer electronics segment continues to demand compact, lightweight, and highly efficient power adapters and internal power supplies for a growing array of portable and connected devices.

Dominant Markets & Segments in Power Supply Devices Market

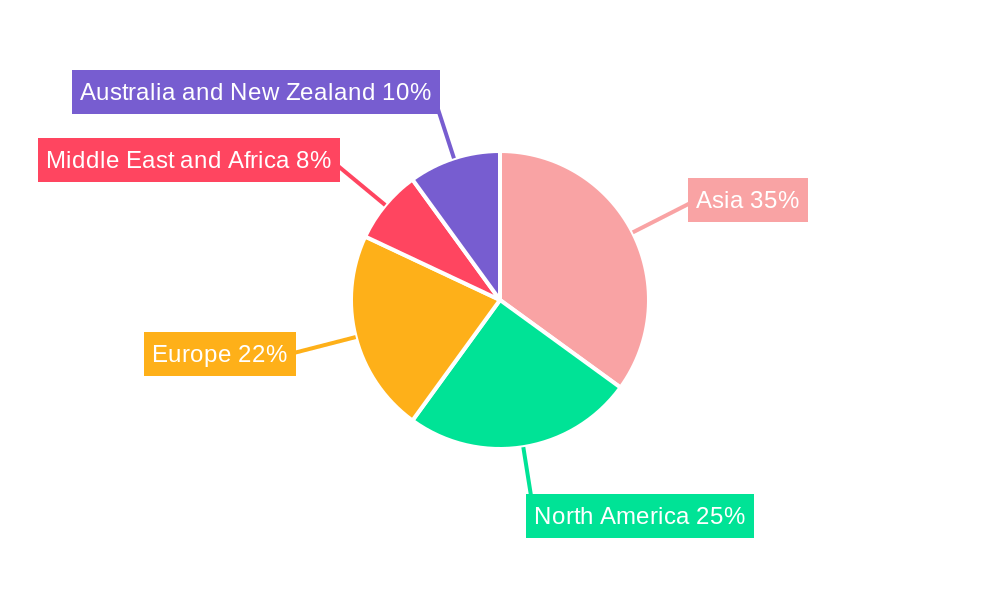

The global Power Supply Devices Market is characterized by distinct regional strengths and segment dominance, driven by specific economic, technological, and infrastructural factors.

Leading Region: North America is currently a dominant market, owing to its advanced technological infrastructure, substantial investments in industrial automation, and the rapid growth of the communication sector, including the deployment of 5G networks. The robust automotive industry and increasing adoption of electric vehicles further contribute to its leading position.

- Key Drivers in North America:

- Significant investments in 5G network expansion.

- High adoption rate of industrial automation and smart manufacturing.

- Government initiatives promoting energy efficiency and renewable energy.

- Growth of the electric vehicle market.

Leading Segment (Device Type): AC-DC Power Supplies represent the largest segment within the market. These are ubiquitous across nearly all electronic devices, converting alternating current from the grid to direct current required by components. The ever-increasing number of electronic gadgets and industrial machinery directly fuels the demand for AC-DC power supplies.

- Dominance Analysis for AC-DC Power Supplies:

- The widespread use in consumer electronics, IT equipment, industrial controls, and medical devices ensures consistent and high-volume demand.

- Technological advancements in AC-DC conversion efficiency and power density further solidify its market dominance.

- The development of compact and integrated AC-DC solutions for embedded applications is a key growth driver.

Leading Segment (End-User Industry): Communication is a pivotal end-user industry, driven by the continuous evolution of telecommunications infrastructure and the proliferation of connected devices. The demand for high-performance, reliable, and efficient power supplies is critical for base stations, data centers, networking equipment, and consumer communication devices.

- Dominance Analysis for Communication:

- The ongoing global rollout of 5G and the development of future wireless technologies necessitate massive deployments of network equipment, all requiring robust power solutions.

- Data centers, the backbone of cloud computing and digital services, have an insatiable appetite for highly efficient and scalable AC-DC power supplies.

- The growth of the Internet of Things (IoT) ecosystem, with billions of connected devices, further amplifies the demand for specialized power solutions within the communication sector.

Other Significant Segments:

- Industrial: This segment is driven by automation, robotics, and the digitalization of manufacturing processes. The need for rugged, reliable, and high-power industrial power supplies is paramount. Key drivers include Industry 4.0 initiatives and the demand for energy-efficient industrial equipment.

- Consumer and Mobile: This segment encompasses power supplies for smartphones, laptops, wearables, and home appliances. Miniaturization, fast charging capabilities, and energy efficiency are key trends.

- Automotive: The rapid growth of electric vehicles (EVs) is a major growth driver, requiring advanced onboard chargers, DC-DC converters, and battery management system power supplies.

- Transportation: This includes power solutions for railway systems, aerospace, and marine applications, demanding ruggedized and highly reliable components capable of operating in extreme conditions.

- Lighting: The transition to LED lighting systems necessitates specialized LED drivers, which are a form of power supply. Energy efficiency and longevity are key considerations.

Power Supply Devices Market Product Developments

Product developments in the Power Supply Devices Market are characterized by an aggressive pursuit of enhanced energy efficiency, reduced form factors, and increased reliability. Manufacturers are leveraging cutting-edge technologies such as GaN and SiC semiconductors to create smaller, lighter, and more powerful AC-DC power supplies and DC-DC converters. These advancements translate into improved thermal management, lower power losses, and enhanced performance across diverse applications. The focus is on delivering intelligent power solutions with advanced protection features and connectivity options, catering to the evolving demands of industries like communication, industrial automation, and automotive electrification.

Report Scope & Segmentation Analysis

This report segment analysis delves into the detailed market segmentation of Power Supply Devices. The market is segmented by Device Type into AC-DC Power Supplies and DC-DC Converters, and by End-user Industry into Communication, Industrial, Consumer and Mobile, Automotive, Transportation, Lighting, and Other End-user Industries.

AC-DC Power Supplies: This segment is projected to grow at a CAGR of xx%, reaching an estimated xx Million by 2033. Its dominance is fueled by widespread adoption across consumer electronics, IT, and industrial applications, driven by continuous demand for reliable power conversion.

DC-DC Converters: Expected to witness a CAGR of xx%, this segment is crucial for voltage regulation and power management in electronic systems. Its growth is propelled by the increasing complexity of electronic devices and the need for efficient power distribution in battery-powered and portable applications.

Communication: This end-user industry segment is anticipated to expand at a CAGR of xx%, driven by 5G infrastructure deployment, data center growth, and the burgeoning IoT ecosystem. The demand for high-density and efficient power solutions is a key growth factor.

Industrial: With an estimated CAGR of xx%, this segment's growth is attributed to industrial automation, smart manufacturing, and the adoption of Industry 4.0 technologies. The requirement for rugged, reliable, and high-power industrial power supplies is significant.

Consumer and Mobile: This segment is projected to grow at a CAGR of xx%, driven by the ever-increasing demand for smartphones, laptops, wearables, and other portable consumer electronics. Miniaturization and fast-charging capabilities are key trends.

Automotive: This segment is poised for substantial growth with a CAGR of xx%, largely due to the rapid adoption of electric vehicles (EVs) and the demand for advanced onboard chargers, DC-DC converters, and battery management system power solutions.

Transportation: Expected to grow at a CAGR of xx%, this segment caters to the power needs of railway, aerospace, and marine applications, emphasizing ruggedness, reliability, and operation in extreme environments.

Lighting: The transition to LED lighting is driving growth in this segment, with an anticipated CAGR of xx%. The demand for energy-efficient and long-lasting LED drivers is a key factor.

Other End-user Industries: This residual category, encompassing segments like medical, defense, and test & measurement, is projected to grow at a CAGR of xx%, driven by specialized power requirements in niche applications.

Key Drivers of Power Supply Devices Market Growth

The Power Supply Devices Market growth is propelled by several interconnected factors. The relentless expansion of the digital economy, characterized by the proliferation of data centers and cloud computing, necessitates highly efficient and scalable power solutions. The widespread adoption of the Internet of Things (IoT) across various sectors, from smart homes to industrial environments, is creating a massive demand for low-power and intelligent power supplies. Furthermore, the global transition towards electric mobility, particularly in the automotive sector, is a significant growth driver, demanding high-power and advanced power conversion systems for EVs. Government initiatives promoting energy efficiency and sustainability are also encouraging the adoption of advanced power supply technologies that reduce energy consumption.

- Digital Transformation & IoT Proliferation: Increasing number of connected devices and data-intensive applications.

- Electric Vehicle (EV) Adoption: Growing demand for onboard chargers and power management systems in EVs.

- 5G Network Deployment: Requirement for robust and efficient power solutions for telecommunication infrastructure.

- Industrial Automation & Smart Manufacturing: Need for reliable and intelligent power for automated systems.

- Energy Efficiency Regulations: Mandates driving the adoption of high-efficiency power supply solutions.

Challenges in the Power Supply Devices Market Sector

Despite the robust growth prospects, the Power Supply Devices Market faces certain challenges. Fluctuations in raw material prices, particularly for rare earth metals and semiconductors, can impact manufacturing costs and profit margins. Geopolitical uncertainties and supply chain disruptions, as witnessed in recent years, can hinder production and timely delivery. Evolving and increasingly stringent regulatory standards across different regions require continuous investment in research and development to ensure compliance, adding to product development costs. Intense competition also leads to price pressures, making it challenging for smaller players to maintain profitability and market share. The rapid pace of technological advancements necessitates constant innovation, requiring significant R&D expenditure to stay ahead of the curve.

- Raw Material Price Volatility: Fluctuations in the cost of key components and materials.

- Supply Chain Disruptions: Vulnerability to global logistics and geopolitical events.

- Stringent Regulatory Compliance: Meeting diverse and evolving international standards.

- Intense Price Competition: Pressure to offer competitive pricing without compromising quality.

- Rapid Technological Obsolescence: The need for continuous innovation and R&D investment.

Emerging Opportunities in Power Supply Devices Market

The Power Supply Devices Market presents numerous emerging opportunities. The accelerating development of renewable energy sources, such as solar and wind power, is creating a growing demand for specialized power conversion and grid integration solutions. The advancements in energy storage technologies, including battery systems for grid-scale applications and electric vehicles, also require sophisticated power management and conditioning. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in various industries is driving the demand for high-performance computing, which in turn requires highly efficient and robust power supplies for servers and data centers. Furthermore, the growing emphasis on smart city initiatives, with their interconnected infrastructure and intelligent systems, will spur demand for innovative power solutions. The medical device industry's continuous innovation also presents opportunities for specialized, reliable, and miniaturized power supplies.

- Renewable Energy Integration: Demand for inverters and power conditioners for solar and wind energy.

- Energy Storage Solutions: Power management for advanced battery systems.

- AI & High-Performance Computing: Efficient power for data centers and AI hardware.

- Smart City Infrastructure: Power solutions for interconnected urban systems.

- Advanced Medical Devices: Need for miniaturized and highly reliable medical-grade power supplies.

Leading Players in the Power Supply Devices Market Market

- Delta Electronics Inc

- Lite-On Technology Corporation

- Emerson Electric Co

- Siemens AG

- Salcomp PLC

- Acbel Polytech Inc

- Mean Well Enterprises Co Ltd

- Murata Manufacturing Co Ltd

- TDK-Lambda Corporation (TDK Corporation)

Key Developments in Power Supply Devices Market Industry

- November 2023: Vox Power announced the introduction of the VCCR300 Conduction Cooled Power Series, a robust, rugged, and highly reliable DC/DC power supply capable of silently delivering 300 Watts of power. The VCCR300 Series provides a wider DC input voltage range, including the standard 48V, 72V, 96V, and 110V railway battery requirements as outlined in EN50155, enhancing the power supply options for the transportation sector.

- October 2023: Mean Well Enterprises Co. Ltd introduced the RQB60W12 series in ultra-wide input railway DC-DC converter. The main features include 14~160Vdc ultra-wide voltage input that can cover the mainstream nominal voltages of global railway systems (24/36/48/72/96/110Vdc), operate under extreme environments of -40~+90℃, an external capacitor can be added to ensure the hold-up time would last for 10~30 ms. In contrast, the DC input is temporarily unstable, 2KVac/3KVdc high isolation withstand voltage, complete protections, etc., demonstrating a commitment to providing rugged power solutions for demanding railway applications.

Strategic Outlook for Power Supply Devices Market Market

- November 2023: Vox Power announced the introduction of the VCCR300 Conduction Cooled Power Series, a robust, rugged, and highly reliable DC/DC power supply capable of silently delivering 300 Watts of power. The VCCR300 Series provides a wider DC input voltage range, including the standard 48V, 72V, 96V, and 110V railway battery requirements as outlined in EN50155, enhancing the power supply options for the transportation sector.

- October 2023: Mean Well Enterprises Co. Ltd introduced the RQB60W12 series in ultra-wide input railway DC-DC converter. The main features include 14~160Vdc ultra-wide voltage input that can cover the mainstream nominal voltages of global railway systems (24/36/48/72/96/110Vdc), operate under extreme environments of -40~+90℃, an external capacitor can be added to ensure the hold-up time would last for 10~30 ms. In contrast, the DC input is temporarily unstable, 2KVac/3KVdc high isolation withstand voltage, complete protections, etc., demonstrating a commitment to providing rugged power solutions for demanding railway applications.

Strategic Outlook for Power Supply Devices Market Market

The strategic outlook for the Power Supply Devices Market is overwhelmingly positive, driven by pervasive technological advancements and the increasing integration of electronic systems across all facets of life. The ongoing digital transformation, coupled with the burgeoning demand for sustainable energy solutions and electric mobility, will continue to fuel market expansion. Companies that focus on developing highly efficient, intelligent, and compact power supply solutions, while adhering to stringent environmental and safety regulations, will be well-positioned for success. Strategic partnerships and collaborations aimed at technological innovation and market penetration, particularly in high-growth segments like renewable energy and automotive, will be crucial for sustained growth. The market is ripe for companies that can offer customized power solutions to meet the unique demands of diverse end-user industries, ensuring a strong competitive edge in the coming years.

Power Supply Devices Market Segmentation

-

1. Device Type

- 1.1. AC-DC Power Supplies

- 1.2. DC-DC Converters

-

2. End-user Industry

- 2.1. Communication

- 2.2. Industrial

- 2.3. Consumer and Mobile

- 2.4. Automotive

- 2.5. Transportation

- 2.6. Lighting

- 2.7. Other End-user Industries

Power Supply Devices Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

Power Supply Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Home and Building Automation Systems; Increasing Demand for Energy-efficient Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Compliance and Safety Standards

- 3.4. Market Trends

- 3.4.1. Consumer and Mobile Segment to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. AC-DC Power Supplies

- 5.1.2. DC-DC Converters

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Communication

- 5.2.2. Industrial

- 5.2.3. Consumer and Mobile

- 5.2.4. Automotive

- 5.2.5. Transportation

- 5.2.6. Lighting

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Americas

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Americas Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. AC-DC Power Supplies

- 6.1.2. DC-DC Converters

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Communication

- 6.2.2. Industrial

- 6.2.3. Consumer and Mobile

- 6.2.4. Automotive

- 6.2.5. Transportation

- 6.2.6. Lighting

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. AC-DC Power Supplies

- 7.1.2. DC-DC Converters

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Communication

- 7.2.2. Industrial

- 7.2.3. Consumer and Mobile

- 7.2.4. Automotive

- 7.2.5. Transportation

- 7.2.6. Lighting

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Asia Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. AC-DC Power Supplies

- 8.1.2. DC-DC Converters

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Communication

- 8.2.2. Industrial

- 8.2.3. Consumer and Mobile

- 8.2.4. Automotive

- 8.2.5. Transportation

- 8.2.6. Lighting

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Australia and New Zealand Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. AC-DC Power Supplies

- 9.1.2. DC-DC Converters

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Communication

- 9.2.2. Industrial

- 9.2.3. Consumer and Mobile

- 9.2.4. Automotive

- 9.2.5. Transportation

- 9.2.6. Lighting

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Middle East and Africa Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. AC-DC Power Supplies

- 10.1.2. DC-DC Converters

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Communication

- 10.2.2. Industrial

- 10.2.3. Consumer and Mobile

- 10.2.4. Automotive

- 10.2.5. Transportation

- 10.2.6. Lighting

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Americas Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Australia and New Zealand Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Power Supply Devices Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Delta Electronics Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lite-On Technology Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Emerson Electric Co

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Siemens AG

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Salcomp PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Acbel Polytech Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Mean Well Enterprises Co Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Murata Manufacturing Co Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 TDK-Lambda Corporation (TDK Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Delta Electronics Inc

List of Figures

- Figure 1: Global Power Supply Devices Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Power Supply Devices Market Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: Americas Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 4: Americas Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 5: Americas Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Americas Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Australia and New Zealand Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Australia and New Zealand Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 17: Australia and New Zealand Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Australia and New Zealand Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Middle East and Africa Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 20: Middle East and Africa Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 21: Middle East and Africa Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East and Africa Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 23: Americas Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 24: Americas Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 25: Americas Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 26: Americas Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 27: Americas Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 28: Americas Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 29: Americas Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Americas Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 31: Americas Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Americas Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 33: Americas Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Americas Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Europe Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 36: Europe Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 37: Europe Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 38: Europe Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 39: Europe Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 40: Europe Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 41: Europe Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Europe Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 43: Europe Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 44: Europe Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 45: Europe Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Europe Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 47: Asia Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 48: Asia Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 49: Asia Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 50: Asia Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 51: Asia Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 52: Asia Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 53: Asia Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 54: Asia Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 55: Asia Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 56: Asia Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 57: Asia Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 59: Australia and New Zealand Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 60: Australia and New Zealand Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 61: Australia and New Zealand Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 62: Australia and New Zealand Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 63: Australia and New Zealand Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 64: Australia and New Zealand Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 65: Australia and New Zealand Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 66: Australia and New Zealand Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 67: Australia and New Zealand Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 68: Australia and New Zealand Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 69: Australia and New Zealand Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 70: Australia and New Zealand Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East and Africa Power Supply Devices Market Revenue (Million), by Device Type 2024 & 2032

- Figure 72: Middle East and Africa Power Supply Devices Market Volume (K Unit), by Device Type 2024 & 2032

- Figure 73: Middle East and Africa Power Supply Devices Market Revenue Share (%), by Device Type 2024 & 2032

- Figure 74: Middle East and Africa Power Supply Devices Market Volume Share (%), by Device Type 2024 & 2032

- Figure 75: Middle East and Africa Power Supply Devices Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 76: Middle East and Africa Power Supply Devices Market Volume (K Unit), by End-user Industry 2024 & 2032

- Figure 77: Middle East and Africa Power Supply Devices Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 78: Middle East and Africa Power Supply Devices Market Volume Share (%), by End-user Industry 2024 & 2032

- Figure 79: Middle East and Africa Power Supply Devices Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Middle East and Africa Power Supply Devices Market Volume (K Unit), by Country 2024 & 2032

- Figure 81: Middle East and Africa Power Supply Devices Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Middle East and Africa Power Supply Devices Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Power Supply Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Power Supply Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 5: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 7: Global Power Supply Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Power Supply Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Power Supply Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Power Supply Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 30: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 31: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 32: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 33: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 36: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 37: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 38: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 39: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 42: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 43: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 44: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 45: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 48: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 49: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 50: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 51: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 53: Global Power Supply Devices Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 54: Global Power Supply Devices Market Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 55: Global Power Supply Devices Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 56: Global Power Supply Devices Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 57: Global Power Supply Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Power Supply Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Power Supply Devices Market?

The projected CAGR is approximately 6.57%.

2. Which companies are prominent players in the Power Supply Devices Market?

Key companies in the market include Delta Electronics Inc, Lite-On Technology Corporation, Emerson Electric Co, Siemens AG, Salcomp PLC, Acbel Polytech Inc, Mean Well Enterprises Co Ltd, Murata Manufacturing Co Ltd, TDK-Lambda Corporation (TDK Corporation.

3. What are the main segments of the Power Supply Devices Market?

The market segments include Device Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Home and Building Automation Systems; Increasing Demand for Energy-efficient Devices.

6. What are the notable trends driving market growth?

Consumer and Mobile Segment to Witness Major Growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Compliance and Safety Standards.

8. Can you provide examples of recent developments in the market?

November 2023: Vox Power announced the introduction of the VCCR300 Conduction Cooled Power Series, a robust, rugged, and highly reliable DC/DC power supply capable of silently delivering 300 Watts of power. The VCCR300 Series provides a wider DC input voltage range, including the standard 48V, 72V, 96V, and 110V railway battery requirements as outlined in EN50155.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Power Supply Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Power Supply Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Power Supply Devices Market?

To stay informed about further developments, trends, and reports in the Power Supply Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence