Key Insights

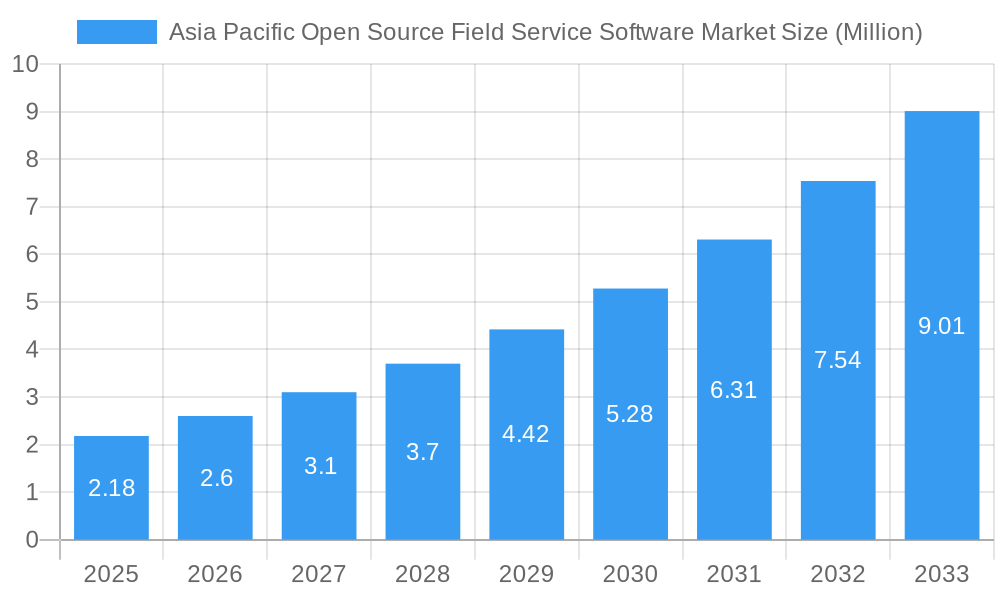

The Asia Pacific Open Source Field Service Software Market is poised for explosive growth, driven by increasing adoption of advanced field service management (FSM) solutions across a diverse range of industries. With a substantial market size of approximately 2.18 million in value units, the region is experiencing a remarkable CAGR of 19.68%, indicating a strong trajectory of expansion throughout the forecast period of 2025-2033. This surge is fueled by the inherent advantages of open-source solutions, including cost-effectiveness, customization capabilities, and rapid innovation, which resonate particularly well with small and medium enterprises (SMEs) and large enterprises alike. The IT and Telecom, Healthcare and Lifesciences, and Manufacturing sectors are emerging as key demand generators, leveraging these platforms to enhance operational efficiency, improve customer satisfaction, and optimize resource allocation in their field operations.

Asia Pacific Open Source Field Service Software Market Market Size (In Million)

The market's dynamism is further amplified by several key drivers. The escalating need for streamlined service delivery, real-time data access for technicians, and enhanced automation of scheduling and dispatching processes are compelling organizations to invest in robust FSM solutions. Cloud deployment models are rapidly gaining traction due to their scalability, accessibility, and reduced infrastructure costs, a trend that aligns perfectly with the adaptable nature of open-source software. While the market presents immense opportunities, certain restraints like the initial integration challenges and the need for skilled personnel to manage and customize open-source platforms require strategic attention. However, the overarching trend of digital transformation and the increasing competitive landscape are pushing businesses in Asia Pacific to embrace these agile and cost-efficient field service management solutions, solidifying its position as a rapidly growing and influential market.

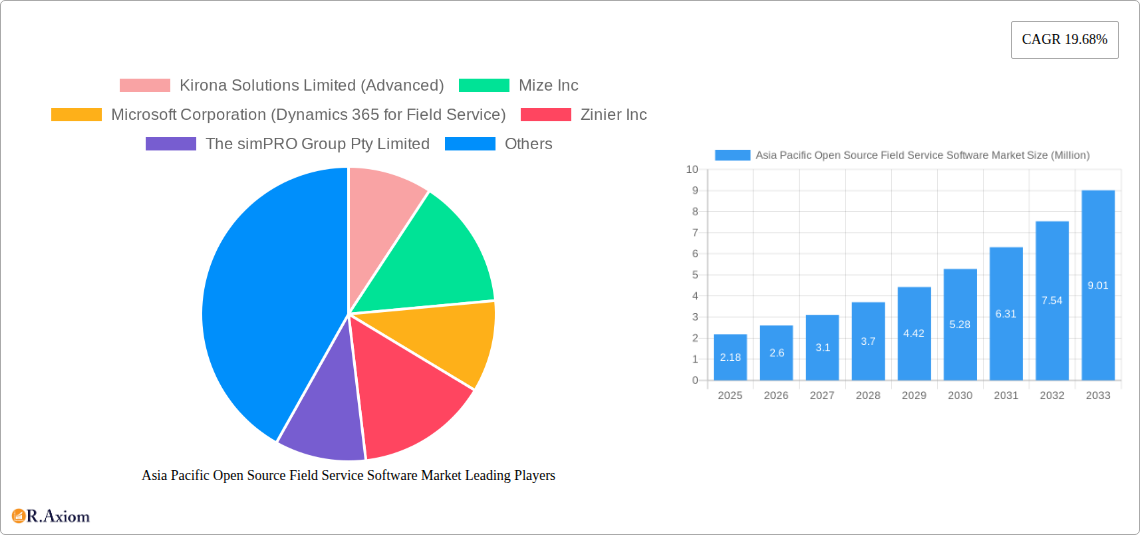

Asia Pacific Open Source Field Service Software Market Company Market Share

Asia Pacific Open Source Field Service Software Market: Comprehensive Analysis and Forecast 2025-2033

This in-depth report provides a detailed analysis of the Asia Pacific Open Source Field Service Software Market, offering critical insights for stakeholders navigating this dynamic sector. Covering the historical period from 2019 to 2024 and projecting through 2033, with a base year of 2025, this study is an essential resource for understanding market trends, competitive landscapes, and future growth trajectories. The report delves into segmentation by deployment type (On-premise, Cloud), organization size (Small and Medium Enterprises, Large Enterprises), and end-user industries (Allied F, IT and Telecom, Healthcare and Lifesciences, Energy and Utilities, Oil and Gas, Manufacturing, Other).

Asia Pacific Open Source Field Service Software Market Market Concentration & Innovation

The Asia Pacific Open Source Field Service Software Market exhibits a moderate to high level of concentration, with a few dominant players like Microsoft Corporation (Dynamics 365 for Field Service) and Salesforce com Inc (Field Service Cloud) holding significant market share. Innovation in this market is primarily driven by the increasing demand for agile field service management solutions, the adoption of IoT and AI in field operations, and the growing need for cost-effective, customizable software. Regulatory frameworks, while varying across countries, are increasingly focusing on data security and privacy, influencing the development of secure open-source field service software. Product substitutes include proprietary field service management software, which often offer comprehensive features but at a higher cost. End-user trends lean towards mobile-first solutions, real-time analytics, and enhanced customer self-service capabilities. Mergers and acquisitions (M&A) are active, with deal values ranging from tens of millions to hundreds of millions of dollars, as companies seek to consolidate market presence and expand their technological portfolios. For instance, SAP SE's acquisition of Coresystems solidified its position in the field service space.

Asia Pacific Open Source Field Service Software Market Industry Trends & Insights

The Asia Pacific Open Source Field Service Software Market is poised for substantial growth, driven by a confluence of technological advancements, evolving business needs, and a growing digital imperative across diverse industries. The increasing adoption of cloud-based solutions is a significant growth driver, offering scalability, flexibility, and reduced upfront costs for businesses of all sizes, particularly Small and Medium Enterprises (SMEs). Technological disruptions, such as the integration of Artificial Intelligence (AI) for predictive maintenance, route optimization, and intelligent scheduling, are revolutionizing field service operations. The rise of the Internet of Things (IoT) enables real-time data collection from assets, allowing for proactive service interventions and improved first-time fix rates. Consumer preferences are shifting towards seamless, on-demand service experiences, pushing companies to invest in field service software that can deliver personalized interactions, self-scheduling options, and real-time status updates. Competitive dynamics are characterized by intense innovation, with companies striving to differentiate through advanced features, intuitive user interfaces, and robust integration capabilities with existing enterprise systems. The forecast CAGR for the Asia Pacific Open Source Field Service Software Market is estimated at approximately 12.5% from 2025 to 2033, indicating a robust expansion phase. Market penetration is steadily increasing, with open-source solutions becoming a viable and attractive alternative to proprietary offerings due to their cost-effectiveness and customization potential. The region's burgeoning economies and rapid industrialization further fuel the demand for efficient field service management, from remote asset maintenance in the Oil and Gas sector to the deployment and support of IT and Telecom infrastructure.

Dominant Markets & Segments in Asia Pacific Open Source Field Service Software Market

The Cloud deployment type is emerging as the dominant segment within the Asia Pacific Open Source Field Service Software Market. This dominance is underpinned by several key drivers:

- Cost-Effectiveness and Scalability: Cloud solutions offer a subscription-based model, significantly lowering initial investment and allowing businesses to scale their operations up or down as needed. This is particularly attractive for Small and Medium Enterprises (SMEs) looking to optimize their IT spend.

- Accessibility and Remote Work Enablement: Cloud-based platforms facilitate access to field service management tools from any location, supporting the growing trend of remote workforces and enabling technicians to access critical information and updates in real-time, irrespective of their geographical position.

- Reduced IT Overhead: Organizations leveraging cloud solutions benefit from reduced in-house IT infrastructure and maintenance burdens, allowing them to focus on core business operations.

Among the Organization Size segments, Small and Medium Enterprises (SMEs) are showing significant traction.

- Budgetary Advantages: Open-source field service software, often coupled with cloud deployment, presents a highly cost-effective solution for SMEs with limited budgets.

- Agility and Customization Needs: SMEs often require flexible solutions that can be tailored to their specific operational workflows, a characteristic well-suited to open-source platforms.

- Digital Transformation Initiatives: Many SMEs are undergoing digital transformation and recognize the critical role of efficient field service in enhancing customer satisfaction and operational efficiency.

In terms of End-User Industries, the IT and Telecom sector, along with Energy and Utilities, are currently the leading segments.

- IT and Telecom: This sector demands highly responsive and efficient field service for network installation, maintenance, and repair. The rapid pace of technological change necessitates agile software solutions that can manage complex deployments and troubleshooting. The use of open-source solutions allows these companies to customize their platforms to integrate with existing network management systems and address specific service level agreements (SLAs).

- Energy and Utilities: This industry relies heavily on the maintenance and repair of critical infrastructure, often in remote locations. Open-source field service software provides the flexibility to manage large fleets of technicians, optimize dispatching for emergency repairs, and ensure compliance with stringent safety regulations. The ability to integrate with IoT devices for remote monitoring of assets further enhances operational efficiency.

The Manufacturing sector is also a significant and growing segment, driven by the need for efficient maintenance of production machinery, warranty services, and after-sales support. The integration of open-source field service software with manufacturing execution systems (MES) and enterprise resource planning (ERP) systems allows for a holistic view of operations.

Asia Pacific Open Source Field Service Software Market Product Developments

Product developments in the Asia Pacific Open Source Field Service Software Market are characterized by a strong emphasis on enhancing user experience, leveraging advanced technologies, and fostering seamless integration. Innovations are focused on delivering intuitive mobile applications for field technicians, incorporating AI-powered predictive maintenance capabilities to minimize downtime, and offering sophisticated scheduling and dispatch tools. Many open-source solutions are being enhanced with robust reporting and analytics dashboards, providing valuable insights into operational efficiency and customer satisfaction. The competitive advantage lies in offering customizable platforms that can be readily adapted to unique industry needs, coupled with features that streamline communication between the back office and field teams. This commitment to iterative development and community-driven enhancements ensures that open-source field service software remains competitive and relevant in meeting evolving market demands.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Asia Pacific Open Source Field Service Software Market, segmenting it by key parameters to provide granular insights.

Deployment Type: The market is bifurcated into On-premise and Cloud deployments. The Cloud segment is projected for robust growth, driven by its scalability and cost-effectiveness, with an estimated market size of over USD 700 Million by 2033. The On-premise segment, while facing declining adoption, will continue to cater to specific security and regulatory needs of certain organizations, estimated at around USD 300 Million.

Organization Size: The market is analyzed across Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs are anticipated to represent the larger share of the market due to the cost advantages and flexibility of open-source solutions, with a projected market size exceeding USD 800 Million. Large Enterprises, while adopting at a slower pace, contribute significantly through larger deal values, estimated at over USD 600 Million.

End-User Industry: The analysis covers Allied F, IT and Telecom, Healthcare and Lifesciences, Energy and Utilities, Oil and Gas, Manufacturing, and Other sectors. The IT and Telecom and Energy and Utilities sectors are expected to lead the market in terms of adoption and market size, collectively projected to exceed USD 1 Billion. Healthcare and Lifesciences and Manufacturing will also exhibit significant growth, driven by specialized service requirements.

Key Drivers of Asia Pacific Open Source Field Service Software Market Growth

The Asia Pacific Open Source Field Service Software Market is propelled by several key drivers. The increasing demand for operational efficiency and cost reduction is a primary catalyst, as businesses seek to optimize resource allocation and minimize service delivery costs. The rapid proliferation of mobile devices and the growing acceptance of BYOD (Bring Your Own Device) policies empower field technicians with unprecedented access to information and communication tools, fueling the need for robust mobile-first field service applications. The growing adoption of IoT devices and the subsequent surge in data generation necessitate sophisticated software solutions for managing, analyzing, and acting upon this data, particularly for predictive maintenance and proactive service. Furthermore, the inherent flexibility and customizability of open-source software appeal to a wide range of organizations seeking tailored solutions that can integrate seamlessly with their existing IT ecosystems.

Challenges in the Asia Pacific Open Source Field Service Software Market Sector

Despite its promising growth, the Asia Pacific Open Source Field Service Software Market faces several challenges. Concerns regarding data security and privacy remain a significant barrier for some organizations, particularly those in highly regulated industries, necessitating robust security protocols and compliance adherence. The availability of skilled IT professionals capable of implementing, customizing, and maintaining open-source solutions can be a bottleneck in certain regions. Fragmented market landscapes and varying levels of technical expertise across diverse countries within the Asia Pacific region can complicate market entry and widespread adoption strategies. Additionally, the perceived lack of dedicated vendor support compared to proprietary solutions can be a deterrent for businesses that require immediate and comprehensive technical assistance.

Emerging Opportunities in Asia Pacific Open Source Field Service Software Market

The Asia Pacific Open Source Field Service Software Market presents several emerging opportunities. The growing demand for AI and machine learning integration offers avenues for developing advanced predictive maintenance, intelligent scheduling, and automated customer service capabilities. The expansion of smart cities and critical infrastructure projects across the region will drive significant demand for field service management solutions in sectors like utilities, transportation, and public safety. The increasing focus on sustainability and green initiatives presents opportunities for field service software that can optimize routes, reduce fuel consumption, and manage the maintenance of renewable energy assets. Furthermore, the continued digital transformation of SMEs across various industries creates a vast untapped market for affordable and scalable open-source field service solutions.

Leading Players in the Asia Pacific Open Source Field Service Software Market Market

- Kirona Solutions Limited

- Mize Inc

- Microsoft Corporation

- Zinier Inc

- The simPRO Group Pty Limited

- IFS AB

- ServiceMax Inc

- Field Aware US Inc

- Salesforce com Inc

- Trimble Inc

- Oracle Corporation

- Accruent LLC

- Coresystems

- ServicePower Inc

Key Developments in Asia Pacific Open Source Field Service Software Market Industry

- August 2022 - ServiceMax, a leader in asset-centric field service management, declared the continued expansion of ServiceMax Core by adding new extra features that can fuel better customer field service management performance, revenue, and margin growth. These advancements benefit not only administrators, field technicians, planners, and dispatchers but also an increasing scope of roles associated with expanding operating margins, driving customer value, and improving revenues.

- October 2021 - Salesforce introduced four new capabilities for Field Service to help businesses equip their mobile workforce for the future. These features will enable businesses to scale field service resources to handle more complex jobs, customize mobile workflows to improve employee experiences, provide customers with self-service scheduling, and use video to troubleshoot issues in real-time.

Strategic Outlook for Asia Pacific Open Source Field Service Software Market Market

The strategic outlook for the Asia Pacific Open Source Field Service Software Market is characterized by significant growth potential, fueled by ongoing digital transformation initiatives and the relentless pursuit of operational excellence. Key growth catalysts include the increasing adoption of cloud-based solutions, the integration of advanced technologies like AI and IoT, and the growing need for cost-effective and customizable software. As businesses across the region increasingly recognize the strategic importance of efficient field service operations in enhancing customer satisfaction and driving revenue growth, the demand for open-source field service software is expected to surge. Companies that focus on delivering intuitive user experiences, robust integration capabilities, and strong community support will be well-positioned to capitalize on the expanding market opportunities and secure a leading position in this dynamic sector. The market is ripe for innovation and strategic partnerships that can address the unique challenges and capitalize on the diverse opportunities present in the Asia Pacific region.

Asia Pacific Open Source Field Service Software Market Segmentation

-

1. Deployment Type

- 1.1. On-premise

- 1.2. Cloud

-

2. Organization Size

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. End-User

- 3.1. Allied F

- 3.2. IT and Telecom

- 3.3. Healthcare and Lifesciences

- 3.4. Energy and Utilities

- 3.5. Oil and Gas

- 3.6. Manufacturing

- 3.7. Other

Asia Pacific Open Source Field Service Software Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Open Source Field Service Software Market Regional Market Share

Geographic Coverage of Asia Pacific Open Source Field Service Software Market

Asia Pacific Open Source Field Service Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Customer Demand for Quicker Response Time enabling FMS Companies to Invest in New Technologies; Growing Emphasis on Maximizing Work Efficiency

- 3.3. Market Restrains

- 3.3.1. Increasing Risk of Counterfeits

- 3.4. Market Trends

- 3.4.1. Adoption of Field Service Management Solutions in India is Increasing at a High Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Open Source Field Service Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Allied F

- 5.3.2. IT and Telecom

- 5.3.3. Healthcare and Lifesciences

- 5.3.4. Energy and Utilities

- 5.3.5. Oil and Gas

- 5.3.6. Manufacturing

- 5.3.7. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kirona Solutions Limited (Advanced)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mize Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microsoft Corporation (Dynamics 365 for Field Service)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zinier Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The simPRO Group Pty Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IFS AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ServiceMax Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Field Aware US Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Salesforce com Inc (Field Service Cloud)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Trimble Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Oracle Corporation (OFSC)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Accruent LLC (Fortive Corp)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Coresystems (SAP SE)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 ServicePower Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Kirona Solutions Limited (Advanced)

List of Figures

- Figure 1: Asia Pacific Open Source Field Service Software Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Open Source Field Service Software Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 2: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 3: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 6: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 7: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Asia Pacific Open Source Field Service Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Open Source Field Service Software Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Open Source Field Service Software Market?

The projected CAGR is approximately 19.68%.

2. Which companies are prominent players in the Asia Pacific Open Source Field Service Software Market?

Key companies in the market include Kirona Solutions Limited (Advanced), Mize Inc, Microsoft Corporation (Dynamics 365 for Field Service), Zinier Inc, The simPRO Group Pty Limited, IFS AB, ServiceMax Inc, Field Aware US Inc, Salesforce com Inc (Field Service Cloud), Trimble Inc, Oracle Corporation (OFSC), Accruent LLC (Fortive Corp), Coresystems (SAP SE), ServicePower Inc.

3. What are the main segments of the Asia Pacific Open Source Field Service Software Market?

The market segments include Deployment Type, Organization Size, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Customer Demand for Quicker Response Time enabling FMS Companies to Invest in New Technologies; Growing Emphasis on Maximizing Work Efficiency.

6. What are the notable trends driving market growth?

Adoption of Field Service Management Solutions in India is Increasing at a High Pace.

7. Are there any restraints impacting market growth?

Increasing Risk of Counterfeits.

8. Can you provide examples of recent developments in the market?

August 2022 - ServiceMax, a leader in asset-centric field service management, declared the continued expansion of ServiceMax Core by adding new extra features that can fuel better customer field service management performance, revenue, and margin growth. These advancements benefit not only administrators, field technicians, planners, and dispatchers but also an increasing scope of roles associated with expanding operating margins, driving customer value, and improving revenues.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Open Source Field Service Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Open Source Field Service Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Open Source Field Service Software Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Open Source Field Service Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence