Key Insights

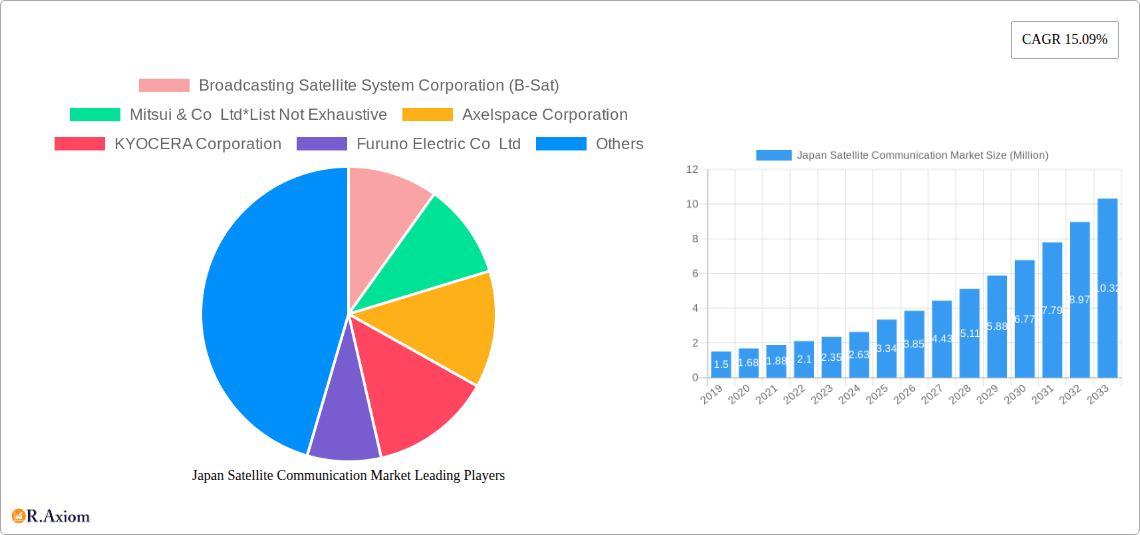

The Japan Satellite Communication Market is poised for robust expansion, projected to reach a substantial USD 3.34 Billion by 2025. This growth is fueled by a dynamic CAGR of 15.09%, indicating a significantly expanding market. Key drivers for this surge include the increasing demand for high-speed broadband connectivity in remote areas, the burgeoning adoption of satellite technology in maritime and airborne applications for enhanced communication and navigation, and the growing need for resilient and secure communication networks for defense and government operations. Furthermore, advancements in satellite technology, such as the development of smaller, more powerful satellites and sophisticated ground equipment, are lowering barriers to entry and fostering innovation. The media and entertainment sector is also increasingly leveraging satellite communications for content distribution and broadcasting, further stimulating market growth.

Japan Satellite Communication Market Market Size (In Million)

The market's trajectory is further shaped by several critical trends. The proliferation of Low Earth Orbit (LEO) satellite constellations is revolutionizing connectivity, offering lower latency and higher bandwidth. This is particularly beneficial for portable and land-based applications requiring real-time data transmission. Concurrently, the growing integration of Artificial Intelligence (AI) and Machine Learning (ML) into satellite communication systems is optimizing network performance, enhancing data analysis, and enabling predictive maintenance. While the market is experiencing strong growth, potential restraints include high initial investment costs for satellite infrastructure and ground equipment, as well as regulatory complexities and spectrum allocation challenges. However, the persistent demand for ubiquitous connectivity across diverse end-user verticals, coupled with ongoing technological innovations, is expected to largely outweigh these challenges, ensuring a promising outlook for the Japan Satellite Communication Market.

Japan Satellite Communication Market Company Market Share

This comprehensive report delivers a deep dive into the Japan Satellite Communication Market, analyzing its current landscape, historical performance, and projected trajectory. Spanning from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this study is an indispensable resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive strategies within Japan's burgeoning satellite communications sector.

Japan Satellite Communication Market Market Concentration & Innovation

The Japan Satellite Communication Market exhibits a moderate level of market concentration, with key players like SKY Perfect JSAT Corporation and Broadcasting Satellite System Corporation (B-Sat) holding significant market share. Innovation is a primary driver, fueled by advancements in High Throughput Satellites (HTS), miniaturization of ground equipment, and the development of AI-powered satellite data analytics. Regulatory frameworks, overseen by bodies such as the Ministry of Internal Affairs and Communications (MIC), are evolving to support the growth of new space initiatives and foster competition. Product substitutes, primarily terrestrial networks like 5G, are present but satellite communication offers unique advantages in terms of ubiquitous coverage, disaster resilience, and specialized applications. End-user trends are shifting towards increased demand for high-bandwidth services, IoT connectivity for remote monitoring, and secure communication for defense and government sectors. Mergers and Acquisitions (M&A) are expected to play a role in consolidation and expansion, with potential deal values in the tens to hundreds of millions of dollars, as companies seek to enhance their service portfolios and geographical reach.

Japan Satellite Communication Market Industry Trends & Insights

The Japan Satellite Communication Market is poised for substantial growth, driven by escalating demand for high-speed internet, the proliferation of connected devices, and the increasing adoption of satellite technology across various industries. The projected Compound Annual Growth Rate (CAGR) for the forecast period is approximately 12.5%, indicating a robust expansion. Technological advancements, including the development of Low Earth Orbit (LEO) satellite constellations, are revolutionizing bandwidth capabilities and latency, making satellite communication a viable alternative to terrestrial networks for many applications. Consumer preferences are increasingly leaning towards seamless connectivity, regardless of location, which satellite services are uniquely positioned to provide. The competitive landscape is characterized by a blend of established players offering geostationary (GEO) satellite services and emerging companies focusing on LEO and Medium Earth Orbit (MEO) constellations. The Japanese government's commitment to digital transformation and its strong emphasis on national security are further bolstering the market. The increasing utilization of satellite imagery for earth observation, precision agriculture, and environmental monitoring also contributes significantly to market penetration. Furthermore, the growing need for reliable communication infrastructure in remote and disaster-prone areas in Japan acts as a consistent demand generator. The integration of AI and machine learning in satellite data processing is unlocking new revenue streams and enhancing the value proposition of satellite services for enterprise clients. The market penetration of satellite communication services is expected to rise from approximately 15% in 2024 to over 25% by 2033, reflecting its growing importance in the national communication ecosystem.

Dominant Markets & Segments in Japan Satellite Communication Market

The Services segment is anticipated to dominate the Japan Satellite Communication Market, driven by the increasing demand for managed services, data transmission, and broadcasting solutions. The Land platform segment will also hold a significant share, catering to enterprise connectivity, IoT applications, and broadband access in underserved areas.

Services Dominance Drivers:

- High-Bandwidth Demand: Enterprises and consumers require ever-increasing data throughput, which managed satellite services can reliably deliver.

- IoT Expansion: The burgeoning Internet of Things ecosystem necessitates robust and widespread connectivity solutions, often provided by satellite services for remote asset tracking and monitoring.

- Broadcasting Evolution: The transition to digital broadcasting and the demand for high-definition content continue to fuel the need for satellite-based distribution.

- Disaster Resilience: The Japanese government and private sector prioritize resilient communication networks, making satellite services crucial for business continuity during natural disasters.

- Value-Added Services: Providers are increasingly offering integrated solutions beyond raw connectivity, including data analytics, cybersecurity, and network management, enhancing revenue streams.

Land Platform Dominance Drivers:

- Enterprise Connectivity: Businesses operating in remote locations or requiring redundant communication links rely heavily on land-based satellite terminals.

- Rural Broadband: Bridging the digital divide in rural Japan is a key objective, with satellite terminals providing essential internet access where terrestrial infrastructure is lacking.

- Mobile Backhaul: Satellite is used to provide backhaul connectivity for mobile networks in areas where fiber optic deployment is not feasible.

- Fixed Satellite Services (FSS): These remain a cornerstone for providing stable internet and data services to fixed locations.

Within end-user verticals, Enterprises and Defense and Government are expected to be the leading segments.

- Enterprises: The adoption of cloud computing, the need for remote work capabilities, and the expansion of IoT applications across industries like logistics, agriculture, and energy are driving demand. Satellite communication provides a reliable and scalable solution for these diverse enterprise needs, with market share projected to reach approximately 35% of the total end-user market.

- Defense and Government: National security concerns, border surveillance, disaster response coordination, and the need for secure, resilient communication channels for military and public service agencies make this a critical segment. Government initiatives supporting space exploration and defense modernization further bolster this sector, with an estimated market share of 30%.

The Media and Entertainment segment will also see robust growth, driven by the demand for live broadcasting of events and the distribution of content to remote areas. The Maritime and Airborne segments, while niche, are experiencing increasing adoption due to the growing need for connectivity in these mobile environments.

Japan Satellite Communication Market Product Developments

Product development in the Japan Satellite Communication Market is characterized by a focus on miniaturization, increased bandwidth, and enhanced data processing capabilities. Innovations in High Throughput Satellites (HTS) are enabling faster data transfer rates and more efficient spectrum utilization. The development of advanced ground equipment, including compact and easily deployable terminals, is expanding the accessibility of satellite services. Furthermore, the integration of AI and machine learning into satellite data analytics is creating novel applications for earth observation, remote sensing, and predictive maintenance, offering a significant competitive advantage to companies investing in these technologies.

Report Scope & Segmentation Analysis

This report meticulously segments the Japan Satellite Communication Market by Type, Platform, and End-user Vertical.

- Type: The market is segmented into Ground Equipment and Services. Ground Equipment encompasses antennas, modems, and user terminals, vital for accessing satellite networks. Services include data transmission, broadcasting, voice communication, and managed solutions, forming the backbone of satellite-based operations.

- Platform: Segmentation by platform includes Portable, Land, Maritime, and Airborne. Portable terminals offer mobility for tactical operations and remote fieldwork. Land-based platforms cater to fixed installations and enterprise connectivity. Maritime platforms provide communication for vessels, while airborne platforms serve aircraft and drones, each with distinct growth trajectories and market sizes.

- End-user Vertical: Key end-user verticals analyzed are Maritime, Defense and Government, Enterprises, Media and Entertainment, and Other End-user Verticals. Each vertical presents unique demands and adoption rates, with specific market sizes and competitive dynamics explored.

Key Drivers of Japan Satellite Communication Market Growth

Several key factors are propelling the growth of the Japan Satellite Communication Market. The Japanese government's strategic initiatives in space exploration and utilization, coupled with significant investments in national security and digital infrastructure, are primary catalysts. The increasing demand for ubiquitous high-speed internet, especially in rural and disaster-prone regions, is a critical driver. Furthermore, the burgeoning adoption of the Internet of Things (IoT) across industries like logistics, agriculture, and environmental monitoring necessitates reliable, wide-area connectivity that satellite communication provides. The ongoing evolution of satellite technology, including the deployment of Low Earth Orbit (LEO) constellations, is enhancing bandwidth capabilities and reducing latency, making satellite services more competitive and accessible for a broader range of applications.

Challenges in the Japan Satellite Communication Market Sector

Despite robust growth, the Japan Satellite Communication Market faces certain challenges. High upfront investment costs for satellite deployment and ground infrastructure can be a barrier for some companies. Regulatory complexities and evolving licensing procedures can also impact the speed of market entry and service expansion. Competition from rapidly advancing terrestrial networks, such as 5G, poses a threat in certain urbanized areas, necessitating clear differentiation of satellite's unique value proposition. Supply chain disruptions and the global shortage of critical electronic components can affect the production and availability of satellite hardware. Additionally, the need for skilled personnel in satellite operations and data analysis presents a talent acquisition challenge.

Emerging Opportunities in Japan Satellite Communication Market

The Japan Satellite Communication Market is ripe with emerging opportunities. The increasing demand for integrated satellite and terrestrial communication solutions (hybrid networks) presents a significant avenue for growth. The expansion of in-orbit servicing, assembly, and manufacturing (ISAM) capabilities will create new service opportunities and support the longevity of satellite assets. The growing market for Earth observation data analytics, driven by AI and machine learning, offers substantial potential for value creation. Furthermore, the development of next-generation satellite technology, including quantum communication and advanced propulsion systems, will open up entirely new application domains and market segments. The push for space situational awareness and debris mitigation also represents an area of growing importance and potential commercialization.

Leading Players in the Japan Satellite Communication Market Market

- Broadcasting Satellite System Corporation (B-Sat)

- Mitsui & Co Ltd

- Axelspace Corporation

- KYOCERA Corporation

- Furuno Electric Co Ltd

- New Japan Radio Co Ltd

- SKY Perfect JSAT Corporation

- Mitsubishi Electric

- Infostellar Inc

- NEC Space Technologies Ltd

Key Developments in Japan Satellite Communication Market Industry

- March 2023 - The Japan Aerospace Exploration Agency, or JAXA, chose SKY Perfect JSAT as a service provider for the Near-Earth Tracking and Control Network. They want to create new ground stations worldwide by cooperating with SKY Perfect JSAT and KSAT to offer Near-Earth Tracking and Control Services to JAXA and other Japanese state organizations.

- November 2022 - Japan Space Imaging Corporation (JSI), a Japanese space firm, and Satellite Vu entered a new agreement under which JSI will employ Satellite Vu's pictures, products, and services to enhance its worldwide imaging portfolio with high-resolution thermal data. The deal comes after Satellite Vu's early access option program (EAOP) launched.

Strategic Outlook for Japan Satellite Communication Market Market

The strategic outlook for the Japan Satellite Communication Market is highly positive, driven by continued government support, rapid technological innovation, and a growing appetite for advanced connectivity solutions. Companies that focus on developing integrated hybrid network solutions, leveraging AI for data analytics, and expanding their service offerings in emerging verticals like smart agriculture and advanced logistics will be well-positioned for success. Investment in LEO constellations and the associated ground infrastructure will be crucial for capturing market share in high-bandwidth applications. Furthermore, strategic partnerships and collaborations will be key to navigating the complex regulatory landscape and accelerating market penetration. The emphasis on national security and disaster resilience will continue to be a strong market anchor, ensuring sustained demand for reliable satellite communication services.

Japan Satellite Communication Market Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

Japan Satellite Communication Market Segmentation By Geography

- 1. Japan

Japan Satellite Communication Market Regional Market Share

Geographic Coverage of Japan Satellite Communication Market

Japan Satellite Communication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in IoT and Autonomous Systems is Driving the Market; Increasing Demand for Broadband Connectivity

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Media and Entertainment Segment is Expected to Hold a Considerable Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Satellite Communication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Broadcasting Satellite System Corporation (B-Sat)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsui & Co Ltd*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Axelspace Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KYOCERA Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Furuno Electric Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 New Japan Radio Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SKY Perfect JSAT Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Infostellar Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NEC Space Technologies Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Broadcasting Satellite System Corporation (B-Sat)

List of Figures

- Figure 1: Japan Satellite Communication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Satellite Communication Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Satellite Communication Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Japan Satellite Communication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Japan Satellite Communication Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Japan Satellite Communication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Japan Satellite Communication Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Japan Satellite Communication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 7: Japan Satellite Communication Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Japan Satellite Communication Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Satellite Communication Market?

The projected CAGR is approximately 15.09%.

2. Which companies are prominent players in the Japan Satellite Communication Market?

Key companies in the market include Broadcasting Satellite System Corporation (B-Sat), Mitsui & Co Ltd*List Not Exhaustive, Axelspace Corporation, KYOCERA Corporation, Furuno Electric Co Ltd, New Japan Radio Co Ltd, SKY Perfect JSAT Corporation, Mitsubishi Electric, Infostellar Inc, NEC Space Technologies Ltd.

3. What are the main segments of the Japan Satellite Communication Market?

The market segments include Type, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in IoT and Autonomous Systems is Driving the Market; Increasing Demand for Broadband Connectivity.

6. What are the notable trends driving market growth?

The Media and Entertainment Segment is Expected to Hold a Considerable Market Share.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

March 2023 - The Japan Aerospace Exploration Agency, or JAXA, chose SKY Perfect JSAT as a service provider for the Near-Earth Tracking and Control Network. They want to create new ground stations worldwide by cooperating with SKY Perfect JSAT and KSAT to offer Near-Earth Tracking and Control Services to JAXA and other Japanese state organizations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Satellite Communication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Satellite Communication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Satellite Communication Market?

To stay informed about further developments, trends, and reports in the Japan Satellite Communication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence