Key Insights

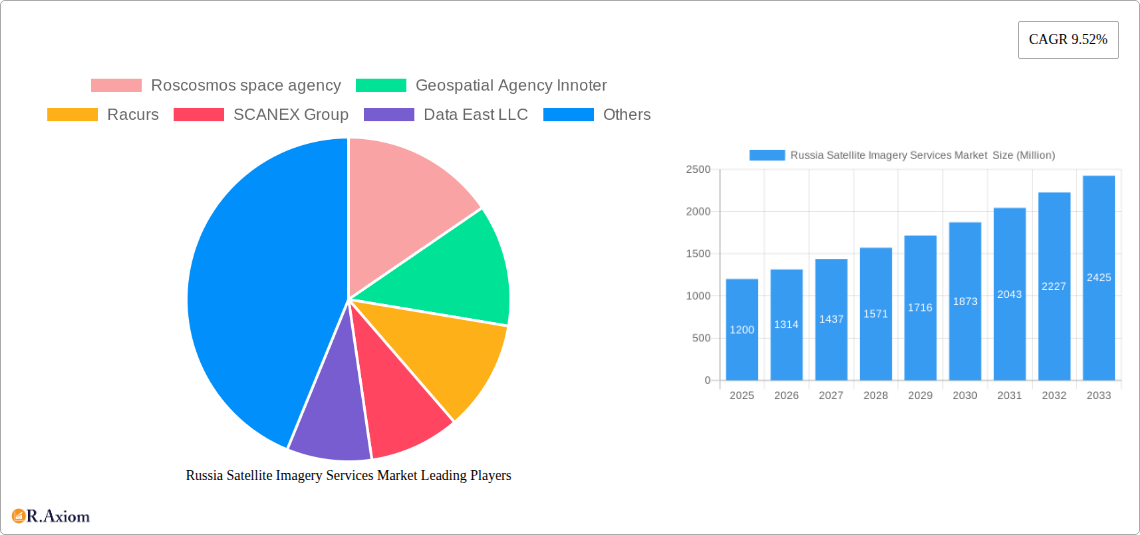

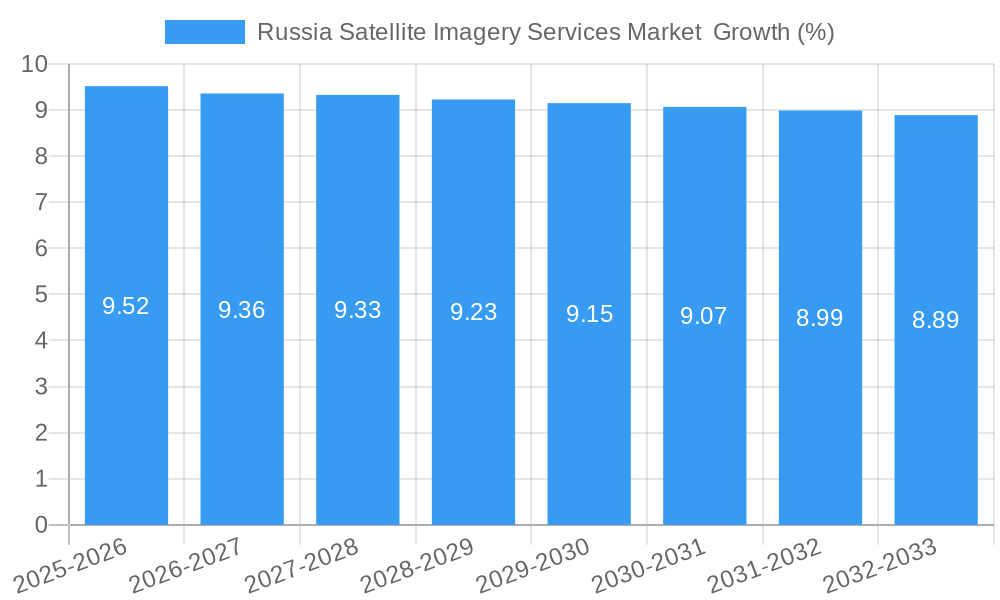

The Russia Satellite Imagery Services Market is poised for significant expansion, with an estimated market size of approximately USD 1.2 billion in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 9.52% projected through 2033. This growth is underpinned by escalating demand across critical sectors, including government applications for mapping and urban planning, natural resource management for monitoring and conservation, and enhanced surveillance and security operations. The ongoing advancements in satellite technology, leading to higher resolution imagery and more frequent revisit times, coupled with increasing investments in geospatial infrastructure, are key catalysts. Furthermore, the integration of AI and machine learning for data analysis is unlocking new application areas and driving efficiency, making satellite imagery services indispensable for informed decision-making in a variety of industries.

The market's trajectory is further shaped by a clear segmentation of end-users, with government entities, construction firms, and the military and defense sectors leading the adoption. The forestry and agriculture segments are also witnessing substantial growth, leveraging satellite data for precision farming and sustainable land management. Challenges such as high initial investment costs and the need for specialized expertise for data interpretation are present, but are being mitigated by the growing availability of user-friendly platforms and cloud-based solutions. Key players like Roscosmos space agency, Innoter, Racurs, and EAST VIEW GEOSPATIAL INC are instrumental in shaping this evolving landscape through continuous innovation and strategic partnerships, ensuring the market's continued upward momentum and its critical role in Russia's technological and economic development.

This in-depth report provides a definitive analysis of the Russia Satellite Imagery Services Market, offering granular insights into its current landscape, historical performance, and future trajectory. Covering the historical period of 2019–2024 and projecting to 2033 with a base year of 2025, this report is an indispensable resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and strategize for success. The Russian satellite imagery services market is witnessing robust expansion driven by increasing demand across various sectors, including government, defense, natural resource management, and infrastructure development. Technological advancements in satellite technology, enhanced resolution capabilities, and the growing adoption of geospatial data analytics are key catalysts for this growth.

The market is characterized by a mix of established players and emerging innovators, with a significant role played by government-backed entities. The study encompasses detailed segmentation by application and end-user, providing a holistic view of market penetration and potential.

Russia Satellite Imagery Services Market Market Concentration & Innovation

The Russia Satellite Imagery Services Market exhibits a moderate level of market concentration, with key players like Roscosmos space agency holding significant influence due to their foundational role in the nation's space infrastructure. Innovation is a critical driver, spurred by the demand for higher resolution imagery, advanced analytics, and specialized applications. Regulatory frameworks, while evolving, generally support the development and deployment of satellite imagery services, particularly for national security and resource management. Product substitutes, such as aerial imagery and ground-based sensors, exist but often lack the comprehensive coverage and scalability of satellite-based solutions. End-user trends are shifting towards real-time data processing, AI-driven analysis, and integrated geospatial solutions. Mergers and acquisitions (M&A) activities, while not as pronounced as in some global markets, are expected to play a role in consolidating expertise and expanding service offerings. While specific market share data for individual companies is proprietary, Roscosmos's dominant position in national satellite development and data provision is undeniable. M&A deal values, though not publicly detailed for all transactions, are likely to see increased activity as companies seek to enhance their technological capabilities and market reach.

- Market Concentration: Moderate to High, with significant government involvement.

- Innovation Drivers: Demand for higher resolution, advanced analytics, AI integration, and specialized applications.

- Regulatory Frameworks: Supportive for national security and resource management, evolving for commercial applications.

- Product Substitutes: Aerial imagery, ground-based sensors.

- End-User Trends: Real-time data, AI analytics, integrated geospatial solutions.

- M&A Activities: Potential for consolidation to enhance capabilities and market presence.

Russia Satellite Imagery Services Market Industry Trends & Insights

The Russia Satellite Imagery Services Market is on a substantial growth trajectory, fueled by a confluence of technological advancements, increasing government investment, and a widening array of commercial applications. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This growth is underpinned by the continuous enhancement of satellite sensor technologies, leading to higher spatial, spectral, and temporal resolutions. The increasing accessibility of satellite data, coupled with sophisticated analytical tools and artificial intelligence, is empowering a broader range of industries to leverage geospatial insights for decision-making. The government's commitment to developing its domestic satellite constellations, as evidenced by ongoing projects and collaborations, is a significant market penetration driver. Furthermore, the growing awareness of the benefits of satellite imagery in areas like environmental monitoring, precision agriculture, urban planning, and disaster response is expanding the market's reach beyond traditional defense and security applications. The competitive landscape is characterized by a dynamic interplay between state-owned enterprises and private sector innovation. Technological disruptions, such as the miniaturization of satellites (CubeSats) and the development of synthetic-aperture radar (SAR) capabilities, are opening up new avenues for data acquisition and analysis, even under adverse weather conditions. Consumer preferences are increasingly leaning towards value-added services, including integrated data platforms, customized analytics, and cloud-based solutions that offer scalability and accessibility. The strategic importance of satellite imagery for national security and economic development continues to shape industry trends, ensuring consistent demand and investment. The market penetration is steadily increasing across all major end-user segments, reflecting the growing recognition of satellite data's indispensable role in modern operations.

Dominant Markets & Segments in Russia Satellite Imagery Services Market

The Government sector stands out as the dominant end-user segment in the Russia Satellite Imagery Services Market. This dominance is driven by the strategic importance of satellite imagery for national security, defense, infrastructure planning, and natural resource management. The government's continuous investment in its space program and the procurement of satellite data for intelligence, surveillance, and reconnaissance (ISR) operations are key contributors to this segment's growth.

- Government: This segment's dominance is propelled by:

- National Security & Defense: Extensive use for border surveillance, military operations monitoring, and intelligence gathering.

- Infrastructure Development: Planning and monitoring of large-scale projects, including transportation networks and energy facilities.

- Resource Management: Oversight of mineral exploration, agricultural productivity, and forestry.

- Disaster Management: Real-time assessment of natural calamities and aid coordination.

Within the application segments, Geospatial Data Acquisition and Mapping represents a foundational and consistently high-demand area. This segment encompasses the core function of capturing, processing, and distributing satellite imagery for a multitude of purposes.

- Geospatial Data Acquisition and Mapping: This segment's strength lies in:

- High-Resolution Mapping: Providing detailed topographic and thematic maps for various industries.

- Cadastral Mapping: Supporting land administration and property management.

- Urban Planning: Facilitating the design and development of cities and urban infrastructure.

- Navigation Systems: Contributing to the accuracy and efficiency of GPS and other navigation platforms.

The Military and Defense sector, closely linked to government applications, is another significant driver of market demand. The ongoing geopolitical landscape underscores the critical need for advanced surveillance and reconnaissance capabilities.

- Military and Defense: This segment's prominence is driven by:

- Surveillance and Reconnaissance: Continuous monitoring of adversary activities and border security.

- Intelligence Gathering: Providing actionable intelligence for strategic and tactical decision-making.

- Mission Planning: Supporting the planning and execution of military operations.

- Target Identification and Monitoring: Precise identification and tracking of strategic assets.

Furthermore, Natural Resource Management is a steadily growing application due to Russia's vast natural resources and the increasing need for sustainable exploitation and environmental protection.

- Natural Resource Management: Key drivers include:

- Exploration and Monitoring: Identifying and assessing reserves of oil, gas, and minerals.

- Environmental Monitoring: Tracking pollution, deforestation, and climate change impacts.

- Precision Agriculture: Optimizing crop yields and resource allocation in the agricultural sector.

- Forestry Management: Monitoring forest health, detecting fires, and planning sustainable harvesting.

The Construction industry is also showing increasing adoption, leveraging satellite imagery for site assessment, project progress monitoring, and land development.

- Construction: Growing applications include:

- Site Selection and Assessment: Evaluating land suitability for new developments.

- Progress Monitoring: Tracking construction timelines and identifying potential delays.

- Infrastructure Planning: Assessing the impact of new construction on surrounding areas.

Russia Satellite Imagery Services Market Product Developments

Product developments in the Russia Satellite Imagery Services Market are increasingly focused on enhancing image resolution, improving data acquisition speed, and integrating advanced analytical capabilities. Companies are investing in next-generation sensors that offer higher spatial detail and broader spectral bands, enabling more precise mapping and monitoring. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into satellite data processing pipelines is a key trend, allowing for automated feature extraction, change detection, and predictive analytics. Developments also include the expansion of Synthetic Aperture Radar (SAR) capabilities, providing all-weather, day-and-night imaging. These advancements offer significant competitive advantages by delivering more actionable insights, reducing processing times, and catering to specialized end-user needs in sectors like defense, agriculture, and disaster management. The growing emphasis on cloud-based platforms further enhances accessibility and scalability of these advanced satellite imagery services.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Russia Satellite Imagery Services Market, segmented by Application and End-User. The Application segments include Geospatial Data Acquisition and Mapping, Natural Resource Management, Surveillance and Security, Conservation and Research, Disaster Management, and Intelligence. The End-User segments comprise Government, Construction, Transportation and Logistics, Military and Defense, Forestry and Agriculture, and Other End-Users. Each segment is analyzed for its current market size, projected growth, and key market drivers. For instance, the Geospatial Data Acquisition and Mapping segment is expected to maintain a significant market share due to its foundational role across all industries. The Military and Defense segment is projected for robust growth driven by increasing security concerns. The Government segment will continue to be a primary consumer due to national strategic interests. The Transportation and Logistics sector is expected to see increasing adoption for route optimization and infrastructure management. The Forestry and Agriculture segments are poised for growth driven by precision farming initiatives and resource management needs.

Key Drivers of Russia Satellite Imagery Services Market Growth

The growth of the Russia Satellite Imagery Services Market is propelled by several key factors. The increasing government investment in space exploration and satellite technology development, including national constellation expansion, provides a strong foundation. Technological advancements in satellite sensor resolution, data processing, and AI integration are crucial drivers, enabling more precise and actionable insights. The growing demand for geospatial data across diverse sectors like agriculture, resource management, urban planning, and infrastructure development significantly fuels market expansion. Furthermore, the geopolitical landscape and enhanced security concerns are driving the adoption of satellite imagery for surveillance, reconnaissance, and intelligence gathering. The need for effective disaster management and environmental monitoring also contributes to market growth as satellite imagery offers a comprehensive view for assessment and response.

- Government Investment: Continued funding for domestic satellite programs.

- Technological Advancements: Higher resolution, AI integration, SAR capabilities.

- Industry Demand: Expanding applications in agriculture, infrastructure, and urban planning.

- Security Concerns: Increased use for defense, surveillance, and intelligence.

- Environmental & Disaster Management: Essential for monitoring and response.

Challenges in the Russia Satellite Imagery Services Market Sector

Despite its growth potential, the Russia Satellite Imagery Services Market faces several challenges. High upfront investment costs for satellite development and launch remain a significant barrier, particularly for private sector entities. Geopolitical tensions and international sanctions can impact access to global technologies, components, and markets, potentially disrupting supply chains and collaborations. Regulatory hurdles and data access policies, while evolving, can sometimes create complexities for commercial service providers. The availability of skilled personnel with expertise in satellite data analysis and geospatial technologies is another constraint. Competition from global players and the need to ensure data security and sovereignty also present ongoing challenges for domestic market participants. Quantifiable impacts include potential delays in new satellite deployments and limitations in accessing cutting-edge processing software.

- High Upfront Costs: Significant capital required for satellite infrastructure.

- Geopolitical Constraints: Sanctions and trade restrictions impacting technology access.

- Regulatory Complexities: Navigating data access and national sovereignty policies.

- Talent Shortage: Demand for specialized geospatial and AI professionals.

- Global Competition: Challenges from established international providers.

Emerging Opportunities in Russia Satellite Imagery Services Market

Emerging opportunities in the Russia Satellite Imagery Services Market are diverse and promising. The development of small satellite constellations offers a more cost-effective approach to data acquisition, catering to niche markets. The increasing demand for real-time analytics and AI-driven insights presents a significant avenue for value-added service providers. Expansion into new commercial sectors, such as precision urban planning, smart city initiatives, and the Internet of Things (IoT) integration, offers substantial growth potential. Opportunities also lie in providing specialized services for renewable energy management, including solar and wind farm site selection and monitoring. Furthermore, the growing emphasis on environmental sustainability and climate change monitoring creates demand for sophisticated satellite-based solutions. Collaboration with international partners for specific projects, where feasible, can also unlock new markets.

- Small Satellite Constellations: Cost-effective data acquisition for specialized needs.

- Real-time Analytics & AI: Value-added services for immediate decision-making.

- Smart City & IoT Integration: Supporting urban development and connectivity.

- Renewable Energy Management: Site selection and performance monitoring.

- Sustainability & Climate Monitoring: Addressing global environmental challenges.

Leading Players in the Russia Satellite Imagery Services Market Market

- Roscosmos space agency

- Geospatial Agency Innoter

- Racurs

- SCANEX Group

- Data East LLC

- Geoaler

- NextGIS

- glavkosmos

- EAST VIEW GEOSPATIAL INC

Key Developments in Russia Satellite Imagery Services Market Industry

- April 2023: The Russian government agreed to continue participation in the International Space Station (ISS) until at least 2028 with international partners. This extension of the agreement supports the growth of Russia's satellite ecosystem and the demand for satellite imagery services.

- August 2022: Russia launched an earth observatory satellite to provide satellite services, including imagery features, to Iran. The country also planned to increase its surveillance of military targets in Ukraine, further fueling the adoption of satellite imagery services in the Military and Defence sector.

Strategic Outlook for Russia Satellite Imagery Services Market Market

The strategic outlook for the Russia Satellite Imagery Services Market is overwhelmingly positive, driven by robust growth catalysts. Continued government investment in indigenous satellite capabilities, coupled with advancements in sensor technology and data analytics, will solidify Russia's position in the global geospatial landscape. The increasing adoption of satellite imagery by diverse commercial sectors, from agriculture to construction, presents significant expansion opportunities. The market is poised to benefit from the integration of AI and machine learning for enhanced data interpretation and the development of value-added services. Furthermore, the strategic importance of satellite imagery for national security and resource management will ensure sustained demand. Opportunities for innovation in small satellite constellations and specialized applications, such as environmental monitoring and precision farming, will shape the market's future, fostering a dynamic and evolving industry poised for continued expansion.

Russia Satellite Imagery Services Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Disaster Management

- 1.6. Intelligence

-

2. End-User

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Forestry and Agriculture

- 2.6. Other End-Users

Russia Satellite Imagery Services Market Segmentation By Geography

- 1. Russia

Russia Satellite Imagery Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The country's Investments in Space Technology and Defence; Adoption of Big Data and Imagery Analytics

- 3.3. Market Restrains

- 3.3.1. High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. The country's Investments in Space Technology and Defence Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Disaster Management

- 5.1.6. Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Forestry and Agriculture

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Western Russia Russia Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Satellite Imagery Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Roscosmos space agency

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Geospatial Agency Innoter

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Racurs

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SCANEX Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Data East LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Geoaler

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 NextGIS

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 glavkosmos

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 EAST VIEW GEOSPATIAL INC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Roscosmos space agency

List of Figures

- Figure 1: Russia Satellite Imagery Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Satellite Imagery Services Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Russia Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Russia Satellite Imagery Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Satellite Imagery Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Satellite Imagery Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Russia Satellite Imagery Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: Russia Satellite Imagery Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Satellite Imagery Services Market ?

The projected CAGR is approximately 9.52%.

2. Which companies are prominent players in the Russia Satellite Imagery Services Market ?

Key companies in the market include Roscosmos space agency, Geospatial Agency Innoter, Racurs, SCANEX Group, Data East LLC, Geoaler, NextGIS, glavkosmos, EAST VIEW GEOSPATIAL INC.

3. What are the main segments of the Russia Satellite Imagery Services Market ?

The market segments include Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The country's Investments in Space Technology and Defence; Adoption of Big Data and Imagery Analytics.

6. What are the notable trends driving market growth?

The country's Investments in Space Technology and Defence Drives the Market Growth.

7. Are there any restraints impacting market growth?

High Cost of Satellite Imaging Data Acquisition and Processing; High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

April 2023: The Russian government has agreed to continue participation in the International Space Station (ISS) until at least 2028 with NASA, the Canadian Space Agency, the Japan Aerospace Agency, and the European Space Agency, which has extended their agreement with the ISS, and would support the growth of the country's satellite ecosystem and would support the need for satellite imagery services in Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Satellite Imagery Services Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Satellite Imagery Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Satellite Imagery Services Market ?

To stay informed about further developments, trends, and reports in the Russia Satellite Imagery Services Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence