Key Insights

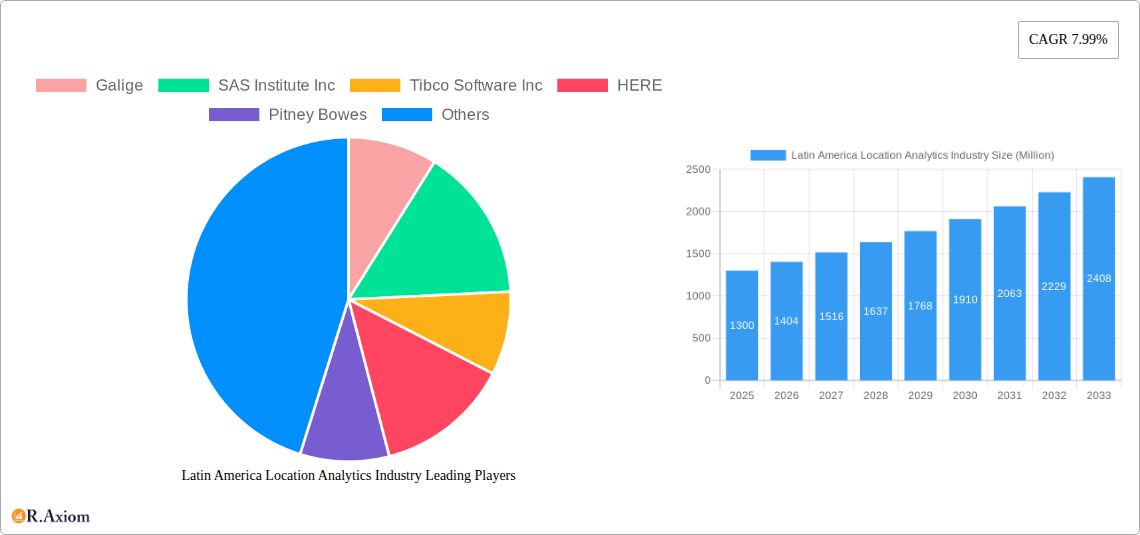

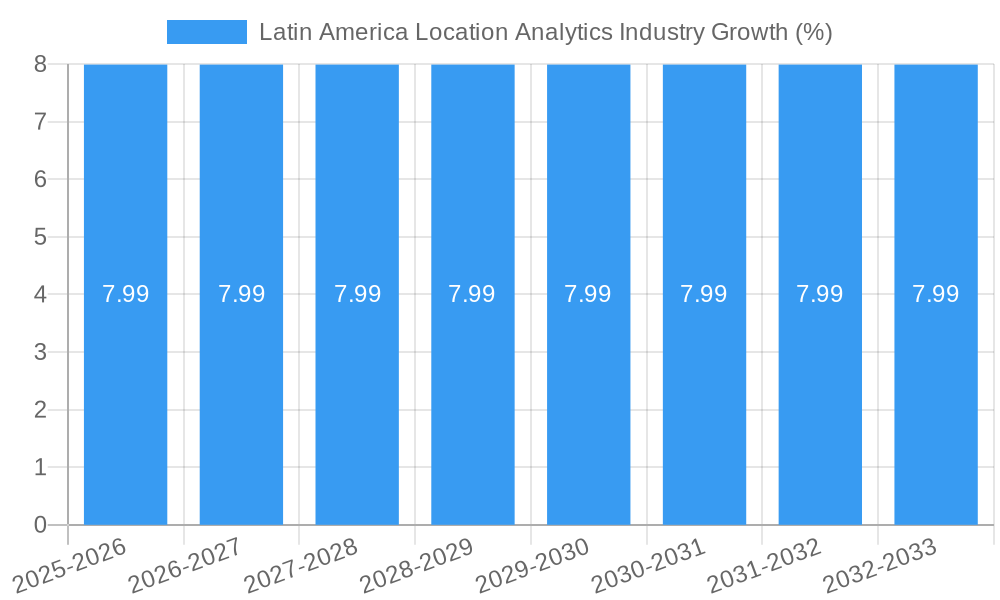

The Latin America Location Analytics Industry is poised for substantial growth, projected to reach a market size of approximately $1.3 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 7.99% extending through 2033. This robust expansion is fueled by a confluence of powerful drivers, including the increasing adoption of IoT devices, the escalating demand for real-time data insights to optimize operations, and the growing need for businesses to understand customer behavior and location-based trends. The industry is witnessing a significant shift towards on-demand deployment models, reflecting the growing preference for cloud-based solutions that offer scalability and flexibility. This trend is particularly evident across key application areas such as remote monitoring, asset management, and facility management, where the ability to access and analyze location data instantaneously is paramount for driving efficiency and informed decision-making.

The diverse applications of location analytics are further propelling its market penetration across various end-user verticals. The retail sector is leveraging these technologies to enhance customer experiences, optimize store layouts, and personalize marketing campaigns. Manufacturing industries are benefiting from improved supply chain visibility, predictive maintenance, and optimized production processes. Healthcare providers are utilizing location analytics for patient tracking, resource allocation, and optimizing emergency response. Government agencies are employing these solutions for urban planning, public safety, and infrastructure management, while the energy and power sector is seeing increased adoption for grid management and asset monitoring. Geographically, Brazil, Argentina, and Mexico represent the core of this burgeoning market, showcasing the highest potential for adoption and innovation. While the market is predominantly driven by software solutions, the services segment, encompassing consulting, integration, and support, is also experiencing significant growth as businesses seek expert guidance to implement and leverage location analytics effectively.

Latin America Location Analytics Industry Market Concentration & Innovation

The Latin America Location Analytics Industry is experiencing dynamic market concentration driven by increasing adoption across various verticals. Key players like Galige, SAS Institute Inc, Tibco Software Inc, HERE, Pitney Bowes, Microsoft Corporation, ESRI (Environmental Systems Research Institute), Oracle Corporation, Cisco Systems, and SAP SE are vying for market share, which is projected to reach approximately $8,500 Million by 2033. Innovation is a critical differentiator, fueled by advancements in AI, IoT, and big data analytics, enabling more sophisticated location-based insights. Regulatory frameworks are evolving, particularly concerning data privacy and security, impacting how location data is collected and utilized. Product substitutes are emerging, including advanced GIS tools and business intelligence platforms with integrated mapping features. End-user trends indicate a growing demand for real-time analytics, predictive modeling, and personalized customer experiences powered by location intelligence. Merger and acquisition (M&A) activities are anticipated to rise as larger companies seek to acquire innovative technologies and expand their geographical reach. While specific M&A deal values are proprietary, the increasing complexity of solutions and the need for comprehensive offerings suggest significant investment in this sector.

- Market Share: Dominated by a few key players, with a trend towards consolidation.

- Innovation Drivers: AI, IoT, Big Data, Real-time Analytics, Geospatial Technology.

- Regulatory Frameworks: Data privacy laws (e.g., LGPD in Brazil), security standards.

- Product Substitutes: Advanced GIS, BI platforms with mapping, custom-built solutions.

- End-User Trends: Demand for real-time insights, predictive analytics, hyper-personalization.

- M&A Activities: Expected to increase as companies seek strategic partnerships and acquisitions to enhance capabilities and market reach.

Latin America Location Analytics Industry Industry Trends & Insights

The Latin America Location Analytics Industry is poised for substantial growth, driven by a confluence of technological advancements, economic recovery, and increasing digital transformation initiatives across the region. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 18.50% from 2025 to 2033, reaching an estimated market size of $8,500 Million by the end of the forecast period. This growth is underpinned by the increasing adoption of location intelligence solutions in sectors such as retail, manufacturing, healthcare, and government, where data-driven decision-making is becoming paramount. The proliferation of smart devices and the Internet of Things (IoT) has generated vast amounts of location-based data, creating a fertile ground for analytics platforms to extract actionable insights. Furthermore, government initiatives focused on smart city development, infrastructure management, and public safety are significantly boosting the demand for sophisticated location analytics tools. The competitive landscape is characterized by intense innovation, with companies continuously developing more advanced algorithms, cloud-based solutions, and specialized applications to cater to diverse industry needs. Consumer preferences are shifting towards personalized experiences, requiring businesses to leverage location data to understand customer behavior and optimize service delivery. The penetration of location analytics is expected to deepen across all segments, moving beyond basic mapping to encompass predictive modeling, risk assessment, and operational efficiency improvements. The ongoing digital transformation in Latin America, coupled with the need for businesses to optimize supply chains, improve customer engagement, and enhance operational effectiveness, presents a robust growth trajectory for the location analytics market. Technological disruptions, including the integration of AI and machine learning into analytics platforms, are further enhancing the capabilities of these solutions, enabling businesses to derive deeper, more predictive insights from their location data. The trend towards on-demand deployment models is also accelerating adoption, offering flexibility and scalability for businesses of all sizes. The industry is witnessing a move towards more integrated and end-to-end solutions that combine data collection, processing, analysis, and visualization, providing a holistic approach to location intelligence. The increasing awareness of the strategic importance of location data in driving business outcomes is a key factor fueling market expansion.

Dominant Markets & Segments in Latin America Location Analytics Industry

The Latin America Location Analytics Industry is characterized by the dominance of specific segments and geographies, driven by distinct economic and technological factors. Geographically, Brazil is emerging as the largest and most influential market, accounting for a substantial portion of the industry's revenue. This dominance is attributed to its large economy, significant investments in smart city initiatives, and a burgeoning retail and manufacturing sector actively seeking to leverage location data for competitive advantage. Mexico and Argentina follow, demonstrating growing adoption rates, particularly in government and energy sectors.

Within the Location segment, Outdoor location analytics commands a larger market share, owing to the widespread application in logistics, transportation, urban planning, and environmental monitoring. However, the Indoor location analytics segment is experiencing rapid growth, driven by the need for enhanced customer experience in retail spaces, improved operational efficiency in manufacturing plants, and better patient tracking in healthcare facilities.

The Deployment Model is witnessing a strong preference for On-demand (cloud-based) solutions, reflecting the growing trend towards subscription-based services, scalability, and reduced upfront infrastructure costs. While On-premise solutions still hold a significant share, particularly among large enterprises with stringent data security requirements or existing IT investments, the agility and cost-effectiveness of on-demand models are driving its ascendancy.

In terms of Application, Remote Monitoring and Asset Management are primary growth drivers, fueled by the need for real-time tracking and management of geographically dispersed assets in industries like energy, logistics, and agriculture. Facility Management is also gaining traction as organizations look to optimize space utilization, energy consumption, and operational workflows within their physical premises.

The Component segment is dominated by Software, which forms the core of location analytics solutions, enabling data processing, analysis, and visualization. However, the Services segment, encompassing consulting, implementation, and support, is experiencing robust growth as businesses increasingly require expert assistance to integrate and maximize the value of their location analytics investments.

Among End-user Verticals, the Retail sector is a significant contributor, utilizing location analytics for foot traffic analysis, store performance optimization, and personalized marketing. Manufacturing leverages these solutions for supply chain visibility, operational efficiency, and quality control. The Government sector is increasingly adopting location analytics for public safety, urban planning, disaster management, and resource allocation. The Energy and Power sector uses it for grid management, asset monitoring, and exploration.

- Key Geographic Drivers:

- Brazil: Large economy, smart city initiatives, retail and manufacturing growth.

- Mexico: Government investments, expanding industrial base.

- Argentina: Growing adoption in government and energy sectors.

- Dominant Location Segments:

- Outdoor: Logistics, transportation, urban planning, environmental monitoring.

- Indoor: Retail customer experience, manufacturing operations, healthcare patient tracking.

- Preferred Deployment Models:

- On-demand: Scalability, cost-effectiveness, flexibility, subscription-based.

- On-premise: Data security, existing infrastructure, specific enterprise needs.

- Key Application Areas:

- Remote Monitoring: Real-time tracking, asset surveillance, IoT data integration.

- Asset Management: Fleet tracking, inventory management, condition monitoring.

- Facility Management: Space optimization, energy efficiency, operational workflow enhancement.

- Component Dominance:

- Software: Core analytics engines, visualization tools, data processing capabilities.

- Services: Implementation, integration, consulting, data management, training.

- Leading End-User Verticals:

- Retail: Customer analytics, store performance, targeted marketing.

- Manufacturing: Supply chain optimization, operational efficiency, predictive maintenance.

- Government: Public safety, urban planning, disaster response, resource management.

- Energy and Power: Grid management, asset health, exploration optimization.

Latin America Location Analytics Industry Product Developments

The Latin America Location Analytics Industry is witnessing rapid product developments focused on enhancing predictive capabilities, real-time processing, and user-friendly interfaces. Companies are integrating AI and machine learning algorithms to offer more sophisticated insights, enabling businesses to anticipate trends, optimize resource allocation, and personalize customer interactions. Cloud-native solutions are becoming prevalent, offering scalability and accessibility for a wider range of users. Innovations are also geared towards enabling seamless integration with existing enterprise systems and IoT devices, creating a more connected and data-rich environment. Competitive advantages are being built around specialized industry solutions, advanced geospatial visualization, and robust data security features, catering to the evolving needs of sectors like retail, manufacturing, and government.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Latin America Location Analytics Industry from 2019 to 2033, with a base year of 2025. The market is segmented across various dimensions to offer detailed insights. The Location segmentation includes Outdoor and Indoor analytics, with projections for their respective market sizes and growth rates. The Deployment Model is analyzed through On-premise and On-demand segments, highlighting adoption trends and competitive dynamics. Application segmentation encompasses Remote Monitoring, Asset Management, and Facility Management, with their projected market penetration and key drivers. The Component segmentation covers Software and Services, detailing their market share and strategic importance. Finally, the End-user Verticals include Retail, Manufacturing, Healthcare, Government, Energy and Power, and Other Verticals, with specific analysis of their market size, growth prospects, and the role of location analytics in their operations across key geographies like Brazil, Argentina, and Mexico.

Key Drivers of Latin America Location Analytics Industry Growth

The growth of the Latin America Location Analytics Industry is propelled by several key factors. The increasing digitalization across businesses and governments necessitates data-driven decision-making, with location intelligence playing a crucial role. The proliferation of IoT devices and sensors generates a wealth of real-time location data, creating opportunities for analytics. Advancements in AI and machine learning are enhancing the predictive and prescriptive capabilities of location analytics solutions. Furthermore, government initiatives focused on smart city development, infrastructure improvement, and public safety are significant catalysts. Economic recovery and a growing emphasis on operational efficiency and customer experience are also driving adoption.

- Digital Transformation: Mandatory need for data-driven insights across all sectors.

- IoT and Big Data: Growing volume of location-specific data for analysis.

- AI & Machine Learning: Enhanced predictive and prescriptive analytics capabilities.

- Smart City Initiatives: Government investment in urban planning and infrastructure.

- Operational Efficiency & Customer Experience: Business focus on optimizing processes and personalization.

Challenges in the Latin America Location Analytics Industry Sector

Despite its promising growth, the Latin America Location Analytics Industry faces several challenges. Data privacy and security concerns, coupled with evolving regulatory landscapes in various countries, can create complexities for data collection and utilization. The availability of skilled talent with expertise in geospatial analytics and data science remains a bottleneck in some regions. High implementation costs and the need for significant upfront investment can be a barrier for small and medium-sized enterprises. Furthermore, the fragmentation of the market and the presence of numerous players can lead to intense competition, potentially impacting pricing and profitability. Ensuring data accuracy and reliability across diverse sources also presents an ongoing challenge.

- Data Privacy & Regulations: Navigating varied and evolving data protection laws.

- Talent Shortage: Limited availability of skilled geospatial and data analytics professionals.

- Implementation Costs: Significant upfront investment for sophisticated solutions.

- Market Fragmentation: Intense competition and pricing pressures.

- Data Accuracy & Reliability: Maintaining data integrity across disparate sources.

Emerging Opportunities in Latin America Location Analytics Industry

Emerging opportunities in the Latin America Location Analytics Industry are driven by nascent technologies and untapped market potential. The expansion of 5G networks will facilitate real-time data processing and the deployment of more advanced location-aware applications. The growing adoption of autonomous vehicles and drones will create new use cases for precise location tracking and navigation. The increasing demand for sustainability and climate action is driving the use of location analytics for environmental monitoring, resource management, and disaster preparedness. Furthermore, the untapped potential in emerging economies within Latin America and the increasing focus on hyper-personalization in e-commerce and digital services present significant avenues for growth.

- 5G Network Expansion: Enabling real-time, data-intensive applications.

- Autonomous Systems: Driving demand for precise location and navigation.

- Sustainability & Climate Action: Applications in environmental monitoring and disaster management.

- Untapped Markets: Growth potential in emerging economies and niche sectors.

- Hyper-Personalization: Enhancing customer experiences in e-commerce and digital services.

Leading Players in the Latin America Location Analytics Industry Market

- Galige

- SAS Institute Inc

- Tibco Software Inc

- HERE

- Pitney Bowes

- Microsoft Corporation

- ESRI (Environmental Systems Research Institute)

- Oracle Corporation

- Cisco Systems

- SAP SE

Key Developments in Latin America Location Analytics Industry Industry

- February 2023: Liberty Latin America collaborated with Ribbon Communications Inc. to enhance its network behavior and business performance through automated fraud control and centralized network monitoring. This integration aimed to improve KPIs and customer safety.

- November 2022: The Ministry of Justice and Public Safety (MJSP) and SCCON launched a large-scale remote sensing project in Brazil to combat illegal activities and environmental crimes in the Amazon region. This initiative supported the Brazilian Federal Police with satellite imagery and project data for over 120 collaborative actions, assisting in reducing corruption, money laundering, and aiding federal decision-making.

Strategic Outlook for Latin America Location Analytics Industry Market

The strategic outlook for the Latin America Location Analytics Industry is exceptionally positive, driven by a robust demand for data-driven insights and the continuous advancement of technology. The ongoing digital transformation across the region, coupled with increasing government support for smart city development and infrastructure projects, will continue to fuel market expansion. Key growth catalysts include the widespread adoption of cloud-based solutions, the integration of AI and machine learning for advanced analytics, and the burgeoning IoT ecosystem. Companies that focus on developing specialized solutions for high-growth verticals such as retail, manufacturing, and government, while also emphasizing data security and user-friendliness, are well-positioned for success. The potential for further M&A activities and strategic partnerships will also shape the competitive landscape, leading to more integrated and comprehensive offerings for end-users.

Latin America Location Analytics Industry Segmentation

-

1. Location

- 1.1. Outdoor

- 1.2. Indoor

-

2. Deployment Model

- 2.1. On-premise

- 2.2. On-demand

-

3. Application

- 3.1. Remote Monitoring

- 3.2. Asset Management

- 3.3. Facility Management

-

4. Component

- 4.1. Software

- 4.2. Services

-

5. End-user Verticals

- 5.1. Retail

- 5.2. Manufacturing

- 5.3. Healthcare

- 5.4. Government

- 5.5. Energy and Power

- 5.6. Other Verticals

-

6. Geography

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Mexico

Latin America Location Analytics Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Mexico

Latin America Location Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.99% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Retail Market; Increasing Adoption of Analytical Business Intelligence and Geographical Information Systems Technology; Increasing Usage of IoT

- 3.3. Market Restrains

- 3.3.1 Concerns over Security and Privacy; Systems are Error-prone - In Cases like Incomplete Business Information

- 3.3.2 Out-of-date Information

- 3.3.3 and Limitation of Place Databases

- 3.4. Market Trends

- 3.4.1. Technological Advances in Various Industries Play a Vital Role

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Outdoor

- 5.1.2. Indoor

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. On-premise

- 5.2.2. On-demand

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Remote Monitoring

- 5.3.2. Asset Management

- 5.3.3. Facility Management

- 5.4. Market Analysis, Insights and Forecast - by Component

- 5.4.1. Software

- 5.4.2. Services

- 5.5. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.5.1. Retail

- 5.5.2. Manufacturing

- 5.5.3. Healthcare

- 5.5.4. Government

- 5.5.5. Energy and Power

- 5.5.6. Other Verticals

- 5.6. Market Analysis, Insights and Forecast - by Geography

- 5.6.1. Brazil

- 5.6.2. Argentina

- 5.6.3. Mexico

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Brazil Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Galige

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SAS Institute Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Tibco Software Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 HERE

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Pitney Bowes

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microsoft Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ESRI (Environmental Systems Research Institute)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Oracle Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cisco Systems

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SAP SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Galige

List of Figures

- Figure 1: Latin America Location Analytics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Location Analytics Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Location Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Location Analytics Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 3: Latin America Location Analytics Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 4: Latin America Location Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Latin America Location Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 6: Latin America Location Analytics Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 7: Latin America Location Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Latin America Location Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Latin America Location Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Argentina Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Peru Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Chile Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Latin America Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Latin America Location Analytics Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Latin America Location Analytics Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 18: Latin America Location Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Latin America Location Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 20: Latin America Location Analytics Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 21: Latin America Location Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Latin America Location Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Mexico Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Location Analytics Industry?

The projected CAGR is approximately 7.99%.

2. Which companies are prominent players in the Latin America Location Analytics Industry?

Key companies in the market include Galige, SAS Institute Inc, Tibco Software Inc, HERE, Pitney Bowes, Microsoft Corporation, ESRI (Environmental Systems Research Institute), Oracle Corporation, Cisco Systems, SAP SE.

3. What are the main segments of the Latin America Location Analytics Industry?

The market segments include Location, Deployment Model, Application, Component, End-user Verticals, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Retail Market; Increasing Adoption of Analytical Business Intelligence and Geographical Information Systems Technology; Increasing Usage of IoT.

6. What are the notable trends driving market growth?

Technological Advances in Various Industries Play a Vital Role.

7. Are there any restraints impacting market growth?

Concerns over Security and Privacy; Systems are Error-prone - In Cases like Incomplete Business Information. Out-of-date Information. and Limitation of Place Databases.

8. Can you provide examples of recent developments in the market?

February 2023: To learn more about its network behavior and improve its business performance, Liberty Latin America collaborated with Ribbon Communications Inc. With automated fraud control and centralized network monitoring, Liberty Latin America's network will perform better in KPIs and keep its customers safer as a result of the addition of Ribbon's expertise.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Location Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Location Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Location Analytics Industry?

To stay informed about further developments, trends, and reports in the Latin America Location Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence