Key Insights

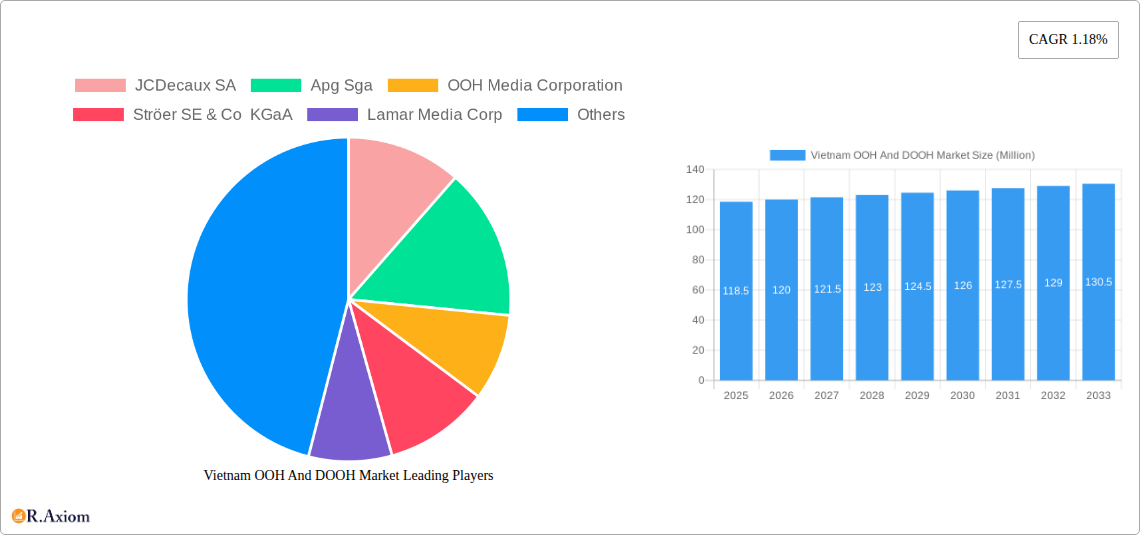

The Vietnam Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market is poised for steady growth, projected to reach an estimated 118.5 million USD in 2025. While the Compound Annual Growth Rate (CAGR) of 1.18% for the forecast period of 2025-2033 indicates a moderate expansion, this trajectory is fueled by several key drivers. The increasing urbanization and a burgeoning middle class in Vietnam are significantly boosting consumer engagement with OOH advertising. Furthermore, the ongoing digital transformation across various sectors is compelling businesses to adopt innovative advertising solutions, with DOOH, especially LED screens and programmatic OOH, emerging as a dominant trend. This shift towards digital formats allows for more dynamic, targeted, and measurable campaigns, appealing to a wider range of advertisers. The adoption of programmatic OOH, in particular, promises to revolutionize how ad spaces are bought and sold, offering greater efficiency and real-time optimization.

Vietnam OOH And DOOH Market Market Size (In Million)

Despite the overall positive outlook, the market faces certain restraints. The initial investment cost for digital OOH infrastructure can be a barrier for smaller businesses, and the regulatory landscape surrounding outdoor advertising, while evolving, can still present challenges in certain areas. However, the diverse applications, from traditional billboards and street furniture to sophisticated place-based media in airports and transit hubs, ensure broad market penetration. Key end-user industries such as Automotive, Retail & Consumer Goods, Healthcare, and BFSI are increasingly recognizing the value of OOH and DOOH in reaching their target audiences effectively. Companies like JCDecaux SA, Apg Sga, and Ströer SE & Co KGaA, alongside prominent local players, are actively shaping the market through innovation and strategic expansion. The continued development of smart city initiatives and the increasing demand for experiential advertising will further solidify the importance of OOH and DOOH in Vietnam's advertising ecosystem.

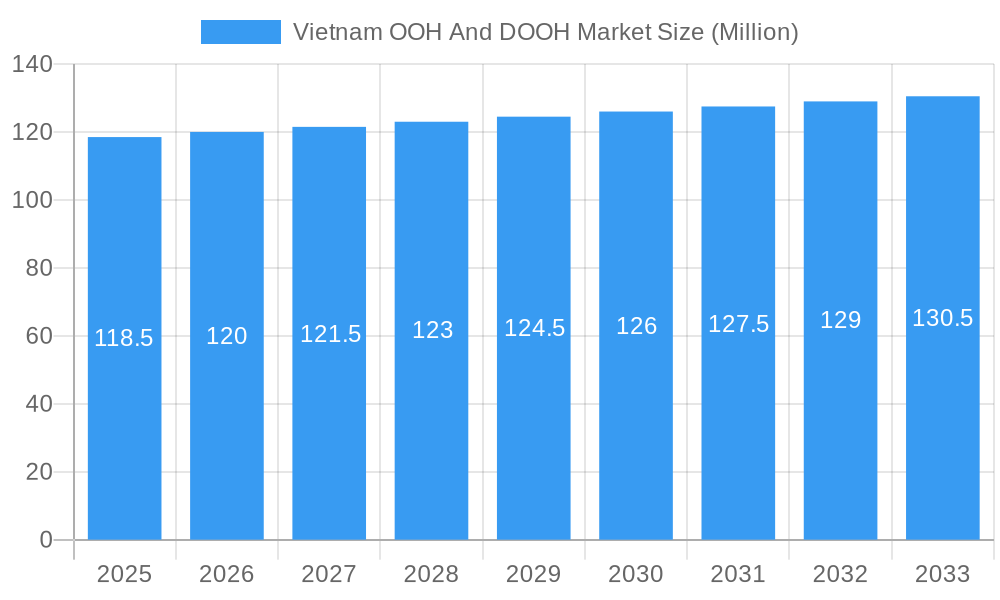

Vietnam OOH And DOOH Market Company Market Share

Here's the SEO-optimized, detailed report description for the Vietnam OOH and DOOH Market, structured as requested.

Vietnam OOH And DOOH Market Market Concentration & Innovation

The Vietnam Out-of-Home (OOH) and Digital Out-of-Home (DOOH) market is characterized by a moderate to high concentration, with a mix of established global players and rapidly growing local enterprises. Key companies like JCDecaux SA, Apg Sga, OOH Media Corporation, Ströer SE & Co KGaA, Lamar Media Corp, Golden Communications Group, DatvietVAC Group Holdings, Goldsun Media Group, NSG Ads Vietnam, and Vietnam Outdoor Advertising JSC are actively shaping the landscape. Innovation is a significant driver, fueled by the increasing adoption of programmatic advertising and the demand for dynamic, data-driven campaigns. Regulatory frameworks are evolving to accommodate the growth of DOOH, particularly concerning data privacy and advertising standards. Product substitutes, such as social media advertising and other digital marketing channels, pose a competitive challenge, but OOH's inherent advantages in reach and impact continue to drive its relevance. End-user trends are shifting towards hyper-targeted campaigns, leveraging DOOH's ability to deliver location-specific and time-sensitive messages. Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to consolidate market share and expand their technological capabilities. M&A deal values are projected to grow as strategic acquisitions become more prevalent.

Vietnam OOH And DOOH Market Industry Trends & Insights

The Vietnam OOH and DOOH market is poised for significant expansion, driven by a robust economic outlook and increasing urbanization. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 15-20% over the forecast period of 2025–2033, a testament to its burgeoning potential. This growth is underpinned by a confluence of factors, including escalating advertiser demand for innovative and impactful advertising solutions, coupled with a growing consumer base with increasing disposable income. Technological advancements are revolutionizing the OOH landscape, with the rapid adoption of Digital Out-of-Home (DOOH) technologies, including LED screens and programmatic DOOH platforms. These advancements enable more dynamic content delivery, real-time audience measurement, and sophisticated campaign management, offering advertisers greater flexibility and ROI. Consumer preferences are evolving, with a greater appreciation for visually engaging and interactive advertising experiences. The widespread availability of smartphones and increasing digital literacy among the Vietnamese population further amplifies the effectiveness of OOH and DOOH campaigns. Competitive dynamics are intensifying, as both local and international players vie for market dominance. Strategic partnerships and collaborations are becoming crucial for companies to enhance their service offerings, expand their network coverage, and leverage technological innovations. The market penetration of DOOH is steadily increasing, moving from premium locations to more widespread deployments across various urban and semi-urban areas. This trend is fueled by decreasing hardware costs and the proven effectiveness of digital displays in capturing consumer attention. Advertisers are increasingly recognizing the power of OOH and DOOH in complementing their digital marketing strategies, leading to integrated campaigns that offer a seamless brand experience across multiple touchpoints. The shift towards programmatic OOH trading is a significant disruptor, offering automation, real-time bidding, and audience segmentation capabilities that were previously exclusive to digital channels. This transition is enhancing efficiency and optimizing ad spend for businesses.

Dominant Markets & Segments in Vietnam OOH And DOOH Market

Within the Vietnam OOH and DOOH market, certain segments are exhibiting exceptional growth and dominance. The Digital OOH (LED Screens) segment, including Programmatic OOH, is emerging as the most dynamic and fastest-growing category. Its ability to deliver dynamic content, real-time updates, and targeted messaging makes it highly attractive to advertisers seeking to optimize campaign performance. This dominance is driven by significant investments in smart city initiatives and the increasing demand for sophisticated advertising solutions in high-traffic urban areas.

The Billboard application segment, particularly digital billboards, continues to hold substantial market share due to its broad reach and high visibility, especially along major roadways and in commercial hubs. However, Transportation (Transit), encompassing Airports and Others (Buses, etc.), is experiencing a surge in popularity. Airports, as premium locations with captive audiences, are seeing increased adoption of DOOH advertising. Similarly, transit advertising on buses and other public transport offers cost-effective reach and frequency, making it a popular choice for brands targeting daily commuters.

In terms of End-user Industry, the Automotive, Retail, and Consumer Goods, and BFSI sectors are the primary drivers of OOH and DOOH advertising spend. The automotive industry utilizes OOH for new model launches and brand building, while retail and consumer goods companies leverage it for promotions and impulse purchases. The BFSI sector increasingly uses OOH to reach a wide demographic for financial products and services.

Key drivers for the dominance of these segments include:

- Government initiatives supporting digital infrastructure development and smart cities, which directly benefit DOOH deployment.

- Increasing urbanization and population density, creating higher demand for effective advertising channels.

- Growth in e-commerce and the need for integrated online-offline marketing strategies, where OOH plays a crucial role in brand awareness and driving traffic to online platforms.

- Technological advancements in display technology, audience measurement, and programmatic trading platforms, making DOOH more efficient and measurable.

- A young and digitally-savvy population that is highly receptive to visually engaging and interactive advertising.

- Strategic investments by major advertising networks expanding their digital footprints and offering comprehensive OOH solutions.

- The inherent advantage of OOH in generating high impact and broad reach, complementing digital campaigns effectively.

Vietnam OOH And DOOH Market Product Developments

Product developments in the Vietnam OOH and DOOH market are primarily focused on enhancing digital capabilities and offering data-driven solutions. Innovations include the integration of Artificial Intelligence (AI) for real-time audience analysis and ad optimization, the expansion of programmatic DOOH platforms for automated buying and selling, and the development of interactive digital screens that engage consumers through touch or augmented reality. These advancements provide advertisers with unparalleled targeting precision, real-time campaign adjustments, and measurable results, thereby boosting the competitive advantage of OOH and DOOH media in Vietnam's evolving advertising ecosystem.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Vietnam OOH and DOOH market, segmented by Type (Static (Traditional) OOH, Digital OOH (LED Screens), Programmatic OOH, and Others), Application (Billboard, Transportation (Transit) including Airports and Others (Buses, etc.), Street Furniture, and Other Place-Based Media), and End-user Industry (Automotive, Retail and Consumer Goods, Healthcare, BFSI, and Other End-user Industries). The Static OOH segment, while mature, continues to offer broad reach. Digital OOH, particularly LED Screens and Programmatic OOH, is projected for substantial growth, driven by technological advancements and increasing advertiser demand for dynamic campaigns. The Billboard application remains strong, while Transportation (Transit) is gaining momentum, especially in urban areas. Retail and Consumer Goods, and Automotive are expected to lead in end-user industry spending, with BFSI and Healthcare also showing increasing adoption.

Key Drivers of Vietnam OOH And DOOH Market Growth

The growth of the Vietnam OOH and DOOH market is propelled by several key factors. Economic development and increasing consumer spending are fostering greater advertising budgets. Urbanization and infrastructure development are expanding the physical spaces for OOH placements. Technological advancements, particularly in DOOH, including high-resolution LED screens and programmatic buying platforms, are enhancing ad effectiveness and measurability. Government support for digital transformation and smart city initiatives provides a conducive environment for DOOH expansion. Furthermore, the increasing demand for integrated marketing campaigns that leverage the strengths of both digital and traditional advertising channels is a significant catalyst.

Challenges in the Vietnam OOH And DOOH Market Sector

Despite its growth potential, the Vietnam OOH and DOOH market faces several challenges. Regulatory hurdles and evolving advertising standards can create complexities for deployment and content approval. High initial investment costs for digital infrastructure, while decreasing, can still be a barrier for smaller players. Ensuring accurate and standardized audience measurement across diverse OOH formats remains a challenge, hindering direct comparison with other digital channels. Intensifying competition from digital advertising channels requires continuous innovation and demonstration of ROI. Supply chain disruptions for hardware components can impact deployment timelines and costs.

Emerging Opportunities in Vietnam OOH And DOOH Market

Emerging opportunities in the Vietnam OOH and DOOH market lie in the expansion of programmatic DOOH capabilities, enabling hyper-targeted advertising and real-time campaign optimization. The growth of smart city projects will create new premium advertising locations. There is also a significant opportunity in leveraging data analytics and AI to offer more personalized and impactful ad experiences. Furthermore, the untapped potential in tier-2 and tier-3 cities presents a significant avenue for market expansion, catering to the growing consumer base in these regions.

Leading Players in the Vietnam OOH And DOOH Market Market

- JCDecaux SA

- Apg Sga

- OOH Media Corporation

- Ströer SE & Co KGaA

- Lamar Media Corp

- Golden Communications Group

- DatvietVAC Group Holdings

- Goldsun Media Group

- NSG Ads Vietnam

- Vietnam Outdoor Advertising JSC

Key Developments in Vietnam OOH And DOOH Market Industry

- August 2023: LG Electronics (LG) launched its global "Life's Good" campaign, featuring digital out-of-home (OOH) ads in prominent locations including Vietnam. This campaign highlights LG's brand image revamp with dynamic and youthful essence, showcasing vibrant images and engaging videos to emphasize its refreshed visual direction.

- December 2023: Unicom Marketing collaborated with Location Media Xchange (LMX), the supply-side division of Moving Walls Group. This partnership allows Unicom to leverage the LMX platform to enhance measurement and automation for its mobile LED truck screens operating in Vietnam, Singapore, Malaysia, and Indonesia.

Strategic Outlook for Vietnam OOH And DOOH Market Market

The strategic outlook for the Vietnam OOH and DOOH market is overwhelmingly positive, driven by a strong foundational growth trajectory and the increasing integration of digital technologies. The ongoing urbanization, coupled with a burgeoning middle class, will continue to fuel demand for impactful advertising. Key strategic imperatives for sustained growth include further investment in programmatic DOOH infrastructure and platforms to enhance automation and data-driven decision-making. Focusing on creating more interactive and engaging ad experiences will be crucial to capture consumer attention in an increasingly cluttered media landscape. Furthermore, strategic partnerships between OOH media owners, technology providers, and advertisers will be vital for developing innovative solutions and expanding market reach. The market is expected to witness a consolidation phase, with larger entities acquiring smaller players to enhance their portfolio and competitive edge.

Vietnam OOH And DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Others

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-Based Media

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End-user Industries

Vietnam OOH And DOOH Market Segmentation By Geography

- 1. Vietnam

Vietnam OOH And DOOH Market Regional Market Share

Geographic Coverage of Vietnam OOH And DOOH Market

Vietnam OOH And DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.18% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided the Spending on Airport Advertisement in Vietnam

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided the Spending on Airport Advertisement in Vietnam

- 3.4. Market Trends

- 3.4.1. Digital OOH (LED Screens) to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam OOH And DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-Based Media

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JCDecaux SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Apg Sga

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OOH Media Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ströer SE & Co KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lamar Media Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Golden Communications Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DatvietVAC Group Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Goldsun Media Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NSG Ads Vietnam

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vietnam Outdoor Advertising JSC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JCDecaux SA

List of Figures

- Figure 1: Vietnam OOH And DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Vietnam OOH And DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam OOH And DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Vietnam OOH And DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 3: Vietnam OOH And DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Vietnam OOH And DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 5: Vietnam OOH And DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Vietnam OOH And DOOH Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Vietnam OOH And DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Vietnam OOH And DOOH Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Vietnam OOH And DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Vietnam OOH And DOOH Market Volume Million Forecast, by Type 2020 & 2033

- Table 11: Vietnam OOH And DOOH Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Vietnam OOH And DOOH Market Volume Million Forecast, by Application 2020 & 2033

- Table 13: Vietnam OOH And DOOH Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Vietnam OOH And DOOH Market Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Vietnam OOH And DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Vietnam OOH And DOOH Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam OOH And DOOH Market?

The projected CAGR is approximately 1.18%.

2. Which companies are prominent players in the Vietnam OOH And DOOH Market?

Key companies in the market include JCDecaux SA, Apg Sga, OOH Media Corporation, Ströer SE & Co KGaA, Lamar Media Corp, Golden Communications Group, DatvietVAC Group Holdings, Goldsun Media Group, NSG Ads Vietnam, Vietnam Outdoor Advertising JSC*List Not Exhaustive.

3. What are the main segments of the Vietnam OOH And DOOH Market?

The market segments include Type , Application , End-user Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 118.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided the Spending on Airport Advertisement in Vietnam.

6. What are the notable trends driving market growth?

Digital OOH (LED Screens) to Drive the Market.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising Aided By Increased Spending On Smart City Projects; Increase in Air Traffic Owing to Growth in Tourism Industry has Aided the Spending on Airport Advertisement in Vietnam.

8. Can you provide examples of recent developments in the market?

August 2023 - LG Electronics (LG) unveiled its latest global campaign, "Life's Good." The campaign marks a significant step in LG's efforts to revamp its brand image, infusing it with a more dynamic and youthful essence. As part of the campaign, LG launched digital out-of-home (OOH) ads in prominent global locations, such as Dubai, London, New York, Vietnam, and Seoul. These ads, comprising vibrant images and engaging videos, are thoughtfully designed to highlight LG's refreshed visual direction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam OOH And DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam OOH And DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam OOH And DOOH Market?

To stay informed about further developments, trends, and reports in the Vietnam OOH And DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence