Key Insights

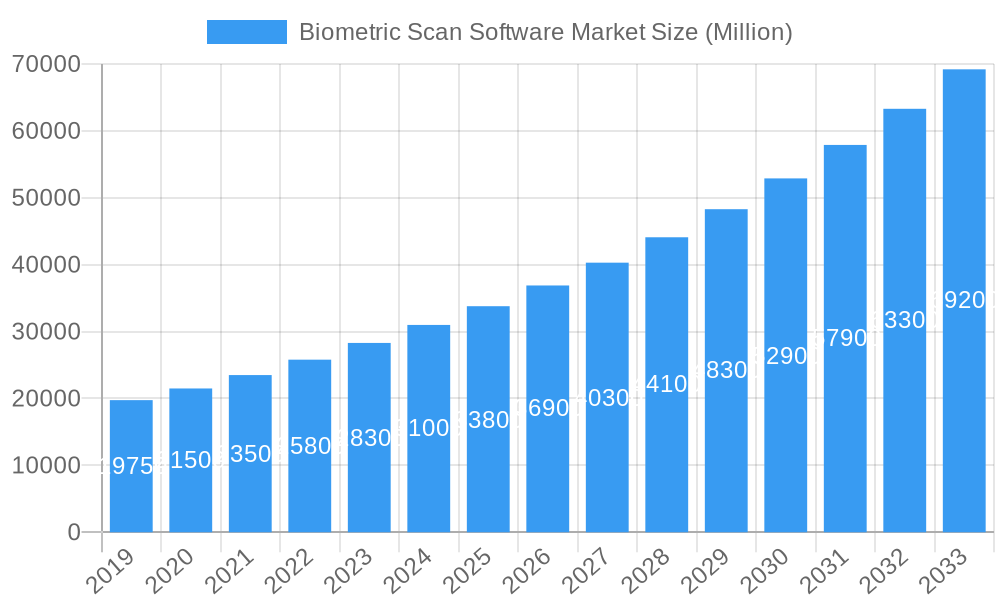

The global Biometric Scan Software Market is projected for significant expansion, estimated to reach $12.3 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.1% forecasted through 2033. This growth is driven by the increasing demand for advanced security solutions across key sectors including government, defense, healthcare, IT, telecom, and BFSI. The adoption of biometric modalities such as fingerprint, palm print, facial, and iris recognition for identity verification and access control is a primary driver. The integration of biometrics into smart devices, mobile applications, and IoT ecosystems further fuels market momentum. The post-pandemic surge in demand for contactless biometrics, prioritizing convenience and hygiene, presents new growth opportunities.

Biometric Scan Software Market Market Size (In Billion)

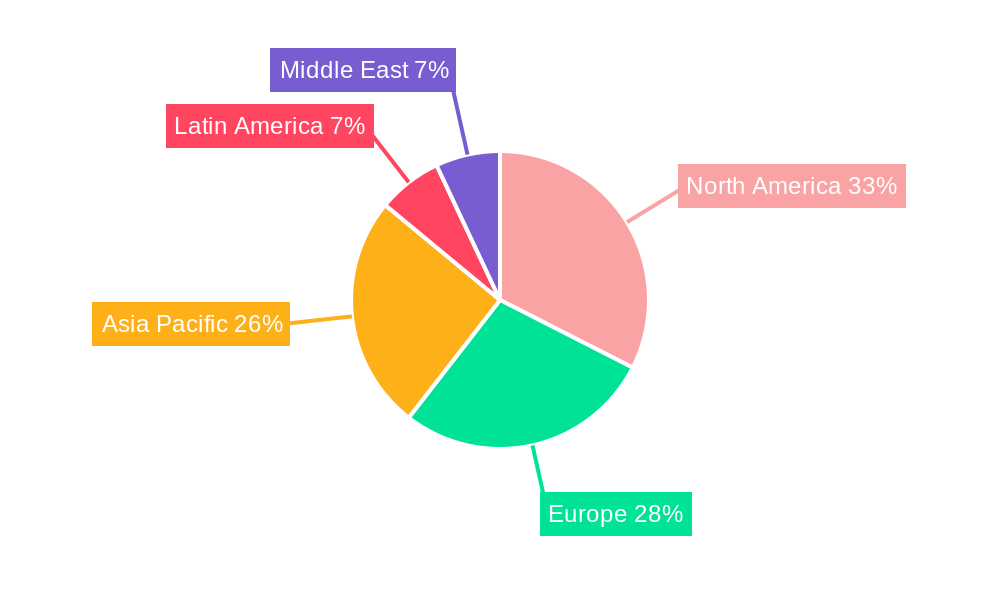

Challenges include high implementation costs for large-scale deployments and advanced systems, alongside ongoing concerns regarding data privacy and security, though stringent regulations and encryption are mitigating these. Continuous innovation in biometric algorithms, the development of multimodal systems for enhanced accuracy, and supportive government initiatives for national security and citizen identification are expected to overcome these obstacles. The market is segmented by biometric type, with fingerprint and facial recognition currently leading, while iris and palm print technologies are gaining traction. North America and Asia Pacific are anticipated to be leading regions due to early technology adoption and a strong emphasis on security.

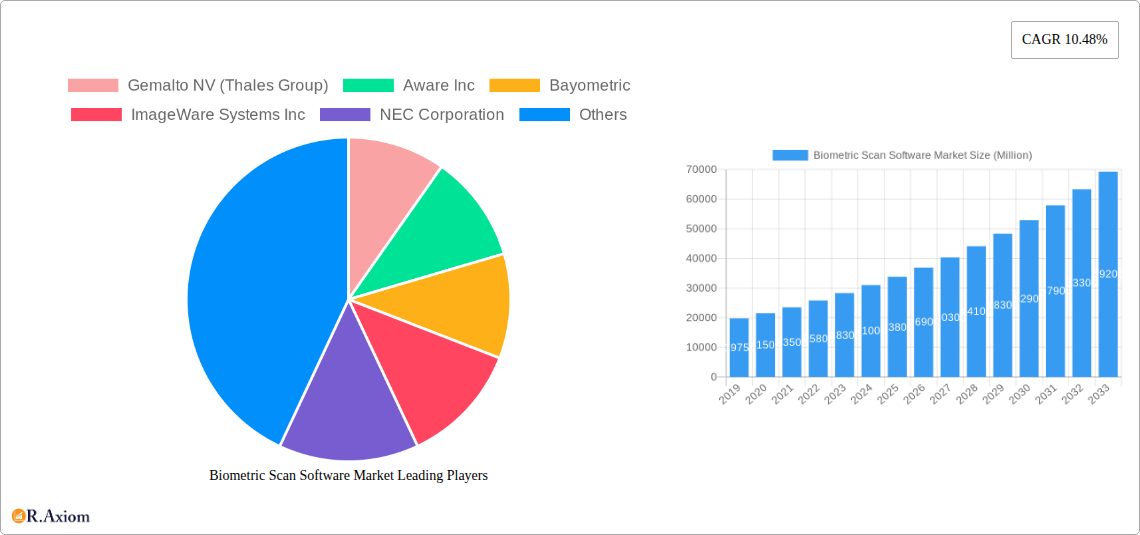

Biometric Scan Software Market Company Market Share

This report provides a comprehensive analysis of the global Biometric Scan Software Market, covering its current state, historical performance, and projected trajectory from the base year: 2025 to 2033. It offers critical insights into market concentration, innovation, industry trends, dominant segments, product developments, growth drivers, challenges, emerging opportunities, and the competitive landscape. The analysis encompasses biometric types including Fingerprint, Palm print, Facial Image, and Iris, and their impact across end-user industries such as Government and Defense, Healthcare, IT and Telecom, BFSI, and others. Market values are presented in billions for clarity and strategic decision-making.

Biometric Scan Software Market Market Concentration & Innovation

The Biometric Scan Software Market exhibits a moderate to high level of concentration, with key players like Gemalto NV (Thales Group), Aware Inc, and NEC Corporation holding significant market share, estimated to be over 35% in 2025. Innovation is a primary driver, fueled by advancements in AI and machine learning for improved accuracy and speed in facial recognition, fingerprint spoof detection, and iris scanning algorithms. The market is also shaped by evolving regulatory frameworks, such as GDPR and CCPA, which necessitate robust data privacy and security measures. Product substitutes, including passwords and PINs, are increasingly being phased out due to their inherent vulnerabilities. End-user trends point towards a growing demand for contactless and multi-modal biometric solutions to enhance security and user experience. Mergers and acquisitions (M&A) are playing a crucial role in market consolidation and technology integration, with M&A deal values projected to reach over $800 million in the forecast period, driven by the strategic acquisition of niche technology providers and market expansion initiatives.

- Key Innovation Drivers: AI/ML for algorithm enhancement, contactless biometrics, multi-modal authentication, privacy-preserving technologies.

- Regulatory Impact: Stringent data protection laws driving demand for secure biometric solutions.

- M&A Trends: Focus on acquiring specialized biometric technologies and expanding geographical reach.

Biometric Scan Software Market Industry Trends & Insights

The Biometric Scan Software Market is poised for substantial growth, driven by a confluence of technological advancements, escalating security concerns, and increasing adoption across diverse sectors. The compound annual growth rate (CAGR) for the period 2025-2033 is projected to be approximately 15.8%. This growth is propelled by the persistent need for robust identity verification and access control solutions in an increasingly digitalized world. Technological disruptions, including the rise of contactless biometrics such as facial recognition and gait analysis, are transforming user interactions and enhancing security. Consumer preferences are shifting towards more convenient and seamless authentication methods, moving away from traditional passwords. The competitive dynamics are characterized by intense innovation, strategic partnerships, and market expansion efforts by established players and emerging startups. Market penetration is expected to deepen, moving beyond traditional high-security applications into mainstream consumer devices and services. The increasing integration of biometrics into smartphones, wearable devices, and smart home systems further amplifies market penetration and revenue generation. The demand for biometric solutions in areas like remote workforce authentication and secure online transactions is also a significant growth catalyst. The global market size is estimated to reach over $15,000 million by 2025.

Dominant Markets & Segments in Biometric Scan Software Market

The Biometric Scan Software Market is significantly influenced by regional economic policies, infrastructure development, and government initiatives promoting digital transformation and security. Geographically, North America and Asia-Pacific are anticipated to dominate the market. In North America, factors such as stringent government regulations for border security and law enforcement, coupled with high adoption rates in the BFSI sector for fraud prevention, are key drivers. The United States, with its advanced technological infrastructure and significant investments in cybersecurity, represents a leading country within this region.

Biometric Type Dominance:

- Fingerprint: Continues to hold a substantial market share due to its long-standing reliability and widespread integration in mobile devices and access control systems. Its affordability and established infrastructure make it a prevalent choice.

- Facial Image: Experiencing rapid growth, driven by advancements in AI, contactless capabilities, and its application in surveillance, identity verification, and personalized user experiences. Its seamless integration into existing camera infrastructures contributes to its rise.

- Iris: Offers extremely high accuracy and security, making it a preferred choice for high-security environments like government facilities and critical infrastructure. Its resistance to spoofing is a key advantage.

- Palm Print: While a niche segment, it is gaining traction in specific applications requiring high levels of assurance and is less susceptible to environmental factors affecting fingerprint scans.

End-User Industry Dominance:

- Government and Defense: This sector remains a major consumer of biometric scan software, utilizing it for national security, border control, law enforcement, and access to sensitive facilities. The need for robust identification and authentication systems in defense operations is paramount.

- BFSI (Banking, Financial Services, and Insurance): Experiencing rapid adoption for fraud detection, customer onboarding, secure transactions, and ATM access. The increasing threat of cybercrimes and financial fraud necessitates advanced security measures provided by biometrics.

- IT and Telecom: Driven by the need for secure access to networks, devices, and cloud services, as well as for customer authentication in telecommunication services. The proliferation of mobile devices and online services fuels this segment.

- Healthcare: Growing adoption for patient identification, electronic health record (EHR) access, and secure access to medical facilities, improving patient safety and data privacy.

Asia-Pacific's dominance is fueled by rapid digitalization, a large and growing population, and increasing investments in smart city initiatives and national identification programs. Countries like China and India are significant contributors due to their vast populations and the government's push for digital identity solutions.

Biometric Scan Software Market Product Developments

Product developments in the Biometric Scan Software Market are heavily focused on enhancing accuracy, speed, and user-friendliness while prioritizing data security and privacy. Innovations include advanced AI-powered algorithms for facial recognition that can perform under challenging lighting conditions and detect liveness, as well as sophisticated fingerprint sensors that can capture high-resolution images and resist spoofing. The trend towards multi-modal biometrics, integrating multiple biometric traits like face and voice, offers superior security and a more robust authentication experience. Furthermore, the development of privacy-preserving biometric technologies, such as those using on-device processing and template encryption, is crucial for meeting evolving regulatory requirements and building user trust. These advancements are expanding the application spectrum of biometric software into areas like personalized retail experiences and enhanced remote work solutions.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Biometric Scan Software Market, segmented by Biometric Type and End-user Industry. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033.

Biometric Type Segmentation:

- Fingerprint: Expected to maintain a strong market presence with a projected market size of over $4,500 million in 2025, driven by its established use in various applications.

- Palm Print: A niche but growing segment, with projected market growth due to specialized security applications.

- Facial Image: Forecasted to experience significant growth, reaching over $6,000 million by 2025, fueled by technological advancements and increasing adoption in consumer electronics and security systems.

- Iris: Anticipated to grow steadily, securing a significant share in high-security environments, with market potential exceeding $2,000 million in 2025.

End-user Industry Segmentation:

- Government and Defense: Projected to be a leading segment with a market size exceeding $3,500 million in 2025, driven by national security imperatives.

- Healthcare: Expected to witness robust growth, reaching over $2,000 million in 2025, due to patient safety and data security needs.

- IT and Telecom: Forecasted to expand significantly, with a market size surpassing $2,500 million in 2025, driven by the increasing need for secure digital access.

- BFSI: Poised for substantial growth, exceeding $3,000 million in 2025, driven by fraud prevention and customer authentication demands.

- Other End-user Industries: This encompasses retail, education, and transportation, expected to contribute over $1,500 million to the market in 2025, showcasing diversifying applications.

Key Drivers of Biometric Scan Software Market Growth

The Biometric Scan Software Market is propelled by several key drivers. Heightened global security concerns, including the rise in identity theft and cybercrimes, necessitate more secure authentication methods than traditional passwords. The increasing demand for seamless and convenient user experiences is driving the adoption of contactless and passive biometric solutions. Technological advancements, particularly in AI and machine learning, are enhancing the accuracy, speed, and capabilities of biometric systems, making them more reliable and versatile. Government initiatives focused on digital transformation and the implementation of national identity programs further boost market expansion. The proliferation of mobile devices and the Internet of Things (IoT) creates a vast ecosystem for biometric integration, enabling secure access and personalized interactions. The financial sector's push for fraud reduction and enhanced customer onboarding also plays a significant role.

Challenges in the Biometric Scan Software Market Sector

Despite its robust growth, the Biometric Scan Software Market faces several challenges. Privacy concerns and the potential for misuse of biometric data remain significant barriers, requiring stringent regulations and robust security protocols. The accuracy of biometric systems can be affected by environmental factors, such as poor lighting for facial recognition or dirty fingers for fingerprint scanners, leading to false positives or negatives. The high initial cost of implementing and integrating sophisticated biometric systems can be a deterrent for smaller organizations. Furthermore, the evolving landscape of cyber threats requires continuous updates and advancements in biometric software to stay ahead of sophisticated spoofing techniques and data breaches. Interoperability issues between different biometric systems and platforms can also pose integration challenges. Competition from alternative authentication methods and the need for user education and acceptance also contribute to the market's complexities.

Emerging Opportunities in Biometric Scan Software Market

Emerging opportunities in the Biometric Scan Software Market are abundant and diverse. The growing demand for remote work solutions presents a significant opportunity for biometric authentication in secure remote access and employee monitoring. The expansion of the smart city concept creates a need for large-scale biometric systems for public safety, access control, and smart transportation. The burgeoning e-commerce and online gaming sectors offer avenues for enhanced customer authentication and fraud prevention. The increasing adoption of biometrics in the retail industry for personalized customer experiences and loyalty programs also presents a growing market. Furthermore, the development of advanced biometric techniques, such as behavioral biometrics and gait analysis, opens up new possibilities for passive and continuous authentication. The integration of biometrics into augmented and virtual reality environments for immersive and secure experiences is another promising frontier.

Leading Players in the Biometric Scan Software Market Market

- Gemalto NV (Thales Group)

- Aware Inc

- Bayometric

- ImageWare Systems Inc

- NEC Corporation

- Fulcrum Biometrics

- BioEnable Technologies Pvt Ltd

- Corvus Integration Inc

Key Developments in Biometric Scan Software Market Industry

- 2023/04: Launch of advanced AI-powered facial recognition algorithms by leading companies, improving accuracy in challenging environments.

- 2023/02: Increased M&A activities as larger players acquire niche biometric technology providers to expand their portfolios.

- 2022/11: Significant advancements in contactless biometric solutions, driven by the ongoing need for hygiene and convenience.

- 2022/09: Introduction of multi-modal biometric authentication systems, integrating facial, fingerprint, and voice recognition for enhanced security.

- 2021/07: Growing focus on privacy-preserving biometric technologies and on-device processing to comply with evolving data protection regulations.

Strategic Outlook for Biometric Scan Software Market Market

The strategic outlook for the Biometric Scan Software Market is highly optimistic, driven by the persistent demand for enhanced security, seamless user experiences, and increasing digitalization across all sectors. Key growth catalysts include ongoing innovation in AI and machine learning, leading to more accurate and sophisticated biometric solutions. The expansion of biometrics into new and emerging markets, such as IoT, smart cities, and the metaverse, will further fuel growth. Strategic partnerships and collaborations between technology providers, end-users, and government bodies will be crucial for developing integrated and secure biometric ecosystems. Addressing privacy concerns through transparent data handling practices and robust security measures will be paramount for sustained market expansion and consumer trust. The market is expected to witness continued consolidation through M&A activities, leading to a more streamlined competitive landscape. The future will likely see a greater emphasis on passive and behavioral biometrics, offering a more natural and continuous authentication experience.

Biometric Scan Software Market Segmentation

-

1. Biometric Type

- 1.1. Fingerprint

- 1.2. Palm print

- 1.3. Facial Image

- 1.4. Iris

-

2. End-user Industry

- 2.1. Government and Defense

- 2.2. Healthcare

- 2.3. IT and Telecom

- 2.4. BFSI

- 2.5. Other End-user Industries

Biometric Scan Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Biometric Scan Software Market Regional Market Share

Geographic Coverage of Biometric Scan Software Market

Biometric Scan Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Need for Improved Workforce Management; Increasing Demand for Safe and Secure Access

- 3.3. Market Restrains

- 3.3.1. ; Cost Involved in Deploying and Maintaining Biometric System Devices

- 3.4. Market Trends

- 3.4.1. Healthcare Sector Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biometric Scan Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Biometric Type

- 5.1.1. Fingerprint

- 5.1.2. Palm print

- 5.1.3. Facial Image

- 5.1.4. Iris

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Government and Defense

- 5.2.2. Healthcare

- 5.2.3. IT and Telecom

- 5.2.4. BFSI

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Biometric Type

- 6. North America Biometric Scan Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Biometric Type

- 6.1.1. Fingerprint

- 6.1.2. Palm print

- 6.1.3. Facial Image

- 6.1.4. Iris

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Government and Defense

- 6.2.2. Healthcare

- 6.2.3. IT and Telecom

- 6.2.4. BFSI

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Biometric Type

- 7. Europe Biometric Scan Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Biometric Type

- 7.1.1. Fingerprint

- 7.1.2. Palm print

- 7.1.3. Facial Image

- 7.1.4. Iris

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Government and Defense

- 7.2.2. Healthcare

- 7.2.3. IT and Telecom

- 7.2.4. BFSI

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Biometric Type

- 8. Asia Pacific Biometric Scan Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Biometric Type

- 8.1.1. Fingerprint

- 8.1.2. Palm print

- 8.1.3. Facial Image

- 8.1.4. Iris

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Government and Defense

- 8.2.2. Healthcare

- 8.2.3. IT and Telecom

- 8.2.4. BFSI

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Biometric Type

- 9. Latin America Biometric Scan Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Biometric Type

- 9.1.1. Fingerprint

- 9.1.2. Palm print

- 9.1.3. Facial Image

- 9.1.4. Iris

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Government and Defense

- 9.2.2. Healthcare

- 9.2.3. IT and Telecom

- 9.2.4. BFSI

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Biometric Type

- 10. Middle East Biometric Scan Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Biometric Type

- 10.1.1. Fingerprint

- 10.1.2. Palm print

- 10.1.3. Facial Image

- 10.1.4. Iris

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Government and Defense

- 10.2.2. Healthcare

- 10.2.3. IT and Telecom

- 10.2.4. BFSI

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Biometric Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gemalto NV (Thales Group)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aware Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bayometric

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ImageWare Systems Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NEC Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fulcrum Biometrics*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BioEnable Technologies Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Corvus Integration Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Gemalto NV (Thales Group)

List of Figures

- Figure 1: Global Biometric Scan Software Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Biometric Scan Software Market Revenue (billion), by Biometric Type 2025 & 2033

- Figure 3: North America Biometric Scan Software Market Revenue Share (%), by Biometric Type 2025 & 2033

- Figure 4: North America Biometric Scan Software Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Biometric Scan Software Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Biometric Scan Software Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Biometric Scan Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Biometric Scan Software Market Revenue (billion), by Biometric Type 2025 & 2033

- Figure 9: Europe Biometric Scan Software Market Revenue Share (%), by Biometric Type 2025 & 2033

- Figure 10: Europe Biometric Scan Software Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Biometric Scan Software Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Biometric Scan Software Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Biometric Scan Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Biometric Scan Software Market Revenue (billion), by Biometric Type 2025 & 2033

- Figure 15: Asia Pacific Biometric Scan Software Market Revenue Share (%), by Biometric Type 2025 & 2033

- Figure 16: Asia Pacific Biometric Scan Software Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Biometric Scan Software Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Biometric Scan Software Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Biometric Scan Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Biometric Scan Software Market Revenue (billion), by Biometric Type 2025 & 2033

- Figure 21: Latin America Biometric Scan Software Market Revenue Share (%), by Biometric Type 2025 & 2033

- Figure 22: Latin America Biometric Scan Software Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Latin America Biometric Scan Software Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Biometric Scan Software Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Biometric Scan Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Biometric Scan Software Market Revenue (billion), by Biometric Type 2025 & 2033

- Figure 27: Middle East Biometric Scan Software Market Revenue Share (%), by Biometric Type 2025 & 2033

- Figure 28: Middle East Biometric Scan Software Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East Biometric Scan Software Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Biometric Scan Software Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Biometric Scan Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biometric Scan Software Market Revenue billion Forecast, by Biometric Type 2020 & 2033

- Table 2: Global Biometric Scan Software Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Biometric Scan Software Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Biometric Scan Software Market Revenue billion Forecast, by Biometric Type 2020 & 2033

- Table 5: Global Biometric Scan Software Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Biometric Scan Software Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Biometric Scan Software Market Revenue billion Forecast, by Biometric Type 2020 & 2033

- Table 8: Global Biometric Scan Software Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Biometric Scan Software Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Biometric Scan Software Market Revenue billion Forecast, by Biometric Type 2020 & 2033

- Table 11: Global Biometric Scan Software Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Biometric Scan Software Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Biometric Scan Software Market Revenue billion Forecast, by Biometric Type 2020 & 2033

- Table 14: Global Biometric Scan Software Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Biometric Scan Software Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Biometric Scan Software Market Revenue billion Forecast, by Biometric Type 2020 & 2033

- Table 17: Global Biometric Scan Software Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Biometric Scan Software Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biometric Scan Software Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Biometric Scan Software Market?

Key companies in the market include Gemalto NV (Thales Group), Aware Inc, Bayometric, ImageWare Systems Inc, NEC Corporation, Fulcrum Biometrics*List Not Exhaustive, BioEnable Technologies Pvt Ltd, Corvus Integration Inc.

3. What are the main segments of the Biometric Scan Software Market?

The market segments include Biometric Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.3 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Need for Improved Workforce Management; Increasing Demand for Safe and Secure Access.

6. What are the notable trends driving market growth?

Healthcare Sector Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

; Cost Involved in Deploying and Maintaining Biometric System Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biometric Scan Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biometric Scan Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biometric Scan Software Market?

To stay informed about further developments, trends, and reports in the Biometric Scan Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence