Key Insights

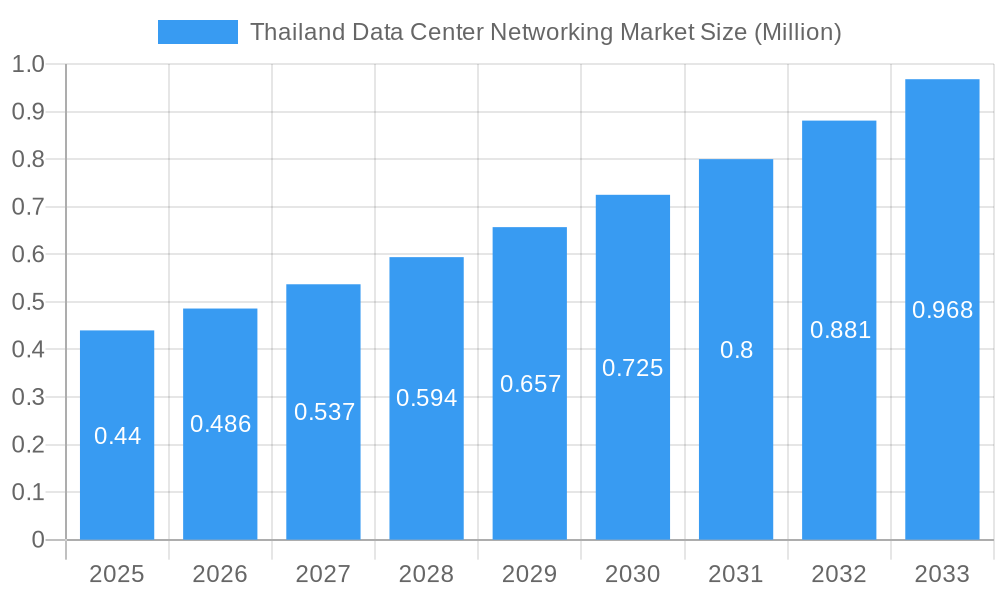

The Thailand Data Center Networking Market is poised for significant expansion, projected to reach approximately USD 0.44 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 10.53% through 2033. This growth is propelled by a confluence of factors, including the escalating demand for cloud computing services, the burgeoning digital transformation initiatives across various sectors, and the increasing adoption of high-performance networking infrastructure. The market is witnessing a surge in investments in advanced networking equipment such as Ethernet switches and routers, crucial for handling the massive data volumes generated by modern applications and services. Furthermore, the demand for robust Storage Area Networks (SAN) and Application Delivery Controllers (ADC) is on the rise as organizations strive for enhanced data accessibility, reliability, and application performance. The "Support & Maintenance" service segment is expected to witness substantial growth, reflecting the critical need for ongoing operational efficiency and technical assistance for complex data center networks.

Thailand Data Center Networking Market Market Size (In Million)

The IT & Telecommunication sector is leading the adoption of sophisticated data center networking solutions in Thailand, driven by the continuous need to upgrade infrastructure to support 5G deployment, IoT expansion, and increased data traffic. The BFSI sector is also a key contributor, investing heavily in secure and high-speed networking to facilitate digital banking services, risk management, and compliance. Emerging trends like the adoption of software-defined networking (SDN) and network function virtualization (NFV) are reshaping the market, offering greater agility and cost-effectiveness. While the market is experiencing strong growth, potential restraints could include the initial high cost of advanced networking hardware and the need for skilled IT professionals to manage and maintain these complex environments. However, the overarching trend of digitalization and the strategic importance of robust data center infrastructure are expected to outweigh these challenges, ensuring a dynamic and expanding market for data center networking in Thailand.

Thailand Data Center Networking Market Company Market Share

Here is a detailed, SEO-optimized report description for the Thailand Data Center Networking Market, designed for immediate use without modification:

Thailand Data Center Networking Market Market Concentration & Innovation

The Thailand data center networking market exhibits a moderate to high concentration, driven by the significant investments required for advanced networking infrastructure. Key players like Cisco Systems Inc., Huawei Technologies Co Ltd, and NVIDIA (Cumulus Networks Inc.) hold substantial market share, influencing innovation and pricing strategies. The primary innovation drivers include the relentless demand for higher bandwidth (400G, 800G), lower latency, and enhanced network security, fueled by the rapid expansion of cloud computing, AI/ML workloads, and digital transformation initiatives across various sectors. Regulatory frameworks, while evolving to support data localization and cybersecurity, generally encourage infrastructure development. Product substitutes are limited in the high-performance data center networking space, with innovation primarily occurring within existing product categories like Ethernet switches and routers. End-user trends show a strong preference for scalable, reliable, and energy-efficient networking solutions. Merger and acquisition (M&A) activities, while not extensively documented for Thailand specifically, globally indicate a trend towards consolidation to acquire technological capabilities or expand market reach, with notable deals often exceeding hundreds of millions of dollars. The market is characterized by a dynamic interplay between established vendors and emerging technology providers, pushing the boundaries of data center network performance and capabilities.

Thailand Data Center Networking Market Industry Trends & Insights

The Thailand data center networking market is poised for significant growth, driven by a confluence of powerful trends shaping the digital landscape. The increasing adoption of cloud services by enterprises of all sizes is a primary catalyst, demanding robust and high-performance networking to support cloud-based applications, data storage, and inter-data center connectivity. The burgeoning digital economy in Thailand, marked by a surge in e-commerce, online entertainment, and digital services, directly translates to a greater need for data processing and storage capacity, necessitating advanced networking solutions. Furthermore, the government's "Thailand 4.0" initiative, focused on developing a data-driven economy and fostering innovation, is a substantial growth driver, encouraging investments in digital infrastructure, including data centers and their underlying networking components.

Technological disruptions are continuously reshaping the market. The evolution towards higher bandwidth speeds, such as 400 Gigabit Ethernet (GbE) and beyond, is becoming increasingly critical for handling the massive data volumes generated by AI, IoT, and big data analytics. Software-defined networking (SDN) and network function virtualization (NFV) are gaining traction, offering greater flexibility, agility, and cost-effectiveness in managing complex data center networks. These technologies enable dynamic resource allocation and automated network management, which are crucial for optimizing performance and reducing operational expenditures.

Consumer preferences are also influencing the market. The demand for seamless, low-latency online experiences, whether for gaming, streaming, or remote work, places a premium on efficient and responsive data center networks. Businesses are prioritizing solutions that can deliver consistent performance and high availability to meet these evolving user expectations. The increasing emphasis on data privacy and security, coupled with stricter regulatory compliance requirements, is driving demand for advanced networking security features, including sophisticated firewalls, intrusion detection systems, and secure connectivity solutions.

The competitive dynamics within the Thailand data center networking market are characterized by the presence of global technology giants offering comprehensive portfolios of switches, routers, and networking software. Broadcom Corp., NVIDIA (Cumulus Networks Inc.), IBM Corporation, Dell EMC, Cisco Systems Inc., HP Development Company L P, Juniper Networks Inc., NEC Corporation, and Huawei Technologies Co Ltd are key players vying for market share. These companies are investing heavily in research and development to introduce next-generation networking solutions that address the growing demands for speed, scalability, and intelligence. The market penetration of advanced networking technologies is steadily increasing as businesses recognize the strategic importance of a well-architected data center network for their digital transformation journeys. The estimated Compound Annual Growth Rate (CAGR) for the forecast period is projected to be robust, reflecting the sustained investment and adoption of data center networking solutions in Thailand.

Dominant Markets & Segments in Thailand Data Center Networking Market

The Thailand data center networking market is segmented by product, service, and end-user, with each segment exhibiting distinct growth trajectories and drivers.

Dominance by Component: By Product

- Ethernet Switches: This segment holds a commanding presence within the market. The proliferation of cloud data centers, enterprise IT modernization, and the increasing demand for high-speed connectivity (100GbE, 400GbE) make Ethernet switches the foundational component of any data center network. Key drivers include the need for massive data throughput, efficient traffic management, and support for virtualization and containerization technologies. Vendors like Cisco, NVIDIA, and Broadcom are at the forefront, offering a wide array of high-performance and scalable switch solutions.

- Routers: Routers remain crucial for directing network traffic, both within the data center and to external networks. Their dominance is tied to the growth of network complexity and the need for efficient inter-data center and internet connectivity. The increasing number of interconnected data centers and the rise of edge computing further bolster the demand for advanced routing capabilities.

- Storage Area Network (SAN): While evolving with the rise of converged and hyper-converged infrastructure, SAN solutions continue to be vital for high-performance data storage access in enterprise data centers. Their dominance is particularly noted in sectors like BFSI and Media & Entertainment where high I/O operations and data integrity are paramount.

- Application Delivery Controller (ADC): ADCs are gaining significant traction as organizations focus on optimizing application performance, availability, and security. With the rise of cloud-native applications and microservices, the demand for intelligent traffic management and load balancing provided by ADCs is increasing substantially.

- Other Networking Equipment: This category, encompassing network interface cards (NICs), optical transceivers, and cabling solutions, forms an essential support system for the primary networking infrastructure. Their dominance is directly proportional to the growth of the core networking components.

Dominance by Component: By Services

- Installation & Integration: As data center infrastructure becomes more complex, the demand for expert installation and seamless integration services is paramount. This segment's dominance stems from the need for specialized knowledge to deploy and configure advanced networking hardware and software, ensuring optimal performance from day one.

- Support & Maintenance: The critical nature of data center operations necessitates continuous support and maintenance to ensure high availability and minimize downtime. This segment's sustained dominance reflects the ongoing operational needs of data center operators, including proactive monitoring, troubleshooting, and hardware/software updates.

- Training & Consulting: The rapid pace of technological evolution requires organizations to upskill their IT personnel and seek expert guidance on network design, optimization, and adoption of new technologies. This segment is crucial for enabling enterprises to leverage their data center networking investments effectively.

Dominance by End-User

- IT & Telecommunication: This sector is the undisputed leader, being the primary driver and consumer of data center networking solutions. Telecom operators and IT service providers require massive, high-capacity, and ultra-reliable networks to support their extensive service offerings, including cloud computing, mobile data, and enterprise connectivity. Their investments in hyperscale and colocation data centers directly fuel the demand for advanced networking.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector exhibits strong adoption due to stringent requirements for data security, compliance, and low-latency transaction processing. Digital transformation initiatives, including online banking, mobile payments, and risk management, necessitate robust data center networking infrastructure.

- Government: Government initiatives focused on digitalization, smart cities, and e-governance are leading to increased investments in data center networking. Secure and reliable infrastructure is crucial for handling sensitive citizen data and ensuring the continuity of public services.

- Media & Entertainment: The exponential growth of digital content, streaming services, and online gaming requires massive data processing and distribution capabilities, making this sector a significant consumer of high-bandwidth networking solutions.

- Other End-Users: This broad category includes manufacturing, retail, and healthcare, all of which are increasingly leveraging data center networking for their digital transformation efforts, including IoT, supply chain optimization, and telehealth services.

Thailand Data Center Networking Market Product Developments

Product innovations in the Thailand data center networking market are primarily focused on enhancing speed, efficiency, and intelligence. Recent developments include the introduction of 400GbE and 800GbE Ethernet switches designed for hyperscale and enterprise data centers, enabling faster data transfer and reduced latency. Advances in programmable silicon and AI-driven network management tools are enhancing network automation, visibility, and security. Furthermore, the integration of DPUs (Data Processing Units) with networking hardware is accelerating data processing and offloading critical tasks from CPUs, leading to improved overall system performance, particularly for AI and machine learning workloads. These developments are crucial for meeting the escalating bandwidth demands and supporting the growing complexity of modern data center environments.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Thailand Data Center Networking Market, segmenting it across key dimensions to provide comprehensive insights. The Component segmentation includes By Product, categorizing the market into Ethernet Switches, Routers, Storage Area Network (SAN), Application Delivery Controller (ADC), and Other Networking Equipment. The By Services segmentation further breaks down the market into Installation & Integration, Training & Consulting, and Support & Maintenance. The End-User segmentation identifies key sectors such as IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-Users. Each segment's analysis includes current market sizes, projected growth rates, and the competitive dynamics influencing its trajectory within the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033.

Key Drivers of Thailand Data Center Networking Market Growth

The Thailand Data Center Networking Market is propelled by several interconnected growth drivers. The rapid expansion of cloud computing adoption across enterprises, fueled by the need for scalable and flexible IT infrastructure, is a primary catalyst. The Thai government's digital transformation initiatives, such as Thailand 4.0, are actively promoting investments in digital infrastructure, including advanced data centers and their networking backbones. The surging demand for high-bandwidth applications, including AI, machine learning, IoT, and big data analytics, necessitates high-performance networking solutions to manage massive data flows. Furthermore, the increasing focus on data security and regulatory compliance, particularly with the growing volume of sensitive data being processed, is driving the adoption of sophisticated networking security features. The growth of the digital economy, encompassing e-commerce, online services, and digital media, further amplifies the need for robust and reliable data center networking.

Challenges in the Thailand Data Center Networking Market Sector

Despite its robust growth, the Thailand Data Center Networking Market faces several challenges. The shortage of skilled IT professionals with expertise in advanced networking technologies and data center management can hinder deployment and operational efficiency. High upfront investment costs associated with cutting-edge networking equipment and infrastructure can be a barrier for some Small and Medium-sized Enterprises (SMEs). Cybersecurity threats continue to evolve, requiring constant vigilance and investment in advanced security solutions, which can strain resources. Furthermore, supply chain disruptions, as experienced globally, can impact the availability and pricing of critical networking components. Navigating the evolving regulatory landscape related to data privacy and localization also presents a complex challenge for market participants.

Emerging Opportunities in Thailand Data Center Networking Market

Emerging opportunities in the Thailand Data Center Networking Market are abundant, driven by ongoing technological advancements and shifting market demands. The increasing demand for edge computing solutions presents a significant opportunity for distributed networking infrastructure closer to data sources. The growth of AI and machine learning workloads is creating a demand for specialized high-speed, low-latency networking fabrics. Furthermore, the expansion of 5G network deployment will necessitate significant upgrades to the underlying data center networking to support increased mobile data traffic. The increasing adoption of sustainably powered data centers opens avenues for networking solutions that emphasize energy efficiency. Lastly, the growing trend of colocation and managed services offers opportunities for service providers to offer advanced networking capabilities to a broader range of clients.

Leading Players in the Thailand Data Center Networking Market Market

- Broadcom Corp

- NVIDIA (Cumulus Networks Inc)

- IBM Corporation

- Dell EMC

- Cisco Systems Inc

- HP Development Company L P

- Juniper Networks Inc

- NEC Corporation

- Huawei Technologies Co Ltd

- VMware Inc

- Schneider Electric

Key Developments in Thailand Data Center Networking Market Industry

- July 2023: Broadcom Inc. announced Trident 4-X7 data center top-of-rack (ToR) switches, designed to provide the same power cloud operators already enjoy. Supporting the growing need for 400G connectivity in enterprise data centres, as bandwidth demand increases, is a key promise of the new Trident 4-X7.

- May 2023: NVIDIA has announced SpectrumXtreme, an accelerated networking platform manufactured to enhance the performance and efficiency of the cloud-based on Ethernet AI. NVIDIA Spectrum-X is developed on networking developments powered by the firm coupling of the NVIDIA Spectrum-4 Ethernet switch with the NVIDIA BlueField-3 DPU, attaining 1.7x better overall AI performance and power efficiency, along with consistent, predictable performance in multi-tenant environments.

Strategic Outlook for Thailand Data Center Networking Market Market

The strategic outlook for the Thailand Data Center Networking Market is exceptionally positive, driven by sustained digital transformation across industries. Investments in hyperscale and enterprise data centers will continue to be a major growth catalyst, demanding sophisticated networking solutions to support increasing data volumes and processing needs. The government's commitment to fostering a digital economy will further incentivize the development of robust network infrastructure. Opportunities abound in areas like edge computing, AI-optimized networking, and the integration of advanced security protocols. Companies that can offer scalable, high-performance, and energy-efficient networking solutions, coupled with comprehensive support and integration services, are well-positioned for significant market penetration and long-term success in this dynamic and rapidly evolving market.

Thailand Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Routers

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

Thailand Data Center Networking Market Segmentation By Geography

- 1. Thailand

Thailand Data Center Networking Market Regional Market Share

Geographic Coverage of Thailand Data Center Networking Market

Thailand Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication is Anticipated to be Fastest Growing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Data Center Networking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Routers

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Broadcom Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NVIDIA (Cumulus Networks Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell EMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HP Development Company L P

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Juniper Networks Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huawei Technologies Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VMware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Schneider Electric

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Broadcom Corp

List of Figures

- Figure 1: Thailand Data Center Networking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Data Center Networking Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Thailand Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Thailand Data Center Networking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Thailand Data Center Networking Market Revenue Million Forecast, by Component 2020 & 2033

- Table 5: Thailand Data Center Networking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Thailand Data Center Networking Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Data Center Networking Market?

The projected CAGR is approximately 10.53%.

2. Which companies are prominent players in the Thailand Data Center Networking Market?

Key companies in the market include Broadcom Corp, NVIDIA (Cumulus Networks Inc ), IBM Corporation, Dell EMC, Cisco Systems Inc, HP Development Company L P, Juniper Networks Inc, NEC Corporation, Huawei Technologies Co Ltd, VMware Inc, Schneider Electric.

3. What are the main segments of the Thailand Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

IT & Telecommunication is Anticipated to be Fastest Growing Segment.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

July 2023: Broadcom Inc. announced Trident 4-X7 data center top-of-rack (ToR) switches, designed to provide the same power cloud operators already enjoy. Supporting the growing need for 400G connectivity in enterprise data centres, as bandwidth demand increases, is a key promise of the new Trident 4-X7.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Data Center Networking Market?

To stay informed about further developments, trends, and reports in the Thailand Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence