Key Insights

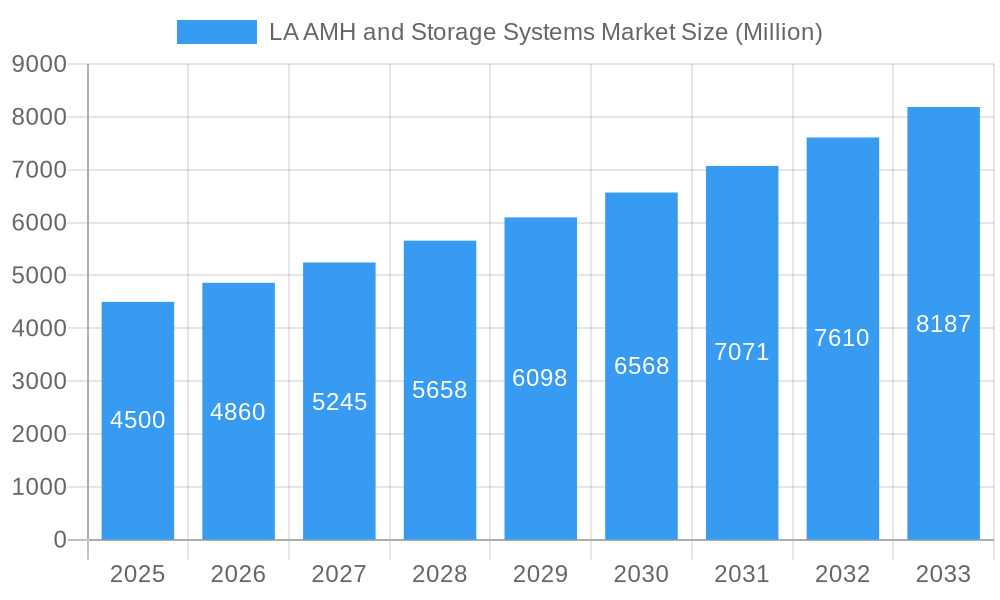

The Latin America (LA) Automated Material Handling (AMH) and Storage Systems Market is projected for substantial growth, reaching an estimated market size of USD 4,500 million by 2025. The market is forecast to expand at a robust Compound Annual Growth Rate (CAGR) of 9.7% through 2033. This expansion is driven by the increasing need for operational efficiency and reduced labor costs across industries. Key growth factors include the demand for optimized warehouse management, the surge in e-commerce requiring faster order fulfillment, and the adoption of AI and IoT for integrated supply chains. Government initiatives promoting industrial automation and infrastructure development in Latin America also contribute significantly. The market is witnessing a strong trend towards Autonomous Mobile Robots (AMRs) and advanced Automated Storage and Retrieval Systems (ASRS), offering greater flexibility and scalability than traditional solutions.

LA AMH and Storage Systems Market Market Size (In Billion)

The market segmentation highlights dynamic growth areas. The "Software" segment is expected to lead growth due to the increasing importance of Warehouse Management Systems (WMS) and Warehouse Control Systems (WCS) for managing complex automated operations. In terms of equipment, "Mobile Robots (AMR)" are anticipated to dominate, reflecting a shift towards agile and adaptable solutions. Key end-user segments contributing to market revenue include "Retail/Wholesale," "Food and Beverage," and "E-commerce/Post and Parcel," driven by the need to streamline logistics and meet consumer expectations. While strong growth drivers are present, challenges such as high initial investment costs for AMH systems and a shortage of skilled labor may impact market growth. However, continuous technological advancements and rising awareness of automation benefits are expected to ensure a positive long-term outlook.

LA AMH and Storage Systems Market Company Market Share

This in-depth market research report provides a comprehensive analysis of the Latin America Automated Material Handling (AMH) and Storage Systems Market. It covers a detailed study period, with a base year of 2025, offering insights into historical trends, current market dynamics, and future projections. The report is designed to equip stakeholders, including manufacturers, suppliers, investors, and end-users, with strategic intelligence for this evolving landscape. With a focus on keywords such as "automated guided vehicle (AGV)," "autonomous mobile robots (AMR)," "automated storage and retrieval systems (ASRS)," "logistics solutions," "warehouse automation," and "supply chain optimization," this report aims to enhance search visibility and drive informed decision-making. The market is experiencing significant growth driven by the increasing demand for efficient, flexible, and scalable material handling and storage solutions across diverse industries.

This in-depth market research report provides a comprehensive analysis of the LA Automated Material Handling (AMH) and Storage Systems Market. It covers a detailed study period from 2019 to 2033, with a base year of 2025, offering invaluable insights into historical trends, current market dynamics, and future projections. The report is designed to equip industry stakeholders, including manufacturers, suppliers, investors, and end-users, with strategic intelligence to navigate this rapidly evolving landscape. With a focus on high-traffic keywords such as "automated guided vehicle (AGV)," "autonomous mobile robots (AMR)," "automated storage and retrieval systems (ASRS)," "logistics solutions," "warehouse automation," and "supply chain optimization," this report aims to enhance search visibility and drive informed decision-making. The global market is experiencing unprecedented growth driven by the increasing demand for efficient, flexible, and scalable material handling and storage solutions across diverse industries.

LA AMH and Storage Systems Market Market Concentration & Innovation

The LA AMH and Storage Systems Market is characterized by a moderate to high level of market concentration, with key players like Jungheinrich AG, SSI SCHAEFER AG, KION Group AG, Daifuku Co Limited, and Kardex Group holding significant market shares. Innovation is a primary driver, fueled by advancements in robotics, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), leading to the development of smarter and more autonomous systems. Regulatory frameworks, while generally supportive of automation for efficiency and safety, can vary by region, impacting adoption rates. Product substitutes exist in the form of manual labor and less advanced equipment, but the superior efficiency and scalability of AMH and storage systems are increasingly pushing these aside. End-user trends, such as the rise of e-commerce and the need for resilient supply chains, are significantly influencing demand for flexible and automated solutions. Mergers and acquisitions (M&A) activities are a notable aspect of market dynamics, with several significant deals observed in the historical period, such as potential M&A deal values estimated in the hundreds of millions. These M&A activities, alongside strategic partnerships, are consolidating market positions and fostering further innovation.

- Market Share Dominance: Key players collectively account for an estimated 60-70% of the global market.

- Innovation Hotspots: Focus on AI-driven optimization, collaborative robotics, and integrated software solutions.

- Regulatory Impact: Evolving safety standards and data privacy regulations influencing system design and deployment.

- End-User Demands: Growing emphasis on real-time visibility, predictive maintenance, and optimized inventory management.

- M&A Activity: Strategic acquisitions aimed at expanding product portfolios and geographic reach, with deal values in the hundreds of millions.

LA AMH and Storage Systems Market Industry Trends & Insights

The LA AMH and Storage Systems Market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer expectations, and the relentless pursuit of operational efficiency by businesses globally. The estimated Compound Annual Growth Rate (CAGR) for the market is projected to be approximately 10-12% over the forecast period (2025–2033). This robust growth is underpinned by the increasing need for supply chain resilience and agility, amplified by recent global events. Technological disruptions, particularly in the realm of robotics and AI, are fundamentally reshaping how warehouses and distribution centers operate. Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) are gaining widespread adoption due to their flexibility, scalability, and ability to integrate seamlessly into existing infrastructures. Furthermore, the development of advanced Automated Storage and Retrieval Systems (ASRS), including high-density vertical solutions and dynamic carousel systems, is addressing the critical challenge of space optimization in increasingly land-constrained urban environments. Consumer preferences for faster delivery times and personalized shopping experiences are compelling businesses to invest in automation that can accelerate order fulfillment processes. The competitive landscape is intensifying, with a growing number of both established players and emerging startups vying for market share. This competition is fostering a rapid pace of innovation, with companies focusing on developing integrated solutions that combine hardware, software, and advanced analytics to provide end-to-end automation capabilities. Market penetration of advanced AMH and storage systems is steadily increasing across various end-user industries, signifying a broad-based adoption trend. The shift towards Industry 4.0 principles, emphasizing connectivity, data analytics, and intelligent automation, is a key trend that will continue to shape the trajectory of this market, driving demand for sophisticated and interconnected material handling and storage solutions. The projected market size for the LA AMH and Storage Systems Market is expected to reach an estimated $XX Billion by 2033, underscoring its significant economic impact and potential.

Dominant Markets & Segments in LA AMH and Storage Systems Market

The LA AMH and Storage Systems Market is witnessing dominance from specific regions and segments, driven by varying economic policies, infrastructure development, and industry-specific demands. North America and Europe currently lead in market adoption due to their well-established industrial bases, high labor costs, and early embrace of technological innovation. Asia-Pacific is emerging as a rapidly growing market, fueled by its burgeoning manufacturing sector, expanding e-commerce landscape, and increasing investments in logistics infrastructure.

Product Type Dominance:

- Hardware: This segment currently holds the largest market share, driven by the fundamental need for physical automation equipment such as AGVs, AMRs, and ASRS. The demand for robust and reliable hardware is a constant, underpinning the entire automation ecosystem.

- Software: While smaller in current market share compared to hardware, the software segment is experiencing the highest growth rate. This is attributed to the increasing sophistication of warehouse management systems (WMS), warehouse control systems (WCS), and fleet management software that are essential for orchestrating complex automated operations. Integration of AI and ML for predictive analytics and optimization is a key growth driver.

- Services: This segment, encompassing installation, maintenance, consulting, and support, is crucial for ensuring the seamless operation of AMH and storage systems. Its growth is directly tied to the expanding installed base of hardware and software.

Equipment Type Dominance:

- Mobile Robots (AGV & AMR): Both AGVs and AMRs are witnessing significant traction. AGVs are favored in structured environments with repetitive tasks, while AMRs are increasingly preferred for their flexibility and adaptability in dynamic environments. The Automotive and Food and Beverage sectors are major adopters.

- Automated Storage and Retrieval Systems (ASRS): ASRS, particularly fixed aisle and vertical lift modules (VLMs), are dominating due to their exceptional space utilization capabilities and high throughput. This is critical for industries facing land scarcity and high inventory volumes, such as Retail/W and Pharmaceuticals.

- Automated Conveyors: Belt and roller conveyors remain workhorses for moving goods within facilities, while pallet and overhead conveyors are essential for high-volume, long-distance transportation.

End-User Dominance:

- Retail/W (Retail and Wholesale): This sector is a powerhouse for AMH and storage systems, driven by the explosive growth of e-commerce, the need for rapid order fulfillment, and efficient inventory management.

- Automotive: The automotive industry has long been an early adopter of automation, with AMH and storage systems playing a vital role in streamlining assembly lines, parts handling, and logistics.

- Food and Beverage: This sector demands high levels of hygiene, efficiency, and traceability, making AMH and storage systems indispensable for cold chain management, processing, and distribution.

Key drivers for dominance in these segments include economic policies encouraging automation, robust infrastructure development, high labor costs, and the specific operational requirements of each industry.

LA AMH and Storage Systems Market Product Developments

Product development in the LA AMH and Storage Systems Market is characterized by a strong emphasis on increased intelligence, flexibility, and integration. Innovations are focused on enhancing the capabilities of autonomous mobile robots (AMRs) with advanced navigation and obstacle avoidance, while automated storage and retrieval systems (ASRS) are becoming more modular and scalable. The integration of AI and machine learning into software platforms is enabling real-time optimization of operations, predictive maintenance, and improved decision-making. Competitive advantages are being achieved through the development of holistic solutions that combine hardware, software, and data analytics, offering end-to-end visibility and control.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation analysis of the LA AMH and Storage Systems Market.

Product Type Segmentation:

- Software: Includes WMS, WCS, fleet management, and analytics platforms. This segment is projected to exhibit a CAGR of approximately 13-15% due to the increasing demand for intelligent operational control.

- Hardware: Encompasses robots, ASRS units, conveyors, and other physical automation equipment. This segment is expected to grow at a CAGR of 9-11%, driven by the continuous need for physical infrastructure.

- Services: Covers installation, maintenance, training, and consulting. This segment is forecast to grow at a CAGR of 10-12%, closely mirroring the expansion of the installed base.

- Integration: Refers to the specialized services for integrating various AMH components into a cohesive system. This segment is anticipated to grow at a CAGR of 11-13% as complex automation solutions become more prevalent.

Equipment Type Segmentation:

- Mobile Robots (AGV & AMR): Expected to grow at a CAGR of 14-16%, driven by their versatility.

- Automated Storage and Retrieval Systems (ASRS): Projected to grow at a CAGR of 10-12%, with significant adoption in space-constrained environments.

- Automated Conveyor: Expected to grow at a CAGR of 8-10%, remaining a foundational element of material flow.

- Palletizer: Anticipated to grow at a CAGR of 9-11%, crucial for end-of-line automation.

- Sortation System: Forecast to grow at a CAGR of 11-13%, essential for high-throughput distribution centers.

End-User Segmentation:

- Airport, Automotive, Food and Beverage, Retail/W, General Manufacturing, Pharmaceuticals, Post and Parcel, Electronics and Semiconductor Manufacturing: Each of these sectors contributes significantly to market growth, with projected CAGRs ranging from 9-15% based on their specific automation adoption rates and market dynamics.

Key Drivers of LA AMH and Storage Systems Market Growth

The LA AMH and Storage Systems Market is propelled by several key drivers. Firstly, the escalating growth of e-commerce necessitates faster order fulfillment and efficient inventory management, directly boosting demand for automated solutions. Secondly, the increasing labor costs and labor shortages in developed economies are compelling businesses to invest in automation for sustained operational efficiency. Thirdly, the push towards Industry 4.0 and smart manufacturing, with a focus on data-driven decision-making and interconnected systems, is driving the adoption of intelligent AMH and storage solutions. Finally, advancements in robotics, AI, and IoT technologies are making these systems more capable, flexible, and cost-effective, thereby expanding their applicability across various industries.

Challenges in the LA AMH and Storage Systems Market Sector

Despite the strong growth trajectory, the LA AMH and Storage Systems Market faces several challenges. The high initial capital investment required for sophisticated automation solutions can be a barrier for small and medium-sized enterprises (SMEs). Integration complexity, particularly in retrofitting existing facilities with new automated systems, poses technical and operational hurdles. Furthermore, the need for a skilled workforce to operate and maintain these advanced systems is a growing concern, potentially leading to labor skill gaps. Cybersecurity threats to connected automated systems also present a risk that requires robust mitigation strategies.

Emerging Opportunities in LA AMH and Storage Systems Market

Emerging opportunities in the LA AMH and Storage Systems Market are abundant. The growing demand for sustainable logistics and green warehousing presents an opportunity for energy-efficient automation solutions. The expansion of automation into new sectors, such as healthcare and agriculture, opens up fresh avenues for growth. The development of collaborative robots (cobots) that can work alongside human employees offers flexible and scalable automation for a wider range of tasks. Furthermore, the increasing adoption of AI and machine learning for predictive analytics and real-time optimization of supply chains creates opportunities for advanced software and service providers.

Leading Players in the LA AMH and Storage Systems Market Market

- Jungheinrich AG

- SSI SCHAEFER AG

- KION Group AG

- Interroll Group

- Daifuku Co Limited

- Murata Machinery Limited

- Kardex Group

- JBT Corporation

- Beumer Group GMBH & Co KG

- System Logistics

Key Developments in LA AMH and Storage Systems Market Industry

- June 2020: La Costena, a prominent producer of canned food in Mexico, partnered with SSI SCHAEFER AG to revolutionize their logistics standards and transform their current supply chain. This collaboration aimed to develop a significant logistics solution designed to enhance storage capacity, picking efficiency, and dispatch production.

Strategic Outlook for LA AMH and Storage Systems Market Market

The strategic outlook for the LA AMH and Storage Systems Market is exceptionally positive. The persistent drive for operational efficiency, coupled with the ongoing digital transformation across industries, will continue to fuel demand for advanced automation. Companies that can offer integrated, intelligent, and flexible solutions, supported by robust service offerings, are best positioned for success. Investment in R&D for next-generation robotics, AI-powered analytics, and seamless software integration will be critical. Furthermore, strategic partnerships and acquisitions will likely continue to shape the market landscape, enabling players to expand their capabilities and market reach, ultimately driving the future of automated material handling and storage.

LA AMH and Storage Systems Market Segmentation

-

1. Product Type

- 1.1. Software

- 1.2. Hardware

- 1.3. Services

- 1.4. Integration

-

2. Equipment Type

-

2.1. Mobile Robots

-

2.1.1. Automated Guided Vehicle(AGV)

- 2.1.1.1. Automated Forklift

- 2.1.1.2. Automated Tow/Tractor/Tug

- 2.1.1.3. Unit Load

- 2.1.1.4. Assembly Line

- 2.1.2. Autonomous Mobile Robots(AMR)

-

2.1.1. Automated Guided Vehicle(AGV)

-

2.2. Automated Storage and Retrieval System(ASRS)

- 2.2.1. Fixed Asile

- 2.2.2. Carousel

- 2.2.3. Vertical Lift Module

-

2.3. Automated Conveyor

- 2.3.1. Belt

- 2.3.2. Roller

- 2.3.3. Pallet

- 2.3.4. Overhead

-

2.4. Palletizer

- 2.4.1. Conventional

- 2.4.2. Robotic

- 2.5. Sortation System

-

2.1. Mobile Robots

-

3. End-User

- 3.1. Airport

- 3.2. Automotive

- 3.3. Food and Beverage

- 3.4. Retail/W

- 3.5. General Manufacturing

- 3.6. Pharmaceuticals

- 3.7. Post and Parcel

- 3.8. Electronics and Semiconductor Manufacturing

- 3.9. Other End-Users

LA AMH and Storage Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

LA AMH and Storage Systems Market Regional Market Share

Geographic Coverage of LA AMH and Storage Systems Market

LA AMH and Storage Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements Aiding Market Growth; Rapid Growth in E-commerce Leading to Warehouse Automation; Industry 4.0 Investments Driving the Demand for Automated Material Handling and Storage Systems

- 3.3. Market Restrains

- 3.3.1. Data Pricacy Concerns

- 3.4. Market Trends

- 3.4.1. Automated Guided Vehicle Expected to Witness Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LA AMH and Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Software

- 5.1.2. Hardware

- 5.1.3. Services

- 5.1.4. Integration

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Mobile Robots

- 5.2.1.1. Automated Guided Vehicle(AGV)

- 5.2.1.1.1. Automated Forklift

- 5.2.1.1.2. Automated Tow/Tractor/Tug

- 5.2.1.1.3. Unit Load

- 5.2.1.1.4. Assembly Line

- 5.2.1.2. Autonomous Mobile Robots(AMR)

- 5.2.1.1. Automated Guided Vehicle(AGV)

- 5.2.2. Automated Storage and Retrieval System(ASRS)

- 5.2.2.1. Fixed Asile

- 5.2.2.2. Carousel

- 5.2.2.3. Vertical Lift Module

- 5.2.3. Automated Conveyor

- 5.2.3.1. Belt

- 5.2.3.2. Roller

- 5.2.3.3. Pallet

- 5.2.3.4. Overhead

- 5.2.4. Palletizer

- 5.2.4.1. Conventional

- 5.2.4.2. Robotic

- 5.2.5. Sortation System

- 5.2.1. Mobile Robots

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Airport

- 5.3.2. Automotive

- 5.3.3. Food and Beverage

- 5.3.4. Retail/W

- 5.3.5. General Manufacturing

- 5.3.6. Pharmaceuticals

- 5.3.7. Post and Parcel

- 5.3.8. Electronics and Semiconductor Manufacturing

- 5.3.9. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America LA AMH and Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Software

- 6.1.2. Hardware

- 6.1.3. Services

- 6.1.4. Integration

- 6.2. Market Analysis, Insights and Forecast - by Equipment Type

- 6.2.1. Mobile Robots

- 6.2.1.1. Automated Guided Vehicle(AGV)

- 6.2.1.1.1. Automated Forklift

- 6.2.1.1.2. Automated Tow/Tractor/Tug

- 6.2.1.1.3. Unit Load

- 6.2.1.1.4. Assembly Line

- 6.2.1.2. Autonomous Mobile Robots(AMR)

- 6.2.1.1. Automated Guided Vehicle(AGV)

- 6.2.2. Automated Storage and Retrieval System(ASRS)

- 6.2.2.1. Fixed Asile

- 6.2.2.2. Carousel

- 6.2.2.3. Vertical Lift Module

- 6.2.3. Automated Conveyor

- 6.2.3.1. Belt

- 6.2.3.2. Roller

- 6.2.3.3. Pallet

- 6.2.3.4. Overhead

- 6.2.4. Palletizer

- 6.2.4.1. Conventional

- 6.2.4.2. Robotic

- 6.2.5. Sortation System

- 6.2.1. Mobile Robots

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Airport

- 6.3.2. Automotive

- 6.3.3. Food and Beverage

- 6.3.4. Retail/W

- 6.3.5. General Manufacturing

- 6.3.6. Pharmaceuticals

- 6.3.7. Post and Parcel

- 6.3.8. Electronics and Semiconductor Manufacturing

- 6.3.9. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America LA AMH and Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Software

- 7.1.2. Hardware

- 7.1.3. Services

- 7.1.4. Integration

- 7.2. Market Analysis, Insights and Forecast - by Equipment Type

- 7.2.1. Mobile Robots

- 7.2.1.1. Automated Guided Vehicle(AGV)

- 7.2.1.1.1. Automated Forklift

- 7.2.1.1.2. Automated Tow/Tractor/Tug

- 7.2.1.1.3. Unit Load

- 7.2.1.1.4. Assembly Line

- 7.2.1.2. Autonomous Mobile Robots(AMR)

- 7.2.1.1. Automated Guided Vehicle(AGV)

- 7.2.2. Automated Storage and Retrieval System(ASRS)

- 7.2.2.1. Fixed Asile

- 7.2.2.2. Carousel

- 7.2.2.3. Vertical Lift Module

- 7.2.3. Automated Conveyor

- 7.2.3.1. Belt

- 7.2.3.2. Roller

- 7.2.3.3. Pallet

- 7.2.3.4. Overhead

- 7.2.4. Palletizer

- 7.2.4.1. Conventional

- 7.2.4.2. Robotic

- 7.2.5. Sortation System

- 7.2.1. Mobile Robots

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Airport

- 7.3.2. Automotive

- 7.3.3. Food and Beverage

- 7.3.4. Retail/W

- 7.3.5. General Manufacturing

- 7.3.6. Pharmaceuticals

- 7.3.7. Post and Parcel

- 7.3.8. Electronics and Semiconductor Manufacturing

- 7.3.9. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe LA AMH and Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Software

- 8.1.2. Hardware

- 8.1.3. Services

- 8.1.4. Integration

- 8.2. Market Analysis, Insights and Forecast - by Equipment Type

- 8.2.1. Mobile Robots

- 8.2.1.1. Automated Guided Vehicle(AGV)

- 8.2.1.1.1. Automated Forklift

- 8.2.1.1.2. Automated Tow/Tractor/Tug

- 8.2.1.1.3. Unit Load

- 8.2.1.1.4. Assembly Line

- 8.2.1.2. Autonomous Mobile Robots(AMR)

- 8.2.1.1. Automated Guided Vehicle(AGV)

- 8.2.2. Automated Storage and Retrieval System(ASRS)

- 8.2.2.1. Fixed Asile

- 8.2.2.2. Carousel

- 8.2.2.3. Vertical Lift Module

- 8.2.3. Automated Conveyor

- 8.2.3.1. Belt

- 8.2.3.2. Roller

- 8.2.3.3. Pallet

- 8.2.3.4. Overhead

- 8.2.4. Palletizer

- 8.2.4.1. Conventional

- 8.2.4.2. Robotic

- 8.2.5. Sortation System

- 8.2.1. Mobile Robots

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Airport

- 8.3.2. Automotive

- 8.3.3. Food and Beverage

- 8.3.4. Retail/W

- 8.3.5. General Manufacturing

- 8.3.6. Pharmaceuticals

- 8.3.7. Post and Parcel

- 8.3.8. Electronics and Semiconductor Manufacturing

- 8.3.9. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa LA AMH and Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Software

- 9.1.2. Hardware

- 9.1.3. Services

- 9.1.4. Integration

- 9.2. Market Analysis, Insights and Forecast - by Equipment Type

- 9.2.1. Mobile Robots

- 9.2.1.1. Automated Guided Vehicle(AGV)

- 9.2.1.1.1. Automated Forklift

- 9.2.1.1.2. Automated Tow/Tractor/Tug

- 9.2.1.1.3. Unit Load

- 9.2.1.1.4. Assembly Line

- 9.2.1.2. Autonomous Mobile Robots(AMR)

- 9.2.1.1. Automated Guided Vehicle(AGV)

- 9.2.2. Automated Storage and Retrieval System(ASRS)

- 9.2.2.1. Fixed Asile

- 9.2.2.2. Carousel

- 9.2.2.3. Vertical Lift Module

- 9.2.3. Automated Conveyor

- 9.2.3.1. Belt

- 9.2.3.2. Roller

- 9.2.3.3. Pallet

- 9.2.3.4. Overhead

- 9.2.4. Palletizer

- 9.2.4.1. Conventional

- 9.2.4.2. Robotic

- 9.2.5. Sortation System

- 9.2.1. Mobile Robots

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Airport

- 9.3.2. Automotive

- 9.3.3. Food and Beverage

- 9.3.4. Retail/W

- 9.3.5. General Manufacturing

- 9.3.6. Pharmaceuticals

- 9.3.7. Post and Parcel

- 9.3.8. Electronics and Semiconductor Manufacturing

- 9.3.9. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific LA AMH and Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Software

- 10.1.2. Hardware

- 10.1.3. Services

- 10.1.4. Integration

- 10.2. Market Analysis, Insights and Forecast - by Equipment Type

- 10.2.1. Mobile Robots

- 10.2.1.1. Automated Guided Vehicle(AGV)

- 10.2.1.1.1. Automated Forklift

- 10.2.1.1.2. Automated Tow/Tractor/Tug

- 10.2.1.1.3. Unit Load

- 10.2.1.1.4. Assembly Line

- 10.2.1.2. Autonomous Mobile Robots(AMR)

- 10.2.1.1. Automated Guided Vehicle(AGV)

- 10.2.2. Automated Storage and Retrieval System(ASRS)

- 10.2.2.1. Fixed Asile

- 10.2.2.2. Carousel

- 10.2.2.3. Vertical Lift Module

- 10.2.3. Automated Conveyor

- 10.2.3.1. Belt

- 10.2.3.2. Roller

- 10.2.3.3. Pallet

- 10.2.3.4. Overhead

- 10.2.4. Palletizer

- 10.2.4.1. Conventional

- 10.2.4.2. Robotic

- 10.2.5. Sortation System

- 10.2.1. Mobile Robots

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Airport

- 10.3.2. Automotive

- 10.3.3. Food and Beverage

- 10.3.4. Retail/W

- 10.3.5. General Manufacturing

- 10.3.6. Pharmaceuticals

- 10.3.7. Post and Parcel

- 10.3.8. Electronics and Semiconductor Manufacturing

- 10.3.9. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jungheinrich AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SSI SCHEFER AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KION Group AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Interroll Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Daifuku Co Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Murata Machinery Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kardex Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JBT Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Beumer Group GMBH & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 System Logistics*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global LA AMH and Storage Systems Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America LA AMH and Storage Systems Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America LA AMH and Storage Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America LA AMH and Storage Systems Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 5: North America LA AMH and Storage Systems Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 6: North America LA AMH and Storage Systems Market Revenue (billion), by End-User 2025 & 2033

- Figure 7: North America LA AMH and Storage Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America LA AMH and Storage Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America LA AMH and Storage Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America LA AMH and Storage Systems Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America LA AMH and Storage Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America LA AMH and Storage Systems Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 13: South America LA AMH and Storage Systems Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 14: South America LA AMH and Storage Systems Market Revenue (billion), by End-User 2025 & 2033

- Figure 15: South America LA AMH and Storage Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: South America LA AMH and Storage Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America LA AMH and Storage Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe LA AMH and Storage Systems Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Europe LA AMH and Storage Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe LA AMH and Storage Systems Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 21: Europe LA AMH and Storage Systems Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 22: Europe LA AMH and Storage Systems Market Revenue (billion), by End-User 2025 & 2033

- Figure 23: Europe LA AMH and Storage Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Europe LA AMH and Storage Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe LA AMH and Storage Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa LA AMH and Storage Systems Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa LA AMH and Storage Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa LA AMH and Storage Systems Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 29: Middle East & Africa LA AMH and Storage Systems Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 30: Middle East & Africa LA AMH and Storage Systems Market Revenue (billion), by End-User 2025 & 2033

- Figure 31: Middle East & Africa LA AMH and Storage Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East & Africa LA AMH and Storage Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa LA AMH and Storage Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific LA AMH and Storage Systems Market Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Asia Pacific LA AMH and Storage Systems Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific LA AMH and Storage Systems Market Revenue (billion), by Equipment Type 2025 & 2033

- Figure 37: Asia Pacific LA AMH and Storage Systems Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 38: Asia Pacific LA AMH and Storage Systems Market Revenue (billion), by End-User 2025 & 2033

- Figure 39: Asia Pacific LA AMH and Storage Systems Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Asia Pacific LA AMH and Storage Systems Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific LA AMH and Storage Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 3: Global LA AMH and Storage Systems Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 7: Global LA AMH and Storage Systems Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 14: Global LA AMH and Storage Systems Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 21: Global LA AMH and Storage Systems Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 22: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 34: Global LA AMH and Storage Systems Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 35: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 43: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 44: Global LA AMH and Storage Systems Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 45: Global LA AMH and Storage Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific LA AMH and Storage Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LA AMH and Storage Systems Market?

The projected CAGR is approximately 9.7%.

2. Which companies are prominent players in the LA AMH and Storage Systems Market?

Key companies in the market include Jungheinrich AG, SSI SCHEFER AG, KION Group AG, Interroll Group, Daifuku Co Limited, Murata Machinery Limited, Kardex Group, JBT Corporation, Beumer Group GMBH & Co KG, System Logistics*List Not Exhaustive.

3. What are the main segments of the LA AMH and Storage Systems Market?

The market segments include Product Type, Equipment Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements Aiding Market Growth; Rapid Growth in E-commerce Leading to Warehouse Automation; Industry 4.0 Investments Driving the Demand for Automated Material Handling and Storage Systems.

6. What are the notable trends driving market growth?

Automated Guided Vehicle Expected to Witness Significant Market Share.

7. Are there any restraints impacting market growth?

Data Pricacy Concerns.

8. Can you provide examples of recent developments in the market?

June 2020 - La Costena, one of the prominent producers of canned food in Mexico, joined SSI SCHAEFER AG to break logistics standards and modify their current supply chain. The company aimed to develop a significant logistics solution that aims at increasing storage capacity, picking efficiency, and dispatch production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LA AMH and Storage Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LA AMH and Storage Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LA AMH and Storage Systems Market?

To stay informed about further developments, trends, and reports in the LA AMH and Storage Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence