Key Insights

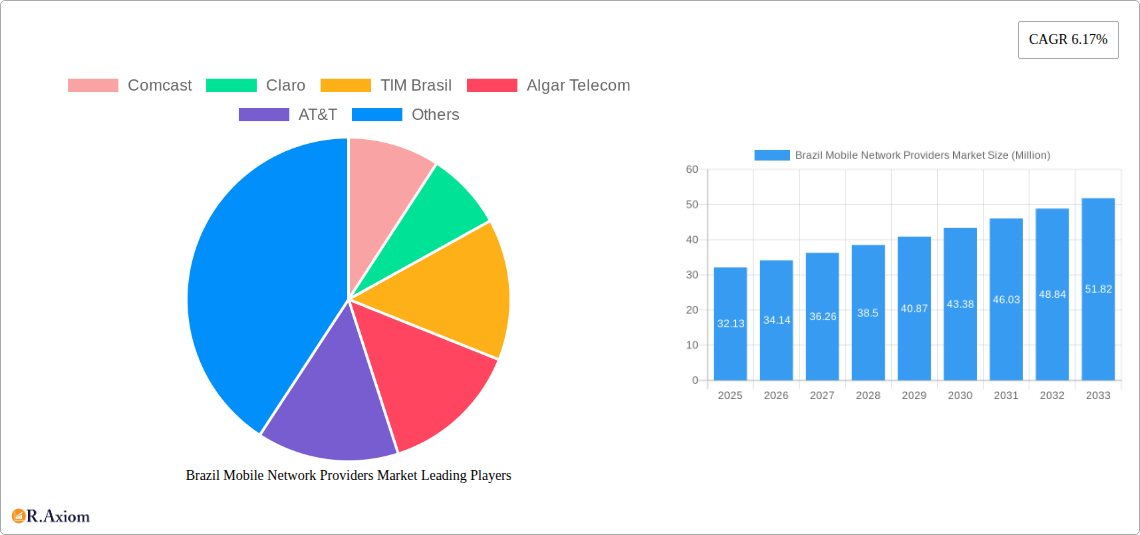

The Brazilian Mobile Network Providers market is poised for significant expansion, projected to reach \$32.13 million by 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 6.17% through 2033. This growth trajectory is propelled by several key drivers, primarily the escalating demand for data-intensive services and the increasing adoption of over-the-top (OTT) and pay-TV services, which are reshaping traditional consumption patterns. Businesses are also a crucial segment, leveraging advanced mobile solutions for enhanced operations and customer engagement. Furthermore, the continuous evolution of mobile technologies, including the ongoing rollout and enhancement of 5G networks, is creating new avenues for revenue and service innovation. The expanding smartphone penetration and a growing appetite for high-speed connectivity are foundational to this upward trend.

Brazil Mobile Network Providers Market Market Size (In Million)

However, the market is not without its challenges. Intense competition among established players like Comcast, Claro, TIM Brasil, AT&T, and Telefonica, alongside emerging disruptors, puts pressure on pricing and necessitates constant investment in network infrastructure and service differentiation. Regulatory hurdles and the high cost of spectrum acquisition and network upgrades can also act as restraints. Despite these challenges, the Brazilian market's inherent dynamism and a large, tech-savvy population present a fertile ground for sustained growth. The integration of voice, data, and increasingly sophisticated digital services will be critical for providers looking to capture market share and cater to the evolving needs of both consumers and businesses in this dynamic landscape.

Brazil Mobile Network Providers Market Company Market Share

Brazil Mobile Network Providers Market Report Description

This comprehensive market research report provides an in-depth analysis of the Brazil Mobile Network Providers Market, offering critical insights into market dynamics, growth trajectories, and competitive landscapes. Spanning the study period from 2019 to 2033, with a base year of 2025, estimated year of 2025, and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within Brazil's rapidly evolving telecommunications sector. The historical period covers 2019–2024.

This report delves into key segments including Voice Services, Data and, OTT and Pay-TV Services, and end-users such as Consumers and Businesses. It examines the influence of major industry developments and highlights the strategies of leading players like Claro, TIM Brasil, Oi, Telefonica, Embratel, Algar Telecom, and global giants such as AT&T, Comcast, BT, and Verizon. Furthermore, it scrutinizes the role of technology providers like Ericsson. With a focus on market concentration, innovation, industry trends, dominant markets, product developments, growth drivers, challenges, emerging opportunities, and strategic outlook, this report equips businesses with the intelligence needed to navigate this dynamic market.

Brazil Mobile Network Providers Market Market Concentration & Innovation

The Brazil Mobile Network Providers Market exhibits a moderately concentrated landscape, dominated by a few key players that hold significant market share. Claro, TIM Brasil, and Oi collectively control a substantial portion of the mobile subscriber base, driving competitive dynamics and influencing pricing strategies. Innovation within the market is primarily fueled by the relentless pursuit of enhanced network capabilities, including the expansion of 5G infrastructure, improvements in data speeds and reliability, and the integration of advanced technologies like AI and IoT. Regulatory frameworks, overseen by bodies such as ANATEL, play a crucial role in shaping market access, spectrum allocation, and consumer protection. While direct product substitutes for mobile network services are limited, the rise of Over-The-Top (OTT) services and alternative communication platforms presents an indirect competitive pressure. End-user trends are leaning towards increased data consumption, demand for seamless connectivity, and personalized service offerings. Merger and acquisition (M&A) activities, though not consistently high, can significantly alter market concentration. For instance, the acquisition of Oi's mobile assets by Claro, TIM Brasil, and Vivo in 2022 represented a substantial consolidation, reshaping market shares and competitive strategies. The value of such M&A deals is projected to fluctuate based on regulatory approvals and strategic imperatives of the involved entities, likely ranging from several hundred million to billions of US dollars when significant player consolidation occurs. The drive for network modernization and the increasing demand for high-speed data services are key innovation drivers, compelling providers to invest heavily in infrastructure upgrades and new service development to maintain their competitive edge and capture a larger market share, estimated to be in the hundreds of millions of US dollars annually in R&D investments by major players.

Brazil Mobile Network Providers Market Industry Trends & Insights

The Brazil Mobile Network Providers Market is currently experiencing a robust growth trajectory, propelled by several interconnected industry trends and insights. The increasing penetration of smartphones across all demographics, coupled with a growing reliance on mobile data for everyday activities, communication, and entertainment, is a primary growth driver. This has led to a significant surge in data consumption, pushing providers to continuously upgrade their network infrastructure to support higher bandwidth demands. The Compound Annual Growth Rate (CAGR) for the market is projected to be robust, estimated to be between 7% and 9% during the forecast period. This growth is further amplified by the ongoing rollout of 5G technology, which promises ultra-fast speeds, lower latency, and the enablement of new applications and services, including the Internet of Things (IoT), enhanced mobile broadband, and critical communications. This technological disruption is fundamentally altering consumer preferences, with a growing demand for seamless, high-quality mobile experiences.

Consumer preferences are shifting towards bundled service offerings that combine mobile voice and data with OTT and Pay-TV services, offering greater convenience and value. This trend necessitates a strategic focus on content partnerships and innovative service integration. Businesses are also increasingly leveraging mobile networks for their operations, demanding reliable and secure connectivity for remote work, cloud-based applications, and M2M communication. The expansion of mobile broadband into underserved rural areas is another significant trend, driven by government initiatives and the recognition of the economic and social benefits of digital inclusion. This expansion opens up new market penetration opportunities, estimated to increase by a notable percentage annually.

The competitive dynamics within the market are intense, with established players fiercely competing for subscriber acquisition and retention. This competition is driving innovation in pricing models, customer service, and the development of value-added services. Companies are investing heavily in network modernization and digital transformation to enhance operational efficiency and customer experience. The impact of global technological advancements, such as advancements in mobile chipset technology and cloud computing, further influences the market by enabling new service possibilities and driving down operational costs for providers. The overall market penetration of mobile services is already high but continues to grow with the adoption of advanced services and increased data usage, projected to exceed 95% in the coming years. The strategic focus on customer-centricity, driven by sophisticated data analytics, is also a defining trend, allowing providers to personalize offers and improve customer loyalty. The continuous need for investment in infrastructure, estimated in the billions of US dollars annually, underscores the capital-intensive nature of this industry and its importance to Brazil's digital economy.

Dominant Markets & Segments in Brazil Mobile Network Providers Market

The Brazil Mobile Network Providers Market is characterized by the dominance of certain segments driven by robust demand and favorable market conditions.

Services

- Data Services: This segment is the undisputed leader in terms of revenue generation and growth. The escalating usage of smartphones, the proliferation of data-intensive applications like social media, streaming services, and online gaming, and the increasing adoption of 4G and the ongoing rollout of 5G are the primary drivers. Brazilian consumers and businesses are heavily reliant on mobile data for communication, information access, and entertainment. The market share for data services is projected to consistently exceed 70% of the total service revenue, with a high annual growth rate driven by increasing average revenue per user (ARPU) and subscriber additions. The expansion of mobile broadband into rural areas further fuels this segment's dominance.

- Voice Services: While historically the cornerstone of mobile services, voice services are witnessing a gradual decline in their relative market share, though still holding significant importance. The increasing adoption of over-the-top (OTT) communication apps like WhatsApp, which offer free or low-cost voice and video calls over data, has shifted consumer preferences. However, the sheer volume of mobile connections ensures a steady, albeit slower-growing, revenue stream. Government initiatives to improve digital inclusion and connect remote populations contribute to maintaining a substantial user base for voice services, especially among older demographics and in regions with less robust data infrastructure. The market share for voice services is estimated to be around 15-20% and is expected to see a low single-digit decline in its proportion of total revenue.

- OTT and Pay-TV Services: This segment represents a significant growth opportunity and is increasingly integrated into the core offerings of mobile network providers. As consumers seek bundled entertainment and communication solutions, providers are partnering with or developing their own OTT platforms and offering integrated Pay-TV packages accessible via mobile networks. The convenience of accessing content on the go, coupled with competitive pricing, is driving adoption. The market share for this segment is steadily increasing, projected to reach 10-15% of the total market revenue by the end of the forecast period, with high growth potential as providers leverage their extensive subscriber bases to cross-sell these services. The development of exclusive content and seamless integration with mobile plans are key competitive advantages.

End-Users

- Consumers: The consumer segment forms the largest portion of the Brazil Mobile Network Providers Market. This is driven by the high mobile penetration rate among individuals, their extensive use of mobile devices for communication, social networking, entertainment, online transactions, and accessing information. Factors like disposable income, urbanization, and the affordability of mobile plans contribute to the dominance of this segment. The demand for data-heavy services, streaming, and gaming is particularly strong within the consumer base. Consumer spending constitutes over 80% of the total market revenue.

- Businesses: The business segment, while smaller in terms of the number of individual connections, represents a significant revenue driver due to the higher average revenue per user (ARPU) and the demand for specialized services. Businesses require reliable, secure, and high-bandwidth mobile connectivity for a range of applications, including remote work solutions, IoT deployments, fleet management, cloud services, and enterprise-grade communication platforms. The increasing adoption of digital transformation initiatives across Brazilian industries is further boosting demand for advanced mobile network solutions. Businesses account for approximately 15-20% of the market revenue, with a strong growth potential driven by digitalization and the need for enhanced operational efficiency. The provision of dedicated business plans, IoT connectivity, and robust cybersecurity features are key to capturing this segment.

Brazil Mobile Network Providers Market Product Developments

Product developments in the Brazil Mobile Network Providers Market are primarily focused on enhancing connectivity, expanding service offerings, and improving customer experience. The ongoing deployment and optimization of 5G networks are at the forefront, promising significantly faster speeds, lower latency, and the capacity to support a massive number of connected devices, thus enabling new applications like enhanced mobile broadband, mission-critical communications, and the Internet of Things. Providers are also innovating in the realm of bundled services, integrating mobile plans with streaming platforms (OTT and Pay-TV), cloud storage, and cybersecurity solutions to offer a more comprehensive and attractive value proposition. Furthermore, advancements in network management technologies, including AI-powered analytics and automation, are being implemented to improve network efficiency, predict and prevent service disruptions, and personalize customer interactions. The introduction of specialized enterprise solutions tailored to the needs of businesses, such as IoT connectivity platforms and secure private networks, is another key development, catering to the growing digitalization trends across various industries. These product developments aim to differentiate providers in a competitive market, drive customer acquisition and retention, and unlock new revenue streams beyond traditional voice and data services, leveraging technological trends like edge computing and network virtualization.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Brazil Mobile Network Providers Market, segmenting it across key dimensions to provide a granular understanding of market dynamics.

Services

The Services segment is further divided into three crucial sub-segments. Voice Services, though mature, continues to hold relevance, particularly in areas with limited data penetration. Growth here is modest, primarily driven by subscriber base maintenance and regulatory requirements. Data and, encompassing mobile broadband, 4G, and the burgeoning 5G services, represents the fastest-growing and most significant segment by revenue and projected market size. The increasing demand for high-speed internet, streaming, and digital services fuels its expansion, with substantial growth projections. OTT and Pay-TV Services, delivered over mobile networks, represent a rapidly expanding segment. As consumers seek integrated entertainment and communication solutions, providers are increasingly offering these services, leading to robust growth and increased market share.

End-Users

The market is also segmented by End-Users, primarily categorizing them into Consumers and Businesses. The Consumer segment, characterized by a vast subscriber base, is the largest contributor to market revenue. High mobile penetration, increasing disposable incomes, and a strong demand for data-intensive applications drive its growth. The Business segment, while smaller in terms of subscriber numbers, generates substantial revenue through demand for specialized, high-bandwidth, and secure mobile solutions, including IoT, enterprise mobility, and cloud connectivity, reflecting the ongoing digital transformation across industries.

Key Drivers of Brazil Mobile Network Providers Market Growth

The Brazil Mobile Network Providers Market is propelled by several significant growth drivers. The increasing smartphone penetration and adoption across all demographics is fundamental, fueling demand for mobile data services. The continuous expansion and upgrade of mobile network infrastructure, particularly the rollout of 5G technology, is a major catalyst, promising enhanced speeds, lower latency, and enabling new use cases. Government initiatives focused on digital inclusion and expanding connectivity to underserved areas also contribute significantly by broadening the subscriber base. Furthermore, the burgeoning demand for digital services, including streaming, e-commerce, and online education, directly translates into higher data consumption and revenue growth for mobile operators. The growing business adoption of mobile solutions for digital transformation, remote work, and IoT applications provides a crucial revenue stream and growth avenue for enterprise-focused services.

Challenges in the Brazil Mobile Network Providers Market Sector

Despite its growth potential, the Brazil Mobile Network Providers Market faces several challenges. High infrastructure investment costs, particularly for 5G deployment and rural expansion, represent a significant financial burden for operators. Intense market competition among established players and the threat of disruptive new entrants can lead to price wars and pressure on ARPU. Regulatory complexities and bureaucracy in obtaining permits and spectrum licenses can slow down deployment and innovation. Economic volatility and fluctuating currency exchange rates can impact investment decisions and the cost of imported equipment. Additionally, ensuring consistent service quality and coverage, especially in vast and diverse geographical regions, remains a technical and logistical challenge. Security concerns and the need for robust cybersecurity measures to protect user data and network integrity add another layer of complexity and cost.

Emerging Opportunities in Brazil Mobile Network Providers Market

The Brazil Mobile Network Providers Market is ripe with emerging opportunities. The continued expansion of 5G services beyond major urban centers presents a significant growth avenue, enabling new applications in areas like smart cities, autonomous vehicles, and advanced industrial automation. The growing demand for Internet of Things (IoT) solutions across various sectors, including agriculture, logistics, and healthcare, offers substantial revenue potential. The digital transformation of businesses is driving the need for specialized enterprise mobile solutions, cloud connectivity, and secure private networks. Furthermore, the increasing consumer adoption of over-the-top (OTT) entertainment and communication services provides opportunities for mobile operators to forge strategic partnerships and create bundled offerings. Initiatives aimed at bridging the digital divide and expanding mobile broadband to rural and remote areas represent both a social imperative and a significant untapped market.

Leading Players in the Brazil Mobile Network Providers Market Market

- Claro

- TIM Brasil

- Oi

- Telefonica

- Embratel

- Algar Telecom

- Comcast

- AT&T

- BT

- Verizon

- Ericsson

Key Developments in Brazil Mobile Network Providers Market Industry

- October 2022: Algar Telecom partnered with Infinera. This partnership aims to modernize and scale its subsea network infrastructure to increase spectrum capacity, reduce transportation costs to enhance network functionality, and expand market opportunities.

- October 2022: Verizon partnered with the legendary Martinsville Speedway in Ridgeway to provide enhanced Wi-Fi services. These Wi-Fi services claim to provide fast and reliable mobile connectivity services.

- July 2022: AT&T introduced its new security service for its fiber customers. These new security services are available via the smart home manager app. The new advanced privacy and protection feature includes VPN (a virtual private network), ID monitoring, and threat protection. AT&T is well-positioned to offer real-time insights on protecting networks and connected devices.

Strategic Outlook for Brazil Mobile Network Providers Market Market

The strategic outlook for the Brazil Mobile Network Providers Market is exceptionally positive, driven by the ongoing digital transformation and the critical role of robust mobile connectivity. Key growth catalysts include the accelerated deployment of 5G infrastructure, which will unlock a new era of applications and services, fostering innovation across industries and enhancing consumer experiences. The increasing demand for data-intensive services, fueled by streaming, gaming, and the proliferation of connected devices, will continue to drive revenue growth. Strategic focus on enterprise solutions, including IoT and private networks, will tap into the growing business digitalization trend. Furthermore, efforts to expand mobile broadband penetration into underserved regions will broaden the market base and promote economic development. Providers who can effectively leverage data analytics to personalize offerings, optimize network performance, and ensure seamless customer experiences will be best positioned to capture market share and achieve sustainable growth in this dynamic telecommunications landscape. The continuous investment in network modernization, coupled with strategic partnerships and service bundling, will be crucial for long-term success.

Brazil Mobile Network Providers Market Segmentation

-

1. Services

- 1.1. Voice Services

- 1.2. Data and

- 1.3. OTT and Pay-TV Services

-

2. End-Users

- 2.1. Consumers

- 2.2. Businesses

Brazil Mobile Network Providers Market Segmentation By Geography

- 1. Brazil

Brazil Mobile Network Providers Market Regional Market Share

Geographic Coverage of Brazil Mobile Network Providers Market

Brazil Mobile Network Providers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for 5G; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. The Emergence of Stiff Competition a Concern for the Industry

- 3.4. Market Trends

- 3.4.1. Deployment of 5G Network in Brazil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Mobile Network Providers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.2. Data and

- 5.1.3. OTT and Pay-TV Services

- 5.2. Market Analysis, Insights and Forecast - by End-Users

- 5.2.1. Consumers

- 5.2.2. Businesses

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Comcast

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Claro

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TIM Brasil

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Algar Telecom

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AT&T

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BT

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Telefonica

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Verizon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Embratel

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ericssion

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Comcast

List of Figures

- Figure 1: Brazil Mobile Network Providers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Mobile Network Providers Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Mobile Network Providers Market Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Brazil Mobile Network Providers Market Volume K Unit Forecast, by Services 2020 & 2033

- Table 3: Brazil Mobile Network Providers Market Revenue Million Forecast, by End-Users 2020 & 2033

- Table 4: Brazil Mobile Network Providers Market Volume K Unit Forecast, by End-Users 2020 & 2033

- Table 5: Brazil Mobile Network Providers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Brazil Mobile Network Providers Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Brazil Mobile Network Providers Market Revenue Million Forecast, by Services 2020 & 2033

- Table 8: Brazil Mobile Network Providers Market Volume K Unit Forecast, by Services 2020 & 2033

- Table 9: Brazil Mobile Network Providers Market Revenue Million Forecast, by End-Users 2020 & 2033

- Table 10: Brazil Mobile Network Providers Market Volume K Unit Forecast, by End-Users 2020 & 2033

- Table 11: Brazil Mobile Network Providers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Brazil Mobile Network Providers Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Mobile Network Providers Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the Brazil Mobile Network Providers Market?

Key companies in the market include Comcast, Claro, TIM Brasil, Algar Telecom, AT&T, BT, Oi, Telefonica, Verizon, Embratel, Ericssion.

3. What are the main segments of the Brazil Mobile Network Providers Market?

The market segments include Services, End-Users .

4. Can you provide details about the market size?

The market size is estimated to be USD 32.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for 5G; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Deployment of 5G Network in Brazil.

7. Are there any restraints impacting market growth?

The Emergence of Stiff Competition a Concern for the Industry.

8. Can you provide examples of recent developments in the market?

October 2022: Algar Telecom partnered with Infinera. This partnership aims to modernize and scale its subsea network infrastructure to increase spectrum capacity, reduce transportation costs to enhance network functionality, and expand market opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Mobile Network Providers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Mobile Network Providers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Mobile Network Providers Market?

To stay informed about further developments, trends, and reports in the Brazil Mobile Network Providers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence