Key Insights

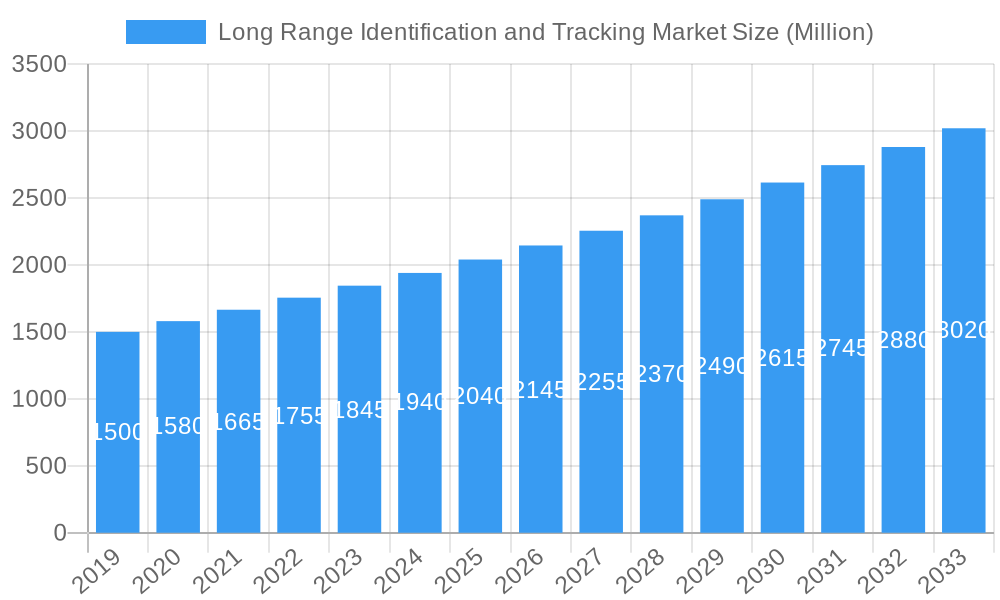

The global Long Range Identification and Tracking (LRIT) market is poised for significant expansion, projected to reach a substantial market size of approximately $2.2 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.40% anticipated to carry it through 2033. This sustained growth is primarily propelled by the increasing emphasis on maritime security, enhanced vessel efficiency, and stringent international regulations mandating real-time tracking of ships. The critical role of LRIT systems in facilitating safer navigation, effective search and rescue operations, and combating illegal activities such as piracy and smuggling underpins its market vitality. The growing adoption of sophisticated technologies like satellite communication and integrated data analytics within LRIT platforms further contributes to its upward trajectory.

Long Range Identification and Tracking Market Market Size (In Billion)

The market is strategically segmented across various platforms, with onshore-based platforms leading in adoption due to their established infrastructure and cost-effectiveness, while vessel-based platforms offer enhanced mobility and real-time data capture directly from ships. Key components driving this market include advanced communication services provided by Communication Service Providers, the development of innovative applications by Application Service Providers, and the crucial infrastructure offered by Data Center and Distribution Providers. End-users span across government and defense sectors, where LRIT is indispensable for national security and surveillance, and the commercial sector, benefiting from improved operational oversight and supply chain management. Emerging trends like the integration of AI and IoT for predictive maintenance and enhanced vessel performance, alongside the increasing demand for comprehensive maritime domain awareness, are expected to shape the future landscape of the LRIT market, driving further innovation and investment.

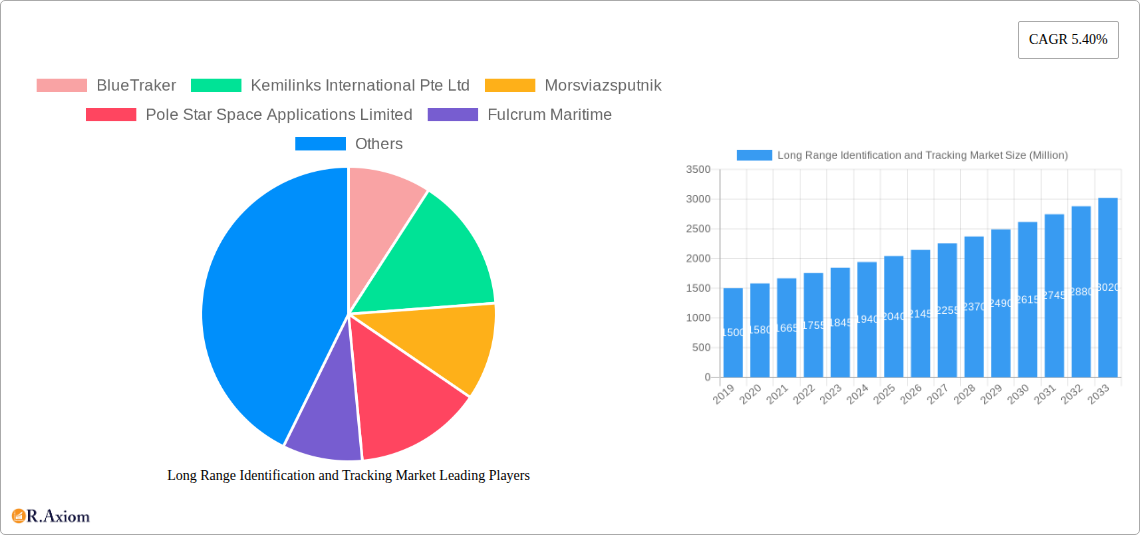

Long Range Identification and Tracking Market Company Market Share

Long Range Identification and Tracking Market Market Concentration & Innovation

The Long Range Identification and Tracking (LRIT) market, a critical component of global maritime security and safety, exhibits moderate concentration. Leading players like BlueTraker, Kemilinks International Pte Ltd, Morsviazsputnik, Pole Star Space Applications Limited, and Fulcrum Maritime collectively hold a significant market share. Innovation within the LRIT sector is primarily driven by the increasing demand for enhanced maritime surveillance, compliance with stringent international regulations such as the IMO's SOLAS convention, and the integration of advanced technologies like Artificial Intelligence (AI) and the Internet of Things (IoT). Regulatory frameworks, while providing a foundation for LRIT adoption, also present challenges for market expansion due to varying national implementations. Product substitutes, such as Automatic Identification System (AIS) for shorter ranges, are complementary rather than direct replacements for LRIT's long-range capabilities. End-user trends reveal a growing adoption by government and defense sectors for border security and maritime domain awareness, alongside increasing commercial interest from shipping companies for fleet management and operational efficiency. Mergers and Acquisitions (M&A) activities are expected to increase as companies seek to consolidate their offerings, expand their geographical reach, and acquire specialized technological expertise. The market size is projected to reach xx Million by 2033, with an estimated M&A deal value of xx Million in the forecast period.

Long Range Identification and Tracking Market Industry Trends & Insights

The global Long Range Identification and Tracking (LRIT) market is poised for significant expansion, driven by an escalating need for robust maritime security, enhanced search and rescue operations, and stricter adherence to international maritime regulations. The market size is anticipated to grow from approximately xx Million in 2019 to xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025-2033. Key growth drivers include the imperative for real-time vessel tracking for piracy prevention, illegal fishing enforcement, and effective disaster response. Technological advancements are at the forefront of shaping this industry, with the integration of satellite-based communication, AI-powered analytics for anomaly detection, and the development of more energy-efficient and reliable LRIT devices. Consumer preferences are shifting towards integrated maritime security solutions that offer not only tracking but also communication and data management capabilities. Competitive dynamics are characterized by a blend of established players and emerging technology providers, all vying for market share through product innovation, strategic partnerships, and competitive pricing. The increasing digitization of maritime operations and the growing emphasis on the Blue Economy are further propelling the adoption of LRIT systems. Market penetration is expected to deepen across both developed and developing maritime nations as awareness of LRIT's benefits grows and its affordability increases. The LRIT market penetration is estimated to reach xx% by 2033.

Dominant Markets & Segments in Long Range Identification and Tracking Market

The Long Range Identification and Tracking (LRIT) market demonstrates a clear dominance in the Government end-user segment, driven by national security imperatives, border surveillance requirements, and international maritime obligations. This segment accounts for an estimated xx% of the total market revenue, projected to reach xx Million by 2033. Key drivers for this dominance include:

- National Security and Border Protection: Governments worldwide utilize LRIT for monitoring maritime borders, detecting illegal activities such as smuggling and piracy, and maintaining maritime situational awareness.

- International Maritime Organization (IMO) Compliance: Adherence to SOLAS V/19 mandates the implementation of LRIT for vessels of a certain size, making it a critical compliance tool for national maritime authorities.

- Search and Rescue (SAR) Operations: LRIT data is indispensable for efficient and effective SAR operations, enabling authorities to quickly locate distressed vessels and coordinate rescue efforts.

Within the platform segmentation, the Onshore-based Platform segment is a major contributor, expected to reach xx Million by 2033. This dominance is attributed to:

- Centralized Monitoring and Control: Onshore facilities provide a robust infrastructure for receiving, processing, and analyzing LRIT data from numerous vessels, enabling centralized command and control.

- Integration with Existing Infrastructure: Governments and large maritime organizations can readily integrate onshore LRIT platforms with their existing communication networks and data management systems.

- Scalability and Cost-Effectiveness: Onshore solutions offer scalability to accommodate growing fleets and can be more cost-effective for large-scale monitoring operations compared to vessel-based solutions for all functions.

In terms of components, Communications Service Providers play a pivotal role, capturing an estimated xx% of the market share. Their dominance stems from:

- Satellite and Terrestrial Network Infrastructure: These providers offer the essential communication channels (satellite and terrestrial) required for transmitting LRIT data from vessels to shore-based receiving stations.

- Global Reach and Reliability: Established communications providers ensure reliable data transmission even in remote oceanic areas, a critical requirement for LRIT.

- Data Security and Integrity: They are responsible for the secure and uninterrupted flow of sensitive maritime data.

The Defense sector also represents a significant and growing segment, with an estimated market share of xx% and projected revenue of xx Million by 2033. This growth is fueled by:

- Naval Surveillance and Intelligence: LRIT is crucial for naval operations, providing intelligence on vessel movements, identifying potential threats, and enhancing maritime domain awareness.

- Fleet Management and Operational Efficiency: Defense forces use LRIT to track their own assets, optimize deployment, and ensure operational readiness.

Long Range Identification and Tracking Market Product Developments

Product development in the Long Range Identification and Tracking (LRIT) market is focused on enhancing the accuracy, reliability, and data processing capabilities of LRIT systems. Innovations include the integration of advanced satellite communication technologies for seamless data transmission, the development of more energy-efficient hardware to reduce operational costs for vessels, and the incorporation of AI and machine learning algorithms for predictive analysis and anomaly detection. These advancements enable better monitoring of vessel movements, early identification of potential threats, and improved efficiency in maritime operations. Companies are also focusing on creating integrated solutions that combine LRIT with other maritime technologies, offering a comprehensive suite of services to end-users and providing a significant competitive advantage.

Report Scope & Segmentation Analysis

The Long Range Identification and Tracking (LRIT) market report encompasses a comprehensive analysis of various segments, providing in-depth insights into market dynamics and growth projections.

Platform Segmentation: The market is segmented into Onshore-based Platform and Vessel-based Platform. The Onshore-based Platform segment is expected to dominate due to its centralized monitoring capabilities and scalability, projected to reach xx Million by 2033. The Vessel-based Platform segment, while smaller, is crucial for real-time data transmission directly from the vessel.

Components Segmentation: This segmentation includes Communications Service Providers, Application Service Providers, Data Center and Distribution Providers, and Others. Communications Service Providers are the largest segment, driven by the need for reliable global connectivity. Application Service Providers are crucial for developing the software and analytics that leverage LRIT data.

End-users Segmentation: The primary end-users are Government, Defense, and Commercial. The Government and Defense sectors are expected to exhibit robust growth due to national security and maritime surveillance needs, with the Government segment projected to reach xx Million by 2033. The Commercial sector is also seeing increased adoption for fleet management and operational efficiency.

Key Drivers of Long Range Identification and Tracking Market Growth

The growth of the Long Range Identification and Tracking (LRIT) market is propelled by a confluence of critical factors:

- Enhanced Maritime Security Imperatives: Increasing global maritime threats, including piracy, illegal fishing, and terrorism, necessitate robust vessel tracking systems like LRIT for national security and international safety.

- Stringent Regulatory Compliance: Adherence to the International Maritime Organization's (IMO) Safety of Life at Sea (SOLAS) convention, which mandates LRIT for specific vessel types, drives widespread adoption.

- Advancements in Satellite Technology: Improvements in satellite communication ensure reliable and widespread coverage, enabling real-time tracking of vessels even in remote oceanic areas.

- Growing Demand for Maritime Domain Awareness (MDA): Governments and maritime organizations are increasingly investing in MDA solutions to gain comprehensive visibility of maritime activities for better decision-making.

- Technological Integration: The convergence of LRIT with other technologies like AI, IoT, and big data analytics is creating more sophisticated and valuable maritime intelligence.

Challenges in the Long Range Identification and Tracking Market Sector

Despite its growth trajectory, the Long Range Identification and Tracking (LRIT) market faces several challenges:

- Varying National Implementations and Regulations: Discrepancies in how different countries implement and enforce LRIT regulations can create complexities for global shipping operations and service providers.

- Cost of Implementation and Maintenance: While becoming more accessible, the initial investment and ongoing maintenance costs of LRIT systems can still be a barrier for some smaller maritime operators.

- Data Security and Privacy Concerns: The sensitive nature of tracking data raises concerns about cybersecurity and the potential for unauthorized access or misuse.

- Interoperability Issues: Ensuring seamless interoperability between different LRIT systems, communication networks, and shore-based receiving stations remains a technical challenge.

- Technological Obsolescence: The rapid pace of technological advancement requires continuous investment in upgrades and new solutions to stay competitive.

Emerging Opportunities in Long Range Identification and Tracking Market

The Long Range Identification and Tracking (LRIT) market is ripe with emerging opportunities driven by evolving maritime needs and technological innovation:

- Integration with Unmanned Systems: The synergy between LRIT and Unmanned Aerial Vehicles (UAVs) and Unmanned Surface Vehicles (USVs) offers enhanced surveillance, search and rescue capabilities, and environmental monitoring.

- Advanced Data Analytics and AI: Leveraging AI and machine learning for predictive analytics of vessel behavior, route optimization, and early threat detection presents significant value.

- Expansion into Emerging Maritime Economies: Growing maritime trade and increased focus on maritime security in developing regions present substantial untapped market potential.

- IoT Integration for Smart Shipping: Connecting LRIT with other IoT devices on vessels for comprehensive asset monitoring, supply chain visibility, and operational efficiency.

- Environmental Monitoring Applications: Expanding the use of LRIT data for monitoring and combating marine pollution, tracking illegal waste dumping, and verifying emissions data.

Leading Players in the Long Range Identification and Tracking Market Market

- BlueTraker

- Kemilinks International Pte Ltd

- Morsviazsputnik

- Pole Star Space Applications Limited

- Fulcrum Maritime

- Fupe Systems A

- Arskom Group

- Modootel Ltd

- China Transportation Telecommunication Center

Key Developments in Long Range Identification and Tracking Market Industry

- December 2021: Swiss Drones and CLS combined the power of satellite data with the agility of unmanned aerial vehicle drones, demonstrating how drones can play an essential role in critical maritime operations such as search and rescue, fishery management, pollution, and vessel emission monitoring. The demonstration took place in the open ocean using the SwissDrones SDO 50V TOL unmanned helicopter system aboard the ship Argonaute off the coast of Bourbon. This development highlights the growing integration of drone technology with satellite-based maritime monitoring systems.

- September 2021: A Memorandum of Understanding (MoU) on regional safety, security, and marine environmental protection was signed between the Government of Maldives and the Government of India. Under the agreement, the Maldives gained free access to India's MRIT service, National Disaster Medical Center (NDC), and LRIT Conformity Testing Facility, enabling the Maldives to fulfill its obligations as a member of the International Maritime Organization (IMO) without establishing its disaster center. The Maldives will also receive India's support in human resources development. This signifies strengthened regional cooperation and resource sharing in maritime safety and security.

Strategic Outlook for Long Range Identification and Tracking Market Market

The strategic outlook for the Long Range Identification and Tracking (LRIT) market is highly promising, driven by an escalating global demand for maritime security, efficiency, and regulatory compliance. Future growth catalysts include the increasing adoption of integrated maritime solutions that combine LRIT with advanced analytics and AI for enhanced situational awareness and threat detection. The growing emphasis on sustainable shipping and environmental monitoring will also unlock new opportunities for LRIT applications. Furthermore, strategic partnerships and collaborations between technology providers, satellite operators, and end-users will be crucial for developing innovative solutions and expanding market reach, particularly in emerging maritime economies. The continuous evolution of satellite technology and communication networks will further underpin the market's expansion, ensuring reliable and comprehensive vessel tracking capabilities worldwide.

Long Range Identification and Tracking Market Segmentation

-

1. Platform

- 1.1. Onshore-based Platform

- 1.2. Vessel-based Platform

-

2. Components

- 2.1. Communications Service Providers

- 2.2. Application Service Providers

- 2.3. Data Center and Distribution Providers

- 2.4. Others

-

3. End-users

- 3.1. Government

- 3.2. Defense

- 3.3. Commercial

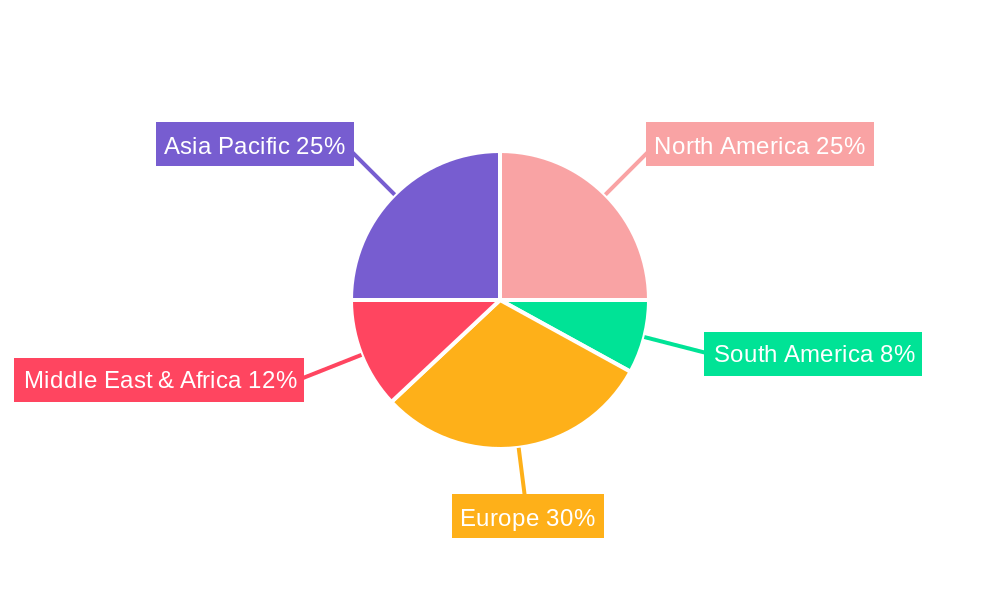

Long Range Identification and Tracking Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Long Range Identification and Tracking Market Regional Market Share

Geographic Coverage of Long Range Identification and Tracking Market

Long Range Identification and Tracking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. A Shift from Full-case or Pallet Picking to Piece Flow and Improved Technology Investments; Increasing Investments in Automation

- 3.3. Market Restrains

- 3.3.1. Lack of Expertise to Maintain the Deployed System is Discouraging the Market Growth

- 3.4. Market Trends

- 3.4.1. Defense to drive the market demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Long Range Identification and Tracking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Onshore-based Platform

- 5.1.2. Vessel-based Platform

- 5.2. Market Analysis, Insights and Forecast - by Components

- 5.2.1. Communications Service Providers

- 5.2.2. Application Service Providers

- 5.2.3. Data Center and Distribution Providers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-users

- 5.3.1. Government

- 5.3.2. Defense

- 5.3.3. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Long Range Identification and Tracking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Onshore-based Platform

- 6.1.2. Vessel-based Platform

- 6.2. Market Analysis, Insights and Forecast - by Components

- 6.2.1. Communications Service Providers

- 6.2.2. Application Service Providers

- 6.2.3. Data Center and Distribution Providers

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by End-users

- 6.3.1. Government

- 6.3.2. Defense

- 6.3.3. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. South America Long Range Identification and Tracking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Onshore-based Platform

- 7.1.2. Vessel-based Platform

- 7.2. Market Analysis, Insights and Forecast - by Components

- 7.2.1. Communications Service Providers

- 7.2.2. Application Service Providers

- 7.2.3. Data Center and Distribution Providers

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by End-users

- 7.3.1. Government

- 7.3.2. Defense

- 7.3.3. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Europe Long Range Identification and Tracking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Onshore-based Platform

- 8.1.2. Vessel-based Platform

- 8.2. Market Analysis, Insights and Forecast - by Components

- 8.2.1. Communications Service Providers

- 8.2.2. Application Service Providers

- 8.2.3. Data Center and Distribution Providers

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by End-users

- 8.3.1. Government

- 8.3.2. Defense

- 8.3.3. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Middle East & Africa Long Range Identification and Tracking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Onshore-based Platform

- 9.1.2. Vessel-based Platform

- 9.2. Market Analysis, Insights and Forecast - by Components

- 9.2.1. Communications Service Providers

- 9.2.2. Application Service Providers

- 9.2.3. Data Center and Distribution Providers

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by End-users

- 9.3.1. Government

- 9.3.2. Defense

- 9.3.3. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Asia Pacific Long Range Identification and Tracking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Onshore-based Platform

- 10.1.2. Vessel-based Platform

- 10.2. Market Analysis, Insights and Forecast - by Components

- 10.2.1. Communications Service Providers

- 10.2.2. Application Service Providers

- 10.2.3. Data Center and Distribution Providers

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by End-users

- 10.3.1. Government

- 10.3.2. Defense

- 10.3.3. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BlueTraker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kemilinks International Pte Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Morsviazsputnik

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pole Star Space Applications Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fulcrum Maritime

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fupe Systems A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arskom Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Modootel Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 China Transportation Telecommunication Center

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 BlueTraker

List of Figures

- Figure 1: Global Long Range Identification and Tracking Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Long Range Identification and Tracking Market Revenue (undefined), by Platform 2025 & 2033

- Figure 3: North America Long Range Identification and Tracking Market Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Long Range Identification and Tracking Market Revenue (undefined), by Components 2025 & 2033

- Figure 5: North America Long Range Identification and Tracking Market Revenue Share (%), by Components 2025 & 2033

- Figure 6: North America Long Range Identification and Tracking Market Revenue (undefined), by End-users 2025 & 2033

- Figure 7: North America Long Range Identification and Tracking Market Revenue Share (%), by End-users 2025 & 2033

- Figure 8: North America Long Range Identification and Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Long Range Identification and Tracking Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Long Range Identification and Tracking Market Revenue (undefined), by Platform 2025 & 2033

- Figure 11: South America Long Range Identification and Tracking Market Revenue Share (%), by Platform 2025 & 2033

- Figure 12: South America Long Range Identification and Tracking Market Revenue (undefined), by Components 2025 & 2033

- Figure 13: South America Long Range Identification and Tracking Market Revenue Share (%), by Components 2025 & 2033

- Figure 14: South America Long Range Identification and Tracking Market Revenue (undefined), by End-users 2025 & 2033

- Figure 15: South America Long Range Identification and Tracking Market Revenue Share (%), by End-users 2025 & 2033

- Figure 16: South America Long Range Identification and Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Long Range Identification and Tracking Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Long Range Identification and Tracking Market Revenue (undefined), by Platform 2025 & 2033

- Figure 19: Europe Long Range Identification and Tracking Market Revenue Share (%), by Platform 2025 & 2033

- Figure 20: Europe Long Range Identification and Tracking Market Revenue (undefined), by Components 2025 & 2033

- Figure 21: Europe Long Range Identification and Tracking Market Revenue Share (%), by Components 2025 & 2033

- Figure 22: Europe Long Range Identification and Tracking Market Revenue (undefined), by End-users 2025 & 2033

- Figure 23: Europe Long Range Identification and Tracking Market Revenue Share (%), by End-users 2025 & 2033

- Figure 24: Europe Long Range Identification and Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Long Range Identification and Tracking Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Long Range Identification and Tracking Market Revenue (undefined), by Platform 2025 & 2033

- Figure 27: Middle East & Africa Long Range Identification and Tracking Market Revenue Share (%), by Platform 2025 & 2033

- Figure 28: Middle East & Africa Long Range Identification and Tracking Market Revenue (undefined), by Components 2025 & 2033

- Figure 29: Middle East & Africa Long Range Identification and Tracking Market Revenue Share (%), by Components 2025 & 2033

- Figure 30: Middle East & Africa Long Range Identification and Tracking Market Revenue (undefined), by End-users 2025 & 2033

- Figure 31: Middle East & Africa Long Range Identification and Tracking Market Revenue Share (%), by End-users 2025 & 2033

- Figure 32: Middle East & Africa Long Range Identification and Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Long Range Identification and Tracking Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Long Range Identification and Tracking Market Revenue (undefined), by Platform 2025 & 2033

- Figure 35: Asia Pacific Long Range Identification and Tracking Market Revenue Share (%), by Platform 2025 & 2033

- Figure 36: Asia Pacific Long Range Identification and Tracking Market Revenue (undefined), by Components 2025 & 2033

- Figure 37: Asia Pacific Long Range Identification and Tracking Market Revenue Share (%), by Components 2025 & 2033

- Figure 38: Asia Pacific Long Range Identification and Tracking Market Revenue (undefined), by End-users 2025 & 2033

- Figure 39: Asia Pacific Long Range Identification and Tracking Market Revenue Share (%), by End-users 2025 & 2033

- Figure 40: Asia Pacific Long Range Identification and Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Long Range Identification and Tracking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 2: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Components 2020 & 2033

- Table 3: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by End-users 2020 & 2033

- Table 4: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 6: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Components 2020 & 2033

- Table 7: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by End-users 2020 & 2033

- Table 8: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 13: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Components 2020 & 2033

- Table 14: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by End-users 2020 & 2033

- Table 15: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 20: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Components 2020 & 2033

- Table 21: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by End-users 2020 & 2033

- Table 22: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 33: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Components 2020 & 2033

- Table 34: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by End-users 2020 & 2033

- Table 35: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 43: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Components 2020 & 2033

- Table 44: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by End-users 2020 & 2033

- Table 45: Global Long Range Identification and Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Long Range Identification and Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Long Range Identification and Tracking Market?

The projected CAGR is approximately 11.4%.

2. Which companies are prominent players in the Long Range Identification and Tracking Market?

Key companies in the market include BlueTraker, Kemilinks International Pte Ltd, Morsviazsputnik, Pole Star Space Applications Limited, Fulcrum Maritime, Fupe Systems A, Arskom Group, Modootel Ltd, China Transportation Telecommunication Center.

3. What are the main segments of the Long Range Identification and Tracking Market?

The market segments include Platform, Components, End-users.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

A Shift from Full-case or Pallet Picking to Piece Flow and Improved Technology Investments; Increasing Investments in Automation.

6. What are the notable trends driving market growth?

Defense to drive the market demand.

7. Are there any restraints impacting market growth?

Lack of Expertise to Maintain the Deployed System is Discouraging the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2021 - Swiss Drones and CLS combine the power of satellite data with the agility of unmanned aerial vehicle drones. The two companies have recently demonstrated how drones can play an essential role in critical maritime operations such as search and rescue, fishery management, pollution, and vessel emission monitoring. The demonstration took place in the open ocean using the SwissDrones SDO 50V TOL unmanned helicopter system aboard the ship Argonaute off the coast of Bourbon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Long Range Identification and Tracking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Long Range Identification and Tracking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Long Range Identification and Tracking Market?

To stay informed about further developments, trends, and reports in the Long Range Identification and Tracking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence