Key Insights

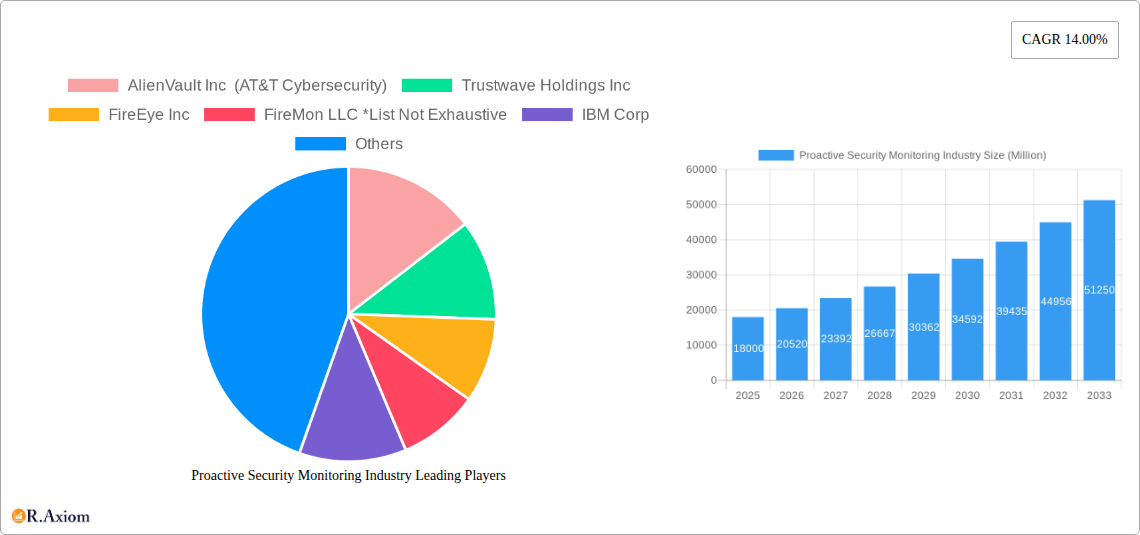

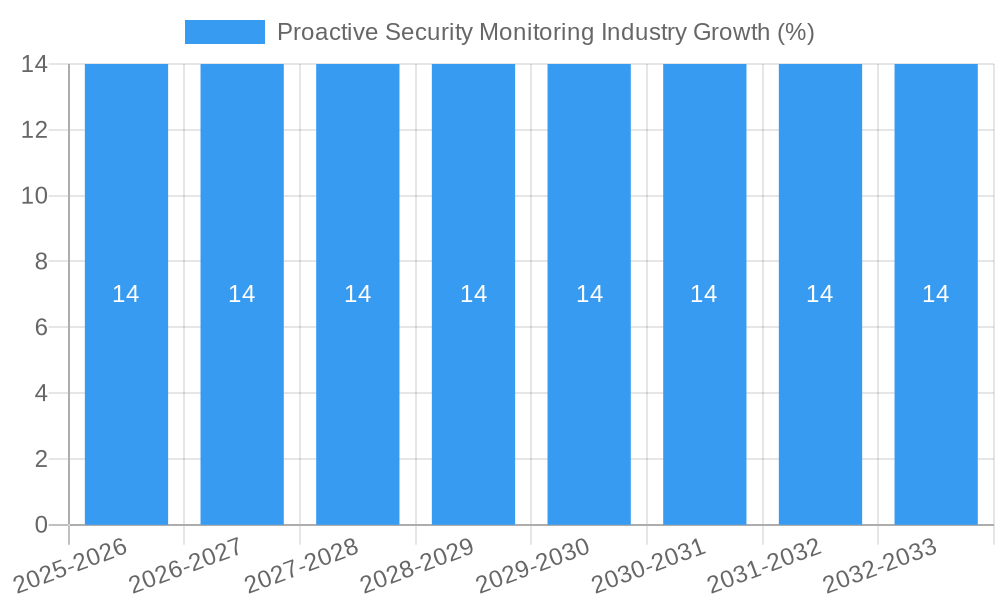

The Proactive Security Monitoring market is poised for substantial growth, projected to reach an estimated market size of approximately $18,000 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 14.00%. This expansion is fueled by an escalating cyber threat landscape, necessitating organizations to move beyond reactive defenses towards sophisticated, forward-looking strategies. Key drivers include the increasing sophistication and frequency of cyberattacks, stringent regulatory compliance mandates across various industries, and the growing adoption of advanced technologies like AI and machine learning for threat detection and response. The "drivers XXX" mentioned in the initial data likely encompass these crucial factors, with a particular emphasis on the need for continuous threat hunting, real-time anomaly detection, and predictive analytics to safeguard critical digital assets.

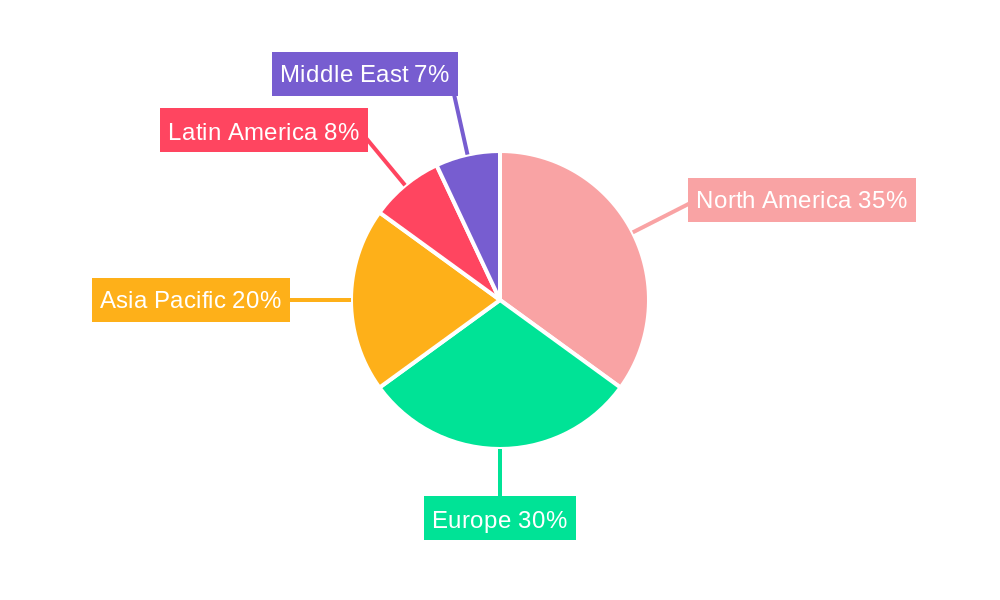

The market is segmented across organization sizes, with large enterprises and small and medium enterprises (SMEs) both representing significant adoption bases, though SMEs are increasingly prioritizing scalable proactive solutions due to budget constraints and evolving threat vectors. The "segments: Solution" highlights the importance of Advanced Malware Protection (AMP), Security Monitoring and Analytics, and Vulnerability Assessment as core components of proactive security. The expanding digital footprint across sectors like IT & Telecommunication, BFSI, Retail, and Government & Defence further bolsters this growth. While "restrains XXX" might indicate challenges such as a shortage of skilled cybersecurity professionals or the complexity of integrating new solutions with legacy systems, the overwhelming demand for robust and continuous security posture management is expected to outweigh these impediments. The global nature of cyber threats ensures significant market presence across all major regions, with North America and Europe currently leading adoption, followed by the rapidly growing Asia Pacific region.

This comprehensive report offers an in-depth analysis of the Proactive Security Monitoring Industry, providing critical insights for stakeholders navigating this dynamic and rapidly evolving market. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report leverages historical data from 2019–2024 to project future market trajectories. We delve into market concentration, innovation drivers, regulatory frameworks, and competitive landscapes, offering actionable intelligence for businesses and investors.

Proactive Security Monitoring Industry Market Concentration & Innovation

The Proactive Security Monitoring Industry exhibits a moderate to high concentration, driven by the significant investment required for advanced technology development and the consolidation of key players. Leading companies such as AlienVault Inc (AT&T Cybersecurity), Trustwave Holdings Inc, FireEye Inc, IBM Corp, Oracle Corp, and Qualys Inc command substantial market share, estimated to be in the range of 200-300 Million collectively. Innovation is a primary catalyst, fueled by the relentless advancement of cyber threats and the growing sophistication of security solutions. The development of AI-driven threat detection, automated response mechanisms, and cloud-native security platforms are key areas of innovation. Regulatory frameworks, including GDPR, CCPA, and industry-specific compliance mandates, are increasingly shaping market strategies, pushing organizations towards robust proactive monitoring. Product substitutes, such as in-house security teams and point solutions, exist but are often outpaced by the comprehensive and integrated nature of proactive security monitoring services. End-user trends point towards a growing demand for continuous monitoring, threat intelligence integration, and managed security services. Mergers and Acquisitions (M&A) activities remain robust, with deal values potentially reaching 50-100 Million annually, as larger entities seek to acquire innovative technologies and expand their market reach.

Proactive Security Monitoring Industry Industry Trends & Insights

The Proactive Security Monitoring Industry is poised for substantial growth, driven by an escalating cyber threat landscape and the increasing adoption of digital technologies across all sectors. The Compound Annual Growth Rate (CAGR) is projected to be between 15-20% during the forecast period. Market penetration for advanced proactive security solutions is rapidly increasing, especially within critical infrastructure and sensitive data environments. Key growth drivers include the proliferation of remote workforces, the expanding attack surface due to IoT adoption, and the increasing financial and reputational damage associated with data breaches, which are estimated to cost organizations an average of 20-30 Million per incident. Technological disruptions are at the forefront, with Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing threat detection and response. AI-powered analytics can process vast amounts of data in real-time, identifying anomalous behaviors and predicting potential attacks with unprecedented accuracy. Automation is another significant trend, enabling faster incident response and reducing the burden on security teams. Consumer preferences are shifting towards integrated security platforms that offer end-to-end visibility and control, rather than fragmented point solutions. This is driving demand for Security Information and Event Management (SIEM), Security Orchestration, Automation, and Response (SOAR), and Extended Detection and Response (XDR) solutions. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a race to capture market share through superior threat intelligence and agile response capabilities. The proactive security monitoring market size is projected to reach 800-1 Billion by the end of 2033.

Dominant Markets & Segments in Proactive Security Monitoring Industry

The IT & Telecommunication sector, alongside the BFSI (Banking, Financial Services, and Insurance) industry, currently dominates the Proactive Security Monitoring Industry. This dominance is attributed to the high volume of sensitive data they handle, the critical nature of their operations, and the stringent regulatory compliance requirements they face. Within the Large Enterprise segment, significant investments in comprehensive security solutions are driven by the vast attack surface and the potentially catastrophic consequences of security breaches, with an estimated spending of 300-400 Million. The Government & Defence sector also represents a substantial market, driven by national security concerns and the need to protect critical infrastructure, with government cybersecurity budgets often exceeding 200-300 Million.

Key Drivers of Dominance:

- Economic Policies: Government initiatives promoting cybersecurity adoption and digital transformation, especially in BFSI and IT, are crucial.

- Infrastructure: The extensive digital infrastructure within these sectors necessitates robust and continuous security monitoring.

- Regulatory Compliance: Strict data protection laws (e.g., PCI DSS, SOX) mandate proactive security measures.

- Threat Landscape: These sectors are consistently targeted by sophisticated cybercriminals, driving the need for advanced defense.

In terms of solutions, Security Monitoring and Analytics forms the largest segment, projected to reach 400-500 Million in market size. This is due to its foundational role in detecting, analyzing, and responding to threats in real-time. Advanced Malware Protection (AMP) and Vulnerability Assessment are also critical components, often integrated into broader proactive monitoring strategies. The Small and Medium Enterprise (SME) segment, while historically lagging, is now showing accelerated growth, driven by the increasing affordability of cloud-based solutions and the growing awareness of cyber risks, with an estimated market size of 150-200 Million.

Proactive Security Monitoring Industry Product Developments

Product innovations in the Proactive Security Monitoring Industry are rapidly advancing, focusing on enhanced threat detection, automated incident response, and improved visibility across complex IT environments. Key developments include the integration of AI and Machine Learning for predictive threat analytics, enabling proactive identification of zero-day exploits and sophisticated persistent threats. Extended Detection and Response (XDR) platforms are gaining traction, consolidating data from multiple security layers (endpoints, networks, cloud) to provide a unified view and streamline investigations. The development of behavioral analytics, User and Entity Behavior Analytics (UEBA), and threat intelligence platforms that can be seamlessly integrated with existing security infrastructure are crucial for providing a competitive advantage. These advancements aim to reduce mean time to detect (MTTD) and mean time to respond (MTTR) by significant margins, thereby bolstering overall organizational resilience.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Proactive Security Monitoring Industry segmented across several key dimensions. The Size of the Organization segment is divided into Large Enterprise and Small and Medium Enterprise, with Large Enterprises currently holding a larger market share but SMEs exhibiting higher growth potential. The Solution segment encompasses Advanced Malware Protection (AMP), Security Monitoring and Analytics, Vulnerability Assessment, and Other Solutions, with Security Monitoring and Analytics being the most dominant. The End-user Industry segmentation includes IT & Telecommunication, BFSI, Retail, Industrial, Government & Defence, and Other End-user Industries, with IT & Telecommunication and BFSI leading in adoption. Growth projections for each segment are detailed, with specific market sizes estimated for each category, reflecting the diverse adoption rates and investment capacities across different organizational types and sectors. Competitive dynamics are analyzed within each segment, highlighting key players and their market positioning.

Key Drivers of Proactive Security Monitoring Industry Growth

The Proactive Security Monitoring Industry's growth is primarily propelled by a confluence of technological advancements, escalating cybersecurity threats, and evolving regulatory landscapes. The increasing sophistication and frequency of cyberattacks, including ransomware, phishing, and advanced persistent threats (APTs), necessitate continuous and proactive defense mechanisms, driving demand for comprehensive monitoring solutions. The widespread adoption of cloud computing, IoT devices, and remote work models has significantly expanded the attack surface, creating a critical need for real-time visibility and threat detection across distributed environments. Furthermore, stringent data privacy regulations globally, such as GDPR and CCPA, compel organizations to invest in robust security monitoring to ensure compliance and avoid hefty penalties, estimated to be in the range of 1-10 Million per violation. The development and integration of Artificial Intelligence (AI) and Machine Learning (ML) in security analytics are also key drivers, enabling more effective threat identification and faster response times.

Challenges in the Proactive Security Monitoring Industry Sector

Despite robust growth, the Proactive Security Monitoring Industry faces several significant challenges. The shortage of skilled cybersecurity professionals is a persistent restraint, making it difficult for organizations to effectively deploy, manage, and interpret data from advanced monitoring solutions. The ever-evolving nature of cyber threats requires continuous updates and adaptation of monitoring tools, leading to ongoing investment requirements. Integration complexities with existing IT infrastructure and legacy systems can hinder seamless deployment and operational efficiency, potentially costing organizations 0.5-1 Million in implementation and customization. Budgetary constraints, particularly for Small and Medium Enterprises, can limit their ability to invest in comprehensive proactive security solutions, even though the cost of a breach can be exponentially higher. Furthermore, regulatory fragmentation across different regions can create compliance challenges for global organizations.

Emerging Opportunities in Proactive Security Monitoring Industry

The Proactive Security Monitoring Industry is brimming with emerging opportunities, driven by new technological frontiers and evolving market demands. The growth of Extended Detection and Response (XDR) solutions presents a significant opportunity for vendors to offer integrated platforms that unify security data across endpoints, networks, cloud, and email, promising enhanced threat visibility and streamlined investigations. The increasing adoption of AI and Machine Learning in security analytics opens avenues for developing more predictive and automated threat detection systems, reducing the reliance on manual analysis. The burgeoning IoT security market requires specialized proactive monitoring solutions to safeguard connected devices, representing a substantial untapped market. Furthermore, the demand for managed security services (MSSPs) continues to rise, offering opportunities for providers to deliver specialized proactive monitoring expertise to organizations lacking in-house capabilities. The expansion into emerging economies with growing digital footprints also presents significant growth potential, with initial market penetration potentially reaching 50-100 Million.

Leading Players in the Proactive Security Monitoring Industry Market

- AlienVault Inc (AT&T Cybersecurity)

- Trustwave Holdings Inc

- FireEye Inc

- FireMon LLC

- IBM Corp

- Cygilant Inc

- Rapid7 Inc

- ThreatConnect Inc

- RSA Security LLC (Dell Technologies)

- Oracle Corp

- Qualys Inc

Key Developments in Proactive Security Monitoring Industry Industry

- 2023 October: Launch of AI-powered predictive threat intelligence platform by a leading vendor, significantly reducing false positives and improving threat detection accuracy.

- 2023 August: A major acquisition in the XDR space, consolidating market offerings and signaling increased competition for integrated security solutions.

- 2023 June: Release of enhanced cloud security monitoring capabilities, addressing the growing need for unified visibility across multi-cloud environments.

- 2023 March: Introduction of behavioral analytics tools that integrate with SIEM platforms, enabling more sophisticated anomaly detection.

- 2022 December: Strategic partnership formed to offer specialized proactive monitoring for Industrial Control Systems (ICS), addressing critical infrastructure security needs.

- 2022 October: Significant investment in R&D for quantum-resistant security solutions, anticipating future cryptographic threats.

- 2022 July: Expansion of managed detection and response (MDR) services by several key players to cater to the growing demand for outsourced security expertise.

Strategic Outlook for Proactive Security Monitoring Industry Market

- 2023 October: Launch of AI-powered predictive threat intelligence platform by a leading vendor, significantly reducing false positives and improving threat detection accuracy.

- 2023 August: A major acquisition in the XDR space, consolidating market offerings and signaling increased competition for integrated security solutions.

- 2023 June: Release of enhanced cloud security monitoring capabilities, addressing the growing need for unified visibility across multi-cloud environments.

- 2023 March: Introduction of behavioral analytics tools that integrate with SIEM platforms, enabling more sophisticated anomaly detection.

- 2022 December: Strategic partnership formed to offer specialized proactive monitoring for Industrial Control Systems (ICS), addressing critical infrastructure security needs.

- 2022 October: Significant investment in R&D for quantum-resistant security solutions, anticipating future cryptographic threats.

- 2022 July: Expansion of managed detection and response (MDR) services by several key players to cater to the growing demand for outsourced security expertise.

Strategic Outlook for Proactive Security Monitoring Industry Market

The strategic outlook for the Proactive Security Monitoring Industry is overwhelmingly positive, characterized by sustained growth and continuous innovation. The market will be shaped by the increasing demand for integrated, AI-driven, and automated security solutions that can effectively combat sophisticated cyber threats. Organizations will increasingly prioritize proactive measures over reactive responses, driving investments in advanced threat intelligence, continuous monitoring, and rapid incident response capabilities. Strategic partnerships and consolidations will continue to reshape the competitive landscape, with companies focusing on expanding their portfolios and enhancing their end-to-end security offerings. The growing importance of cybersecurity resilience and compliance will ensure a consistent demand for proactive security monitoring services, positioning the industry as a critical enabler of digital transformation and business continuity. The market is projected to witness a CAGR of 15-20%, reaching an estimated value of 800-1 Billion by 2033.

Proactive Security Monitoring Industry Segmentation

-

1. Size of the Organization

- 1.1. Large Enterprise

- 1.2. Small and Medium Enterprise

-

2. Solution

- 2.1. Advanced Malware Protection (AMP)

- 2.2. Security Monitoring and Analytics

- 2.3. Vulnerability Assessment

- 2.4. Other Solutions

-

3. End-user Industry

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Retail

- 3.4. Industrial

- 3.5. Government & Defence

- 3.6. Other End-user Industries

Proactive Security Monitoring Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

- 5. Middle East

Proactive Security Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Trend of BYOD and IoT Adoption across Enterprises; Stringent Government Regulations to Safeguard the Enterprise Data

- 3.3. Market Restrains

- 3.3.1. ; Lack of Skilled Cybersecurity Professionals

- 3.4. Market Trends

- 3.4.1. BFSI Sector Expected to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 5.1.1. Large Enterprise

- 5.1.2. Small and Medium Enterprise

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Advanced Malware Protection (AMP)

- 5.2.2. Security Monitoring and Analytics

- 5.2.3. Vulnerability Assessment

- 5.2.4. Other Solutions

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Retail

- 5.3.4. Industrial

- 5.3.5. Government & Defence

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 6. North America Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 6.1.1. Large Enterprise

- 6.1.2. Small and Medium Enterprise

- 6.2. Market Analysis, Insights and Forecast - by Solution

- 6.2.1. Advanced Malware Protection (AMP)

- 6.2.2. Security Monitoring and Analytics

- 6.2.3. Vulnerability Assessment

- 6.2.4. Other Solutions

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. IT & Telecommunication

- 6.3.2. BFSI

- 6.3.3. Retail

- 6.3.4. Industrial

- 6.3.5. Government & Defence

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 7. Europe Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 7.1.1. Large Enterprise

- 7.1.2. Small and Medium Enterprise

- 7.2. Market Analysis, Insights and Forecast - by Solution

- 7.2.1. Advanced Malware Protection (AMP)

- 7.2.2. Security Monitoring and Analytics

- 7.2.3. Vulnerability Assessment

- 7.2.4. Other Solutions

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. IT & Telecommunication

- 7.3.2. BFSI

- 7.3.3. Retail

- 7.3.4. Industrial

- 7.3.5. Government & Defence

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 8. Asia Pacific Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 8.1.1. Large Enterprise

- 8.1.2. Small and Medium Enterprise

- 8.2. Market Analysis, Insights and Forecast - by Solution

- 8.2.1. Advanced Malware Protection (AMP)

- 8.2.2. Security Monitoring and Analytics

- 8.2.3. Vulnerability Assessment

- 8.2.4. Other Solutions

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. IT & Telecommunication

- 8.3.2. BFSI

- 8.3.3. Retail

- 8.3.4. Industrial

- 8.3.5. Government & Defence

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 9. Latin America Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 9.1.1. Large Enterprise

- 9.1.2. Small and Medium Enterprise

- 9.2. Market Analysis, Insights and Forecast - by Solution

- 9.2.1. Advanced Malware Protection (AMP)

- 9.2.2. Security Monitoring and Analytics

- 9.2.3. Vulnerability Assessment

- 9.2.4. Other Solutions

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. IT & Telecommunication

- 9.3.2. BFSI

- 9.3.3. Retail

- 9.3.4. Industrial

- 9.3.5. Government & Defence

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 10. Middle East Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 10.1.1. Large Enterprise

- 10.1.2. Small and Medium Enterprise

- 10.2. Market Analysis, Insights and Forecast - by Solution

- 10.2.1. Advanced Malware Protection (AMP)

- 10.2.2. Security Monitoring and Analytics

- 10.2.3. Vulnerability Assessment

- 10.2.4. Other Solutions

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. IT & Telecommunication

- 10.3.2. BFSI

- 10.3.3. Retail

- 10.3.4. Industrial

- 10.3.5. Government & Defence

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Size of the Organization

- 11. North America Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Australia

- 13.1.4 Japan

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Rest of Latin America

- 15. Middle East Proactive Security Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 AlienVault Inc (AT&T Cybersecurity)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Trustwave Holdings Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 FireEye Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 FireMon LLC *List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 IBM Corp

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Cygilant Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Rapid7 Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ThreatConnect Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 RSA Security LLC (Dell Technologies)

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Oracle Corp

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Qualys Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 AlienVault Inc (AT&T Cybersecurity)

List of Figures

- Figure 1: Global Proactive Security Monitoring Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Proactive Security Monitoring Industry Revenue (Million), by Size of the Organization 2024 & 2032

- Figure 13: North America Proactive Security Monitoring Industry Revenue Share (%), by Size of the Organization 2024 & 2032

- Figure 14: North America Proactive Security Monitoring Industry Revenue (Million), by Solution 2024 & 2032

- Figure 15: North America Proactive Security Monitoring Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 16: North America Proactive Security Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Proactive Security Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Proactive Security Monitoring Industry Revenue (Million), by Size of the Organization 2024 & 2032

- Figure 21: Europe Proactive Security Monitoring Industry Revenue Share (%), by Size of the Organization 2024 & 2032

- Figure 22: Europe Proactive Security Monitoring Industry Revenue (Million), by Solution 2024 & 2032

- Figure 23: Europe Proactive Security Monitoring Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 24: Europe Proactive Security Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Europe Proactive Security Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Europe Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Proactive Security Monitoring Industry Revenue (Million), by Size of the Organization 2024 & 2032

- Figure 29: Asia Pacific Proactive Security Monitoring Industry Revenue Share (%), by Size of the Organization 2024 & 2032

- Figure 30: Asia Pacific Proactive Security Monitoring Industry Revenue (Million), by Solution 2024 & 2032

- Figure 31: Asia Pacific Proactive Security Monitoring Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 32: Asia Pacific Proactive Security Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Asia Pacific Proactive Security Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Asia Pacific Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Proactive Security Monitoring Industry Revenue (Million), by Size of the Organization 2024 & 2032

- Figure 37: Latin America Proactive Security Monitoring Industry Revenue Share (%), by Size of the Organization 2024 & 2032

- Figure 38: Latin America Proactive Security Monitoring Industry Revenue (Million), by Solution 2024 & 2032

- Figure 39: Latin America Proactive Security Monitoring Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 40: Latin America Proactive Security Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Latin America Proactive Security Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Latin America Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East Proactive Security Monitoring Industry Revenue (Million), by Size of the Organization 2024 & 2032

- Figure 45: Middle East Proactive Security Monitoring Industry Revenue Share (%), by Size of the Organization 2024 & 2032

- Figure 46: Middle East Proactive Security Monitoring Industry Revenue (Million), by Solution 2024 & 2032

- Figure 47: Middle East Proactive Security Monitoring Industry Revenue Share (%), by Solution 2024 & 2032

- Figure 48: Middle East Proactive Security Monitoring Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 49: Middle East Proactive Security Monitoring Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 50: Middle East Proactive Security Monitoring Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East Proactive Security Monitoring Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 3: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 4: Global Proactive Security Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Australia Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Mexico Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Brazil Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Latin America Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 27: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 28: Global Proactive Security Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Canada Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 33: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 34: Global Proactive Security Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 35: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United Kingdom Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Germany Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of Europe Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 41: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 42: Global Proactive Security Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 43: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: China Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: India Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Australia Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 50: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 51: Global Proactive Security Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 52: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Mexico Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Brazil Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Latin America Proactive Security Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Size of the Organization 2019 & 2032

- Table 57: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Solution 2019 & 2032

- Table 58: Global Proactive Security Monitoring Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 59: Global Proactive Security Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Proactive Security Monitoring Industry?

The projected CAGR is approximately 14.00%.

2. Which companies are prominent players in the Proactive Security Monitoring Industry?

Key companies in the market include AlienVault Inc (AT&T Cybersecurity), Trustwave Holdings Inc, FireEye Inc, FireMon LLC *List Not Exhaustive, IBM Corp, Cygilant Inc, Rapid7 Inc, ThreatConnect Inc, RSA Security LLC (Dell Technologies), Oracle Corp, Qualys Inc.

3. What are the main segments of the Proactive Security Monitoring Industry?

The market segments include Size of the Organization, Solution, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Trend of BYOD and IoT Adoption across Enterprises; Stringent Government Regulations to Safeguard the Enterprise Data.

6. What are the notable trends driving market growth?

BFSI Sector Expected to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

; Lack of Skilled Cybersecurity Professionals.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Proactive Security Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Proactive Security Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Proactive Security Monitoring Industry?

To stay informed about further developments, trends, and reports in the Proactive Security Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence