Key Insights

The European Automated Material Handling (AMH) market is experiencing robust expansion, projected to reach a significant valuation. Driven by escalating demand for operational efficiency, labor cost optimization, and enhanced safety across diverse end-user industries, the market is poised for substantial growth. The surge in e-commerce, particularly in the retail and post and parcel sectors, necessitates faster order fulfillment and streamlined logistics, directly fueling the adoption of advanced AMH solutions. Furthermore, increasing investments in smart factory initiatives and Industry 4.0 adoption by automotive and general manufacturing sectors are creating significant opportunities. Innovations in robotics, AI, and IoT integration are leading to the development of more sophisticated and flexible AMH systems, such as Autonomous Mobile Robots (AMRs), which offer greater agility compared to traditional Automated Guided Vehicles (AGVs). The pharmaceutical industry's stringent requirements for precision and contamination control also contribute to the adoption of specialized AMH equipment.

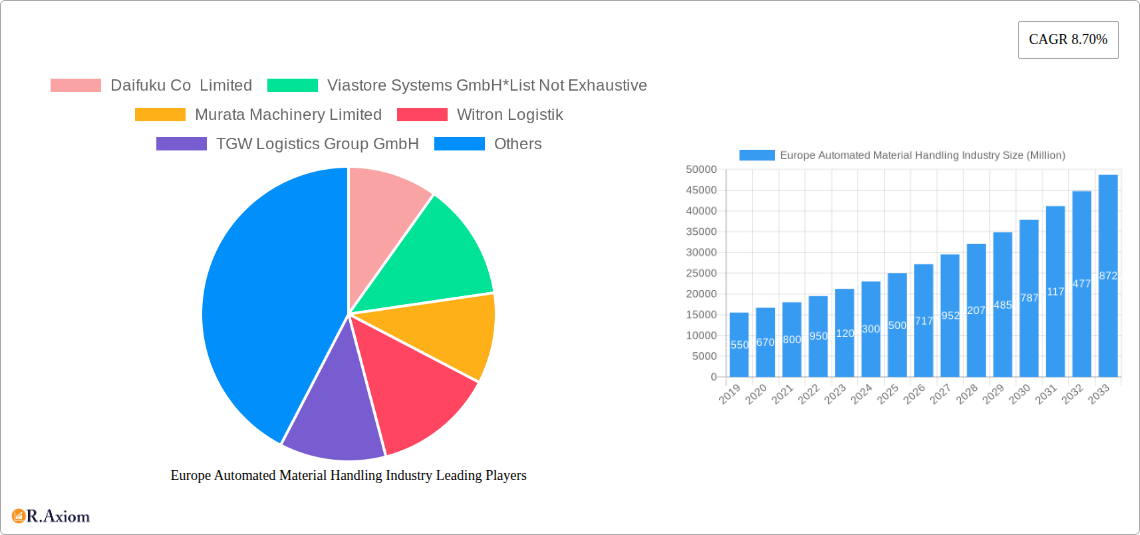

Europe Automated Material Handling Industry Market Size (In Billion)

The market's trajectory is further bolstered by continuous technological advancements and a growing awareness of the productivity gains and error reduction offered by automation. Key segments like Automated Storage and Retrieval Systems (ASRS) and automated conveyors are witnessing considerable uptake due to their ability to optimize warehouse space and throughput. While the adoption of AMH solutions is widespread, certain factors such as high initial investment costs and the need for skilled personnel for installation and maintenance can present challenges. However, the long-term benefits of reduced operational expenses, improved inventory management, and increased throughput are compelling businesses to overcome these hurdles. The European market, with its strong industrial base and forward-thinking regulatory environment, is well-positioned to lead this transformation, with countries like Germany and the United Kingdom at the forefront of AMH adoption.

Europe Automated Material Handling Industry Company Market Share

Europe Automated Material Handling Industry Market: In-depth Analysis and Future Projections (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Automated Material Handling Industry, offering actionable insights and strategic recommendations for stakeholders. The study covers the historical period from 2019–2024, with a base year of 2025 and a forecast period extending to 2033. The report includes detailed segmentation across product types, equipment types, and end-user verticals, alongside an analysis of market concentration, industry trends, key drivers, challenges, and emerging opportunities.

Europe Automated Material Handling Industry Market Concentration & Innovation

The Europe Automated Material Handling industry exhibits a moderate to high degree of market concentration, with a few key players holding significant market shares. Leading companies like Daifuku Co Limited, Viastore Systems GmbH, Murata Machinery Limited, Witron Logistik, TGW Logistics Group GmbH, Kardex Group, KUKA AG, Honeywell Intelligrated, Beumer Group GMBH & Co KG, Vanderlande Industries BV, SSI SCHAEFER AG, and Mecalux SA are instrumental in shaping market dynamics. Innovation is a critical driver, fueled by advancements in robotics, AI, IoT, and data analytics. Regulatory frameworks, particularly those pertaining to workplace safety and environmental standards, are influencing product development and adoption. While product substitutes exist, the unique benefits of automated material handling systems in terms of efficiency, accuracy, and cost reduction are increasingly outweighing them. End-user trends are leaning towards greater automation to combat labor shortages, improve operational throughput, and enhance supply chain resilience. Mergers and acquisitions (M&A) are a notable aspect of market concentration, with significant deal values driving consolidation and market share gains. For instance, recent M&A activities in the broader industrial automation sector have seen valuations reaching hundreds of millions of Euros, signaling investor confidence in the growth trajectory of automated solutions.

Europe Automated Material Handling Industry Industry Trends & Insights

The Europe Automated Material Handling Industry is experiencing robust growth, driven by a confluence of economic, technological, and societal factors. The Compound Annual Growth Rate (CAGR) is projected to be XX% during the forecast period, indicating a substantial expansion in market value. Key growth drivers include the relentless pursuit of operational efficiency and cost reduction across various industries. Labor shortages, particularly in warehousing and logistics, are compelling businesses to invest in automated solutions to maintain productivity and competitiveness. The burgeoning e-commerce sector, with its demand for faster order fulfillment and sophisticated inventory management, is a significant catalyst. Technological disruptions, such as the widespread adoption of Autonomous Mobile Robots (AMRs) and the continuous evolution of Automated Storage and Retrieval Systems (ASRS), are transforming material flow. Advancements in AI and machine learning are enabling smarter, more adaptive automation solutions that can optimize operations in real-time. Consumer preferences for faster delivery times and personalized products further necessitate agile and efficient logistics. Competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on providing integrated solutions encompassing hardware, software, and services. Market penetration of automated material handling solutions is steadily increasing across all major European economies, with a particular surge in adoption within the retail/e-commerce and food and beverage sectors. The integration of Industry 4.0 principles, including the Internet of Things (IoT) and digital twins, is creating more interconnected and intelligent supply chains, further propelling market growth. The estimated market size for the Europe Automated Material Handling Industry in the base year of 2025 is projected to be XX Million Euros.

Dominant Markets & Segments in Europe Automated Material Handling Industry

Germany is expected to remain the dominant market within the Europe Automated Material Handling Industry, driven by its strong industrial base, advanced manufacturing capabilities, and significant investments in logistics infrastructure. The Automotive and General Manufacturing end-user verticals are also leading segments, characterized by high adoption rates of sophisticated automation solutions to optimize production lines and supply chains.

Product Type Dominance:

- Hardware: Constituting a substantial portion of the market, hardware, including Mobile Robots (AGVs and AMRs) and Automated Storage and Retrieval Systems (ASRS), will continue to lead due to the inherent need for physical automation of material movement and storage. The estimated market size for hardware in 2025 is XX Million Euros.

- Software: The increasing complexity of automated systems necessitates sophisticated WMS, WCS, and fleet management software, driving significant growth in this segment. The estimated market size for software in 2025 is XX Million Euros.

- Services: Installation, maintenance, and support services are crucial for the seamless operation of automated systems, making this a consistently growing segment. The estimated market size for services in 2025 is XX Million Euros.

Equipment Type Dominance:

- Mobile Robots:

- Autonomous Mobile Robots (AMRs): Showing the fastest growth due to their flexibility, adaptability, and ease of integration, AMRs are revolutionizing intra-logistics. The estimated market size for AMRs in 2025 is XX Million Euros.

- Automated Guided Vehicles (AGVs): Traditional AGVs, including Automated Forklifts and Automated Tow/Tractor/Tugs, continue to be vital for high-volume, predictable material movement in established industrial settings. The estimated market size for AGVs in 2025 is XX Million Euros.

- Automated Storage and Retrieval Systems (ASRS):

- Fixed Aisle (Stacker Crane + Shuttle System): Essential for high-density storage and retrieval in large warehouses, this sub-segment remains a cornerstone of automated warehousing. The estimated market size for Fixed Aisle ASRS in 2025 is XX Million Euros.

- Carousel Systems (Horizontal & Vertical): Increasingly adopted for order picking efficiency, especially in pharmaceuticals and retail, these systems offer space-saving solutions. The estimated market size for Carousel Systems in 2025 is XX Million Euros.

- Automated Conveyors: Integral to moving goods between different points in a facility, Belt Conveyors and Roller Conveyors will maintain significant market presence. The estimated market size for Automated Conveyors in 2025 is XX Million Euros.

- Palletizers: Robotic Palletizers are gaining traction due to their flexibility in handling diverse product types and pallet configurations. The estimated market size for Palletizers in 2025 is XX Million Euros.

- Sortation Systems: Crucial for high-speed sorting in distribution centers, particularly for Post and Parcel and Retail/Wholesale sectors, these systems are vital for efficient order processing. The estimated market size for Sortation Systems in 2025 is XX Million Euros.

- Mobile Robots:

End-User Vertical Dominance:

- Retail/Wholesale: Driven by the e-commerce boom and the need for efficient order fulfillment, this vertical is a major consumer of automated material handling solutions. The estimated market size for Retail/Wholesale in 2025 is XX Million Euros.

- Food and Beverage: The demand for hygiene, traceability, and efficient handling of perishable goods makes this sector a key adopter of automation. The estimated market size for Food and Beverage in 2025 is XX Million Euros.

- Automotive: High production volumes and complex supply chains necessitate advanced automation for material handling throughout the manufacturing process. The estimated market size for Automotive in 2025 is XX Million Euros.

Europe Automated Material Handling Industry Product Developments

Product development in the Europe Automated Material Handling Industry is characterized by a strong emphasis on intelligence, flexibility, and integration. Innovations are geared towards enhancing robot autonomy, improving energy efficiency in ASRS, and developing more sophisticated software for real-time operational management. The integration of AI and machine learning into mobile robots is enabling dynamic pathfinding and collaborative operation. Furthermore, advancements in gripper technology for robotic palletizers are expanding their application range. These developments provide a competitive advantage by offering increased throughput, reduced operational costs, and improved safety for end-users across various sectors. The estimated market value for new product developments in 2025 is XX Million Euros.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Europe Automated Material Handling Industry across its key segments. The Product Type segmentation includes Hardware (estimated market size in 2025: XX Million Euros), Software (estimated market size in 2025: XX Million Euros), and Services (estimated market size in 2025: XX Million Euros). The Equipment Type segmentation delves into Mobile Robots (including AGVs with sub-segments like Automated Forklift, Automated Tow/Tractor/Tug, Unit Load, Assembly Line, and Special Purpose, estimated market size in 2025: XX Million Euros), Autonomous Mobile Robots (AMR) (estimated market size in 2025: XX Million Euros), Laser Guided Vehicles (estimated market size in 2025: XX Million Euros), Automated Storage and Retrieval Systems (ASRS) (encompassing Fixed Aisle (Stacker Crane + Shuttle System), Carousel (Horizontal Carousel + Vertical Carousel), and Vertical Lift Module, estimated market size in 2025: XX Million Euros), Automated Conveyor (Belt, Roller, Pallet, Overhead, estimated market size in 2025: XX Million Euros), Palletizer (Conventional (High Level + Low Level), Robotic, estimated market size in 2025: XX Million Euros), and Sortation System (estimated market size in 2025: XX Million Euros). The End-user Vertical segmentation covers Airport, Automotive, Food and Beverage, Retail/W, General Manufacturing, Pharmaceuticals, Post and Parcel, and Other End Users (estimated market size for all end-user verticals combined in 2025: XX Million Euros). Growth projections and competitive dynamics are detailed for each segment.

Key Drivers of Europe Automated Material Handling Industry Growth

Several key factors are propelling the growth of the Europe Automated Material Handling Industry:

- Labor Shortages and Rising Labor Costs: An aging workforce and difficulties in recruitment are forcing industries to invest in automation to maintain operational capacity.

- E-commerce Boom: The surge in online shopping necessitates faster order fulfillment, efficient inventory management, and sophisticated warehousing solutions, driving demand for automated systems.

- Technological Advancements: Innovations in AI, robotics, IoT, and machine learning are making automated material handling solutions more intelligent, flexible, and cost-effective.

- Focus on Operational Efficiency and Productivity: Businesses are seeking to optimize their supply chains, reduce errors, and increase throughput, all of which are core benefits of automation.

- Government Initiatives and Industry 4.0 Adoption: Support for automation and digitization through government programs and the broader adoption of Industry 4.0 principles are encouraging investment.

Challenges in the Europe Automated Material Handling Industry Sector

Despite its strong growth trajectory, the Europe Automated Material Handling Industry faces several challenges:

- High Initial Investment Costs: The upfront capital expenditure for sophisticated automated systems can be a significant barrier for small and medium-sized enterprises (SMEs).

- Integration Complexity: Integrating new automated systems with existing legacy infrastructure can be complex and time-consuming, requiring specialized expertise.

- Workforce Reskilling and Training: A skilled workforce is required to operate, maintain, and manage automated systems, necessitating investment in training and development programs.

- Cybersecurity Concerns: The increasing connectivity of automated systems raises concerns about data security and vulnerability to cyber threats.

- Regulatory Hurdles: Evolving regulations concerning safety standards and data privacy can sometimes create compliance challenges for new implementations. The estimated impact of these challenges on market growth is approximately XX% reduction in potential CAGR.

Emerging Opportunities in Europe Automated Material Handling Industry

The Europe Automated Material Handling Industry is ripe with emerging opportunities:

- Expansion in SMEs: As the cost of automation decreases and solutions become more user-friendly, there is a significant opportunity to penetrate the SME market.

- Sustainable and Green Automation: Growing environmental consciousness is driving demand for energy-efficient automated systems and solutions that reduce waste.

- Collaborative Robots (Cobots) in Logistics: The increasing use of cobots alongside human workers presents opportunities for flexible automation in tasks requiring human dexterity.

- AI-Powered Predictive Maintenance: Leveraging AI for predictive maintenance of automated equipment can significantly reduce downtime and operational costs, creating a strong value proposition.

- Customized and Flexible Solutions: The demand for tailored automation solutions that can adapt to specific operational needs and evolving market demands is creating new avenues for innovation and market differentiation.

Leading Players in the Europe Automated Material Handling Industry Market

- Daifuku Co Limited

- Viastore Systems GmbH

- Murata Machinery Limited

- Witron Logistik

- TGW Logistics Group GmbH

- Kardex Group

- KUKA AG

- Honeywell Intelligrated

- Beumer Group GMBH & Co KG

- Vanderlande Industries BV

- SSI SCHAEFER AG

- Mecalux SA

Key Developments in Europe Automated Material Handling Industry Industry

- March 2021: XPO Logistics, a global provider of transport and logistics solutions, launched a new autonomous forklift truck technology pilot program in collaboration with Balyo, a specialist developer of robotics for goods handling equipment. This development signals a growing trend towards adopting advanced autonomous vehicle technology for logistics operations.

- May 2021: Third Wave Automation Inc. and Toyota Industries Corp. signed a strategic partnership to produce the next generation of intelligent, fully autonomous material handling vehicles. The partnership will include capabilities such as dynamic navigation, advanced load handling, shared autonomy, fleet control, and WMS integration, indicating a move towards more integrated and intelligent autonomous solutions.

Strategic Outlook for Europe Automated Material Handling Industry Market

The strategic outlook for the Europe Automated Material Handling Industry is overwhelmingly positive, driven by sustained demand for efficiency and innovation. The continued growth of e-commerce, coupled with persistent labor shortages across Europe, will ensure a steady influx of investment into automated solutions. Key growth catalysts include the increasing adoption of AI and machine learning to create more adaptive and intelligent systems, the expansion of AMRs into diverse applications, and the growing emphasis on integrated solutions encompassing hardware, software, and services. Companies that focus on offering flexible, scalable, and sustainable automation solutions, while addressing the integration challenges for SMEs, are poised for significant market success. The estimated market potential for further expansion in the forecast period is XX Million Euros.

Europe Automated Material Handling Industry Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Equipment Type

-

2.1. Mobile Robots

-

2.1.1. Automated Guided Vehicle (AGV)

- 2.1.1.1. Automated Forklift

- 2.1.1.2. Automated Tow/Tractor/Tug

- 2.1.1.3. Unit Load

- 2.1.1.4. Assembly Line

- 2.1.1.5. Special Purpose

- 2.1.2. Autonomous Mobile Robots (AMR)

- 2.1.3. Laser Guided Vehicle

-

2.1.1. Automated Guided Vehicle (AGV)

-

2.2. Automated Storage and Retrieval System (ASRS)

- 2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 2.2.3. Vertical Lift Module

-

2.3. Automated Conveyor

- 2.3.1. Belt

- 2.3.2. Roller

- 2.3.3. Pallet

- 2.3.4. Overhead

-

2.4. Palletizer

- 2.4.1. Conventional (High Level + Low Level)

- 2.4.2. Robotic

- 2.5. Sortation System

-

2.1. Mobile Robots

-

3. End-user Vertical

- 3.1. Airport

- 3.2. Automotive

- 3.3. Food and Beverage

- 3.4. Retail/W

- 3.5. General Manufacturing

- 3.6. Pharmaceuticals

- 3.7. Post and Parcel

- 3.8. Other End Users

Europe Automated Material Handling Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

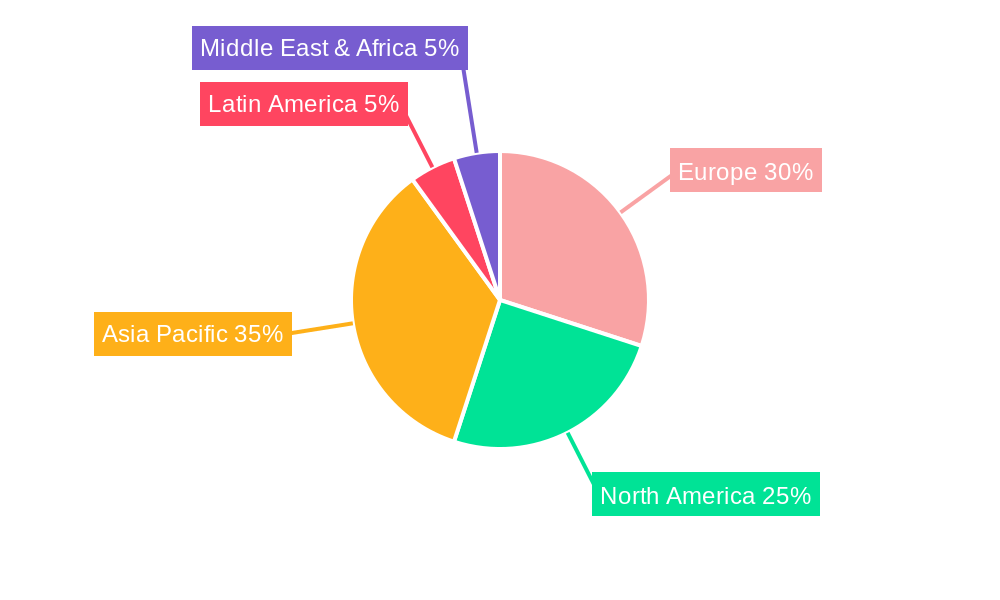

Europe Automated Material Handling Industry Regional Market Share

Geographic Coverage of Europe Automated Material Handling Industry

Europe Automated Material Handling Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 86.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Adoption of Automation in Warehouse Applications; Supporting Government Policies for Automation; Industry 4.0 investments driving the demand for automation and material handling

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Workforce; High Initial Costs

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automated Material Handling Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Mobile Robots

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.1.1.1. Automated Forklift

- 5.2.1.1.2. Automated Tow/Tractor/Tug

- 5.2.1.1.3. Unit Load

- 5.2.1.1.4. Assembly Line

- 5.2.1.1.5. Special Purpose

- 5.2.1.2. Autonomous Mobile Robots (AMR)

- 5.2.1.3. Laser Guided Vehicle

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.2. Automated Storage and Retrieval System (ASRS)

- 5.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.2.3. Vertical Lift Module

- 5.2.3. Automated Conveyor

- 5.2.3.1. Belt

- 5.2.3.2. Roller

- 5.2.3.3. Pallet

- 5.2.3.4. Overhead

- 5.2.4. Palletizer

- 5.2.4.1. Conventional (High Level + Low Level)

- 5.2.4.2. Robotic

- 5.2.5. Sortation System

- 5.2.1. Mobile Robots

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Airport

- 5.3.2. Automotive

- 5.3.3. Food and Beverage

- 5.3.4. Retail/W

- 5.3.5. General Manufacturing

- 5.3.6. Pharmaceuticals

- 5.3.7. Post and Parcel

- 5.3.8. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Daifuku Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Viastore Systems GmbH*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Murata Machinery Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Witron Logistik

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TGW Logistics Group GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kardex Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KUKA AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Honeywell Intelligrated

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beumer Group GMBH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vanderlande Industries BV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SSI SCHAEFER AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mecalux SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Daifuku Co Limited

List of Figures

- Figure 1: Europe Automated Material Handling Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Automated Material Handling Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automated Material Handling Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Europe Automated Material Handling Industry Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 3: Europe Automated Material Handling Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 4: Europe Automated Material Handling Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Europe Automated Material Handling Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Europe Automated Material Handling Industry Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 7: Europe Automated Material Handling Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 8: Europe Automated Material Handling Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Automated Material Handling Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automated Material Handling Industry?

The projected CAGR is approximately 86.5%.

2. Which companies are prominent players in the Europe Automated Material Handling Industry?

Key companies in the market include Daifuku Co Limited, Viastore Systems GmbH*List Not Exhaustive, Murata Machinery Limited, Witron Logistik, TGW Logistics Group GmbH, Kardex Group, KUKA AG, Honeywell Intelligrated, Beumer Group GMBH & Co KG, Vanderlande Industries BV, SSI SCHAEFER AG, Mecalux SA.

3. What are the main segments of the Europe Automated Material Handling Industry?

The market segments include Product Type, Equipment Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Wide Adoption of Automation in Warehouse Applications; Supporting Government Policies for Automation; Industry 4.0 investments driving the demand for automation and material handling.

6. What are the notable trends driving market growth?

Automotive is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Shortage of Skilled Workforce; High Initial Costs.

8. Can you provide examples of recent developments in the market?

March 2021 -XPO Logistics, a global provider of transport and logistics solutions, launched a new autonomous forklift truck technology pilot program in collaboration with Balyo, a specialist developer of robotics for goods handling equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automated Material Handling Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automated Material Handling Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automated Material Handling Industry?

To stay informed about further developments, trends, and reports in the Europe Automated Material Handling Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence