Key Insights

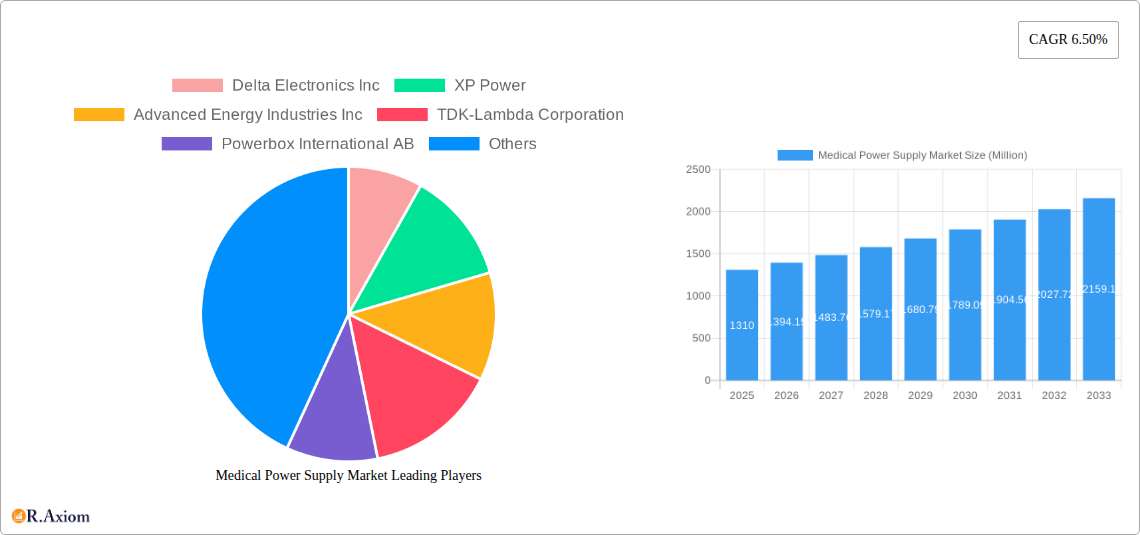

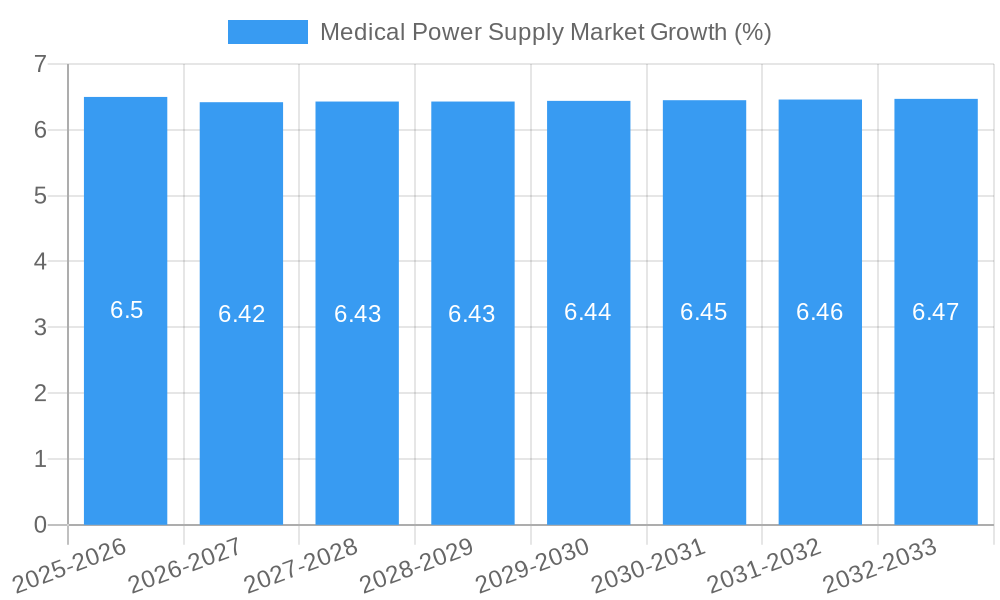

The global Medical Power Supply Market is poised for robust expansion, projected to reach approximately USD 1.31 billion in 2025 and grow at a compound annual growth rate (CAGR) of 6.50% through 2033. This significant growth is primarily fueled by the increasing demand for sophisticated medical devices, particularly in diagnostic, imaging, and monitoring applications, as well as the escalating adoption of home healthcare solutions. The continuous advancements in medical technology, necessitating more reliable and efficient power solutions, are a key driver. Furthermore, an aging global population and a rise in chronic diseases are boosting the need for advanced medical equipment, from complex imaging systems to compact home monitoring devices, all of which rely heavily on specialized power supplies. The market's trajectory is also influenced by the increasing focus on miniaturization and energy efficiency in medical device design, pushing manufacturers to innovate power supply solutions that are smaller, lighter, and consume less power while meeting stringent safety and performance standards.

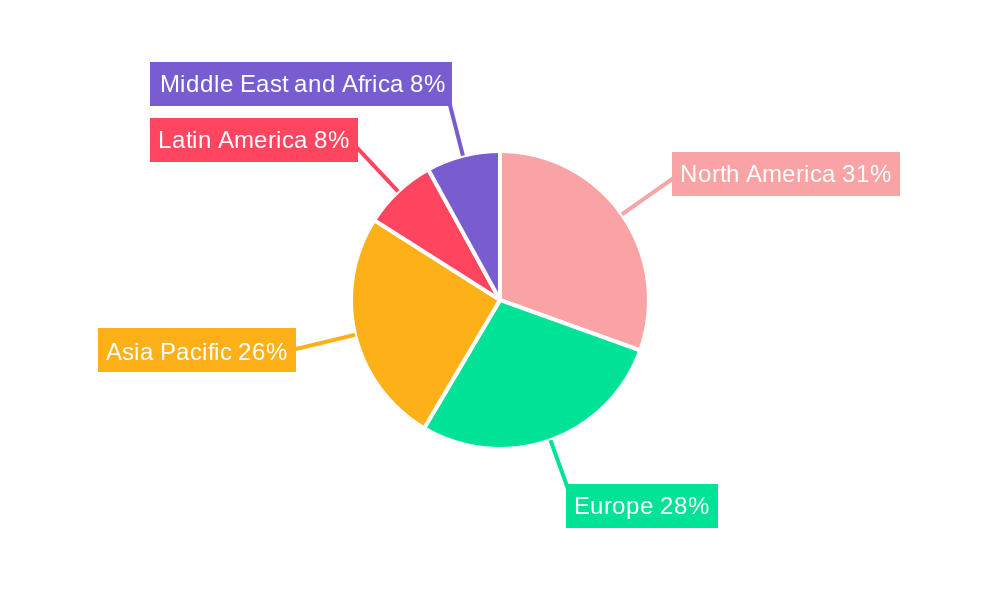

The market is characterized by a diverse range of product types and applications, catering to specific needs within the healthcare sector. The prevalence of AC to DC and DC to DC power supplies highlights the industry's reliance on versatile power conversion capabilities. Open frame, enclosed, and adapter power supplies, along with converters, represent the varied form factors and functionalities required by different medical equipment. The application segment of Diagnostic, Imaging, and Monitoring Equipment is expected to be a dominant force, driven by the widespread use of MRI, CT scanners, ultrasound devices, and advanced patient monitoring systems. Surgical equipment and home medical equipment are also significant contributors, reflecting the expanding scope of healthcare delivery. Geographically, North America and Europe are anticipated to maintain a leading market share due to established healthcare infrastructure and high R&D investments, while the Asia Pacific region is expected to witness the fastest growth, propelled by increasing healthcare expenditure, growing medical tourism, and a rapidly expanding patient base.

Medical Power Supply Market Report: Comprehensive Analysis and Future Outlook (2019–2033)

Dive deep into the dynamic Medical Power Supply Market with our in-depth report. This comprehensive analysis covers market size, growth projections, key trends, and competitive landscapes, providing actionable insights for stakeholders across the healthcare technology and electronics industries. Explore the intricate details of AC to DC Power Supply, DC to DC Power Supply, Open Frame Power Supply, Enclosed Power Supply, Adapter Power Supply, and Converters, alongside crucial applications in Diagnostic, Imaging, and Monitoring Equipment, Surgical Equipment, Home Medical Equipment, and Other Applications.

This report meticulously examines the market from 2019 to 2033, with a detailed base year analysis of 2025 and a forecast period of 2025–2033. We leverage historical data from 2019–2024 to provide a robust foundation for our future projections. Discover the driving forces behind market expansion, technological innovations, regulatory shifts, and the strategic moves of leading players like Delta Electronics Inc., XP Power, Advanced Energy Industries Inc., TDK-Lambda Corporation, Powerbox International AB, Spellman High Voltage Electronics Corporation, Globtek Inc., Mean Well Enterprises Co Ltd, CUI Inc (Bel Fuse Inc), and SL Industries Inc. Unlock a strategic roadmap for success in this critical and rapidly evolving sector.

Medical Power Supply Market Market Concentration & Innovation

The Medical Power Supply Market exhibits a moderate to high level of concentration, with a few dominant players holding significant market share. This concentration is driven by substantial R&D investments, stringent regulatory compliance requirements, and the need for specialized expertise in designing and manufacturing highly reliable power solutions for life-saving medical devices. Innovation is a key differentiator, with companies continuously investing in developing smaller, lighter, more efficient, and safer power supplies. This includes advancements in power density, thermal management, and compliance with evolving international standards such as IEC 60601.

Key Innovation Drivers:

- Miniaturization: The demand for portable and implantable medical devices fuels innovation in compact power supply designs.

- Increased Efficiency: Higher power conversion efficiency reduces energy consumption and heat dissipation, crucial for battery-powered and enclosed medical equipment.

- Enhanced Safety and Reliability: Meeting rigorous safety standards (e.g., 2 x MOPP) and ensuring long-term reliability are paramount for patient care.

- Connectivity and Intelligence: Integration of smart features for remote monitoring and diagnostics in power supplies.

Regulatory Frameworks: Strict adherence to medical device regulations, such as those from the FDA, EMA, and IEC, profoundly shapes market entry and product development. These regulations often necessitate extensive testing and certification, acting as a barrier to entry but also ensuring a high standard of quality and safety.

Product Substitutes: While direct substitutes for medical-grade power supplies are limited due to the critical nature of their applications, advancements in battery technology and wireless power transfer are emerging as complementary or alternative solutions for specific low-power portable devices.

End-User Trends: The increasing adoption of home healthcare solutions, the growing demand for advanced diagnostic and imaging equipment, and the ongoing development of minimally invasive surgical technologies are shaping the demand for specialized medical power supplies.

Mergers & Acquisitions (M&A) Activities: The market witnesses strategic M&A activities aimed at consolidating market position, acquiring new technologies, or expanding product portfolios. While specific M&A deal values for medical power supplies are often part of broader corporate transactions, the trend indicates a drive towards synergy and market dominance. For instance, acquisitions of smaller, specialized power supply manufacturers by larger conglomerates are common. The estimated total M&A value in the broader industrial power supply sector, which includes medical, often runs into hundreds of millions to billions of US dollars annually, with medical segment deals contributing significantly due to high-value niche technologies.

Medical Power Supply Market Industry Trends & Insights

The Medical Power Supply Market is experiencing robust growth, driven by a confluence of technological advancements, escalating healthcare expenditures, and an aging global population. The estimated market size in the base year 2025 is projected to be in the range of USD 4,500 million to USD 5,500 million. This growth is underpinned by a compound annual growth rate (CAGR) estimated between 6.5% and 7.5% during the forecast period of 2025–2033. The increasing prevalence of chronic diseases worldwide necessitates more sophisticated medical diagnostic, monitoring, and therapeutic equipment, directly translating into higher demand for specialized and reliable power solutions.

Technological disruptions are reshaping the landscape of medical power supplies. There is a continuous push towards miniaturization, allowing for more compact and portable medical devices, which are essential for home healthcare and point-of-care applications. This miniaturization is achieved through the adoption of advanced semiconductor technologies and innovative thermal management techniques. Furthermore, the development of higher efficiency power supplies is a significant trend, not only reducing energy consumption and heat generation but also contributing to the longer operational life of battery-powered medical devices. The stringent safety and reliability requirements for medical applications, mandated by global regulatory bodies like the FDA and IEC, are driving innovation in fail-safe designs, low leakage currents, and high dielectric strength.

Consumer preferences are increasingly leaning towards user-friendly, less intrusive, and more accessible healthcare solutions. This translates into a demand for medical power supplies that can support home-use medical equipment, wearable health monitors, and telehealth devices. The shift from hospital-centric care to home-based care is a major catalyst, necessitating power solutions that are safe, reliable, and easy for patients or caregivers to use. Medical professionals also demand power supplies that ensure uninterrupted operation of critical equipment during procedures, highlighting the importance of robust design and advanced protection features.

The competitive dynamics within the Medical Power Supply Market are characterized by intense rivalry among established global players and emerging niche manufacturers. Companies are vying for market share through product innovation, strategic partnerships, and a strong emphasis on regulatory compliance and quality assurance. The market penetration of advanced medical power supply technologies is steadily increasing as healthcare providers and device manufacturers recognize the value of superior power solutions in enhancing patient outcomes and operational efficiency. The global market penetration of medical power supplies is estimated to be around 70-80% of the total addressable market for medical devices requiring power, with room for growth in emerging economies and advanced technological adoption. Key players are focused on expanding their product portfolios to cater to a wider range of medical applications and geographical regions, often through strategic alliances or targeted acquisitions.

Dominant Markets & Segments in Medical Power Supply Market

The Medical Power Supply Market is segmented across various technologies, types, and applications, each exhibiting unique growth patterns and dominance.

Technology Segmentation:

- AC to DC Power Supply: This segment holds the largest market share, estimated to be around 60-70% of the total market value. The ubiquity of AC power in healthcare facilities and homes makes AC to DC converters fundamental for a vast array of medical equipment, from large imaging systems to patient monitoring devices.

- Key Drivers: High power requirements of diagnostic and surgical equipment, widespread availability of AC mains power, continuous innovation in switching power supply technology for improved efficiency and smaller form factors.

- DC to DC Power Supply: This segment is growing at a faster pace, estimated at a CAGR of 7-8%. It is crucial for internal power management within complex medical devices and for battery-powered portable equipment.

- Key Drivers: Increasing use of battery-operated medical devices, need for voltage conversion within intricate electronic systems of advanced medical equipment, growing demand for implantable medical devices.

Type Segmentation:

- Enclosed Power Supply: This segment is dominant, accounting for approximately 40-50% of the market. Enclosed power supplies offer enhanced protection against environmental factors and are vital for equipment requiring robust casing and safety features.

- Key Drivers: Requirement for protection against dust, moisture, and physical damage in clinical and home environments, regulatory mandates for safety and insulation.

- Open Frame Power Supply: This segment is significant, particularly for integration into larger medical equipment where space is a premium. It represents around 25-35% of the market.

- Key Drivers: Cost-effectiveness for integration into larger systems, flexibility in design for manufacturers, essential for high-power medical equipment like MRI machines and CT scanners.

- Adapter Power Supply: This segment is experiencing rapid growth, driven by the proliferation of portable and home medical devices. It constitutes around 15-25% of the market.

- Key Drivers: Rise of home healthcare, demand for portable diagnostic and monitoring tools, convenience for end-users.

- Converters: This is a niche but growing segment, focusing on specific voltage or signal conversion needs within medical devices.

- Key Drivers: Specialized application requirements, need for precise voltage regulation in sensitive medical electronics.

Application Segmentation:

- Diagnostic, Imaging, and Monitoring Equipment: This is the largest and most lucrative segment, estimated to be 35-45% of the market value. The continuous advancement in imaging technologies (MRI, CT, X-ray) and the increasing demand for real-time patient monitoring drive this segment.

- Key Drivers: Growing aging population, increasing incidence of chronic diseases, technological advancements in imaging resolution and speed, demand for remote patient monitoring.

- Surgical Equipment: This segment, accounting for around 20-30% of the market, is driven by the development of advanced surgical tools, robotics, and electro-medical devices.

- Key Drivers: Adoption of minimally invasive surgical techniques, increasing use of robotic surgery systems, demand for precision and reliability in the operating room.

- Home Medical Equipment: This segment is experiencing the highest growth rate, with an estimated CAGR of 8-9%. The shift towards home-based care, driven by an aging population and the desire for patient comfort, fuels this expansion.

- Key Drivers: Government initiatives promoting home healthcare, patient preference for in-home treatment, development of user-friendly medical devices for home use.

- Other Applications: This segment includes therapeutic devices, laboratory equipment, and sterilization devices, contributing around 10-20% of the market.

Dominant Regions: North America and Europe currently dominate the Medical Power Supply Market due to their advanced healthcare infrastructure, high R&D spending, and stringent regulatory standards, leading to early adoption of sophisticated medical technologies. However, the Asia-Pacific region is emerging as a significant growth driver, fueled by increasing healthcare investments, a growing patient base, and the expanding medical device manufacturing sector in countries like China and India.

Medical Power Supply Market Product Developments

Product development in the Medical Power Supply Market is sharply focused on meeting the evolving demands for safety, efficiency, and miniaturization in healthcare devices. Companies are consistently introducing new product lines that offer higher power density, improved thermal performance, and advanced safety certifications, such as compliance with IEC 60601-1 standards for medical electrical equipment. For instance, the development of compact AC-DC adapters with low earth leakage and enhanced electric shock protection is crucial for portable and home-use medical equipment. Innovations in convection-cooled power supplies that eliminate the need for additional cooling systems are also gaining traction, enabling quieter and more reliable operation of sensitive medical instruments. These developments directly address the market's need for smaller, lighter, and more integrated power solutions that enhance device portability and patient comfort while maintaining uncompromising safety and performance.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Medical Power Supply Market, covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. The market is segmented based on Technology, Type, and Application.

Technology Segmentation:

- AC to DC Power Supply: This segment, projected to reach approximately USD 3,200 million by 2025, is driven by its extensive use in larger medical equipment and healthcare facilities. Its growth is steady, supported by ongoing advancements in efficiency and power density.

- DC to DC Power Supply: This segment, estimated at around USD 1,500 million in 2025, is experiencing a higher growth trajectory due to the increasing demand for battery-powered portable devices and internal power management in complex medical systems.

Type Segmentation:

- Open Frame Power Supply: This segment, valued at approximately USD 1,600 million in 2025, is critical for integration into larger medical systems where space efficiency is paramount. It's expected to grow moderately.

- Enclosed Power Supply: Holding a significant share, estimated at USD 2,000 million in 2025, this segment benefits from the need for robust protection in various medical environments. Growth is expected to be stable.

- Adapter Power Supply: This segment, projected at USD 900 million in 2025, is poised for substantial growth, driven by the burgeoning home healthcare market and the demand for portable medical devices.

- Converters: This specialized segment, valued at around USD 300 million in 2025, caters to specific voltage regulation needs and is expected to see consistent growth.

Application Segmentation:

- Diagnostic, Imaging, and Monitoring Equipment: This dominant segment, projected to reach USD 1,900 million in 2025, is propelled by technological advancements and the increasing prevalence of diseases.

- Surgical Equipment: Valued at approximately USD 1,000 million in 2025, this segment's growth is linked to the adoption of advanced surgical techniques and robotic systems.

- Home Medical Equipment: This rapidly expanding segment, estimated at USD 800 million in 2025, is a key growth engine due to the rise of telehealth and home-based care.

- Other Applications: This segment, including therapeutic and laboratory equipment, is projected at around USD 500 million in 2025, with moderate growth.

Key Drivers of Medical Power Supply Market Growth

The Medical Power Supply Market is propelled by several critical growth drivers that are reshaping its trajectory. The most significant is the aging global population, which leads to an increased incidence of chronic diseases and a greater demand for healthcare services, including advanced diagnostic, monitoring, and therapeutic equipment. This directly translates into a higher need for reliable and sophisticated medical power supplies. Furthermore, technological advancements in medical devices, such as the development of higher resolution imaging systems, smaller portable diagnostic tools, and advanced robotic surgical systems, necessitate power supplies with increased power density, higher efficiency, and enhanced safety features.

The growing adoption of home healthcare solutions and telehealth is another pivotal driver. As more patients opt for in-home care and remote monitoring, the demand for user-friendly, safe, and reliable medical power supplies for portable devices surges. Regulatory bodies worldwide are also pushing for stricter safety and performance standards, which, while challenging, also act as a catalyst for innovation and the development of premium, compliant power solutions. Finally, increased healthcare expenditure in both developed and emerging economies is fueling investments in healthcare infrastructure and medical technology, thereby boosting the demand for medical power supplies.

Challenges in the Medical Power Supply Market Sector

Despite its robust growth, the Medical Power Supply Market faces several significant challenges. Stringent and evolving regulatory compliance remains a primary hurdle. Meeting the exacting standards set by bodies like the FDA, EMA, and IEC requires substantial investment in R&D, testing, and certification, which can delay product launches and increase manufacturing costs. Supply chain disruptions, as evidenced by recent global events, can impact the availability of critical components and raw materials, leading to production delays and price volatility.

Intense competition and price pressures from both established players and new entrants can challenge profit margins, especially for more commoditized segments of the market. The rapid pace of technological obsolescence necessitates continuous innovation and significant R&D investment to stay competitive, which can be a burden for smaller companies. Furthermore, the need for high reliability and safety means that failures can have severe consequences, demanding meticulous design and quality control, thus increasing development timelines and costs. The shift towards more sophisticated, multi-functional medical devices also requires power supplies that can handle complex power demands and offer advanced features, posing a design and integration challenge.

Emerging Opportunities in Medical Power Supply Market

The Medical Power Supply Market is ripe with emerging opportunities driven by shifting healthcare paradigms and technological breakthroughs. The burgeoning home healthcare market presents a significant opportunity for compact, user-friendly, and safe adapter power supplies and smaller enclosed units that support remote patient monitoring, therapeutic devices, and diagnostic tools used in domestic settings. The ongoing advancements in wearable medical devices and implantable electronics are creating demand for miniaturized, high-efficiency DC-DC converters and custom power solutions with ultra-low power consumption.

The increasing integration of artificial intelligence (AI) and the Internet of Medical Things (IoMT) into healthcare devices is opening avenues for "smart" power supplies that can offer predictive maintenance, remote diagnostics, and enhanced power management capabilities. Furthermore, the growing emphasis on sustainability and energy efficiency in healthcare facilities creates opportunities for manufacturers to develop power supplies that meet stringent energy standards like Level VI and contribute to reduced operational costs. Emerging markets in Asia-Pacific and Latin America, with their rapidly expanding healthcare sectors and increasing disposable incomes, offer substantial growth potential for a wide range of medical power supply solutions.

Leading Players in the Medical Power Supply Market Market

- Delta Electronics Inc.

- XP Power

- Advanced Energy Industries Inc.

- TDK-Lambda Corporation

- Powerbox International AB

- Spellman High Voltage Electronics Corporation

- Globtek Inc.

- Mean Well Enterprises Co Ltd

- CUI Inc (Bel Fuse Inc)

- SL Industries Inc.

Key Developments in Medical Power Supply Market Industry

- December 2020: CUI Inc. announced the addition of two 120-watt ac-dc external power supply series, expanding its existing 60601 certified medical power supply family. The new series footprint is 35% smaller than its non-medical counterpart, providing a lighter and less cumbersome adapter that can power a wide range of medical and dental devices. The SDM120-U is available with a C14 inlet, and the SDM120-UD comes with a C8 inlet. Both series meet the current average efficiency and no-load power specifications mandated by the US Department of Energy (DoE) under the Level VI standard, as well as the European Union's (EU) Ecodesign 2019/1782 and CoC Tier 2 directives for external power supplies. This development addresses the growing need for compact and efficient power solutions in portable medical equipment.

- April 2020: XP Power released its new UCH600 series of convection cooled, 600W AC-DC power supplies. The ultra-compact power supplies do not require additional cooling and deliver full load power under a wide range of conditions. This series can be used in medical devices, as well as for industrial electronics applications. This innovation signifies a move towards more integrated and thermally efficient power solutions for demanding medical applications.

- March 2020: Delta Electronics launched MEA-065A, a new 65W output to MEA Series of Medical AC-DC desktop type adapter, which offers four single output voltages of 12V, 15V, 19V, and 24V in an extremely compact size, i.e., 50 x 115 x 29 mm, and finds its application in various types of portable equipment, such as home healthcare equipment, and test and measurement equipment. Key features include 0.1mA low earth leakage and electric shock protection complying with 2 x MOPP. This launch highlights the increasing focus on compact, safe, and versatile power adapters for portable medical devices and home healthcare.

Strategic Outlook for Medical Power Supply Market Market

The strategic outlook for the Medical Power Supply Market is exceptionally positive, characterized by sustained demand and continuous innovation. The aging global population and the increasing prevalence of chronic diseases will continue to drive the need for advanced medical equipment, directly benefiting the power supply sector. The ongoing trend towards home healthcare and telehealth services presents a substantial opportunity for manufacturers to develop specialized, user-friendly power solutions for portable and connected medical devices. Furthermore, the integration of AI and IoMT technologies in healthcare is poised to create demand for intelligent and connected power supplies, offering advanced monitoring and diagnostic capabilities. Investments in emerging markets, coupled with a focus on energy efficiency and miniaturization, will be key strategic imperatives for companies aiming to capture market share. Strategic partnerships and potential mergers and acquisitions will likely continue as companies seek to enhance their technological capabilities and expand their product portfolios to meet the diverse and evolving needs of the global healthcare industry.

Medical Power Supply Market Segmentation

-

1. Technology

- 1.1. AC to DC Power Supply

- 1.2. DC to DC Power Supply

-

2. Type

- 2.1. Open Frame Power Supply

- 2.2. Enclosed Power Supply

- 2.3. Adapter Power Supply

- 2.4. Converters

-

3. Application

- 3.1. Diagnostic, Imaging, and Monitoring Equipment

- 3.2. Surgical Equipment

- 3.3. Home Medical Equipment

- 3.4. Other Applications

Medical Power Supply Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Medical Power Supply Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in Healthcare Equipment; Increasing Demand for Portable Home Care Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Compliance and Safety Standards

- 3.4. Market Trends

- 3.4.1. Diagnostic and Monitoring Equipment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. AC to DC Power Supply

- 5.1.2. DC to DC Power Supply

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Open Frame Power Supply

- 5.2.2. Enclosed Power Supply

- 5.2.3. Adapter Power Supply

- 5.2.4. Converters

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 5.3.2. Surgical Equipment

- 5.3.3. Home Medical Equipment

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. AC to DC Power Supply

- 6.1.2. DC to DC Power Supply

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Open Frame Power Supply

- 6.2.2. Enclosed Power Supply

- 6.2.3. Adapter Power Supply

- 6.2.4. Converters

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 6.3.2. Surgical Equipment

- 6.3.3. Home Medical Equipment

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. AC to DC Power Supply

- 7.1.2. DC to DC Power Supply

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Open Frame Power Supply

- 7.2.2. Enclosed Power Supply

- 7.2.3. Adapter Power Supply

- 7.2.4. Converters

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 7.3.2. Surgical Equipment

- 7.3.3. Home Medical Equipment

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. AC to DC Power Supply

- 8.1.2. DC to DC Power Supply

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Open Frame Power Supply

- 8.2.2. Enclosed Power Supply

- 8.2.3. Adapter Power Supply

- 8.2.4. Converters

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 8.3.2. Surgical Equipment

- 8.3.3. Home Medical Equipment

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. AC to DC Power Supply

- 9.1.2. DC to DC Power Supply

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Open Frame Power Supply

- 9.2.2. Enclosed Power Supply

- 9.2.3. Adapter Power Supply

- 9.2.4. Converters

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 9.3.2. Surgical Equipment

- 9.3.3. Home Medical Equipment

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. AC to DC Power Supply

- 10.1.2. DC to DC Power Supply

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Open Frame Power Supply

- 10.2.2. Enclosed Power Supply

- 10.2.3. Adapter Power Supply

- 10.2.4. Converters

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Diagnostic, Imaging, and Monitoring Equipment

- 10.3.2. Surgical Equipment

- 10.3.3. Home Medical Equipment

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. North America Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Medical Power Supply Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Delta Electronics Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 XP Power

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Advanced Energy Industries Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 TDK-Lambda Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Powerbox International AB

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Spellman High Voltage Electronics Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Globtek Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Mean Well Enterprises Co Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 CUI Inc (Bel Fuse Inc )

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SL Industries Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Delta Electronics Inc

List of Figures

- Figure 1: Global Medical Power Supply Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 13: North America Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 14: North America Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 21: Europe Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 22: Europe Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Europe Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Europe Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 29: Asia Pacific Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 30: Asia Pacific Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Asia Pacific Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 37: Latin America Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 38: Latin America Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Latin America Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Latin America Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Medical Power Supply Market Revenue (Million), by Technology 2024 & 2032

- Figure 45: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Technology 2024 & 2032

- Figure 46: Middle East and Africa Medical Power Supply Market Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East and Africa Medical Power Supply Market Revenue (Million), by Application 2024 & 2032

- Figure 49: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: Middle East and Africa Medical Power Supply Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Medical Power Supply Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Power Supply Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Medical Power Supply Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Medical Power Supply Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 21: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 25: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 29: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Medical Power Supply Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 33: Global Medical Power Supply Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Medical Power Supply Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Medical Power Supply Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Power Supply Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Medical Power Supply Market?

Key companies in the market include Delta Electronics Inc, XP Power, Advanced Energy Industries Inc, TDK-Lambda Corporation, Powerbox International AB, Spellman High Voltage Electronics Corporation, Globtek Inc, Mean Well Enterprises Co Ltd, CUI Inc (Bel Fuse Inc ), SL Industries Inc.

3. What are the main segments of the Medical Power Supply Market?

The market segments include Technology, Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in Healthcare Equipment; Increasing Demand for Portable Home Care Devices.

6. What are the notable trends driving market growth?

Diagnostic and Monitoring Equipment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Regulatory Compliance and Safety Standards.

8. Can you provide examples of recent developments in the market?

December 2020 - CUI Inc. announced the addition of two 120-watt ac-dc external power supply series, expanding its existing 60601 certified medical power supply family. The new series footprint is 35% smaller than its non-medical counterpart, providing a lighter and less cumbersome adapter that can power a wide range of medical and dental devices. The SDM120-U is available with a C14 inlet, and the SDM120-UD comes with a C8 inlet. Both series meet the current average efficiency and no-load power specifications mandated by the US Department of Energy (DoE) under the Level VI standard, as well as the European Union's (EU) Ecodesign 2019/1782 and CoC Tier 2 directives for external power supplies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Power Supply Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Power Supply Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Power Supply Market?

To stay informed about further developments, trends, and reports in the Medical Power Supply Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence