Key Insights

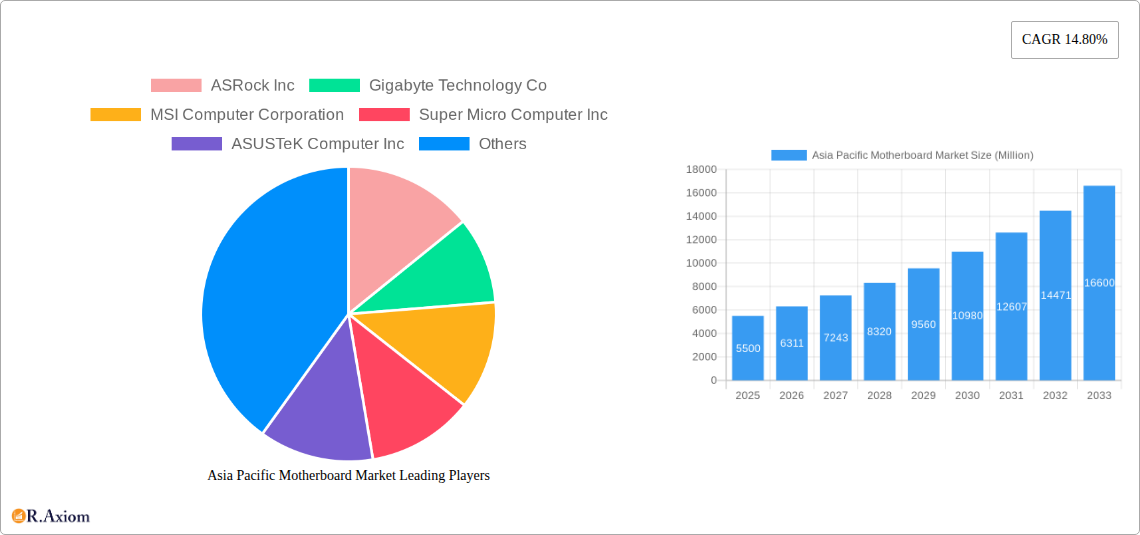

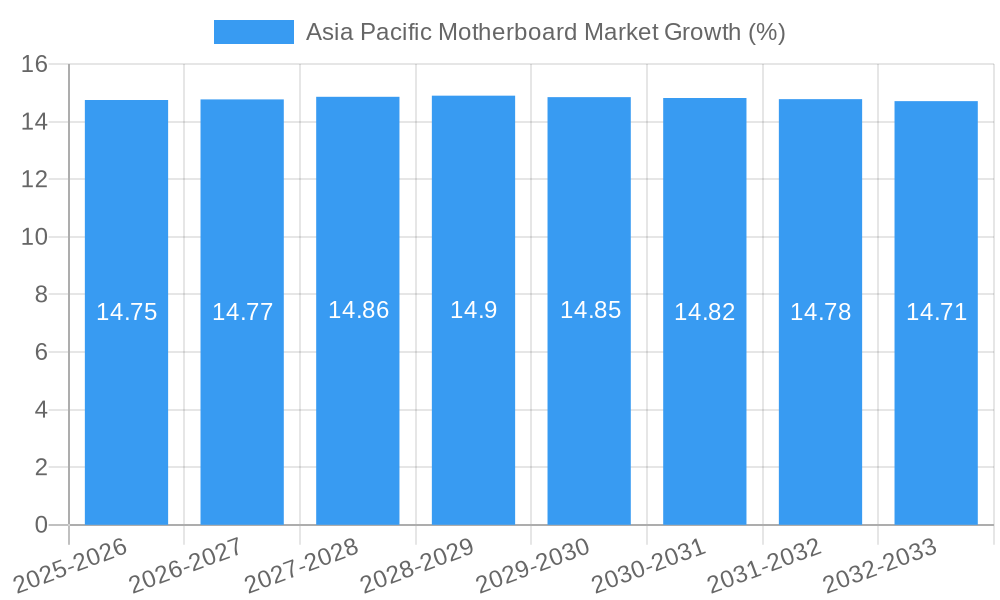

The Asia Pacific Motherboard Market is poised for substantial growth, projected to reach an estimated USD 5,500 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 14.80%. This impressive expansion is primarily fueled by the escalating demand for advanced computing solutions across both industrial and commercial sectors. The region's burgeoning economies, particularly China and India, are witnessing a surge in digitalization, leading to increased adoption of sophisticated IT infrastructure. Furthermore, Japan's established technological prowess continues to contribute significantly to market dynamics, while the Rest of Asia Pacific presents emerging opportunities. The market is segmented by form factors including ATX, Micro-ATX, and Mini-ITX, catering to diverse application needs, from high-performance gaming rigs to compact embedded systems. The proliferation of artificial intelligence, big data analytics, and the Internet of Things (IoT) are key drivers, necessitating more powerful and efficient motherboards.

The competitive landscape features prominent players such as ASRock Inc., Gigabyte Technology Co., MSI Computer Corporation, Super Micro Computer Inc., ASUSTeK Computer Inc., Biostar Inc., and Advantech Co Ltd. These companies are actively engaged in research and development, focusing on innovation in areas like power efficiency, connectivity, and integrated features to meet the evolving demands of the Asia Pacific market. While growth is strong, potential restraints could include supply chain disruptions and fluctuating component costs, though the overall market trajectory remains highly optimistic. The continuous evolution of consumer electronics, coupled with government initiatives promoting technological advancement, will further solidify the Asia Pacific Motherboard Market's expansion over the forecast period of 2025-2033.

This in-depth report provides a detailed analysis of the Asia Pacific Motherboard Market, a critical component for the rapidly evolving technology landscape across the region. With a forecast period extending from 2025 to 2033, building upon a historical analysis from 2019-2024 and a base year of 2025, this study offers unparalleled insights into market dynamics, key players, emerging trends, and strategic opportunities. The report leverages high-traffic keywords such as "motherboard market Asia Pacific," "PC components APAC," "ATX motherboard China," "Mini ITX India," "industrial motherboards Japan," and "gaming motherboards Southeast Asia" to enhance search visibility and reach industry stakeholders.

Asia Pacific Motherboard Market Market Concentration & Innovation

The Asia Pacific Motherboard Market exhibits a moderate to high level of market concentration, driven by the presence of established global manufacturers and a growing number of regional players. Key innovators like ASUSTeK Computer Inc., Gigabyte Technology Co., and MSI Computer Corporation are at the forefront of technological advancements, consistently introducing products with enhanced performance, power efficiency, and advanced features. Innovation in this sector is primarily fueled by the relentless demand for higher processing speeds, improved graphics capabilities for gaming and content creation, and the increasing integration of AI and IoT functionalities. Regulatory frameworks in the Asia Pacific region are generally supportive of technological growth, though specific import/export regulations and standards can vary by country. Product substitutes, while present in the broader computing market, are limited at the motherboard level, making it a distinct and crucial component. End-user trends are heavily influenced by the burgeoning gaming community, the expansion of the professional content creation sector, and the increasing adoption of industrial PCs and embedded systems. Mergers and acquisitions (M&A) activities, while not as frequent as in some other tech sectors, play a role in consolidating market share and acquiring innovative technologies. For instance, past M&A deals in the broader PC component space, with deal values ranging from tens of millions to hundreds of millions of USD, indicate the strategic importance of acquiring manufacturing capabilities and intellectual property in this region. The market share of leading players is closely watched, with ASUSTeK, Gigabyte, and MSI collectively holding a significant portion of the consumer segment.

Asia Pacific Motherboard Market Industry Trends & Insights

The Asia Pacific Motherboard Market is experiencing robust growth, propelled by a confluence of powerful market growth drivers. The escalating demand for high-performance computing, driven by the burgeoning gaming industry and the exponential rise of content creators, is a primary catalyst. This is further amplified by the increasing adoption of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) across various industrial and commercial applications, necessitating powerful and feature-rich motherboards. Technological disruptions, including the continuous innovation in CPU and GPU architectures, demand frequent motherboard upgrades to leverage the full potential of these components. The integration of faster memory technologies (DDR5), PCIe 5.0 support, and advanced cooling solutions are becoming standard. Consumer preferences are shifting towards specialized motherboards catering to specific needs, whether it's for high-end gaming rigs, compact SFF (Small Form Factor) builds, or reliable industrial solutions. Competitive dynamics are intense, with manufacturers vying for market share through product differentiation, aggressive pricing strategies, and strategic marketing campaigns. The estimated Compound Annual Growth Rate (CAGR) for the Asia Pacific Motherboard Market is projected to be in the range of 5% to 7% over the forecast period. Market penetration for advanced motherboards is steadily increasing as consumers and businesses alike recognize the value proposition of investing in superior hardware for enhanced productivity and performance. The region’s large population, growing disposable income, and a strong propensity for early adoption of new technologies further solidify its position as a key growth engine for the global motherboard industry.

Dominant Markets & Segments in Asia Pacific Motherboard Market

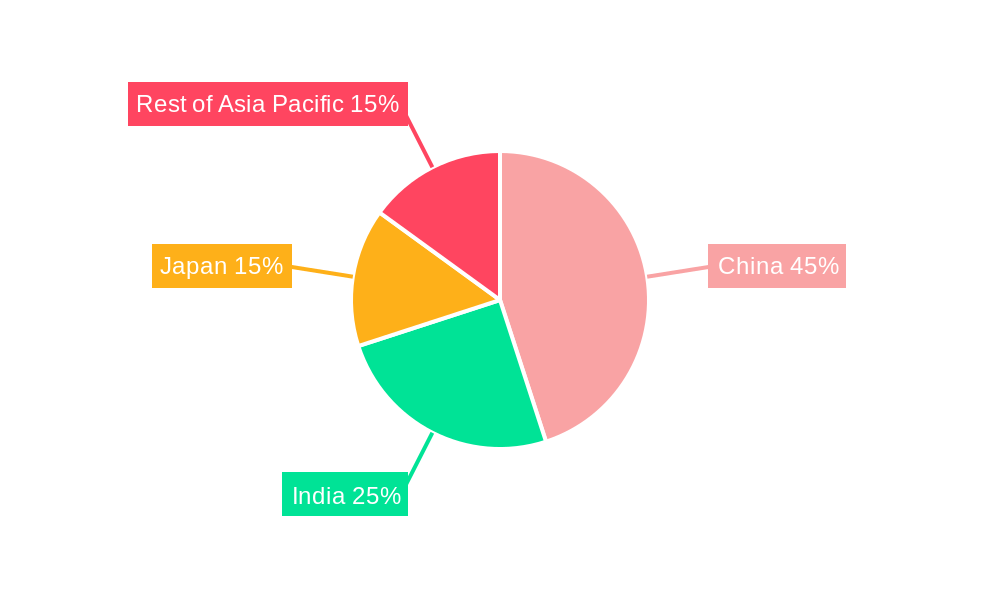

Within the Asia Pacific Motherboard Market, China stands out as the dominant geographical market, propelled by its massive manufacturing capabilities, a vast domestic consumer base, and a burgeoning technology ecosystem. The country's significant role in global electronics production, coupled with substantial investments in research and development, positions it as a key hub for both motherboard manufacturing and consumption.

- China's Dominance:

- Economic Policies: Favorable government policies supporting the electronics manufacturing sector and incentives for technological innovation contribute significantly to China's leadership.

- Infrastructure: Highly developed manufacturing infrastructure and supply chains enable efficient production and distribution of motherboards.

- Consumer Demand: A large and growing middle class with increasing disposable income drives demand for personal computers, gaming setups, and high-performance workstations.

- Industrial Adoption: The widespread adoption of industrial PCs and embedded systems in manufacturing, automation, and smart city initiatives further bolsters demand.

In terms of Form Factor, the ATX form factor continues to dominate the market due to its widespread compatibility, ample expansion slots, and robust cooling capabilities, making it the go-to choice for mainstream gaming PCs, workstations, and high-end desktop systems. However, the Micro-ATX and Mini ITX segments are experiencing notable growth, driven by the increasing popularity of compact PC builds for space-constrained environments and a growing interest in home theater PCs (HTPCs) and portable gaming rigs.

- ATX Dominance:

- Compatibility: Extensive support for multiple expansion cards, RAM slots, and storage devices.

- Cooling Solutions: Facilitates better airflow and supports larger CPU coolers and multiple chassis fans.

- Mainstream Appeal: Preferred by a vast majority of PC builders for its balance of features and expandability.

In the Type segmentation, the Commercial segment, encompassing business desktops, workstations, and server motherboards, holds a substantial market share due to the continuous demand for reliable computing solutions in enterprises. However, the Industrial segment is exhibiting the most rapid growth, fueled by the expansion of the Industrial Internet of Things (IIoT), smart manufacturing, automation, and the deployment of robust computing solutions in harsh environments.

- Industrial Segment Growth:

- IIoT Expansion: Increasing integration of connectivity and processing power in industrial machinery.

- Automation: Demand for reliable and durable motherboards for control systems in manufacturing and logistics.

- Harsh Environment Suitability: Industrial motherboards are designed for extended operation in extreme temperatures, humidity, and vibration.

India is emerging as a significant growth market, driven by a rapidly expanding IT sector, increasing PC penetration, and a growing gaming community. The "Make in India" initiative and government investments in digital infrastructure are further stimulating demand. Japan, with its mature technology market, continues to be a strong consumer of high-end motherboards, particularly for professional workstations and specialized industrial applications. The Rest of Asia-Pacific, including Southeast Asian nations like Vietnam, Thailand, and Indonesia, presents a burgeoning market with increasing disposable incomes and a growing appetite for gaming and personal computing devices.

Asia Pacific Motherboard Market Product Developments

Product developments in the Asia Pacific Motherboard Market are characterized by a relentless pursuit of performance enhancement and feature integration. Manufacturers are focused on supporting the latest CPU generations, offering advanced connectivity options like Wi-Fi 6E and 10Gb Ethernet, and incorporating robust power delivery systems for overclocking enthusiasts. Innovations also extend to improved audio solutions, enhanced VRM (Voltage Regulator Module) designs for better power stability, and user-friendly BIOS interfaces. Competitive advantages are being built through unique thermal management solutions, aesthetic design considerations for RGB lighting and custom builds, and specialized firmware optimizations for gaming and content creation workloads.

Report Scope & Segmentation Analysis

This report meticulously segments the Asia Pacific Motherboard Market across key dimensions, providing granular insights into market dynamics and growth prospects.

- Form Factor Segmentation: The report analyzes the ATX, Micro-ATX, and Mini ITX segments. The ATX form factor is expected to maintain its leading position due to its versatility, while Micro-ATX and Mini ITX are poised for significant growth driven by the demand for compact and SFF builds.

- Type Segmentation: The study delves into the Industrial and Commercial motherboard segments. The Commercial segment, encompassing business and enterprise solutions, will continue to be a stable revenue generator, while the Industrial segment is projected to witness the highest growth rate, fueled by IIoT and automation.

- Geography Segmentation: The report offers in-depth analysis of the China, India, Japan, and Rest of Asia-Pacific markets. China is identified as the dominant market, with India and the Rest of Asia-Pacific expected to exhibit the highest growth rates. Japan will remain a significant market for premium and specialized solutions.

Key Drivers of Asia Pacific Motherboard Market Growth

The Asia Pacific Motherboard Market is propelled by a powerful combination of technological advancements, economic factors, and evolving consumer behavior. The rapid proliferation of gaming and e-sports, coupled with the growing demand for content creation tools, fuels the need for high-performance motherboards that can support powerful CPUs and GPUs. The increasing adoption of AI and IoT in industrial and commercial sectors necessitates robust and feature-rich motherboards for advanced computing solutions. Economic growth across the region, leading to increased disposable incomes, translates into higher consumer spending on personal computing devices. Furthermore, government initiatives promoting digitalization and technological adoption in countries like India and China are creating a fertile ground for market expansion.

Challenges in the Asia Pacific Motherboard Market Sector

Despite its promising growth trajectory, the Asia Pacific Motherboard Market faces several challenges. Supply chain disruptions, exacerbated by global geopolitical events and component shortages, can impact production volumes and lead times, consequently affecting pricing. Intense competition among a large number of manufacturers leads to price wars, potentially squeezing profit margins. Evolving technological standards and the rapid pace of innovation require continuous investment in R&D, which can be a significant barrier for smaller players. Additionally, stringent environmental regulations and the need for sustainable manufacturing practices add to operational complexities and costs.

Emerging Opportunities in Asia Pacific Motherboard Market

The Asia Pacific Motherboard Market is ripe with emerging opportunities. The burgeoning market for Mini PCs and Small Form Factor (SFF) builds presents a significant growth avenue, driven by increasing urban density and demand for space-saving solutions. The rapid expansion of the Industrial Internet of Things (IIoT) and smart manufacturing initiatives across the region is creating substantial demand for specialized industrial motherboards with enhanced durability and connectivity. The growing e-sports and professional content creation sectors continue to drive demand for high-end motherboards with advanced features and superior performance. Furthermore, the increasing focus on sustainable technology is opening opportunities for manufacturers to develop energy-efficient and eco-friendly motherboard solutions.

Leading Players in the Asia Pacific Motherboard Market Market

- ASRock Inc

- Gigabyte Technology Co

- MSI Computer Corporation

- Super Micro Computer Inc

- ASUSTeK Computer Inc

- Biostar Inc

- Advantech Co Ltd

Key Developments in Asia Pacific Motherboard Market Industry

- July 2022: GIGABYTE won the Red Dot and iF Design Awards for 5 of its motherboard products, including the Z690 Aorus Xtreme Waterforce and Z690 Aorus Master. This marks the company's third consecutive year of recognition for motherboards designed for distinct, white-themed PCs.

- May 2022: Colorful Technology Company Limited, a China-based motherboard manufacturer, launched the iGame Z690D5 Ultra motherboard. This product is specifically engineered for gamers and content creators utilizing 12th generation Intel Core processors, focusing on high-performance PC builds.

Strategic Outlook for Asia Pacific Motherboard Market Market

- July 2022: GIGABYTE won the Red Dot and iF Design Awards for 5 of its motherboard products, including the Z690 Aorus Xtreme Waterforce and Z690 Aorus Master. This marks the company's third consecutive year of recognition for motherboards designed for distinct, white-themed PCs.

- May 2022: Colorful Technology Company Limited, a China-based motherboard manufacturer, launched the iGame Z690D5 Ultra motherboard. This product is specifically engineered for gamers and content creators utilizing 12th generation Intel Core processors, focusing on high-performance PC builds.

Strategic Outlook for Asia Pacific Motherboard Market Market

The strategic outlook for the Asia Pacific Motherboard Market is overwhelmingly positive, characterized by sustained growth and significant innovation. The region's strong economic fundamentals, coupled with a rapidly expanding digital economy and a tech-savvy population, will continue to drive demand across consumer, commercial, and industrial segments. Key growth catalysts include the ongoing evolution of gaming hardware, the persistent demand for high-performance workstations for content creation and professional applications, and the accelerating adoption of industrial IoT and automation solutions. Manufacturers are strategically investing in R&D to integrate next-generation technologies, optimize power efficiency, and enhance user experience, positioning them to capitalize on emerging market trends and secure a substantial share of this dynamic and expanding market.

Asia Pacific Motherboard Market Segmentation

-

1. Form

- 1.1. ATX

- 1.2. Micro-ATX

- 1.3. Mini ITX

-

2. Type

- 2.1. Industrial

- 2.2. Commercial

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia-Pacific

Asia Pacific Motherboard Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia Pacific Motherboard Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5.1 Increasing Focus on Miniaturization of Electronics5.2 Increasing Penetration of Connected and Smart Devices and Other Electronics in Asia-Pacific Region

- 3.3. Market Restrains

- 3.3.1. High cost involved in replacing the existing Deep UV with EUV lasers; Monopoly existing within the market

- 3.4. Market Trends

- 3.4.1. China is expected to acquire a significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. ATX

- 5.1.2. Micro-ATX

- 5.1.3. Mini ITX

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. China Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. ATX

- 6.1.2. Micro-ATX

- 6.1.3. Mini ITX

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. India Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. ATX

- 7.1.2. Micro-ATX

- 7.1.3. Mini ITX

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Japan Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. ATX

- 8.1.2. Micro-ATX

- 8.1.3. Mini ITX

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Rest of Asia Pacific Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. ATX

- 9.1.2. Micro-ATX

- 9.1.3. Mini ITX

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Industrial

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. China Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 11. Japan Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 12. India Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 13. South Korea Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 14. Taiwan Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 15. Australia Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia-Pacific Asia Pacific Motherboard Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 ASRock Inc

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Gigabyte Technology Co

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 MSI Computer Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Super Micro Computer Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 ASUSTeK Computer Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Biostar Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Advantech Co Ltd

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.1 ASRock Inc

List of Figures

- Figure 1: Asia Pacific Motherboard Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Motherboard Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Motherboard Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Motherboard Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 5: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 7: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: Asia Pacific Motherboard Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia Pacific Motherboard Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: China Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: China Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Japan Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: India Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Taiwan Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Taiwan Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia-Pacific Asia Pacific Motherboard Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Asia-Pacific Asia Pacific Motherboard Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 28: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 29: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 31: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 36: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 37: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 39: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 41: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 44: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 45: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 47: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 48: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 49: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: Asia Pacific Motherboard Market Revenue Million Forecast, by Form 2019 & 2032

- Table 52: Asia Pacific Motherboard Market Volume K Unit Forecast, by Form 2019 & 2032

- Table 53: Asia Pacific Motherboard Market Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Asia Pacific Motherboard Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 55: Asia Pacific Motherboard Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 56: Asia Pacific Motherboard Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 57: Asia Pacific Motherboard Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Asia Pacific Motherboard Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Motherboard Market?

The projected CAGR is approximately 14.80%.

2. Which companies are prominent players in the Asia Pacific Motherboard Market?

Key companies in the market include ASRock Inc, Gigabyte Technology Co, MSI Computer Corporation, Super Micro Computer Inc, ASUSTeK Computer Inc, Biostar Inc, Advantech Co Ltd.

3. What are the main segments of the Asia Pacific Motherboard Market?

The market segments include Form , Type , Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

5.1 Increasing Focus on Miniaturization of Electronics5.2 Increasing Penetration of Connected and Smart Devices and Other Electronics in Asia-Pacific Region.

6. What are the notable trends driving market growth?

China is expected to acquire a significant market share.

7. Are there any restraints impacting market growth?

High cost involved in replacing the existing Deep UV with EUV lasers; Monopoly existing within the market.

8. Can you provide examples of recent developments in the market?

May 2022 - Colorful Technology Company Limited, a manufacturer of motheboards in China announced the launch of iGame Z690D5 Ultra motherboard for the 12th generation Intel Core processors. The product is designed with respect to the gamers and content creators for building high-perfomance PC.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Motherboard Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Motherboard Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Motherboard Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Motherboard Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence