Key Insights

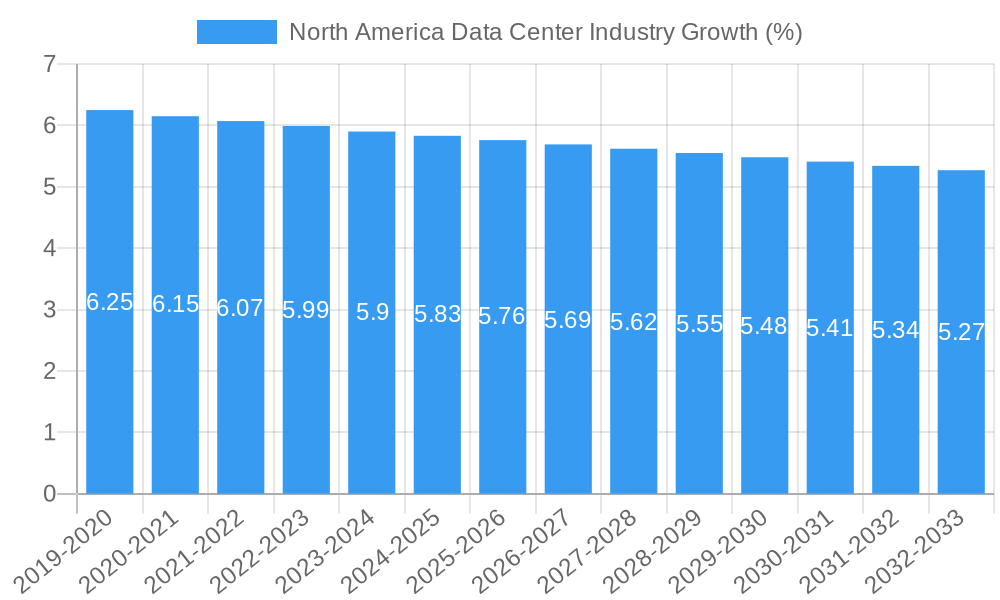

The North America Data Center Industry is poised for robust growth, projected to reach a market size of approximately $85,000 million by 2025, driven by a compound annual growth rate (CAGR) of 6.00%. This expansion is fueled by an insatiable demand for digital infrastructure, propelled by the escalating adoption of cloud computing, the rapid growth of e-commerce, and the increasing reliance on data-intensive applications across various sectors. Key drivers include the continuous expansion of hyperscale facilities to support massive data processing and storage needs, alongside the burgeoning demand for colocation services as businesses increasingly outsource their IT infrastructure to specialized providers. The proliferation of 5G technology, the advancement of AI and machine learning, and the rise of the Internet of Things (IoT) are further intensifying the need for high-performance, scalable, and secure data center solutions. While the market benefits from substantial investments and technological advancements, it also faces restraints such as the high capital expenditure required for building and maintaining advanced data centers, along with growing concerns around energy consumption and environmental sustainability. Emerging trends like edge computing and the development of more energy-efficient cooling systems are shaping the future landscape, promising to address these challenges and unlock new avenues for growth.

The market segmentation offers a nuanced view of the opportunities within the North America Data Center Industry. The "Large" and "Mega" data center sizes are expected to dominate, reflecting the scale of operations for hyperscale and large enterprise clients. The dominance of "Tier 3" and "Tier 4" facilities underscores the critical need for high availability and fault tolerance, particularly for end-users like BFSI and Government sectors. Colocation continues to be a significant segment, with "Hyperscale" colocation leading the charge due to the immense scale required by cloud providers and large tech companies. "Wholesale" colocation is also experiencing strong demand as businesses seek dedicated space and power for their growing infrastructure. The "Cloud" and "BFSI" end-users are anticipated to be the most significant contributors to market revenue, owing to their extensive data needs and stringent uptime requirements. The "Telecom" sector is also a vital component, supporting the infrastructure for 5G and expanding network capabilities. As the digital transformation accelerates across all industries, the demand for flexible, scalable, and resilient data center solutions in North America is set to experience sustained and significant expansion.

North America Data Center Industry Report: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the North America Data Center Industry, a critical sector experiencing unprecedented growth and transformation. Covering the period from 2019 to 2033, with a base year of 2025, this research offers critical insights for data center operators, investors, technology providers, and end-users. We delve into market concentration, innovation drivers, emerging trends, dominant segments, product developments, growth catalysts, challenges, and future opportunities. This report is essential for understanding the competitive landscape, strategic decision-making, and capitalizing on the vast potential of the North American data center market.

North America Data Center Industry Market Concentration & Innovation

The North America Data Center Industry is characterized by a moderate to high level of market concentration, with a few key players dominating significant market share. Major companies like Equinix Inc., Digital Realty Trust Inc., and CyrusOne Inc. hold substantial portions of the market, driven by extensive infrastructure, strategic acquisitions, and long-term customer contracts. Innovation is a continuous driver, fueled by the increasing demand for higher power densities, advanced cooling technologies, and sustainable energy solutions. Key innovation areas include liquid cooling, AI-powered operational efficiency, and modular data center designs. Regulatory frameworks, while varied across different regions, are increasingly focusing on energy efficiency, data privacy, and environmental impact, influencing construction and operational standards. Product substitutes are limited in the core data center colocation market, but edge computing and on-premises solutions can represent alternative strategies for some end-users. End-user trends highlight a strong shift towards cloud adoption, hyperscale deployments, and the increasing need for low-latency connectivity, especially for AI and IoT applications. Mergers and acquisitions (M&A) activity remains robust, with significant deal values reflecting the consolidation and expansion strategies within the industry. For instance, the USD 11 billion acquisition of Switch, Inc. by DigitalBridge Group, Inc. and IFM Investors in December 2022 underscores the significant capital investment and strategic consolidation occurring. Companies are actively acquiring smaller players to expand their geographic reach, enhance their service portfolios, and secure market share.

North America Data Center Industry Industry Trends & Insights

The North America Data Center Industry is poised for substantial growth, driven by a confluence of technological advancements, escalating digital transformation, and evolving consumer behaviors. The Compound Annual Growth Rate (CAGR) for the forecast period is projected to be robust, exceeding xx% annually as organizations increasingly rely on digital infrastructure to support their operations and innovation. Market penetration of data center services continues to expand across various sectors, with significant growth anticipated in cloud computing, artificial intelligence, and the Internet of Things (IoT).

Technological disruptions are at the forefront of this evolution. The proliferation of 5G networks is creating a demand for distributed data center infrastructure, including edge data centers, to reduce latency and enhance real-time processing capabilities. Artificial intelligence (AI) and machine learning (ML) are not only driving the demand for more powerful and scalable computing resources but are also being integrated into data center operations for optimized power management, predictive maintenance, and enhanced security. The ongoing shift towards sustainability is another critical trend, with a growing emphasis on renewable energy sources, efficient cooling systems (such as liquid cooling), and carbon footprint reduction. This focus is driven by both regulatory pressures and corporate social responsibility initiatives.

Consumer preferences are also shaping the industry. The exponential growth in data generation from streaming services, online gaming, social media, and e-commerce necessitates continuous expansion and modernization of data center facilities. Businesses are demanding greater flexibility, scalability, and resilience from their data center providers, leading to increased adoption of hybrid and multi-cloud strategies. This, in turn, requires data centers to offer seamless connectivity and interoperability.

Competitive dynamics are intensifying, with established players like Equinix Inc., Digital Realty Trust Inc., and CyrusOne Inc. facing competition from both established infrastructure providers expanding their data center footprints and newer, specialized companies focusing on niche markets or innovative technologies. The demand for hyperscale data centers is soaring, driven by cloud service providers, while retail and wholesale colocation services continue to cater to a broader range of enterprise needs. The industry is witnessing significant investment in new constructions and expansions, reflecting the optimistic outlook and the critical role of data centers in the global digital economy.

Dominant Markets & Segments in North America Data Center Industry

The North America Data Center Industry is a multifaceted market with distinct dominant regions and segments, driven by a complex interplay of economic policies, robust infrastructure, and strong technological adoption.

Dominant Region: The United States stands as the undisputed leader in the North American data center market, accounting for a significant majority of deployed capacity and investment. This dominance is attributed to its large, technologically advanced economy, a robust regulatory environment conducive to business, and a high concentration of major cloud providers and enterprises. Key data center hubs in Northern Virginia, Silicon Valley, Dallas, and Chicago continue to attract substantial investments and exhibit high absorption rates.

Dominant Data Center Size: Mega and Large data centers are increasingly dominant, reflecting the insatiable demand from hyperscale cloud providers and large enterprises for massive computing power and storage. These facilities, often exceeding 1 Million square feet, are crucial for supporting global cloud infrastructure and massive data processing needs. However, the growth of edge computing is also spurring the development and deployment of Medium and even Small data centers in strategic, localized areas to reduce latency for specific applications.

Dominant Tier Type: Tier 3 and Tier 4 data centers are the most sought-after and dominant categories. This is driven by the critical nature of the services hosted within these facilities, where uptime and redundancy are paramount. Tier 3 facilities offer concurrently maintainable systems, while Tier 4 provides fault tolerance for all IT components. While Tier 1 and 2 data centers may exist for less critical applications, the majority of new investments and deployments focus on higher-tier certifications to meet stringent reliability requirements.

Dominant Absorption Status: While Non-Utilized capacity is a necessary component of any healthy data center market, the trend is towards higher utilization rates for existing facilities due to strong demand. The focus is on new development and expansion to meet projected future needs.

Dominant Colocation Type: Hyperscale colocation is the leading segment, driven by the massive build-outs of major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These providers require vast, dedicated spaces within data centers to house their global infrastructure. Wholesale colocation also holds significant market share, catering to large enterprises that require substantial, dedicated space and power. Retail colocation, while important for smaller businesses and specific needs, represents a smaller portion of the overall market growth compared to hyperscale and wholesale.

Dominant End User: The Cloud sector is by far the largest and fastest-growing end-user segment, driving demand for hyperscale facilities. The BFSI (Banking, Financial Services, and Insurance) sector is another major consumer, requiring secure and highly available data center infrastructure for their sensitive operations and extensive transaction processing. E-Commerce businesses also contribute significantly to demand, fueled by the global surge in online retail. Telecom providers are increasingly expanding their footprint within data centers to support network infrastructure and evolving connectivity demands. The Government sector, particularly for national security and public services, also represents a substantial and stable demand driver. Manufacturing is seeing increased adoption of data center solutions for industrial automation and IoT, while Media & Entertainment relies heavily on data centers for content creation, storage, and distribution.

Key drivers for dominance in these segments include:

- Economic Policies: Favorable tax incentives and investment policies in regions like the US encourage data center development.

- Infrastructure: Availability of robust power grids, fiber optic networks, and skilled labor are critical.

- Technological Advancement: Leading adoption of new technologies like AI, 5G, and IoT fuels demand.

- Data Privacy Regulations: Stringent data privacy laws in North America necessitate secure, compliant data center solutions.

- Digital Transformation Initiatives: Widespread adoption of digital services across all industries requires scalable data center capacity.

North America Data Center Industry Product Developments

Product developments in the North America Data Center Industry are focused on enhancing efficiency, scalability, and sustainability. Innovations in liquid cooling technologies are enabling higher power densities to support increasingly powerful hardware. Advancements in modular and prefabricated data center designs are speeding up deployment times and offering greater flexibility. The integration of AI and machine learning into data center management software is optimizing power usage, improving cooling efficiency, and enabling predictive maintenance, thereby enhancing operational resilience and reducing costs. Furthermore, there's a growing emphasis on sustainable energy solutions, including advanced battery storage, on-site renewable energy generation, and energy-efficient hardware, giving providers a competitive advantage in meeting the ESG demands of their clients. These developments are crucial for meeting the evolving needs of hyperscale cloud providers, enterprises, and the burgeoning edge computing market.

Report Scope & Segmentation Analysis

This report meticulously analyzes the North America Data Center Industry across several key segmentation dimensions, providing granular insights into market sizes, growth projections, and competitive dynamics for the period 2019–2033.

- Data Center Size: The market is segmented into Large, Massive, Medium, Mega, and Small data centers. The Mega and Massive segments are projected to witness the highest growth due to hyperscale demand, while Medium and Small data centers will see significant expansion driven by edge computing deployments and specialized enterprise needs.

- Tier Type: Analysis includes Tier 1 and 2, Tier 3, and Tier 4 data centers. The Tier 3 and Tier 4 segments are expected to dominate in terms of investment and deployment, reflecting the critical need for high availability and redundancy across industries.

- Absorption: The report examines Non-Utilized capacity, essential for market flexibility, and also projects the increasing utilization rates in occupied facilities as demand escalates.

- Colocation Type: Segments covered are Hyperscale, Retail, and Wholesale. The Hyperscale segment is anticipated to experience the most rapid growth, driven by cloud providers. Wholesale colocation will remain a significant segment for large enterprises, while Retail will cater to a broader range of SME needs.

- End User: Key end-user industries analyzed include BFSI, Cloud, E-Commerce, Government, Manufacturing, Media & Entertainment, Telecom, and Other End User. The Cloud sector is expected to lead in market size and growth, followed closely by BFSI and E-Commerce.

Key Drivers of North America Data Center Industry Growth

The North America Data Center Industry's growth is propelled by several powerful forces:

- Digital Transformation: The ongoing, widespread digital transformation across all sectors of the economy, from BFSI to manufacturing, necessitates robust and scalable data center infrastructure to support cloud computing, big data analytics, and AI/ML initiatives.

- Exponential Data Growth: The relentless increase in data generation from sources like IoT devices, streaming services, and social media is driving demand for increased storage and processing capacity.

- Cloud Computing Adoption: The continued migration of workloads to public, private, and hybrid clouds by businesses of all sizes is a primary growth catalyst, requiring extensive hyperscale and wholesale data center capacity.

- Emergence of Edge Computing: The demand for low-latency applications, such as autonomous vehicles, smart cities, and real-time analytics, is fueling the growth of distributed edge data centers.

- 5G Network Rollout: The widespread deployment of 5G networks is creating new opportunities and demanding localized data processing capabilities, further stimulating data center growth.

Challenges in the North America Data Center Industry Sector

Despite robust growth, the North America Data Center Industry faces several significant challenges:

- High Energy Consumption and Sustainability Pressures: The substantial energy requirements of data centers are leading to increased scrutiny regarding their environmental impact, necessitating investments in renewable energy and energy-efficient technologies.

- Land Acquisition and Permitting: Securing suitable land in desirable locations and navigating complex, often lengthy, permitting processes can be a major bottleneck for new construction and expansion projects.

- Supply Chain Disruptions and Material Costs: Global supply chain issues and rising costs of key components like transformers, switchgear, and specialized cooling equipment can impact project timelines and budgets.

- Skilled Labor Shortage: The industry faces a growing shortage of skilled professionals for designing, building, operating, and maintaining advanced data center facilities.

- Regulatory Compliance: Adhering to diverse and evolving regulations related to data privacy, security, and environmental standards across different jurisdictions adds complexity and cost.

Emerging Opportunities in North America Data Center Industry

The North America Data Center Industry is ripe with emerging opportunities:

- Edge Data Centers: The rapid expansion of 5G, IoT, and AI is creating a significant demand for distributed edge data centers closer to end-users, enabling lower latency and real-time processing.

- Sustainable Data Centers: Growing environmental consciousness and regulatory pressures present opportunities for providers who can offer highly energy-efficient facilities powered by renewable energy sources, including innovative cooling solutions and waste heat reuse.

- AI/ML-Optimized Infrastructure: The surge in AI and ML workloads demands specialized infrastructure, including high-density computing and advanced cooling, creating opportunities for providers who can cater to these specific needs.

- Data Center as a Service (DaaS): Emerging models offering comprehensive data center solutions, including infrastructure, connectivity, and managed services, are gaining traction with businesses looking to offload operational complexities.

- Expansion into Secondary and Tertiary Markets: As primary markets become saturated and land becomes scarce, there are growing opportunities to develop data centers in less established, but strategically important, secondary and tertiary markets.

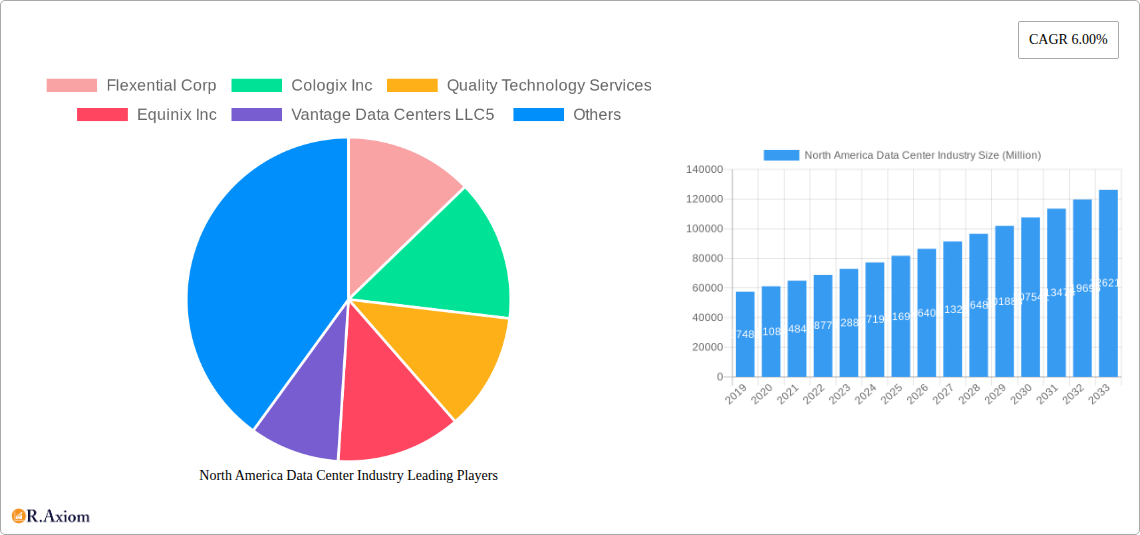

Leading Players in the North America Data Center Industry Market

- Flexential Corp

- Cologix Inc

- Quality Technology Services

- Equinix Inc

- Vantage Data Centers LLC

- Cyxtera Technologies

- Switch

- CoreSite (America Tower Corporation)

- Digital Realty Trust Inc

- CyrusOne Inc

- Edgecore (Partners Group)

- NTT Ltd

Key Developments in North America Data Center Industry Industry

- January 2023: Construction has begun on a new facility for US data center operator EdgeCore Digital Infrastructure in Santa Clara, California. On the intersection of Juliet Lane and Laurelwood Road, the first of two planned data centers has officially begun construction, according to the business. The two-story SV01 will have 255,200 square feet of space and provide 36 Megawatts.

- December 2022: DigitalBridge Group, Inc. and IFM Investors announced completing their previously announced transaction in which funds affiliated with the investment management platform of DigitalBridge and an affiliate of IFM Investors acquired all outstanding common shares of Switch, Inc. for USD approximately USD 11 billion, including the repayment of outstanding debt.

- October 2022: Three additional data centers in Charlotte, Nashville, and Louisville have been made available to Flexential's cloud customers, according to the supplier of data center colocation, cloud computing, and connectivity. By the end of the year, clients will have access to more than 220MW of hybrid IT capacity spread across 40 data centers in 19 markets, which is well aligned with Flexential's 2022 ambition to add 33MW of new, sustainable data center development projects.

Strategic Outlook for North America Data Center Industry Market

The strategic outlook for the North America Data Center Industry remains exceptionally positive, driven by the persistent demand for digital infrastructure. Future growth will be shaped by continued investment in hyperscale and edge computing capabilities, with a strong emphasis on sustainable practices and energy efficiency becoming a competitive differentiator. Companies that can offer innovative solutions for AI/ML workloads, robust connectivity, and flexible, scalable capacity will be well-positioned. Strategic partnerships and consolidations are expected to continue as players seek to expand their geographic reach and service offerings. The industry's ability to navigate regulatory landscapes, secure power, and address skilled labor shortages will be crucial for sustained expansion and meeting the ever-increasing digital demands of businesses and consumers.

North America Data Center Industry Segmentation

-

1. Data Center Size

- 1.1. Large

- 1.2. Massive

- 1.3. Medium

- 1.4. Mega

- 1.5. Small

-

2. Tier Type

- 2.1. Tier 1 and 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

- 3.1. Non-Utilized

-

4. Colocation Type

- 4.1. Hyperscale

- 4.2. Retail

- 4.3. Wholesale

-

5. End User

- 5.1. BFSI

- 5.2. Cloud

- 5.3. E-Commerce

- 5.4. Government

- 5.5. Manufacturing

- 5.6. Media & Entertainment

- 5.7. Telecom

- 5.8. Other End User

North America Data Center Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Data Center Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 5.1.1. Large

- 5.1.2. Massive

- 5.1.3. Medium

- 5.1.4. Mega

- 5.1.5. Small

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 and 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Non-Utilized

- 5.4. Market Analysis, Insights and Forecast - by Colocation Type

- 5.4.1. Hyperscale

- 5.4.2. Retail

- 5.4.3. Wholesale

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. BFSI

- 5.5.2. Cloud

- 5.5.3. E-Commerce

- 5.5.4. Government

- 5.5.5. Manufacturing

- 5.5.6. Media & Entertainment

- 5.5.7. Telecom

- 5.5.8. Other End User

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 6. United States North America Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Flexential Corp

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Cologix Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Quality Technology Services

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Equinix Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Vantage Data Centers LLC5

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cyxtera Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Switch

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 CoreSite (America Tower Corporation)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Digital Realty Trust Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 CyrusOne Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Edgecore (Partners Group)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 NTT Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Flexential Corp

List of Figures

- Figure 1: North America Data Center Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Data Center Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Data Center Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Data Center Industry Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: North America Data Center Industry Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 5: North America Data Center Industry Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 6: North America Data Center Industry Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 7: North America Data Center Industry Revenue Million Forecast, by Absorption 2019 & 2032

- Table 8: North America Data Center Industry Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 9: North America Data Center Industry Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 10: North America Data Center Industry Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 11: North America Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 12: North America Data Center Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 13: North America Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: North America Data Center Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 15: North America Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Data Center Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: United States North America Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States North America Data Center Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Canada North America Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Data Center Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico North America Data Center Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of North America North America Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of North America North America Data Center Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: North America Data Center Industry Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 26: North America Data Center Industry Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 27: North America Data Center Industry Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 28: North America Data Center Industry Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 29: North America Data Center Industry Revenue Million Forecast, by Absorption 2019 & 2032

- Table 30: North America Data Center Industry Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 31: North America Data Center Industry Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 32: North America Data Center Industry Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 33: North America Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 34: North America Data Center Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 35: North America Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Data Center Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: United States North America Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United States North America Data Center Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Canada North America Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Canada North America Data Center Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Mexico North America Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico North America Data Center Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Data Center Industry?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the North America Data Center Industry?

Key companies in the market include Flexential Corp, Cologix Inc, Quality Technology Services, Equinix Inc, Vantage Data Centers LLC5 , Cyxtera Technologies, Switch, CoreSite (America Tower Corporation), Digital Realty Trust Inc, CyrusOne Inc, Edgecore (Partners Group), NTT Ltd.

3. What are the main segments of the North America Data Center Industry?

The market segments include Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

January 2023: Construction has begun on a new facility for US data center operator EdgeCore Digital Infrastructure in Santa Clara, California. On the intersection of Juliet Lane and Laurelwood Road, the first of two planned data centers has officially begun construction, according to the business. The two-story SV01 will have 255,200 square feet of space and provide 36 Megawatts.December 2022: DigitalBridge Group, Inc. and IFM Investors announced completing their previously announced transaction in which funds affiliated with the investment management platform of DigitalBridge and an affiliate of IFM Investors acquired all outstanding common shares of Switch, Inc. for USD approximately USD 11 billion, including the repayment of outstanding debt.October 2022: Three additional data centers in Charlotte, Nashville, and Louisville have been made available to Flexential's cloud customers, according to the supplier of data center colocation, cloud computing, and connectivity. By the end of the year, clients will have access to more than 220MW of hybrid IT capacity spread across 40 data centers in 19 markets, which is well aligned with Flexential's 2022 ambition to add 33MW of new, sustainable data center development projects.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Data Center Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Data Center Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Data Center Industry?

To stay informed about further developments, trends, and reports in the North America Data Center Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence