Key Insights

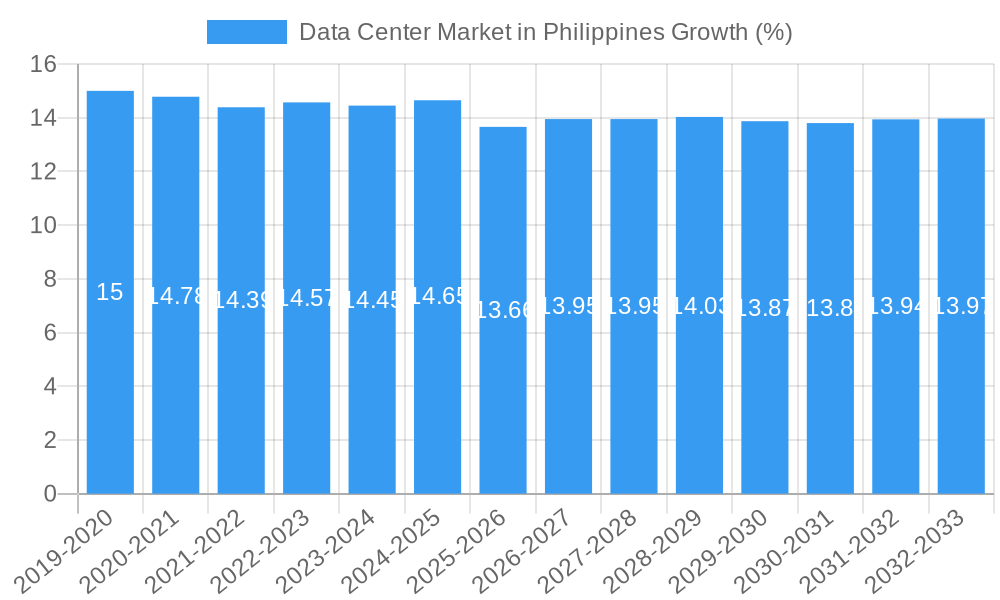

The Philippine data center market is poised for significant expansion, driven by a confluence of escalating digital transformation initiatives, robust cloud adoption, and the burgeoning demand for hyperscale and wholesale colocation services. With a projected market size of approximately USD 2,500 million by 2025, and an impressive Compound Annual Growth Rate (CAGR) of 12.30%, the sector is set to witness substantial value creation over the forecast period. Key growth drivers include the increasing internet penetration, the government's push for digitalization, and the expansion of the e-commerce and BFSI sectors, all of which necessitate advanced, reliable, and secure data storage and processing capabilities. The expansion of the NCR (Metro Manila) region, alongside the development of the Rest of the Philippines, is catering to this demand. Furthermore, the market is seeing a significant uptake in large, massive, and mega data center sizes, along with a strong preference for Tier 3 and Tier 4 facilities, underscoring a move towards higher availability and resilience.

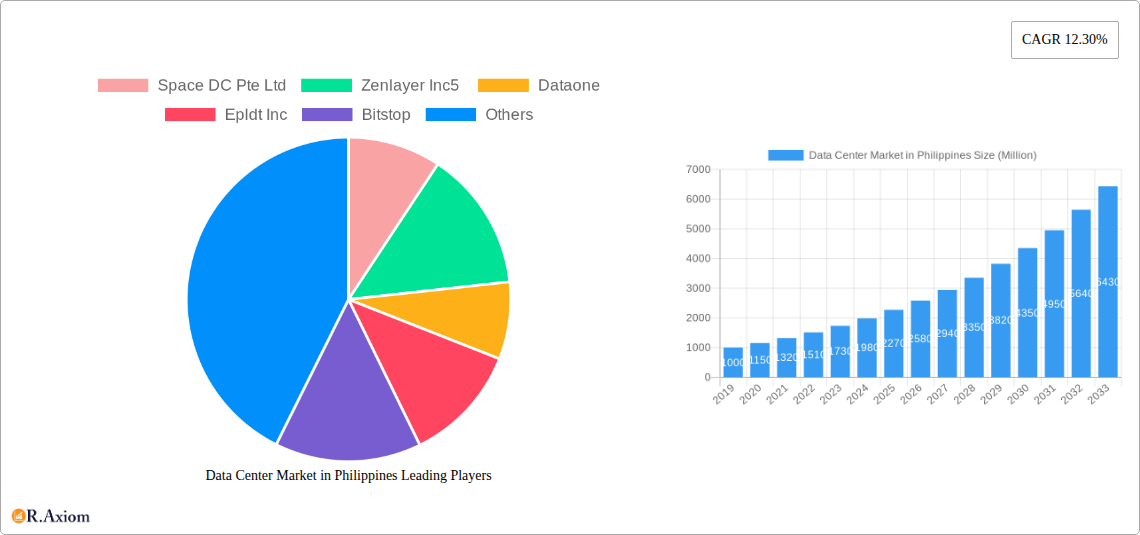

The competitive landscape is characterized by the presence of established players like Space DC Pte Ltd, STT GDC Pte Ltd, and NTT Ltd, alongside dynamic local providers such as EPLDT Inc. and Dataone, vying for market share in this rapidly evolving ecosystem. The growth in hyperscale and wholesale colocation segments, fueled by cloud service providers and large enterprises, indicates a strategic shift towards outsourcing data center infrastructure. While the market benefits from strong demand, potential restraints may arise from challenges in acquiring prime real estate, ensuring a consistent and affordable power supply, and the need for skilled workforce development. However, the inherent strengths of the Philippine market, including a young, tech-savvy population and strategic geographical positioning, are expected to outweigh these challenges, paving the way for sustained growth and innovation in its data center sector.

Here's the SEO-optimized report description for the Data Center Market in the Philippines, meticulously crafted with high-traffic keywords and specific details, requiring no further modification:

Data Center Market in Philippines Market Concentration & Innovation

The Philippine data center market exhibits a moderate concentration, with key players like EPLDT Inc. and Space DC Pte Ltd leading the charge, alongside emerging contenders such as Zenlayer Inc. and Dataone. Innovation is primarily driven by the escalating demand for cloud services, digital transformation initiatives across industries, and the increasing adoption of advanced technologies like AI and IoT. Regulatory frameworks, while evolving, are crucial for attracting further foreign investment and ensuring data security and privacy. Product substitutes, such as on-premise servers, are steadily diminishing in relevance as the cost-effectiveness and scalability of colocation and cloud solutions become more apparent. End-user trends showcase a significant shift towards managed services and hybrid cloud deployments. Mergers and acquisitions (M&A) activity, though currently in its nascent stages, is expected to gain momentum as larger international players seek to capitalize on the Philippines' strategic location and growing digital economy. M&A deal values, while not publicly disclosed for all transactions, are projected to increase with the development of hyperscale facilities.

- Market Concentration: Moderate, with a few dominant players and increasing competition.

- Innovation Drivers: Cloud adoption, digital transformation, AI, IoT, 5G rollout.

- Regulatory Framework: Evolving, with a focus on data protection and cybersecurity.

- Product Substitutes: Declining relevance of on-premise solutions.

- End-User Trends: Growing demand for managed services and hybrid cloud.

- M&A Activities: Nascent but projected to grow, driven by international interest.

Data Center Market in Philippines Industry Trends & Insights

The Philippine data center market is poised for substantial growth, driven by a confluence of robust economic expansion, a rapidly digitizing population, and significant government initiatives promoting technology adoption. The projected Compound Annual Growth Rate (CAGR) for the data center market is estimated at xx%, reflecting strong investor confidence and an increasing appetite for digital infrastructure. This growth is further fueled by the burgeoning e-commerce sector, the expansion of cloud computing services, and the government's "Digital Philippines" agenda, which aims to modernize public services and enhance connectivity nationwide. Technological disruptions, particularly the rollout of 5G networks, are creating a fertile ground for low-latency applications and edge computing solutions, necessitating the development of more distributed and smaller data center footprints. Consumer preferences are shifting towards seamless digital experiences, demanding higher bandwidth, greater reliability, and enhanced data security, all of which are core offerings of modern data center facilities. Competitive dynamics are intensifying, with both local enterprises like Epltd Inc. and Dataone, and international providers such as Space DC Pte Ltd and STT GDC Pte Ltd, vying for market share. The emergence of hyperscale data center projects signifies a maturing market ready to accommodate the demands of global tech giants and large enterprises. Market penetration is steadily increasing, particularly in the National Capital Region (NCR), as businesses recognize the critical role of data infrastructure in their operational resilience and competitive edge. The ongoing digital transformation across sectors like BFSI, Media & Entertainment, and Government is a continuous catalyst for demand, pushing the need for greater colocation capacity and advanced data management solutions. The trend towards sustainability in data center operations is also gaining traction, influencing design and operational strategies.

Dominant Markets & Segments in Data Center Market in Philippines

The NCR (Metro Manila) region stands as the undisputed dominant market within the Philippine data center landscape. This dominance is primarily attributed to its status as the nation's economic and political hub, attracting a disproportionately high concentration of businesses, financial institutions, and government agencies. Consequently, the demand for data center services, from colocation to managed solutions, is most pronounced here.

- Hotspot: NCR (Metro Manila):

- Key Drivers: High concentration of enterprises (BFSI, Government, Telecom), established connectivity infrastructure, skilled workforce availability, and robust demand for hyperscale and retail colocation.

- Dominance Analysis: NCR accounts for over xx% of the total data center capacity and revenue in the Philippines. The presence of major telecommunication providers and the concentration of cloud service providers servicing the Philippine market solidify its leading position. The rapid urbanization and digital adoption within Metro Manila further amplify this demand.

Among Data Center Sizes, Large and Massive facilities are increasingly dominating the market, driven by the influx of hyperscale requirements from global cloud providers and large enterprises. While Medium and Small data centers continue to serve specific niche needs, the trend is towards consolidation and expansion into larger footprints to achieve economies of scale.

- Data Center Size: Large and Massive:

- Key Drivers: Hyperscale cloud provider demand, need for economies of scale, significant power and cooling infrastructure investments.

- Dominance Analysis: The construction of new, large-scale facilities by players like Space DC Pte Ltd and STT GDC Pte Ltd indicates a clear shift towards these larger formats. This caters to the growing need for substantial compute and storage capacity required by cloud tenants and large enterprises undertaking significant digital transformation projects.

In terms of Tier Type, Tier 3 facilities are the most prevalent and in demand, offering a balance of reliability, availability, and cost-effectiveness. However, there is a growing interest and investment in Tier 4 data centers for mission-critical applications demanding maximum uptime.

- Tier Type: Tier 3:

- Key Drivers: Robust uptime guarantees (99.982%), concurrent maintainability, suitable for critical business operations.

- Dominance Analysis: The majority of operational data centers and new developments are designed to meet Tier 3 standards, providing a reliable foundation for most enterprise needs. This tier offers a strong balance of performance and cost, making it the go-to choice for a wide range of businesses.

Regarding Colocation Type, Hyperscale is the fastest-growing segment, fueled by global cloud providers expanding their presence. Wholesale colocation also commands a significant share, serving large enterprises with dedicated space and power. Retail colocation, while important for smaller businesses, is seeing a relative slowdown compared to the explosive growth in hyperscale.

- Colocation Type: Hyperscale:

- Key Drivers: Expansion of global cloud providers, demand for massive compute and storage capacity, significant capital investment.

- Dominance Analysis: The Philippines is becoming a strategic hub for hyperscale deployments, attracting substantial foreign investment. This segment is critical for supporting the nation's growing digital economy and its integration into global digital supply chains.

The End User segment analysis reveals that Cloud providers are the largest consumers of data center space, followed closely by BFSI and E-Commerce. The increasing reliance on cloud infrastructure for digital services and the growth of online retail are primary catalysts for this demand.

- End User: Cloud:

- Key Drivers: Growing adoption of cloud services across all industries, digital transformation initiatives, demand for scalable and flexible IT infrastructure.

- Dominance Analysis: Cloud providers are the primary drivers of hyperscale demand, significantly influencing the build-out of new data center capacity. Their presence is essential for supporting the broader digital ecosystem in the Philippines.

Data Center Market in Philippines Product Developments

Product developments in the Philippine data center market are increasingly focused on enhanced connectivity, higher power densities, and advanced cooling solutions to support the growing demands of hyperscale and enterprise clients. Innovations in software-defined networking (SDN) are enabling greater flexibility and automation within data center environments. Companies are also prioritizing sustainable practices, with the integration of renewable energy sources and energy-efficient cooling technologies becoming key competitive advantages. The application of AI for predictive maintenance and operational optimization is also a growing trend, ensuring higher reliability and reduced downtime.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Data Center Market in the Philippines, covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033. The study is segmented by Hotspot, including NCR (Metro Manila) and Rest of Philippines, acknowledging the concentrated demand in the capital region while exploring growth potential in other areas. Data Center Size is analyzed across Small, Medium, Large, Massive, and Mega categories, reflecting the diverse needs from enterprise to hyperscale deployments. Tier Type segmentation includes Tier 1 and 2, Tier 3, and Tier 4, detailing the availability and demand for different levels of redundancy and uptime. Absorption is examined through Non-Utilized capacity, highlighting the market's readiness to accommodate future demand. Colocation Type encompasses Hyperscale, Retail, and Wholesale, crucial for understanding the market's structure and dominant business models. Finally, End User segmentation covers BFSI, Cloud, E-Commerce, Government, Manufacturing, Media & Entertainment, Telecom, and Other End User, providing insights into the key industries driving data center growth and their specific requirements.

Key Drivers of Data Center Market in Philippines Growth

The Philippine data center market is experiencing robust growth driven by several key factors. The rapid adoption of cloud computing services by businesses across all sectors, from BFSI to manufacturing, is a primary catalyst. The government's push for digital transformation and the implementation of e-governance initiatives are further accelerating demand for secure and reliable data infrastructure. The expansion of e-commerce platforms and digital payment systems, coupled with the increasing penetration of smartphones and internet connectivity, especially with the rollout of 5G technology, is creating an insatiable appetite for data storage and processing capabilities. Furthermore, the strategic geographical location of the Philippines makes it an attractive hub for international hyperscale cloud providers looking to expand their reach in Southeast Asia.

Challenges in the Data Center Market in Philippines Sector

Despite significant growth, the Philippine data center market faces several challenges. A primary restraint is the escalating cost of electricity, a critical operational expense for data centers, impacting profitability and investment decisions. Regulatory hurdles and lengthy permitting processes can also slow down the development and expansion of new facilities. Furthermore, the availability of sufficient skilled labor for managing and maintaining advanced data center operations remains a concern. Supply chain disruptions, particularly for specialized equipment and components, can lead to project delays and increased costs. Finally, intense competition from existing players and new entrants can put pressure on pricing and service margins.

Emerging Opportunities in Data Center Market in Philippines

Emerging opportunities in the Philippine data center market are abundant, particularly in the development of specialized facilities. The growing demand for edge computing solutions, driven by the proliferation of IoT devices and low-latency applications, presents a significant opportunity for smaller, distributed data centers. The increasing emphasis on sustainability is creating a market for green data centers powered by renewable energy, appealing to environmentally conscious enterprises. Furthermore, the expansion of digital infrastructure in the Rest of the Philippines, beyond NCR, offers untapped potential for growth as businesses decentralize operations. The ongoing digital transformation in sectors like healthcare and education also presents new avenues for data center service providers.

Leading Players in the Data Center Market in Philippines Market

- Space DC Pte Ltd

- Zenlayer Inc.

- Dataone

- Epltd Inc.

- Bitstop

- VSTECS Phils Inc

- STT GDC Pte Ltd

- GTI Corporation

- NTT Ltd.

Key Developments in Data Center Market in Philippines Industry

- October 2022: Zenlayer entered into a joint venture with Megaport to strengthen and expand its presence globally. The partnership is aimed at providing enhanced services such as improved network connectivity, real-time provisioning, and on-demand private connectivity for its clients around the globe.

- August 2022: ePLDT has partnered with Abra State Institute of Science and Technology (ASIST) for offering smart campus digitalization solutions to provide better learning experience to students.

- June 2022: BNS has been certified and included in the list of Cybersecurity Assessment provider by DICT.

Strategic Outlook for Data Center Market in Philippines Market

The strategic outlook for the Philippine data center market is exceptionally positive, driven by sustained digital transformation and increasing foreign investment. The government's commitment to fostering a digitally advanced economy, coupled with the growing adoption of cloud-native solutions by local enterprises, will continue to fuel demand for colocation and managed services. The ongoing expansion of hyperscale facilities by global players signifies the Philippines' growing importance as a digital hub in Southeast Asia. Strategic investments in enhancing power infrastructure, promoting renewable energy sources, and developing a skilled workforce will be crucial for realizing the market's full potential and ensuring long-term, sustainable growth. The market is expected to see further consolidation and specialized offerings catering to niche requirements.

Data Center Market in Philippines Segmentation

-

1. Hotspot

- 1.1. NCR (Metro Manila)

- 1.2. Rest of Philippines

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

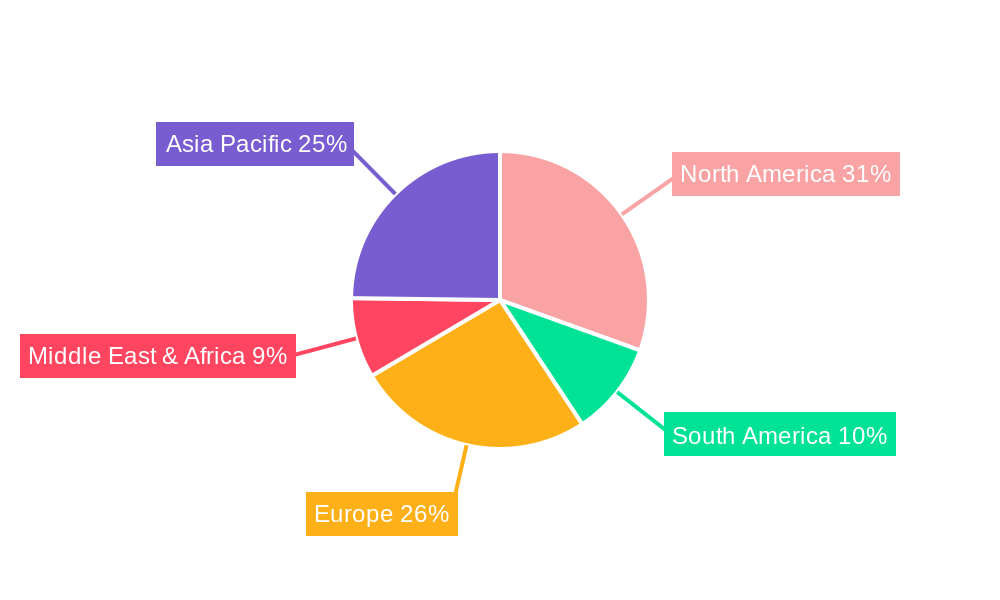

Data Center Market in Philippines Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Data Center Market in Philippines REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth of Smart Devices; Increasing number of Data Breaches

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness about Cyberattacks

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center Market in Philippines Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. NCR (Metro Manila)

- 5.1.2. Rest of Philippines

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. North America Data Center Market in Philippines Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 6.1.1. NCR (Metro Manila)

- 6.1.2. Rest of Philippines

- 6.2. Market Analysis, Insights and Forecast - by Data Center Size

- 6.2.1. Large

- 6.2.2. Massive

- 6.2.3. Medium

- 6.2.4. Mega

- 6.2.5. Small

- 6.3. Market Analysis, Insights and Forecast - by Tier Type

- 6.3.1. Tier 1 and 2

- 6.3.2. Tier 3

- 6.3.3. Tier 4

- 6.4. Market Analysis, Insights and Forecast - by Absorption

- 6.4.1. Non-Utilized

- 6.5. Market Analysis, Insights and Forecast - by Colocation Type

- 6.5.1. Hyperscale

- 6.5.2. Retail

- 6.5.3. Wholesale

- 6.6. Market Analysis, Insights and Forecast - by End User

- 6.6.1. BFSI

- 6.6.2. Cloud

- 6.6.3. E-Commerce

- 6.6.4. Government

- 6.6.5. Manufacturing

- 6.6.6. Media & Entertainment

- 6.6.7. Telecom

- 6.6.8. Other End User

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 7. South America Data Center Market in Philippines Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 7.1.1. NCR (Metro Manila)

- 7.1.2. Rest of Philippines

- 7.2. Market Analysis, Insights and Forecast - by Data Center Size

- 7.2.1. Large

- 7.2.2. Massive

- 7.2.3. Medium

- 7.2.4. Mega

- 7.2.5. Small

- 7.3. Market Analysis, Insights and Forecast - by Tier Type

- 7.3.1. Tier 1 and 2

- 7.3.2. Tier 3

- 7.3.3. Tier 4

- 7.4. Market Analysis, Insights and Forecast - by Absorption

- 7.4.1. Non-Utilized

- 7.5. Market Analysis, Insights and Forecast - by Colocation Type

- 7.5.1. Hyperscale

- 7.5.2. Retail

- 7.5.3. Wholesale

- 7.6. Market Analysis, Insights and Forecast - by End User

- 7.6.1. BFSI

- 7.6.2. Cloud

- 7.6.3. E-Commerce

- 7.6.4. Government

- 7.6.5. Manufacturing

- 7.6.6. Media & Entertainment

- 7.6.7. Telecom

- 7.6.8. Other End User

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 8. Europe Data Center Market in Philippines Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 8.1.1. NCR (Metro Manila)

- 8.1.2. Rest of Philippines

- 8.2. Market Analysis, Insights and Forecast - by Data Center Size

- 8.2.1. Large

- 8.2.2. Massive

- 8.2.3. Medium

- 8.2.4. Mega

- 8.2.5. Small

- 8.3. Market Analysis, Insights and Forecast - by Tier Type

- 8.3.1. Tier 1 and 2

- 8.3.2. Tier 3

- 8.3.3. Tier 4

- 8.4. Market Analysis, Insights and Forecast - by Absorption

- 8.4.1. Non-Utilized

- 8.5. Market Analysis, Insights and Forecast - by Colocation Type

- 8.5.1. Hyperscale

- 8.5.2. Retail

- 8.5.3. Wholesale

- 8.6. Market Analysis, Insights and Forecast - by End User

- 8.6.1. BFSI

- 8.6.2. Cloud

- 8.6.3. E-Commerce

- 8.6.4. Government

- 8.6.5. Manufacturing

- 8.6.6. Media & Entertainment

- 8.6.7. Telecom

- 8.6.8. Other End User

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 9. Middle East & Africa Data Center Market in Philippines Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 9.1.1. NCR (Metro Manila)

- 9.1.2. Rest of Philippines

- 9.2. Market Analysis, Insights and Forecast - by Data Center Size

- 9.2.1. Large

- 9.2.2. Massive

- 9.2.3. Medium

- 9.2.4. Mega

- 9.2.5. Small

- 9.3. Market Analysis, Insights and Forecast - by Tier Type

- 9.3.1. Tier 1 and 2

- 9.3.2. Tier 3

- 9.3.3. Tier 4

- 9.4. Market Analysis, Insights and Forecast - by Absorption

- 9.4.1. Non-Utilized

- 9.5. Market Analysis, Insights and Forecast - by Colocation Type

- 9.5.1. Hyperscale

- 9.5.2. Retail

- 9.5.3. Wholesale

- 9.6. Market Analysis, Insights and Forecast - by End User

- 9.6.1. BFSI

- 9.6.2. Cloud

- 9.6.3. E-Commerce

- 9.6.4. Government

- 9.6.5. Manufacturing

- 9.6.6. Media & Entertainment

- 9.6.7. Telecom

- 9.6.8. Other End User

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 10. Asia Pacific Data Center Market in Philippines Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 10.1.1. NCR (Metro Manila)

- 10.1.2. Rest of Philippines

- 10.2. Market Analysis, Insights and Forecast - by Data Center Size

- 10.2.1. Large

- 10.2.2. Massive

- 10.2.3. Medium

- 10.2.4. Mega

- 10.2.5. Small

- 10.3. Market Analysis, Insights and Forecast - by Tier Type

- 10.3.1. Tier 1 and 2

- 10.3.2. Tier 3

- 10.3.3. Tier 4

- 10.4. Market Analysis, Insights and Forecast - by Absorption

- 10.4.1. Non-Utilized

- 10.5. Market Analysis, Insights and Forecast - by Colocation Type

- 10.5.1. Hyperscale

- 10.5.2. Retail

- 10.5.3. Wholesale

- 10.6. Market Analysis, Insights and Forecast - by End User

- 10.6.1. BFSI

- 10.6.2. Cloud

- 10.6.3. E-Commerce

- 10.6.4. Government

- 10.6.5. Manufacturing

- 10.6.6. Media & Entertainment

- 10.6.7. Telecom

- 10.6.8. Other End User

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Space DC Pte Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zenlayer Inc5

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dataone

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Epldt Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bitstop

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 VSTECS Phils Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 STT GDC Pte Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GTI Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NTT Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Space DC Pte Ltd

List of Figures

- Figure 1: Global Data Center Market in Philippines Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Philippines Data Center Market in Philippines Revenue (Million), by Country 2024 & 2032

- Figure 3: Philippines Data Center Market in Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Data Center Market in Philippines Revenue (Million), by Hotspot 2024 & 2032

- Figure 5: North America Data Center Market in Philippines Revenue Share (%), by Hotspot 2024 & 2032

- Figure 6: North America Data Center Market in Philippines Revenue (Million), by Data Center Size 2024 & 2032

- Figure 7: North America Data Center Market in Philippines Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 8: North America Data Center Market in Philippines Revenue (Million), by Tier Type 2024 & 2032

- Figure 9: North America Data Center Market in Philippines Revenue Share (%), by Tier Type 2024 & 2032

- Figure 10: North America Data Center Market in Philippines Revenue (Million), by Absorption 2024 & 2032

- Figure 11: North America Data Center Market in Philippines Revenue Share (%), by Absorption 2024 & 2032

- Figure 12: North America Data Center Market in Philippines Revenue (Million), by Colocation Type 2024 & 2032

- Figure 13: North America Data Center Market in Philippines Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 14: North America Data Center Market in Philippines Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Data Center Market in Philippines Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Data Center Market in Philippines Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Data Center Market in Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Data Center Market in Philippines Revenue (Million), by Hotspot 2024 & 2032

- Figure 19: South America Data Center Market in Philippines Revenue Share (%), by Hotspot 2024 & 2032

- Figure 20: South America Data Center Market in Philippines Revenue (Million), by Data Center Size 2024 & 2032

- Figure 21: South America Data Center Market in Philippines Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 22: South America Data Center Market in Philippines Revenue (Million), by Tier Type 2024 & 2032

- Figure 23: South America Data Center Market in Philippines Revenue Share (%), by Tier Type 2024 & 2032

- Figure 24: South America Data Center Market in Philippines Revenue (Million), by Absorption 2024 & 2032

- Figure 25: South America Data Center Market in Philippines Revenue Share (%), by Absorption 2024 & 2032

- Figure 26: South America Data Center Market in Philippines Revenue (Million), by Colocation Type 2024 & 2032

- Figure 27: South America Data Center Market in Philippines Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 28: South America Data Center Market in Philippines Revenue (Million), by End User 2024 & 2032

- Figure 29: South America Data Center Market in Philippines Revenue Share (%), by End User 2024 & 2032

- Figure 30: South America Data Center Market in Philippines Revenue (Million), by Country 2024 & 2032

- Figure 31: South America Data Center Market in Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 32: Europe Data Center Market in Philippines Revenue (Million), by Hotspot 2024 & 2032

- Figure 33: Europe Data Center Market in Philippines Revenue Share (%), by Hotspot 2024 & 2032

- Figure 34: Europe Data Center Market in Philippines Revenue (Million), by Data Center Size 2024 & 2032

- Figure 35: Europe Data Center Market in Philippines Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 36: Europe Data Center Market in Philippines Revenue (Million), by Tier Type 2024 & 2032

- Figure 37: Europe Data Center Market in Philippines Revenue Share (%), by Tier Type 2024 & 2032

- Figure 38: Europe Data Center Market in Philippines Revenue (Million), by Absorption 2024 & 2032

- Figure 39: Europe Data Center Market in Philippines Revenue Share (%), by Absorption 2024 & 2032

- Figure 40: Europe Data Center Market in Philippines Revenue (Million), by Colocation Type 2024 & 2032

- Figure 41: Europe Data Center Market in Philippines Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 42: Europe Data Center Market in Philippines Revenue (Million), by End User 2024 & 2032

- Figure 43: Europe Data Center Market in Philippines Revenue Share (%), by End User 2024 & 2032

- Figure 44: Europe Data Center Market in Philippines Revenue (Million), by Country 2024 & 2032

- Figure 45: Europe Data Center Market in Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East & Africa Data Center Market in Philippines Revenue (Million), by Hotspot 2024 & 2032

- Figure 47: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Hotspot 2024 & 2032

- Figure 48: Middle East & Africa Data Center Market in Philippines Revenue (Million), by Data Center Size 2024 & 2032

- Figure 49: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 50: Middle East & Africa Data Center Market in Philippines Revenue (Million), by Tier Type 2024 & 2032

- Figure 51: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Tier Type 2024 & 2032

- Figure 52: Middle East & Africa Data Center Market in Philippines Revenue (Million), by Absorption 2024 & 2032

- Figure 53: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Absorption 2024 & 2032

- Figure 54: Middle East & Africa Data Center Market in Philippines Revenue (Million), by Colocation Type 2024 & 2032

- Figure 55: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 56: Middle East & Africa Data Center Market in Philippines Revenue (Million), by End User 2024 & 2032

- Figure 57: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by End User 2024 & 2032

- Figure 58: Middle East & Africa Data Center Market in Philippines Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East & Africa Data Center Market in Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 60: Asia Pacific Data Center Market in Philippines Revenue (Million), by Hotspot 2024 & 2032

- Figure 61: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Hotspot 2024 & 2032

- Figure 62: Asia Pacific Data Center Market in Philippines Revenue (Million), by Data Center Size 2024 & 2032

- Figure 63: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 64: Asia Pacific Data Center Market in Philippines Revenue (Million), by Tier Type 2024 & 2032

- Figure 65: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Tier Type 2024 & 2032

- Figure 66: Asia Pacific Data Center Market in Philippines Revenue (Million), by Absorption 2024 & 2032

- Figure 67: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Absorption 2024 & 2032

- Figure 68: Asia Pacific Data Center Market in Philippines Revenue (Million), by Colocation Type 2024 & 2032

- Figure 69: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 70: Asia Pacific Data Center Market in Philippines Revenue (Million), by End User 2024 & 2032

- Figure 71: Asia Pacific Data Center Market in Philippines Revenue Share (%), by End User 2024 & 2032

- Figure 72: Asia Pacific Data Center Market in Philippines Revenue (Million), by Country 2024 & 2032

- Figure 73: Asia Pacific Data Center Market in Philippines Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Center Market in Philippines Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Center Market in Philippines Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Global Data Center Market in Philippines Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Global Data Center Market in Philippines Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Global Data Center Market in Philippines Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Global Data Center Market in Philippines Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 7: Global Data Center Market in Philippines Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Global Data Center Market in Philippines Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Global Data Center Market in Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Data Center Market in Philippines Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 11: Global Data Center Market in Philippines Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 12: Global Data Center Market in Philippines Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Global Data Center Market in Philippines Revenue Million Forecast, by Absorption 2019 & 2032

- Table 14: Global Data Center Market in Philippines Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 15: Global Data Center Market in Philippines Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Global Data Center Market in Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Data Center Market in Philippines Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 21: Global Data Center Market in Philippines Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Global Data Center Market in Philippines Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 23: Global Data Center Market in Philippines Revenue Million Forecast, by Absorption 2019 & 2032

- Table 24: Global Data Center Market in Philippines Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 25: Global Data Center Market in Philippines Revenue Million Forecast, by End User 2019 & 2032

- Table 26: Global Data Center Market in Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Data Center Market in Philippines Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 31: Global Data Center Market in Philippines Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 32: Global Data Center Market in Philippines Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 33: Global Data Center Market in Philippines Revenue Million Forecast, by Absorption 2019 & 2032

- Table 34: Global Data Center Market in Philippines Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 35: Global Data Center Market in Philippines Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global Data Center Market in Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United Kingdom Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Russia Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Benelux Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Nordics Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Data Center Market in Philippines Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 47: Global Data Center Market in Philippines Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 48: Global Data Center Market in Philippines Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 49: Global Data Center Market in Philippines Revenue Million Forecast, by Absorption 2019 & 2032

- Table 50: Global Data Center Market in Philippines Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 51: Global Data Center Market in Philippines Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Data Center Market in Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Turkey Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Israel Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: GCC Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: North Africa Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Africa Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East & Africa Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Data Center Market in Philippines Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 60: Global Data Center Market in Philippines Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 61: Global Data Center Market in Philippines Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 62: Global Data Center Market in Philippines Revenue Million Forecast, by Absorption 2019 & 2032

- Table 63: Global Data Center Market in Philippines Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 64: Global Data Center Market in Philippines Revenue Million Forecast, by End User 2019 & 2032

- Table 65: Global Data Center Market in Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 66: China Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: India Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Japan Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Korea Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: ASEAN Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Oceania Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of Asia Pacific Data Center Market in Philippines Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center Market in Philippines?

The projected CAGR is approximately 12.30%.

2. Which companies are prominent players in the Data Center Market in Philippines?

Key companies in the market include Space DC Pte Ltd, Zenlayer Inc5 , Dataone, Epldt Inc, Bitstop, VSTECS Phils Inc, STT GDC Pte Ltd, GTI Corporation, NTT Ltd.

3. What are the main segments of the Data Center Market in Philippines?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growth of Smart Devices; Increasing number of Data Breaches.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Lack of Awareness about Cyberattacks.

8. Can you provide examples of recent developments in the market?

October 2022: Zenlayer entered into a joint venture with Megaport to strengthen and expand its presence globally. The partnership is aimed at providing enhanced services such as improved network connectivity, real time provisioning, and on demand private connectivity for its clients around the globe.August 2022: ePLDT has partnered with Abra State Institute of Science and Technology (ASIST) for offering smart campus digitalization solutions to provide better learning experience to students.June 2022: BNS has been caertified and included in the list of Cybersecurity Assessment provider by DICT.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center Market in Philippines," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center Market in Philippines report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center Market in Philippines?

To stay informed about further developments, trends, and reports in the Data Center Market in Philippines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence