Key Insights

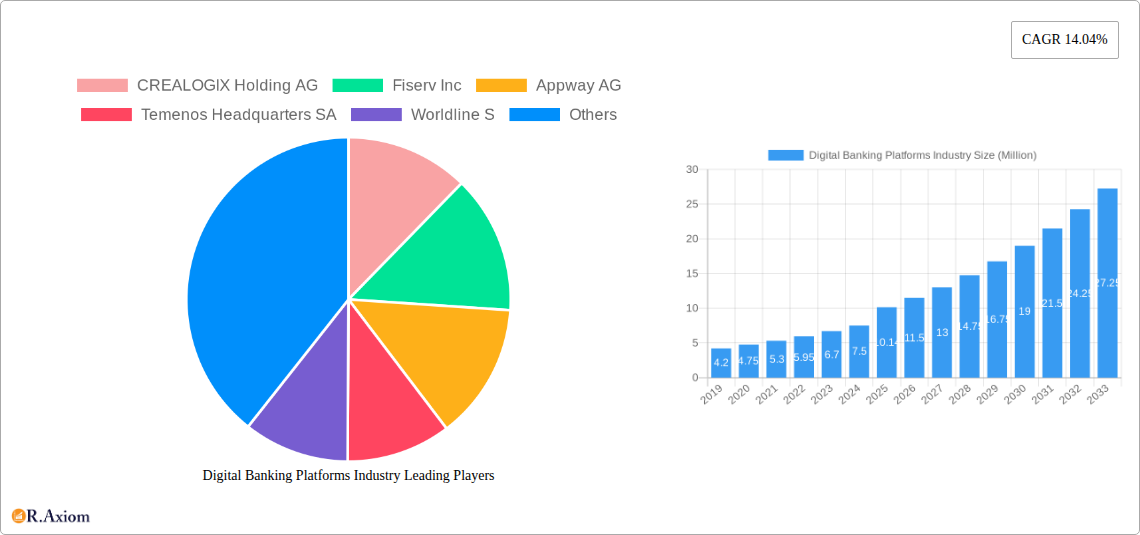

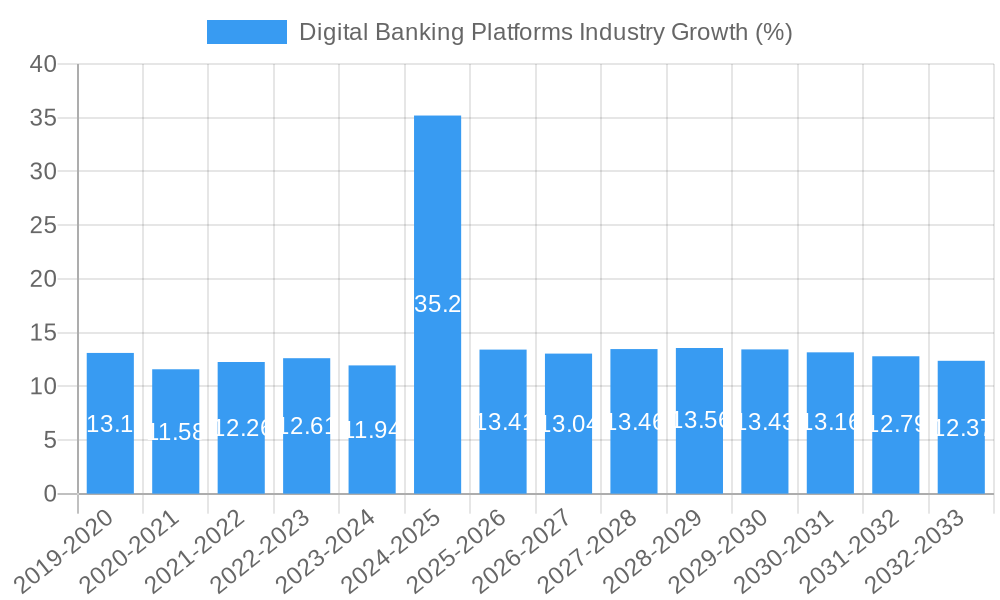

The global Digital Banking Platforms market is poised for substantial expansion, projected to reach an estimated USD 10.14 billion by 2025. This robust growth is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 14.04% anticipated over the forecast period of 2025-2033. The increasing demand for enhanced customer experiences, the imperative for financial institutions to streamline operations, and the continuous innovation in fintech solutions are the primary drivers behind this upward trajectory. Digital banking platforms are becoming indispensable for banks to offer seamless, personalized, and secure services across various channels, thereby attracting and retaining a digitally-savvy customer base. This technological evolution is critical for banks to maintain competitiveness in an increasingly digital financial landscape.

The market segments reveal a clear dichotomy in deployment strategies, with both Cloud and On-Premises solutions finding significant adoption. The Cloud segment is expected to witness accelerated growth due to its scalability, cost-effectiveness, and rapid deployment capabilities. Simultaneously, the On-Premises segment continues to cater to institutions with stringent regulatory or data security requirements. Across banking types, both Corporate Banking and Retail Banking are driving demand, as businesses and individuals alike increasingly expect sophisticated digital financial tools. Key players like CREALOGIX Holding AG, Fiserv Inc., and Temenos Headquarters SA are actively shaping the market through their advanced platform offerings, focusing on areas such as open banking, AI-driven personalization, and enhanced cybersecurity measures. The market's dynamic nature is also influenced by emerging trends in embedded finance and the growing adoption of API-driven banking solutions.

Digital Banking Platforms Industry Market Analysis & Forecast 2024-2033

This comprehensive report provides an in-depth analysis of the global Digital Banking Platforms industry, offering critical insights for stakeholders navigating this rapidly evolving landscape. Spanning the historical period of 2019-2024, the base year of 2025, and extending through a robust forecast period of 2025-2033, this study delves into market concentration, innovation, industry trends, dominant segments, product developments, growth drivers, challenges, and emerging opportunities. With a focus on key players and strategic outlook, this report is your definitive guide to understanding and capitalizing on the future of digital finance.

Digital Banking Platforms Industry Market Concentration & Innovation

The Digital Banking Platforms industry exhibits a dynamic market concentration, characterized by a mix of large established financial technology providers and agile, innovative startups. While the market is not fully consolidated, a significant portion of market share is held by key players who continuously invest in R&D. Innovation in this sector is primarily driven by the relentless pursuit of enhanced customer experience, operational efficiency, and regulatory compliance. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is a paramount innovation driver, enabling personalized services, sophisticated fraud detection, and predictive analytics. Open Banking initiatives and the adoption of APIs are further fueling innovation by fostering collaboration and enabling the creation of new financial ecosystems. Regulatory frameworks, while sometimes posing compliance challenges, are also increasingly promoting digital transformation by mandating data sharing and security standards. Product substitutes, such as traditional banking channels or specialized fintech solutions, are being steadily eroded by the comprehensive and integrated offerings of digital banking platforms. End-user trends, including the growing demand for seamless mobile experiences, instant transactions, and personalized financial advice, are dictating product development roadmaps. Mergers and acquisitions (M&A) activities are also a significant factor, with deal values in the hundreds of millions of dollars shaping the competitive landscape. For instance, strategic acquisitions are enabling larger players to integrate cutting-edge technologies and expand their market reach. The market share of leading digital banking platform providers is estimated to be in the double-digit percentages for some segments, with ongoing consolidation expected.

Digital Banking Platforms Industry Industry Trends & Insights

The Digital Banking Platforms industry is experiencing a transformative growth phase, fueled by a confluence of technological advancements, evolving consumer behaviors, and a supportive regulatory environment. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15-20% during the forecast period. This robust growth is primarily driven by the increasing adoption of digital channels for financial transactions and services across both retail and corporate segments. Technological disruptions, particularly in the realm of cloud computing, AI, ML, blockchain, and APIs, are reshaping the industry at an unprecedented pace. Cloud-based platforms are gaining significant traction due to their scalability, flexibility, and cost-effectiveness, enabling financial institutions to rapidly deploy new services and reduce operational overhead. AI and ML are revolutionizing customer engagement through personalized recommendations, intelligent chatbots for customer support, and sophisticated fraud detection systems, thereby enhancing user experience and security. Blockchain technology is being explored for its potential to streamline cross-border payments, improve transaction transparency, and enhance security. Open Banking initiatives, mandated in various regions, are fostering innovation by allowing third-party providers to develop applications and services around financial institutions' data, leading to a more competitive and customer-centric ecosystem. Consumer preferences are rapidly shifting towards digital-first banking experiences, demanding instant access to services, intuitive user interfaces, and personalized financial management tools. The proliferation of smartphones and increased internet penetration globally are further accelerating the adoption of digital banking. Competitive dynamics are intensifying, with traditional banks investing heavily in digital transformation, while neobanks and challenger banks are disrupting the market with innovative, digital-native offerings. The market penetration of digital banking platforms is expected to exceed 70% in developed economies by 2030. Furthermore, the increasing demand for embedded finance, where banking services are integrated into non-financial platforms, presents a significant growth avenue. The ability of digital banking platforms to offer a unified and seamless experience across multiple touchpoints – from mobile apps to web portals – is a key differentiator in this competitive landscape. The ongoing evolution of cybersecurity threats also necessitates continuous innovation in security protocols and fraud prevention mechanisms, a trend that is pushing the boundaries of technological development within the industry.

Dominant Markets & Segments in Digital Banking Platforms Industry

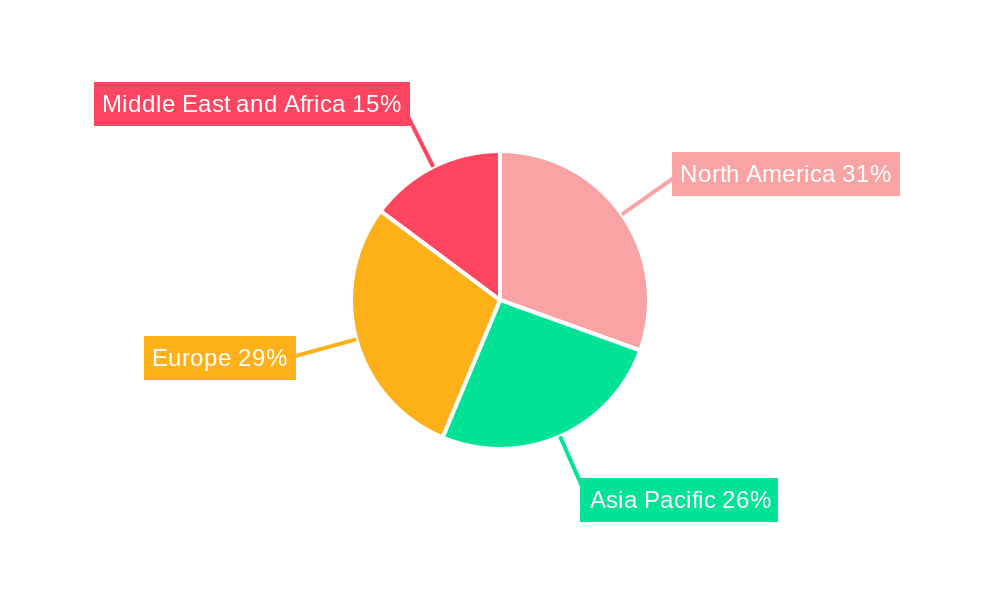

The Digital Banking Platforms industry showcases distinct dominance across various geographical regions and market segments, driven by economic policies, technological infrastructure, and evolving consumer demands.

Deployment: Cloud Dominance

- Key Drivers: The widespread adoption of cloud-first strategies by financial institutions is a primary driver for cloud deployment. Cloud platforms offer unparalleled scalability, agility, and cost-efficiency, enabling rapid deployment of new digital banking solutions and reducing the burden of on-premises infrastructure management. Government initiatives promoting cloud adoption and data localization in certain regions also influence this trend.

- Dominance Analysis: Cloud-based digital banking platforms are experiencing significant market penetration, projected to capture over 75% of the market share by 2030. Financial institutions are increasingly migrating their core banking systems and customer-facing applications to the cloud to leverage its benefits for innovation and operational efficiency. The ability to quickly scale resources up or down based on demand, coupled with enhanced disaster recovery capabilities, makes cloud deployment a compelling choice for modern banking operations. This segment is characterized by strong growth in North America and Europe, with Asia-Pacific rapidly catching up due to increasing digitalization and cloud investments.

Deployment: On-Premises Resilience

- Key Drivers: While cloud adoption is soaring, on-premises deployments continue to hold relevance, particularly for institutions with stringent regulatory requirements concerning data sovereignty and security. Legacy system integration challenges and existing substantial investments in on-premises infrastructure also contribute to its sustained presence.

- Dominance Analysis: The on-premises segment, while gradually losing market share to cloud solutions, still represents a substantial portion of the digital banking platforms market, particularly within established financial institutions that prioritize complete control over their data and infrastructure. This segment is often favored by large, tier-1 banks with complex existing IT ecosystems and a high degree of sensitivity to data privacy. The forecast period will see a gradual decline in its overall market share, but it will remain a critical deployment option for specific use cases and organizations with specialized needs, likely accounting for around 20-25% of the market by 2030.

Type: Retail Banking Leadership

- Key Drivers: The sheer volume of retail banking customers and the ubiquitous nature of personal financial management make this segment a primary focus for digital banking platforms. The demand for convenient, accessible, and personalized banking services for individuals drives innovation and adoption.

- Dominance Analysis: Retail banking remains the largest and most dominant segment within the digital banking platforms industry. The widespread availability of smartphones and the increasing comfort of consumers with online transactions have propelled the adoption of digital channels for everyday banking needs. Digital platforms offer enhanced customer experiences through intuitive mobile apps, personalized financial advice, seamless payment solutions, and access to a wide array of banking products. This segment is characterized by intense competition and continuous innovation to capture and retain individual customers. The market size for retail banking digital platforms is projected to reach several hundred billion dollars globally within the forecast period.

Type: Corporate Banking Growth

- Key Drivers: The increasing complexity of corporate financial operations and the demand for integrated treasury management solutions are driving the growth of digital banking platforms in the corporate segment. Businesses are seeking efficient ways to manage cash, payments, trade finance, and risk.

- Dominance Analysis: While historically a more complex segment to digitize, corporate banking is experiencing rapid growth in digital platform adoption. Businesses are recognizing the efficiency gains and strategic advantages offered by digital solutions for managing their finances. These platforms provide features such as enhanced payment processing, real-time cash visibility, automated reconciliation, and sophisticated trade finance capabilities. The adoption of AI and ML in corporate banking platforms is enabling personalized services for business clients, leading to greater operational efficiency and risk mitigation. The corporate banking segment is expected to exhibit a higher CAGR than retail banking in the coming years, driven by the demand for advanced treasury management and global financial operations.

Digital Banking Platforms Industry Product Developments

- Key Drivers: While cloud adoption is soaring, on-premises deployments continue to hold relevance, particularly for institutions with stringent regulatory requirements concerning data sovereignty and security. Legacy system integration challenges and existing substantial investments in on-premises infrastructure also contribute to its sustained presence.

- Dominance Analysis: The on-premises segment, while gradually losing market share to cloud solutions, still represents a substantial portion of the digital banking platforms market, particularly within established financial institutions that prioritize complete control over their data and infrastructure. This segment is often favored by large, tier-1 banks with complex existing IT ecosystems and a high degree of sensitivity to data privacy. The forecast period will see a gradual decline in its overall market share, but it will remain a critical deployment option for specific use cases and organizations with specialized needs, likely accounting for around 20-25% of the market by 2030.

Type: Retail Banking Leadership

- Key Drivers: The sheer volume of retail banking customers and the ubiquitous nature of personal financial management make this segment a primary focus for digital banking platforms. The demand for convenient, accessible, and personalized banking services for individuals drives innovation and adoption.

- Dominance Analysis: Retail banking remains the largest and most dominant segment within the digital banking platforms industry. The widespread availability of smartphones and the increasing comfort of consumers with online transactions have propelled the adoption of digital channels for everyday banking needs. Digital platforms offer enhanced customer experiences through intuitive mobile apps, personalized financial advice, seamless payment solutions, and access to a wide array of banking products. This segment is characterized by intense competition and continuous innovation to capture and retain individual customers. The market size for retail banking digital platforms is projected to reach several hundred billion dollars globally within the forecast period.

Type: Corporate Banking Growth

- Key Drivers: The increasing complexity of corporate financial operations and the demand for integrated treasury management solutions are driving the growth of digital banking platforms in the corporate segment. Businesses are seeking efficient ways to manage cash, payments, trade finance, and risk.

- Dominance Analysis: While historically a more complex segment to digitize, corporate banking is experiencing rapid growth in digital platform adoption. Businesses are recognizing the efficiency gains and strategic advantages offered by digital solutions for managing their finances. These platforms provide features such as enhanced payment processing, real-time cash visibility, automated reconciliation, and sophisticated trade finance capabilities. The adoption of AI and ML in corporate banking platforms is enabling personalized services for business clients, leading to greater operational efficiency and risk mitigation. The corporate banking segment is expected to exhibit a higher CAGR than retail banking in the coming years, driven by the demand for advanced treasury management and global financial operations.

Digital Banking Platforms Industry Product Developments

- Key Drivers: The increasing complexity of corporate financial operations and the demand for integrated treasury management solutions are driving the growth of digital banking platforms in the corporate segment. Businesses are seeking efficient ways to manage cash, payments, trade finance, and risk.

- Dominance Analysis: While historically a more complex segment to digitize, corporate banking is experiencing rapid growth in digital platform adoption. Businesses are recognizing the efficiency gains and strategic advantages offered by digital solutions for managing their finances. These platforms provide features such as enhanced payment processing, real-time cash visibility, automated reconciliation, and sophisticated trade finance capabilities. The adoption of AI and ML in corporate banking platforms is enabling personalized services for business clients, leading to greater operational efficiency and risk mitigation. The corporate banking segment is expected to exhibit a higher CAGR than retail banking in the coming years, driven by the demand for advanced treasury management and global financial operations.

Digital Banking Platforms Industry Product Developments

Product innovation in the Digital Banking Platforms industry is largely centered on enhancing user experience, streamlining operational processes, and leveraging advanced technologies. Key developments include the integration of AI-powered chatbots for customer support, enabling 24/7 assistance and personalized query resolution. Advanced analytics and ML algorithms are being incorporated to offer predictive financial insights, personalized product recommendations, and sophisticated fraud detection mechanisms. The rise of open banking APIs is facilitating the development of innovative third-party applications and services, creating richer ecosystems. Furthermore, platforms are evolving to support a wider range of financial products, including embedded finance solutions and specialized offerings for niche market segments like small businesses and freelancers. These innovations are providing significant competitive advantages by improving customer engagement, increasing operational efficiency, and enabling faster time-to-market for new financial products.

Report Scope & Segmentation Analysis

This report offers a granular analysis of the Digital Banking Platforms industry, segmented across key dimensions to provide actionable insights.

- Deployment: Cloud: This segment analyzes the market for digital banking platforms deployed on cloud infrastructure. It encompasses public, private, and hybrid cloud environments, focusing on their market size, growth projections, and competitive dynamics. The segment is expected to witness substantial growth driven by scalability and cost-efficiency.

- Deployment: On-Premises: This segment examines the market for digital banking platforms hosted on the client's own servers. It details the market share, growth trends, and competitive landscape of on-premises solutions, often favored for security and control. While experiencing slower growth compared to cloud, it remains a significant segment.

- Type: Corporate Banking: This segment focuses on digital banking platforms designed for businesses. It includes analysis of market size, growth forecasts, and competitive dynamics related to treasury management, payments, trade finance, and other corporate financial services. This segment is projected for robust expansion.

- Type: Retail Banking: This segment delves into digital banking platforms catering to individual consumers. It covers market size, growth projections, and competitive trends for personal finance management, payments, loans, and other retail banking services. This segment currently holds the largest market share.

Key Drivers of Digital Banking Platforms Industry Growth

The Digital Banking Platforms industry is propelled by several pivotal growth drivers:

- Technological Advancements: The rapid evolution of technologies such as AI, ML, cloud computing, and blockchain is enabling the development of more sophisticated, efficient, and personalized digital banking solutions.

- Evolving Consumer Expectations: Consumers, accustomed to seamless digital experiences in other sectors, demand similar convenience, accessibility, and personalization from their banking services.

- Regulatory Support for Digitalization: Many governments are actively promoting digital transformation in the financial sector through supportive regulations and initiatives like open banking, fostering innovation and competition.

- Cost Optimization and Operational Efficiency: Digital platforms enable financial institutions to reduce operational costs associated with traditional branch networks and manual processes, leading to improved profitability.

- Growth of Mobile Penetration and Internet Access: The widespread availability of smartphones and increasing internet penetration globally provide a fertile ground for the adoption and expansion of digital banking services.

Challenges in the Digital Banking Platforms Industry Sector

Despite its robust growth, the Digital Banking Platforms industry faces several significant challenges:

- Regulatory Compliance and Evolving Frameworks: Navigating complex and constantly evolving regulatory landscapes across different jurisdictions presents a significant hurdle, requiring continuous investment in compliance measures.

- Cybersecurity Threats and Data Privacy Concerns: The increasing sophistication of cyberattacks necessitates robust security protocols and continuous vigilance to protect sensitive customer data and maintain trust.

- Legacy System Integration: Many established financial institutions grapple with the challenge of integrating new digital banking platforms with their existing, often outdated, core banking systems.

- Intense Competition and Customer Acquisition Costs: The market is highly competitive, with numerous players vying for customer attention, leading to high customer acquisition costs and pressure on profit margins.

- Digital Divide and Financial Inclusion: Ensuring equitable access to digital banking services for all segments of the population, particularly in underserved or less technologically advanced regions, remains a critical challenge.

Emerging Opportunities in Digital Banking Platforms Industry

The Digital Banking Platforms industry is ripe with emerging opportunities:

- Embedded Finance: Integrating banking services seamlessly into non-financial platforms and applications presents a vast opportunity for expanding reach and creating new revenue streams.

- Personalized Financial Wellness Tools: Leveraging AI and data analytics to offer highly personalized financial advice, budgeting tools, and investment recommendations can deepen customer engagement.

- Decentralized Finance (DeFi) Integration: Exploring the potential of blockchain and DeFi technologies to offer new, innovative financial products and services, such as tokenized assets and smart contracts.

- ESG (Environmental, Social, and Governance) Focused Banking: Developing digital platforms that support sustainable finance initiatives and provide transparent ESG reporting for corporate clients.

- Expansion into Emerging Markets: The rapidly growing middle class and increasing digital adoption in emerging economies offer significant untapped potential for digital banking platforms.

Leading Players in the Digital Banking Platforms Industry Market

- CREALOGIX Holding AG

- Fiserv Inc

- Appway AG

- Temenos Headquarters SA

- Worldline S

- Sopra Steria

- Tata Consultancy Services Limited

- Oracle Corporation

- EdgeVerve Systems Limited

- SAP SE

Key Developments in Digital Banking Platforms Industry Industry

- January 2023: Next Bank, a Taiwanese digital bank, has launched using Temenos. Next Bank can bring products to market quickly and effectively with Temenos' open platform. The bank intends to add foreign exchange services, such as remittance services for migrant workers and wealth management tools, over time. Next Bank, which is powered by Temenos, intends to swiftly expand to approximately 300,000 users within nine months of its launch.

- December 2022: Wells Fargo has introduced a one-stop digital banking portal for its corporate investment and commercial banking clients. With this launch, the company is looking forward to leveraging artificial intelligence and machine learning (AI and ML) to provide organizations with individualized corporate and commercial financial services based on their unique needs.

Strategic Outlook for Digital Banking Platforms Industry Market

The strategic outlook for the Digital Banking Platforms industry is overwhelmingly positive, driven by sustained demand for digital financial services and continuous technological innovation. The forecast period anticipates further consolidation as larger players acquire innovative startups to enhance their offerings and market reach. A key growth catalyst will be the deeper integration of AI and ML, moving beyond basic automation to deliver truly predictive and personalized banking experiences for both retail and corporate clients. The expansion of embedded finance will unlock new distribution channels and customer touchpoints, blurring the lines between traditional banking and other industries. Financial institutions that prioritize agility, customer-centricity, and robust cybersecurity will be best positioned to thrive. The ongoing digitalization of economies worldwide, coupled with favorable regulatory environments, will continue to fuel the expansion of digital banking platforms, making them indispensable tools for modern financial management.

Digital Banking Platforms Industry Segmentation

-

1. Deployment

- 1.1. Cloud

- 1.2. On-Premises

-

2. Type

- 2.1. Corporate Banking

- 2.2. Retail Banking

Digital Banking Platforms Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. Middle East and Africa

Digital Banking Platforms Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Cloud-Based Platforms to Obtain Higher Scalability; Rising demand for smart mobile devices and digital banking services among consumers

- 3.3. Market Restrains

- 3.3.1. Increasing Security Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Cloud-Based Platforms to Boost the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud

- 5.1.2. On-Premises

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Corporate Banking

- 5.2.2. Retail Banking

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud

- 6.1.2. On-Premises

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Corporate Banking

- 6.2.2. Retail Banking

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Asia Pacific Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud

- 7.1.2. On-Premises

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Corporate Banking

- 7.2.2. Retail Banking

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Europe Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud

- 8.1.2. On-Premises

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Corporate Banking

- 8.2.2. Retail Banking

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Middle East and Africa Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud

- 9.1.2. On-Premises

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Corporate Banking

- 9.2.2. Retail Banking

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. North America Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. Europe Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Italy

- 11.1.6 Spain

- 11.1.7 Belgium

- 11.1.8 Netherland

- 11.1.9 Nordics

- 11.1.10 Rest of Europe

- 12. Asia Pacific Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Southeast Asia

- 12.1.6 Australia

- 12.1.7 Indonesia

- 12.1.8 Phillipes

- 12.1.9 Singapore

- 12.1.10 Thailandc

- 12.1.11 Rest of Asia Pacific

- 13. South America Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Argentina

- 13.1.3 Peru

- 13.1.4 Chile

- 13.1.5 Colombia

- 13.1.6 Ecuador

- 13.1.7 Venezuela

- 13.1.8 Rest of South America

- 14. North America Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United States

- 14.1.2 Canada

- 14.1.3 Mexico

- 15. MEA Digital Banking Platforms Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 CREALOGIX Holding AG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Fiserv Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Appway AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Temenos Headquarters SA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Worldline S

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Sopra Steria

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Tata Consultancy Services Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Oracle Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 EdgeVerve Systems Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SAP SE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 CREALOGIX Holding AG

List of Figures

- Figure 1: Global Digital Banking Platforms Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Digital Banking Platforms Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 15: North America Digital Banking Platforms Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: North America Digital Banking Platforms Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: North America Digital Banking Platforms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: North America Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Digital Banking Platforms Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 21: Asia Pacific Digital Banking Platforms Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 22: Asia Pacific Digital Banking Platforms Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Asia Pacific Digital Banking Platforms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Asia Pacific Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Digital Banking Platforms Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 27: Europe Digital Banking Platforms Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 28: Europe Digital Banking Platforms Industry Revenue (Million), by Type 2024 & 2032

- Figure 29: Europe Digital Banking Platforms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 30: Europe Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East and Africa Digital Banking Platforms Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 33: Middle East and Africa Digital Banking Platforms Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 34: Middle East and Africa Digital Banking Platforms Industry Revenue (Million), by Type 2024 & 2032

- Figure 35: Middle East and Africa Digital Banking Platforms Industry Revenue Share (%), by Type 2024 & 2032

- Figure 36: Middle East and Africa Digital Banking Platforms Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East and Africa Digital Banking Platforms Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Banking Platforms Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Banking Platforms Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Digital Banking Platforms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Digital Banking Platforms Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Digital Banking Platforms Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Digital Banking Platforms Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 51: Global Digital Banking Platforms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Digital Banking Platforms Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 54: Global Digital Banking Platforms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 55: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Digital Banking Platforms Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 57: Global Digital Banking Platforms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Digital Banking Platforms Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 60: Global Digital Banking Platforms Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 61: Global Digital Banking Platforms Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Banking Platforms Industry?

The projected CAGR is approximately 14.04%.

2. Which companies are prominent players in the Digital Banking Platforms Industry?

Key companies in the market include CREALOGIX Holding AG, Fiserv Inc, Appway AG, Temenos Headquarters SA, Worldline S, Sopra Steria, Tata Consultancy Services Limited, Oracle Corporation, EdgeVerve Systems Limited, SAP SE.

3. What are the main segments of the Digital Banking Platforms Industry?

The market segments include Deployment, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Cloud-Based Platforms to Obtain Higher Scalability; Rising demand for smart mobile devices and digital banking services among consumers.

6. What are the notable trends driving market growth?

Increasing Adoption of Cloud-Based Platforms to Boost the Market Growth.

7. Are there any restraints impacting market growth?

Increasing Security Concerns.

8. Can you provide examples of recent developments in the market?

January 2023: Next Bank, a Taiwanese digital bank, has launched Temenos. Next Bank can bring products to market quickly and effectively with Temenos' open platform. The bank intends to add foreign exchange services, such as remittance services for migrant workers and wealth management tools, over time. Next Bank, which is powered by Temenos, intends to swiftly expand to approximately 300,000 users within nine months of its launch.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Banking Platforms Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Banking Platforms Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Banking Platforms Industry?

To stay informed about further developments, trends, and reports in the Digital Banking Platforms Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence