Key Insights

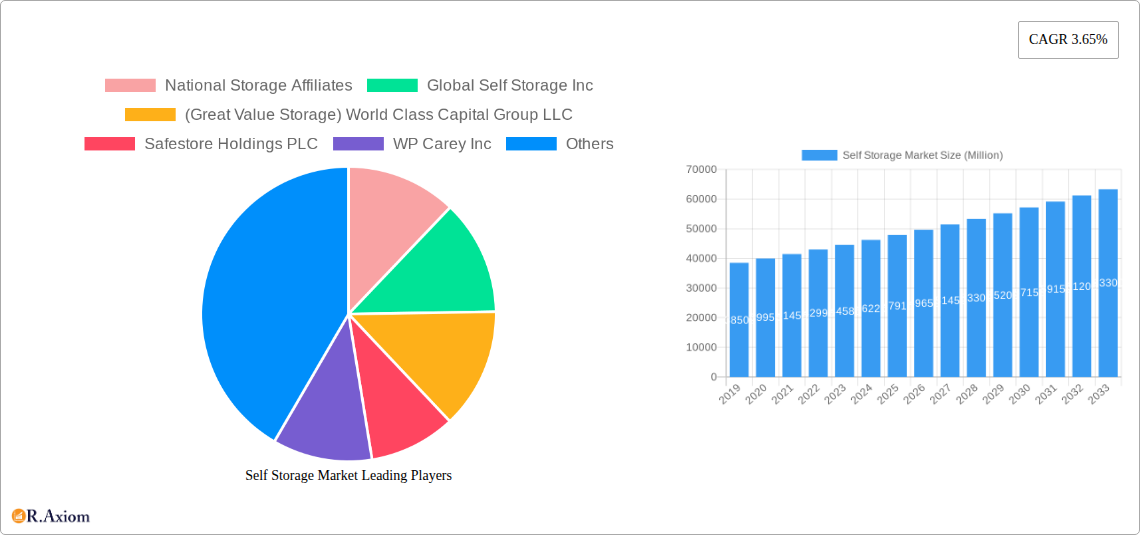

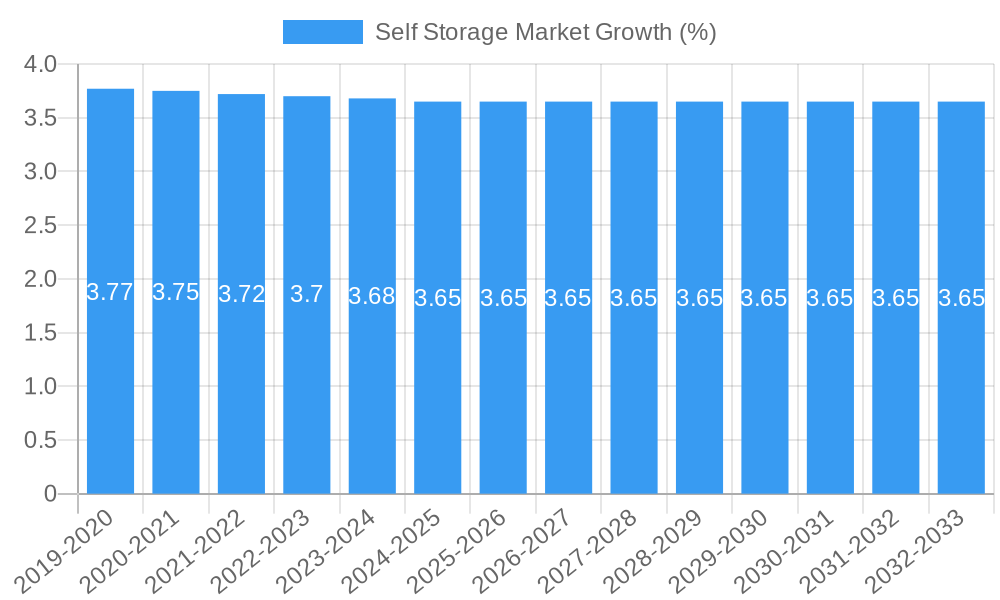

The global Self Storage Market is poised for significant expansion, projected to reach a market size of approximately $50 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.65% expected to propel it to an estimated $70 billion by 2033. This growth is primarily fueled by a confluence of evolving lifestyle patterns, including increased urbanization, smaller living spaces, and a growing trend towards decluttering and minimalism. The rising demand from both personal and business segments underscores the market's resilience and adaptability. Personal users are increasingly leveraging self-storage solutions for managing excess belongings, seasonal items, and during life transitions like moving or downsizing. Businesses, on the other hand, are utilizing self-storage for inventory management, document archiving, and as flexible storage for operational needs, especially in fast-paced urban environments where commercial real estate is at a premium.

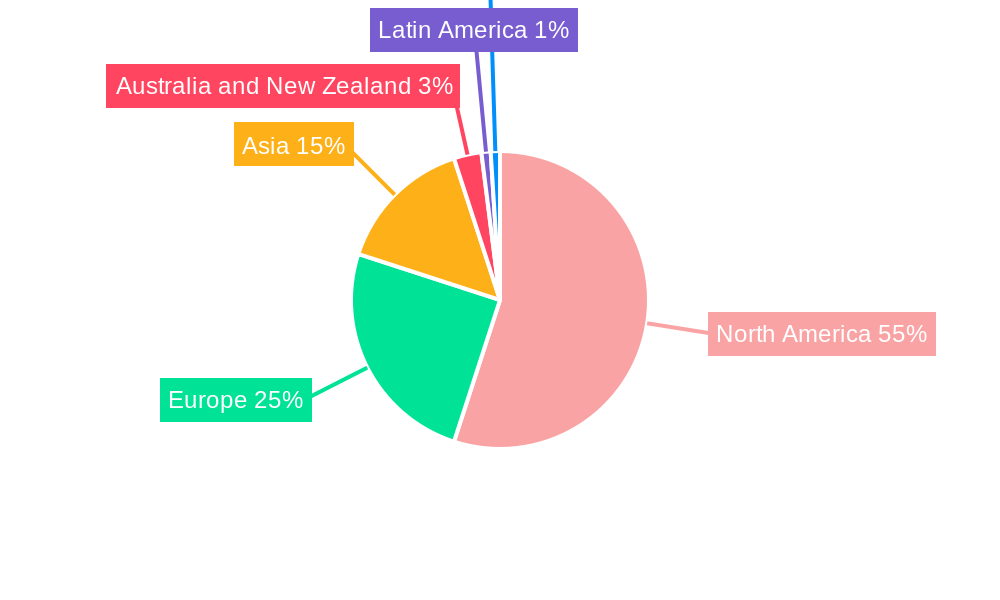

Key drivers for this sustained growth include the increasing prevalence of e-commerce, necessitating efficient last-mile logistics and inventory overflow solutions for businesses, and the demographic shifts towards smaller households and apartments. Furthermore, advancements in technology, such as smart locks, online booking platforms, and enhanced security features, are improving user experience and driving adoption. Despite some restraints like the high initial capital investment for facility development and evolving regulatory landscapes in certain regions, the market is expected to overcome these challenges. The competitive landscape features a mix of established players like National Storage Affiliates and U-Haul International Inc., alongside emerging companies, all vying for market share across diverse geographical regions. North America currently holds a dominant position, but the Asia-Pacific region, particularly China and South Korea, presents substantial growth opportunities due to rapid economic development and increasing disposable incomes.

Self Storage Market Market Concentration & Innovation

The self-storage market exhibits a moderate level of concentration, with a mix of large publicly traded Real Estate Investment Trusts (REITs) and a substantial number of smaller, privately held operators. Innovation in the self-storage sector is primarily driven by technological advancements aimed at enhancing customer experience, operational efficiency, and security. Key innovations include advanced access control systems leveraging mobile technology, AI-powered surveillance for improved security, and sophisticated pricing and revenue management software. Regulatory frameworks, while generally supportive of business operations, can vary by municipality, influencing development and operational standards. Product substitutes, such as traditional warehousing or home organization solutions, are limited due to the specific convenience and flexibility offered by self-storage. End-user trends point towards increasing demand from both personal and business segments, driven by urbanization, smaller living spaces, and the growth of e-commerce requiring inventory storage solutions. Mergers and acquisitions (M&A) activities are a significant indicator of market consolidation and strategic expansion. For instance, recent M&A deals have seen established players acquire smaller portfolios to expand their geographical reach and market share. Valued in the hundreds of millions of dollars, these transactions underscore the strategic importance of scale and network density in the competitive self-storage landscape. The market is characterized by a continuous drive for operational excellence and the integration of smart technologies to differentiate services and attract a diverse customer base, including key players like National Storage Affiliates, CubeSmart LP, and Life Storage Inc.

Self Storage Market Industry Trends & Insights

The self-storage market is experiencing robust growth, fueled by a confluence of economic, demographic, and technological trends. The compound annual growth rate (CAGR) is projected to remain strong throughout the forecast period of 2025–2033, indicating sustained expansion in market penetration and revenue. This growth is primarily attributed to increasing urbanization, leading to smaller residential units and a greater need for off-site storage solutions for personal belongings. The burgeoning e-commerce sector also contributes significantly, as businesses increasingly rely on self-storage facilities for inventory management, warehousing, and last-mile delivery logistics. Technological disruptions are playing a pivotal role in reshaping the industry. The integration of smart technology, including AI-powered security systems, contactless rentals via mobile apps, and data analytics for dynamic pricing, is enhancing operational efficiency and customer convenience. These advancements are not only improving the user experience but also enabling operators to optimize revenue and reduce operational costs. Consumer preferences are evolving towards greater flexibility, accessibility, and affordability. Self-storage providers are responding by offering a wider range of unit sizes, climate-controlled options, and flexible lease terms. Furthermore, the demand for specialized storage solutions, such as vehicle storage and wine storage, is also on the rise. The competitive dynamics within the industry are intensifying, with both large, established players and emerging operators vying for market share. Mergers, acquisitions, and strategic partnerships are common as companies seek to expand their geographical footprint and service offerings. The industry is also witnessing a growing focus on sustainability, with operators investing in energy-efficient facilities and environmentally friendly practices. The overall industry outlook remains highly positive, driven by these multifaceted trends and a persistent need for flexible storage solutions across various user segments.

Dominant Markets & Segments in Self Storage Market

The global self-storage market is characterized by regional dominance and distinct segment performance, with North America currently leading in market penetration and revenue. This dominance is underpinned by several key drivers, including established economic policies that favor real estate investment, a well-developed infrastructure that supports the construction and operation of storage facilities, and a mature consumer culture that readily adopts self-storage solutions. The Personal User Type segment is a cornerstone of the market's dominance, driven by factors such as increasing population density in urban centers, a rising number of single-person households, and a general trend towards decluttering and minimalist living. The desire for additional space to store seasonal items, furniture during moves, or sentimental possessions contributes significantly to the demand from individuals. Economic stability and disposable income levels further bolster the ability of individuals to afford self-storage services.

In parallel, the Business User Type segment is experiencing substantial growth and is a critical driver of market expansion. This segment encompasses a diverse range of businesses, from small startups and e-commerce retailers needing inventory management to larger corporations requiring document storage, equipment warehousing, or overflow space for seasonal surges in demand. The flexibility and cost-effectiveness of self-storage compared to traditional warehousing or office space make it an attractive option for businesses of all sizes. The growth of online retail and the gig economy have further amplified the need for accessible and scalable storage solutions for businesses.

Key drivers for the dominance of these segments include:

- Economic Policies: Favorable investment climates, tax incentives for real estate development, and access to capital for expansion projects.

- Infrastructure Development: Availability of suitable land, efficient transportation networks for accessibility, and robust utility services for facility operations.

- Consumer Behavior: High adoption rates for convenience services, cultural acceptance of renting storage space, and a propensity for proactive space management in both personal and professional lives.

- Demographic Shifts: Urbanization, smaller living spaces, and an aging population requiring space management solutions.

- E-commerce Growth: A continuous increase in online retail necessitates efficient inventory management and warehousing solutions.

Regions like the United States, with a high density of self-storage facilities and a large addressable market, are spearheading this dominance. The market penetration in these leading regions is significantly higher, indicating a deeply integrated role of self-storage within the broader economy and lifestyle. The interplay between these economic, social, and infrastructural factors creates a fertile ground for continued growth and dominance in the leading markets and segments.

Self Storage Market Product Developments

Product developments in the self-storage market are increasingly focused on enhancing customer experience and operational efficiency through technology. Innovations include smart locks integrated with mobile applications for seamless, contactless access, allowing users to rent, access, and manage their units remotely. Advanced security systems utilizing AI-powered cameras and sensors provide real-time monitoring and alerts, offering peace of mind to customers. Furthermore, many facilities are now offering climate-controlled units with precise temperature and humidity regulation to protect sensitive items like electronics, artwork, and wine. The competitive advantage is gained through superior security, user-friendly digital interfaces, and tailored storage solutions that meet the evolving needs of both personal and business users, thereby driving market appeal and customer loyalty.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the Self Storage Market, focusing on key segments vital for understanding market dynamics and future growth. The segmentation is divided into two primary user types: Personal and Business.

The Personal segment encompasses individual consumers seeking storage solutions for personal belongings. This includes renters moving between homes, homeowners decluttering, students storing items during academic breaks, and individuals needing space for hobby equipment or seasonal items. Growth projections for this segment are driven by urbanization and smaller living spaces, with estimated market sizes reflecting a consistent demand for convenience and affordability.

The Business segment caters to commercial entities requiring storage for inventory, documents, equipment, or other operational needs. This includes e-commerce businesses, retail stores, startups, and larger corporations. Growth in this segment is propelled by the expansion of online retail, the need for flexible warehousing, and cost-effective document management solutions. Competitive dynamics within this segment are influenced by the demand for specialized services and tailored solutions for businesses.

Key Drivers of Self Storage Market Growth

The self-storage market's growth is propelled by several interconnected factors. Economically, increasing disposable incomes and a high propensity for consumers and businesses to outsource space needs are significant drivers. Demographically, urbanization and the trend towards smaller living spaces in residential areas create a consistent demand for auxiliary storage. Technologically, advancements in smart access systems, mobile rental platforms, and AI-driven security enhance convenience and operational efficiency, attracting a wider customer base. Regulatory frameworks, while sometimes posing challenges, also create opportunities for developers in underserved areas. The expansion of e-commerce further fuels demand from businesses needing flexible inventory and warehousing solutions.

Challenges in the Self Storage Market Sector

Despite its growth, the self-storage market faces several challenges. Regulatory hurdles, including zoning laws and permitting processes, can significantly delay or restrict new facility development. Intense competition from a growing number of operators, both large and small, can lead to pricing pressures and reduced profit margins. Supply chain issues can impact the construction and material costs for new facilities. Furthermore, the industry is susceptible to economic downturns, which can reduce consumer spending on non-essential services like self-storage. The need for continuous investment in technology to remain competitive also presents a capital expenditure challenge.

Emerging Opportunities in Self Storage Market

Emerging opportunities in the self-storage market are abundant, driven by evolving consumer and business needs. The expansion into new geographic markets, particularly in emerging economies with growing urban populations, presents significant untapped potential. Technological innovation continues to offer avenues for differentiation, such as the integration of advanced IoT devices for enhanced unit management and customer interaction. The increasing demand for specialized storage, like wine storage, fine art, or secure document archiving, allows operators to carve out niche markets. Furthermore, the growing trend of utilizing self-storage facilities as micro-fulfillment centers for e-commerce businesses opens up new revenue streams and strategic partnerships.

Leading Players in the Self Storage Market Market

- National Storage Affiliates

- Global Self Storage Inc

- World Class Capital Group LLC (Great Value Storage)

- Safestore Holdings PLC

- WP Carey Inc

- Metro Storage LLC

- Prime Storage Group

- All Storage

- U-Haul International Inc

- Amsdell Cos / Compass Self Storage

- CubeSmart LP

- StorageMart

- Life Storage Inc

- Simply Self Storage Management LLC

- Urban Self Storage Inc

- SmartStop Asset Management LLC

Key Developments in Self Storage Market Industry

- March 2024: Singapore's StorHub, a leading self-storage operator, entered the Australian market with the launch of StorHub Australia, supported by a USD 300 million equity commitment. StorHub's Australian platform begins with five properties in Sydney, Melbourne, and Canberra, featuring a combined gross floor area (GFA) of 56,210 square meters. These acquisitions enhance StorHub's presence in Australia and align with its pan-Asia growth strategy, adding 655,000 sq m to its portfolio across seven markets in the Asia-Pacific region.

- February 2024: SecureSpace Self Storage announced the opening of a new self-storage facility, SecureSpace San Bernardino, located in San Bernardino, California. The self-storage facility has a proprietary high-security platform with artificial intelligence-enabled cameras and sensors offering state-of-the-art security and monitoring.

- January 2024: Etude Capital, a company of self-storage facilities in the United States, and San Felipe Financing LLC, a private real estate entity, announced the launch of a Joint Venture, Etude Storage Partners, which would invest across the North American self-storage market.

Strategic Outlook for Self Storage Market Market

The strategic outlook for the self-storage market remains exceptionally promising, fueled by a sustained demand from both personal and business sectors. Growth catalysts include ongoing urbanization, the persistent expansion of e-commerce, and the increasing need for flexible, scalable storage solutions across various industries. Continued investment in technology, such as AI-powered management systems and enhanced digital customer interfaces, will be crucial for competitive differentiation and operational efficiency. Strategic partnerships and consolidation through M&A activities are expected to continue as companies seek to expand their geographic reach and achieve economies of scale. The market is poised for further innovation in service offerings, including specialized storage solutions and the integration of self-storage facilities into broader logistics networks, promising significant future market potential and opportunities for growth.

Self Storage Market Segmentation

-

1. User Type

- 1.1. Personal

- 1.2. Business

Self Storage Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Belgium

- 2.7. Netherlands

- 2.8. Luxembourg

- 2.9. Denmark

- 2.10. Finland

- 2.11. Norway

- 2.12. Sweden

- 2.13. Iceland

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. Taiwan

- 3.4. South Korea

- 3.5. Malaysia

- 3.6. Hong Kong

- 3.7. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Self Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior

- 3.3. Market Restrains

- 3.3.1. Government Regulations on Storage are Hindering the Market Growth

- 3.4. Market Trends

- 3.4.1. Personal Storage Segment is Expected to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 5.1.1. Personal

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 6. North America Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by User Type

- 6.1.1. Personal

- 6.1.2. Business

- 6.1. Market Analysis, Insights and Forecast - by User Type

- 7. Europe Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by User Type

- 7.1.1. Personal

- 7.1.2. Business

- 7.1. Market Analysis, Insights and Forecast - by User Type

- 8. Asia Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by User Type

- 8.1.1. Personal

- 8.1.2. Business

- 8.1. Market Analysis, Insights and Forecast - by User Type

- 9. Latin America Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by User Type

- 9.1.1. Personal

- 9.1.2. Business

- 9.1. Market Analysis, Insights and Forecast - by User Type

- 10. Middle East and Africa Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by User Type

- 10.1.1. Personal

- 10.1.2. Business

- 10.1. Market Analysis, Insights and Forecast - by User Type

- 11. North America Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Belgium

- 12.1.7 Netherlands

- 12.1.8 Luxembourg

- 12.1.9 Denmark

- 12.1.10 Finland

- 12.1.11 Norway

- 12.1.12 Sweden

- 12.1.13 Iceland

- 13. Asia Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 Taiwan

- 13.1.4 South Korea

- 13.1.5 Malaysia

- 13.1.6 Hong Kong

- 13.1.7 Australia and New Zealand

- 14. Latin America Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Self Storage Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 National Storage Affiliates

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Global Self Storage Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 (Great Value Storage) World Class Capital Group LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Safestore Holdings PLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 WP Carey Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Metro Storage LLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Prime Storage Group

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 All Storage

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 U-Haul International Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Amsdell Cos /Compass Self Storage

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 CubeSmart LP

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 StorageMart

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Life Storage Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Simply Self Storage Management LLC

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Urban Self Storage Inc

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 SmartStop Asset Management LLC

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 National Storage Affiliates

List of Figures

- Figure 1: Global Self Storage Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Self Storage Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 5: North America Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Self Storage Market Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 9: Europe Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Self Storage Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 13: Asia Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Self Storage Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Latin America Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Latin America Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 17: Latin America Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Latin America Self Storage Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Middle East and Africa Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 20: Middle East and Africa Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 21: Middle East and Africa Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East and Africa Self Storage Market Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Self Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 24: North America Self Storage Market Volume (Billion), by User Type 2024 & 2032

- Figure 25: North America Self Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 26: North America Self Storage Market Volume Share (%), by User Type 2024 & 2032

- Figure 27: North America Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 28: North America Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 29: North America Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: North America Self Storage Market Volume Share (%), by Country 2024 & 2032

- Figure 31: Europe Self Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 32: Europe Self Storage Market Volume (Billion), by User Type 2024 & 2032

- Figure 33: Europe Self Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 34: Europe Self Storage Market Volume Share (%), by User Type 2024 & 2032

- Figure 35: Europe Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Europe Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Europe Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Self Storage Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Asia Self Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 40: Asia Self Storage Market Volume (Billion), by User Type 2024 & 2032

- Figure 41: Asia Self Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 42: Asia Self Storage Market Volume Share (%), by User Type 2024 & 2032

- Figure 43: Asia Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 44: Asia Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 45: Asia Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Asia Self Storage Market Volume Share (%), by Country 2024 & 2032

- Figure 47: Latin America Self Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 48: Latin America Self Storage Market Volume (Billion), by User Type 2024 & 2032

- Figure 49: Latin America Self Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 50: Latin America Self Storage Market Volume Share (%), by User Type 2024 & 2032

- Figure 51: Latin America Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 52: Latin America Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 53: Latin America Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: Latin America Self Storage Market Volume Share (%), by Country 2024 & 2032

- Figure 55: Middle East and Africa Self Storage Market Revenue (Million), by User Type 2024 & 2032

- Figure 56: Middle East and Africa Self Storage Market Volume (Billion), by User Type 2024 & 2032

- Figure 57: Middle East and Africa Self Storage Market Revenue Share (%), by User Type 2024 & 2032

- Figure 58: Middle East and Africa Self Storage Market Volume Share (%), by User Type 2024 & 2032

- Figure 59: Middle East and Africa Self Storage Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Middle East and Africa Self Storage Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Middle East and Africa Self Storage Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Middle East and Africa Self Storage Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Self Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Self Storage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Self Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 4: Global Self Storage Market Volume Billion Forecast, by User Type 2019 & 2032

- Table 5: Global Self Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Self Storage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 9: United States Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United States Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 11: Canada Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Germany Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: France Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Spain Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Italy Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Belgium Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Belgium Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Netherlands Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Luxembourg Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Luxembourg Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Denmark Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Finland Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Finland Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Norway Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Norway Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Sweden Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Sweden Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Iceland Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Iceland Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 43: China Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: China Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: Japan Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 47: Taiwan Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Taiwan Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 49: South Korea Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 51: Malaysia Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Malaysia Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 53: Hong Kong Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Hong Kong Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: Australia and New Zealand Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia and New Zealand Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 57: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 59: Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 61: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 63: Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 65: Global Self Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 66: Global Self Storage Market Volume Billion Forecast, by User Type 2019 & 2032

- Table 67: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 68: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 69: United States Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: United States Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 71: Canada Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Canada Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 73: Global Self Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 74: Global Self Storage Market Volume Billion Forecast, by User Type 2019 & 2032

- Table 75: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 77: United Kingdom Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: United Kingdom Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 79: Germany Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Germany Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 81: France Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: France Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 83: Spain Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Spain Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 85: Italy Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Italy Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 87: Belgium Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Belgium Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 89: Netherlands Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Netherlands Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 91: Luxembourg Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: Luxembourg Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 93: Denmark Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Denmark Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 95: Finland Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Finland Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 97: Norway Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Norway Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 99: Sweden Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Sweden Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 101: Iceland Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: Iceland Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 103: Global Self Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 104: Global Self Storage Market Volume Billion Forecast, by User Type 2019 & 2032

- Table 105: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 106: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 107: China Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: China Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 109: Japan Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 110: Japan Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 111: Taiwan Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 112: Taiwan Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 113: South Korea Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 114: South Korea Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 115: Malaysia Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: Malaysia Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 117: Hong Kong Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 118: Hong Kong Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 119: Australia and New Zealand Self Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 120: Australia and New Zealand Self Storage Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 121: Global Self Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 122: Global Self Storage Market Volume Billion Forecast, by User Type 2019 & 2032

- Table 123: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 124: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 125: Global Self Storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 126: Global Self Storage Market Volume Billion Forecast, by User Type 2019 & 2032

- Table 127: Global Self Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 128: Global Self Storage Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self Storage Market?

The projected CAGR is approximately 3.65%.

2. Which companies are prominent players in the Self Storage Market?

Key companies in the market include National Storage Affiliates, Global Self Storage Inc, (Great Value Storage) World Class Capital Group LLC, Safestore Holdings PLC, WP Carey Inc, Metro Storage LLC, Prime Storage Group, All Storage, U-Haul International Inc, Amsdell Cos /Compass Self Storage, CubeSmart LP, StorageMart, Life Storage Inc, Simply Self Storage Management LLC, Urban Self Storage Inc, SmartStop Asset Management LLC.

3. What are the main segments of the Self Storage Market?

The market segments include User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior.

6. What are the notable trends driving market growth?

Personal Storage Segment is Expected to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Government Regulations on Storage are Hindering the Market Growth.

8. Can you provide examples of recent developments in the market?

In March 2024, Singapore's StorHub, a leading self-storage operator, entered the Australian market with the launch of StorHub Australia, supported by a USD 300 million equity commitment. StorHub's Australian platform begins with five properties in Sydney, Melbourne, and Canberra, featuring a combined gross floor area (GFA) of 56,210 square meters. These acquisitions enhance StorHub's presence in Australia and align with its pan-Asia growth strategy, adding 655,000 sq m to its portfolio across seven markets in the Asia-Pacific region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self Storage Market?

To stay informed about further developments, trends, and reports in the Self Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence