Key Insights

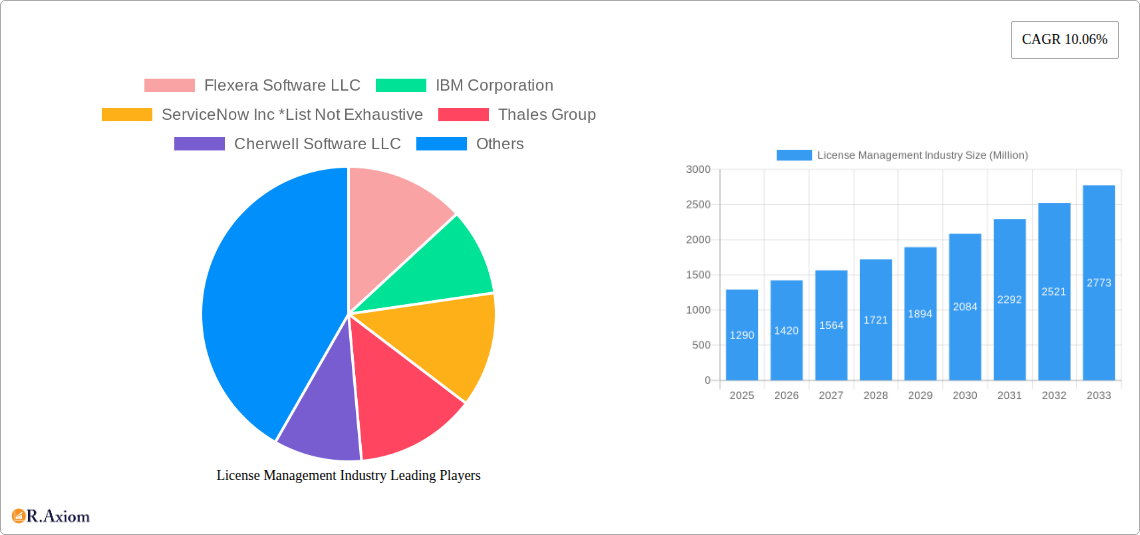

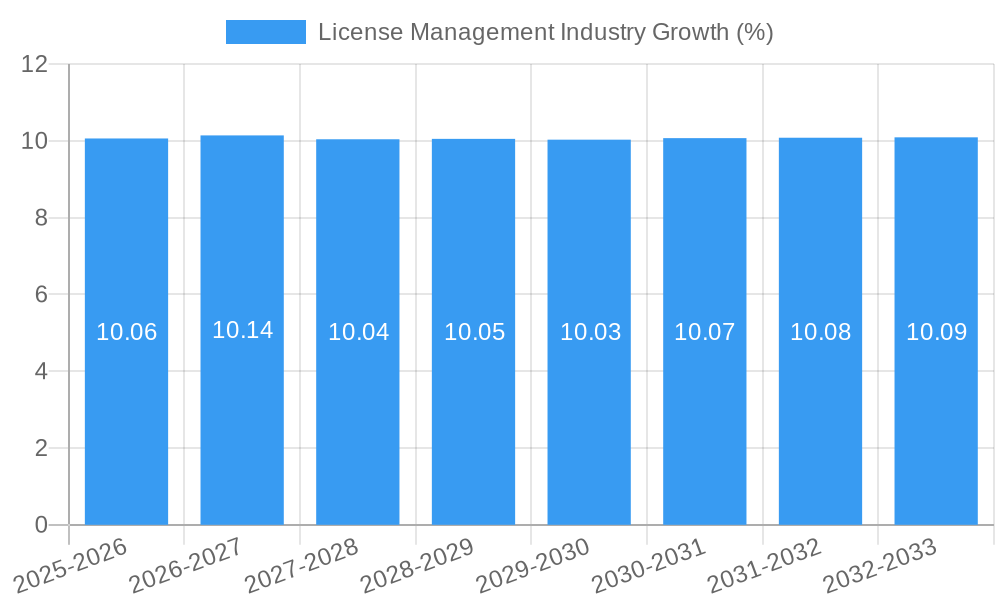

The License Management Industry is poised for significant expansion, projected to reach a market size of approximately $1.29 billion, driven by a robust Compound Annual Growth Rate (CAGR) of 10.06%. This dynamic growth is underpinned by several critical factors. The increasing complexity of software ecosystems, the proliferation of cloud-based solutions, and the growing emphasis on regulatory compliance are compelling organizations to adopt sophisticated license management strategies. Businesses across all sectors are recognizing the substantial financial implications of software over-licensing, under-licensing, and the associated risks of non-compliance. Consequently, there's a surging demand for solutions that offer comprehensive audit services, expert advisory, and streamlined compliance management. The shift towards cloud deployments, coupled with the need for efficient license entitlement and optimization, further fuels this market. Key industries like BFSI, Healthcare and Life Sciences, and IT and Telecommunication are leading this adoption, seeking to mitigate risks and maximize their return on investment in software assets.

The competitive landscape is characterized by a mix of established technology giants and specialized software providers. Companies such as IBM Corporation, ServiceNow Inc., Oracle Corporation, and Flexera Software LLC are actively shaping the market with their advanced offerings, while emerging players are focusing on niche solutions and innovative technologies. The forecast period from 2025 to 2033 indicates continued strong performance, with an anticipated growth trajectory that will see the market value climb significantly. While the market is generally characterized by healthy growth, potential restraints could include the initial cost of implementation for some advanced solutions and the inertia of legacy systems within some organizations. However, the overarching benefits of enhanced cost control, improved security posture, and streamlined operational efficiency are expected to outweigh these challenges, ensuring sustained and impactful market expansion.

Here's an SEO-optimized, detailed report description for the License Management Industry, incorporating high-traffic keywords and structured as requested.

License Management Industry Market Concentration & Innovation

The global License Management Industry is characterized by a moderate to high level of market concentration, driven by the strategic importance of software asset management (SAM) and the increasing complexity of digital licensing models. Key players like Flexera Software LLC, IBM Corporation, and ServiceNow Inc. command significant market share, leveraging their extensive product portfolios and established client bases. Innovation within the sector is primarily fueled by advancements in cloud computing, artificial intelligence (AI), and machine learning (ML) for enhanced license optimization and compliance. Regulatory frameworks, particularly data privacy laws like GDPR and CCPA, are increasingly influencing license management strategies, driving demand for robust compliance solutions. Product substitutes, while emerging in the form of open-source alternatives and evolving SaaS models, have not significantly diminished the core need for comprehensive license management. End-user trends indicate a strong preference for integrated solutions that offer end-to-end visibility and control across diverse software estates. Mergers and acquisitions (M&A) remain a significant factor in market consolidation, with notable deal values often exceeding several hundred million dollars, as companies seek to expand their capabilities and geographic reach. For instance, the acquisition of Reprise Software by FOG Software Group in January 2022 highlights the ongoing consolidation and strategic positioning within the industry.

Market Concentration Metrics:

- Top 5 Player Market Share: Projected to be over 60% by 2025, indicating substantial influence.

- M&A Deal Value (Past 2 Years): Estimated to be in the range of $500 Million to $1 Billion.

License Management Industry Industry Trends & Insights

The License Management Industry is experiencing robust growth, projected to maintain a significant Compound Annual Growth Rate (CAGR) of approximately 12% from 2025 to 2033. This expansion is primarily driven by the escalating adoption of cloud-based solutions and the burgeoning complexity of software licensing agreements, especially within multi-cloud and hybrid environments. Businesses are increasingly recognizing the financial and operational benefits of effective license management, including cost reduction through optimization, mitigation of compliance risks, and improved strategic IT planning. Technological disruptions are at the forefront of this evolution, with AI and ML algorithms transforming how licenses are tracked, allocated, and optimized. Predictive analytics are enabling organizations to forecast future license needs more accurately, thereby preventing over-spending and under-licensing penalties. Consumer preferences are shifting towards integrated Software Asset Management (SAM) platforms that offer a unified view of all software assets, regardless of deployment model. This demand for seamless integration extends to procurement, deployment, and ongoing management processes. Competitive dynamics are intensifying, with established vendors enhancing their offerings and new entrants focusing on niche solutions, particularly in areas like containerized software licensing and SaaS subscription management. The increasing volume of software and data necessitates sophisticated license management tools to ensure regulatory compliance and maximize ROI. The market penetration of dedicated license management solutions is expected to rise considerably as organizations prioritize digital transformation initiatives and aim to gain greater control over their software investments.

Key Growth Catalysts:

- Digital Transformation Initiatives: Accelerating the need for efficient software asset visibility.

- Cloud Migration Strategies: Driving demand for flexible and scalable license management solutions.

- SaaS Adoption Surge: Requiring granular tracking of subscription-based software.

- Cybersecurity Concerns: Emphasizing the importance of license compliance for security posture.

Dominant Markets & Segments in License Management Industry

The License Management Industry exhibits distinct dominance across various segments, driven by specific sector needs and technological advancements.

Component Dominance:

- Software Segment: This segment holds a commanding lead, valued at an estimated $5 Billion in 2025. The inherent need to manage software licenses, track usage, and ensure compliance makes software the core focus of the industry. With the proliferation of custom applications, commercial off-the-shelf (COTS) software, and SaaS solutions, the complexity and volume of software assets continue to grow, fueling demand for sophisticated software license management tools. The ongoing transition to subscription-based software models further solidifies the dominance of this component.

- Services Segment: While secondary to software, the services segment, including audit, advisory, and optimization services, is experiencing rapid growth, projected at a 13% CAGR. As organizations grapple with complex licensing agreements and evolving regulations, they increasingly rely on expert services to navigate these challenges and achieve optimal outcomes.

Deployment Dominance:

- Cloud Deployment: This segment is rapidly emerging as the dominant deployment model, projected to capture over 60% of the market by 2028. The widespread adoption of cloud-based software, SaaS applications, and hybrid cloud infrastructures necessitates license management solutions that are inherently cloud-native and scalable. The agility and flexibility offered by cloud deployments align perfectly with the dynamic nature of modern IT environments.

- On-Premise Deployment: While still significant, particularly for legacy systems and highly regulated industries, on-premise deployment's market share is gradually declining as organizations migrate to the cloud.

Application Dominance (Qualitative Trend Analysis):

- License Entitlement and Optimization: This application area is paramount, accounting for an estimated 40% of the overall market value. The core function of license management lies in ensuring organizations possess the correct entitlements and are utilizing them efficiently to minimize costs and avoid penalties. This includes license reconciliation, usage monitoring, and proactive optimization strategies.

- Compliance Management: Increasingly critical due to stringent regulatory requirements, this application is a major growth driver. Companies are investing heavily in solutions that guarantee adherence to vendor license terms and industry regulations.

- Operations and Analytics: Essential for strategic IT decision-making, this segment provides crucial insights into software usage patterns, costs, and risks, driving operational efficiency.

End User Dominance:

- IT and Telecommunication: This sector represents the largest end-user market, estimated at over $3 Billion in 2025. The extensive use of software, rapid technological advancements, and the need for strict vendor compliance make this industry a prime adopter of advanced license management solutions. The constant evolution of network infrastructure and service offerings necessitates robust SAM practices.

- BFSI (Banking, Financial Services, and Insurance): A significant and growing market, driven by stringent regulatory compliance, data security mandates, and the need to manage a vast array of financial software and applications. The high value of transactions and sensitive data handled by BFSI firms places a premium on accurate and secure license management.

- Healthcare and Life Sciences: This sector is experiencing substantial growth due to the increasing digitization of patient records, adoption of specialized medical software, and stringent regulatory compliance requirements like HIPAA. Effective license management is crucial for ensuring data security and operational continuity.

Key Drivers for Segment Dominance:

- Economic Policies: Government incentives for software development and adoption.

- Infrastructure Development: Expansion of cloud and network infrastructure.

- Regulatory Landscape: Increasing compliance mandates across industries.

- Technological Advancement: Rapid innovation in AI, ML, and cloud computing.

License Management Industry Product Developments

Product developments in the License Management Industry are rapidly evolving to meet the demands of increasingly complex IT landscapes. Key innovations focus on AI-driven automation for license discovery and reconciliation, predictive analytics for optimizing software spend, and enhanced integration capabilities with cloud platforms and DevOps workflows. Companies are developing solutions that offer granular tracking of containerized software and microservices, addressing the challenges posed by modern application architectures. Competitive advantages are being built through specialized modules for SaaS subscription management, robust security features for license key protection, and user-friendly interfaces that democratize SAM for broader IT teams.

Report Scope & Segmentation Analysis

This comprehensive report offers an in-depth analysis of the global License Management Industry, segmenting the market across several key dimensions. The Component segmentation includes Software and Services, analyzing their respective market sizes and growth trajectories. Deployment types are categorized into On-premise and Cloud, with projections for adoption shifts. The Application segmentation delves into Audit Services, Advisory Services, Compliance Management, License Entitlement and Optimization, Operations and Analytics, and Other Applications, examining their specific market contributions and future potential. The End User analysis covers BFSI, Healthcare and Life Sciences, IT and Telecommunication, Media and Entertainment, and Other End Users, highlighting their unique adoption drivers and market penetration. Growth projections and competitive dynamics are detailed for each segment.

Key Drivers of License Management Industry Growth

The License Management Industry's growth is propelled by several critical factors. The accelerating pace of digital transformation and cloud adoption across enterprises necessitates robust tools to manage burgeoning software assets and complex licensing models. Increasing regulatory scrutiny, including data privacy and software compliance mandates, drives demand for comprehensive audit and compliance solutions. The pursuit of cost optimization and operational efficiency encourages businesses to leverage advanced license optimization capabilities, preventing unnecessary software expenditure and potential penalties. Furthermore, the rise of sophisticated cybersecurity threats emphasizes the need for accurate software inventory and license validation as part of a strong security posture.

Challenges in the License Management Industry Sector

Despite robust growth, the License Management Industry faces several challenges. The rapid evolution of software licensing models, particularly with SaaS and subscription-based offerings, creates ongoing complexity for tracking and management. Ensuring comprehensive discovery of all software assets across diverse and often siloed IT environments remains a persistent hurdle. The shortage of skilled professionals with specialized SAM expertise can limit effective implementation and utilization of license management tools. Furthermore, resistance to change within organizations and the perception of license management as a purely cost-center activity can hinder investment and adoption. The dynamic nature of regulatory landscapes also presents a continuous challenge for maintaining up-to-date compliance strategies.

Emerging Opportunities in License Management Industry

Emerging opportunities in the License Management Industry lie in the increasing demand for AI and ML-powered automation to streamline SAM processes, predict license needs, and identify optimization opportunities. The growing adoption of containerization technologies and microservices presents a new frontier for specialized license management solutions. The expanding market for SaaS management platforms, offering granular control over subscription lifecycles, is another significant growth avenue. Furthermore, the focus on Environmental, Social, and Governance (ESG) initiatives is driving opportunities for solutions that help organizations optimize their digital footprint and reduce software-related waste. The integration of license management with broader IT Service Management (ITSM) and cybersecurity platforms also presents a key opportunity for synergistic growth.

Leading Players in the License Management Industry Market

- Flexera Software LLC

- IBM Corporation

- ServiceNow Inc.

- Thales Group

- Cherwell Software LLC

- USU Software AG

- DXC Technology Co

- Snow Software AB

- Oracle Corporation

- Reprise Software Inc

Key Developments in License Management Industry Industry

- February 2022: Thales collaborated with Lantronix Inc. and Taoglas to develop and deliver application-specific smart industrial IoT solutions for connecting data-dependent vertical industries, including Industrial 4.0, security, and transportation markets.

- January 2022: Reprise Software, inventors of the Reprise License Management (RLM) solution, was acquired by FOG Software Group, an operational group of Vela Software, and Constellation Software Inc.

Strategic Outlook for License Management Industry Market

The strategic outlook for the License Management Industry is highly positive, driven by the persistent need for control, compliance, and cost optimization in increasingly complex digital environments. The ongoing shift towards cloud-native architectures and advanced software deployment models will continue to fuel demand for intelligent, automated license management solutions. Key growth catalysts include the integration of AI and machine learning for predictive analytics and proactive optimization, as well as the expansion of capabilities to manage the nuances of SaaS subscriptions and containerized applications. Companies that can offer comprehensive, integrated platforms that enhance visibility, reduce risk, and drive significant ROI will be best positioned for sustained success in this dynamic market. The industry is set to witness further innovation in user experience and advanced reporting, empowering a broader range of IT professionals to effectively manage software assets.

License Management Industry Segmentation

-

1. Component

- 1.1. Software

- 1.2. Services

-

2. Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. Application (Qualitative Trend Analysis)

- 3.1. Audit Services

- 3.2. Advisory Services

- 3.3. Compliance Management

- 3.4. License Entitlement and Optimization

- 3.5. Operations and Analytics

- 3.6. Other Applications

-

4. End User

- 4.1. BFSI

- 4.2. Healthcare and Life Sciences

- 4.3. IT and Telecommunication

- 4.4. Media and Entertainment

- 4.5. Other End Users

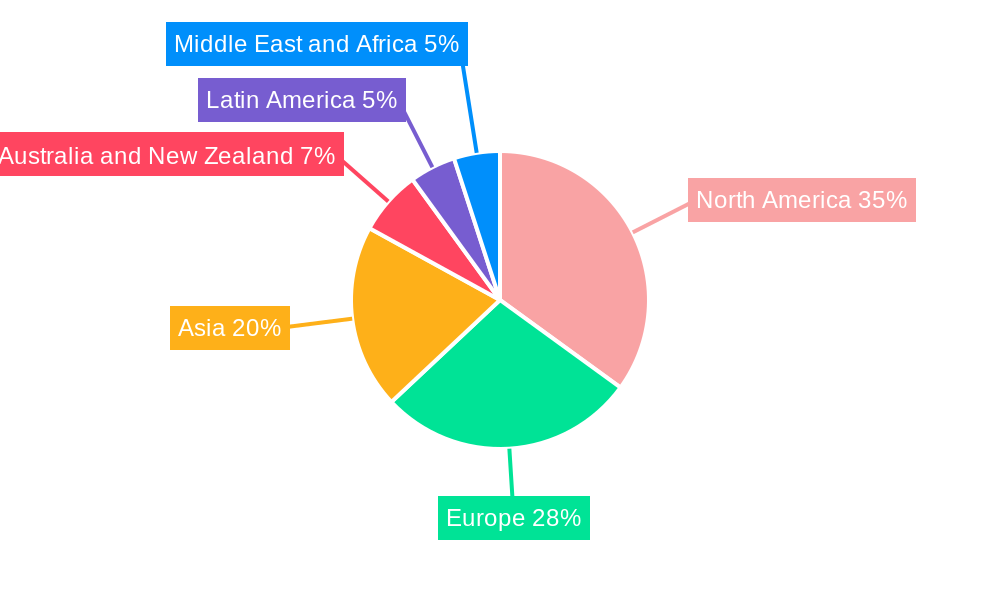

License Management Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

License Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand to Optimize Software Investments; Growing Requirement for Audit-readiness among Organizations

- 3.3. Market Restrains

- 3.3.1. Uncertain Regulatory Standards and Frameworks

- 3.4. Market Trends

- 3.4.1. Healthcare Segment to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global License Management Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Application (Qualitative Trend Analysis)

- 5.3.1. Audit Services

- 5.3.2. Advisory Services

- 5.3.3. Compliance Management

- 5.3.4. License Entitlement and Optimization

- 5.3.5. Operations and Analytics

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. BFSI

- 5.4.2. Healthcare and Life Sciences

- 5.4.3. IT and Telecommunication

- 5.4.4. Media and Entertainment

- 5.4.5. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Australia and New Zealand

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America License Management Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Software

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. Cloud

- 6.3. Market Analysis, Insights and Forecast - by Application (Qualitative Trend Analysis)

- 6.3.1. Audit Services

- 6.3.2. Advisory Services

- 6.3.3. Compliance Management

- 6.3.4. License Entitlement and Optimization

- 6.3.5. Operations and Analytics

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. BFSI

- 6.4.2. Healthcare and Life Sciences

- 6.4.3. IT and Telecommunication

- 6.4.4. Media and Entertainment

- 6.4.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe License Management Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Software

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. Cloud

- 7.3. Market Analysis, Insights and Forecast - by Application (Qualitative Trend Analysis)

- 7.3.1. Audit Services

- 7.3.2. Advisory Services

- 7.3.3. Compliance Management

- 7.3.4. License Entitlement and Optimization

- 7.3.5. Operations and Analytics

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. BFSI

- 7.4.2. Healthcare and Life Sciences

- 7.4.3. IT and Telecommunication

- 7.4.4. Media and Entertainment

- 7.4.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia License Management Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Software

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. Cloud

- 8.3. Market Analysis, Insights and Forecast - by Application (Qualitative Trend Analysis)

- 8.3.1. Audit Services

- 8.3.2. Advisory Services

- 8.3.3. Compliance Management

- 8.3.4. License Entitlement and Optimization

- 8.3.5. Operations and Analytics

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. BFSI

- 8.4.2. Healthcare and Life Sciences

- 8.4.3. IT and Telecommunication

- 8.4.4. Media and Entertainment

- 8.4.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand License Management Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Software

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. Cloud

- 9.3. Market Analysis, Insights and Forecast - by Application (Qualitative Trend Analysis)

- 9.3.1. Audit Services

- 9.3.2. Advisory Services

- 9.3.3. Compliance Management

- 9.3.4. License Entitlement and Optimization

- 9.3.5. Operations and Analytics

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. BFSI

- 9.4.2. Healthcare and Life Sciences

- 9.4.3. IT and Telecommunication

- 9.4.4. Media and Entertainment

- 9.4.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America License Management Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Software

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-premise

- 10.2.2. Cloud

- 10.3. Market Analysis, Insights and Forecast - by Application (Qualitative Trend Analysis)

- 10.3.1. Audit Services

- 10.3.2. Advisory Services

- 10.3.3. Compliance Management

- 10.3.4. License Entitlement and Optimization

- 10.3.5. Operations and Analytics

- 10.3.6. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. BFSI

- 10.4.2. Healthcare and Life Sciences

- 10.4.3. IT and Telecommunication

- 10.4.4. Media and Entertainment

- 10.4.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa License Management Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Software

- 11.1.2. Services

- 11.2. Market Analysis, Insights and Forecast - by Deployment

- 11.2.1. On-premise

- 11.2.2. Cloud

- 11.3. Market Analysis, Insights and Forecast - by Application (Qualitative Trend Analysis)

- 11.3.1. Audit Services

- 11.3.2. Advisory Services

- 11.3.3. Compliance Management

- 11.3.4. License Entitlement and Optimization

- 11.3.5. Operations and Analytics

- 11.3.6. Other Applications

- 11.4. Market Analysis, Insights and Forecast - by End User

- 11.4.1. BFSI

- 11.4.2. Healthcare and Life Sciences

- 11.4.3. IT and Telecommunication

- 11.4.4. Media and Entertainment

- 11.4.5. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. North America License Management Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe License Management Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific License Management Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America License Management Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa License Management Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Flexera Software LLC

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 IBM Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 ServiceNow Inc *List Not Exhaustive

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Thales Group

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Cherwell Software LLC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 USU Software AG

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 DXC Technology Co

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Snow Software AB

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Oracle Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Reprise Software Inc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Flexera Software LLC

List of Figures

- Figure 1: Global License Management Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America License Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 13: North America License Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America License Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 15: North America License Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: North America License Management Industry Revenue (Million), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 17: North America License Management Industry Revenue Share (%), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 18: North America License Management Industry Revenue (Million), by End User 2024 & 2032

- Figure 19: North America License Management Industry Revenue Share (%), by End User 2024 & 2032

- Figure 20: North America License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe License Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 23: Europe License Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 24: Europe License Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 25: Europe License Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 26: Europe License Management Industry Revenue (Million), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 27: Europe License Management Industry Revenue Share (%), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 28: Europe License Management Industry Revenue (Million), by End User 2024 & 2032

- Figure 29: Europe License Management Industry Revenue Share (%), by End User 2024 & 2032

- Figure 30: Europe License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia License Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 33: Asia License Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 34: Asia License Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 35: Asia License Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 36: Asia License Management Industry Revenue (Million), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 37: Asia License Management Industry Revenue Share (%), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 38: Asia License Management Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: Asia License Management Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Asia License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Australia and New Zealand License Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 43: Australia and New Zealand License Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 44: Australia and New Zealand License Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 45: Australia and New Zealand License Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 46: Australia and New Zealand License Management Industry Revenue (Million), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 47: Australia and New Zealand License Management Industry Revenue Share (%), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 48: Australia and New Zealand License Management Industry Revenue (Million), by End User 2024 & 2032

- Figure 49: Australia and New Zealand License Management Industry Revenue Share (%), by End User 2024 & 2032

- Figure 50: Australia and New Zealand License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Australia and New Zealand License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Latin America License Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 53: Latin America License Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 54: Latin America License Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 55: Latin America License Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 56: Latin America License Management Industry Revenue (Million), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 57: Latin America License Management Industry Revenue Share (%), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 58: Latin America License Management Industry Revenue (Million), by End User 2024 & 2032

- Figure 59: Latin America License Management Industry Revenue Share (%), by End User 2024 & 2032

- Figure 60: Latin America License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Latin America License Management Industry Revenue Share (%), by Country 2024 & 2032

- Figure 62: Middle East and Africa License Management Industry Revenue (Million), by Component 2024 & 2032

- Figure 63: Middle East and Africa License Management Industry Revenue Share (%), by Component 2024 & 2032

- Figure 64: Middle East and Africa License Management Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 65: Middle East and Africa License Management Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 66: Middle East and Africa License Management Industry Revenue (Million), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 67: Middle East and Africa License Management Industry Revenue Share (%), by Application (Qualitative Trend Analysis) 2024 & 2032

- Figure 68: Middle East and Africa License Management Industry Revenue (Million), by End User 2024 & 2032

- Figure 69: Middle East and Africa License Management Industry Revenue Share (%), by End User 2024 & 2032

- Figure 70: Middle East and Africa License Management Industry Revenue (Million), by Country 2024 & 2032

- Figure 71: Middle East and Africa License Management Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global License Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global License Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global License Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global License Management Industry Revenue Million Forecast, by Application (Qualitative Trend Analysis) 2019 & 2032

- Table 5: Global License Management Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Global License Management Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: License Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: License Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: License Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: License Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: License Management Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global License Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 18: Global License Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 19: Global License Management Industry Revenue Million Forecast, by Application (Qualitative Trend Analysis) 2019 & 2032

- Table 20: Global License Management Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global License Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 23: Global License Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 24: Global License Management Industry Revenue Million Forecast, by Application (Qualitative Trend Analysis) 2019 & 2032

- Table 25: Global License Management Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 26: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global License Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 28: Global License Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 29: Global License Management Industry Revenue Million Forecast, by Application (Qualitative Trend Analysis) 2019 & 2032

- Table 30: Global License Management Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 31: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global License Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 33: Global License Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 34: Global License Management Industry Revenue Million Forecast, by Application (Qualitative Trend Analysis) 2019 & 2032

- Table 35: Global License Management Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Global License Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 38: Global License Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 39: Global License Management Industry Revenue Million Forecast, by Application (Qualitative Trend Analysis) 2019 & 2032

- Table 40: Global License Management Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 41: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global License Management Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 43: Global License Management Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 44: Global License Management Industry Revenue Million Forecast, by Application (Qualitative Trend Analysis) 2019 & 2032

- Table 45: Global License Management Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 46: Global License Management Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the License Management Industry?

The projected CAGR is approximately 10.06%.

2. Which companies are prominent players in the License Management Industry?

Key companies in the market include Flexera Software LLC, IBM Corporation, ServiceNow Inc *List Not Exhaustive, Thales Group, Cherwell Software LLC, USU Software AG, DXC Technology Co, Snow Software AB, Oracle Corporation, Reprise Software Inc.

3. What are the main segments of the License Management Industry?

The market segments include Component, Deployment, Application (Qualitative Trend Analysis), End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand to Optimize Software Investments; Growing Requirement for Audit-readiness among Organizations.

6. What are the notable trends driving market growth?

Healthcare Segment to Drive Market Growth.

7. Are there any restraints impacting market growth?

Uncertain Regulatory Standards and Frameworks.

8. Can you provide examples of recent developments in the market?

February 2022 - Thales collaborated with Lantronix Inc. and Taoglas to develop and deliver application-specific smart industrial IoT solutions for connecting data-dependent vertical industries, including Industrial 4.0, security, and transportation markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "License Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the License Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the License Management Industry?

To stay informed about further developments, trends, and reports in the License Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence