Key Insights

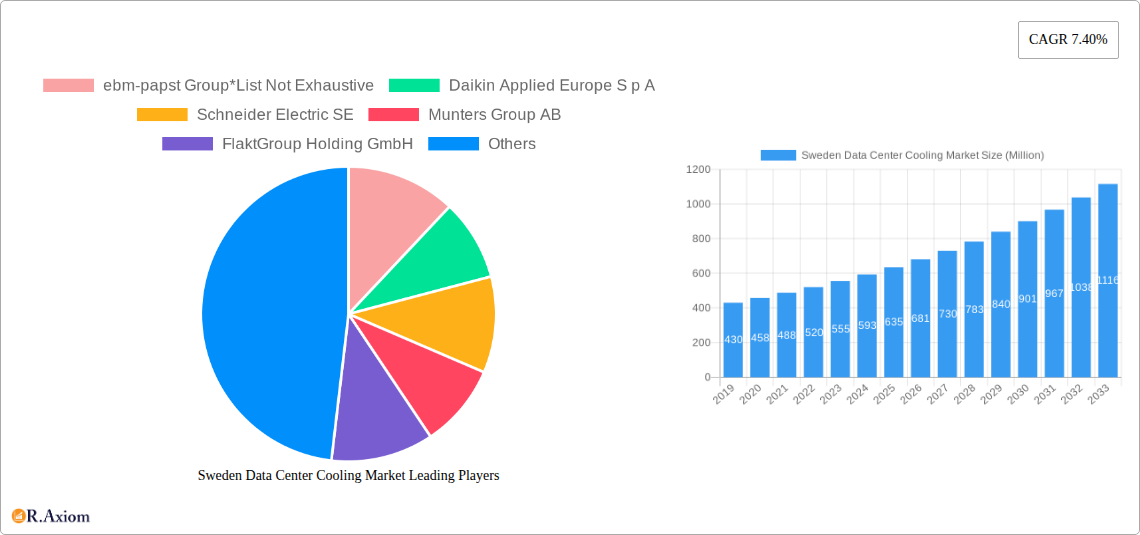

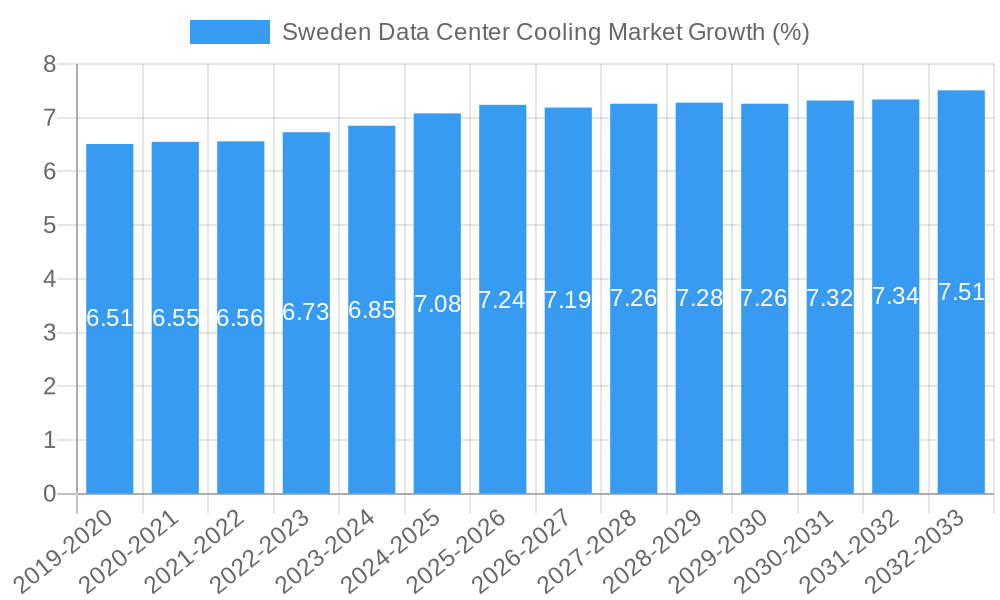

The Sweden Data Center Cooling Market is poised for robust growth, projected to reach approximately $750 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.40% anticipated through 2033. This expansion is fundamentally driven by the escalating demand for advanced cooling solutions to manage the heat generated by increasingly powerful and dense data processing units. Key growth enablers include the significant investments in hyperscale data centers, fueled by the burgeoning cloud computing sector and the proliferation of AI and IoT technologies. Furthermore, the growing adoption of energy-efficient liquid-based cooling technologies, such as immersion cooling and direct-to-chip cooling, is a critical trend, offering superior thermal management and substantial operational cost savings compared to traditional air-based methods. This shift is being accelerated by a heightened focus on sustainability and reducing the environmental footprint of data centers, aligning with Sweden's strong commitment to green initiatives.

The market's trajectory is also influenced by evolving industry verticals. The IT & Telecom sector remains a dominant force, consistently requiring scalable and efficient cooling infrastructure to support its rapid advancements. However, significant growth is also expected from Healthcare, driven by the digitization of patient records and medical imaging, and Media & Entertainment, with the increasing demand for streaming services and high-definition content delivery. While the market benefits from these strong drivers, certain restraints, such as the high initial capital investment for advanced cooling systems and the need for specialized technical expertise, could present challenges. Nevertheless, the overarching trend towards more sustainable and high-performance data center operations, coupled with government incentives for green technology adoption, positions the Sweden Data Center Cooling Market for a period of sustained and dynamic expansion. The market is segmented across various cooling technologies, including air-based (chillers, CRAHs) and liquid-based solutions, and caters to diverse end-users from hyperscalers to enterprise and colocation facilities.

Sweden Data Center Cooling Market: A Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides an unparalleled view of the Sweden Data Center Cooling Market, a critical sector driving the efficiency and sustainability of digital infrastructure. We deliver granular insights into market dynamics, technological advancements, competitive landscapes, and future projections for the period of 2019–2033, with a robust base year of 2025. Our analysis encompasses a detailed breakdown of market segments, including cooling technologies like Air-based Cooling (Chiller and Economizer, CRAH, Cooling, Others) and Liquid-based Cooling (Immersion Cooling, Direct-to-Chip Cooling, Rear-Door Heat Exchanger), alongside classifications by Type (Hyperscalers - owned & Leased, Enterprise - On-premise, Colocation) and End-user Vertical (IT & Telecom, Retail & Consumer Goods, Healthcare, Media & Entertainment, Federal & Institutional agencies, Other end-users). This report is essential for data center operators, IT infrastructure providers, cooling solution manufacturers, investors, and policymakers seeking to understand and capitalize on the evolving Swedish data center cooling ecosystem.

Sweden Data Center Cooling Market Market Concentration & Innovation

The Sweden Data Center Cooling Market exhibits a moderate level of concentration, with a few dominant players alongside a growing number of specialized and innovative firms. Innovation is primarily driven by the relentless pursuit of energy efficiency, increased power densities within data halls, and the stringent environmental regulations governing cooling technologies. Key innovation drivers include the development of advanced liquid cooling solutions to manage high-performance computing (HPC) workloads, the integration of AI and IoT for intelligent cooling management, and the adoption of sustainable refrigerants. Regulatory frameworks, such as those promoting energy efficiency and carbon footprint reduction, are crucial in shaping product development and market adoption. Product substitutes, while present, are increasingly being differentiated by their energy efficiency, scalability, and total cost of ownership. End-user trends highlight a growing demand for highly reliable, scalable, and environmentally responsible cooling solutions, particularly from hyperscale operators and enterprise clients migrating to the cloud or expanding their on-premise facilities. Mergers and acquisitions (M&A) activities, while not as prevalent as in larger global markets, are expected to increase as companies seek to consolidate offerings, acquire new technologies, or expand their market reach. For instance, strategic acquisitions of smaller, specialized cooling technology providers by larger HVAC and data center infrastructure firms could reshape market dynamics. Current market share estimates for leading companies are approximately 15-25% for top players, with significant fragmentation among smaller vendors.

Sweden Data Center Cooling Market Industry Trends & Insights

The Sweden Data Center Cooling Market is experiencing robust growth, propelled by a confluence of powerful industry trends and evolving market dynamics. A primary growth driver is the escalating demand for digital services, fueled by the proliferation of AI, big data analytics, IoT devices, and the continuous expansion of cloud computing infrastructure. As data centers process increasingly larger volumes of data and house more powerful hardware, the thermal management challenges intensify, creating a substantial market opportunity for advanced cooling solutions. The Swedish government's commitment to sustainability and its ambitious climate goals are further stimulating the adoption of energy-efficient cooling technologies. This aligns with the industry's shift towards greener data center operations, emphasizing reduced energy consumption and lower carbon emissions. Technological disruptions are playing a pivotal role, with liquid-based cooling solutions gaining significant traction as they offer superior thermal dissipation capabilities compared to traditional air-based methods, especially for high-density computing environments. Immersion cooling and direct-to-chip cooling are emerging as critical technologies for future data center designs. Consumer preferences are increasingly aligned with the environmental impact of data centers, pushing operators to adopt sustainable practices and visible energy-saving measures. This is driving demand for solutions that not only provide efficient cooling but also contribute to a lower overall environmental footprint. The competitive landscape is characterized by a blend of established global players and agile local innovators, all vying for market share. Companies are differentiating themselves through product innovation, service offerings, and strategic partnerships. The estimated Compound Annual Growth Rate (CAGR) for the Sweden Data Center Cooling Market is projected to be between 8% and 10% during the forecast period (2025–2033). Market penetration of advanced cooling technologies is expected to rise significantly, from approximately 20% in 2025 to over 45% by 2033, indicating a substantial shift towards more sophisticated thermal management strategies.

Dominant Markets & Segments in Sweden Data Center Cooling Market

The Sweden Data Center Cooling Market is shaped by the dominance of specific segments driven by infrastructure development, technological adoption, and end-user requirements.

Cooling Technology:

- Air-based Cooling: This segment remains dominant due to its established presence and cost-effectiveness for many applications.

- Chiller and Economizer: These systems are crucial for large-scale deployments and are favored for their ability to efficiently cool significant volumes of air, especially with the increasing adoption of free cooling opportunities in Sweden's climate. Growth drivers include the need for energy-efficient cooling in new hyperscale facilities and expansions of existing colocation centers.

- CRAH (Computer Room Air Handler) Units: CRAH units are fundamental to maintaining precise temperature and humidity levels within server rooms. Their widespread adoption across enterprise and colocation facilities makes them a significant contributor to the air-based cooling market.

- Cooling & Others: This sub-segment encompasses a range of supplementary cooling solutions and older technologies still in use, contributing to the overall market share.

- Liquid-based Cooling: This segment is experiencing rapid growth and is poised to become increasingly significant, driven by the need to manage higher heat loads from modern IT equipment.

- Immersion Cooling: Gaining momentum for its high efficiency and ability to handle extremely dense compute environments, particularly for HPC and AI workloads. Its market penetration is expected to surge as technology matures and costs become more competitive.

- Direct-to-Chip Cooling: Offers precise cooling for individual components, making it ideal for high-performance servers and specialized applications. Its adoption is linked to advancements in server technology and the demand for optimized thermal performance.

- Rear-Door Heat Exchanger: A cost-effective way to supplement existing air cooling, particularly in high-density racks, by capturing heat at the source.

Type:

- Hyperscalers (Owned & Leased): This segment is a major driver of demand due to the sheer scale of their operations and their continuous need for cutting-edge cooling infrastructure to support massive data processing. The trend towards building new hyperscale facilities in Sweden, attracted by renewable energy sources and favorable business environments, fuels this dominance.

- Colocation: The colocation segment is also a significant contributor, as third-party data centers provide infrastructure-as-a-service, requiring efficient and scalable cooling to attract and retain a diverse clientele. The expansion of colocation facilities to meet growing cloud demand further bolsters this segment.

- Enterprise (On-premise): While some enterprises are migrating to the cloud, many continue to maintain on-premise data centers for specific needs, driving demand for reliable and efficient cooling solutions.

End-user Vertical:

- IT & Telecom: This is the leading end-user vertical due to the inherent nature of data centers being core to these industries. Their constant need for robust and scalable infrastructure makes them the primary consumers of data center cooling solutions.

- Retail & Consumer Goods: Growing reliance on e-commerce and digital services necessitates robust data center infrastructure, driving demand for cooling solutions.

- Healthcare: The increasing digitization of healthcare records and the adoption of advanced medical technologies require secure and efficient data storage, leading to growth in this segment.

- Media & Entertainment: The surge in streaming services, content creation, and digital media distribution demands significant data processing and storage, thereby increasing the need for advanced cooling.

- Federal & Institutional Agencies: Government and public sector entities are increasingly adopting digital solutions, necessitating secure and reliable data center infrastructure with efficient cooling.

Sweden Data Center Cooling Market Product Developments

Recent product developments in the Sweden Data Center Cooling Market highlight a strong focus on environmental responsibility and enhanced efficiency. Daikin's upcoming release of a new line of air-cooled scroll chillers featuring the eco-friendly refrigerant R-32 signifies a commitment to sustainability, building on their established R-32 chiller series from 2018. These new variations, including standard cooling-only and hydronic-free cooling models, aim to set new benchmarks for energy efficiency and environmental standards in HVAC. Concurrently, Rittal's introduction of their Blue e+ S range of smart cooling units showcases a dedication to innovation in compact, highly efficient cooling solutions. Available in various output categories, these units are designed to minimize footprint and operational costs, catering to the evolving needs of modern data centers for optimized thermal management and reduced energy consumption. These developments underscore the market's drive towards greener and more performant cooling technologies.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Sweden Data Center Cooling Market, meticulously segmented to provide actionable insights. The Cooling Technology segmentation includes Air-based Cooling, encompassing Chiller and Economizer, CRAH, and other related cooling solutions, as well as Liquid-based Cooling, further categorized into Immersion Cooling, Direct-to-Chip Cooling, and Rear-Door Heat Exchanger. The Type segmentation covers Hyperscalers (both owned and leased facilities), Enterprise (on-premise data centers), and Colocation providers. The End-user Vertical analysis spans IT & Telecom, Retail & Consumer Goods, Healthcare, Media & Entertainment, Federal & Institutional agencies, and Other end-users. For the forecast period 2025–2033, the market for liquid-based cooling, particularly immersion cooling, is projected to witness the highest growth rate, driven by increasing server power densities and the demand for ultra-efficient heat dissipation. Hyperscale data centers will continue to be the largest segment by market size, with steady growth fueled by global cloud infrastructure expansion. The IT & Telecom sector will remain the dominant end-user vertical, consistently demanding advanced cooling solutions to support their evolving digital services.

Key Drivers of Sweden Data Center Cooling Market Growth

The Sweden Data Center Cooling Market growth is propelled by several key factors. Foremost is the exponential increase in data generation and consumption, driven by cloud computing, AI, big data, and IoT, necessitating larger and more efficient data center capacities. Sweden's strong commitment to renewable energy sources and its favorable regulatory environment for data centers, including tax incentives and sustainable energy policies, attract significant investment in the sector. Furthermore, the growing global concern for sustainability and energy efficiency is pushing data center operators to adopt advanced cooling technologies that reduce power consumption and environmental impact. The development of high-density computing infrastructure, requiring sophisticated thermal management, also plays a crucial role.

Challenges in the Sweden Data Center Cooling Market Sector

Despite robust growth, the Sweden Data Center Cooling Market faces several challenges. The high initial investment cost for advanced liquid cooling solutions can be a barrier for some smaller enterprises and colocation providers. Stringent environmental regulations, while a driver for innovation, can also lead to increased compliance costs and complexity for manufacturers and operators. Supply chain disruptions, as witnessed globally, can impact the availability of critical components and raw materials, potentially leading to project delays and increased costs. Competition from established players and the need for continuous innovation to keep pace with rapidly evolving IT hardware also present ongoing challenges.

Emerging Opportunities in Sweden Data Center Cooling Market

Emerging opportunities in the Sweden Data Center Cooling Market lie in the accelerating adoption of sustainable cooling solutions and the growth of specialized computing workloads. The increasing demand for green data centers presents significant opportunities for manufacturers offering energy-efficient technologies, such as liquid cooling and advanced economizers. The expansion of AI and HPC applications within Sweden creates a niche market for high-density cooling solutions, including immersion cooling and direct-to-chip technologies. Furthermore, the growing trend of edge computing and the development of smaller, distributed data centers offer new avenues for compact and modular cooling systems.

Leading Players in the Sweden Data Center Cooling Market Market

- ebm-papst Group

- Daikin Applied Europe S p A

- Schneider Electric SE

- Munters Group AB

- FlaktGroup Holding GmbH

- Excool Ltd

- Stulz GmbH

- Rittal GMBH & Co KG

- Green Revolution Cooling Inc

- Submer Technologies S L

Key Developments in Sweden Data Center Cooling Market Industry

- February 2023: Daikin unveiled an upcoming release of a new line of air-cooled scroll chillers featuring the environmentally friendly refrigerant R-32. This marks the second generation of Daikin R-32 chillers, a product range that initially revolutionized the HVAC industry's energy efficiency and environmental standards when it was first introduced in 2018. The new series is now available in two variations: the standard cooling-only version (EWAT-B-C) and the hydronic-free cooling version (EWFT-B-C).

- May 2022: Rittal launched its smart cooling unit solutions. They introduced the new Blue e+ S range, representing their latest generation of cooling units, available in output categories of 300, 500, and 1,000 watts. These innovative units are designed with a focus on efficiency, resulting in a reduced footprint and lowered operational costs.

Strategic Outlook for Sweden Data Center Cooling Market Market

The strategic outlook for the Sweden Data Center Cooling Market is highly optimistic, driven by several growth catalysts. The ongoing digital transformation and the expanding adoption of advanced technologies like AI and 5G will continue to fuel the demand for data center infrastructure, thereby increasing the need for sophisticated cooling solutions. Sweden's position as a leader in renewable energy and sustainability provides a competitive advantage, attracting further investment in its data center sector. The market is expected to witness a sustained shift towards liquid-based cooling technologies due to their superior performance in managing high heat densities. Strategic collaborations between cooling solution providers and data center operators, focusing on integrated and energy-efficient designs, will be crucial for future success. Continuous innovation in environmentally friendly refrigerants and smart cooling management systems will also define the market's trajectory.

Sweden Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Others

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-Chip Cooling

- 1.2.3. Rear-Door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type

- 2.1. Hyperscalers (owned & Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End user Vertical

- 3.1. IT & Telecom

- 3.2. Retail & Consumer Goods

- 3.3. Healthcare

- 3.4. Media & Entertainment

- 3.5. Federal & Institutional agencies

- 3.6. Other end-users

Sweden Data Center Cooling Market Segmentation By Geography

- 1. Sweden

Sweden Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development of IT Infrastructure in the Country; Emergence of Green Data Centers

- 3.3. Market Restrains

- 3.3.1. Adaptability Requirements and Power Outages

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Others

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-Chip Cooling

- 5.1.2.3. Rear-Door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hyperscalers (owned & Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End user Vertical

- 5.3.1. IT & Telecom

- 5.3.2. Retail & Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media & Entertainment

- 5.3.5. Federal & Institutional agencies

- 5.3.6. Other end-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ebm-papst Group*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Daikin Applied Europe S p A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schneider Electric SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Munters Group AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FlaktGroup Holding GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Excool Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stulz GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rittal GMBH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Green Revolution Cooling Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Submer Technologies S L

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ebm-papst Group*List Not Exhaustive

List of Figures

- Figure 1: Sweden Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Sweden Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: Sweden Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Sweden Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: Sweden Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Sweden Data Center Cooling Market Revenue Million Forecast, by End user Vertical 2019 & 2032

- Table 5: Sweden Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Sweden Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Sweden Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 8: Sweden Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Sweden Data Center Cooling Market Revenue Million Forecast, by End user Vertical 2019 & 2032

- Table 10: Sweden Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Data Center Cooling Market?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Sweden Data Center Cooling Market?

Key companies in the market include ebm-papst Group*List Not Exhaustive, Daikin Applied Europe S p A, Schneider Electric SE, Munters Group AB, FlaktGroup Holding GmbH, Excool Ltd, Stulz GmbH, Rittal GMBH & Co KG, Green Revolution Cooling Inc, Submer Technologies S L.

3. What are the main segments of the Sweden Data Center Cooling Market?

The market segments include Cooling Technology, Type, End user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Development of IT Infrastructure in the Country; Emergence of Green Data Centers.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Share.

7. Are there any restraints impacting market growth?

Adaptability Requirements and Power Outages.

8. Can you provide examples of recent developments in the market?

February 2023: Daikin unveiled an upcoming release of a new line of air-cooled scroll chillers featuring the environmentally friendly refrigerant R-32. This marks the second generation of Daikin R-32 chillers, a product range that initially revolutionized the HVAC industry's energy efficiency and environmental standards when it was first introduced in 2018. The new series is now available in two variations: the standard cooling-only version (EWAT-B-C) and the hydronic-free cooling version (EWFT-B-C).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the Sweden Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence