Key Insights

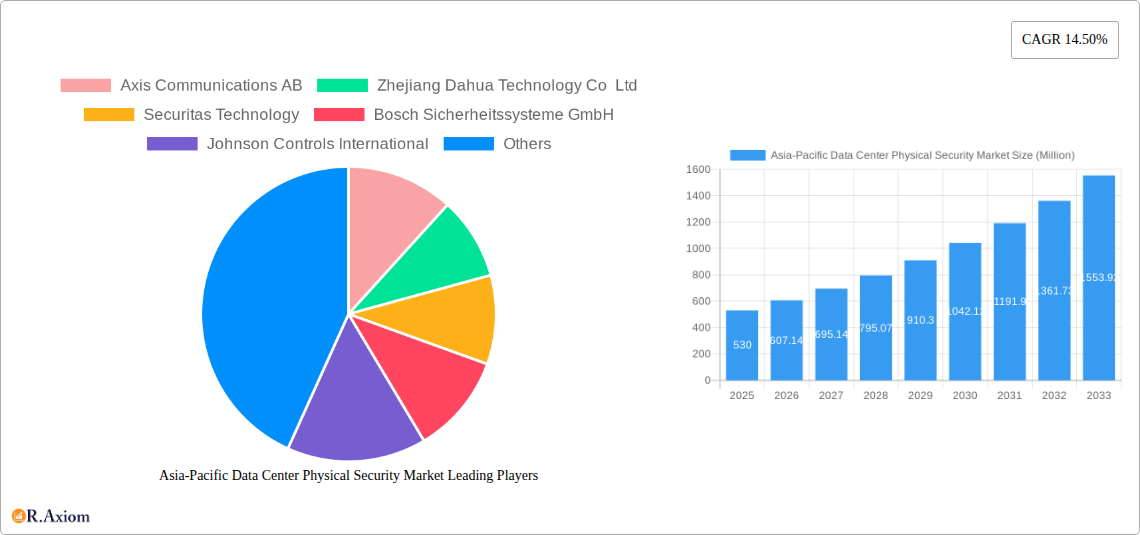

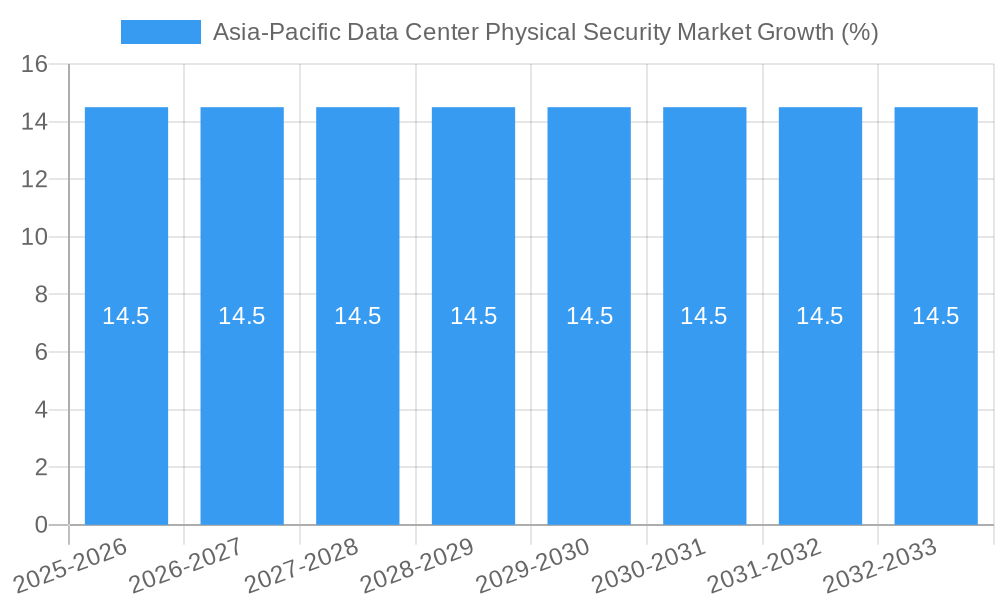

The Asia-Pacific Data Center Physical Security Market is poised for significant expansion, projected to reach approximately USD 530 million in 2025. This robust growth trajectory is underscored by an impressive Compound Annual Growth Rate (CAGR) of 14.50% expected to persist throughout the forecast period. The region's increasing reliance on digital infrastructure, fueled by rapid digitalization and the burgeoning demand for cloud services, data storage, and high-performance computing, is a primary catalyst for this surge. Key drivers include the escalating need for advanced video surveillance systems capable of real-time monitoring and threat detection, alongside sophisticated access control solutions to safeguard sensitive data and critical infrastructure. As data centers become more prevalent and their importance grows across sectors like IT & Telecommunication, BFSI, Government, and Healthcare, the demand for comprehensive and integrated physical security measures will continue to intensify. Emerging trends such as the adoption of AI-powered analytics, biometric authentication, and intelligent perimeter security systems are further shaping the market landscape, promising more proactive and efficient security paradigms.

The market's dynamism is further propelled by the increasing investment in new data center constructions and upgrades across key Asia-Pacific economies such as China, Japan, India, and South Korea. While the market is ripe with opportunity, certain restraints, such as the high initial cost of implementing advanced security solutions and the evolving regulatory landscape concerning data privacy and security, may present challenges. However, the persistent emphasis on operational resilience, disaster recovery, and the mitigation of physical threats, including unauthorized access and environmental hazards, will ensure sustained demand. Service providers offering consulting, professional services, and system integration will play a crucial role in tailoring and deploying these complex security architectures to meet the unique requirements of diverse end-users. Companies like Axis Communications AB, Zhejiang Dahua Technology Co Ltd, and Bosch Sicherheitssysteme GmbH are key players actively shaping this evolving market with their innovative offerings and strategic expansions.

This in-depth report analyzes the Asia-Pacific Data Center Physical Security Market, a critical and rapidly expanding sector driven by the escalating demand for data storage, cloud computing, and robust data protection. The study covers the historical period from 2019 to 2024, with a base year of 2025, and provides detailed forecasts up to 2033. We delve into market dynamics, segmentations, key players, and emerging trends, offering actionable insights for stakeholders.

Asia-Pacific Data Center Physical Security Market Market Concentration & Innovation

The Asia-Pacific Data Center Physical Security Market exhibits a moderate to high level of concentration, with a mix of established global security giants and agile regional players vying for market share. Innovation is a primary driver, fueled by advancements in AI-powered video analytics, intelligent access control systems, biometrics, and advanced intrusion detection technologies. Regulatory frameworks, while evolving, are increasingly emphasizing data privacy and security compliance, pushing for more sophisticated physical security solutions. The threat of cyber-physical attacks necessitates integrated security approaches. Product substitutes are limited within the core physical security domain, but integration with cybersecurity solutions is a growing trend. End-user demands for highly secure, scalable, and reliable data center infrastructure are reshaping product development and service offerings. Merger and acquisition (M&A) activities, estimated to be in the hundreds of millions of US dollars annually, are strategically consolidating the market, with larger players acquiring innovative smaller companies to expand their technological capabilities and geographical reach.

Asia-Pacific Data Center Physical Security Market Industry Trends & Insights

The Asia-Pacific Data Center Physical Security Market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 12.5% over the forecast period of 2025–2033. This surge is primarily attributed to the exponential growth in data generation and consumption across the region, necessitating the expansion and fortification of data center infrastructure. The escalating adoption of cloud computing services by enterprises and governments alike, coupled with the rapid digitalization of economies, directly fuels the demand for advanced physical security solutions to protect these critical assets. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into video surveillance systems for intelligent threat detection, behavioral analysis, and facial recognition, are redefining industry standards. Furthermore, the rise of the Internet of Things (IoT) is enabling seamless integration of various physical security components, creating a more comprehensive and automated security ecosystem. Consumer preferences are shifting towards sophisticated, multi-layered security approaches that offer real-time monitoring, remote management, and predictive threat assessment capabilities. The competitive dynamics within the market are characterized by intense innovation, strategic partnerships, and a focus on providing end-to-end security solutions. As market penetration deepens, the focus is increasingly on customized solutions tailored to the specific needs and risk profiles of diverse end-users, including IT & Telecommunication, BFSI, Government, and Healthcare sectors. The continuous need to comply with stringent data protection regulations and to safeguard against sophisticated physical and cyber threats is a persistent market dynamic.

Dominant Markets & Segments in Asia-Pacific Data Center Physical Security Market

The Asia-Pacific Data Center Physical Security Market is heavily influenced by the rapid economic development and increasing digitalization across key countries. China stands out as a dominant market, driven by its massive investments in data center infrastructure to support its vast digital economy and growing cloud adoption. Significant growth is also observed in India, Japan, and South Korea, fueled by government initiatives for digital transformation and a burgeoning technology sector.

Solution Type Dominance:

- Video Surveillance: This segment holds a substantial market share, driven by the need for continuous monitoring, evidence recording, and AI-powered threat detection. Key drivers include the increasing resolution of cameras, advanced analytics capabilities (e.g., object detection, anomaly recognition), and integration with other security systems.

- Access Control Solutions: This segment is critical for managing and restricting entry to sensitive data center areas. Growth is propelled by the adoption of advanced technologies like biometric authentication (fingerprint, iris, facial recognition), smart cards, and multi-factor authentication, enhancing security and audit trails.

- Other So (Physical Security Information Management - PSIM): While smaller, this segment is growing as organizations seek integrated platforms to unify and manage disparate security systems, providing a holistic view of security operations.

Service Type Dominance:

- Professional Services: This includes installation, configuration, and ongoing maintenance of physical security systems, crucial for ensuring optimal performance and compliance.

- Other Service Types (System Integration Services): The complexity of modern data center security necessitates expert system integrators to design and deploy comprehensive, interoperable security solutions. This segment is vital for delivering customized and effective security architectures.

- Consulting Services: As data center security threats evolve, organizations increasingly rely on expert consulting to assess risks, develop security strategies, and ensure compliance with evolving regulations.

End User Dominance:

- IT & Telecommunication: This sector is the largest consumer of data center physical security solutions, driven by the immense scale of their operations and the critical nature of their data.

- BFSI (Banking, Financial Services, and Insurance): High-value data and stringent regulatory requirements make BFSI a significant and demanding segment, prioritizing robust physical security measures.

- Government: National security concerns and the increasing digitalization of government services necessitate highly secure data centers, making this an important end-user segment.

- Healthcare: The sensitive nature of patient data (PHI) and increasing digitization of healthcare records drive demand for advanced physical security in healthcare data centers.

Asia-Pacific Data Center Physical Security Market Product Developments

Product innovation in the Asia-Pacific Data Center Physical Security Market is characterized by the integration of AI and ML into video surveillance for advanced anomaly detection and predictive analytics. Biometric access control systems are becoming more sophisticated, offering enhanced accuracy and multi-modal authentication options. The development of intelligent sensor networks for perimeter security and environmental monitoring is also a key trend. These developments aim to provide proactive threat identification, automated response, and a more unified security posture, offering competitive advantages through enhanced efficiency, reduced false alarms, and improved overall data center resilience.

Report Scope & Segmentation Analysis

This report meticulously segments the Asia-Pacific Data Center Physical Security Market across several key dimensions. The Solution Type segmentation includes Video Surveillance, Access Control Solutions, and Other Software & Solutions, detailing market sizes and growth projections for each. The Service Type is analyzed through Consulting Services, Professional Services, and Other Service Types such as System Integration Services, highlighting their respective market shares and growth trajectories. Furthermore, the End User segmentation examines the IT & Telecommunication, BFSI, Government, Healthcare, and Other End Users segments, providing granular insights into their specific security needs, market penetration, and competitive dynamics. Each segment's current market valuation and projected growth rates are comprehensively analyzed.

Key Drivers of Asia-Pacific Data Center Physical Security Market Growth

The growth of the Asia-Pacific Data Center Physical Security Market is propelled by several interconnected factors. The accelerating digital transformation across industries fuels the expansion of data center capacities, demanding enhanced physical security. Increasing cyber-physical threats necessitate robust protective measures to safeguard sensitive data and critical infrastructure. Stringent data privacy regulations, such as GDPR-like frameworks emerging in the region, compel organizations to invest in comprehensive security solutions. The surge in cloud computing adoption and the proliferation of edge data centers also contribute significantly to market expansion by creating new physical security needs.

Challenges in the Asia-Pacific Data Center Physical Security Market Sector

Despite strong growth, the Asia-Pacific Data Center Physical Security Market faces several challenges. High initial investment costs for advanced security systems can be a barrier for some organizations, particularly smaller enterprises. Lack of skilled professionals for the installation, operation, and maintenance of complex security technologies poses a significant constraint. Evolving regulatory landscapes can create compliance complexities and require continuous adaptation of security strategies. Supply chain disruptions, impacting the availability of critical security hardware, can also hinder project timelines and implementations. The competitive pressure among vendors to offer innovative yet cost-effective solutions is also a persistent challenge.

Emerging Opportunities in Asia-Pacific Data Center Physical Security Market

Emerging opportunities within the Asia-Pacific Data Center Physical Security Market lie in the growing demand for integrated security solutions that combine physical and cybersecurity. The expansion of hyperscale and colocation data centers presents significant opportunities for vendors offering scalable and advanced security platforms. The increasing adoption of AI and ML in physical security is creating new avenues for intelligent analytics and predictive threat detection. Furthermore, the development of smart city initiatives and the need for secure data handling in critical infrastructure projects offer substantial untapped potential. The rising awareness of data sovereignty and the need to comply with localized data regulations will also drive demand for region-specific security solutions.

Leading Players in the Asia-Pacific Data Center Physical Security Market Market

- Axis Communications AB

- Zhejiang Dahua Technology Co Ltd

- Securitas Technology

- Bosch Sicherheitssysteme GmbH

- Johnson Controls International

- Honeywell International Inc

- Schneider Electric

- Convergint Technologies LLC

- ASSA ABLOY

- Cisco Systems Inc

- ABB Ltd

Key Developments in Asia-Pacific Data Center Physical Security Market Industry

- August 2023: Securitas signed an expanded 5-year agreement to provide data center security for Microsoft in 31 countries (including APAC countries), solidifying a strong relationship. The global agreement includes risk management, comprehensive security technology as a system integrator, specialised safety, and security resources, guarding services and digital interfaces. Securitas ensures that the data center physical security program remains innovative, robust, and effective. This demonstrates stability as a collaborator, assisting in navigating the challenges of Microsoft's expanding business.

- August 2023: Metrasens announced its partnership with Convergint. Through this partnership, Metrasens will provide its advanced detection systems through Convergint’s portfolio offering to its customers.

Strategic Outlook for Asia-Pacific Data Center Physical Security Market Market

- August 2023: Securitas signed an expanded 5-year agreement to provide data center security for Microsoft in 31 countries (including APAC countries), solidifying a strong relationship. The global agreement includes risk management, comprehensive security technology as a system integrator, specialised safety, and security resources, guarding services and digital interfaces. Securitas ensures that the data center physical security program remains innovative, robust, and effective. This demonstrates stability as a collaborator, assisting in navigating the challenges of Microsoft's expanding business.

- August 2023: Metrasens announced its partnership with Convergint. Through this partnership, Metrasens will provide its advanced detection systems through Convergint’s portfolio offering to its customers.

Strategic Outlook for Asia-Pacific Data Center Physical Security Market Market

The strategic outlook for the Asia-Pacific Data Center Physical Security Market is exceptionally positive, driven by sustained demand for secure data storage and processing. Future growth will be shaped by the continued integration of advanced technologies like AI, IoT, and biometrics into physical security systems. Strategic partnerships and collaborations will be crucial for expanding market reach and offering comprehensive, end-to-end solutions. The increasing focus on cyber-physical security convergence will create opportunities for solution providers capable of delivering unified security platforms. Furthermore, adherence to evolving regulatory compliance and the development of sustainable and energy-efficient security infrastructure will be key growth catalysts, ensuring long-term market relevance and profitability for stakeholders.

Asia-Pacific Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Other So

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Other Service Types (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Asia-Pacific Data Center Physical Security Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Data Center Activities and Investment by the Hyperscale and Colocation Operators; Advancements in Video Surveillance Systems Connected to Cloud Systems

- 3.3. Market Restrains

- 3.3.1. Increased Data Center Activities and Investment by the Hyperscale and Colocation Operators; Advancements in Video Surveillance Systems Connected to Cloud Systems

- 3.4. Market Trends

- 3.4.1. The IT & Telecom Segment is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Other So

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Other Service Types (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Axis Communications AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zhejiang Dahua Technology Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Securitas Technology

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bosch Sicherheitssysteme GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Controls International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Convergint Technologies LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ASSA ABLOY

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cisco Systems Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ABB Ltd*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Axis Communications AB

List of Figures

- Figure 1: Asia-Pacific Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Data Center Physical Security Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 4: Asia-Pacific Data Center Physical Security Market Volume Billion Forecast, by Solution Type 2019 & 2032

- Table 5: Asia-Pacific Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 6: Asia-Pacific Data Center Physical Security Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 7: Asia-Pacific Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Asia-Pacific Data Center Physical Security Market Volume Billion Forecast, by End User 2019 & 2032

- Table 9: Asia-Pacific Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Asia-Pacific Data Center Physical Security Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Asia-Pacific Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 12: Asia-Pacific Data Center Physical Security Market Volume Billion Forecast, by Solution Type 2019 & 2032

- Table 13: Asia-Pacific Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Asia-Pacific Data Center Physical Security Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 15: Asia-Pacific Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Asia-Pacific Data Center Physical Security Market Volume Billion Forecast, by End User 2019 & 2032

- Table 17: Asia-Pacific Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Data Center Physical Security Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: China Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Japan Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: South Korea Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: India Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: India Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Australia Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: New Zealand Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: New Zealand Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Indonesia Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Indonesia Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Malaysia Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Malaysia Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Singapore Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Singapore Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Thailand Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Thailand Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: Vietnam Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Vietnam Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Philippines Asia-Pacific Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Philippines Asia-Pacific Data Center Physical Security Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Data Center Physical Security Market?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the Asia-Pacific Data Center Physical Security Market?

Key companies in the market include Axis Communications AB, Zhejiang Dahua Technology Co Ltd, Securitas Technology, Bosch Sicherheitssysteme GmbH, Johnson Controls International, Honeywell International Inc, Schneider Electric, Convergint Technologies LLC, ASSA ABLOY, Cisco Systems Inc, ABB Ltd*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.53 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Data Center Activities and Investment by the Hyperscale and Colocation Operators; Advancements in Video Surveillance Systems Connected to Cloud Systems.

6. What are the notable trends driving market growth?

The IT & Telecom Segment is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Increased Data Center Activities and Investment by the Hyperscale and Colocation Operators; Advancements in Video Surveillance Systems Connected to Cloud Systems.

8. Can you provide examples of recent developments in the market?

August 2023: Securitas signed an expanded 5-year agreement to provide data center security for Microsoft in 31 countries (including APAC countries), solidifying a strong relationship. The global agreement includes risk management, comprehensive security technology as a system integrator, specialised safety, and security resources, guarding services and digital interfaces. Securitas ensures that the data center physical security program remains innovative, robust, and effective. This demonstrates stability as a collaborator, assisting in navigating the challenges of Microsoft's expanding business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence