Key Insights

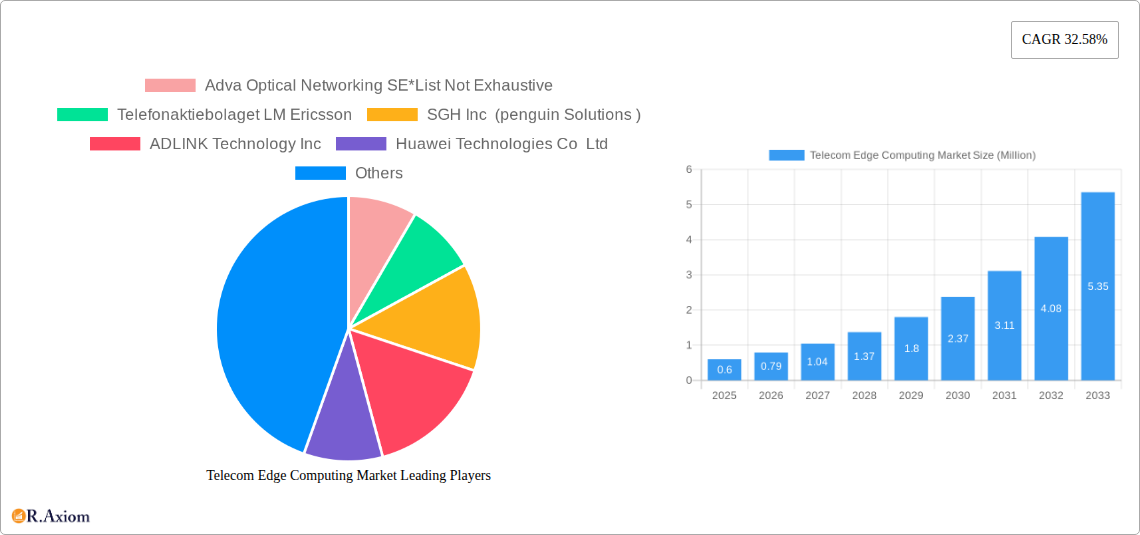

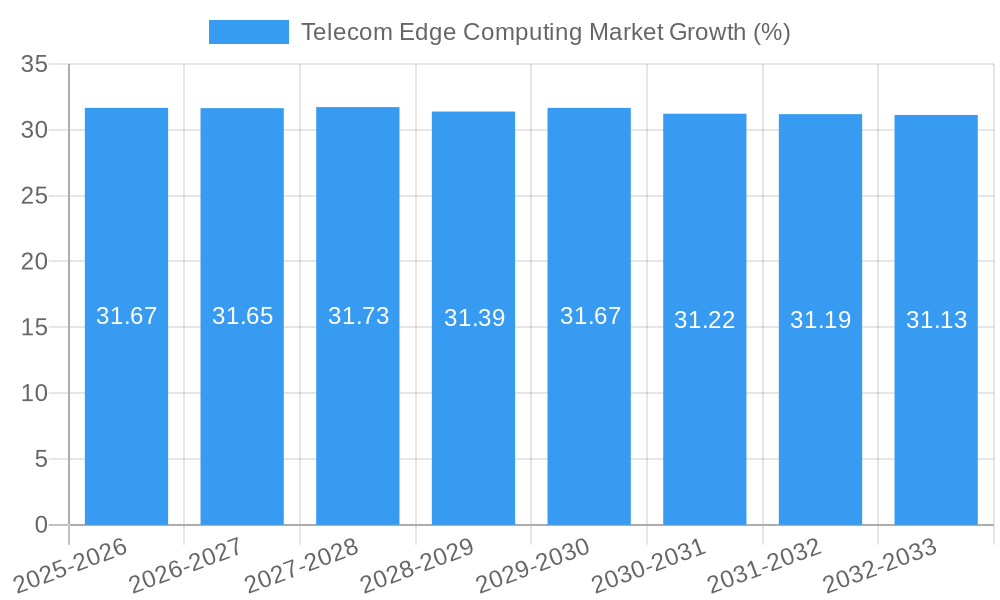

The Telecom Edge Computing Market is poised for explosive growth, projected to expand from a base of \$0.6 million in 2025 to significantly larger figures by 2033, driven by a remarkable Compound Annual Growth Rate (CAGR) of 32.58%. This surge is primarily fueled by the escalating demand for real-time data processing and low-latency applications across various industries. Key drivers include the proliferation of 5G networks, enabling faster and more ubiquitous connectivity that is essential for edge deployments. The increasing adoption of IoT devices, generating vast amounts of data at the network's edge, further necessitates localized processing capabilities. Furthermore, the growing need for enhanced security and data privacy, by processing sensitive information closer to its source, plays a crucial role. The market is witnessing significant innovation in hardware and software solutions specifically designed for edge environments, from powerful, ruggedized edge servers to advanced AI and machine learning platforms optimized for edge deployment.

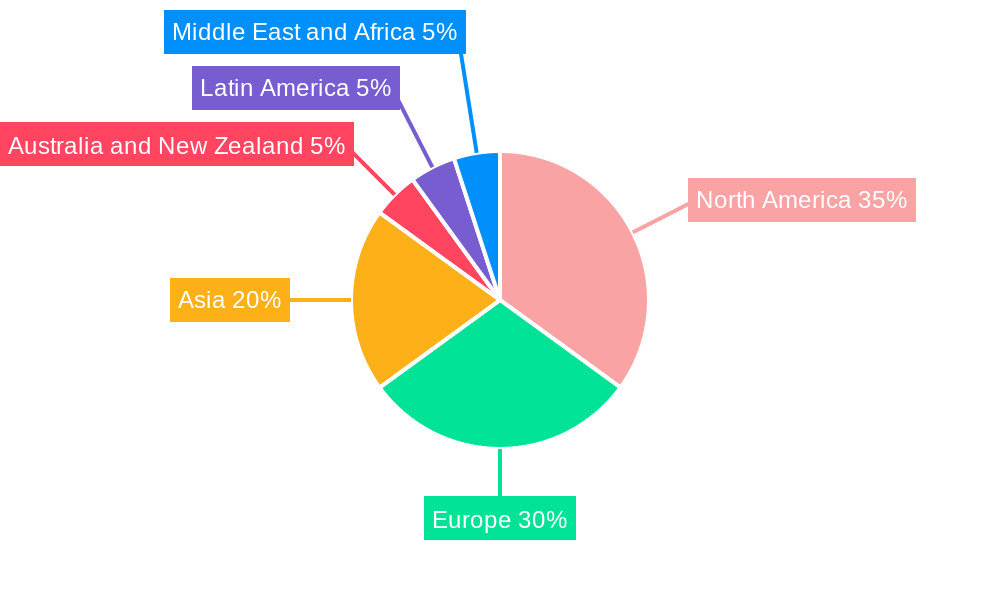

The Telecom Edge Computing Market is characterized by its diverse end-user landscape, with the Financial and Banking Industry, Retail, and Healthcare and Life Sciences sectors emerging as early adopters and major growth areas. These industries leverage edge computing for applications such as real-time fraud detection, personalized in-store experiences, remote patient monitoring, and enhanced diagnostics. The Industrial sector is also a significant contributor, utilizing edge computing for predictive maintenance, automation, and real-time operational intelligence. Telecommunications companies themselves are pivotal in both providing the infrastructure and adopting edge solutions to optimize network performance and deliver new services. Looking ahead, the market is expected to see continued expansion in regions like North America and Europe, which currently lead in adoption due to advanced network infrastructure and strong technological investment. Asia is anticipated to be a rapidly growing region, fueled by its massive consumer base and increasing digitalization initiatives. While significant opportunities exist, potential restraints could include the complexity of integrating edge solutions with existing infrastructure and the need for skilled professionals to manage these distributed environments.

This in-depth market research report provides a holistic view of the global Telecom Edge Computing Market, meticulously analyzing its current state, historical trajectory, and future prospects. With a study period spanning from 2019 to 2033, encompassing a base year of 2025 and a forecast period from 2025 to 2033, this report offers invaluable insights for industry stakeholders, investors, and decision-makers. We delve into critical aspects such as market concentration, innovation drivers, regulatory landscapes, competitive dynamics, emerging trends, and the pivotal role of key players.

The report is structured to deliver actionable intelligence, covering market size estimations, growth projections, and detailed segmentation by components and end-users. Leveraging high-traffic keywords such as "edge computing," "telecom infrastructure," "5G edge," "network edge," "edge deployment," and "telco edge solutions," this report aims to maximize search visibility and attract relevant industry attention. Our analysis incorporates recent industry developments, including strategic alliances and pioneering trials, to provide a contemporary understanding of the market's evolution.

Telecom Edge Computing Market Market Concentration & Innovation

The Telecom Edge Computing Market is characterized by a moderate to high level of concentration, driven by significant capital investments and the specialized expertise required for deployment and management. Key innovation drivers include the relentless pursuit of lower latency for real-time applications, enhanced data security, and the proliferation of 5G networks. Regulatory frameworks, while still evolving, are increasingly focused on data privacy and interoperability, shaping the landscape of edge solutions. Product substitutes, such as centralized cloud solutions with improved connectivity, are present but often fall short in addressing the critical latency and bandwidth demands of edge-native applications. End-user trends are shifting towards decentralized processing, demanding localized data analytics and faster response times across various industries. Mergers and acquisitions (M&A) activities are a significant feature, with M&A deal values in the multi-million range, signaling consolidation and strategic acquisitions by major players to bolster their edge capabilities and market share. For instance, the acquisition of edge infrastructure providers by large telecommunication companies aims to integrate these capabilities seamlessly into their existing networks, further consolidating market power. The market share of leading hardware and software providers within the edge ecosystem is a key indicator of this concentration.

Telecom Edge Computing Market Industry Trends & Insights

The Telecom Edge Computing Market is poised for substantial growth, fueled by an escalating demand for real-time data processing and the transformative capabilities of 5G technology. The CAGR (Compound Annual Growth Rate) is projected to be robust, indicating a significant expansion in market penetration over the forecast period. This growth is intrinsically linked to the increasing volume of data generated by IoT devices, smart cities, and a myriad of connected applications, necessitating localized data processing to overcome the limitations of traditional cloud architectures. Technological disruptions, such as advancements in AI and machine learning algorithms that can be effectively deployed at the edge, are further accelerating adoption. Consumer preferences are evolving towards seamless, instant experiences, driving the need for ultra-low latency and high-bandwidth solutions that edge computing intrinsically provides. The competitive dynamics within the market are intensifying, with telecommunication companies, cloud providers, and specialized edge solution vendors vying for market dominance. Market penetration is expected to deepen as more enterprises recognize the strategic advantages of deploying compute and storage resources closer to the data source. The development of standardized protocols and open-source platforms is also playing a crucial role in fostering interoperability and reducing deployment complexities, thereby driving broader adoption. The ongoing evolution of 5G network capabilities, particularly the enhanced mobile broadband (eMBB), ultra-reliable low-latency communications (URLLC), and massive machine-type communications (mMTC) aspects, directly translates into greater opportunities for edge computing solutions to leverage these advancements for innovative applications in areas like autonomous driving, industrial automation, and augmented reality. The increasing reliance on remote work and distributed operations further amplifies the need for resilient and responsive edge infrastructure.

Dominant Markets & Segments in Telecom Edge Computing Market

The Telecommunications segment is a dominant force within the Telecom Edge Computing Market, serving as both a primary enabler and a significant end-user of edge solutions. This dominance stems from the inherent need for telecommunication providers to enhance their network infrastructure, support burgeoning 5G services, and deliver new, high-value applications to their enterprise and consumer customers. The proliferation of 5G networks, with their low latency and high bandwidth capabilities, creates a fertile ground for edge deployments within the telecommunications sector itself.

- Telecommunications:

- Key Drivers: The strategic imperative for telecom operators to deploy private 5G networks for enterprise clients, support massive IoT deployments, and offer new services like network slicing directly fuels edge computing adoption. The need to manage and process vast amounts of network traffic efficiently at the edge is paramount. Economic policies that encourage digital transformation and infrastructure investment further bolster this segment.

- Dominance Analysis: Telecom companies are investing heavily in edge data centers and distributed compute infrastructure to support their core network functions and create new revenue streams. This segment represents a substantial portion of the overall market size due to the sheer scale of network infrastructure and the continuous need for upgrades and innovation.

Beyond telecommunications, other end-user segments are exhibiting significant growth and contributing to the market's expansion:

Industrial:

- Key Drivers: Industrial automation, predictive maintenance, real-time monitoring of machinery, and the adoption of Industry 4.0 principles are driving demand for edge computing to process data locally, reduce latency, and improve operational efficiency.

- Dominance Analysis: Industries such as manufacturing, oil and gas, and logistics are leveraging edge solutions for critical operations that require immediate decision-making and autonomous control.

Healthcare and Life Sciences:

- Key Drivers: The need for real-time patient monitoring, remote surgery, AI-driven diagnostics, and secure handling of sensitive medical data is pushing edge computing adoption.

- Dominance Analysis: Edge deployments enable faster processing of medical imagery, real-time analysis of patient vital signs, and the development of innovative telemedicine solutions.

Retail:

- Key Drivers: Edge computing is being utilized for smart inventory management, personalized customer experiences, video analytics for security and foot traffic analysis, and frictionless checkout systems.

- Dominance Analysis: Retailers are deploying edge solutions to optimize store operations, enhance customer engagement, and improve supply chain visibility.

Financial and Banking Industry:

- Key Drivers: Enhanced security for transactions, real-time fraud detection, algorithmic trading, and personalized customer services are key drivers for edge adoption in this sector.

- Dominance Analysis: The stringent security and low-latency requirements of financial services make edge computing an attractive solution for localized data processing and immediate threat mitigation.

Telecom Edge Computing Market Product Developments

Product developments in the Telecom Edge Computing Market are focused on enhancing the capabilities of hardware and software solutions for distributed environments. Innovations include the miniaturization and ruggedization of edge servers and gateways, the development of AI-powered edge analytics platforms, and the creation of secure, scalable edge operating systems. These advancements enable telcos and enterprises to deploy sophisticated applications closer to the data source, reducing latency and improving real-time decision-making. Competitive advantages are derived from optimized power consumption, increased processing power at the edge, seamless integration with existing network infrastructure, and robust security features to protect sensitive data. The trend is towards more intelligent, autonomous, and interconnected edge devices and platforms that can run complex workloads efficiently.

Report Scope & Segmentation Analysis

The Telecom Edge Computing Market is segmented comprehensively to provide granular insights into its various facets. This segmentation allows for a detailed analysis of growth projections and market sizes for each sub-category, alongside an understanding of their respective competitive dynamics.

Component: The market is divided into Hardware and Software segments. The hardware segment encompasses edge servers, gateways, network equipment, and storage solutions, while the software segment includes edge operating systems, orchestration platforms, analytics software, and application development tools. Both segments are expected to witness substantial growth, with hardware advancements enabling more powerful edge deployments and software innovations driving new use cases.

End-user: The report analyzes several key end-user segments, including the Financial and Banking Industry, Retail, Healthcare and Life Sciences, Industrial, Energy and Utilities, and Telecommunications. Additionally, a category for Other End-users captures emerging adoption across diverse sectors. Each segment presents unique adoption drivers and challenges, influencing market penetration and competitive landscapes. For example, the Telecommunications segment is projected to hold a significant market share due to its foundational role in edge infrastructure deployment and service delivery.

Key Drivers of Telecom Edge Computing Market Growth

Several interconnected factors are driving the rapid growth of the Telecom Edge Computing Market. The widespread adoption of 5G networks, with their promise of ultra-low latency and high bandwidth, is a primary catalyst, enabling a new generation of real-time applications. The exponential growth of data generated by the Internet of Things (IoT) devices across industries necessitates localized processing to manage bandwidth constraints and reduce operational costs. Furthermore, the increasing demand for real-time analytics and AI-driven decision-making at the point of data creation is a significant growth driver. Regulatory mandates around data sovereignty and privacy are also pushing for localized data processing. The need for enhanced operational efficiency and improved customer experiences in sectors like manufacturing, retail, and healthcare further fuels the adoption of edge computing solutions.

Challenges in the Telecom Edge Computing Market Sector

Despite its strong growth trajectory, the Telecom Edge Computing Market faces several challenges. Regulatory hurdles, particularly concerning data privacy, security standards, and cross-border data flows, can complicate deployments and increase compliance costs. Supply chain issues for specialized hardware components can lead to delays and increased costs. Interoperability between different vendor solutions and the lack of standardized protocols remain a concern, hindering seamless integration. High initial investment costs for deploying and managing distributed edge infrastructure can be a barrier for smaller enterprises. Finally, competitive pressures from established cloud providers expanding their edge offerings and the need for skilled personnel to manage complex edge environments present ongoing challenges.

Emerging Opportunities in Telecom Edge Computing Market

The Telecom Edge Computing Market presents numerous emerging opportunities. The development of edge-native AI and machine learning applications that can perform complex computations locally offers significant potential for innovation across industries. The growing adoption of private 5G networks by enterprises creates a strong demand for dedicated edge infrastructure and services. Opportunities also lie in the fusion of edge computing with other emerging technologies like augmented reality (AR), virtual reality (VR), and the metaverse, which require ultra-low latency and high-bandwidth processing. The expansion of edge data center services and the provision of managed edge solutions are also promising areas. Furthermore, the increasing focus on sustainability and energy-efficient edge deployments presents an opportunity for innovative solutions.

Leading Players in the Telecom Edge Computing Market Market

- Adva Optical Networking SE

- Telefonaktiebolaget LM Ericsson

- SGH Inc (penguin Solutions )

- ADLINK Technology Inc

- Huawei Technologies Co Ltd

- Nokia Corporation

- Verizon Communication Ltd

- AT&T Inc

- Comsovereign Holding Corp

- Vodafone Group PLC

Key Developments in Telecom Edge Computing Market Industry

- April 2024: Swisscom and Ericsson have prolonged their strategic alliance for three years. Ericsson will persist as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer experience and advance its mobile network, with a pronounced emphasis on sustainability.

- February 2024: Nokia and A1 Austria (A1) have achieved a significant milestone by conducting the industry's inaugural trial of 5G edge cloud network slicing in collaboration with Microsoft. This trial, conducted in Vienna, Austria, leveraged Nokia's 5G edge slicing solution, seamlessly integrated with Microsoft Azure's managed edge compute, on A1's operational network. By implementing edge cloud network slicing, A1 can now deliver enterprise cloud applications to mobile users, ensuring a high-capacity, secure, and ultra-low latency network experience.

Strategic Outlook for Telecom Edge Computing Market Market

- April 2024: Swisscom and Ericsson have prolonged their strategic alliance for three years. Ericsson will persist as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer experience and advance its mobile network, with a pronounced emphasis on sustainability.

- February 2024: Nokia and A1 Austria (A1) have achieved a significant milestone by conducting the industry's inaugural trial of 5G edge cloud network slicing in collaboration with Microsoft. This trial, conducted in Vienna, Austria, leveraged Nokia's 5G edge slicing solution, seamlessly integrated with Microsoft Azure's managed edge compute, on A1's operational network. By implementing edge cloud network slicing, A1 can now deliver enterprise cloud applications to mobile users, ensuring a high-capacity, secure, and ultra-low latency network experience.

Strategic Outlook for Telecom Edge Computing Market Market

The strategic outlook for the Telecom Edge Computing Market is exceptionally promising, driven by the accelerating digital transformation across all sectors. The ongoing build-out of 5G infrastructure will continue to be a fundamental growth catalyst, creating a ubiquitous foundation for edge deployments. Partnerships between telecommunication providers, cloud giants, and specialized edge solution vendors will become increasingly critical for delivering comprehensive end-to-end solutions. Future market potential lies in the development of sophisticated edge AI capabilities, enabling autonomous operations and hyper-personalized services. As enterprises increasingly prioritize real-time data processing, low latency, and enhanced security, edge computing will evolve from a niche technology to an indispensable component of modern IT infrastructure, unlocking new revenue streams and driving unprecedented innovation.

Telecom Edge Computing Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

-

2. End-user

- 2.1. Financial and Banking Industry

- 2.2. Retail

- 2.3. Healthcare and Life Sciences

- 2.4. Industrial

- 2.5. Energy and Utilities

- 2.6. Telecommunications

- 2.7. Other End-users

Telecom Edge Computing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Telecom Edge Computing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 32.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Widespread Adoption and Growth of Latency-specific Applications; Rising Application of 5G & Industrial IoT Services Among End-user Industries

- 3.3. Market Restrains

- 3.3.1. Lack of a Common Security Framework

- 3.4. Market Trends

- 3.4.1. Rising Application of 5G and Industrial IoT Services Among End-user Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Financial and Banking Industry

- 5.2.2. Retail

- 5.2.3. Healthcare and Life Sciences

- 5.2.4. Industrial

- 5.2.5. Energy and Utilities

- 5.2.6. Telecommunications

- 5.2.7. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Financial and Banking Industry

- 6.2.2. Retail

- 6.2.3. Healthcare and Life Sciences

- 6.2.4. Industrial

- 6.2.5. Energy and Utilities

- 6.2.6. Telecommunications

- 6.2.7. Other End-users

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Financial and Banking Industry

- 7.2.2. Retail

- 7.2.3. Healthcare and Life Sciences

- 7.2.4. Industrial

- 7.2.5. Energy and Utilities

- 7.2.6. Telecommunications

- 7.2.7. Other End-users

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Financial and Banking Industry

- 8.2.2. Retail

- 8.2.3. Healthcare and Life Sciences

- 8.2.4. Industrial

- 8.2.5. Energy and Utilities

- 8.2.6. Telecommunications

- 8.2.7. Other End-users

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Financial and Banking Industry

- 9.2.2. Retail

- 9.2.3. Healthcare and Life Sciences

- 9.2.4. Industrial

- 9.2.5. Energy and Utilities

- 9.2.6. Telecommunications

- 9.2.7. Other End-users

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Financial and Banking Industry

- 10.2.2. Retail

- 10.2.3. Healthcare and Life Sciences

- 10.2.4. Industrial

- 10.2.5. Energy and Utilities

- 10.2.6. Telecommunications

- 10.2.7. Other End-users

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Middle East and Africa Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Hardware

- 11.1.2. Software

- 11.2. Market Analysis, Insights and Forecast - by End-user

- 11.2.1. Financial and Banking Industry

- 11.2.2. Retail

- 11.2.3. Healthcare and Life Sciences

- 11.2.4. Industrial

- 11.2.5. Energy and Utilities

- 11.2.6. Telecommunications

- 11.2.7. Other End-users

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. North America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Australia and New Zealand Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Telecom Edge Computing Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Adva Optical Networking SE*List Not Exhaustive

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Telefonaktiebolaget LM Ericsson

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 SGH Inc (penguin Solutions )

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 ADLINK Technology Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Huawei Technologies Co Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Nokia Corporation

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Verizon Communication Ltd

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 AT&T Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Comsovereign Holding Corp

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Vodafone Group PLC

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Adva Optical Networking SE*List Not Exhaustive

List of Figures

- Figure 1: Global Telecom Edge Computing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 17: North America Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 18: North America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 23: Europe Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 24: Europe Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 29: Asia Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 30: Asia Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 33: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 34: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 35: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 36: Australia and New Zealand Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 39: Latin America Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 40: Latin America Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 41: Latin America Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 42: Latin America Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by Component 2024 & 2032

- Figure 45: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by Component 2024 & 2032

- Figure 46: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by End-user 2024 & 2032

- Figure 47: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by End-user 2024 & 2032

- Figure 48: Middle East and Africa Telecom Edge Computing Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Telecom Edge Computing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Telecom Edge Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 4: Global Telecom Edge Computing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Telecom Edge Computing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 18: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 19: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 21: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 22: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 24: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 25: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 27: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 28: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 31: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Telecom Edge Computing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 33: Global Telecom Edge Computing Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 34: Global Telecom Edge Computing Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Edge Computing Market?

The projected CAGR is approximately 32.58%.

2. Which companies are prominent players in the Telecom Edge Computing Market?

Key companies in the market include Adva Optical Networking SE*List Not Exhaustive, Telefonaktiebolaget LM Ericsson, SGH Inc (penguin Solutions ), ADLINK Technology Inc, Huawei Technologies Co Ltd, Nokia Corporation, Verizon Communication Ltd, AT&T Inc, Comsovereign Holding Corp, Vodafone Group PLC.

3. What are the main segments of the Telecom Edge Computing Market?

The market segments include Component, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.6 Million as of 2022.

5. What are some drivers contributing to market growth?

Widespread Adoption and Growth of Latency-specific Applications; Rising Application of 5G & Industrial IoT Services Among End-user Industries.

6. What are the notable trends driving market growth?

Rising Application of 5G and Industrial IoT Services Among End-user Industries.

7. Are there any restraints impacting market growth?

Lack of a Common Security Framework.

8. Can you provide examples of recent developments in the market?

April 2024 - Swisscom and Ericsson have prolonged their strategic alliance for three years. Ericsson will persist as the primary provider of hardware and software for what is recognized as Switzerland's premier network. This extended collaboration is poised to empower Swisscom to elevate its customer experience and advance its mobile network, with a pronounced emphasis on sustainability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Edge Computing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Edge Computing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Edge Computing Market?

To stay informed about further developments, trends, and reports in the Telecom Edge Computing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence