Key Insights

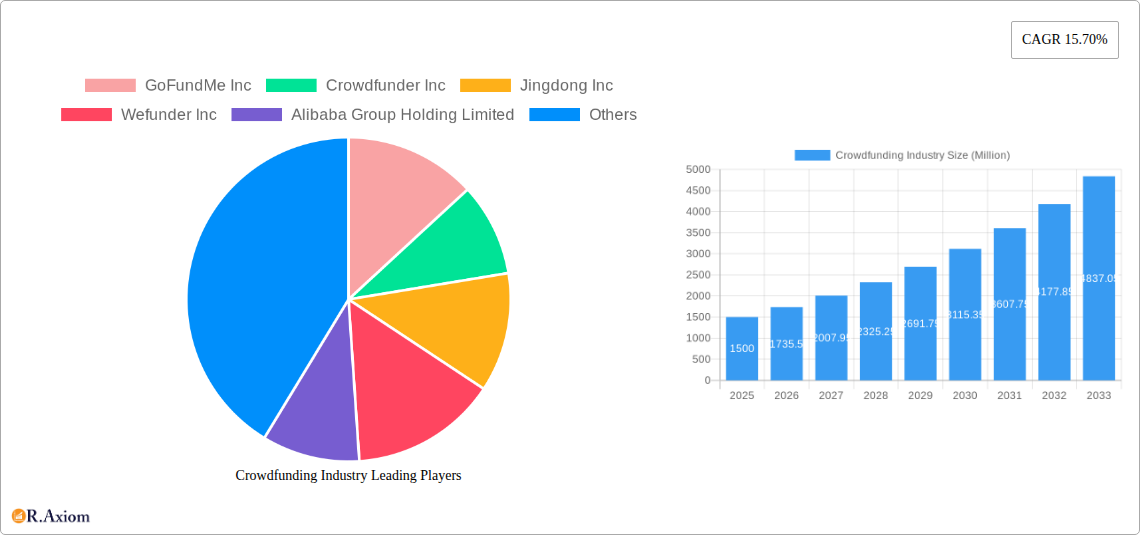

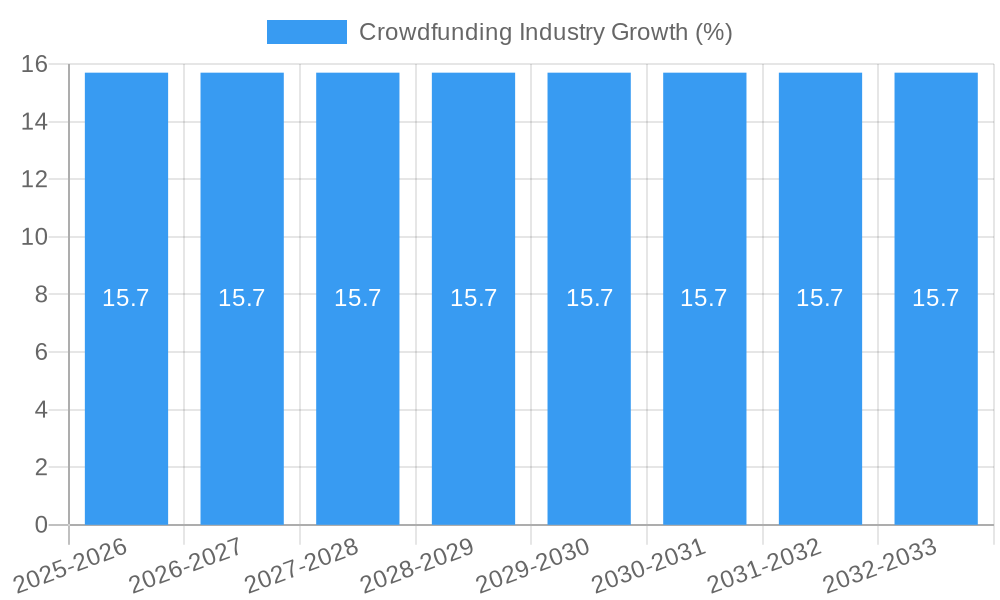

The global crowdfunding market is poised for remarkable expansion, projecting a substantial market size of USD 1.5 billion and an impressive Compound Annual Growth Rate (CAGR) of 15.70% from 2025 to 2033. This robust growth is fueled by increasing digital adoption, a growing preference for alternative funding models, and the democratization of investment opportunities. Reward-based crowdfunding continues to dominate, enabling creators and entrepreneurs to bring innovative products and projects to life by offering tangible rewards to backers. Equity crowdfunding is emerging as a significant driver, providing startups and small businesses with vital capital and offering investors early-stage access to promising ventures. Donation-based crowdfunding remains crucial for charitable causes and social initiatives, demonstrating its enduring impact on community support and philanthropic endeavors. The market's dynamism is further shaped by the diverse range of end-user applications, with the technology sector leading the charge, closely followed by cultural projects, product launches, and the healthcare industry.

The market's upward trajectory is supported by several key drivers, including enhanced online payment infrastructure, growing investor confidence in peer-to-peer funding, and increased regulatory clarity in many regions, fostering a more secure and transparent environment. Emerging trends such as the rise of social impact investing, specialized niche platforms, and the integration of blockchain technology are expected to further propel market growth and innovation. While the crowdfunding landscape is predominantly optimistic, potential restraints such as evolving regulatory frameworks, the need for robust due diligence on projects, and market saturation in certain segments warrant careful consideration. However, the inherent agility and accessibility of crowdfunding platforms, coupled with their ability to tap into global investor pools, position the industry for sustained and significant growth across all its diverse applications and regions throughout the forecast period.

Here is a detailed, SEO-optimized report description for the Crowdfunding Industry, incorporating high-traffic keywords and structured as requested.

Crowdfunding Industry Market Concentration & Innovation

This comprehensive report delves into the intricate dynamics of the global Crowdfunding Industry, offering a deep dive into market concentration and the relentless pace of innovation. With a study period spanning from 2019 to 2033, and a base year of 2025, the analysis meticulously examines the competitive landscape, identifying key players and their market shares. The report highlights the primary drivers of innovation, including advancements in digital payment gateways, blockchain technology for enhanced security and transparency, and the increasing adoption of AI-powered analytics for campaign optimization. Regulatory frameworks, such as those governing equity crowdfunding and investor protection, are analyzed for their impact on market accessibility and growth. We also assess the threat of product substitutes, such as traditional venture capital and angel investing, and their evolving roles. End-user trends, particularly the surge in demand for diverse funding solutions across cultural, technological, and healthcare sectors, are thoroughly explored. Furthermore, mergers and acquisitions (M&A) activities are quantified, with deal values estimated to reach XX Million globally, indicating significant consolidation and strategic expansion within the sector. Key companies analyzed include GoFundMe Inc, Crowdfunder Inc, Jingdong Inc, Wefunder Inc, Alibaba Group Holding Limited, Owners Circle, Crowdcube Limited, Fundable LLC, Indiegogo Inc, Realcrowd Inc, GoGetFunding, Fundly, Suning com Co Ltd, Kickstarter PBC.

Crowdfunding Industry Industry Trends & Insights

The Crowdfunding Industry is experiencing an unprecedented period of growth and transformation, driven by a confluence of factors detailed in this extensive report. Market growth drivers are underpinned by increasing digitalization, greater access to capital for individuals and small businesses, and a growing investor appetite for alternative investment opportunities. Technological disruptions, such as the integration of AI for personalized campaign recommendations, the use of big data for risk assessment, and the burgeoning potential of decentralized finance (DeFi) in crowdfunding platforms, are reshaping the industry's operational paradigms. Consumer preferences are shifting towards peer-to-peer funding models, transparency in fund allocation, and the desire to support innovative projects and social causes. The competitive dynamics are characterized by intense innovation, strategic partnerships, and the continuous emergence of niche platforms catering to specific industries or investor types. The Compound Annual Growth Rate (CAGR) for the Crowdfunding Industry is projected to be XX% during the forecast period of 2025–2033, with market penetration expected to reach XX% by the end of the study period. This growth is fueled by a robust historical performance from 2019–2024, where the market demonstrated resilience and adaptability. Insights into regulatory evolution, user experience enhancements, and the increasing institutional adoption of crowdfunding as an asset class provide a forward-looking perspective for all industry stakeholders.

Dominant Markets & Segments in Crowdfunding Industry

This section meticulously dissects the dominant markets and segments within the expansive Crowdfunding Industry, providing a granular understanding of growth pockets and strategic focal points. Equity Crowdfunding is emerging as a leading product type, driven by its ability to provide significant capital for startups and early-stage companies, coupled with attractive potential returns for investors. The regulatory clarity in several key economies for equity crowdfunding is a significant driver, alongside the increasing sophistication of platforms in managing investor relations and compliance. In terms of end-user applications, the Technology sector continues to dominate, fueled by a constant stream of innovative products and disruptive technologies requiring substantial seed and growth funding. The accessibility of crowdfunding platforms allows tech entrepreneurs to bypass traditional funding gatekeepers, fostering rapid product development and market entry.

Product Type Dominance:

- Equity Crowdfunding: Driven by investor demand for high-growth potential and regulatory support, with an estimated market size of XX Million in 2025. Key drivers include accessible valuation tools and robust due diligence processes on platforms.

- Reward-based Crowdfunding: Continues its strong performance, particularly for consumer products and creative projects, with a projected market size of XX Million in 2025. Its popularity stems from direct consumer engagement and pre-order sales models.

- Donation and Other Product Types: These segments, while smaller, show consistent growth, especially in social impact and charitable giving, with a combined market size of XX Million in 2025.

End-User Application Dominance:

- Technology: Leading the pack due to the inherent capital-intensive nature of R&D and product launches, with an estimated market size of XX Million in 2025. Economic policies supporting innovation and the proliferation of tech hubs are key catalysts.

- Product: Broad appeal across various consumer goods, from electronics to lifestyle products, with a projected market size of XX Million in 2025. Market growth is supported by strong consumer spending and e-commerce integration.

- Cultural Sector: Experiencing steady growth, with platforms enabling artists, filmmakers, and musicians to secure funding directly from their audience, contributing an estimated XX Million in 2025.

- Healthcare: Showing significant potential, particularly for medical devices, research, and health tech startups, with a projected market size of XX Million in 2025.

Crowdfunding Industry Product Developments

The Crowdfunding Industry is characterized by continuous product innovation, enhancing user experience and expanding funding capabilities. Platforms are increasingly integrating advanced analytics to predict campaign success and optimize marketing efforts, offering a competitive advantage. Developments in blockchain technology are leading to more secure, transparent, and potentially fractionalized equity offerings, attracting a wider investor base. AI-powered chatbots and personalized recommendation engines are improving engagement and conversion rates for both project creators and backers. Furthermore, the specialization of platforms to cater to specific niches, such as sustainable projects or impact investing, represents a significant trend in product development, aligning with evolving consumer values and market demands.

Report Scope & Segmentation Analysis

This report provides an exhaustive analysis of the Crowdfunding Industry, segmented by Product Type and End-User Application. The study period covers 2019–2033, with the base year at 2025 and the forecast period from 2025–2033.

- Reward-based Crowdfunding: Expected to grow at a CAGR of XX% from 2025–2033, with a projected market size of XX Million in 2025. This segment benefits from its accessibility for consumer-facing products and creative endeavors.

- Equity Crowdfunding: Forecasted to expand at a CAGR of XX%, reaching an estimated XX Million in 2025. This growth is driven by regulatory clarity and the demand for venture capital alternatives.

- Donation and Other Product Types: These segments, including donation-based crowdfunding, are projected to witness a CAGR of XX%, with a combined market size of XX Million in 2025. They are crucial for social impact and non-profit funding.

- Cultural Sector: Expected to grow at XX% CAGR, reaching XX Million in 2025, fueled by increasing appreciation for arts and independent content creation.

- Technology: Dominating the end-user applications with a CAGR of XX% and a market size of XX Million in 2025, driven by rapid innovation and startup creation.

- Product: Projected to grow at XX% CAGR, with a market size of XX Million in 2025, benefiting from strong consumer demand and e-commerce integration.

- Healthcare: Demonstrating strong potential with a CAGR of XX%, reaching XX Million in 2025, driven by advancements in medical technology and research funding needs.

- Other End-User Applications: This segment, encompassing diverse sectors, is expected to grow at XX% CAGR, with a market size of XX Million in 2025.

Key Drivers of Crowdfunding Industry Growth

The Crowdfunding Industry's robust growth is propelled by several interconnected factors. Technologically, the increasing sophistication of online platforms, enhanced payment gateway security, and the growing integration of AI and blockchain are democratizing access to capital and investor bases. Economically, the persistent need for alternative funding for startups and SMEs, coupled with low-interest rates in traditional finance, drives individuals and institutions towards crowdfunding. Regulatory advancements, particularly the clearer frameworks for equity crowdfunding in various jurisdictions, are fostering investor confidence and market expansion. The increasing global adoption of digital services and the growing propensity for online investment further amplify these growth drivers.

Challenges in the Crowdfunding Industry Sector

Despite its promising trajectory, the Crowdfunding Industry faces significant challenges. Regulatory hurdles remain a primary concern, with varying compliance requirements across different countries impacting cross-border campaigns and investor protection. The risk of fraudulent campaigns and the need for robust due diligence processes to mitigate potential financial losses for investors are persistent issues. Supply chain disruptions can impact the delivery of products funded through reward-based campaigns, leading to customer dissatisfaction. Furthermore, intense competition among platforms necessitates continuous innovation and differentiation to attract and retain both project creators and investors, with some platforms struggling to achieve profitability and sustainable growth.

Emerging Opportunities in Crowdfunding Industry

The Crowdfunding Industry is ripe with emerging opportunities, driven by evolving consumer preferences and technological advancements. The rise of impact investing and sustainable finance presents a significant avenue, with a growing demand for platforms that facilitate funding for environmentally and socially responsible projects. The integration of Decentralized Finance (DeFi) offers potential for more efficient, transparent, and accessible crowdfunding mechanisms, including tokenized equity and fractional ownership models. Expansion into underdeveloped or emerging markets with a growing population of entrepreneurs and a need for capital access represents another key opportunity. Furthermore, the increasing acceptance of crowdfunding by institutional investors as a viable alternative asset class opens up substantial new funding streams.

Leading Players in the Crowdfunding Industry Market

The Crowdfunding Industry is populated by a diverse range of influential companies, each contributing to the sector's dynamic growth. These include:

- GoFundMe Inc

- Crowdfunder Inc

- Jingdong Inc

- Wefunder Inc

- Alibaba Group Holding Limited

- Owners Circle

- Crowdcube Limited

- Fundable LLC

- Indiegogo Inc

- Realcrowd Inc

- GoGetFunding

- Fundly

- Suning com Co Ltd

- Kickstarter PBC

Key Developments in Crowdfunding Industry Industry

- 2023: Increased regulatory clarity for equity crowdfunding in several key markets, leading to a surge in platform launches and investor participation.

- 2023: Advancements in AI-powered analytics for campaign optimization, with platforms reporting higher success rates for creators.

- 2024: Growing adoption of blockchain technology for enhanced transparency and security in reward-based and equity crowdfunding.

- 2024: Emergence of specialized platforms focusing on impact investing and sustainability, attracting significant capital.

- 2024: M&A activity shows consolidation, with larger platforms acquiring smaller, niche players to expand service offerings and market reach.

Strategic Outlook for Crowdfunding Industry Market

The strategic outlook for the Crowdfunding Industry remains exceptionally positive, fueled by ongoing innovation and increasing global adoption. The continuous evolution of digital technologies, particularly AI and blockchain, will further enhance platform efficiency, transparency, and user experience, driving greater participation from both creators and investors. The growing institutional interest in alternative investments presents a significant growth catalyst, promising to inject substantial capital into the sector. Furthermore, the increasing demand for diverse funding solutions across various industries, coupled with the growing acceptance of crowdfunding as a legitimate financing channel, indicates a sustained upward trajectory for the market. Strategic focus on regulatory compliance, enhanced risk mitigation, and catering to niche market demands will be crucial for sustained success.

Crowdfunding Industry Segmentation

-

1. Product Type

- 1.1. Reward-based Crowdfunding

- 1.2. Equity Crowdfunding

- 1.3. Donation and Other Product Types

-

2. End-User Application

- 2.1. Cultural Sector

- 2.2. Technology

- 2.3. Product

- 2.4. Healthcare

- 2.5. Other End-User Applications

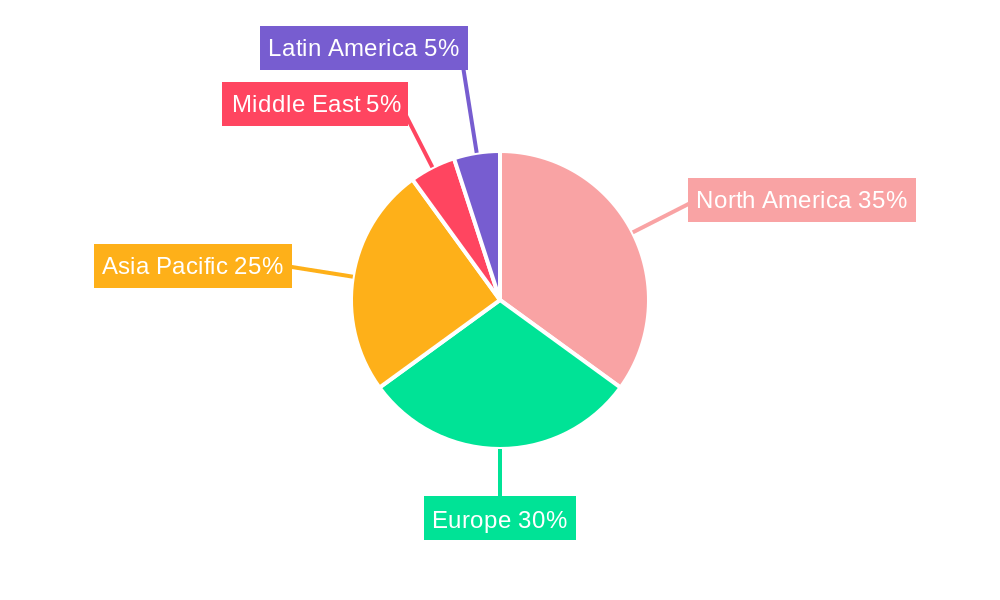

Crowdfunding Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia pacific

- 4. Middle East

- 5. Latin America

Crowdfunding Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Use of Social Media as a Free of Cost Promotion Source; Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors

- 3.3. Market Restrains

- 3.3.1. Time Consuming Process and Stringent Regulatory Compliance

- 3.4. Market Trends

- 3.4.1. Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Reward-based Crowdfunding

- 5.1.2. Equity Crowdfunding

- 5.1.3. Donation and Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Application

- 5.2.1. Cultural Sector

- 5.2.2. Technology

- 5.2.3. Product

- 5.2.4. Healthcare

- 5.2.5. Other End-User Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia pacific

- 5.3.4. Middle East

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Reward-based Crowdfunding

- 6.1.2. Equity Crowdfunding

- 6.1.3. Donation and Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-User Application

- 6.2.1. Cultural Sector

- 6.2.2. Technology

- 6.2.3. Product

- 6.2.4. Healthcare

- 6.2.5. Other End-User Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Reward-based Crowdfunding

- 7.1.2. Equity Crowdfunding

- 7.1.3. Donation and Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-User Application

- 7.2.1. Cultural Sector

- 7.2.2. Technology

- 7.2.3. Product

- 7.2.4. Healthcare

- 7.2.5. Other End-User Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia pacific Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Reward-based Crowdfunding

- 8.1.2. Equity Crowdfunding

- 8.1.3. Donation and Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-User Application

- 8.2.1. Cultural Sector

- 8.2.2. Technology

- 8.2.3. Product

- 8.2.4. Healthcare

- 8.2.5. Other End-User Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Reward-based Crowdfunding

- 9.1.2. Equity Crowdfunding

- 9.1.3. Donation and Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-User Application

- 9.2.1. Cultural Sector

- 9.2.2. Technology

- 9.2.3. Product

- 9.2.4. Healthcare

- 9.2.5. Other End-User Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Latin America Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Reward-based Crowdfunding

- 10.1.2. Equity Crowdfunding

- 10.1.3. Donation and Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-User Application

- 10.2.1. Cultural Sector

- 10.2.2. Technology

- 10.2.3. Product

- 10.2.4. Healthcare

- 10.2.5. Other End-User Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia pacific Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Middle East Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Crowdfunding Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 GoFundMe Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Crowdfunder Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Jingdong Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Wefunder Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Alibaba Group Holding Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Owners Circle

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Crowdcube Limited

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Fundable LLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Indiegogo Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Realcrowd Inc *List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 GoGetFunding

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Fundly

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Suning com Co Ltd

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Kickstarter PBC

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 GoFundMe Inc

List of Figures

- Figure 1: Global Crowdfunding Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia pacific Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia pacific Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 15: North America Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 16: North America Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 21: Europe Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 22: Europe Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia pacific Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia pacific Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia pacific Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 27: Asia pacific Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 28: Asia pacific Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia pacific Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Middle East Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Middle East Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 33: Middle East Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 34: Middle East Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Crowdfunding Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Latin America Crowdfunding Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Latin America Crowdfunding Industry Revenue (Million), by End-User Application 2024 & 2032

- Figure 39: Latin America Crowdfunding Industry Revenue Share (%), by End-User Application 2024 & 2032

- Figure 40: Latin America Crowdfunding Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Crowdfunding Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Crowdfunding Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 4: Global Crowdfunding Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Crowdfunding Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 17: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 20: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 23: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 26: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Crowdfunding Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Global Crowdfunding Industry Revenue Million Forecast, by End-User Application 2019 & 2032

- Table 29: Global Crowdfunding Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crowdfunding Industry?

The projected CAGR is approximately 15.70%.

2. Which companies are prominent players in the Crowdfunding Industry?

Key companies in the market include GoFundMe Inc, Crowdfunder Inc, Jingdong Inc, Wefunder Inc, Alibaba Group Holding Limited, Owners Circle, Crowdcube Limited, Fundable LLC, Indiegogo Inc, Realcrowd Inc *List Not Exhaustive, GoGetFunding, Fundly, Suning com Co Ltd, Kickstarter PBC.

3. What are the main segments of the Crowdfunding Industry?

The market segments include Product Type, End-User Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Use of Social Media as a Free of Cost Promotion Source; Increasing Investor Forward looking Strategic Behaviour and Social Interactions among Investors.

6. What are the notable trends driving market growth?

Reward-Based Crowdfunding is Anticipated to Augment the Growth of the Market.

7. Are there any restraints impacting market growth?

Time Consuming Process and Stringent Regulatory Compliance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crowdfunding Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crowdfunding Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crowdfunding Industry?

To stay informed about further developments, trends, and reports in the Crowdfunding Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence