Key Insights

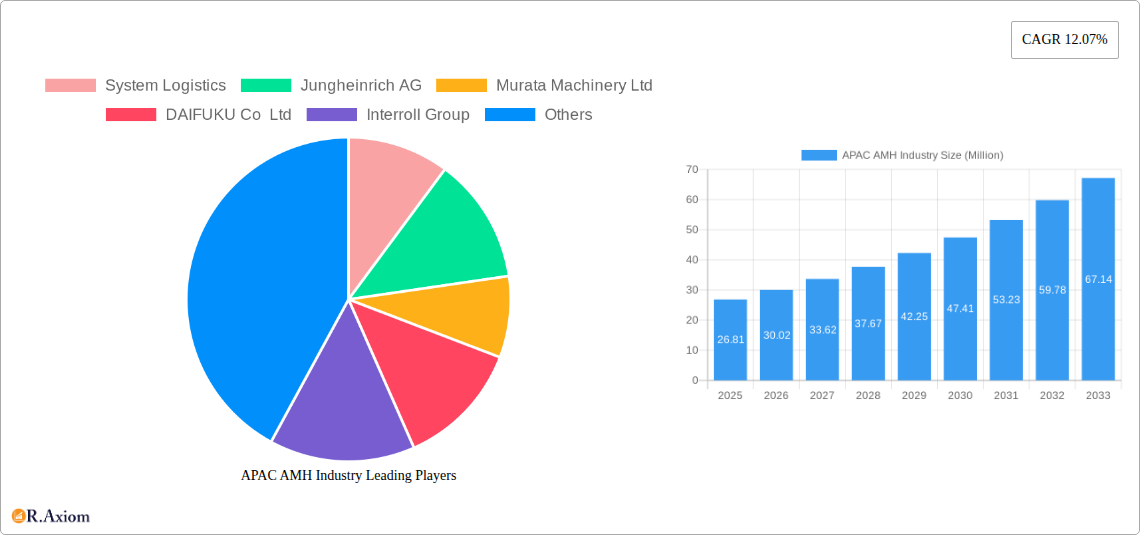

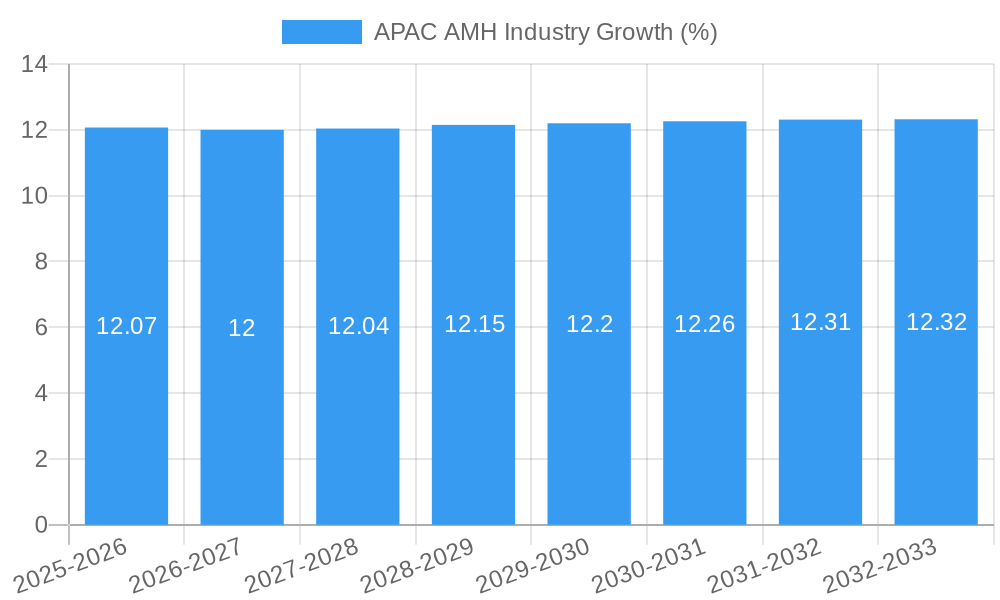

The Asia Pacific Automated Material Handling (AMH) market is poised for substantial growth, projected to reach a significant market size with a robust Compound Annual Growth Rate (CAGR) of 12.07%. This expansion is fundamentally driven by the escalating demand for enhanced operational efficiency and productivity across various industries. Key sectors like e-commerce, retail, and general manufacturing are heavily investing in AMH solutions to streamline their supply chains, reduce labor costs, and improve accuracy in warehousing and logistics operations. The increasing adoption of sophisticated technologies such as Autonomous Mobile Robots (AMRs) and Automated Storage and Retrieval Systems (ASRS) is a major trend, offering greater flexibility and scalability compared to traditional fixed automation. Furthermore, government initiatives promoting industrial automation and smart manufacturing in countries like China and India are acting as significant catalysts for market penetration.

Despite the promising outlook, the AMH market in APAC faces certain restraints, primarily revolving around the high initial investment costs associated with advanced AMH systems, which can be a barrier for small and medium-sized enterprises. Skilled labor shortages for the installation, operation, and maintenance of these complex systems also present a challenge. However, the continuous innovation in product development, including the integration of AI and IoT for predictive maintenance and optimized operations, along with the emergence of more affordable and modular AMH solutions, are expected to mitigate these challenges. The market is segmented across hardware, software, and services, with mobile robots and ASRS leading the equipment types. Key end-user verticals like food and beverage, pharmaceuticals, and post and parcel are witnessing rapid adoption due to stringent quality control and rapid delivery requirements, further fueling market expansion across the APAC region.

APAC AMH Industry: Comprehensive Market Report 2025-2033

Gain an in-depth understanding of the APAC Automated Material Handling (AMH) Industry with this comprehensive report, covering the period from 2019 to 2033. The study provides a detailed analysis of market dynamics, segmentation, key players, and future outlook, with a base year of 2025 and a forecast period extending from 2025 to 2033. This report is an essential resource for stakeholders seeking to capitalize on the burgeoning AMH market in the Asia-Pacific region, a critical hub for technological innovation and industrial growth.

Key Report Highlights:

- Market Size & Forecast: Detailed market size estimations and future projections for the APAC AMH industry.

- Segmentation Analysis: In-depth analysis across Product Type (Hardware, Software, Services), Equipment Type (Mobile Robots, ASRS, Automated Conveyors, Palletizers, Sortation Systems), and End-user Verticals (Airport, Automotive, Food & Beverage, Retail/Wholesale, General Manufacturing, Pharmaceuticals, Post & Parcel).

- Key Players: Comprehensive profiling of leading companies and their strategic initiatives.

- Industry Trends & Developments: Analysis of critical trends, technological advancements, and recent developments shaping the market.

- Growth Drivers & Challenges: Identification of key factors propelling market growth and potential barriers.

This report leverages high-traffic keywords such as "Automated Material Handling APAC," "AMH market Asia," "Robotics in Warehousing Asia," "AGV market APAC," "ASRS solutions Asia," "logistics automation trends," and "supply chain technology Asia" to ensure maximum search visibility for industry professionals, investors, and decision-makers.

APAC AMH Industry Market Concentration & Innovation

The APAC AMH industry is characterized by a dynamic mix of established global players and emerging regional innovators, leading to a moderately concentrated market. Innovation is a primary driver, fueled by the relentless pursuit of operational efficiency, labor cost reduction, and enhanced supply chain resilience across diverse end-user verticals. Key innovation areas include the integration of Artificial Intelligence (AI) and Machine Learning (ML) into AMH systems for predictive maintenance and optimized routing, advancements in sensor technology for improved robot navigation, and the development of flexible and scalable modular systems. Regulatory frameworks, while evolving, are increasingly supporting the adoption of AMH technologies through initiatives promoting smart manufacturing and e-commerce growth. Product substitutes, such as manual labor and less automated solutions, are gradually being displaced by the superior performance and cost-effectiveness of AMH. End-user trends strongly favor solutions that can adapt to fluctuating demand, reduce human error, and ensure worker safety. Mergers and acquisitions (M&A) activity is a significant factor in shaping market concentration. For instance, strategic acquisitions aimed at expanding technological portfolios or market reach are common. While specific deal values are proprietary, the trend indicates a consolidation of key capabilities and market access. The increasing demand for automation in industries like e-commerce and automotive in APAC is a testament to the ongoing innovation and strategic investments in this sector.

APAC AMH Industry Industry Trends & Insights

The APAC Automated Material Handling (AMH) industry is experiencing robust growth, driven by a confluence of factors including rapid industrialization, the burgeoning e-commerce sector, and the strategic push for supply chain optimization across the region. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period (2025–2033). This expansion is underpinned by a strong demand for increased productivity, reduced operational costs, and improved accuracy in warehousing and logistics operations. Technological disruptions are at the forefront of this growth, with significant advancements in robotics, artificial intelligence, and the Internet of Things (IoT) enabling more sophisticated and autonomous material handling solutions. The adoption of Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) is particularly noteworthy, offering unprecedented flexibility and scalability compared to traditional fixed automation. Consumer preferences are increasingly leaning towards faster delivery times and greater transparency in order fulfillment, compelling businesses to invest in advanced AMH systems that can handle higher volumes and complex order picking processes. Furthermore, the ongoing labor shortages in many APAC economies are acting as a powerful catalyst for automation adoption, as companies seek to mitigate the impact of reduced human workforce availability. Competitive dynamics are intense, with both global AMH giants and agile local players vying for market share. Companies are focusing on developing integrated solutions that combine hardware, software, and services to offer end-to-end capabilities. The market penetration of advanced AMH solutions is steadily increasing across various end-user verticals, including retail, food and beverage, pharmaceuticals, and automotive, as businesses recognize the strategic imperative to modernize their material handling operations. The ongoing digital transformation across industries in APAC is creating a fertile ground for the widespread adoption of smart, connected, and data-driven AMH systems. The estimated market size for AMH in APAC is expected to reach over $35 Million by 2025, with significant growth anticipated throughout the forecast period.

Dominant Markets & Segments in APAC AMH Industry

The APAC AMH industry is dominated by a few key regions and segments, reflecting diverse economic development and industry-specific demands.

Leading Region:

East Asia: This sub-region, particularly China, Japan, and South Korea, stands as the dominant force in the APAC AMH market.

- Economic Policies: Government initiatives promoting Industry 4.0, smart manufacturing, and digital transformation have significantly boosted AMH adoption. Subsidies and tax incentives for automation investments further fuel growth.

- Infrastructure Development: Extensive investments in logistics infrastructure, including ports, airports, and road networks, necessitate advanced material handling solutions to manage increased trade volumes efficiently.

- Manufacturing Hub: APAC's role as a global manufacturing hub, especially in electronics, automotive, and consumer goods, creates a massive demand for efficient material flow within factories and distribution centers.

- E-commerce Dominance: The rapid growth of e-commerce in countries like China drives demand for highly efficient automated warehouses and fulfillment centers.

Dominant Segments:

Product Type:

- Hardware: This segment holds the largest market share due to the foundational nature of physical AMH equipment.

- Mobile Robots (AGV, AMR): The surge in demand for flexible and scalable automation solutions has made mobile robots a key growth area. They are critical for dynamic warehouse layouts and efficient internal logistics.

- Automated Storage and Retrieval Systems (ASRS): ASRS are crucial for optimizing warehouse space utilization and increasing storage density, particularly in high-value sectors like pharmaceuticals and automotive. Fixed Aisle (Stacker Crane + Shuttle System) remains a dominant ASRS configuration for large-scale operations.

- Services: The services segment, encompassing installation, maintenance, and software support, is witnessing substantial growth as companies increasingly seek integrated solutions and ongoing operational assistance.

- Software: WMS (Warehouse Management Systems) and WCS (Warehouse Control Systems) are vital for orchestrating complex AMH operations, leading to consistent growth in this segment.

- Hardware: This segment holds the largest market share due to the foundational nature of physical AMH equipment.

Equipment Type:

- Mobile Robots:

- Autonomous Mobile Robots (AMR): AMRs are rapidly gaining traction due to their flexibility, ease of deployment, and ability to navigate dynamic environments, making them ideal for evolving logistics needs.

- Automated Guided Vehicle (AGV): While AMRs are gaining prominence, traditional AGVs, especially Unit Load and Automated Forklift variants, continue to be widely deployed in established industrial settings.

- Automated Storage and Retrieval System (ASRS):

- Fixed Aisle (Stacker Crane + Shuttle System): These systems offer high density and throughput for large-scale, fixed warehouse operations.

- Automated Conveyor:

- Belt and Roller Conveyors: These are fundamental for transporting goods within facilities, playing a crucial role in high-throughput environments.

- Palletizer:

- Robotic Palletizers: These are increasingly favored for their adaptability and precision in handling diverse product types and configurations.

- Mobile Robots:

End-user Vertical:

- Retail/Wholesale: Driven by the massive growth of e-commerce and the need for efficient order fulfillment, this sector is a primary driver of AMH demand.

- Food and Beverage: High demand for traceability, hygiene, and temperature-controlled environments makes AMH solutions essential for this sector.

- Automotive: The automotive industry relies heavily on AMH for just-in-time manufacturing, component handling, and assembly line automation.

- General Manufacturing: Continuous efforts to improve production efficiency and reduce operational costs propel AMH adoption across various manufacturing sub-sectors.

APAC AMH Industry Product Developments

Recent product developments in the APAC AMH industry are focused on enhancing autonomy, flexibility, and integration. Innovations in AI-powered navigation for Autonomous Mobile Robots (AMRs) enable more sophisticated pathfinding and obstacle avoidance, improving operational efficiency. Advances in modular ASRS solutions offer businesses scalable storage options that can adapt to changing demands. Collaborative robots (cobots) are being increasingly integrated into AMH workflows, working alongside human operators for tasks like picking and packing. The development of predictive maintenance software for AMH equipment reduces downtime and optimizes asset utilization. These product advancements aim to provide businesses with more adaptable, intelligent, and cost-effective material handling solutions that can seamlessly integrate into existing supply chain ecosystems, offering significant competitive advantages.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the APAC Automated Material Handling (AMH) industry, segmented across key areas to offer granular insights. The Product Type segmentation includes Hardware, Software, and Services, each crucial for the complete AMH ecosystem. Hardware encompasses the physical equipment like robots and ASRS, while Software includes WMS and WCS for operational control. Services cover installation, maintenance, and consulting.

The Equipment Type segmentation is extensive, detailing the market for Mobile Robots (AGVs, AMRs, etc.), Automated Storage and Retrieval Systems (ASRS), Automated Conveyors, Palletizers, and Sortation Systems. Within Mobile Robots, specific sub-segments like Automated Forklifts and Autonomous Mobile Robots are analyzed for their distinct market dynamics and growth trajectories. The ASRS segment covers Fixed Aisle, Carousel, and Vertical Lift Modules, reflecting diverse storage needs.

Furthermore, the analysis extends to crucial End-user Verticals, including Airport, Automotive, Food and Beverage, Retail/Wholesale, General Manufacturing, Pharmaceuticals, and Post and Parcel. Each vertical presents unique AMH requirements and adoption patterns, influencing market growth and technological innovation. Growth projections, market sizes, and competitive dynamics are detailed for each segment, offering a holistic view of the APAC AMH landscape.

Key Drivers of APAC AMH Industry Growth

The APAC AMH industry is propelled by several key drivers:

- Rapid E-commerce Growth: The surge in online retail mandates faster order fulfillment and efficient warehousing, directly increasing demand for AMH solutions.

- Labor Shortages & Rising Labor Costs: Many APAC economies face demographic shifts leading to labor scarcity and increasing wages, making automation an economically viable solution.

- Government Initiatives & Smart Manufacturing Push: Policies promoting Industry 4.0, digitalization, and advanced manufacturing encourage investment in automated technologies.

- Technological Advancements: Continuous innovation in robotics, AI, and IoT enables more intelligent, flexible, and cost-effective AMH systems.

- Supply Chain Resilience: The need for robust and adaptable supply chains, highlighted by recent global disruptions, drives investment in automation to ensure continuity.

Challenges in the APAC AMH Industry Sector

Despite robust growth, the APAC AMH industry faces several challenges:

- High Initial Investment Costs: The upfront capital required for advanced AMH systems can be a barrier for small and medium-sized enterprises (SMEs).

- Integration Complexity: Integrating new AMH systems with existing legacy IT infrastructure and manual processes can be complex and time-consuming.

- Skilled Workforce Gap: A shortage of trained personnel to operate, maintain, and manage sophisticated AMH systems poses a significant challenge.

- Regulatory Variations: Divergent regulations across different APAC countries regarding automation, data privacy, and safety standards can create implementation hurdles.

- Cybersecurity Concerns: The increasing connectivity of AMH systems raises concerns about potential cyber threats and data breaches, necessitating robust security measures.

Emerging Opportunities in APAC AMH Industry

The APAC AMH industry presents significant emerging opportunities:

- Expansion in Tier 2 & 3 Cities: As e-commerce penetration grows beyond major metropolitan areas, there's an increasing demand for AMH solutions in smaller cities and logistics hubs.

- Growth in Cold Chain Logistics: The expanding pharmaceutical and frozen food sectors require specialized AMH solutions for temperature-controlled environments.

- Integration of AI & ML for Predictive Analytics: Leveraging AI for predictive maintenance, demand forecasting, and route optimization offers substantial value creation.

- Sustainable & Green Logistics: Developing energy-efficient AMH solutions aligns with growing environmental concerns and government mandates for sustainability.

- Robotics-as-a-Service (RaaS): The RaaS model can lower the barrier to entry for businesses by offering flexible, subscription-based access to AMH technology.

Leading Players in the APAC AMH Industry Market

- System Logistics

- Jungheinrich AG

- Murata Machinery Ltd

- DAIFUKU Co Ltd

- Interroll Group

- BEUMER Group GmbH & Co KG

- VisionNav Robotics

- SSI Schaefer AG

- Witron Logistik

- KION Group

- Kardex Group

- JBT Corporation

- Honeywell Intelligrated Inc

- Toyota Industries Corporation

- Kuka AG

Key Developments in APAC AMH Industry Industry

- August 2022: Juki Automation Systems (JAS), Inc. announced plans to exhibit at the SMTA Guadalajara Expo & Tech Forum to demonstrate the award-winning Autonomous Material Handling System and JM-50.

- June 2022: Lodige Industries announced the installation of a new fully automated air cargo terminal at Chengdu Tianfu International Airport. The core of the new international cargo facility consists of two elevating transfer vehicles (ETVs) with a five-level, three-directional automated ULD storage and handling system for 227 20ft storage positions, ensuring a smooth and efficient flow of cargo at the cutting-edge airport.

- March 2022: VisionNav Robotics demonstrated the applications of the VNP15 counterbalanced automated forklift in the stacking scenario of multi-layer material frames at the MODEX 2022 site.

- December 2021: In Jinan, China, the KION Group establishes a new forklift truck manufacturing. Jinan is the fifth-largest production site in China for the KION Group. Industrial vehicles from KION's Linde Material Handling and Baoli brands will be constructed in the future on a 2,400,000-square-foot site.

- September 2021: AFT Industries AG and Daifuku of Japan have created a cooperative business agreement aimed at leveraging both businesses' material handling capabilities in the automobile industry. Both companies will take advantage of this mutually beneficial business cooperation to expand their worldwide reach and obtain increased demand and investment from automakers.

Strategic Outlook for APAC AMH Industry Market

The strategic outlook for the APAC AMH industry remains exceptionally positive, driven by continued digital transformation and the imperative for enhanced supply chain efficiency. Future market potential will be unlocked through the widespread adoption of AI-powered intelligent automation, enabling more dynamic and self-optimizing operations. The growth of emerging economies within APAC, coupled with evolving consumer demands for faster and more personalized delivery, will further fuel the need for advanced material handling solutions. Investments in robotics-as-a-service (RaaS) models are expected to democratize access to automation, particularly for SMEs. Furthermore, the increasing focus on sustainability will drive innovation in energy-efficient AMH technologies. Strategic partnerships and mergers will continue to shape the competitive landscape, fostering greater integration and broader market reach for key players. The ongoing evolution of e-commerce and the manufacturing sector will ensure that AMH remains a critical enabler of business growth and operational excellence in the APAC region.

APAC AMH Industry Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Equipment Type

-

2.1. Mobile Robots

-

2.1.1. Automated Guided Vehicle (AGV)

- 2.1.1.1. Automated Forklift

- 2.1.1.2. Automated Tow/Tractor/Tug

- 2.1.1.3. Unit Load

- 2.1.1.4. Assembly Line

- 2.1.1.5. Special Purpose

- 2.1.2. Autonomous Mobile Robots (AMR)

- 2.1.3. Laser Guided Vehicle

-

2.1.1. Automated Guided Vehicle (AGV)

-

2.2. Automated Storage and Retrieval System (ASRS)

- 2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 2.2.3. Vertical Lift Module

-

2.3. Automated Conveyor

- 2.3.1. Belt

- 2.3.2. Roller

- 2.3.3. Pallet

- 2.3.4. Overhead

-

2.4. Palletizer

- 2.4.1. Conventional (High Level + Low Level)

- 2.4.2. Robotic

- 2.5. Sortation System

-

2.1. Mobile Robots

-

3. End-user Vertical

- 3.1. Airport

- 3.2. Automotive

- 3.3. Food and Beverage

- 3.4. Retail/W

- 3.5. General Manufacturing

- 3.6. Pharmaceuticals

- 3.7. Post and Parcel

- 3.8. Other End-Users

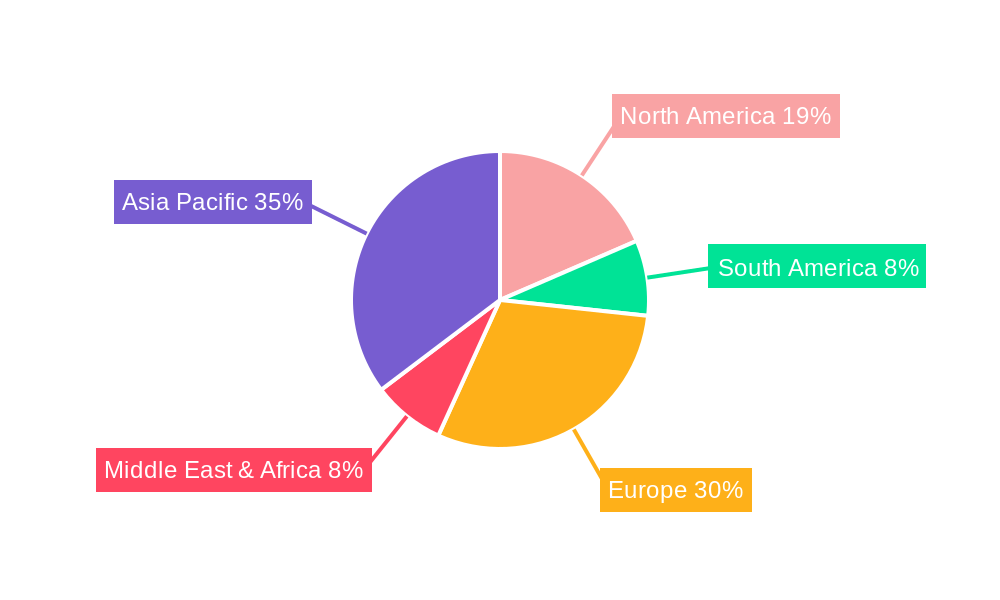

APAC AMH Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC AMH Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancments Aiding Market Growth; Industry 4.0 Investments Driving The Demand For Automation And Material Handling; Rapid Growth In E-commerce

- 3.3. Market Restrains

- 3.3.1. High Initial Costs; Unavailability Of Skilled Workforce

- 3.4. Market Trends

- 3.4.1. Airports to Hold a Dominant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Mobile Robots

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.1.1.1. Automated Forklift

- 5.2.1.1.2. Automated Tow/Tractor/Tug

- 5.2.1.1.3. Unit Load

- 5.2.1.1.4. Assembly Line

- 5.2.1.1.5. Special Purpose

- 5.2.1.2. Autonomous Mobile Robots (AMR)

- 5.2.1.3. Laser Guided Vehicle

- 5.2.1.1. Automated Guided Vehicle (AGV)

- 5.2.2. Automated Storage and Retrieval System (ASRS)

- 5.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.2.3. Vertical Lift Module

- 5.2.3. Automated Conveyor

- 5.2.3.1. Belt

- 5.2.3.2. Roller

- 5.2.3.3. Pallet

- 5.2.3.4. Overhead

- 5.2.4. Palletizer

- 5.2.4.1. Conventional (High Level + Low Level)

- 5.2.4.2. Robotic

- 5.2.5. Sortation System

- 5.2.1. Mobile Robots

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Airport

- 5.3.2. Automotive

- 5.3.3. Food and Beverage

- 5.3.4. Retail/W

- 5.3.5. General Manufacturing

- 5.3.6. Pharmaceuticals

- 5.3.7. Post and Parcel

- 5.3.8. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Equipment Type

- 6.2.1. Mobile Robots

- 6.2.1.1. Automated Guided Vehicle (AGV)

- 6.2.1.1.1. Automated Forklift

- 6.2.1.1.2. Automated Tow/Tractor/Tug

- 6.2.1.1.3. Unit Load

- 6.2.1.1.4. Assembly Line

- 6.2.1.1.5. Special Purpose

- 6.2.1.2. Autonomous Mobile Robots (AMR)

- 6.2.1.3. Laser Guided Vehicle

- 6.2.1.1. Automated Guided Vehicle (AGV)

- 6.2.2. Automated Storage and Retrieval System (ASRS)

- 6.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 6.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 6.2.2.3. Vertical Lift Module

- 6.2.3. Automated Conveyor

- 6.2.3.1. Belt

- 6.2.3.2. Roller

- 6.2.3.3. Pallet

- 6.2.3.4. Overhead

- 6.2.4. Palletizer

- 6.2.4.1. Conventional (High Level + Low Level)

- 6.2.4.2. Robotic

- 6.2.5. Sortation System

- 6.2.1. Mobile Robots

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Airport

- 6.3.2. Automotive

- 6.3.3. Food and Beverage

- 6.3.4. Retail/W

- 6.3.5. General Manufacturing

- 6.3.6. Pharmaceuticals

- 6.3.7. Post and Parcel

- 6.3.8. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Equipment Type

- 7.2.1. Mobile Robots

- 7.2.1.1. Automated Guided Vehicle (AGV)

- 7.2.1.1.1. Automated Forklift

- 7.2.1.1.2. Automated Tow/Tractor/Tug

- 7.2.1.1.3. Unit Load

- 7.2.1.1.4. Assembly Line

- 7.2.1.1.5. Special Purpose

- 7.2.1.2. Autonomous Mobile Robots (AMR)

- 7.2.1.3. Laser Guided Vehicle

- 7.2.1.1. Automated Guided Vehicle (AGV)

- 7.2.2. Automated Storage and Retrieval System (ASRS)

- 7.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 7.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 7.2.2.3. Vertical Lift Module

- 7.2.3. Automated Conveyor

- 7.2.3.1. Belt

- 7.2.3.2. Roller

- 7.2.3.3. Pallet

- 7.2.3.4. Overhead

- 7.2.4. Palletizer

- 7.2.4.1. Conventional (High Level + Low Level)

- 7.2.4.2. Robotic

- 7.2.5. Sortation System

- 7.2.1. Mobile Robots

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Airport

- 7.3.2. Automotive

- 7.3.3. Food and Beverage

- 7.3.4. Retail/W

- 7.3.5. General Manufacturing

- 7.3.6. Pharmaceuticals

- 7.3.7. Post and Parcel

- 7.3.8. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Equipment Type

- 8.2.1. Mobile Robots

- 8.2.1.1. Automated Guided Vehicle (AGV)

- 8.2.1.1.1. Automated Forklift

- 8.2.1.1.2. Automated Tow/Tractor/Tug

- 8.2.1.1.3. Unit Load

- 8.2.1.1.4. Assembly Line

- 8.2.1.1.5. Special Purpose

- 8.2.1.2. Autonomous Mobile Robots (AMR)

- 8.2.1.3. Laser Guided Vehicle

- 8.2.1.1. Automated Guided Vehicle (AGV)

- 8.2.2. Automated Storage and Retrieval System (ASRS)

- 8.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 8.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 8.2.2.3. Vertical Lift Module

- 8.2.3. Automated Conveyor

- 8.2.3.1. Belt

- 8.2.3.2. Roller

- 8.2.3.3. Pallet

- 8.2.3.4. Overhead

- 8.2.4. Palletizer

- 8.2.4.1. Conventional (High Level + Low Level)

- 8.2.4.2. Robotic

- 8.2.5. Sortation System

- 8.2.1. Mobile Robots

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Airport

- 8.3.2. Automotive

- 8.3.3. Food and Beverage

- 8.3.4. Retail/W

- 8.3.5. General Manufacturing

- 8.3.6. Pharmaceuticals

- 8.3.7. Post and Parcel

- 8.3.8. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Equipment Type

- 9.2.1. Mobile Robots

- 9.2.1.1. Automated Guided Vehicle (AGV)

- 9.2.1.1.1. Automated Forklift

- 9.2.1.1.2. Automated Tow/Tractor/Tug

- 9.2.1.1.3. Unit Load

- 9.2.1.1.4. Assembly Line

- 9.2.1.1.5. Special Purpose

- 9.2.1.2. Autonomous Mobile Robots (AMR)

- 9.2.1.3. Laser Guided Vehicle

- 9.2.1.1. Automated Guided Vehicle (AGV)

- 9.2.2. Automated Storage and Retrieval System (ASRS)

- 9.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 9.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 9.2.2.3. Vertical Lift Module

- 9.2.3. Automated Conveyor

- 9.2.3.1. Belt

- 9.2.3.2. Roller

- 9.2.3.3. Pallet

- 9.2.3.4. Overhead

- 9.2.4. Palletizer

- 9.2.4.1. Conventional (High Level + Low Level)

- 9.2.4.2. Robotic

- 9.2.5. Sortation System

- 9.2.1. Mobile Robots

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Airport

- 9.3.2. Automotive

- 9.3.3. Food and Beverage

- 9.3.4. Retail/W

- 9.3.5. General Manufacturing

- 9.3.6. Pharmaceuticals

- 9.3.7. Post and Parcel

- 9.3.8. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Equipment Type

- 10.2.1. Mobile Robots

- 10.2.1.1. Automated Guided Vehicle (AGV)

- 10.2.1.1.1. Automated Forklift

- 10.2.1.1.2. Automated Tow/Tractor/Tug

- 10.2.1.1.3. Unit Load

- 10.2.1.1.4. Assembly Line

- 10.2.1.1.5. Special Purpose

- 10.2.1.2. Autonomous Mobile Robots (AMR)

- 10.2.1.3. Laser Guided Vehicle

- 10.2.1.1. Automated Guided Vehicle (AGV)

- 10.2.2. Automated Storage and Retrieval System (ASRS)

- 10.2.2.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 10.2.2.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 10.2.2.3. Vertical Lift Module

- 10.2.3. Automated Conveyor

- 10.2.3.1. Belt

- 10.2.3.2. Roller

- 10.2.3.3. Pallet

- 10.2.3.4. Overhead

- 10.2.4. Palletizer

- 10.2.4.1. Conventional (High Level + Low Level)

- 10.2.4.2. Robotic

- 10.2.5. Sortation System

- 10.2.1. Mobile Robots

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Airport

- 10.3.2. Automotive

- 10.3.3. Food and Beverage

- 10.3.4. Retail/W

- 10.3.5. General Manufacturing

- 10.3.6. Pharmaceuticals

- 10.3.7. Post and Parcel

- 10.3.8. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Italy

- 12.1.4 Germany

- 12.1.5 Rest of Europe

- 13. Asia Pacific APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Rest of Asia Pacific

- 14. Latin America APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Mexico

- 14.1.4 Rest of Latin America

- 15. Middle East and Africa APAC AMH Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Israel

- 15.1.3 Saudi Arabia

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 System Logistics

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Jungheinrich AG

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Murata Machinery Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DAIFUKU Co Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Interroll Group

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 BEUMER Group GmbH & Co KG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 VisionNav Robotics

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 SSI Schaefer AG

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Witron Logistik

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 KION Group

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Kardex Group

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 JBT Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Honeywell Intelligrated Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Toyota Industries Corporation

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Kuka AG

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.1 System Logistics

List of Figures

- Figure 1: Global APAC AMH Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America APAC AMH Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America APAC AMH Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America APAC AMH Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 15: North America APAC AMH Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 16: North America APAC AMH Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 17: North America APAC AMH Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 18: North America APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America APAC AMH Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: South America APAC AMH Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: South America APAC AMH Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 23: South America APAC AMH Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 24: South America APAC AMH Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 25: South America APAC AMH Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 26: South America APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: South America APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe APAC AMH Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Europe APAC AMH Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Europe APAC AMH Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 31: Europe APAC AMH Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 32: Europe APAC AMH Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Europe APAC AMH Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Europe APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa APAC AMH Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East & Africa APAC AMH Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East & Africa APAC AMH Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 39: Middle East & Africa APAC AMH Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 40: Middle East & Africa APAC AMH Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 41: Middle East & Africa APAC AMH Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 42: Middle East & Africa APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific APAC AMH Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 45: Asia Pacific APAC AMH Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 46: Asia Pacific APAC AMH Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 47: Asia Pacific APAC AMH Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 48: Asia Pacific APAC AMH Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 49: Asia Pacific APAC AMH Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 50: Asia Pacific APAC AMH Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific APAC AMH Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC AMH Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 4: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: Global APAC AMH Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Mexico APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Latin America APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South Africa APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Israel APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Saudi Arabia APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Middle East and Africa APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 32: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 33: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Canada APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 39: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 40: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: Brazil APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Argentina APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of South America APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 45: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 46: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 47: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: United Kingdom APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Germany APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: France APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Italy APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Russia APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Benelux APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Nordics APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 58: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 59: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 60: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 61: Turkey APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Israel APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: GCC APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: North Africa APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: South Africa APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Rest of Middle East & Africa APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Global APAC AMH Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 68: Global APAC AMH Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 69: Global APAC AMH Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 70: Global APAC AMH Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 71: China APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: India APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Japan APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Korea APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: ASEAN APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Oceania APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Rest of Asia Pacific APAC AMH Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC AMH Industry?

The projected CAGR is approximately 12.07%.

2. Which companies are prominent players in the APAC AMH Industry?

Key companies in the market include System Logistics, Jungheinrich AG, Murata Machinery Ltd, DAIFUKU Co Ltd, Interroll Group, BEUMER Group GmbH & Co KG, VisionNav Robotics, SSI Schaefer AG, Witron Logistik, KION Group, Kardex Group, JBT Corporation, Honeywell Intelligrated Inc, Toyota Industries Corporation, Kuka AG.

3. What are the main segments of the APAC AMH Industry?

The market segments include Product Type, Equipment Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancments Aiding Market Growth; Industry 4.0 Investments Driving The Demand For Automation And Material Handling; Rapid Growth In E-commerce.

6. What are the notable trends driving market growth?

Airports to Hold a Dominant Market Share.

7. Are there any restraints impacting market growth?

High Initial Costs; Unavailability Of Skilled Workforce.

8. Can you provide examples of recent developments in the market?

August 2022 - Juki Automation Systems (JAS), Inc., a world-leading provider of automated assembly products and systems, announced plans to exhibit at the SMTA Guadalajara Expo & Tech Forum to demonstrate the award-winning Autonomous Material Handling System and JM-50 to demonstrate the award-winning Autonomous Material Handling System and JM-50.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC AMH Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC AMH Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC AMH Industry?

To stay informed about further developments, trends, and reports in the APAC AMH Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence