Key Insights

The Global Trace Detection Screening Market is experiencing robust expansion, projected to reach a substantial valuation with a Compound Annual Growth Rate (CAGR) of 7.93% over the forecast period. This growth is fueled by an escalating demand for enhanced security measures across various sectors, including aviation, critical infrastructure, and public spaces, driven by a persistent threat landscape. Key market drivers include advancements in sensor technology leading to more sensitive and accurate detection capabilities, alongside the increasing adoption of portable and handheld devices for on-the-spot screening. Furthermore, stringent regulatory mandates and a growing awareness of the critical need to prevent illicit activities such as terrorism, smuggling, and illegal trafficking are significantly propelling market adoption. The market is segmented across diverse applications, from explosives and narcotics detection to a variety of product forms like handheld, portable, and fixed systems, catering to a broad spectrum of end-user industries such as commercial, military and defense, law enforcement, and ports and borders.

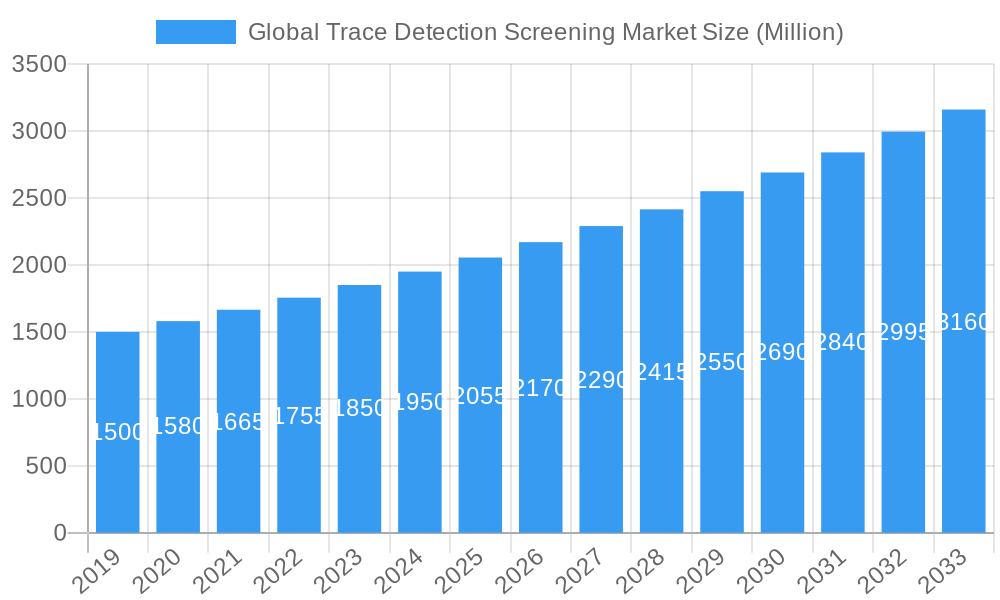

Global Trace Detection Screening Market Market Size (In Billion)

The market's trajectory is also shaped by evolving trends, including the integration of artificial intelligence and machine learning for faster threat identification and reduced false alarm rates, as well as the development of integrated screening solutions that combine trace detection with other security technologies. While the market presents significant opportunities, certain restraints, such as the high initial cost of advanced detection equipment and the need for continuous operator training, may pose challenges. However, the increasing focus on homeland security and the continuous innovation by leading companies like Smiths Detection Group Ltd, Teledyne Flir LLC, and Rapiscan Systems Inc. are expected to mitigate these challenges and sustain the market's upward momentum. Geographically, North America and Europe are anticipated to remain dominant regions due to early adoption of advanced security technologies and robust government spending, while the Asia Pacific region is poised for rapid growth driven by increasing investments in security infrastructure and a rising number of large-scale events.

Global Trace Detection Screening Market Company Market Share

Here is the SEO-optimized, detailed report description for the Global Trace Detection Screening Market:

Global Trace Detection Screening Market: Market Concentration & Innovation

The Global Trace Detection Screening Market is characterized by a moderate to high level of concentration, with key players investing significantly in research and development to drive innovation. The primary innovation drivers include the escalating threat landscape, demanding more sophisticated and rapid detection capabilities for explosives, narcotics, and chemical agents. Regulatory frameworks, particularly those mandated by governmental bodies for security screening at critical infrastructure and border control points, play a crucial role in shaping product development and market adoption. While direct product substitutes are limited, advancements in other security screening technologies can indirectly influence market dynamics. End-user trends are leaning towards enhanced mobility, ease of use, and integrated detection solutions across multiple threat types. Mergers and acquisitions (M&A) are active, with companies seeking to expand their product portfolios and global reach. For instance, recent M&A activities suggest deal values in the tens to hundreds of millions, consolidating market share and fostering synergistic growth. Companies like Smiths Detection Group Ltd, Rapiscan Systems Inc., and Teledyne FLIR LLC are at the forefront of these innovative efforts.

Global Trace Detection Screening Market: Industry Trends & Insights

The Global Trace Detection Screening Market is poised for robust growth, driven by a confluence of factors including escalating global security concerns, increasing illicit trade of narcotics and explosives, and the continuous evolution of terrorist tactics. The market is projected to witness a significant Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This growth is underpinned by the increasing adoption of advanced trace detection technologies across various end-user industries such as military and defense, law enforcement, and ports and borders. Technological disruptions, including the integration of artificial intelligence and machine learning for enhanced threat identification and reduced false positives, are reshaping the competitive landscape. Consumer preferences are shifting towards handheld and portable solutions that offer greater operational flexibility and faster screening times. The market penetration of these sophisticated screening devices is expected to rise substantially as governments and private entities prioritize homeland security and public safety. Market participants are focusing on developing more sensitive, specific, and user-friendly instruments to meet the evolving demands of security agencies worldwide. The estimated market size in the base year of 2025 is valued at around $1.8 billion, with projections indicating a substantial increase by the end of the forecast period.

Dominant Markets & Segments in Global Trace Detection Screening Market

The Global Trace Detection Screening Market is dominated by several key segments and regions.

By Type:

- Explosive Detection: This segment holds the largest market share due to persistent global threats and stringent security protocols at airports, public spaces, and sensitive installations. The demand for rapid and accurate identification of a wide range of explosive materials drives innovation and market growth. For example, increased security measures at major international airports and critical infrastructure like power plants and government buildings contribute significantly to this segment's dominance.

- Narcotics Detection: The ongoing global war on drugs and the rise in synthetic drug trafficking have propelled the narcotics detection segment. Law enforcement agencies and border control units are increasingly deploying trace detection systems to combat drug smuggling. Economic policies aimed at interdicting illicit substances and safeguarding public health are key drivers.

By Product:

- Handheld Trace Detectors: This category exhibits the highest growth potential and market penetration. Their portability, ease of use, and real-time detection capabilities make them indispensable for on-site screening by first responders, security personnel, and law enforcement. The market demand is fueled by the need for quick deployment in diverse scenarios, from vehicle checkpoints to event security.

- Portable/Movable Trace Detectors: These systems offer a balance between portability and advanced detection capabilities, often used for broader area screening or in mobile laboratory settings. Their increasing adoption is linked to their versatility in various operational environments.

By End-user Industry:

- Military and Defense: This sector represents a substantial market share, driven by the need for advanced threat detection in combat zones, military bases, and the transportation of sensitive materials. Government defense budgets and ongoing geopolitical tensions are significant growth catalysts.

- Law Enforcement: Police departments, federal agencies, and special units widely utilize trace detection systems for crime scene investigation, drug interdiction, and counter-terrorism operations. The growing emphasis on proactive security measures and evidence collection supports this segment's expansion.

- Ports and Borders: Securing national borders and major ports of entry is paramount. Trace detection screening plays a critical role in preventing the illegal entry of explosives, narcotics, and hazardous materials. International trade volume and global security cooperation initiatives influence demand in this segment.

- Public Safety: This encompasses screening at public events, transportation hubs, and critical infrastructure to ensure the safety of citizens. Increased public awareness of security threats and government mandates for enhanced public safety measures are driving growth.

Global Trace Detection Screening Market: Product Developments

The Global Trace Detection Screening Market is witnessing rapid product innovations focused on enhancing detection sensitivity, specificity, and operational efficiency. Smiths Detection's recent launch of the Lightweight Chemical Detector (LCD) 4 and its LCD XID extension exemplifies this trend, expanding detection capabilities to include street explosives, narcotics, and other toxic chemical threats. This innovation transforms vapor detection devices into ruggedized mobile trace detectors suitable for any CBRNE scenario. Such advancements are crucial for providing comprehensive security solutions and adapting to evolving threat profiles, thereby offering competitive advantages to manufacturers and enabling end-users to conduct more effective screening operations.

Report Scope & Segmentation Analysis

The Global Trace Detection Screening Market report provides a comprehensive analysis of the market, segmented by Type, Product, and End-user Industry.

- Type: The market is segmented into Explosive detection and Narcotics detection. Both segments are experiencing steady growth, driven by distinct security imperatives. Explosive detection benefits from counter-terrorism efforts, while narcotics detection is fueled by global drug control initiatives.

- Product: Key product categories include Handheld, Portable/Movable, and Fixed trace detection systems. Handheld devices are expected to see the fastest growth due to their agility and immediate deployment capabilities. Portable/Movable units offer broader application in varied scenarios, while fixed systems cater to high-volume, static screening points.

- End-user Industry: The analysis covers Commercial, Military and Defense, Law Enforcement, Ports and Borders, Public Safety, and Other End-user Industries. The Military and Defense and Law Enforcement sectors currently hold significant market shares, with Public Safety and Ports and Borders expected to show substantial growth driven by increased security investments and global trade.

Key Drivers of Global Trace Detection Screening Market Growth

The Global Trace Detection Screening Market is propelled by several critical drivers:

- Rising Global Security Threats: Persistent terrorist activities and the increasing threat of chemical, biological, radiological, nuclear, and explosive (CBRNE) attacks necessitate advanced detection capabilities.

- Stringent Regulatory Frameworks: Government mandates and international security standards for screening at airports, borders, and critical infrastructure are driving the adoption of trace detection systems.

- Technological Advancements: Continuous innovation in sensor technology, miniaturization, and data analytics is leading to more sensitive, faster, and user-friendly detection devices.

- Increasing Illicit Trafficking: The persistent challenges posed by the global narcotics trade and the smuggling of illegal substances are driving demand for effective detection solutions.

- Growing Public Safety Concerns: heightened awareness and demand for safety in public spaces, including large events and transportation hubs, are spurring investments in security screening technologies.

Challenges in the Global Trace Detection Screening Market Sector

Despite robust growth prospects, the Global Trace Detection Screening Market faces several challenges:

- High Cost of Advanced Technology: Sophisticated trace detection systems can be prohibitively expensive, limiting adoption by smaller agencies or in budget-constrained regions.

- False Alarm Rates: Achieving high specificity and minimizing false positives remains a technical challenge, which can impact operational efficiency and user confidence.

- Maintenance and Calibration Requirements: Many advanced detectors require regular maintenance and precise calibration, adding to operational costs and demanding specialized expertise.

- Environmental Factors: Performance of trace detection devices can be affected by ambient environmental conditions such as humidity, temperature, and airflow, impacting accuracy.

- Limited Awareness and Training: In some sectors, a lack of comprehensive awareness regarding the benefits and proper usage of trace detection technology can hinder market penetration.

Emerging Opportunities in Global Trace Detection Screening Market

The Global Trace Detection Screening Market is ripe with emerging opportunities:

- Integration with AI and IoT: Leveraging artificial intelligence for faster analysis and Internet of Things (IoT) for networked detection systems can create smarter, more responsive security infrastructures.

- Development of Multi-Threat Detectors: Creating single devices capable of simultaneously identifying explosives, narcotics, and chemical agents offers significant value and efficiency gains for end-users.

- Expansion into Emerging Economies: Increasing security investments and infrastructure development in rapidly growing economies present substantial untapped market potential.

- Customized Solutions for Niche Applications: Tailoring detection technologies for specific industries like pharmaceuticals, food safety, or environmental monitoring can open new market avenues.

- Advanced Materials and Nanotechnology: Utilizing novel materials and nanotechnology in sensor development can lead to breakthroughs in sensitivity, speed, and miniaturization of trace detectors.

Leading Players in the Global Trace Detection Screening Market Market

- Smiths Detection Group Ltd

- DetectaChem

- Teledyne Flir LLC

- Vehant Technologies Pvt Ltd

- Westminster Group PLC

- DSA Detection LLC

- Rapiscan Systems Inc

- Leidos Holdings Inc

- Autoclear LLC

- Biosensor Applications A

- High Tech Detection Systems (HTDS)

- Bruker Corporation

- Mass Spec Analytical Ltd

Key Developments in Global Trace Detection Screening Market Industry

- March 2023: Smiths Detection launched its latest chemical agent identifier, Lightweight Chemical Detector (LCD) 4, with an LCD XID extension, expanding its detection capabilities to include street explosives, narcotics, pharmaceuticals, and other super toxic chemical threats. The LCD's capability can be transformed by placing the detector into the XID cradle, turning the vapor detection device into a ruggedized mobile trace detector for any CBRNE scenario.

- January 2023: Rapiscan Systems Inc. acquired all assets of VOTI Detection Inc. This strategic move, supported by Rapiscan Global Service's extensive reach and over 350 service professionals, aims to deliver a more streamlined and superior customer experience compared to VOTI Detection's previous offerings.

Strategic Outlook for Global Trace Detection Screening Market Market

The strategic outlook for the Global Trace Detection Screening Market is highly promising, driven by the sustained need for robust security and the ongoing evolution of threat landscapes. Key growth catalysts include the increasing integration of advanced technologies such as AI and IoT to enhance threat detection and response times, leading to more intelligent and interconnected security systems. The continuous development of multi-threat detection capabilities, enabling the simultaneous identification of a wider range of hazardous substances, will be a significant market differentiator. Furthermore, the expansion into emerging economies, coupled with the increasing demand for customized solutions for niche applications, presents substantial untapped market potential. Manufacturers focusing on innovation, cost-effectiveness, and user-friendly interfaces are well-positioned to capitalize on these opportunities and secure a strong market presence in the coming years.

Global Trace Detection Screening Market Segmentation

-

1. Type

- 1.1. Explosive

- 1.2. Narcotics

-

2. Product

- 2.1. Handheld

- 2.2. Portable/Movable

- 2.3. Fixed

-

3. End-user Industry

- 3.1. Commercial

- 3.2. Military and Defense

- 3.3. Law Enforcement

- 3.4. Ports and Borders

- 3.5. Public Safety

- 3.6. Other End-user Industries

Global Trace Detection Screening Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Middle East and Africa

- 6. Latin America

Global Trace Detection Screening Market Regional Market Share

Geographic Coverage of Global Trace Detection Screening Market

Global Trace Detection Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Upsurge in Terrorist Activities Across the Globe; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel

- 3.4. Market Trends

- 3.4.1. The Law Enforcement Segment is Anticipated to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Trace Detection Screening Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Explosive

- 5.1.2. Narcotics

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Handheld

- 5.2.2. Portable/Movable

- 5.2.3. Fixed

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Commercial

- 5.3.2. Military and Defense

- 5.3.3. Law Enforcement

- 5.3.4. Ports and Borders

- 5.3.5. Public Safety

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Middle East and Africa

- 5.4.6. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Trace Detection Screening Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Explosive

- 6.1.2. Narcotics

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Handheld

- 6.2.2. Portable/Movable

- 6.2.3. Fixed

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Commercial

- 6.3.2. Military and Defense

- 6.3.3. Law Enforcement

- 6.3.4. Ports and Borders

- 6.3.5. Public Safety

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Trace Detection Screening Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Explosive

- 7.1.2. Narcotics

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Handheld

- 7.2.2. Portable/Movable

- 7.2.3. Fixed

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Commercial

- 7.3.2. Military and Defense

- 7.3.3. Law Enforcement

- 7.3.4. Ports and Borders

- 7.3.5. Public Safety

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Global Trace Detection Screening Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Explosive

- 8.1.2. Narcotics

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Handheld

- 8.2.2. Portable/Movable

- 8.2.3. Fixed

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Commercial

- 8.3.2. Military and Defense

- 8.3.3. Law Enforcement

- 8.3.4. Ports and Borders

- 8.3.5. Public Safety

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Global Trace Detection Screening Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Explosive

- 9.1.2. Narcotics

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Handheld

- 9.2.2. Portable/Movable

- 9.2.3. Fixed

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Commercial

- 9.3.2. Military and Defense

- 9.3.3. Law Enforcement

- 9.3.4. Ports and Borders

- 9.3.5. Public Safety

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Global Trace Detection Screening Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Explosive

- 10.1.2. Narcotics

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Handheld

- 10.2.2. Portable/Movable

- 10.2.3. Fixed

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Commercial

- 10.3.2. Military and Defense

- 10.3.3. Law Enforcement

- 10.3.4. Ports and Borders

- 10.3.5. Public Safety

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Latin America Global Trace Detection Screening Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Explosive

- 11.1.2. Narcotics

- 11.2. Market Analysis, Insights and Forecast - by Product

- 11.2.1. Handheld

- 11.2.2. Portable/Movable

- 11.2.3. Fixed

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Commercial

- 11.3.2. Military and Defense

- 11.3.3. Law Enforcement

- 11.3.4. Ports and Borders

- 11.3.5. Public Safety

- 11.3.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Smiths Detection Group Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DetectaChem

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Teledyne Flir LLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Vehant Technologies Pvt Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Westminster Group PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DSA Detection LLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Rapiscan Systems Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Leidos Holdings Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Autoclear LLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Biosensor Applications A

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 High Tech Detection Systems (HTDS)

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Bruker Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Mass Spec Analytical Ltd

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Smiths Detection Group Ltd

List of Figures

- Figure 1: Global Global Trace Detection Screening Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Global Trace Detection Screening Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Global Trace Detection Screening Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Trace Detection Screening Market Revenue (Million), by Product 2025 & 2033

- Figure 5: North America Global Trace Detection Screening Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Global Trace Detection Screening Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Global Trace Detection Screening Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Trace Detection Screening Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Global Trace Detection Screening Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Global Trace Detection Screening Market Revenue (Million), by Product 2025 & 2033

- Figure 13: Europe Global Trace Detection Screening Market Revenue Share (%), by Product 2025 & 2033

- Figure 14: Europe Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Global Trace Detection Screening Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Global Trace Detection Screening Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Global Trace Detection Screening Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Global Trace Detection Screening Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Global Trace Detection Screening Market Revenue (Million), by Product 2025 & 2033

- Figure 21: Asia Global Trace Detection Screening Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Asia Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Global Trace Detection Screening Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Global Trace Detection Screening Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Australia and New Zealand Global Trace Detection Screening Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Australia and New Zealand Global Trace Detection Screening Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Australia and New Zealand Global Trace Detection Screening Market Revenue (Million), by Product 2025 & 2033

- Figure 29: Australia and New Zealand Global Trace Detection Screening Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Australia and New Zealand Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Australia and New Zealand Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Australia and New Zealand Global Trace Detection Screening Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Australia and New Zealand Global Trace Detection Screening Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Global Trace Detection Screening Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Global Trace Detection Screening Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Global Trace Detection Screening Market Revenue (Million), by Product 2025 & 2033

- Figure 37: Middle East and Africa Global Trace Detection Screening Market Revenue Share (%), by Product 2025 & 2033

- Figure 38: Middle East and Africa Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Global Trace Detection Screening Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Global Trace Detection Screening Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Global Trace Detection Screening Market Revenue (Million), by Type 2025 & 2033

- Figure 43: Latin America Global Trace Detection Screening Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Latin America Global Trace Detection Screening Market Revenue (Million), by Product 2025 & 2033

- Figure 45: Latin America Global Trace Detection Screening Market Revenue Share (%), by Product 2025 & 2033

- Figure 46: Latin America Global Trace Detection Screening Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 47: Latin America Global Trace Detection Screening Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: Latin America Global Trace Detection Screening Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Latin America Global Trace Detection Screening Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Trace Detection Screening Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 15: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 19: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Trace Detection Screening Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Trace Detection Screening Market Revenue Million Forecast, by Product 2020 & 2033

- Table 27: Global Trace Detection Screening Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Trace Detection Screening Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Trace Detection Screening Market?

The projected CAGR is approximately 7.93%.

2. Which companies are prominent players in the Global Trace Detection Screening Market?

Key companies in the market include Smiths Detection Group Ltd, DetectaChem, Teledyne Flir LLC, Vehant Technologies Pvt Ltd, Westminster Group PLC, DSA Detection LLC, Rapiscan Systems Inc, Leidos Holdings Inc, Autoclear LLC, Biosensor Applications A, High Tech Detection Systems (HTDS), Bruker Corporation, Mass Spec Analytical Ltd.

3. What are the main segments of the Global Trace Detection Screening Market?

The market segments include Type, Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Upsurge in Terrorist Activities Across the Globe; Growing Government Investments in Security Infrastructure; Increasing Government Guidelines for Aviation Security Screening.

6. What are the notable trends driving market growth?

The Law Enforcement Segment is Anticipated to Drive the Market Demand.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation and Subsequent Maintenance Costs; Technological Limitations and the Lack of Trained Personnel.

8. Can you provide examples of recent developments in the market?

March 2023: Smiths Detection announced the launch of its latest chemical agent identifier, Lightweight Chemical Detector (LCD) 4, along with the LCD XID extension. This would expand the detection capabilities of the LCD to include street explosives, narcotics, pharmaceuticals, and other super toxic chemical threats. The capability of LCD could also be transformed by placing the detector into the XID cradle, where it immediately turns the vapor detection device into a ruggedized mobile trace detector that can be utilized in any CBRNE (chemical, biological, radiological, nuclear, and explosive) scenario.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Trace Detection Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Trace Detection Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Trace Detection Screening Market?

To stay informed about further developments, trends, and reports in the Global Trace Detection Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence