Key Insights

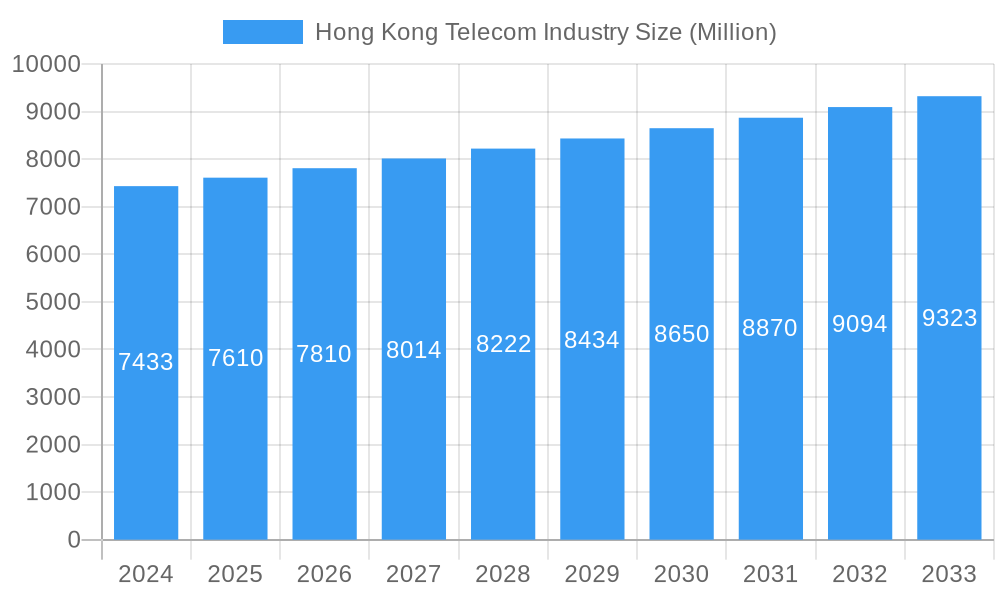

The Hong Kong telecommunications industry is poised for steady growth, projected to reach a market size of $7.61 million by 2025 with a Compound Annual Growth Rate (CAGR) of 2.60% expected throughout the forecast period of 2025-2033. This sustained expansion is primarily driven by the increasing demand for high-speed data services, the proliferation of Over-The-Top (OTT) content and pay-TV offerings, and the continuous evolution of wireless technologies. As consumers and businesses increasingly rely on seamless connectivity for communication, entertainment, and critical operations, the telecom sector remains an indispensable pillar of Hong Kong's advanced digital economy. The market's robust infrastructure and a highly competitive landscape are expected to foster innovation and service enhancements, further bolstering its trajectory.

Hong Kong Telecom Industry Market Size (In Billion)

Despite the overall positive outlook, the industry faces certain restraints that could temper its growth potential. These include the significant capital expenditure required for network upgrades to support next-generation technologies like 5G and beyond, as well as the intensifying competition, particularly from OTT players, which puts pressure on traditional voice and data revenue streams. Regulatory shifts and the ongoing need to address cybersecurity concerns also present challenges. However, strategic investments in fiber optic expansion, the deployment of advanced wireless solutions, and the diversification of service portfolios to include value-added services like cloud solutions and IoT connectivity are expected to mitigate these restraints and drive future market development. Key players like China Mobile Hong Kong, HKT, and SmarTone are actively engaged in these strategic initiatives to maintain their competitive edge.

Hong Kong Telecom Industry Company Market Share

This comprehensive report delves into the dynamic Hong Kong Telecom Industry, offering an in-depth analysis of market concentration, technological advancements, consumer behavior, and the competitive landscape. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study provides critical insights for industry stakeholders, investors, and policymakers. The report examines key segments including Voice Services (Wired, Wireless), Data and Messaging Services, and OTT and Pay-TV Services, highlighting their growth trajectories and the innovations shaping their future. With an estimated market size of XX Million by 2025, the Hong Kong telecom sector is a crucial hub for connectivity and digital services in Asia.

Hong Kong Telecom Industry Market Concentration & Innovation

The Hong Kong telecom market exhibits a moderate level of concentration, with a few major players dominating a significant portion of the market share. Key companies like Hong Kong Telecommunications (HKT) Limited, China Mobile Hong Kong Company Limited, and SmarTone Telecommunications Holdings Limited hold substantial sway. Innovation is a key differentiator, driven by the rapid adoption of new technologies and increasing consumer demand for advanced services. The regulatory framework, overseen by the Office of the Communications Authority (OFCA), aims to foster competition and protect consumer interests. While product substitutes exist, the high cost of infrastructure and switching for businesses often limits their immediate impact. End-user trends are heavily influenced by the demand for high-speed data, mobile-first services, and integrated entertainment solutions. Merger and acquisition (M&A) activities, valued at approximately XX Million, have played a role in market consolidation and strategic expansion, further shaping the competitive environment.

- Market Share Snapshot:

- Hong Kong Telecommunications (HKT) Limited: XX%

- China Mobile Hong Kong Company Limited: XX%

- SmarTone Telecommunications Holdings Limited: XX%

- Hutchison Telecommunications Hong Kong Holdings Limited: XX%

- Innovation Drivers:

- 5G network deployment and monetization

- Growth of Over-The-Top (OTT) services

- Demand for seamless multi-device connectivity

- Smart city initiatives and IoT integration

Hong Kong Telecom Industry Industry Trends & Insights

The Hong Kong telecom industry is characterized by robust growth, propelled by relentless technological advancements and evolving consumer preferences. The market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033), driven by the increasing penetration of high-speed mobile and broadband services. Technological disruptions, particularly the widespread adoption of 5G, are fundamentally altering the service delivery models and creating new revenue streams. The shift towards digital transformation, accelerated by events like the COVID-19 pandemic, has amplified the demand for cloud-based solutions, remote working tools, and immersive digital entertainment. Consumer preferences are increasingly leaning towards personalized experiences, bundled service offerings, and a seamless, always-on connectivity. Competitive dynamics remain intense, with operators focusing on customer retention through enhanced service quality, innovative product development, and strategic pricing. The market penetration of mobile broadband is already high, nearing XX%, while fixed broadband continues to expand, offering speeds upwards of Gigabits per second. The rise of Over-The-Top (OTT) and Pay-TV services is a significant trend, challenging traditional broadcasting models and pushing incumbents to adapt. Investment in network infrastructure, including fiber optics and advanced wireless technologies, is crucial for maintaining a competitive edge and supporting the burgeoning digital economy. The industry is also witnessing a surge in demand for enterprise solutions, including private 5G networks, cybersecurity, and IoT connectivity, catering to the diverse needs of businesses across various sectors. The continuous pursuit of enhanced user experience, coupled with the integration of artificial intelligence (AI) for network optimization and customer service, will be pivotal in shaping the future of the Hong Kong telecom market.

Dominant Markets & Segments in Hong Kong Telecom Industry

The Data and Messaging Services segment stands out as the dominant force within the Hong Kong Telecom Industry, showcasing exceptional growth and market penetration. This dominance is fueled by the pervasive use of smartphones, the increasing reliance on instant messaging applications, and the ever-growing demand for mobile data consumption. Hong Kong's digitally savvy population, coupled with its status as a global financial hub, necessitates robust and high-speed data connectivity for both personal and professional use. The economic policies in Hong Kong, which encourage technological adoption and digital innovation, further bolster this segment.

- Key Drivers of Data and Messaging Services Dominance:

- Ubiquitous Smartphone Penetration: Approaching XX% of the population, smartphones are the primary devices for communication and data access.

- High Mobile Data Consumption: Average monthly data usage per subscriber stands at XX GB, driven by video streaming, social media, and cloud services.

- Growth of OTT Messaging Apps: Platforms like WhatsApp, Telegram, and Signal have become integral to daily communication, driving the need for reliable data plans.

- Enterprise Demand for Data Solutions: Businesses require high-capacity data services for cloud computing, remote work, and digital operations.

While Voice Services (Wired and Wireless) remain foundational, their growth trajectory is less steep compared to data-centric services. Wireless voice services, however, continue to be essential, supported by the extensive mobile network coverage. OTT and Pay-TV Services represent a rapidly evolving and increasingly important segment, driven by changing media consumption habits. The development of sophisticated digital platforms and the integration of content streaming are key to their expansion. The government's commitment to fostering a digital economy and supporting the development of smart city initiatives further amplifies the importance of reliable and advanced telecommunication infrastructure, underpinning the continued dominance of data and messaging services.

Hong Kong Telecom Industry Product Developments

The Hong Kong telecom industry is characterized by continuous product innovation driven by advancements in 5G technology, IoT, and cloud services. Companies are actively developing enhanced mobile broadband experiences, including faster download/upload speeds and lower latency, critical for gaming, AR/VR applications, and real-time communication. The proliferation of smart devices has spurred the development of integrated IoT solutions for homes and businesses, offering seamless connectivity and data management. Furthermore, the focus on digital transformation has led to the creation of robust cloud-based platforms and enterprise solutions, including private 5G networks and advanced cybersecurity services, providing businesses with the tools for digital innovation and operational efficiency.

Report Scope & Segmentation Analysis

This report meticulously segments the Hong Kong Telecom Industry into key service areas.

- Voice Services (Wired, Wireless): This segment, while mature, continues to provide essential communication. Wired voice services are crucial for enterprise infrastructure, while wireless voice remains a fundamental mobile offering. The market size for voice services is estimated at XX Million in 2025, with a projected slight decline in revenue share due to the increasing prevalence of data-based communication.

- Data and Messaging Services: This is the fastest-growing segment, encompassing mobile data, broadband internet, and messaging solutions. With an estimated market size of XX Million in 2025, it is expected to see robust growth driven by increasing data consumption and the expansion of 5G. Competitive dynamics are intense, with a focus on speed, reliability, and data allowances.

- OTT and Pay-TV Services: This segment includes streaming services, on-demand content, and digital television platforms. The market size is estimated at XX Million in 2025, with significant growth potential as consumers increasingly shift towards digital entertainment. Innovations in content delivery and personalized viewing experiences are key competitive factors.

Key Drivers of Hong Kong Telecom Industry Growth

The growth of the Hong Kong Telecom Industry is propelled by a confluence of technological, economic, and regulatory factors. The ongoing rollout and adoption of 5G technology is a primary driver, enabling higher speeds, lower latency, and new service possibilities like enhanced mobile broadband and massive IoT deployments. Government initiatives focused on developing Hong Kong into a smart city and a digital hub further stimulate demand for advanced connectivity solutions. A robust economic environment and a high disposable income in Hong Kong also support the uptake of premium telecom services and devices. Furthermore, the increasing demand for digital entertainment, remote work solutions, and cloud-based services, amplified by evolving consumer lifestyles, acts as a significant growth catalyst.

Challenges in the Hong Kong Telecom Industry Sector

Despite its growth, the Hong Kong telecom sector faces several challenges. Intense competition among major players leads to price wars and pressure on margins. High capital expenditure required for network upgrades, particularly for 5G and fiber optic infrastructure, poses a significant financial burden. Regulatory hurdles and spectrum allocation policies can also influence deployment timelines and costs. Furthermore, the need for continuous innovation to keep pace with evolving consumer demands and emerging technologies requires substantial investment in R&D. Supply chain disruptions for critical hardware components can also impact service delivery and expansion plans, creating potential delays and cost overruns.

Emerging Opportunities in Hong Kong Telecom Industry

The Hong Kong telecom industry is ripe with emerging opportunities. The expansion of 5G is paving the way for innovative applications in areas such as the Internet of Things (IoT), smart cities, and augmented/virtual reality (AR/VR). The growing demand for enterprise-grade solutions, including private 5G networks, edge computing, and cybersecurity services, presents a significant growth avenue. The digital transformation journey of businesses across various sectors creates opportunities for telecommunication providers to offer integrated ICT solutions. Furthermore, the increasing popularity of over-the-top (OTT) content and streaming services offers potential for partnerships and the development of converged entertainment offerings. The Guangdong-Hong Kong-Macao Greater Bay Area (GBA) initiative also presents opportunities for cross-border connectivity and service integration.

Leading Players in the Hong Kong Telecom Industry Market

- Loop Mobility Ltd

- China Unicom (Hong Kong) Limited

- SmarTone Telecommunications Holdings Limited

- China Mobile Hong Kong Company Limited

- Hutchison Telecommunications Hong Kong Holdings Limited

- CITIC Telecom International CPC Limited

- Hong Kong Telecommunications (HKT) Limited

- Pai Telecommunications Lt

- I-cable Communications Limited

- Hong Kong Broadband Network Limited (HKBN)

Key Developments in Hong Kong Telecom Industry Industry

- January 2024: Now TV, a prominent pay-TV operator in Hong Kong, rolled out an OTT app. This app enables customers and monthly subscribers to access Now TV’s content on mobile devices. Users may also enjoy the content on both their mobile devices and TV simultaneously. This strategic move is poised to broaden Now TV's audience, offering enhanced flexibility and convenience in content consumption. The feature allowing simultaneous viewing on multiple devices aligns with the modern consumer's preference for on-the-go entertainment, boosting user engagement and satisfaction. The launch of this OTT app not only underscores Now TV's forward-thinking approach but also mirrors a broader industry shift toward digital transformation.

- December 2023: CTM collaborated with China Mobile Hong Kong through the CITIC Telecom international roaming hub (IPX) platform to conduct the first 5G SA+VoNR roaming trial between Hong Kong and Macau. This collaboration could further enhance the 5G roaming service experience. It provides a new type of 5G roaming experience with seamless, fast, and secure connections while supporting the further development of 5G integration in the smart city of the Guangdong-Hong Kong-Macao Greater Bay Area. This trial was a milestone in the evolution of 5G technology, showcasing the potential for improved connectivity and integration across regions.

Strategic Outlook for Hong Kong Telecom Industry Market

The strategic outlook for the Hong Kong Telecom Industry remains highly positive, driven by continued investment in 5G infrastructure, the burgeoning demand for data-intensive services, and the government's commitment to digital innovation. The industry is poised to capitalize on opportunities presented by the growth of IoT, enterprise solutions, and the evolving digital entertainment landscape. Strategic collaborations and M&A activities will likely continue to shape the market, leading to greater efficiency and enhanced service offerings. The focus on customer experience, technological integration, and the expansion into new service areas like edge computing and AI-powered solutions will be critical for sustained growth and competitiveness in the coming years. The industry's ability to adapt to evolving consumer behaviors and leverage emerging technologies will determine its long-term success.

Hong Kong Telecom Industry Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and Pay-TV Services

-

1.1. Voice Services

Hong Kong Telecom Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

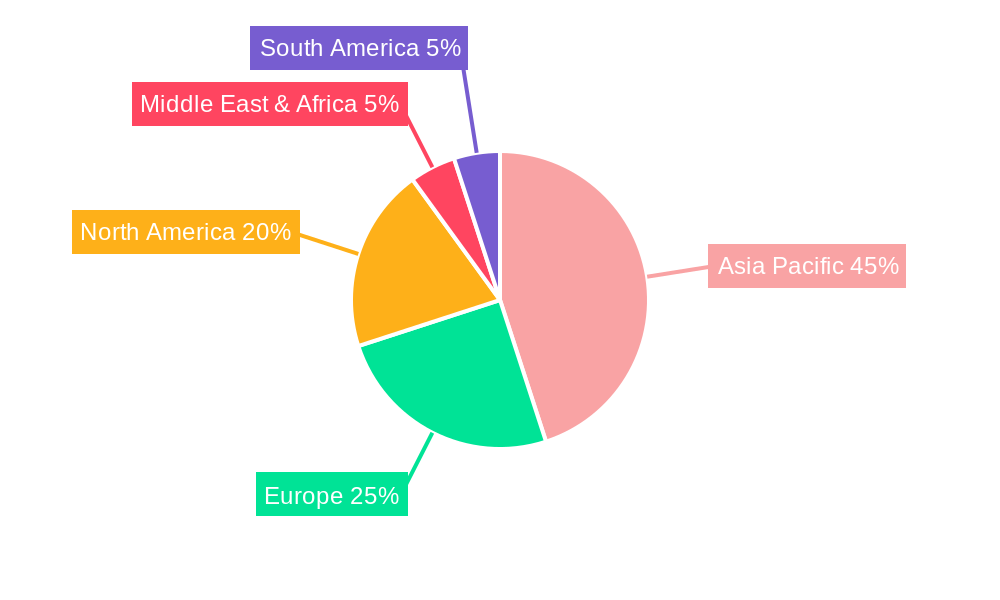

Hong Kong Telecom Industry Regional Market Share

Geographic Coverage of Hong Kong Telecom Industry

Hong Kong Telecom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G Rollout in Hong Kong; Digital Transformation Through IoT and AI; Robust Mobile Penetration

- 3.3. Market Restrains

- 3.3.1. Stiff Competition in the Market

- 3.4. Market Trends

- 3.4.1. 5G Rollout in Hong Kong Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and Pay-TV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Voice Services

- 6.1.1.1. Wired

- 6.1.1.2. Wireless

- 6.1.2. Data and Messaging Services

- 6.1.3. OTT and Pay-TV Services

- 6.1.1. Voice Services

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Voice Services

- 7.1.1.1. Wired

- 7.1.1.2. Wireless

- 7.1.2. Data and Messaging Services

- 7.1.3. OTT and Pay-TV Services

- 7.1.1. Voice Services

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Voice Services

- 8.1.1.1. Wired

- 8.1.1.2. Wireless

- 8.1.2. Data and Messaging Services

- 8.1.3. OTT and Pay-TV Services

- 8.1.1. Voice Services

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Voice Services

- 9.1.1.1. Wired

- 9.1.1.2. Wireless

- 9.1.2. Data and Messaging Services

- 9.1.3. OTT and Pay-TV Services

- 9.1.1. Voice Services

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Voice Services

- 10.1.1.1. Wired

- 10.1.1.2. Wireless

- 10.1.2. Data and Messaging Services

- 10.1.3. OTT and Pay-TV Services

- 10.1.1. Voice Services

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Loop Mobility Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Unicom (Hong Kong) Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SmarTone Telecommunications Holdings Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Mobile Hong Kong Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hutchison Telecommunications Hong Kong Holdings Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CITIC Telecom International CPC Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hong Kong Telecommunications (HKT) Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pai Telecommunications Lt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 I-cable Communications Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hong Kong Broadband Network Limited (HKBN)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Loop Mobility Ltd

List of Figures

- Figure 1: Global Hong Kong Telecom Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 3: North America Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 7: South America Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 8: South America Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 11: Europe Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 12: Europe Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 15: Middle East & Africa Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 16: Middle East & Africa Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 19: Asia Pacific Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 20: Asia Pacific Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global Hong Kong Telecom Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 9: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 14: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 25: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 33: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Telecom Industry?

The projected CAGR is approximately 2.60%.

2. Which companies are prominent players in the Hong Kong Telecom Industry?

Key companies in the market include Loop Mobility Ltd, China Unicom (Hong Kong) Limited, SmarTone Telecommunications Holdings Limited, China Mobile Hong Kong Company Limited, Hutchison Telecommunications Hong Kong Holdings Limited, CITIC Telecom International CPC Limited, Hong Kong Telecommunications (HKT) Limited, Pai Telecommunications Lt, I-cable Communications Limited, Hong Kong Broadband Network Limited (HKBN).

3. What are the main segments of the Hong Kong Telecom Industry?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.61 Million as of 2022.

5. What are some drivers contributing to market growth?

5G Rollout in Hong Kong; Digital Transformation Through IoT and AI; Robust Mobile Penetration.

6. What are the notable trends driving market growth?

5G Rollout in Hong Kong Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Stiff Competition in the Market.

8. Can you provide examples of recent developments in the market?

January 2024: Now TV, a prominent pay-TV operator in Hong Kong, rolled out an OTT app. This app enables customers and monthly subscribers to access Now TV’s content on mobile devices. Users may also enjoy the content on both their mobile devices and TV simultaneously. This strategic move is poised to broaden Now TV's audience, offering enhanced flexibility and convenience in content consumption. The feature allowing simultaneous viewing on multiple devices aligns with the modern consumer's preference for on-the-go entertainment, boosting user engagement and satisfaction. The launch of this OTT app not only underscores Now TV's forward-thinking approach but also mirrors a broader industry shift toward digital transformation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Telecom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Telecom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Telecom Industry?

To stay informed about further developments, trends, and reports in the Hong Kong Telecom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence