Key Insights

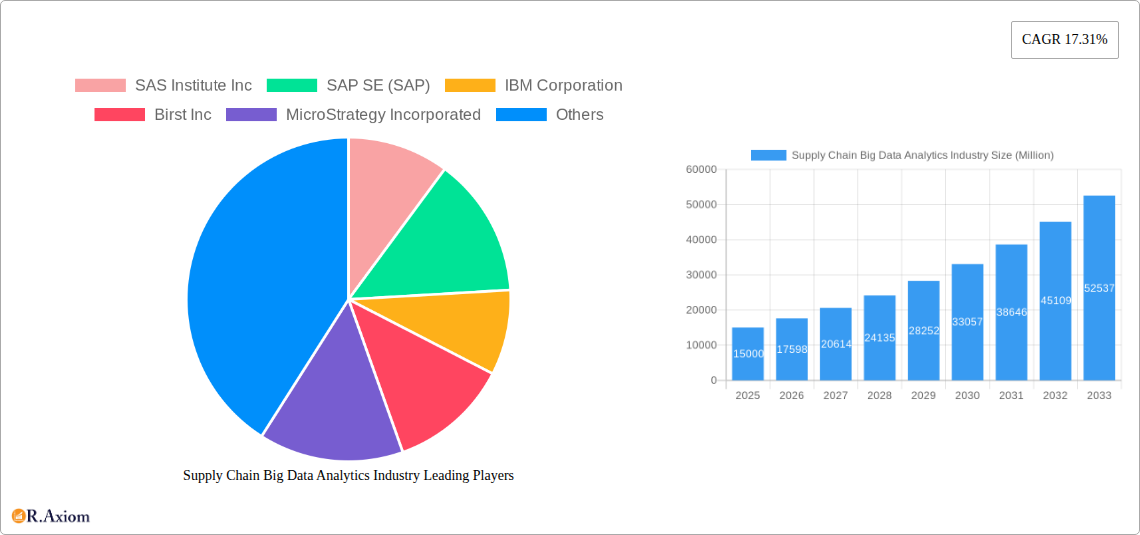

The Supply Chain Big Data Analytics market is experiencing robust expansion, projected to reach a significant market size of approximately \$XX million, driven by a compelling compound annual growth rate (CAGR) of 17.31% from 2025 to 2033. This surge is primarily fueled by the escalating need for enhanced operational efficiency, proactive risk mitigation, and a more profound understanding of complex global supply chains. Businesses are increasingly leveraging advanced analytics to optimize inventory management, improve demand forecasting accuracy, and streamline logistics, thereby reducing costs and enhancing customer satisfaction. The growing volume of data generated across supply chain operations, from procurement to last-mile delivery, presents an immense opportunity for big data analytics solutions to unlock actionable insights. Key drivers include the digital transformation initiatives across industries, the adoption of IoT devices for real-time tracking, and the demand for greater supply chain visibility and resilience in an increasingly volatile global landscape.

Supply Chain Big Data Analytics Industry Market Size (In Billion)

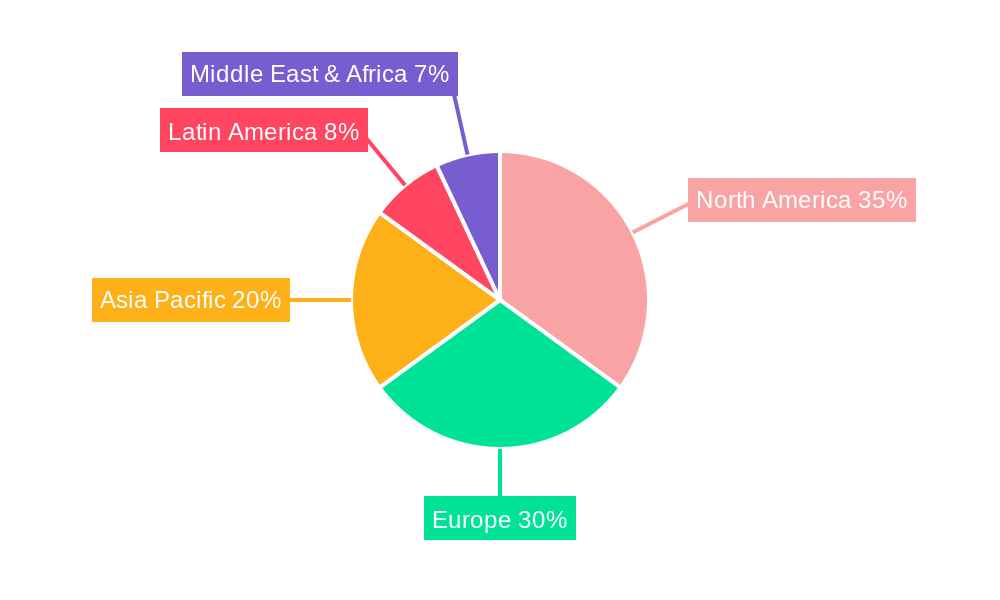

The market is segmented across various solutions, including Supply Chain Procurement and Planning Tools, Sales and Operations Planning, Manufacturing Analytics, and Transportation and Logistics Analytics, each addressing specific pain points within the supply chain ecosystem. Professional services and support offerings are also crucial, ensuring effective implementation and ongoing utilization of these advanced analytical capabilities. Key end-users like Retail, Transportation and Logistics, Manufacturing, and Healthcare are actively investing in these solutions to gain a competitive edge. Geographically, North America and Europe are leading the adoption, driven by established technological infrastructure and a strong emphasis on data-driven decision-making. However, the Asia Pacific region is expected to witness the fastest growth due to rapid industrialization and increasing adoption of digital technologies. Restraints, such as data security concerns and the need for skilled personnel, are being addressed through advancements in security protocols and specialized training programs, paving the way for continued market dominance.

Supply Chain Big Data Analytics Industry Company Market Share

This comprehensive report delves into the dynamic Supply Chain Big Data Analytics Industry, offering in-depth analysis, actionable insights, and strategic recommendations for stakeholders. With a study period spanning 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this report provides a robust understanding of market dynamics, growth drivers, and future trajectories. We meticulously examine how businesses are leveraging big data in supply chain management, supply chain analytics solutions, and predictive supply chain modeling to achieve unparalleled operational efficiency and competitive advantages.

The global supply chain big data analytics market is undergoing a transformative phase, driven by the increasing complexity of global supply networks, the proliferation of data sources, and the urgent need for real-time visibility and intelligent decision-making. This report offers a granular view of the market, dissecting key segments, dominant players, and emerging trends. Our analysis focuses on critical areas such as supply chain procurement analytics, sales and operations planning (S&OP) optimization, manufacturing analytics, transportation and logistics analytics, and warehouse management analytics.

Supply Chain Big Data Analytics Industry Market Concentration & Innovation

The Supply Chain Big Data Analytics Industry is characterized by moderate to high market concentration, with several dominant players vying for market share. Innovation is a primary catalyst, fueled by advancements in Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT) technologies. These innovations enable sophisticated demand forecasting, inventory optimization, risk management, and route optimization. Regulatory frameworks, while evolving, are largely supportive of data-driven decision-making, although data privacy concerns require careful navigation. Product substitutes are emerging, including advanced ERP systems with integrated analytics capabilities and specialized SaaS solutions. End-user trends indicate a strong demand for real-time visibility, predictive analytics, and prescriptive recommendations across all sectors. Mergers and Acquisitions (M&A) are active, with significant deal values reflecting the strategic importance of acquiring data analytics capabilities. For instance, Accenture's acquisition of MacGregor Partner in September 2022, a specialist in smart logistics and warehouse administration, highlights the ongoing consolidation and strategic expansion within the ecosystem, bolstering Accenture's capabilities in intelligent logistics and warehouse management powered by Blue Yonder technology.

Supply Chain Big Data Analytics Industry Industry Trends & Insights

The Supply Chain Big Data Analytics Industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 15-20% over the forecast period. This expansion is predominantly driven by the escalating need for supply chain visibility, resilience, and agility in the face of increasing global uncertainties and evolving consumer expectations. Technological advancements are at the forefront, with the integration of AI and ML enabling predictive capabilities that go beyond mere descriptive analytics. Companies are increasingly adopting solutions for real-time supply chain monitoring, anomaly detection, and proactive risk mitigation. Consumer preferences are shifting towards faster delivery times, personalized products, and sustainable sourcing, all of which necessitate sophisticated data-driven supply chain operations. Competitive dynamics are intense, with established tech giants and specialized analytics providers competing to offer comprehensive solutions. The market penetration of advanced analytics tools is steadily increasing, moving from early adopters in large enterprises to small and medium-sized businesses seeking to optimize their operations. The evolving landscape of supply chain digitization is a key trend, with initiatives like the collaboration between o9 Solutions and Genpact for Eckes - Granini's global supply chain automation and optimization, focusing on eliminating information silos and streamlining operations. Microsoft's unveiling of the Microsoft Supply Chain System, an open platform integrating AI, low-code, security, and SaaS applications, further underscores the industry's direction towards scalable and integrated solutions.

Dominant Markets & Segments in Supply Chain Big Data Analytics Industry

The Retail sector stands out as a dominant end-user segment within the Supply Chain Big Data Analytics Industry. This dominance is driven by the high volume of transactions, the need for precise inventory management, dynamic pricing strategies, and the increasing demand for personalized customer experiences. The rapid growth of e-commerce further amplifies the requirement for efficient logistics and fulfillment, making advanced analytics indispensable.

- Retail: Key drivers include the need for omnichannel inventory visibility, personalized marketing based on purchase history, and optimized last-mile delivery. Economic policies supporting consumer spending and robust retail infrastructure in developed economies contribute to this segment's prominence.

- Transportation and Logistics: This segment is crucial due to the inherent complexity of global shipping, route optimization, fleet management, and real-time tracking. Infrastructure development, free trade agreements, and the increasing volume of global trade fuel its growth.

- Manufacturing: With the advent of Industry 4.0, manufacturers are leveraging big data for predictive maintenance, production scheduling optimization, quality control, and supply chain traceability. Automation and advanced manufacturing techniques necessitate sophisticated data analysis.

- Healthcare: The healthcare sector is increasingly adopting supply chain analytics for pharmaceutical cold chain management, medical device tracking, and efficient distribution of critical supplies. Regulatory compliance and patient safety are paramount drivers.

Geographically, North America and Europe are leading markets due to their mature economies, high adoption rates of advanced technologies, and the presence of major players in the supply chain analytics domain. The continuous investment in R&D and the strong emphasis on operational efficiency by businesses in these regions solidify their leadership.

Supply Chain Big Data Analytics Industry Product Developments

Product developments in the Supply Chain Big Data Analytics Industry are focused on enhancing real-time visibility, predictive forecasting, and prescriptive decision-making. Innovations include AI-powered platforms that can analyze vast datasets from various sources—IoT devices, ERP systems, market intelligence—to provide actionable insights. Key advancements involve self-learning algorithms for dynamic inventory management, automated risk assessment tools for supply chain disruptions, and sophisticated route optimization engines that factor in real-time traffic and weather conditions. These developments offer competitive advantages by improving agility, reducing costs, and enhancing resilience.

Report Scope & Segmentation Analysis

This report provides an exhaustive analysis of the Supply Chain Big Data Analytics Industry, segmented by Type, Service, and End User.

- Type: The Solution segment encompasses Supply Chain Procurement and Planning Tools, Sales and Operations Planning (S&OP), Manufacturing Analytics, Transportation and Logistics Analytics, and Other Solutions. Growth in these areas is driven by specific operational needs, with S&OP and Transportation & Logistics Analytics showing particularly strong adoption.

- Service: The Service segment is further divided into Professional Services and Support and Maintenance Services. Professional services are critical for implementation and customization, while ongoing support ensures optimal utilization of analytics platforms.

- End User: Key end-user segments include Retail, Transportation and Logistics, Manufacturing, Healthcare, and Other End Users. Retail and Transportation & Logistics are projected to exhibit the highest growth rates due to the inherent data-intensiveness of these industries.

Key Drivers of Supply Chain Big Data Analytics Industry Growth

The growth of the Supply Chain Big Data Analytics Industry is propelled by several key factors. Technologically, the proliferation of IoT devices generates a continuous stream of real-time data, essential for analytics. Advancements in AI and ML are enabling more sophisticated predictive and prescriptive capabilities. Economically, the globalized nature of supply chains and the increasing volatility of markets necessitate better risk management and cost optimization. Regulatory drivers, such as mandates for transparency and traceability in certain industries (e.g., pharmaceuticals), also contribute to the demand for robust analytics solutions.

Challenges in the Supply Chain Big Data Analytics Industry Sector

Despite its growth, the Supply Chain Big Data Analytics Industry faces several challenges. Data integration across disparate systems remains a significant hurdle, often leading to data silos. The complexity of supply chains, coupled with the sheer volume and velocity of data, requires substantial investment in infrastructure and skilled personnel. Cybersecurity threats and data privacy concerns pose ongoing risks, necessitating robust security measures. Furthermore, the initial cost of implementing advanced analytics solutions can be a barrier for smaller enterprises, and the shortage of data scientists and analytics professionals exacerbates implementation challenges.

Emerging Opportunities in Supply Chain Big Data Analytics Industry

Emerging opportunities in the Supply Chain Big Data Analytics Industry lie in the growing demand for sustainability analytics, enabling companies to track and reduce their environmental footprint across the supply chain. The rise of the circular economy presents opportunities for analytics solutions that optimize reverse logistics and material recovery. Furthermore, the increasing adoption of blockchain technology for enhanced transparency and traceability in supply chains opens new avenues for integration with big data analytics platforms. The expansion into emerging markets and the development of niche analytics solutions for specific industry verticals also represent significant growth potential.

Leading Players in the Supply Chain Big Data Analytics Industry Market

- SAS Institute Inc

- SAP SE

- IBM Corporation

- Birst Inc

- MicroStrategy Incorporated

- Salesforce com Inc (Tableau Software Inc)

- Capgemini Group

- Sage Clarity Systems

- Oracle Corporation

- Kinaxis Inc

- Genpact Limited

Key Developments in Supply Chain Big Data Analytics Industry Industry

- September 2022: Accenture announced the acquisition of MacGregor Partner, a prominent supply chain consultant and technology supplier specializing in smart logistics and warehouse administration. This strategic move enhances Accenture's capabilities in intelligent logistics and warehouse management, further strengthened by Blue Yonder technology.

- November 2022: o9 Solutions, a provider of AI software platforms for decision-making and planning, collaborated with Genpact to facilitate a digitization process for Eckes - Granini. The project aims to eliminate information silos and transparently integrate and streamline operations for the European fruit drinks and beverages provider, with the initial phase focusing on automating and optimizing Eckes Granini's worldwide supply chain.

- November 2022: Microsoft Corp. unveiled the Microsoft Supply Chain System. This innovative platform leverages Microsoft AI, low-code capabilities, enhanced security, collaboration tools, and SaaS applications to help enterprises optimize their supply chain data estate investment through an open and scalable approach.

Strategic Outlook for Supply Chain Big Data Analytics Industry Market

The strategic outlook for the Supply Chain Big Data Analytics Industry is exceptionally positive, driven by the relentless pursuit of operational excellence and resilience. Future growth catalysts include the increasing integration of AI and ML for predictive and prescriptive analytics, enabling proactive disruption management and hyper-personalized customer experiences. The ongoing push for supply chain sustainability will create significant demand for analytics solutions that measure and mitigate environmental impact. Furthermore, the expansion of cloud-based analytics platforms will democratize access to powerful tools, driving adoption across a wider range of businesses, including SMEs. Strategic partnerships and continued M&A activity will further consolidate the market and foster innovation, ensuring that businesses can effectively navigate the complexities of modern supply chains.

Supply Chain Big Data Analytics Industry Segmentation

-

1. Type

-

1.1. Solution

- 1.1.1. Supply Chain Procurement and Planning Tool

- 1.1.2. Sales and Operations Planning

- 1.1.3. Manufacturing Analytics

- 1.1.4. Transportation and Logistics Analytics

- 1.1.5. Other So

-

1.2. Service

- 1.2.1. Professional Service

- 1.2.2. Support and Maintenance Service

-

1.1. Solution

-

2. End User

- 2.1. Retail

- 2.2. Transportation and Logistics

- 2.3. Manufacturing

- 2.4. Healthcare

- 2.5. Other End Users

Supply Chain Big Data Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

Supply Chain Big Data Analytics Industry Regional Market Share

Geographic Coverage of Supply Chain Big Data Analytics Industry

Supply Chain Big Data Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need of Business Data to Improve Efficiency

- 3.3. Market Restrains

- 3.3.1. Operational Complexity Coupled with High Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Retail is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solution

- 5.1.1.1. Supply Chain Procurement and Planning Tool

- 5.1.1.2. Sales and Operations Planning

- 5.1.1.3. Manufacturing Analytics

- 5.1.1.4. Transportation and Logistics Analytics

- 5.1.1.5. Other So

- 5.1.2. Service

- 5.1.2.1. Professional Service

- 5.1.2.2. Support and Maintenance Service

- 5.1.1. Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Retail

- 5.2.2. Transportation and Logistics

- 5.2.3. Manufacturing

- 5.2.4. Healthcare

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solution

- 6.1.1.1. Supply Chain Procurement and Planning Tool

- 6.1.1.2. Sales and Operations Planning

- 6.1.1.3. Manufacturing Analytics

- 6.1.1.4. Transportation and Logistics Analytics

- 6.1.1.5. Other So

- 6.1.2. Service

- 6.1.2.1. Professional Service

- 6.1.2.2. Support and Maintenance Service

- 6.1.1. Solution

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Retail

- 6.2.2. Transportation and Logistics

- 6.2.3. Manufacturing

- 6.2.4. Healthcare

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solution

- 7.1.1.1. Supply Chain Procurement and Planning Tool

- 7.1.1.2. Sales and Operations Planning

- 7.1.1.3. Manufacturing Analytics

- 7.1.1.4. Transportation and Logistics Analytics

- 7.1.1.5. Other So

- 7.1.2. Service

- 7.1.2.1. Professional Service

- 7.1.2.2. Support and Maintenance Service

- 7.1.1. Solution

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Retail

- 7.2.2. Transportation and Logistics

- 7.2.3. Manufacturing

- 7.2.4. Healthcare

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solution

- 8.1.1.1. Supply Chain Procurement and Planning Tool

- 8.1.1.2. Sales and Operations Planning

- 8.1.1.3. Manufacturing Analytics

- 8.1.1.4. Transportation and Logistics Analytics

- 8.1.1.5. Other So

- 8.1.2. Service

- 8.1.2.1. Professional Service

- 8.1.2.2. Support and Maintenance Service

- 8.1.1. Solution

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Retail

- 8.2.2. Transportation and Logistics

- 8.2.3. Manufacturing

- 8.2.4. Healthcare

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solution

- 9.1.1.1. Supply Chain Procurement and Planning Tool

- 9.1.1.2. Sales and Operations Planning

- 9.1.1.3. Manufacturing Analytics

- 9.1.1.4. Transportation and Logistics Analytics

- 9.1.1.5. Other So

- 9.1.2. Service

- 9.1.2.1. Professional Service

- 9.1.2.2. Support and Maintenance Service

- 9.1.1. Solution

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Retail

- 9.2.2. Transportation and Logistics

- 9.2.3. Manufacturing

- 9.2.4. Healthcare

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Solution

- 10.1.1.1. Supply Chain Procurement and Planning Tool

- 10.1.1.2. Sales and Operations Planning

- 10.1.1.3. Manufacturing Analytics

- 10.1.1.4. Transportation and Logistics Analytics

- 10.1.1.5. Other So

- 10.1.2. Service

- 10.1.2.1. Professional Service

- 10.1.2.2. Support and Maintenance Service

- 10.1.1. Solution

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Retail

- 10.2.2. Transportation and Logistics

- 10.2.3. Manufacturing

- 10.2.4. Healthcare

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Supply Chain Big Data Analytics Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Solution

- 11.1.1.1. Supply Chain Procurement and Planning Tool

- 11.1.1.2. Sales and Operations Planning

- 11.1.1.3. Manufacturing Analytics

- 11.1.1.4. Transportation and Logistics Analytics

- 11.1.1.5. Other So

- 11.1.2. Service

- 11.1.2.1. Professional Service

- 11.1.2.2. Support and Maintenance Service

- 11.1.1. Solution

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Retail

- 11.2.2. Transportation and Logistics

- 11.2.3. Manufacturing

- 11.2.4. Healthcare

- 11.2.5. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 SAS Institute Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SAP SE (SAP)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Birst Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 MicroStrategy Incorporated

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Salesforce com Inc (Tableau Software Inc )

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Capgemini Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sage Clarity Systems

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Oracle Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Kinaxis Inc *List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Genpact Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Supply Chain Big Data Analytics Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Pacific Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Latin America Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Latin America Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: Middle East Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue (undefined), by Type 2025 & 2033

- Figure 33: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue Share (%), by Type 2025 & 2033

- Figure 34: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue (undefined), by End User 2025 & 2033

- Figure 35: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 36: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: United Arab Emirates Supply Chain Big Data Analytics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 11: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Germany Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Italy Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 19: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: China Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 27: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Mexico Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Brazil Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Latin America Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 36: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 37: Global Supply Chain Big Data Analytics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: South Africa Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East Supply Chain Big Data Analytics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Supply Chain Big Data Analytics Industry?

The projected CAGR is approximately 11.4%.

2. Which companies are prominent players in the Supply Chain Big Data Analytics Industry?

Key companies in the market include SAS Institute Inc, SAP SE (SAP), IBM Corporation, Birst Inc, MicroStrategy Incorporated, Salesforce com Inc (Tableau Software Inc ), Capgemini Group, Sage Clarity Systems, Oracle Corporation, Kinaxis Inc *List Not Exhaustive, Genpact Limited.

3. What are the main segments of the Supply Chain Big Data Analytics Industry?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need of Business Data to Improve Efficiency.

6. What are the notable trends driving market growth?

Retail is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Operational Complexity Coupled with High Maintenance Costs.

8. Can you provide examples of recent developments in the market?

September 2022: Accenture announced the acquisition of MacGregor Partner, a prominent supply chain consultant and technology supplier specializing in smart logistics and warehouse administration. It is an intelligent logistics and warehouse management company, as well as a supply chain consultant and technology supplier. Accenture's supply chain network, powered by Blue Yonder technology, has grown due to the acquisition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Supply Chain Big Data Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Supply Chain Big Data Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Supply Chain Big Data Analytics Industry?

To stay informed about further developments, trends, and reports in the Supply Chain Big Data Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence