Key Insights

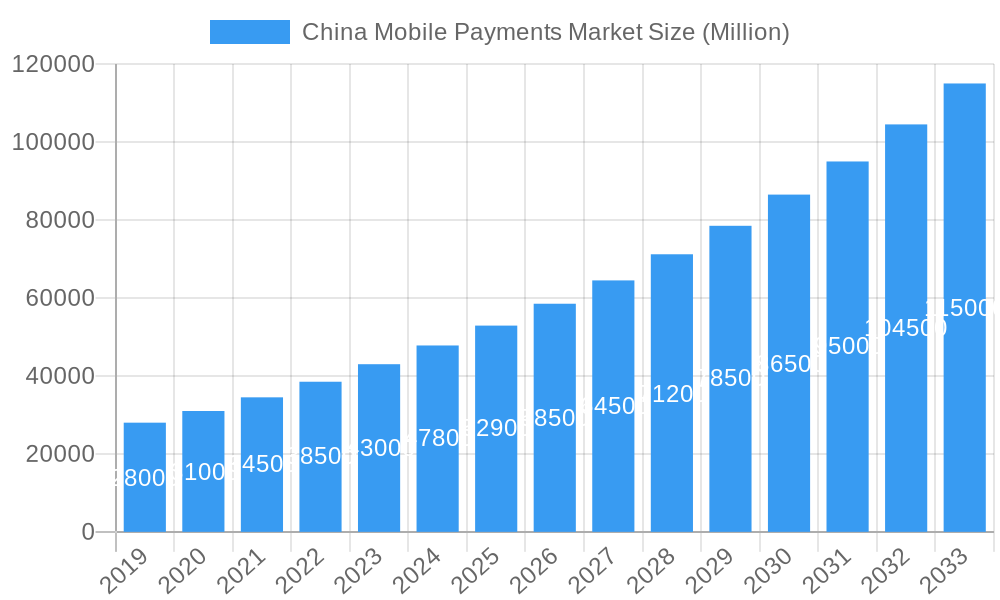

The China Mobile Payments Market is poised for substantial expansion, projected to reach $9.6 billion by 2025. Fueled by a rapidly digitizing economy and extensive smartphone adoption, mobile payments are integral to daily consumer transactions. Continuous technological innovation and widespread integration across retail, e-commerce, and transportation sectors further propel market growth. Proximity payment solutions, utilizing NFC and QR codes, lead due to their convenience in physical retail and transit. Remote payment capabilities are essential for the thriving e-commerce sector, facilitating seamless online transactions. The increasing demand for secure, convenient, and integrated payment experiences is a primary growth driver.

China Mobile Payments Market Market Size (In Billion)

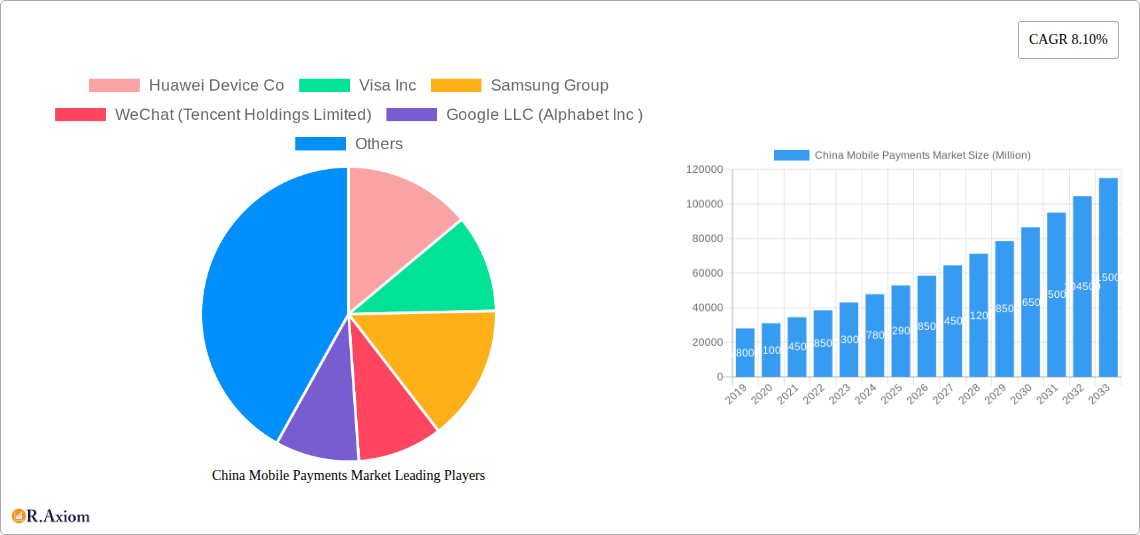

The market's impressive CAGR of 14.6% underscores a dynamic and competitive environment. Key industry participants, including Huawei Device Co, Visa Inc, Samsung Group, WeChat, Google LLC, 99bill, PAYPAL INC, AliPay, and Apple Inc, are actively introducing advanced features and expanding their service portfolios. The prominence of Chinese technology leaders, Tencent (WeChat Pay) and Alibaba (Alipay), reflects the market's localized nature, although global players are also making strategic advancements. While robust growth factors are present, potential challenges include evolving regulatory frameworks, increasing data security concerns, and the imperative for continuous infrastructure upgrades to accommodate escalating transaction volumes. Despite these considerations, the outlook for China's mobile payments market is exceptionally promising, supported by government initiatives promoting digital transformation and a growing consumer base embracing cashless convenience.

China Mobile Payments Market Company Market Share

This comprehensive report offers an in-depth analysis of the China Mobile Payments Market, detailing its growth trajectory, key trends, competitive landscape, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this research provides actionable insights for industry stakeholders. We examine market concentration, innovation drivers, regulatory environments, and evolving consumer preferences, alongside a detailed market segmentation by type and industry. This report is essential for understanding China's burgeoning digital payment ecosystem, its significant impact on sectors like retail, e-commerce, transportation, banking, and travel, and the strategic imperatives for navigating this rapidly evolving market.

China Mobile Payments Market Market Concentration & Innovation

The China Mobile Payments Market is characterized by high concentration, with a few dominant players controlling a significant market share. AliPay and WeChat Pay, operated by Ant Group and Tencent Holdings Limited respectively, are the titans, commanding over 90% of the market. Innovation is a relentless driving force, fueled by advancements in QR code technology, NFC, and the integration of artificial intelligence for personalized payment experiences and enhanced security. The regulatory framework, notably the November 2021 guidelines by the People's Bank of China (PBOC) concerning payment barcodes, is shaping the market by enhancing security and combating illicit activities, potentially influencing market structures and compliance costs. Product substitutes, such as traditional credit/debit cards and nascent digital yuan solutions, present ongoing competitive pressures. End-user trends show an increasing demand for seamless, integrated payment experiences across diverse platforms, from e-commerce to public transportation. Mergers and acquisitions (M&A) activity, while not as prevalent as in other tech sectors, continues to be a strategic tool for consolidation and expansion, with deal values influenced by technological capabilities and market reach. For instance, strategic partnerships and minority stake acquisitions in fintech startups by larger players are common.

China Mobile Payments Market Industry Trends & Insights

The China Mobile Payments Market is poised for substantial growth, projected to experience a Compound Annual Growth Rate (CAGR) of over 20% during the forecast period. This robust expansion is underpinned by several key trends. Firstly, the accelerating adoption of smartphones and increasing internet penetration, especially in Tier 3 and Tier 4 cities, is a primary growth driver, expanding the addressable market. Mobile payment penetration is estimated to exceed 85% by 2025, reflecting its deep integration into daily life. Technological disruptions, including the ongoing development and rollout of the Central Bank Digital Currency (CBDC), the digital yuan, are set to revolutionize payment infrastructure, potentially offering a new avenue for transactions and further enhancing financial inclusion. Consumer preferences are increasingly skewed towards convenience, speed, and security, leading to innovations in biometric authentication, facial recognition payments, and integrated loyalty programs within payment apps. Competitive dynamics are intense, with AliPay and WeChat Pay constantly innovating to retain their market dominance, introducing new features and expanding their service ecosystems to include financial services, e-commerce, and social networking integrations. Other players like 99bill and international entities such as Visa Inc. and Samsung Group are seeking niche opportunities or strategic alliances to participate in this lucrative market. The pandemic further accelerated the shift towards contactless and mobile payments, solidifying their position as the preferred payment method.

Dominant Markets & Segments in China Mobile Payments Market

The E-commerce segment stands out as the dominant industry for mobile payments in China. The sheer volume of online transactions, facilitated by user-friendly platforms and the ubiquitous presence of mobile payment solutions, drives this dominance. E-commerce is projected to account for over 50% of all mobile payment transactions in the forecast period. Key drivers for this segment's leadership include China's massive online consumer base, the widespread availability of secure and instant payment options, and sophisticated logistics networks that support online retail.

Retail is another significant industry, closely following e-commerce. Mobile payments are deeply ingrained in both online and offline retail environments, from large hypermarkets to small street vendors. The ease of QR code scanning for in-store purchases has made it a preferred method for consumers and merchants alike. Government initiatives promoting digital consumption and the integration of payment services with retail loyalty programs further bolster this segment.

The Transportation sector has also witnessed a remarkable transformation due to mobile payments. The adoption of mobile ticketing for subways, buses, and even ride-sharing services has become standard practice. This not only enhances convenience for commuters but also provides valuable data for urban planning and public transport management.

While Banking is fundamentally intertwined with mobile payments, its role is more as an enabler and beneficiary. Banks are integrating their services with mobile payment platforms, offering digital wallets, P2P transfers, and loan facilities.

The Travel industry is increasingly leveraging mobile payments for booking flights, hotels, and local experiences, further demonstrating the versatility and broad applicability of this payment method.

China Mobile Payments Market Product Developments

Product developments in the China Mobile Payments Market are characterized by a relentless pursuit of enhanced user experience and expanded functionality. Innovations include sophisticated QR code scanning technologies for faster and more secure transactions, the integration of biometric authentication methods like facial recognition and fingerprint scanning for improved security, and the embedding of loyalty programs and discount features directly within payment applications. These advancements aim to create a seamless, all-in-one digital wallet that transcends simple payment processing. Competitive advantages are being carved out through superior user interface design, broader acceptance networks, and the integration of value-added services such as wealth management, insurance, and micro-loans, all accessible through a single app.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the China Mobile Payments Market segmented by Type and Industry.

Type Segmentation:

- Proximity Payment: This segment encompasses transactions made using devices in close physical proximity, such as NFC-enabled smartphones or QR code scanning at point-of-sale terminals. Its market size is projected to reach over 50 Million Yuan by 2025.

- Remote Payment: This segment includes payments made for goods and services online or through mobile applications without physical proximity, such as e-commerce purchases and bill payments. This segment is expected to dominate the market with a projected size exceeding 150 Million Yuan by 2025.

Industry Segmentation:

- Retail: This segment covers transactions in both online and offline retail environments.

- E-commerce: This segment focuses specifically on transactions conducted through online retail platforms.

- Transportation: This segment includes payments for public transit, ride-sharing, and other travel-related services.

- Banking: This segment encompasses mobile payment services offered by financial institutions, including P2P transfers and digital wallet integration.

- Travel: This segment covers payments for booking flights, hotels, and other travel-related services.

Key Drivers of China Mobile Payments Market Growth

The robust growth of the China Mobile Payments Market is propelled by several intertwined factors. Firstly, the unparalleled penetration of smartphones and internet connectivity across all demographics is a foundational driver. Secondly, government initiatives promoting digital transformation and financial inclusion have created a fertile ground for mobile payment adoption. Thirdly, the inherent convenience and speed of mobile payment solutions, coupled with their integration into a wide array of daily activities, from online shopping to public transportation, have fostered widespread consumer preference. Furthermore, the continuous innovation by market leaders like AliPay and WeChat Pay, introducing new features and expanding service ecosystems, further stimulates demand and user engagement. The security enhancements, including advanced encryption and biometric authentication, have also played a crucial role in building consumer trust.

Challenges in the China Mobile Payments Market Sector

Despite its impressive growth, the China Mobile Payments Market faces certain challenges. Regulatory shifts, such as the PBOC's new guidelines on barcode usage, while aimed at enhancing security, can introduce compliance complexities and potential operational adjustments for market participants. Intense competition among established players and the potential for new entrants can lead to price wars and pressure on profit margins. Furthermore, ensuring universal accessibility and usability for all segments of the population, particularly the elderly or those in remote areas with limited digital literacy, remains an ongoing challenge. Cybersecurity threats and data privacy concerns also require constant vigilance and robust protective measures to maintain consumer trust. The cost of maintaining and upgrading technological infrastructure to support growing transaction volumes is also a significant consideration.

Emerging Opportunities in China Mobile Payments Market

Emerging opportunities in the China Mobile Payments Market are abundant, driven by technological advancements and evolving consumer behaviors. The widespread adoption of the digital yuan presents a significant opportunity for a new paradigm of secure and efficient transactions. The continued expansion of cross-border mobile payment solutions offers lucrative avenues for international trade and tourism. Furthermore, the integration of mobile payments with emerging technologies like the Internet of Things (IoT) for smart home devices and connected vehicles opens up new use cases. The burgeoning demand for personalized financial services, such as micro-investments and digital insurance offered through payment platforms, represents another significant growth area. Addressing the needs of underserved populations and expanding into rural areas with tailored mobile payment solutions also presents substantial untapped potential.

Leading Players in the China Mobile Payments Market Market

- AliPay

- WeChat (Tencent Holdings Limited)

- Huawei Device Co

- Samsung Group

- Apple Inc

- 99bill

- PAYPAL INC

- Visa Inc

- Google LLC (Alphabet Inc )

Key Developments in China Mobile Payments Market Industry

- November 2021: China implemented new guidelines for mobile payments, which will pave the way for the country's central bank's digital currency. The People's Bank of China (PBOC), the country's central bank, has announced new regulations for mobile payments, the country's most significant payment method, that aims to better specify the usage and classification of payment collection barcodes to combat crimes such as unlawful gambling. This development signifies a move towards greater regulatory oversight and security enhancement in the mobile payment ecosystem, potentially influencing how merchants and payment providers operate.

Strategic Outlook for China Mobile Payments Market Market

The strategic outlook for the China Mobile Payments Market remains exceptionally strong, driven by continued digital transformation and evolving consumer habits. The ongoing rollout and adoption of the digital yuan will likely reshape the competitive landscape, offering new opportunities for integration and innovation. Market players are expected to focus on expanding their service offerings beyond basic payments, venturing further into areas like financial services, e-commerce platforms, and lifestyle applications to create comprehensive digital ecosystems. The push towards greater security and compliance, as evidenced by recent regulatory developments, will also shape strategic decisions. Furthermore, exploring untapped markets, both domestically in less penetrated regions and internationally through cross-border payment solutions, will be critical for sustained growth and market leadership.

China Mobile Payments Market Segmentation

-

1. Type

- 1.1. Proximity Payment

- 1.2. Remote Payment

-

2. Industry

- 2.1. Retail

- 2.2. E-commerce

- 2.3. Transportation

- 2.4. Banking

- 2.5. Travel

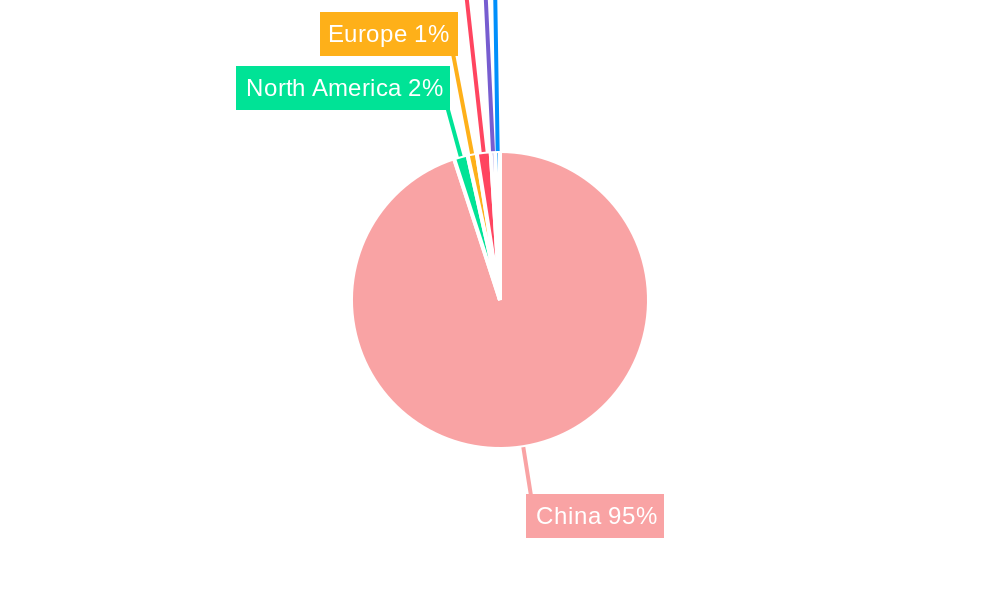

China Mobile Payments Market Segmentation By Geography

- 1. China

China Mobile Payments Market Regional Market Share

Geographic Coverage of China Mobile Payments Market

China Mobile Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration and Growing M-Commerce Market; Increasing Number of Loyalty Benefits in Mobile Environment

- 3.3. Market Restrains

- 3.3.1. Internet Breakdown and Bandwidth Limitation

- 3.4. Market Trends

- 3.4.1. Proximity Payment Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Mobile Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proximity Payment

- 5.1.2. Remote Payment

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Retail

- 5.2.2. E-commerce

- 5.2.3. Transportation

- 5.2.4. Banking

- 5.2.5. Travel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Huawei Device Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Visa Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WeChat (Tencent Holdings Limited)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Google LLC (Alphabet Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 99bill

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PAYPAL INC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AliPay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apple Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Huawei Device Co

List of Figures

- Figure 1: China Mobile Payments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Mobile Payments Market Share (%) by Company 2025

List of Tables

- Table 1: China Mobile Payments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Mobile Payments Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: China Mobile Payments Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 4: China Mobile Payments Market Volume K Unit Forecast, by Industry 2020 & 2033

- Table 5: China Mobile Payments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Mobile Payments Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: China Mobile Payments Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: China Mobile Payments Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: China Mobile Payments Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 10: China Mobile Payments Market Volume K Unit Forecast, by Industry 2020 & 2033

- Table 11: China Mobile Payments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: China Mobile Payments Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Mobile Payments Market?

The projected CAGR is approximately 14.6%.

2. Which companies are prominent players in the China Mobile Payments Market?

Key companies in the market include Huawei Device Co, Visa Inc, Samsung Group, WeChat (Tencent Holdings Limited), Google LLC (Alphabet Inc ), 99bill, PAYPAL INC, AliPay, Apple Inc.

3. What are the main segments of the China Mobile Payments Market?

The market segments include Type , Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration and Growing M-Commerce Market; Increasing Number of Loyalty Benefits in Mobile Environment.

6. What are the notable trends driving market growth?

Proximity Payment Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Internet Breakdown and Bandwidth Limitation.

8. Can you provide examples of recent developments in the market?

November 2021 - China implemented new guidelines for mobile payments, which will pave the way for the country's central bank's digital currency. The People's Bank of China (PBOC), the country's central bank, has announced new regulations for mobile payments, the country's most significant payment method, that aims to better specify the usage and classification of payment collection barcodes to combat crimes such as unlawful gambling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Mobile Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Mobile Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Mobile Payments Market?

To stay informed about further developments, trends, and reports in the China Mobile Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence