Key Insights

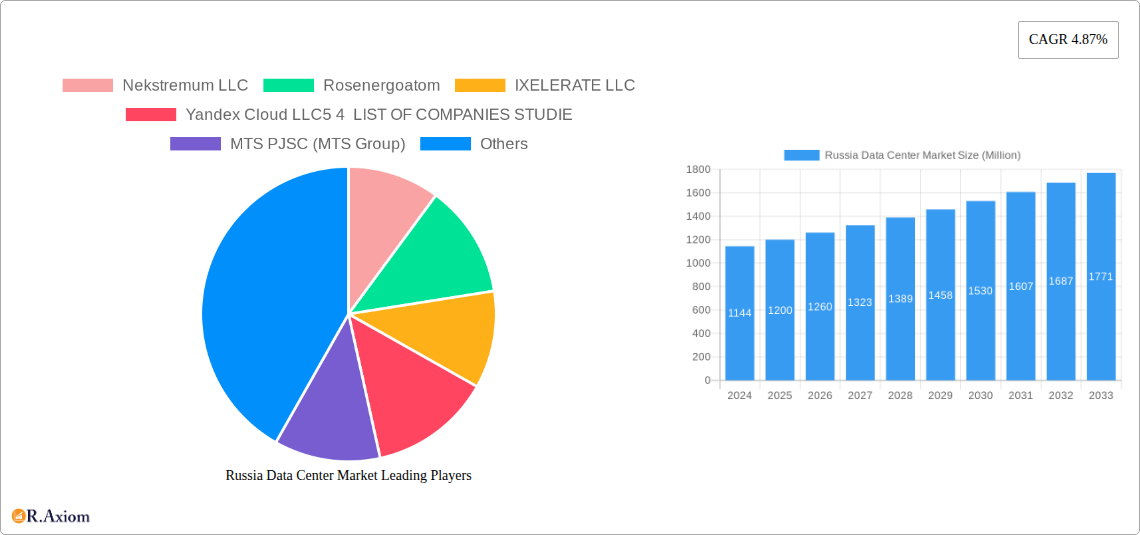

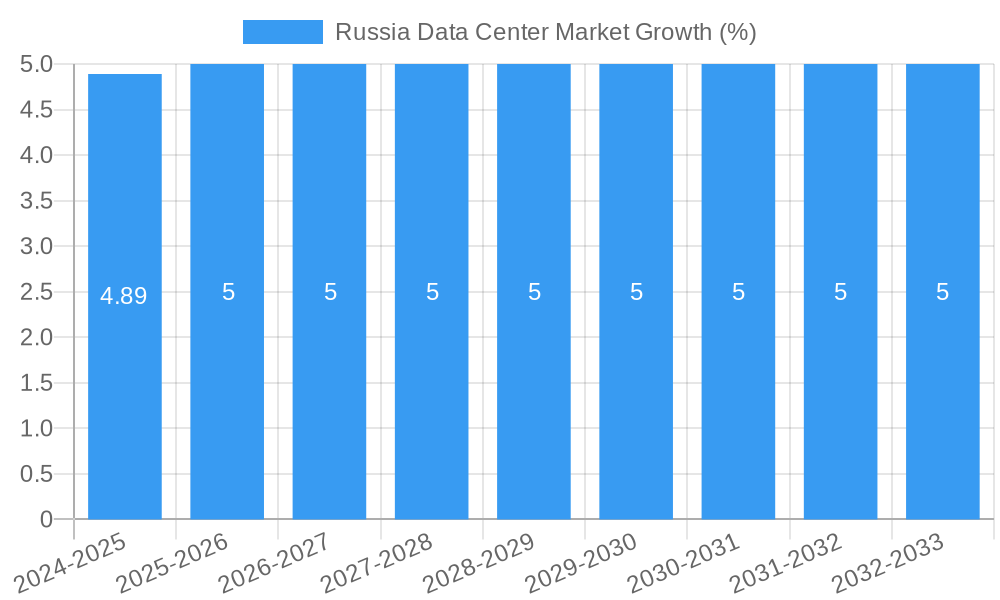

The Russian data center market is poised for robust growth, projected to reach an estimated market size of approximately $1,200 million by 2025, with a compelling compound annual growth rate (CAGR) of 4.87% extending through 2033. This expansion is primarily fueled by the accelerating digital transformation across various sectors, the burgeoning demand for cloud services, and the increasing adoption of big data analytics and IoT technologies. Key drivers include significant investments in national digital infrastructure, governmental initiatives promoting data localization, and the growing need for secure and efficient data storage and processing capabilities from enterprises. The rise of hyperscale colocation and the expansion of carrier-neutral facilities are key trends shaping the market landscape, offering greater flexibility and cost-effectiveness for businesses.

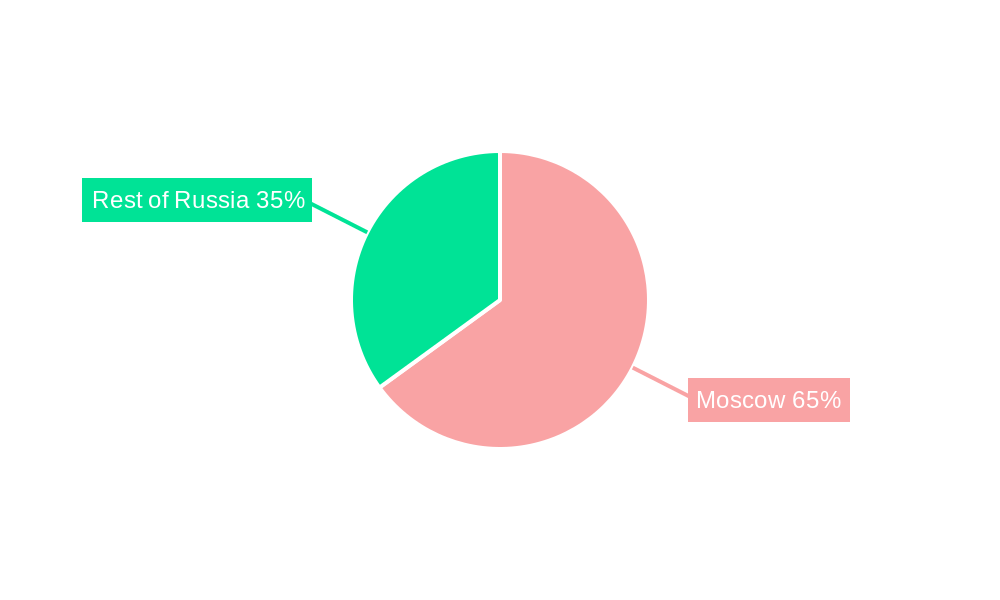

However, certain restraints could temper this growth trajectory. These include the complex regulatory environment, geopolitical uncertainties impacting foreign investment, and the significant capital expenditure required for building and maintaining state-of-the-art data center facilities. Furthermore, the availability of skilled IT professionals and the continuous need for technological upgrades to keep pace with evolving industry standards present ongoing challenges. The market segmentation reveals a strong focus on large and massive data center sizes, with Tier 3 and Tier 4 facilities gaining prominence. Moscow continues to be the dominant hotspot, though significant growth is anticipated in other regions of Russia. Key end-users driving demand include BFSI, cloud providers, e-commerce, and telecom sectors, all seeking to leverage advanced data center solutions for enhanced performance and scalability.

Here is a detailed, SEO-optimized report description for the Russia Data Center Market:

Russia Data Center Market Market Concentration & Innovation

The Russia Data Center Market is characterized by a moderate level of market concentration, with key players like Rosenergoatom and Yandex Cloud LLC driving significant capacity. Innovation is primarily fueled by the demand for hyperscale cloud services and the increasing adoption of advanced cooling technologies to enhance efficiency and sustainability. Regulatory frameworks, while evolving, aim to ensure data security and localization. Product substitutes are limited in the context of physical data center infrastructure, but advancements in edge computing and distributed infrastructure present potential shifts. End-user trends show a strong preference for scalable, high-availability colocation solutions across BFSI, cloud, and e-commerce sectors. M&A activities are anticipated to increase as established players seek to expand their footprint and capabilities, with estimated deal values in the hundreds of millions of dollars. The market share is distributed, with Nekstremum LLC, IXELERATE LLC, and Selectel Ltd holding significant portions, alongside emerging players like 3Data and DataPro.

Russia Data Center Market Industry Trends & Insights

The Russia Data Center Market is poised for substantial growth, driven by the relentless digital transformation across various industries. The forecast indicates a Compound Annual Growth Rate (CAGR) of approximately 12% from 2025 to 2033, reflecting robust expansion in demand for data processing, storage, and connectivity. Key growth drivers include the burgeoning Russian e-commerce sector, increasing cloud adoption by enterprises and government bodies, and the ongoing need for enhanced cybersecurity measures. Technological disruptions, such as the rise of AI, IoT, and big data analytics, necessitate the deployment of more powerful and specialized data center infrastructure. Consumer preferences are shifting towards colocation services that offer flexibility, scalability, and cost-efficiency, with a growing emphasis on Tier III and Tier IV facilities. Competitive dynamics are intensifying, with both established Russian providers like Rostelecom and MTS PJSC, and international players (where permitted) vying for market share. The market penetration of advanced data center solutions is expected to deepen significantly during the forecast period.

Dominant Markets & Segments in Russia Data Center Market

The Moscow region continues to be the dominant market within Russia's data center landscape, accounting for over 60% of the current installed capacity. This dominance is attributed to its status as the primary economic hub, access to skilled labor, and its central role in national and international connectivity.

Key drivers for Moscow's dominance include:

- Proximity to End-Users: A high concentration of corporate headquarters, financial institutions, and government agencies.

- Robust Infrastructure: Well-developed power grids and fiber optic networks essential for data center operations.

- Investment Hub: Attracts significant domestic and, historically, international investment in technology and infrastructure.

In terms of Data Center Size, Large and Mega facilities are experiencing the most significant demand. Hyperscale providers and large enterprises require substantial footprints to accommodate their growing compute and storage needs. This trend is fueled by the scalability demands of cloud services and big data processing.

The Tier III and Tier IV segments are witnessing accelerated growth. End-users, particularly in BFSI and Government sectors, prioritize high availability and fault tolerance, making these higher tier certifications crucial for their operations. The recent opening of DataPro Moscow II, a Tier IV facility, underscores this trend.

By Colocation Type, Hyperscale is the fastest-growing segment, driven by the expansion of major cloud providers. Wholesale colocation also remains strong, catering to large enterprises and service providers seeking dedicated space and power. Retail colocation is important for SMEs and specific niche applications.

Analyzing End Users, the Cloud sector is the primary driver of data center demand, followed closely by BFSI and E-Commerce. The digital transformation initiatives across these sectors are creating an insatiable appetite for reliable and scalable data infrastructure. The Government sector is also a significant contributor, with increasing investments in national digital infrastructure and data security.

Russia Data Center Market Product Developments

Product developments in the Russia Data Center Market are focused on enhancing efficiency, scalability, and sustainability. Innovations in modular data center designs are enabling faster deployment and greater flexibility. Advancements in cooling technologies, such as liquid cooling, are gaining traction to support high-density computing requirements. Competitive advantages are being built around energy efficiency, power redundancy, and advanced security features. The market is seeing a trend towards integrated solutions that combine colocation, connectivity, and managed services.

Report Scope & Segmentation Analysis

The Russia Data Center Market is meticulously segmented to provide comprehensive insights. Hotspot: Moscow is the focal point, with Rest of Russia showing increasing development. Data Center Size spans Small to Mega facilities, with Large and Mega dominating growth. Tier Type includes Tier 1 and 2, Tier 3, and Tier 4, with Tier 3 and 4 seeing elevated demand. Absorption is analyzed, with Non-Utilized capacity playing a role in strategic planning. Colocation Type includes Hyperscale, Retail, and Wholesale, with Hyperscale experiencing the most rapid expansion. End User segments are diverse, encompassing BFSI, Cloud, E-Commerce, Government, Manufacturing, Media & Entertainment, Telecom, and Other End Users, each with unique demand patterns and growth projections.

Key Drivers of Russia Data Center Market Growth

The Russia Data Center Market is propelled by several key drivers. The ongoing digital transformation initiatives across all sectors necessitate robust IT infrastructure. The rapid growth of e-commerce and online services in Russia fuels demand for scalable storage and processing power. Increasing cloud adoption by both enterprises and government entities is a significant catalyst. Furthermore, the growing emphasis on data localization and cybersecurity compliance drives investment in secure, in-country data center facilities. Technological advancements in AI, IoT, and big data analytics also contribute to the demand for high-performance computing capabilities.

Challenges in the Russia Data Center Market Sector

Despite its growth potential, the Russia Data Center Market faces several challenges. Regulatory complexities and evolving data sovereignty laws can create hurdles for market participants. Supply chain disruptions and the sourcing of critical hardware components can impact project timelines and costs. The availability of skilled labor for the design, construction, and operation of advanced data centers remains a concern. Furthermore, intense competition among existing providers and potential new entrants can exert downward pressure on pricing and margins, requiring strategic differentiation and operational efficiency.

Emerging Opportunities in Russia Data Center Market

Emerging opportunities in the Russia Data Center Market lie in the expansion of edge computing infrastructure to support low-latency applications. The growing demand for specialized data centers, such as those catering to high-performance computing (HPC) or AI workloads, presents a significant avenue for growth. The development of sustainable data center solutions, incorporating renewable energy sources and advanced cooling techniques, aligns with global environmental trends and regulatory pressures. Furthermore, the increasing adoption of digital technologies in underserved regions of Russia presents opportunities for distributed data center development.

Leading Players in the Russia Data Center Market Market

- Nekstremum LLC

- Rosenergoatom

- IXELERATE LLC

- Yandex Cloud LLC

- MTS PJSC (MTS Group)

- Selectel Ltd

- Linxdatacenter

- Rostelecom

- Stack Net (Stack Group)

- 3Data

- DataPro

- RackStore

Key Developments in Russia Data Center Market Industry

- October 2022: DataPro Moscow II, the first data center in Eastern Europe with a Tier-IV integrity level, was opened by the DataPro corporation. The facility can accommodate 1,600 racks, with the initial batch of 800 in use and the second lot of 800 planned for usability by the end of 2020, positioning DataPro as a significant player with 3,600 total racks.

- September 2022: Yandex plans to construct a brand-new 63MW data center in western Russia's Kaluga Oblast, located in Kaluga's Grabtsevo Industrial Park. With a 130,000 square meter footprint and 63 MW of power, it can accommodate over 3,800 server racks with a 15 kW load.

- May 2022: The Russian data center company 3data and investment firm Alias Group announced plans to build a data center in Krasnodar, with an expected opening around the end of 2023 under a franchise agreement.

Strategic Outlook for Russia Data Center Market Market

The strategic outlook for the Russia Data Center Market is characterized by sustained growth and increasing sophistication. The market will witness continued expansion driven by cloud adoption, e-commerce, and the government's digital agenda. Investments in higher-tier facilities and energy-efficient technologies will be paramount for competitive advantage. Opportunities exist for players focusing on specialized colocation services and expanding their reach beyond the Moscow region. The integration of advanced technologies and a focus on resilience and security will be critical for navigating the evolving landscape and capturing future market potential.

Russia Data Center Market Segmentation

-

1. Hotspot

- 1.1. Moscow

- 1.2. Rest of Russia

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

4.2. By Colocation Type

- 4.2.1. Hyperscale

- 4.2.2. Retail

- 4.2.3. Wholesale

-

4.3. By End User

- 4.3.1. BFSI

- 4.3.2. Cloud

- 4.3.3. E-Commerce

- 4.3.4. Government

- 4.3.5. Manufacturing

- 4.3.6. Media & Entertainment

- 4.3.7. Telecom

- 4.3.8. Other End User

Russia Data Center Market Segmentation By Geography

- 1. Russia

Russia Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Automation in the Security Screening Industry

- 3.2.2 Especially to Detect Advanced Threats

- 3.2.3 etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities

- 3.3. Market Restrains

- 3.3.1 Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic

- 3.3.2 etc.; High Installation and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Moscow

- 5.1.2. Rest of Russia

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.4.2. By Colocation Type

- 5.4.2.1. Hyperscale

- 5.4.2.2. Retail

- 5.4.2.3. Wholesale

- 5.4.3. By End User

- 5.4.3.1. BFSI

- 5.4.3.2. Cloud

- 5.4.3.3. E-Commerce

- 5.4.3.4. Government

- 5.4.3.5. Manufacturing

- 5.4.3.6. Media & Entertainment

- 5.4.3.7. Telecom

- 5.4.3.8. Other End User

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Western Russia Russia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nekstremum LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rosenergoatom

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IXELERATE LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Yandex Cloud LLC5 4 LIST OF COMPANIES STUDIE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 MTS PJSC (MTS Group)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Selectel Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Linxdatacenter

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rostelecom

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Stack Net (Stack Group)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 3Data

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 DataPro

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 RackStore

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Nekstremum LLC

List of Figures

- Figure 1: Russia Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Russia Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Russia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Russia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Russia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Russia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Western Russia Russia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Eastern Russia Russia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Russia Russia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Northern Russia Russia Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 13: Russia Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 14: Russia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 15: Russia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 16: Russia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Data Center Market?

The projected CAGR is approximately 4.87%.

2. Which companies are prominent players in the Russia Data Center Market?

Key companies in the market include Nekstremum LLC, Rosenergoatom, IXELERATE LLC, Yandex Cloud LLC5 4 LIST OF COMPANIES STUDIE, MTS PJSC (MTS Group), Selectel Ltd, Linxdatacenter, Rostelecom, Stack Net (Stack Group), 3Data, DataPro, RackStore.

3. What are the main segments of the Russia Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation in the Security Screening Industry. Especially to Detect Advanced Threats. etc.; Upsurge in Terror Activities Across the Region; Increasing Government Initiatives on Security Inspection in Schools and Colleges; Increasing Government Initiatives for Smart Cities.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supply Chain Issues Caused By Geopolitical Scenario and the COVID-19 Pandemic. etc.; High Installation and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

October 2022: DataPro Moscow II, the first data center in Eastern Europe with a Tier-IV integrity level, was opened by the DataPro corporation, an independent operator of data processing facilities in Russia. The new DataPro data center can accommodate 1,600 racks in total. The initial batch of 800 racks is currently in use. By the end of 2020, the second lot of 800 racks will be usable. It will enable DataPro to hold second place in the Russian commercial data-center market with 3,600 racks overall in its data centers.September 2022: Yandex plans to construct a brand-new 63MW data center in western Russia's Kaluga Oblast. The brand-new building will be situated in Kaluga's Grabtsevo Industrial Park, around 100 miles south of Moscow. With a 130,000 square meter footprint and 63 MW of power, the new data center can accommodate more than 3,800 server racks with a 15 kW load.May 2022: The Russian data center company 3data and the investment firm Alias Group will build a data center in Krasnodar. A new facility will open in the Krasnodar Territory, according to 3data. According to the business, the facility will open around the end of 2023 under a franchise agreement with the investment firm Alias Group.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Data Center Market?

To stay informed about further developments, trends, and reports in the Russia Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence